ProAssurance Corporation (NYSE: PRA) reports net income of $6.4

million, or $0.12 per diluted share, and an operating loss(1) of

$2.5 million, or $0.05 per diluted share, for the three months

ended December 31, 2023.

Fourth Quarter 2023(2)

- Gross premiums written: $209 million (-7%)

- New business written: $24 million (+103%)

- Favorable prior accident year reserve development of $3 million

driven primarily by our Segregated Portfolio Cell Reinsurance

segment

- Consolidated combined ratio of 112.0%

- Consolidated operating ratio of 98.4%

- Net investment income of $34 million (+17%)

- Book value per share of $21.82 as of December 31, 2023 improved

7%, driven by $88 million of after-tax unrealized holding gains

from our fixed maturity portfolio (which directly impacts equity

through AOCI)

(1)

Represents a Non-GAAP financial measure.

See a reconciliation to its GAAP counterpart under the heading

“Non-GAAP Financial Measures” that follows.

(2)

Comparisons are to the fourth quarter of

2022.

Management Commentary & Results of Operations

“We continue to manage our business with a focus on returning to

underwriting profitability. We are drawing on our decades of

successful underwriting, effective claims management and superior

service delivery to counter the twin effects of challenging market

conditions and worsening litigation trends. We continue to add new

business which we believe will perform better overall than business

that we are non-renewing. At the same time, we continue to walk

away from business that fails to meet our pricing goals or

underwriting standards and retain existing insureds at renewal

pricing that we believe reflects the current market realities,”

said Ned Rand, President and Chief Executive Officer of

ProAssurance. He added, “Our experience in medical professional

liability and workers’ compensation, the two highly cyclical lines

of insurance in which we operate, has shown that our operating

discipline and the long-term strategic improvements we’ve been

implementing will ultimately ensure our success.”

Our consolidated combined ratio increased 7.8 points

quarter-over-quarter primarily due to the increase in the current

accident year net loss ratio in our Workers Compensation Insurance

segment, reflecting the continuation of significant increases in

average claim costs in that segment. At the same time, the 17%

improvement in our net investment income resulted in a higher

investment income ratio.

While our actions in the current competitive landscape resulted

in lower gross premiums written, new business we believe to be

appropriately priced increased in all of our operating segments.

This underscores the value our insureds and distribution partners

place on our ability to deliver superior insurance protection

coupled with effective service strategies. We continue to be

encouraged by our ability to retain significant business despite

those higher renewal premiums. In summary, across our operating

segments, our reunderwriting, successful pursuit of rate adequacy,

and focus on risk selection better positions us for future

profitability.

Book value per share at quarter end was $21.82, up 7% from the

December 31, 2022 book value of $20.46 driven by after-tax

unrealized holding gains of $88 million on our fixed maturity

portfolio. Adjusted book value per share, which excludes our

Accumulated Other Comprehensive Loss, is $25.83 as of December 31,

2023 as compared to $25.99 as of December 31, 2022. Share

repurchases year-to-date have contributed a $0.59 per share

increase to adjusted book value per share.

CONSOLIDATED INCOME STATEMENT

HIGHLIGHTS

Selected consolidated financial data for

each period is summarized in the table below.

Three Months Ended December

31

Year Ended December 31

($ in thousands, except per share

data)

2023

2022

Change

2023

2022

Change

Revenues

Gross premiums written(1)

$

208,795

$

224,481

(7.0

%)

$

1,082,279

$

1,103,993

(2.0

%)

Net premiums written

$

195,016

$

211,082

(7.6

%)

$

985,994

$

1,014,137

(2.8

%)

Net premiums earned

$

247,329

$

258,243

(4.2

%)

$

977,397

$

1,029,581

(5.1

%)

Net investment income

33,705

28,840

16.9

%

128,419

95,972

33.8

%

Equity in earnings (loss) of

unconsolidated subsidiaries

1,341

(1,059

)

226.6

%

6,791

4,888

38.9

%

Net investment gains (losses)(2)

10,672

12,495

(14.6

%)

13,828

(33,157

)

141.7

%

Other income (loss)(1)

3,913

(3,812

)

202.6

%

10,777

9,404

14.6

%

Total revenues(1)

296,960

294,707

0.8

%

1,137,212

1,106,688

2.8

%

Expenses

Net losses and loss adjustment

expenses

195,248

191,596

1.9

%

800,494

776,762

3.1

%

Underwriting, policy acquisition and

operating expenses(1)

81,965

77,550

5.7

%

300,744

307,338

(2.1

%)

SPC U.S. federal income tax expense

(benefit)

278

335

(17.0

%)

1,629

1,759

(7.4

%)

SPC dividend expense (income)

3,064

4,976

(38.4

%)

