Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

25 Septembre 2024 - 3:16PM

Edgar (US Regulatory)

Nuveen

Municipal

Income

Fund,

Inc.

Portfolio

of

Investments

July

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

INVESTMENTS

-

99.1%

X

–

MUNICIPAL

BONDS

-

99.1%

X

100,766,883

ALABAMA

-

2.4%

$

260

Jefferson

County,

Alabama,

Sewer

Revenue

Warrants,

Series

2024,

5.250%,

10/01/49

10/33

at

100.00

$

280,985

1,000

Southeast

Energy

Authority,

Alabama,

Commodity

Supply

Revenue

Bonds,

Project

4,

Series

2022B-1,

5.000%,

5/01/53,

(Mandatory

Put

8/01/28)

5/28

at

100.34

1,045,045

1,000

Southeast

Energy

Authority,

Alabama,

Commodity

Supply

Revenue

Bonds,

Project

5,

Series

2023A,

5.250%,

1/01/54,

(Mandatory

Put

7/01/29)

4/29

at

100.18

1,062,230

100

(c)

Tuscaloosa

County

Industrial

Development

Authority,

Alabama,

Gulf

Opportunity

Zone

Bonds,

Hunt

Refining

Project,

Refunding

Series

2019A,

5.250%,

5/01/44

5/29

at

100.00

101,248

TOTAL

ALABAMA

2,489,508

ARIZONA

-

5.9%

275

Arizona

Industrial

Development

Authority

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2023,

5.250%,

7/01/43

7/31

at

100.00

280,901

1,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2018A,

5.000%,

7/01/48

1/28

at

100.00

1,005,812

1,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

KIPPC

NYC

Public

Charter

Schools

-

Macombs

Facility

Project,

Series

2021A,

4.000%,

7/01/41

7/31

at

100.00

965,048

665

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Legacy

Traditional

Schools

Projects,

Series

2024,

4.250%,

7/01/44

7/31

at

100.00

644,402

1,495

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Junior

Lien

Series

2019A,

5.000%,

7/01/49

7/29

at

100.00

1,576,077

515

Salt

Verde

Financial

Corporation,

Arizona,

Senior

Gas

Revenue

Bonds,

Citigroup

Energy

Inc

Prepay

Contract

Obligations,

Series

2007,

5.250%,

12/01/28

No

Opt.

Call

543,488

1,000

(c)

Sierra

Vista

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Desert

Heights

Charter

School

Project,

Refunding

Series

2024,

6.125%,

6/01/57

6/32

at

102.00

1,002,606

TOTAL

ARIZONA

6,018,334

ARKANSAS

-

0.4%

200

(c)

Arkansas

Development

Finance

Authority,

Arkansas,

Environmental

Improvement

Revenue

Bonds,

United

States

Steel

Corporation,

Green

Series

2022,

5.450%,

9/01/52,

(AMT)

9/25

at

105.00

206,885

200

Arkansas

Development

Finance

Authority,

Arkansas,

Environmental

Improvement

Revenue

Bonds,

United

States

Steel

Corporation,

Green

Series

2023,

5.700%,

5/01/53,

(AMT)

5/26

at

105.00

210,375

TOTAL

ARKANSAS

417,260

CALIFORNIA

-

5.0%

250

California

Housing

Finance

Agency,

California,

Multifamily

Housing

Revenue

Bonds,

Power

Station

Block

7B,

Limited

Obligation

Senior

Series

2024L,

5.200%,

12/01/27

6/27

at

100.00

252,078

625

California

Municipal

Finance

Authority,

Special

Tax

Revenue

Bonds,

Bold

Program,

Series

2023B,

5.500%,

9/01/43

9/30

at

103.00

671,158

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

CALIFORNIA

(continued)

$

375

California

Municipal

Finance

Authority,

Special

Tax

Revenue

Bonds,

Bold

Program,

Series

2024A,

5.000%,

9/01/48

9/30

at

103.00

$

382,054

500

(c)

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2016A,

5.250%,

12/01/56

6/26

at

100.00

505,739

5

(d),(e)

California

Statewide

Community

Development

Authority,

Revenue

Bonds,

Daughters

of

Charity

Health

System,

Series

2005A,

5.500%,

7/01/39

1/22

at

100.00

4,930

300

M-S-R

Energy

Authority,

California,

Gas

Revenue

Bonds,

Citigroup

Prepay

Contracts,

Series

2009A,

7.000%,

11/01/34

No

Opt.

Call

369,355

525

Palm

Desert,

California,

Special

Tax

Bonds,

Community

Facilities

District

2021-1

University

Park,

Series

2024,

5.000%,

9/01/53

9/30

at

103.00

539,795

500

(c)

San

Francisco

City

and

County

Special

Tax

District

2020-1,

California,

Special

Tax

Bonds,

Mission

Rock

Facilities

and

Services,

Shoreline

Tax

Zone

1

Series

2023C,

5.750%,

9/01/53

9/30

at

103.00

537,813

San

Francisco

City

and

County,

California,

Special

Tax

Bonds,

Community

Facilities

District

2016-1

Treasure

Island

Improvement

Area

2,

Series

2023A

:

710

(c)

5.000%,

9/01/38

9/30

at

103.00

761,979

490

(c)

5.000%,

9/01/43

9/30

at

103.00

513,674

500

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2014B,

5.250%,

1/15/44

1/25

at

100.00

503,009

TOTAL

CALIFORNIA

5,041,584

COLORADO

-

11.5%

500

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

Christian

Living

Neighborhoods

Project,

Refunding

Series

2016,

5.000%,

1/01/37

9/24

at

102.00

502,625

1,000

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

CommonSpirit

Health,

Series

2019A-2,

5.000%,

8/01/44

8/29

at

100.00

1,039,991

1,395

Denver

City

and

County,

Colorado,

Airport

System

Revenue

Bonds,

Subordinate

Lien

Series

2018A,

5.000%,

12/01/43,

(AMT)

