Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Décembre 2024 - 7:16PM

Edgar (US Regulatory)

Portfolio

of

Investments

October

31,

2024

NPFD

(Unaudited)

PRINCIPAL

/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

LONG-TERM

INVESTMENTS

-

157.0%

(99.6%

of

Total

Investments)

532293474

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

108.2%

(68.7%

of

Total

Investments)

532293474

AUTOMOBILES

&

COMPONENTS

-

3.7%

(2.3%

of

Total

Investments)

$

10,476,000

(a)

General

Motors

Financial

Co

Inc

5.750

%

N/A

$

10,150,893

8,195,000

(a)

General

Motors

Financial

Co

Inc

5.700

N/A

7,908,980

TOTAL

AUTOMOBILES

&

COMPONENTS

18,059,873

BANKS

-

38.3%

(24.3%

of

Total

Investments)

5,000,000

(a)

Bank

of

America

Corp

5.875

N/A

5,046,185

1,775,000

(a)

Bank

of

America

Corp

6.300

N/A

1,798,982

2,219,000

(a)

Bank

of

America

Corp

6.100

N/A

2,216,114

1,470,000

Bank

of

Montreal

7.700

05/26/84

1,537,388

1,206,000

Bank

of

Montreal

7.300

11/26/84

1,255,289

3,090,000

(b)

Bank

of

Nova

Scotia/The

8.000

01/27/84

3,264,604

3,014,000

(a)

Citigroup

Inc

7.000

N/A

3,189,774

3,375,000

(a)

Citigroup

Inc

5.950

N/A

3,362,871

2,875,000

(a)

Citigroup

Inc

6.250

N/A

2,909,474

5,351,000

(a)

Citigroup

Inc

7.125

N/A

5,497,553

1,650,000

(a)

Citigroup

Inc

7.375

N/A

1,725,301

13,100,000

(a)

Citigroup

Inc

7.625

N/A

13,938,617

2,500,000

(a),(c)

Citizens

Financial

Group

Inc

(TSFR3M

+

3.419%)

8.008

N/A

2,484,698

3,680,000

(a)

Citizens

Financial

Group

Inc

4.000

N/A

3,488,100

6,050,000

(a)

CoBank

ACB

6.450

N/A

6,076,723

50,000

(a),(d)

Farm

Credit

Bank

of

Texas

5.700

N/A

49,498

50,000

(a),(d)

Farm

Credit

Bank

of

Texas

6.200

N/A

49,250

2,224,000

(a),(c)

Fifth

Third

Bancorp

(TSFR3M

+

3.295%)

7.898

N/A

2,215,002

3,271,000

(a)

Fifth

Third

Bancorp

4.500

N/A

3,221,992

7,070,000

(a),(c)

First

Citizens

BancShares

Inc

/NC

(TSFR3M

+

4.234%)

9.180

N/A

7,211,294

8,400,000

(a)

Huntington

Bancshares

Inc

/OH

5.625

N/A

8,365,615

17,767,000

(a)

JPMorgan

Chase

&

Co

6.875

N/A

18,774,051

1,755,000

(a)

KeyCorp

5

.000

N/A

1,686,962

8,000,000

(a)

M&T

Bank

Corp

5.125

N/A

7,878,307

3,534,000

(a)

PNC

Financial

Services

Group

Inc

/The

5.000

N/A

3,490,582

5,735,000

(a)

PNC

Financial

Services

Group

Inc

/The

6.250

N/A

5,741,286

3,990,000

(a)

PNC

Financial

Services

Group

Inc

/The

6.200

N/A

4,023,344

3,057,000

(a),(c)

PNC

Financial

Services

Group

Inc

/The

(TSFR3M

+

3.302%)

8.317

N/A

3,064,432

2,445,000

(a)

PNC

Financial

Services

Group

Inc

/The

6.000

N/A

2,447,672

2,470,000

(a)

Regions

Financial

Corp

5.750

N/A

2,462,164

3,495,000

Toronto-Dominion

Bank/The

8.125

10/31/82

3,682,524

8,195,000

(a)

Truist

Financial

Corp

5.100

N/A

7,954,404

8,209,000

(a)

Truist

Financial

Corp

6.669

N/A

8,165,167

7,970,000

(a),(c)

Truist

Financial

Corp

(TSFR3M

+

3.364%)

8.310

N/A

7,974,368

5,000,000

(a)