6,234

6,673

(6.6

%)

Interest expense

6,672

5,499

21.3

%

23,150

20,372

13.6

%

Goodwill impairment

—

—

nm

44,110

—

nm

Total expenses(1)

287,227

279,956

2.6

%

1,176,361

1,112,904

5.7

%

Income (loss) before income taxes

9,733

14,751

(34.0

%)

(39,149

)

(6,216

)

(529.8

%)

Income tax expense (benefit)

3,356

809

314.8

%

(545

)

(5,814

)

90.6

%

Net income (loss)

$

6,377

$

13,942

(54.3

%)

$

(38,604

)

$

(402

)

(9,503.0

%)

Non-GAAP operating income (loss)

$

(2,548

)

$

7,617

(133.5

%)

$

(7,331

)

$

22,911

(132.0

%)

Weighted average number of common

shares outstanding

Basic

50,969

53,963

52,642

54,008

Diluted

51,153

54,108

52,788

54,140

Earnings (loss) per share

Net income (loss) per diluted share

$

0.12

$

0.26

$

(0.14

)

$

(0.73

)

$

(0.01

)

$

(0.72

)

Non-GAAP operating income (loss) per

diluted share

$

(0.05

)

$

0.14

$

(0.19

)

$

(0.14

)

$

0.42

$

(0.56

)

(1)

Consolidated totals include inter-segment

eliminations. The eliminations affect individual line items only

and have no effect on net income (loss). See Note 16 of the Notes

to Consolidated Financial Statements in our December 31, 2023

report on Form 10-K for amounts by line item.

(2)

This line item typically includes both

realized and unrealized investment gains and losses, investment

impairments losses, and the change in the fair value of the

contingent consideration in relation to the NORCAL acquisition.

Detailed information regarding the components of net investment

gains (losses) are included in Note 3 of the Notes to Consolidated

Financial Statements in our December 31, 2023 report on Form

10-K.

The abbreviation “nm” indicates that the information or the

percentage change is not meaningful.

BALANCE SHEET HIGHLIGHTS

($ in thousands, except per share

data)

December

31, 2023

December

31, 2022

Total investments

$

4,349,781

$

4,387,683

Total assets

$

5,631,925

$

5,699,999

Total liabilities

$

4,519,945

$

4,595,981

Common shares (par value $0.01)

$

636

$

634

Retained earnings

$

1,381,981

$

1,423,286

Treasury shares

$

(469,702

)

$

(419,214

)

Shareholders’ equity

$

1,111,980

$

1,104,018

Book value per share

$

21.82

$

20.46

Non-GAAP adjusted book value per

share(1)

$

25.83

$

25.99

(1)

Adjusted book value per share is a

Non-GAAP financial measure. See a reconciliation of book value per

share to Non-GAAP adjusted book value per share under the heading

“Non-GAAP Financial Measures” that follows.

CONSOLIDATED KEY RATIOS

Three Months Ended December

31

Year Ended December 31

2023

2022

2023

2022

Current accident year net loss ratio

80.0

%

76.2

%

81.3

%

79.0

%

Effect of prior accident years’ reserve

development

(1.1

%)

(2.0

%)

0.6

%

(3.6

%)

Net loss ratio

78.9

%

74.2

%

81.9

%

75.4

%

Underwriting expense ratio

33.1

%

30.0

%

30.8

%

29.9

%

Combined ratio

112.0

%

104.2

%

112.7

%

105.3

%

Operating ratio

98.4

%

93.0

%

99.6

%

96.0

%

Return on equity(1)

2.3

%

2.7

%

(3.5

%)

—

%

Non-GAAP operating return on

equity(1)(2)

(1.0

%)

2.8

%

(0.7

%)

1.8

%

(1)

Quarterly amounts are annualized. Refer to

our December 31, 2023 report on Form 10-K under the heading

“Non-GAAP Operating ROE” in the Executive Summary of Operations

section for details on our calculation.

(2)

See a reconciliation of ROE to Non-GAAP

operating ROE under the heading “Non-GAAP Financial Measures” that

follows.

SEGMENT REORGANIZATION

As a result of our decision to no longer participate in the

results of Syndicate 1729 for the 2024 underwriting year, we

reorganized our segment reporting during the third quarter of 2023

to align with how our Chief Operating Decision Maker currently

oversees the business, allocates resources and evaluates operating

performance and, as a result, the number of our operating and

reportable segments decreased from five to four: Specialty P&C,

Workers' Compensation Insurance, Segregated Portfolio Cell

Reinsurance and Corporate. As a result of the segment

reorganization, we now report the underwriting results from our

participation in Lloyd’s Syndicates in the Specialty P&C

segment and the investment results of assets solely allocated to

our Lloyd's Syndicate operations and U.K. income taxes in our

Corporate segment. All prior period segment information has been

recast to conform to the current period presentation and the

segment reorganization had no impact on previously reported

consolidated financial results.