12/28

at

100.00

1,433,156

500

Erie

Highlands

Metropolitan

District

2,

Weld

County,

Colorado,

General

Obligation

Bonds,

Limited

Tax

Series

2018A,

5.250%,

12/01/48

8/24

at

103.00

503,650

700

(c)

Falcon

Area

Water

and

Wastewater

Authority

(El

Paso

County,

Colorado),

Tap

Fee

Revenue

Bonds,

Series

2022A,

6.750%,

12/01/34

9/27

at

103.00

692,631

200

Hess

Ranch

Metropolitan

District

5,

Parker,

Colorado,

Special

Assessment

Revenue

Bonds,

Special

Improvement

District

1,

Series

2024A-2,

6.500%,

12/01/43,

(WI/DD)

3/29

at

103.00

202,734

500

(c)

Kremmling

Memorial

Hospital

District,

Colorado,

Certificates

of

Participation,

Series

2024,

6.625%,

12/01/56

12/31

at

103.00

486,244

1,000

Lewis

Pointe

Metropolitan

District,

Thornton,

Colorado,

Limited

Tax

General

Obligation

Bonds,

Refunding

Series

2021,

4.000%,

12/01/47

-

BAM

Insured

12/31

at

100.00

950,581

500

Park

Creek

Metropolitan

District,

Colorado,

Senior

Limited

Property

Tax

Supported

Revenue

Bonds,

Series

2017A,

5.000%,

12/01/46

12/25

at

100.00

503,835

500

(c)

Parkdale

Community

Authority,

Erie

County,

Colorado,

Limited

Tax

Supported

Convertible

Capital

Appreciation

Revenue

Bonds,

District

2,

Series

2024A,

7.750%,

12/01/53

3/29

at

103.00

386,948

500

(c)

Peak

Metropolitan

District

1,

Colorado

Springs,

El

Paso

County,

Colorado,

Limited

Tax

General

Obligation

Bonds,

Series

2021A,

5.000%,

12/01/41

3/26

at

103.00

463,216

839

(c)

Platte

River

Metropolitan

District,

Weld

County,

Colorado,

General

Obligation

Bonds,

Limited

Tax

Refunding

Series

2023A,

6.500%,

8/01/53

8/29

at

103.00

872,561

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

COLORADO

(continued)

$

500

Raindance

Metropolitan

District

1,

Acting

by

and

through

its

Water

Activity

Enterprise

In

the

Town

of

Windsor,

Weld

County,

Colorado,

Non-Potable

Water

Enterprise

Revenue

Bonds,

Series

2020,

5.250%,

12/01/50

12/25

at

103.00

$

500,671

750

Silverstone

Metropolitan

District

3,

Weld

County,

Colorado,

General

Obligation

and

Special

Revenue

Bonds,

Limited

Tax

Series

2023,

7.750%,

12/01/45

12/28

at

103.00

771,548

1,275

(c)

Ventana

Metropolitan

District,

El

Paso

County,

Colorado,

General

Obligation

Bonds,

Limited

Tax

Refunding

and

Improvement

Series

2023A,

6.500%,

9/01/53

12/28

at

103.00

1,344,459

525

Waterview

II

Metropolitan

District,

El

Paso

County,

Colorado,

Limited

Tax

General

Obligation

Bonds,

Series

2022A,

4.500%,

12/01/31

3/27

at

103.00

518,622

500

West

Globeville

Metropolitan

District

1,

Denver,

Colorado,

General

Obligation

Limited

Tax

Bonds,

Series

2022,

6.750%,

12/01/52

12/29

at

103.00

491,089

TOTAL

COLORADO

11,664,561

DELAWARE

-

0.1%

100

Delaware

Health

Facilities

Authroity,

Revenue

Bonds,

Beebe

Medical

Center

Project,

Series

2018,

5.000%,

6/01/48

12/28

at

100.00

100,643

TOTAL

DELAWARE

100,643

DISTRICT

OF

COLUMBIA

-

0.1%

105

Metropolitan

Washington

Airports

Authority,

District

of

Columbia,

Dulles

Toll

Road

Revenue

Bonds,

Dulles

Metrorail

&

Capital

improvement

Projects,

Refunding

&

Subordinate

Lien

Series

2019B,

4.000%,

10/01/49

10/29

at

100.00

98,639

TOTAL

DISTRICT

OF

COLUMBIA

98,639

FLORIDA

-

11.5%

815

Bay

County,

Florida,

Educational

Facilities

Revenue

Refunding

Bonds,

Bay

Haven

Charter

Academy,

Inc.

Project,

Series

2013A,

5.000%,

9/01/33

9/24

at

100.00

815,649

500

(c)

Bridgewalk

Community

Development

District,

Osceola

County,

Florida,

Special

Assessment

Bonds,

Assessment

Area

2

Series

2023,

6.500%,

12/15/53

12/33

at

100.00

533,176

550

(c)

Capital

Projects

Finance

Authority,

Florida,

Educational

Revenue

Bonds,

Imagine

Kissimmee

Charter

Academy

Project,

Series

2024,

6.500%,

6/15/54

6/34

at

100.00

565,676

1,000

(c)

Capital

Trust

Authority,

Florida,

Educational

Facilities

Revenue

Bonds,

IPS

Enterprises,

Inc.