US

Bancorp

5.300

N/A

4,937,104

12,345,000

(a)

Wells

Fargo

&

Co

7.625

N/A

13,268,332

7,874,000

(a)

Wells

Fargo

&

Co

6.850

N/A

8,118,196

4,608,000

(a)

Wells

Fargo

&

Co

3.900

N/A

4,462,768

1,200,000

(a),(c)

Zions

Bancorp

NA

(3-Month

LIBOR

+

4.440%)

9.648

N/A

1,187,573

TOTAL

BANKS

188,223,560

CAPITAL

GOODS

-

3.2%

(2.0%

of

Total

Investments)

3,200,000

(d)

AerCap

Global

Aviation

Trust

6.500

06/15/45

3,196,686

2,101,000

(a)

Air

Lease

Corp

6.000

N/A

2,069,402

4,841,000

(a)

Air

Lease

Corp

4.650

N/A

4,694,935

2,897,000

(a)

Air

Lease

Corp

4.125

N/A

2,720,559

3,673,000

(d)

ILFC

E-Capital

Trust

I

6.565

12/21/65

2,934,853

TOTAL

CAPITAL

GOODS

15,616,435

ENERGY

-

10.1%

(6.4%

of

Total

Investments)

2,350,000

Enbridge

Inc

6.000

01/15/77

2,325,719

6,360,000

Enbridge

Inc

7.625

01/15/83

6,741,314

8,546,000

(b)

Enbridge

Inc

5.500

07/15/77

8,290,044

6,956,000

Enbridge

Inc

8.500

01/15/84

7,728,401

4,279,000

(a)

Energy

Transfer

LP

7.125

N/A

4,349,646

Portfolio

of

Investments

October

31,

2024

(continued)

NPFD

PRINCIPAL/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

ENERGY

(continued)

$

5,345,000

(a)

Energy

Transfer

LP

6.500

%

N/A

$

5,328,149

761,000

(a)

Energy

Transfer

LP

6.625

N/A

744,927

1,570,000

Energy

Transfer

LP

8.000

05/15/54

1,663,564

3,554,000

(d)

South

Bow

Canadian

Infrastructure

Holdings

Ltd

7.500

03/01/55

3,690,964

1,460,000

Transcanada

Trust

5.500

09/15/79

1,402,517

2,155,000

Transcanada

Trust

5.600

03/07/82

2,057,082

4,000,000

Transcanada

Trust

5.625

05/20/75

3,957,543

1,500,000

Transcanada

Trust

5.875

08/15/76

1,494,609

TOTAL

ENERGY

49,774,479

FINANCIAL

SERVICES

-

19.4%

(12.3%

of

Total

Investments)

3,350,000

AerCap

Ireland

Capital

DAC

/

AerCap

Global

Aviation

Trust

6.950

03/10/55

3,453,186

4,200,000

(a)

Ally

Financial

Inc

4.700

N/A

3,407,628

2,320,000

(a)

Ally

Financial

Inc

4.700

N/A

2,087,109

3,785,000

(a)

American

Express

Co

3.550

N/A

3,582,681

2,405,000

(a)

Bank

of

New

York

Mellon

Corp/The

4.700

N/A

2,384,750

3,250,000

(a),(d)

Capital

Farm

Credit

ACA

5.000

N/A

3,136,254

3,845,000

(a)

Capital

One

Financial

Corp

3.950

N/A

3,618,388

10,128,000

(a)

Charles

Schwab

Corp/The

5.375

N/A

10,075,663

5,000,000

(a)

Charles

Schwab

Corp/The

4.000

N/A

4,798,487

350,000

(a),(d)

Compeer

Financial

ACA

4.875

N/A

336,000

1,745,000

(a)

Discover

Financial

Services

6

.125

N/A

1,740,197

3,690,000

(a)

Discover

Financial

Services

5.500

N/A

3,521,315

6,310,000

(a)

Equitable

Holdings

Inc

4.950

N/A

6,240,890

5,249,000

(a)

Goldman

Sachs

Group

Inc

/The

6.125

N/A

5,206,250

5,890,000

(a)

Goldman

Sachs

Group

Inc

/The

5.300

N/A

5,865,911

9,875,000

(a)

Goldman

Sachs

Group

Inc

/The

7.379

N/A

9,914,253

5,140,000

(a)

Goldman

Sachs

Group

Inc

/The

7.500

N/A

5,495,354

6,071,000

(a)