SPECIALTY P&C SEGMENT

RESULTS

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2023

2022

%

Change

2023

2022

%

Change

Gross premiums written

$

161,770

$

176,644

(8.4

%)

$

835,430

$

856,861

(2.5

%)

Net premiums written

$

154,636

$

168,166

(8.0

%)

$

762,580

$

784,020

(2.7

%)

Net premiums earned

$

193,611

$

199,864

(3.1

%)

$

755,817

$

793,400

(4.7

%)

Other income

1,589

934

70.1

%

4,695

5,122

(8.3

%)

Total revenues

195,200

200,798

(2.8

%)

760,512

798,522

(4.8

%)

Net losses and loss adjustment

expenses

(148,620

)

(156,353

)

(4.9

%)

(624,809

)

(626,045

)

(0.2

%)

Underwriting, policy acquisition and

operating expenses

(54,356

)

(51,466

)

5.6

%

(195,303

)

(199,809

)

(2.3

%)

Total expenses

(202,976

)

(207,819

)

(2.3

%)

(820,112

)

(825,854

)

(0.7

%)

Segment results

$

(7,776

)

$

(7,021

)

(10.8

%)

$

(59,600

)

$

(27,332

)

(118.1

%)

SPECIALTY P&C SEGMENT KEY

RATIOS

Three Months Ended December

31

Year Ended December 31

2023

2022

2023

2022

Current accident year net loss ratio

77.5

%

78.6

%

82.6

%

81.7

%

Effect of prior accident years’ reserve

development

(0.7

%)

(0.4

%)

0.1

%

(2.8

%)

Net loss ratio

76.8

%

78.2

%

82.7

%

78.9

%

Underwriting expense ratio

28.1

%

25.8

%

25.8

%

25.2

%

Combined ratio

104.9

%

104.0

%

108.5

%

104.1

%

The fourth quarter results for the Specialty P&C segment are

relatively stable as compared to the prior year; however, the

competitive market conditions and the continuation of the

challenging loss environment in our HCPL line of business continue

to impact our underwriting results.

Compared to the fourth quarter of last year, gross written

premium declined by $14.9 million or 8.4%, driven by net renewal

timing differences of $7.3 million in our Custom Physicians line

and our pursuit of rate adequacy in a competitive market. Premium

retention in the segment was 83%, down two points from the fourth

quarter of 2022, driven by an 84% retention in our Standard

Physician line of business including the loss of a $2.5 million

policy due to price competition. Despite the decline in written

premium, the results were positively impacted by price increases in

all product lines, and solid new business writings at appropriate

rates for the risk we assumed. We achieved renewal pricing

increases of 6%, level with the prior-year quarter. New business

written improved to $18.1 million for the quarter, compared to $9.9

million last year. Both measures reflect the value proposition

presented by ProAssurance. Net premiums earned declined 3.1% as a

result of the aforementioned market conditions we have experienced

over the preceding twelve months.

Within the segment, written premium in our Standard Physician

line declined $2.7 million reflecting the loss of a $2.6 million

policy due to price competition in the fourth quarter of 2023.

Specialty lines were 21.9% lower driven by a 46.9% decrease in the

Custom Physician line resulting from net timing differences, as

previously discussed. At the same time, we saw a 7.5% increase in

the Hospital and Facilities line reflecting the addition of two

large policies totaling $6.9 million in the fourth quarter of 2023

and our increasing relevance in this growing portion of the

market.

During the current quarter, we decreased our estimate of ULAE

for the full year due to the difference between actual allocable

expenses and earned premium as compared to original estimates

established at the beginning of the year. This adjustment resulted

in a 2.3 point decrease in our current period accident year loss

ratio with an offsetting 2.3 point increase in our current period

expense ratio, with no impact to our combined ratio, total

expenses, or segment results. Excluding the impact of the decrease

in ULAE estimate, the current accident year net loss ratio

increased by 1.2 points primarily attributable to the continued

effects of social inflation and higher than anticipated loss

severity trends throughout the healthcare market.

We recognized net favorable prior accident year reserve

development of $1.4 million in the fourth quarter, compared to $0.8

million in the same period of 2022. The net favorable development

for the quarter was due to the beneficial amortization of the

purchase accounting adjustments on NORCAL's reserves.

During the fourth quarter of 2023, we recognized unfavorable

development in NORCAL’s 2020 and prior accident year reserves which

was entirely offset by favorable development in NORCAL’s 2021 and

2022 accident year reserves. While these adjustments to NORCAL’s

reserves did not impact the segment’s net losses or net loss ratio,

they did result in a decrease in the fair value of the contingent

consideration liability of $2.5 million in the fourth quarter which

favorably impacted the segment expense ratio by 1.3 points.