Projects,

Refunding

Series

2023A,

6.250%,

6/15/53

6/30

at

100.00

1,047,842

140

Capital

Trust

Authority,

Florida,

Educational

Facilities

Revenue

Bonds,

KIPP

Miami

North

Campus

Project,

Refunding

Series

2024A,

6.000%,

6/15/54

6/29

at

103.00

146,781

210

(c)

Florida

Development

Finance

Corporation,

Educational

Facilities

Revenue

Bonds,

Renaissance

Charter

School

Income

Projects,

Series

2023A,

6.500%,

6/15/38

6/30

at

103.00

234,329

1,000

Florida

Development

Finance

Corporation,

Revenue

Bonds,

Brightline

Florida

Passenger

Rail

Expansion

Project,

Brightline

Trains

Florida

LLC

Issue,

Series

2024,

5.500%,

7/01/53,

(AMT)

7/32

at

100.00

1,039,859

485

(c)

Florida

Development

Finance

Corporation,

Revenue

Bonds,

Brightline

Florida

Passenger

Rail

Expansion

Project,

Series

2023C,

8.250%,

7/01/57,

(AMT),

(Mandatory

Put

8/15/24)

8/24

at

104.50

506,382

500

Greater

Orlando

Aviation

Authority,

Florida,

Orlando

Airport

Facilities

Revenue

Bonds,

Priority

Subordinated

Series

2017A,

5.000%,

10/01/42,

(AMT)

10/27

at

100.00

512,047

255

(c)

Hamilton

Bluff

Community

Development

District,

Lake

Hamilton,

Florida,

Special

Assessment

Bonds,

Area

1

Project,

Series

2024,

5.800%,

5/01/54

5/34

at

100.00

258,002

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

FLORIDA

(continued)

$

885

(c)

Highland

Trails

Community

Development

District,

Pasco

County,

Florida,

Special

Assessment

Revenue

Bonds,

Assessment

Area

One

Capital

Improvement

Series

2024,

5.850%,

5/01/54

5/34

at

100.00

$

901,361

1,145

Hillsborough

County

Industrial

Development

Authority,

Florida,

Hospital

Revenue

Bonds,

Florida

Health

Sciences

Center

Inc

D/B/A

Tampa

General

Hospital,

Series

2020A,

4.000%,

8/01/55

2/31

at

100.00

1,022,358

150

Hobe-Saint

Lucie

Conservancy

District,

Florida,

Special

Assessment

Revenue

Bonds,

Improvement

Unit

1A,

Series

2024,

5.875%,

5/01/55

5/34

at

100.00

154,953

1,000

Lakeside

Preserve

Community

Development

District,

Lakeland,

Florida,

Special

Assessment

Bonds,

2023

Project

Series

2023,

6.375%,

5/01/54

5/34

at

100.00

1,061,049

300

Lakewood

Ranch

Stewardship

District,

Florida,

Special

Assessment

Revenue

Bonds,

Taylor

Ranch

Project,

Series

2023,

6.125%,

5/01/43

5/33

at

100.00

320,259

130

(c)

North

AR-1

of

Pasco

Community

Development

District,

Florida,

Capital

Improvement

Revenue

Bonds,

Assessment

Area

4,

Series

2024,

5.750%,

5/01/54

5/34

at

100.00

131,565

1,000

(c)

River

Hall

Community

Development

District,

Lee

County,

Florida,

Capital

Improvement

Revenue

Bonds,

Assessment

Area

4

Series

2023A,

6.500%,

5/01/54

5/34

at

100.00

1,066,858

225

Sawgrass

Village

Community

Development

District,

Manatee

County,

Florida,

Special

Assessment

Bonds,

Assessment

Area

2

Series

2023,

6.125%,

11/01/43

11/33

at

100.00

238,516

400

Stonegate

Preserve

Community

Development

District,

Florida,

Manatee

County,

Special

Assessment

Revenue

Bonds,

2023

Project

Area

Series

2023,

6.125%,

12/15/53

12/33

at

100.00

421,080

645

(c)

Woodsdale

Community

Development

District,

Pasco

County,

Florida,

Revenue

Bonds,

Capital

Improvement

Series

2023,

6.125%,

11/01/43

11/33

at

100.00

684,903

TOTAL

FLORIDA

11,662,645

GEORGIA

-

2.2%

130

Atlanta

Urban

Residential

Finance

Authority,

Georgia,

Multifamily

Housing

Revenue

Bonds,

Testletree

Village

Apartments,

Series

2013A,

4.000%,

11/01/25

9/24

at

100.00

125,742

600

Cobb

County

Development

Authority,

Georgia,

Charter

School

Revenue

Bonds,

Northwest

Classical

Academy,

Inc.

Project,

Series

2023A,

6.400%,

6/15/53

6/31

at

100.00

616,365

500

Fulton

County

Development

Authority,

Georgia,

Hospital

Revenue

Bonds,

Wellstar

Health

System,

Inc

Project,

Series

2017A,

4.000%,

4/01/50

4/30

at

100.00

478,710

1,000

Main

Street

Natural

Gas

Inc.,

Georgia,

Gas

Supply

Revenue

Bonds,

Series

2023B,

5.000%,

7/01/53,

(Mandatory

Put

3/01/30)

12/29

at

100.31

1,066,116

TOTAL

GEORGIA

2,286,933

HAWAII

-

0.2%

250

(c)

Hawaii

Department

of

Budget

and

Finance,

Special

Purpose

Revenue

Bonds,

Hawaii

Pacific

University

Project,

Refunding

Series

2024,

5.125%,

7/01/43

7/34

at

100.00

247,452

TOTAL

HAWAII

247,452

IDAHO

-

0.5%

500

(c)