Goldman

Sachs

Group

Inc

/The

7.500

N/A

6,365,738

5,700,000

(a)

Goldman

Sachs

Group

Inc

/The

4.125

N/A

5,458,067

4,250,000

(a)

State

Street

Corp

6.700

N/A

4,375,434

4,352,000

(a)

Voya

Financial

Inc

7.758

N/A

4,591,926

TOTAL

FINANCIAL

SERVICES

95,655,481

INSURANCE

-

18.1%

(11.5%

of

Total

Investments)

2,595,000

Aegon

Ltd

5.500

04/11/48

2,566,724

2,250,000

(b)

American

International

Group

Inc

5.750

04/01/48

2,244,682

8,045,000

(b)

Assurant

Inc

7.000

03/27/48

8,180,959

3,000,000

(d)

Assured

Guaranty

Municipal

Holdings

Inc

6.400

12/15/66

2,741,945

3,050,000

(b)

AXIS

Specialty

Finance

LLC

4.900

01/15/40

2,899,180

3,982,000

Corebridge

Financial

Inc

6.375

09/15/54

3,964,732

1,000,000

Enstar

Finance

LLC

5.750

09/01/40

982,965

6,115,000

Enstar

Finance

LLC

5.500

01/15/42

5,732,793

10,345,000

(a)

Markel

Group

Inc

6.000

N/A

10,328,118

2,000,000

MetLife

Inc

10.750

08/01/39

2,775,812

6,495,000

(a)

MetLife

Inc

5.875

N/A

6,532,794

3,395,000

Prudential

Financial

Inc

5.125

03/01/52

3,280,803

3,248,000

(b)

Prudential

Financial

Inc

6.750

03/01/53

3,450,441

6,688,000

Prudential

Financial

Inc

6.500

03/15/54

6,976,233

3,600,000

(a),(d)

QBE

Insurance

Group

Ltd

5.875

N/A

3,586,949

7,735,000

QBE

Insurance

Group

Ltd,

Reg

S

6.750

12/02/44

7,746,324

13,500,000

(a),(d)

SBL

Holdings

Inc

7.000

N/A

12,212,274

3,415,000

(a),(d)

SBL

Holdings

Inc

6.500

N/A

2,935,432

TOTAL

INSURANCE

89,139,160

MEDIA

&

ENTERTAINMENT

-

0.9%

(0.6%

of

Total

Investments)

2,566,000

(a),(d)

Farm

Credit

Bank

of

Texas

7.750

N/A

2,686,448

2,375,000

Paramount

Global

6.375

03/30/62

2,198,793

TOTAL

MEDIA

&

ENTERTAINMENT

4,885,241

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.6%

(0.4%

of

Total

Investments)

2,713,000

(d)

EUSHI

Finance

Inc

7.625

12/15/54

2,809,168

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

2,809,168

PRINCIPAL/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

TELECOMMUNICATION

SERVICES

-

2.1%

(1.4%

of

Total

Investments)

$

10,000,000

Vodafone

Group

PLC

7.000

%

04/04/79

$

10,474,120

TOTAL

TELECOMMUNICATION

SERVICES

10,474,120

UTILITIES

-

11.8%

(7.5%

of

Total

Investments)

1,300,000

(d)

AES

Andes

SA

8.150

06/10/55

1,327,737

1,700,000

(d)

AES

Andes

SA

6.350

10/07/79

1,689,288

1,635,000

AES

Corp/The

7.600

01/15/55

1,694,451

1,302,000

(d)

AltaGas

Ltd

7.200

10/15/54

1,305,239

2,600,000

American

Electric

Power

Co

Inc

3.875

02/15/62

2,452,793

2,500,000

CMS

Energy

Corp

4.750

06/01/50

2,404,586

3,593,000

Dominion

Energy

Inc

7.000

06/01/54

3,822,955

1,539,000

Duke

Energy

Corp

6.450

09/01/54

1,564,197

1,445,000

(a)

Edison

International

5.375

N/A

1,430,612

3,910,000

(a)

Edison

International

5.000

N/A

3,805,575

12,143,000

(b)

Emera

Inc

6.750

06/15/76

12,157,972

4,322,000

(b)

Entergy

Corp

7.125

12/01/54

4,418,722

3,174,000

(b)

NextEra

Energy

Capital

Holdings

Inc

6.750

06/15/54

3,323,603

982,000

PG&E

Corp

7.375

03/15/55

1,014,326

3,400,000

Sempra

4.125

04/01/52

3,224,944

3,210,000

(a)