Excluding the impact of the decrease in ULAE estimate and

contingent consideration, our expense ratio for the quarter

increased 1.3 points primarily due to an increase in

compensation-related costs and higher DPAC amortization.

WORKERS’ COMPENSATION INSURANCE SEGMENT

RESULTS

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2023

2022

%

Change

2023

2022

%

Change

Gross premiums written

$

47,033

$

47,837

(1.7

%)

$

246,857

$

247,132

(0.1

%)

Net premiums written

$

28,005

$

28,964

(3.3

%)

$

162,285

$

160,760

0.9

%

Net premiums earned

$

38,328

$

41,916

(8.6

%)

$

160,034

$

166,371

(3.8

%)

Other income

289

449

(35.6

%)

1,854

2,201

(15.8

%)

Total revenues

38,617

42,365

(8.8

%)

161,888

168,572

(4.0

%)

Net losses and loss adjustment

expenses

(37,508

)

(28,102

)

33.5

%

(139,322

)

(111,407

)

25.1

%

Underwriting, policy acquisition and

operating expenses

(14,139

)

(13,923

)

1.6

%

(55,061

)

(54,737

)

0.6

%

Total expenses

(51,647

)

(42,025

)

22.9

%

(194,383

)

(166,144

)

17.0

%

Segment results

$

(13,030

)

$

340

(3,932.4

%)

$

(32,495

)

$

2,428

(1,438.3

%)

WORKERS’ COMPENSATION INSURANCE SEGMENT

KEY RATIOS

Three Months Ended December

31

Year Ended December 31

2023

2022

2023

2022

Current accident year net loss ratio

97.9

%

71.8

%

81.3

%

71.8

%

Effect of prior accident years’ reserve

development

0.0

%

(4.8

%)

5.8

%

(4.8

%)

Net loss ratio

97.9

%

67.0

%

87.1

%

67.0

%

Underwriting expense ratio

36.9

%

33.2

%

34.4

%

32.9

%

Combined ratio

134.8

%

100.2

%

121.5

%

99.9

%

The Workers’ Compensation Insurance segment underwriting results

for the fourth quarter of 2023 reflect an increase in the current

accident year net loss ratio driven by higher average claim costs,

and lower net premiums earned related to the ongoing impact of

competitive market conditions.

Gross premiums declined in the fourth quarter compared to the

same period of 2022, primarily reflecting lower renewal and audit

premium in our alternative market business ceded to the Segregated

Portfolio Cell Reinsurance segment. In our traditional business,

gross premiums were relatively flat in 2023, compared to 2022. New

and renewal premium were both higher in 2023, compared to 2022,

increasing $1.1 million and $1.4 million respectively, driven by

our continued focus on achieving pricing that reflects the current

market factors. Audit premium, including our estimate of earned but

unbilled audit premium, decreased $2.2 million in 2023 fourth

quarter, compared to 2022. While audit premium for the 2023 full

year was higher than 2022, the level of audit premium is beginning

to normalize. Renewal premium reflected rate decreases and

retention of 2.6% and 84.6%, respectively, in 2023, compared to

6.8% and 73.2%, respectively, for the same period in 2022. The

decrease in net premiums earned in 2023 primarily reflected the

lower audit premium, reinstatement premium of $1.6 million related

to a large reserve increase on a prior year reinsured claim, and

the continuation of competitive market conditions.

The current accident year net loss ratio for the fourth quarter

of 2023 reflected an increase in the full year loss ratio to 81.3%,

from 76.0% as of September 30, 2023. The increase in the loss ratio

reflected the continuation of higher than expected loss trends

driven by medical inflation. Reported claim frequency continues to

trend lower but is being more than offset by an increase in our

average cost per claim, which we attribute to higher medical costs

driven by healthcare wage inflation and medical advancements. We

continue to believe we are observing these trends ahead of the

market because of the early intervention and case management

strategies within our claim process which have proven to result in

returning injured workers to productivity and closing claims much

sooner than the industry average.

There was no change in prior accident year reserve estimates in

the fourth quarter of 2023, compared to $2.0 million of favorable

development for the same period in 2022.

Underwriting expenses were essentially unchanged

quarter-over-quarter. The underwriting expense ratio was 3.7 points

higher than the prior year quarter reflecting the decrease in net

premiums earned.