Idaho

Housing

and

Finance

Association,

Nonprofit

Facilities

Revenue

Bonds,

The

College

of

Idaho

Project,

Series

2023,

5.875%,

11/01/53

11/33

at

100.00

516,841

TOTAL

IDAHO

516,841

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

ILLINOIS

-

10.3%

$

250

Chicago

Board

of

Education,

Illinois,

Dedicated

Capital

Improvement

Tax

Revenue

Bonds,

Series

2016,

6.000%,

4/01/46

4/27

at

100.00

$

261,416

500

Chicago

Board

of

Education,

Illinois,

Dedicated

Capital

Improvement

Tax

Revenue

Bonds,

Series

2023,

5.750%,

4/01/48

4/33

at

100.00

555,399

435

Chicago

Board

of

Education,

Illinois,

General

Obligation

Bonds,

Dedicated

Revenues,

Refunding

Series

2018D,

5.000%,

12/01/46

12/28

at

100.00

436,477

650

Chicago

Board

of

Education,

Illinois,

General

Obligation

Bonds,

Dedicated

Revenues,

Series

2016A,

7.000%,

12/01/44

12/25

at

100.00

669,590

500

Chicago

Board

of

Education,

Illinois,

General

Obligation

Bonds,

Dedicated

Revenues,

Series

2023A,

6.000%,

12/01/49

12/33

at

100.00

552,980

1,000

Chicago,

Illinois,

General

Airport

Revenue

Bonds,

O'Hare

International

Airport,

Senior

Lien

Series

2022A,

5.500%,

1/01/55

1/32

at

100.00

1,073,751

200

Illinois

Educational

Facilities

Authority,

Revenue

Bonds,

Field

Museum

of

Natural

History,

Series

2002.RMKT,

4.500%,

11/01/36

11/24

at

100.00

200,056

500

Illinois

Finance

Authority,

Revenue

Bonds,

Bradley

University,

Refunding

Series

2021A,

4.000%,

8/01/51

8/31

at

100.00

433,303

1,105

Illinois

Finance

Authority,

Revenue

Bonds,

OSF

Healthcare

System,

Series

2015A,

5.000%,

11/15/45

11/25

at

100.00

1,111,756

200

Illinois

Finance

Authority,

Revenue

Bonds,

Silver

Cross

Hospital

and

Medical

Centers,

Refunding

Series

2015C,

5.000%,

8/15/44

8/25

at

100.00

200,964

540

Illinois

State,

General

Obligation

Bonds,

June

Series

2022A,

5.500%,

3/01/47

3/32

at

100.00

589,840

500

Illinois

State,

General

Obligation

Bonds,

March

Series

2021A,

5.000%,

3/01/46

3/31

at

100.00

528,642

400

Illinois

State,

General

Obligation

Bonds,

May

Series

2020,

5.500%,

5/01/39

5/30

at

100.00

438,580

1,000

Illinois

State,

General

Obligation

Bonds,

October

Series

2022C,

5.500%,

10/01/41

10/32

at

100.00

1,123,001

1,900

Illinois

Toll

Highway

Authority,

Toll

Highway

Revenue

Bonds,

Senior

Lien

Series

2019A,

5.000%,

1/01/44

7/29

at

100.00

2,006,928

200

Metropolitan

Pier

and

Exposition

Authority,

Illinois,

McCormick

Place

Expansion

Project

Bonds,

Series

2015A,

5.500%,

6/15/53

12/25

at

100.00

202,578

205

Metropolitan

Pier

and

Exposition

Authority,

Illinois,

Revenue

Bonds,

McCormick

Place

Expansion

Project,

Series

2002A,

0.000%,

12/15/35

-

NPFG

Insured

No

Opt.

Call

131,480

TOTAL

ILLINOIS

10,516,741

INDIANA

-

2.6%

735

(c)

Gary

Local

Public

Improvement

Bond

Bank,

Indiana,

Economic

Development

Revenue

Bonds,

Drexel

Foundation

for

Educational

Excellence

Project,

Refunding

Series

2020A,

5.875%,

6/01/55

6/30

at

100.00

702,262

1,000

Indiana

Finance

Authority,

Hospital

Revenue

Bonds,

Indiana

University

Health

Obligation

Group,

Fixed

Rate

Series

2023A,

5.000%,

10/01/46

10/33

at

100.00

1,086,343

500

Indianapolis

Local

Public

Improvement

Bond

Bank,

Indiana,

Revenue

Bonds,

Convention

Center

Hotel

Senior

Series

2023E,

6.000%,

3/01/53

3/33

at

100.00

552,287

250

(c)

Valparaiso,

Indiana,

Exempt

Facilities

Revenue

Bonds,

Pratt

Paper

LLC

Project,

Refunding

Series

2024,

5.000%,

1/01/54,

(AMT)