Sempra

4.875

N/A

3,183,016

2,000,000

Southern

Co/The

4.000

01/15/51

1,957,830

1,560,000

(a),(d)

Vistra

Corp

8.000

N/A

1,602,368

2,850,000

(a),(d)

Vistra

Corp

8.875

N/A

3,042,033

2,215,000

(a),(d)

Vistra

Corp

7.000

N/A

2,233,710

TOTAL

UTILITIES

57,655,957

TOTAL

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

(Cost

$548,498,315)

532,293,474

SHARES

DESCRIPTION

RATE

VALUE

79014910

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

16.1%

(10.2%

of

Total

Investments)

79014910

BANKS

-

3.7%

(2.4%

of

Total

Investments)

21,500

CoBank

ACB

6.200

2,133,873

121,601

Fifth

Third

Bancorp

9.296

3,122,714

62,700

KeyCorp

6.125

1,595,715

297,600

KeyCorp

6.200

7,425,120

163,723

Regions

Financial

Corp

5.700

4,115,996

TOTAL

BANKS

18,393,418

CAPITAL

GOODS

-

0.4%

(0.2%

of

Total

Investments)

72,300

WESCO

International

Inc

10.625

1,879,800

TOTAL

CAPITAL

GOODS

1,879,800

FINANCIAL

SERVICES

-

1.9%

(1.2%

of

Total

Investments)

143,950

Morgan

Stanley

6.625

3,800,280

211,000

Voya

Financial

Inc

5.350

5,399,490

TOTAL

FINANCIAL

SERVICES

9,199,770

FOOD,

BEVERAGE

&

TOBACCO

-

2.1%

(1.3%

of

Total

Investments)

253,375

CHS

Inc

7.100

6,557,345

132,200

CHS

Inc

6.750

3,349,948

4,400

(d)

Dairy

Farmers

of

America

Inc

7.875

417,381

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

10,324,674

INSURANCE

-

8.0%

(5.1%

of

Total

Investments)

290,550

American

National

Group

Inc

5.950

7,298,616

160,150

American

National

Group

Inc

6.625

4,066,209

340,200

Aspen

Insurance

Holdings

Ltd

8.915

9,011,898

194,775

Athene

Holding

Ltd

6.350

4,883,009

157,150

Athene

Holding

Ltd

6.375

3,950,751

131,900

Enstar

Group

Ltd

7.000

2,821,341

188,600

Reinsurance

Group

of

America

Inc

5.750

4,699,912

Portfolio

of

Investments

October

31,

2024

(continued)

NPFD

SHARES

DESCRIPTION

RATE

VALUE

INSURANCE

(continued)

93,300

Reinsurance

Group

of

America

Inc

7.125

%

$

2,485,512

TOTAL

INSURANCE

39,217,248

TOTAL

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

(Cost

$85,521,286)

79,014,910

PRINCIPAL

DESCRIPTION

(e)

RATE

MATURITY

VALUE

154652312

CONTINGENT

CAPITAL

SECURITIES

-

31.5%

(19.9%

of

Total

Investments)

154652312

BANKS

-

25.5%

(16.2%

of

Total

Investments)

$

1,000,000

(a),(d)

Australia

&

New

Zealand

Banking

Group

Ltd/United

Kingdom

6.750

N/A

1,013,309

1,980,000

(a)

Banco

Bilbao

Vizcaya

Argentaria

SA

6.500

N/A

1,980,428

2,495,000

(a)

Banco

Bilbao

Vizcaya

Argentaria

SA

6.125

N/A

2,408,003

3,075,000

(a)

Banco

Bilbao

Vizcaya

Argentaria

SA

9.375

N/A

3,329,512

715,000

(a),(d)

Banco

Mercantil

del

Norte

SA/Grand

Cayman

7.500

N/A

703,204

1,595,000

(a),(d)

Banco

Mercantil

del

Norte

SA/Grand

Cayman

7.625

N/A

1,582,630

5,200,000

(a)

Banco

Santander

SA

9.625

N/A

5,988,622

1,800,000

(a)

Banco

Santander

SA

4.750

N/A

1,705,340

4,200,000

(a)

Banco

Santander

SA

8.000

N/A

4,375,518

5,490,000

(a)

Barclays

PLC

8.000

N/A

5,674,508

1,960,000

(a)