SEGREGATED PORTFOLIO CELL REINSURANCE

SEGMENT RESULTS

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2023

2022

%

Change

2023

2022

%

Change

Gross premiums written

$

14,335

$

16,055

(10.7

%)

$

70,259

$

78,937

(11.0

%)

Net premiums written

$

12,375

$

13,952

(11.3

%)

$

61,129

$

69,357

(11.9

%)

Net premiums earned

$

15,390

$

16,463

(6.5

%)

$

61,546

$

69,810

(11.8

%)

Net investment income

664

412

61.2

%

2,289

1,029

122.4

%

Net investment gains (losses)

1,850

1,159

59.6

%

3,680

(3,067

)

220.0

%

Other income

2

1

100.0

%

5

2

150.0

%

Net losses and loss adjustment

expenses

(9,120

)

(7,141

)

27.7

%

(36,363

)

(39,310

)

(7.5

%)

Underwriting, policy acquisition and

operating expenses

(5,213

)

(5,114

)

1.9

%

(20,457

)

(20,316

)

0.7

%

SPC U.S. federal income tax (expense)

benefit(1)

(278

)

(335

)

(17.0

%)

(1,629

)

(1,759

)

(7.4

%)

SPC net results

3,295

5,445

(39.5

%)

9,071

6,389

42.0

%

SPC dividend (expense) income (2)

(3,064

)

(4,976

)

(38.4

%)

(6,234

)

(6,673

)

(6.6

%)

Segment results (3)

$

231

$

469

(50.7

%)

$

2,837

$

(284

)

1,098.9

%

(1)

Represents the provision for U.S. federal

income taxes for SPCs at Inova Re, which have elected to be taxed

as a U.S. corporation under Section 953(d) of the Internal Revenue

Code. U.S. federal income taxes are included in the total SPC net

results and are paid by the individual SPCs.

(2)

Represents the net (profit) loss

attributable to external cell participants.

(3)

Represents our share of the net profit

(loss) and OCI of the SPCs in which we participate.

SEGREGATED PORTFOLIO CELL REINSURANCE

SEGMENT KEY RATIOS

Three Months Ended December

31

Year Ended December 31

2023

2022

2023

2022

Current accident year net loss ratio

68.0

%

58.2

%

65.5

%

65.3

%

Effect of prior accident years’ reserve

development

(8.7

%)

(14.8

%)

(6.4

%)

(9.0

%)

Net loss ratio

59.3

%

43.4

%

59.1

%

56.3

%

Underwriting expense ratio

33.9

%

31.1

%

33.2

%

29.1

%

Combined ratio

93.2

%

74.5

%

92.3

%

85.4

%

Premiums in our Segregated Portfolio Cell Reinsurance segment

are primarily comprised of workers' compensation coverages assumed

from our Workers' Compensation Insurance segment and, to a lesser

extent, healthcare professional liability coverages from our

Specialty P&C segment.

Gross premiums written decreased in the fourth quarter compared

to the same period in 2022, primarily reflecting lower workers’

compensation renewal and audit premium. Renewal premium reflected

rate decreases of 5.9% and renewal retention of 90.5% in the

quarter. Audit premium decreased to $0.9 million in 2023, compared

to $1.4 million in 2022. New business was relatively flat in the

quarter.

The increase in the net loss ratio reflects a higher current

accident year net loss ratio in both the workers’ compensation and

healthcare professional liability programs. While the workers’

compensation loss ratio increased during the fourth quarter, the

full year current accident year net loss ratio decreased 1.2

percentage points, reflecting a reduction in claim frequency and

severity. The increase in the healthcare professional liability

current accident year net loss ratio is primarily due to an

increase in expected claim frequency related to one program in

which we do not participate.

We recognized $1.3 million in net favorable prior accident year

reserve development in the quarter related entirely to workers’

compensation business due to favorable trends in claim closing

patterns primarily in accident years 2018 through 2022. Net

favorable prior accident year development was $2.4 million in the

fourth quarter of 2022.

CORPORATE SEGMENT

Three Months Ended December

31

Year Ended December 31

($ in thousands)

2023

2022

%

Change

2023

2022

%

Change

Net investment income

$

33,041

$

28,428

16.2

%

$

126,130

$

94,943

32.8

%

Equity in earnings (loss) of

unconsolidated subsidiaries:

All other investments, primarily

investment fund LPs/LLCs

1,452

(393

)

469.5

%

9,196

11,954

(23.1

%)

Tax credit partnerships

(111

)

(666

)

(83.3

%)

(2,405

)

(7,066

)

(66.0

%)

Total equity in earnings (loss) of

unconsolidated subsidiaries:

1,341

(1,059

)

226.6

%

6,791

4,888

38.9

%

Net investment gains (losses)

8,322

2,336

256.3

%

5,148

(39,090

)

113.2

%

Other income (loss)

2,960

(4,188

)

170.7

%

8,307

6,198

34.0

%

Operating expenses

(9,184

)

(8,055

)

14.0

%

(34,007

)

(34,733

)

(2.1

%)

Interest expense

(6,672

)

(5,499

)

21.3

%

(23,150

)

(20,372

)

13.6

%

Income tax (expense) benefit

(3,356

)

(809

)

314.8

%

545

5,423

90.0

%

Segment results

$

26,452

$

11,154

137.2

%

$

89,764

$

17,257

420.2

%

Consolidated effective tax rate

34.5

%

5.5

%

1.4

%

93.5

%

The high interest rate environment continues to be a benefit to

our net investment income, which increased to $33.0 million in the

quarter, driven by higher average book yields on our fixed maturity

investments as our reinvestment rate exceeds that of the maturing

assets.