1/34

at

100.00

258,917

TOTAL

INDIANA

2,599,809

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

IOWA

-

0.5%

$

500

Iowa

Finance

Authority,

Iowa,

Midwestern

Disaster

Area

Revenue

Bonds,

Iowa

Fertilizer

Company

Project,

Refunding

Series

2022,

5.000%,

12/01/50

12/29

at

103.00

$

531,104

TOTAL

IOWA

531,104

LOUISIANA

-

2.0%

1,000

Louisiana

Local

Government

Environmental

Facilities

and

Community

Development

Authority,

Louisiana,

Revenue

Bonds,

Womans

Hospital

Foundation

Project,

Refunding

Series

2017A,

5.000%,

10/01/44

10/27

at

100.00

1,018,246

1,000

Louisiana

Public

Facilities

Authority,

Louisiana,

Revenue

Bonds,

Loyola

University

of

New

Orleans

Project,

Refunding

Series

2023A,

5.250%,

10/01/53

4/33

at

100.00

1,044,065

TOTAL

LOUISIANA

2,062,311

MINNESOTA

-

1.9%

75

Baytown

Township,

Minnesota

Charter

School

Lease

Revenue

Bonds,

Saint

Croix

Preparatory

Academy,

Refunding

Series

2016A,

4.250%,

8/01/46

8/26

at

100.00

67,268

1,000

Duluth

Economic

Development

Authority,

Minnesota,

Health

Care

Facilities

Revenue

Bonds,

Essentia

Health

Obligated

Group,

Series

2018A,

5.000%,

2/15/48

2/28

at

100.00

1,019,216

555

Saint

Paul

Housing

&

Redevelopment

Authority,

Minnesota,

Charter

School

Lease

Revenue

Bonds,

Twin

Cities

German

Immersion

School

Project,

Series

2019,

5.000%,

7/01/49

7/27

at

102.00

524,762

300

Saint

Paul

Park,

Minnesota,

Senior

Housing

and

Health

Care

Revenue

Bonds,

Presbyterian

Homes

Bloomington

Project,

Refunding

Series

2017,

4.250%,

9/01/37

9/24

at

100.00

290,040

TOTAL

MINNESOTA

1,901,286

MISSISSIPPI

-

1.0%

1,000

Mississippi

Hospital

Equipment

and

Facilities

Authority,

Revenue

Bonds,

Baptist

Memorial

Healthcare,

Series

2016A,

5.000%,

9/01/41

9/26

at

100.00

1,011,137

TOTAL

MISSISSIPPI

1,011,137

MISSOURI

-

2.8%

1,000

Missouri

Health

and

Educational

Facilities

Authority,

Educational

Facilities

Revenue

Bonds,

Southwest

Baptist

University

Project,

Series

2012,

5.000%,

10/01/33

9/24

at

100.00

999,256

500

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Lutheran

Senior

Services

Projects,

Series

2016A,

5.000%,

2/01/46

2/26

at

100.00

502,867

500

Missouri

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Lutheran

Senior

Services

Projects,

Series

2024A,

5.250%,

2/01/54

2/34

at

100.00

524,775

100

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Friendship

Village

Saint

Louis

Obligated

Group,

Series

2017,

5.000%,

9/01/48

9/27

at

100.00

96,999

215

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Friendship

Village

Saint

Louis

Obligated

Group,

Series

2018A,

5.250%,

9/01/53

9/25

at

103.00

213,090

335

Saline

County

Industrial

Development

Authority,

Missouri,

First

Mortgage

Revenue

Bonds,

Missouri

Valley

College,

Series

2017,

4.500%,

10/01/40

9/24

at

100.00

299,735

225

(c)

Taney

County

Industrial

Development

Authority,

Missouri,

Sales

Tax

Revenue

Improvement

Bonds,

Big

Cedar

Infrastructure

Project

Series

2023,

6.000%,

10/01/49

10/30

at

100.00

226,553

TOTAL

MISSOURI

2,863,275

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

NEBRASKA

-

0.5%

$

500

Central

Plains

Energy

Project,

Nebraska,

Gas

Project

3

Revenue

Bonds,

Refunding

Crossover

Series

2017A,

5.000%,

9/01/42

No

Opt.

Call

$

549,783

TOTAL

NEBRASKA

549,783

NEVADA

-

0.4%

350

Las

Vegas

Special

Improvement

District

817,

Nevada,

Local

Improvement

Revenue

Bonds,

Summerlin

Village

29

Series

2023,

6.000%,

6/01/48

6/33

at

100.00

367,666

TOTAL

NEVADA

367,666

NEW

JERSEY

-

1.6%

15

(f)

Gloucester

County

Pollution

Control

Financing

Authority,

New

Jersey,

Pollution

Control

Revenue

Bonds,

Logan

Project,

Refunding

Series

2014A,

5.000%,

12/01/24,

(AMT),

(ETM)

No

Opt.

Call

15,088

545

New

Jersey

Transportation

Trust

Fund

Authority,

Transportation

System

Bonds,

Series

2015AA,

5.000%,

6/15/45

6/25

at

100.00

548,789

1,000

Tobacco

Settlement

Financing

Corporation,

New

Jersey,

Tobacco

Settlement

Asset-Backed

Bonds,

Series

2018A,

5.000%,

6/01/46

6/28

at

100.00

1,023,728

TOTAL

NEW

JERSEY

1,587,605

NEW

YORK

-

5.8%

60

Buffalo

and

Erie

County

Industrial

Land

Development

Corporation,

New

York,

Revenue

Bonds,

Catholic

Health

System,

Inc.

Project,

Series

2015,

5.250%,

7/01/35

7/25

at

100.00

59,165

1,500

Dormitory

Authority

of

the

State

of

New

York,

State

Personal

Income

Tax

Revenue

Bonds,

General

Purpose

Series

2022A,

5.000%,

3/15/46

3/32

at

100.00

1,626,206

250

Genesee

County

Funding

Corporation,

New

York,

Revenue

Bonds,

Rochester

Regional

Health

Project,

Series

2022A,

5.250%,

12/01/52

12/32

at

100.00

260,494

315

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Green

Climate

Bond

Certified

Series

2020C-1,

5.250%,

11/15/55

5/30

at

100.00

331,979

500

(c)

New

York

Liberty

Development

Corporation,

New

York,

Liberty

Revenue

Bonds,

3

World

Trade

Center

Project,

Class

1

Series

2014,

5.000%,

11/15/44

11/24

at

100.00

500,501

1,000

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

John

F

Kennedy

International

Airport

New

Terminal

1

Project,

Green

Series

2024,

5.500%,

6/30/54,

(AMT)

6/33

at

100.00

1,067,706

445

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

New

Terminal

1

John

F

Kennedy

International

Airport

Project,

Green

Series

2023,

6.000%,

6/30/54,

(AMT)

6/31

at

100.00

484,643

500

New

York

Transportation

Development

Corporation,

Special

Facility

Revenue

Bonds,

Delta

Air

Lines,

Inc.