Barclays

PLC

6.125

N/A

1,949,276

3,083,000

(a)

Barclays

PLC

9.625

N/A

3,392,468

1,513,000

(a),(d)

BNP

Paribas

SA

7.000

N/A

1,506,237

2,150,000

(a),(d)

BNP

Paribas

SA

9.250

N/A

2,318,803

2,430,000

(a),(d)

BNP

Paribas

SA

8.500

N/A

2,537,220

3,770,000

(a),(d)

BNP

Paribas

SA

8.000

N/A

3,920,408

1,997,000

(a),(d)

BNP

Paribas

SA

7.375

N/A

2,015,009

4,801,000

(a),(d)

BNP

Paribas

SA

7.750

N/A

4,972,084

4,941,000

(a),(d)

Credit

Agricole

SA

6.700

N/A

4,802,560

5,240,000

(a),(d)

Credit

Agricole

SA

8.125

N/A

5,375,454

7,560,000

(a)

HSBC

Holdings

PLC

8.000

N/A

7,932,390

4,539,000

(a)

HSBC

Holdings

PLC

6.950

N/A

4,520,000

3,763,000

(a)

HSBC

Holdings

PLC

6.875

N/A

3,778,948

975,000

(a)

HSBC

Holdings

PLC

6.500

N/A

971,211

4,553,000

(a)

HSBC

Holdings

PLC

6.375

N/A

4,553,291

335,000

(a)

ING

Groep

NV

5.750

N/A

331,206

6,795,000

(a)

ING

Groep

NV,

Reg

S

7.500

N/A

6,957,400

4,413,000

(a),(d)

Intesa

Sanpaolo

SpA

7.700

N/A

4,406,809

6,996,000

(a)

Lloyds

Banking

Group

PLC

8.000

N/A

7,290,944

784,000

(a)

Lloyds

Banking

Group

PLC

6.750

N/A

751,792

1,500,000

(a),(d)

Macquarie

Bank

Ltd/London

6.125

N/A

1,508,983

4,400,000

(a)

NatWest

Group

PLC

8.125

N/A

4,714,882

2,625,000

(a)

NatWest

Group

PLC

8.000

N/A

2,658,193

1,589,000

(a),(d)

Nordea

Bank

Abp

6.300

N/A

1,519,253

1,559,000

(a),(d)

Nordea

Bank

Abp

6.625

N/A

1,566,811

3,631,000

(a),(d)

Societe

Generale

SA

10.000

N/A

3,868,954

1,487,000

(a),(d)

Societe

Generale

SA

8.000

N/A

1,506,789

1,680,000

(a),(d)

Societe

Generale

SA

9.375

N/A

1,757,045

770,000

(a),(d)

Societe

Generale

SA

8.500

N/A

770,116

1,700,000

(a),(d)

Standard

Chartered

PLC

7.750

N/A

1,748,503

755,000

(a),(d)

Standard

Chartered

PLC

6.000

N/A

753,525

TOTAL

BANKS

125,417,638

FINANCIAL

SERVICES

-

5.4%

(3.3%

of

Total

Investments)

1,800,000

(a)

Deutsche

Bank

AG

7.500

N/A

1,797,609

4,290,000

(a)

Deutsche

Bank

AG

6.000

N/A

4,193,596

1,800,000

(a)

Deutsche

Bank

AG,

Reg

S

4.789

N/A

1,754,415

3,853,000

(a),(d)

UBS

Group

AG

9.250

N/A

4,460,976

2,465,000

(a),(d)

UBS

Group

AG

7.750

N/A

2,584,254

4,325,000

(a),(d)

UBS

Group

AG

9.250

N/A

4,712,905

6,872,000

(a)

UBS

Group

AG,

Reg

S

6.875

N/A

6,883,957

TOTAL

FINANCIAL

SERVICES

26,387,712

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

PRINCIPAL

DESCRIPTION

(e)

RATE

MATURITY

VALUE

INSURANCE

-

0.6%

(0.4%

of

Total

Investments)

$

2,755,000

(a)

Phoenix

Group

Holdings

PLC,

Reg

S

8.500

%

N/A

$

2,846,962

TOTAL

INSURANCE

2,846,962

TOTAL

CONTINGENT

CAPITAL

SECURITIES

(Cost

$154,764,757)

154,652,312

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

3906251

CORPORATE

BONDS

-

0.8%

(0.5%

of

Total

Investments)