Equity in earnings from our investment in LPs/LLCs, which are

typically reported to us on a one-quarter lag, reflected a $1.5

million gain in the quarter as compared to a loss of $0.4 million

in the year-ago quarter driven by the performance of one LP which

reflected higher market valuations during the third quarter of

2023.

The corporate segment results include $8.3 million of net

investment gains for the quarter driven by unrealized holding gains

resulting from changes in the fair value of our equity investments

and convertible securities. These unrealized gains reverse the

trend noted over the year and underscore the variable effect of

measuring these investments at fair value each period which we

believe to be temporary as we have the intent and capability to

hold to these investments to maturity.

Other income was $3.0 million compared to a loss of $4.2 million

in 2022. The increase in other income was driven by proceeds of

$5.4 million associated with the sale of our remaining ownership

interest in the underwriting and operations entity associated with

Syndicate 1729 to an unrelated third party. Further, other income

reflected foreign currency exchange rate movements related to

euro-denominated loss reserves in our Specialty P&C segment.

Foreign exchange movements resulted in a loss of $3.6 million and

$5.0 million in the fourth quarters of 2023 and 2022,

respectively.

Operating expenses increased by $1.1 million primarily due to an

increase in compensation-related costs driven by an increase in

headcount as we have filled open positions during the year.

NON-GAAP FINANCIAL MEASURES

Non-GAAP Operating Income

(Loss)

Non-GAAP operating income (loss) is a financial measure that is

widely used to evaluate performance within the insurance sector. In

calculating Non-GAAP operating income (loss), we have excluded the

effects of the items listed in the following table that do not

reflect normal results. We believe Non-GAAP operating income (loss)

presents a useful view of the performance of our insurance

operations; however, it should be considered in conjunction with

net income (loss) computed in accordance with GAAP. The following

table reconciles net income (loss) to Non-GAAP operating income

(loss):

RECONCILIATION OF NET INCOME (LOSS) TO

NON-GAAP OPERATING INCOME (LOSS)

Three Months Ended December

31

Year Ended December 31

($ in thousands, except per share

data)

2023

2022

2023

2022

Net income (loss)

$

6,377

$

13,942

$

(38,604

)

$

(402

)

Items excluded in the calculation of

Non-GAAP operating income (loss):

Net investment (gains) losses (1)

(10,672

)

(12,495

)

(13,828

)

33,157

Net investment gains (losses) attributable

to SPCs which no profit/loss is retained (2)

1,504

1,224

2,925

(2,138

)

Transaction-related costs (3)

—

—

—

1,862

Goodwill impairment

—

—

44,110

—

Foreign currency exchange rate (gains)

losses(4)

3,484

5,241

2,993

(2,022

)

Non-operating income (5)

(5,416

)

—

(6,878

)

—

Guaranty fund assessments

(recoupments)

28

412

57

541

Pre-tax effect of exclusions

(11,072

)

(5,618

)

29,379

31,400

Tax effect, at 21% (6)

2,147

(707

)

1,894

(8,087

)

After-tax effect of exclusions

(8,925

)

(6,325

)

31,273

23,313

Non-GAAP operating income (loss)

$

(2,548

)

$

7,617

$

(7,331

)

$

22,911

Per diluted common share:

Net income (loss)

$

0.12

$

0.26

$

(0.73

)

$

(0.01

)

Effect of exclusions

(0.17

)

(0.12

)

0.59

0.43

Non-GAAP operating income (loss) per

diluted common share

$

(0.05

)

$

0.14

$

(0.14

)

$

0.42

(1)

Net investment gains (losses) for the

quarter and year ended December 31, 2023 include gains of $0.5

million and $5.0 million, respectively, as compared to $9.0 million

in each of the same respective periods of 2022 related to the

change in the fair value of contingent consideration issued in

connection with the NORCAL acquisition. We have excluded these

adjustments as they do not reflect normal operating results. See

further discussion around the contingent consideration in Note 2

and Note 8 of the Notes to Consolidated Financial Statements and

discussion on our accounting policy in the Critical Accounting

Estimates section under the heading "Contingent Consideration" of

our December 31, 2023 report on Form 10-K.