-

LaGuardia

Airport

Terminals

C&D

Redevelopment

Project,

Series

2023,

6.000%,

4/01/35,

(AMT)

4/31

at

100.00

564,530

100

Oneida

Indian

Nation,

New

York,

Tax

Revenue

Bonds,

Series

2024B,

6.000%,

9/01/43

9/31

at

102.00

109,890

1,000

TSASC

Inc.,

New

York,

Tobacco

Asset-Backed

Bonds,

Series

2006,

5.000%,

6/01/48

6/27

at

100.00

889,037

TOTAL

NEW

YORK

5,894,151

NORTH

CAROLINA

-

2.7%

685

North

Carolina

Medical

Care

Commission, Retirement

Facilities

First

Mortgage

Revenue

Bonds,

Southminster

Project,

Refunding

Series

2016,

5.000%,

10/01/31

10/24

at

102.00

692,941

2,000

North

Carolina

Turnpike

Authority,

Triangle

Expressway

System

Revenue

Bonds,

Senior

Lien

Series

2019,

5.000%,

1/01/49

1/30

at

100.00

2,077,689

TOTAL

NORTH

CAROLINA

2,770,630

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

NORTH

DAKOTA

-

0.1%

$

100

Grand

Forks,

North

Dakota,

Senior

Housing

&

Nursing

Facilities

Revenue

Bonds,

Valley

Homes

and

Services

Obligated

Group,

Series

2017,

5.000%,

12/01/36

12/26

at

100.00

$

97,214

TOTAL

NORTH

DAKOTA

97,214

OHIO

-

3.3%

1,000

Buckeye

Tobacco

Settlement

Financing

Authority,

Ohio,

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Refunding

Senior

Lien

Series

2020B-2

Class

2,

5.000%,

6/01/55

6/30

at

100.00

927,461

1,000

Cleveland-Cuyahoga

County

Port

Authroity,

Ohio,

Cultural

Facility

Revenue

Bonds,

The

Cleveland

Museum

of

Natural

History

Project,

Series

2021,

4.000%,

7/01/51

7/31

at

100.00

912,270

500

(c)

Columbus-Franklin

County

Finance

Authority,

Ohio,

Revenue

Bonds,

Bridge

Park

G

Block

Project,

Public

Infrastructure

Series

2022,

5.000%,

12/01/45

12/29

at

100.00

505,432

500

(c)

Jefferson

County

Port

Authority,

Ohio,

Economic

Development

Revenue

Bonds,

JSW

Steel

USA

Ohio,

Inc.

Project,

Series

2023,

5.000%,

12/01/53,

(AMT),

(Mandatory

Put

12/01/28)

9/28

at

100.00

509,030

500

(c)

Ohio

Air

Quality

Development

Authority,

Ohio,

Exempt

Facilities

Revenue

Bonds,

AMG

Vanadium

Project,

Series

2019,

5.000%,

7/01/49,

(AMT)

7/29

at

100.00

472,758

TOTAL

OHIO

3,326,951

OKLAHOMA

-

0.7%

670

Oklahoma

Development

Finance

Authority,

Health

System

Revenue

Bonds,

OU

Medicine

Project,

Series

2018B,

5.500%,

8/15/52

8/28

at

100.00

691,085

TOTAL

OKLAHOMA

691,085

OREGON

-

0.1%

55

Clackamas

County

Hospital

Facility

Authority,

Oregon,

Revenue

Bonds,

Rose

Villa

Inc.,

Series

2020A,

5.250%,

11/15/50

11/25

at

102.00

53,244

TOTAL

OREGON

53,244

PENNSYLVANIA

-

3.2%

400

(c)

Allentown

Neighborhood

Improvement

Zone

Development

Authority,

Pennsylvania,

Tax

Revenue

Bonds,

Neuweiler

Lofts

Project,

Series

2023,

6.250%,

5/01/42

5/33

at

100.00

404,121

250

Allentown

Neighborhood

Improvement

Zone

Development

Authority,

Pennsylvania,

Tax

Revenue

Bonds,

Waterfront-30

E

Allen

Street

Project,

Subordinate

Series

2024B,

6.000%,

5/01/42

5/31

at

103.00

264,836

1,000

Berks

County

Municipal

Authority,

Pennsylvania,

Revenue

Bonds,

Reading

Hospital

&

Medical

Center

Project,

Series

2012A,

5.000%,

11/01/40

8/24

at

100.00

640,000

500

Lancaster

County

Hospital

Authority,

Pennsylvania,

Revenue

Bonds,

Penn

State

Health,

Series

2021,

5.000%,

11/01/51

11/29

at

100.00

515,998

495

Lehigh

County,

Pennsylvania,

Revenue

Bonds,

Lehigh

Valley

Dual

Language

Charter

School,

General

Purpose

Authority,

Series

2023,

7.000%,

6/01/53

6/30

at

103.00

540,831

560

(f)

Montgomery

County

Industrial

Development

Authority,

Pennsylvania,

Health

System

Revenue

Bonds,

Albert

Einstein

Healthcare

Network

Issue,

Series

2015A,

5.250%,

1/15/36,

(Pre-refunded

1/15/25)

1/25

at

100.00

565,654

350

Montgomery

County

Redevelopment

Authority,

Pennsylvania,

Special

Obligation

Revenue

Bonds,

River

Pointe

Project

Series

2023,

6.500%,

9/01/43

9/33

at

100.00

360,015

TOTAL

PENNSYLVANIA

3,291,455

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

PUERTO

RICO

-

2.1%

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1

:

$

1,760

0.000%,

7/01/51

7/28

at

30.01

$

428,388

500

4.750%,

7/01/53

7/28

at

100.00

497,954

1,000

5.000%,

7/01/58

7/28

at

100.00

1,005,251

200

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2,

4.329%,

7/01/40

7/28

at

100.00

198,924

TOTAL

PUERTO

RICO

2,130,517

SOUTH

CAROLINA

-

1.1%

620

South

Carolina

Jobs-Economic

Development

Authority,

Economic

Development

Revenue

Bonds,

Bishop

Gadsden

Episcopal

Retirement

Community,

Series

2019A,

4.000%,

4/01/49

4/26

at

103.00

519,492

560

South

Carolina

Jobs-Economic

Development

Authority,

Educational

Facilities

Revenue

Bonds,

Riverwalk

Academy

Project

Series

2023A,

7.000%,

6/15/43

6/33

at

100.00

588,995

TOTAL

SOUTH

CAROLINA

1,108,487

SOUTH

DAKOTA

-

0.1%

100

Sioux

Falls,

South

Dakota,

Health

Facilities

Revenue

Bonds,

Dow

Rummel

Village

Project,

Series

2017,

5.125%,

11/01/47

11/26

at

100.00

92,271

TOTAL

SOUTH

DAKOTA

92,271

TENNESSEE

-

0.3%

250

Metropolitan

Nashville

Airport

Authority,

Tennessee,

Airport

Improvement

Revenue

Bonds,

Series

2022B,

5.500%,

7/01/42,

(AMT)