3906251

ENERGY

-

0.3%

(0.2%

of

Total

Investments)

1,600,000

TransCanada

PipeLines

Ltd

2.490

05/15/67

1,481,168

TOTAL

ENERGY

1,481,168

FINANCIAL

SERVICES

-

0.5%

(0.3%

of

Total

Investments)

9,004,000

(f)

Credit

Suisse

Group

AG

0.000

01/17/72

1,057,970

2,460,000

(f)

Credit

Suisse

Group

AG

7.500

06/11/72

289,050

5,850,000

(f)

Credit

Suisse

Group

AG

6.380

02/21/72

687,375

3,325,000

(f)

Credit

Suisse

Group

AG

7.500

01/17/72

390,688

TOTAL

FINANCIAL

SERVICES

2,425,083

TOTAL

CORPORATE

BONDS

(Cost

$23,094,093)

3,906,251

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

2,142,878

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

-

0.4%

(0.3%

of

Total

Investments)

2,142,878

2,062,000

CoBank

ACB

7.250

07/01/73

2,142,878

TOTAL

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

(Cost

$2,062,000)

2,142,878

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$813,940,451)

772,009,825

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

0.6% (0.4%

of

Total

Investments)

2,950,000

REPURCHASE

AGREEMENTS

-

0.6%

(0.4%

of

Total

Investments)

2,950,000

2,950,000

(g)

Fixed

Income

Clearing

Corporation

4.800

11/01/24

2,950,000

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$2,950,000)

2,950,000

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$2,950,000)

2,950,000

TOTAL

INVESTMENTS

-

157.6%

(Cost

$

816,890,451

)

774,959,825

BORROWINGS

-

(35.4)%

(h),(

i

)

(174,314,000)

REVERSE

REPURCHASE

AGREEMENTS,

INCLUDING

ACCRUED

INTEREST

-

(5.6)%(j)

(27,686,173)

TFP

SHARES,

NET

-

(17.2)%(k)

(84,510,930)

OTHER

ASSETS

&

LIABILITIES,

NET

- 0.6%

3,371,883

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

491,820,605

Portfolio

of

Investments

October

31,

2024

(continued)

NPFD

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

$1,000

Par

(or

similar)

Institutional

Preferred

$

–

$

532,293,474

$

–

$

532,293,474

$25

Par

(or

similar)

Retail

Preferred

79,014,910

–

–

79,014,910

Contingent

Capital

Securities

–

154,652,312

–

154,652,312

Corporate

Bonds

–

1,481,168

2,425,083

3,906,251

U.S.

Government

and

Agency

Obligations

–

2,142,878

–

2,142,878

Short-Term

Investments:

Repurchase

Agreements

–

2,950,000

–

2,950,000

Total

$

79,014,910

$

693,519,832

$

2,425,083

$

774,959,825

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Perpetual

security.

Maturity

date

is

not

applicable.

(b)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$38,404,420

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(c)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(d)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$113,895,318

or

14.7%

of

Total

Investments.

(e)

Contingent

Capital

Securities

(“

CoCos

”)

are

hybrid

securities

with

loss

absorption

characteristics

built

into

the

terms

of

the

security

for

the

benefit

of

the

issuer.

For

example,

the

terms

may

specify

an

automatic

write-down

of

principal

or

a

mandatory

conversion

into

the

issuer’s

common

stock

under

certain

adverse

circumstances,

such

as

the

issuer’s

capital

ratio

falling

below

a

specified

level.

(f)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(g)

Agreement

with

Fixed

Income

Clearing

Corporation,

4.800%

dated

10/31/24

to

be

repurchased

at

$2,950,393

on

11/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

2.375%

and

maturity

date

11/15/49,

valued

at

$3,009,036.

(h)

Borrowings

as

a

percentage

of

Total

Investments

is

22.5%.

(

i

)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$306,051,006

have

been

pledged

as

collateral

for

borrowings.

(j)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

3.6%.

(k)

TFP

Shares,

Net

as

a

percentage

of

Total

Investments

is

10.9%.

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

TSFR

3M

CME

Term

Secured

Overnight

Financing

Rate

3

Month

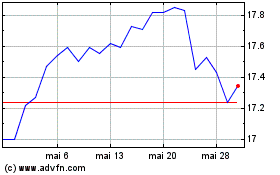

Nuveen Variable Rate Pre... (NYSE:NPFD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Nuveen Variable Rate Pre... (NYSE:NPFD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025