(2)

Net investment gains (losses) on

investments related to SPCs are recognized in our Segregated

Portfolio Cell Reinsurance segment. SPC results, including any net

investment gain or loss, that are attributable to external cell

participants are reflected in the SPC dividend expense (income). To

be consistent with our exclusion of net investment gains (losses)

recognized in earnings, we are excluding the portion of net

investment gains (losses) that is included in the SPC dividend

expense (income) which is attributable to the external cell

participants.

(3)

Transaction-related costs associated with

our acquisition of NORCAL. We are excluding these costs as they do

not reflect normal operating results and are unique and

non-recurring in nature.

(4)

Foreign currency exchange rate gains

(losses) relate to the impact of foreign exchange rate movements on

foreign currency denominated loss reserves predominately associated

with premium assumed from an international medical professional

liability insured in our Specialty P&C segment. Our

participation in this program has grown in recent years which has

led to greater volatility in our results of operations even with

nominal movements in exchange rates given the size of the reserve.

We mitigate foreign exchange rate exposure on our Consolidated

Balance Sheet by generally matching the currency and duration of

associated investments to the corresponding loss reserves. In

accordance with GAAP, the impact on the market value of

available-for-sale fixed maturities due to changes in foreign

currency exchange rates is reflected as a part of OCI. Conversely,

the impact of changes in foreign currency exchange rates on loss

reserves is reflected through net income (loss) as a component of

other income. Therefore, we believe foreign currency exchange rate

gains (losses) in our Consolidated Statements of Income and

Comprehensive Income in isolation are not indicative of our

operating performance.

(5)

Proceeds associated with the sale of our

ownership interest in the underwriting and operations entity

associated with Syndicate 1729 to unrelated third parties

recognized in other income in our Corporate segment. We are

excluding these costs as they do not reflect normal operating

results and are unique and non-recurring in nature.

(6)

The 21% rate is the statutory tax rate

associated with the taxable or tax deductible items listed above.

Our statutory tax rate was applied to these items in calculating

net income (loss), excluding the 2023 goodwill impairment which is

not tax deductible. In addition, the 2023 and 2022 gains related to

the change in the fair value of contingent consideration are

non-taxable and therefore had no associated income tax impact. The

taxes associated with the net investment gains (losses) related to

SPCs in our Segregated Portfolio Cell Reinsurance segment are paid

by the individual SPCs and are not included in our consolidated tax

provision or net income (loss); therefore, both the net investment

gains (losses) from our Segregated Portfolio Cell Reinsurance

segment and the adjustment to exclude the portion of net investment

gains (losses) included in the SPC dividend expense (income) in the

table above are not tax effected.

Non-GAAP Operating ROE

The following table is a reconciliation of ROE to Non-GAAP

operating ROE for the quarter and year ended December 31, 2023 and

2022:

Three Months Ended

December 31

Year Ended December 31

2023

2022

2023

2022

ROE(1)

2.3

%

2.7

%

(3.5

%)

—

%

Pre-tax effect of items excluded in the

calculation of Non-GAAP operating ROE

(4.1

%)

0.4

%

2.6

%

2.4

%

Tax effect, at 21%(2)

0.8

%

(0.3

%)

0.2

%

(0.6

%)

Non-GAAP operating ROE

(1.0

%)

2.8

%

(0.7

%)

1.8

%

(1)

Quarterly amounts are annualized. Refer to

our December 31, 2023 report on Form 10-K under the heading

“Non-GAAP Operating ROE” in the Executive Summary of Operations

section for details on our calculation.

(2)

The 21% rate is the statutory tax rate

associated with the taxable or tax deductible items. See further

discussion in footnote 6 in this section under the heading

"Non-GAAP Operating Income."

Non-GAAP Adjusted Book Value per

Share

The following table is a reconciliation of our book value per

share to Non-GAAP adjusted book value per share at December 31,

2023 and December 31, 2022:

Book Value Per Share

Book Value Per Share at December 31,

2022

$

20.46

Less: AOCI Per Share(1)

(5.53

)

Non-GAAP Adjusted Book Value Per Share at

December 31, 2022

25.99

Increase (decrease) to Non-GAAP Adjusted

Book Value Per Share during the year ended December 31, 2023

attributable to:

Dividends paid

(0.05

)

Cumulative repurchase of shares(2)

0.59

Net income (loss)(3)

(0.76

)

Other(4)

0.06

Non-GAAP Adjusted Book Value Per Share at

December 31, 2023

25.83

Add: AOCI Per Share(1)

(4.01

)

Book Value Per Share at December 31,

2023

$

21.82

(1)

Primarily the impact of accumulated

unrealized investment gains (losses) on our available-for-sale

fixed maturity investments. See Note 10 of the Notes to

Consolidated Financial Statements in our December 31, 2023 report

on Form 10-K for additional information.