7/32

at

100.00

275,976

TOTAL

TENNESSEE

275,976

TEXAS

-

6.7%

1,000

Dallas-Fort

Worth

International

Airport,

Texas,

Joint

Revenue

Bonds,

Refunding

Series

2021A,

4.000%,

11/01/46

11/30

at

100.00

972,429

500

(c)

Kyle,

Texas,

Special

Assessment

Revenue

Bonds,

Southwest

Kyle

Public

Improvement

District

1

Improvement

Area

2

Project,

Series

2023,

6.750%,

9/01/48

9/33

at

100.00

530,793

125

(c)

Mission

Economic

Development

Corporation,

Texas,

Revenue

Bonds,

Natgasoline

Project,

Senior

Lien

Series

2018,

4.625%,

10/01/31,

(AMT)

8/24

at

103.00

124,879

1,000

(c)

Mustang

Ridge,

Travis

and

Caldwell

Counties,

Texas,

Special

Assessment

Revenue

Bonds,

Durango

Public

Improvement

District

Improvement

Area

1

Series

2023,

6.375%,

9/01/53

9/31

at

100.00

1,031,896

1,000

New

Hope

Cultural

Education

Facilities

Finance

Corporation,

Texas,

Student

Housing

Revenue

Bonds,

CHF-Collegiate

Housing

Foundation

-

College

Station

I

LLC

-

Texas

A&M

University

Project,

Series

2014A,

5.000%,

4/01/46

-

AGM

Insured

8/24

at

100.00

1,000,057

200

(f)

North

Texas

Tollway

Authority,

Special

Projects

System

Revenue

Bonds,

Convertible

Capital

Appreciation

Series

2011C,

7.000%,

9/01/43,

(Pre-

refunded

9/01/31)

9/31

at

100.00

243,885

535

(c)

Plano,

Collin

and

Denton

Counties,

Texas,

Special

Assessment

Revenue

Bonds,

Haggard

Farm

Public

Improvement

District

Project,

Area

1

Project

Series

2023,

7.500%,

9/15/53

9/33

at

100.00

570,233

240

Reagan

Hospital

District

of

Reagan

County,

Texas,

Limited

Tax

Revenue

Bonds,

Series

2014A,

5.000%,

2/01/34

9/24

at

100.00

238,376

295

SA

Energy

Acquisition

Public

Facilities

Corporation,

Texas,

Gas

Supply

Revenue

Bonds,

Series

2007,

5.500%,

8/01/27

No

Opt.

Call

305,383

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

TEXAS

(continued)

$

1,000

Texas

Private

Activity

Bond

Surface

Transporation

Corporation,

Senior

Lien

Revenue

Bonds,

NTE

Mobility

Partners

Segments

3

LLC

Segments

3C

Project,

Series

2019,

5.000%,

6/30/58,

(AMT)

6/29

at

100.00

$

1,006,663

250

(c)

Travis

County

Development

Authority,

Texas,

Contract

Assessment

Revenue

Bonds,

Bella

Fortuna

Public

Improvement

District,

Series

2024,

5.625%,

9/01/51

9/32

at

100.00

252,530

500

(c)

Vista

Lago,

Travis

County,

Texas,

Special

Assessment

Revenue

Bonds,

Tessera

on

Lake

Travis

Public

Improvement

District

Improvement

Area

#3

Project,

Series

2024,

6.000%,

9/01/54

9/34

at

100.00

510,723

TOTAL

TEXAS

6,787,847

UTAH

-

0.4%

410

Salt

Lake

City,

Utah,

Airport

Revenue

Bonds,

International

Airport

Series

2023A,

5.250%,

7/01/53,

(AMT)

7/33

at

100.00

438,075

TOTAL

UTAH

438,075

VIRGIN

ISLANDS

-

0.4%

380

Matching

Fund

Special

Purpose

Securitization

Corporation,

Virgin

Islands,

Revenue

Bonds,

Series

2022A,

5.000%,

10/01/32

No

Opt.

Call

402,540

TOTAL

VIRGIN

ISLANDS

402,540

VIRGINIA

-

2.2%

100

James

City

County

Economic

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Williamsburg

Landing

Inc.,

Series

2024A,

6.875%,

12/01/58

12/30

at

103.00

110,410

100

Virginia

Beach

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Westminster

Canterbury

on

Chesapeake

Bay,

Series

2023A,

7.000%,

9/01/53

9/30

at

103.00

115,054

1,265

Virginia

Small

Business

Financing

Authority,

Private

Activity

Revenue

Bonds,

Transform

66

P3

Project,

Senior

Lien

Series

2017,

5.000%,

12/31/56,

(AMT)

6/27

at

100.00

1,279,633

750

Virginia

Small

Business

Financing

Authority,

Revenue

Bonds,

95

Express

Lanes

LLC

Project,

Refunding

Senior

Lien

Series

2022,

5.000%,

12/31/47,

(AMT)

12/32

at

100.00

781,542

TOTAL

VIRGINIA

2,286,639

WASHINGTON

-

1.6%

1,000

Grays

Harbor

Public

Hospital

District

1,

Washington,

Revenue

Bonds,

Summit

Pacific

Medial

Center

Series

2023,

6.750%,

12/01/44

12/33

at

100.00

1,105,848

500

Jefferson

County

Public

Hospital

District

2,

Washington,

Hospital

Revenue

Bonds,

Refunding

Series

2023A,

6.875%,

12/01/53

12/30

at

103.00

506,763

TOTAL

WASHINGTON

1,612,611

WEST

VIRGINIA

-

1.2%

225

(c)