(2)

Represents the impact of our repurchase of

3.1 million common shares, conducted through a series of 10b5-1

stock repurchase plans during 2023. See Note 10 of the Notes to

Consolidated Financial Statements in our December 31, 2023 report

on Form 10-K for additional information.

(3)

Includes the $44.1 million goodwill

impairment associated with the Workers' Compensation Insurance

segment, which accounted for $0.87 of the decrease in book value

per share. See Note 5 of the Notes to Consolidated Financial

Statements in our December 31, 2023 report on Form 10-K for

additional information.

(4)

Includes the impact of share-based

compensation.

Conference Call Information

ProAssurance management will discuss fourth quarter 2023 results

during a conference call at 10:00 a.m. ET on Wednesday, February

28, 2024. US-based investors may access the call by dialing either

(833) 470-1428 (toll free) or (404) 975-4839 (local). International

investors may find a toll-free number here:

https://www.netroadshow.com/events/global-numbers?confId=60355. The

access code for all attendees is 688177.

Callers may also choose to pre-register to receive unique call

access details and avoid operator wait times; pre-register here if

desired:

www.netroadshow.com/events/login?show=11e40410&confId=60355.

The conference call will also be webcast at

https://events.q4inc.com/attendee/777467232.

A replay will be available by telephone for at least 7 days

after the call date. US-based investors may access the replay by

dialing (866) 813-9403 (toll free) or (929) 458-6194, and

international investors may dial +44 (204) 525-0658. The access

code for all attendees is 341261. A replay will also be available

for at least one year at investor.proassurance.com. Investors may

follow @ProAssurance on X (formerly Twitter) to be notified of the

latest news about ProAssurance.

About ProAssurance

ProAssurance Corporation is an industry-leading specialty

insurer with extensive expertise in healthcare professional

liability, products liability for medical technology and life

sciences, legal professional liability, and workers’ compensation

insurance.

ProAssurance Group is rated “A” (Excellent) by AM Best.

ProAssurance and its operating subsidiaries (excluding NORCAL

Group) are rated “A-” (Strong) by Fitch Ratings. For the latest on

ProAssurance and its industry-leading suite of products and

services, cutting-edge risk management and practice enhancement

programs, follow @ProAssurance on X (formerly Twitter) or LinkedIn.

ProAssurance’s YouTube channel regularly presents

thought-provoking, insightful videos that communicate effective

practice management, patient safety and risk management

strategies.

Caution Regarding Forward-Looking Statements

Any statements in this news release that are not historical

facts or explicitly stated as an opinion are specifically

identified as forward-looking statements. These statements are

based upon our estimates and anticipation of future events and are

subject to significant risks, assumptions and uncertainties that

could cause actual results to differ materially from the expected

results described in the forward-looking statements.

Forward-looking statements are identified by words such as, but not

limited to, “anticipate,” “believe,” “estimate,” “expect,” “hope,”

“hopeful,” “intend,” “likely,” “may,” “optimistic,” “possible,”

“potential,” “preliminary,” “project,” “should,” “will,” and other

analogous expressions.

Although it is not possible to identify all of these risks and

factors, they include, among others, the following: inadequate loss

reserves to cover the Company's actual losses; inherent uncertainty

of models resulting in actual losses that are materially different

than the Company's estimates; adverse economic factors; a decline

in the Company's financial strength rating; loss of one or more key

executives; loss of a group of agents or brokers that generate

significant portions of the Company's business; failure of any of

the loss limitations or exclusions the Company employs, or change

in other claims or coverage issues; adverse performance of the

Company's investment portfolio; adverse market conditions that

affect its excess and surplus lines insurance operations; and other

risks described in the Company's filings with the Securities and

Exchange Commission. These forward-looking statements speak only as

of the date of this release and the Company does not undertake and

specifically declines any obligation to update or revise any

forward-looking information to reflect changes in assumptions, the

occurrence of unanticipated events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240227533601/en/

Dana Hendricks EVP, Chief Financial Officer 800-282-6242 •

205-877-4462 • DanaHendricks@ProAssurance.com

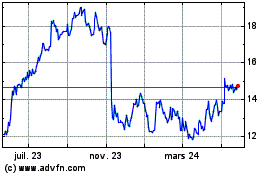

ProAssurance (NYSE:PRA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

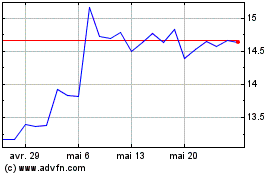

ProAssurance (NYSE:PRA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024