Monongalia

County

Commission,

West

Virginia,

Special

District

Excise

Tax

Revenue

Bonds,

University

Town

Centre

Economic

Opportunity

Development

District,

Subordinate

Improvement

Series

2023A,

7.000%,

6/01/43

6/30

at

103.00

241,444

1,000

West

Virginia

Hospital

Finance

Authority,

Revenue

Bonds,

West

Virginia

University

Health

System

Obligated

Group,

Improvement

Series

2017A,

5.000%,

6/01/47

6/27

at

100.00

1,018,183

TOTAL

WEST

VIRGINIA

1,259,627

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

WISCONSIN

-

3.7%

Public

Finance

Authority

of

Wisconsin,

Conference

Center

and

Hotel

Revenue

Bonds,

Lombard

Public

Facilities

Corporation,

Second

Tier

Series

2018B

:

$

4

(c),(d)

0.000%,

1/01/46

No

Opt.

Call

$

106

4

(c),(d)

0.000%,

1/01/47

No

Opt.

Call

97

4

(c),(d)

0.000%,

1/01/48

No

Opt.

Call

91

4

(c),(d)

0.000%,

1/01/49

No

Opt.

Call

85

3

(c),(d)

0.000%,

1/01/50

No

Opt.

Call

78

4

(c),(d)

0.000%,

1/01/51

No

Opt.

Call

81

98

(c),(d)

3.750%,

7/01/51

3/28

at

100.00

70,423

4

(c),(d)

0.000%,

1/01/52

No

Opt.

Call

75

4

(c),(d)

0.000%,

1/01/53

No

Opt.

Call

70

4

(c),(d)

0.000%,

1/01/54

No

Opt.

Call

66

4

(c),(d)

0.000%,

1/01/55

No

Opt.

Call

61

4

(c),(d)

0.000%,

1/01/56

No

Opt.

Call

57

4

(c),(d)

0.000%,

1/01/57

No

Opt.

Call

54

4

(c),(d)

0.000%,

1/01/58

No

Opt.

Call

50

3

(c),(d)

0.000%,

1/01/59

No

Opt.

Call

47

3

(c),(d)

0.000%,

1/01/60

No

Opt.

Call

44

3

(c),(d)

0.000%,

1/01/61

No

Opt.

Call

41

3

(c),(d)

0.000%,

1/01/62

No

Opt.

Call

39

3

(c),(d)

0.000%,

1/01/63

No

Opt.

Call

36

3

(c),(d)

0.000%,

1/01/64

No

Opt.

Call

34

3

(c),(d)

0.000%,

1/01/65

No

Opt.

Call

32

3

(c),(d)

0.000%,

1/01/66

No

Opt.

Call

29

42

(c),(d)

0.000%,

1/01/67

No

Opt.

Call

344

1,000

(c)

Public

Finance

Authority

of

Wisconsin,

Multifamily

Housing

Revenue

Bonds,

Promenade

Apartments

Project,

Series

2024,

6.250%,

2/01/39

2/29

at

103.00

1,038,108

500

(c)

Public

Finance

Authority

of

Wisconsin,

Revenue

Bonds,

Revolution

Academy,

Refunding

Series

2023A,

6.250%,

10/01/53

10/31

at

100.00

525,844

535

(c)

Public

Finance

Authority

of

Wisconsin,

Revenue

Bonds,

Unity

Classical

Charter

School,

A

Challenge

Foundation

Academy,

Series

2023,

6.625%,

7/01/43

7/30

at

100.00

560,073

250

(c)

Public

Finance

Authority,

Wisconsin,

Tax

Increment,

Revenue

Senior

Bonds,

Miami,

Miami

World

Center

Project,

Series

2024A,

5.000%,

6/01/41

6/29

at

103.00

253,646

200

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

Dickson

Hollow

Project.

Series

2014,

5.125%,

10/01/34

9/24

at

101.00

200,057

200

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

Oakwood

Lutheran

Senior

Ministries,

Series

2021,

4.000%,

1/01/57

1/27

at

103.00

146,272

1,000

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

PHW

Oconomowoc,

Inc.

Project,

Series

2018,

5.125%,

10/01/48

9/24

at

102.00

916,406

TOTAL

WISCONSIN

3,712,446

TOTAL

MUNICIPAL

BONDS

(cost

$98,045,629)

100,766,883

TOTAL

LONG-TERM

INVESTMENTS

(cost

$98,045,629)

100,766,883

OTHER

ASSETS

&

LIABILITIES,

NET

- 0.9%

932,773

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

101,699,656

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2024

(Unaudited)

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

100,761,953

$

4,930

$

100,766,883

Total

$

–

$

100,761,953

$

4,930

$

100,766,883

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(c)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$23,862,173

or

23.7%

of

Total

Investments.

(d)

Defaulted

security.

A

security

whose

issuer

has

failed

to

fully

pay

principal

and/or

interest

when

due,

or

is

under

the

protection

of

bankruptcy.

(e)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(f)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

AMT

Alternative

Minimum

Tax

ETM

Escrowed

to

maturity

WI/DD

When-issued

or

delayed

delivery

security.

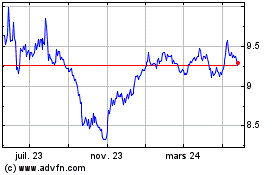

Nuveen Muni Income (NYSE:NMI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

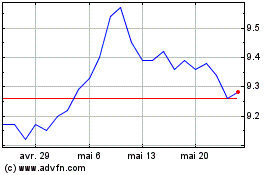

Nuveen Muni Income (NYSE:NMI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024