Permianville Royalty Trust Announces Monthly Operational Update

18 Décembre 2023 - 10:15PM

Business Wire

Permianville Royalty Trust (NYSE: PVL, the “Trust”) today

announced the net profits interest calculation for December 2023.

The net profits interest calculation represents reported oil

production for the month of September 2023 and reported natural gas

production during August 2023. The calculation includes accrued

costs incurred in October 2023.

As a result of the cumulative outstanding net profits shortfall,

which declined from approximately $1.2 million in the prior month

to approximately $0.9 million in the current month, no distribution

will be paid in January 2024 to the Trust’s unitholders of record

on December 29, 2023. As discussed below, distributions cannot

resume until the cumulative net profits shortfall is eliminated.

Excluding the current shortfall, income from the net profits

interest would have been approximately $0.3 million in the current

month.

The following table displays reported underlying oil and natural

gas sales volumes and average received wellhead prices attributable

to the current and prior month recorded net profits interest

calculations.

Underlying Sales

Volumes

Average Price

Oil

Natural Gas

Oil

Natural Gas

Bbls

Bbls/D

Mcf

Mcf/D

(per Bbl)

(per Mcf)

Current Month

30,663

1,022

263,045

8,485

$

86.53

$

2.30

Prior Month

36,086

1,164

227,059

7,324

$

78.95

$

2.33

Recorded oil cash receipts from the oil and gas properties

underlying the Trust (the “Underlying Properties”) totaled $2.7

million for the current month on realized wellhead prices of

$86.53/Bbl, down $0.1 million from the prior month’s oil cash

receipts.

Recorded natural gas cash receipts from the Underlying

Properties totaled $0.6 million for the current month on realized

wellhead prices of $2.30/Mcf, up $0.1 million from the prior

month.

Total accrued operating expenses for the period were $2.4

million, a $0.4 million decrease month-over-month. Capital

expenditures decreased $1.5 million from the prior period, to $0.5

million.

The cumulative shortfall in net profits for the current month

will be deducted from any net profits in next month’s net profits

interest calculation. The Trust will not receive proceeds pursuant

to its net profits interest until the cumulative net profits

shortfall is eliminated. In addition, if the Trust’s cash on hand

is not sufficient to pay ordinary course administrative expenses

and the Trust borrows funds or draws on the letter of credit that

has been provided to the Trust, or if COERT Holdings 1, LLC (the

“Sponsor”) advances funds to the Trust to pay such expenses, no

further distributions will be made to Trust unitholders until such

amounts borrowed or drawn, or advanced to the Trust, are repaid. At

this time based on current commodity prices, the Sponsor

anticipates that the Underlying Properties will return to

generating positive net profits by early 2024.

About Permianville Royalty Trust

Permianville Royalty Trust is a Delaware statutory trust formed

to own a net profits interest representing the right to receive 80%

of the net profits from the sale of oil and natural gas production

from certain, predominantly non-operated, oil and gas properties in

the states of Texas, Louisiana and New Mexico. As described in the

Trust’s filings with the Securities and Exchange Commission (the

“SEC”), the amount of the periodic distributions is expected to

fluctuate, depending on the proceeds received by the Trust as a

result of actual production volumes, oil and gas prices, the amount

and timing of capital expenditures, and the Trust’s administrative

expenses, among other factors. Future distributions are expected to

be made on a monthly basis. For additional information on the

Trust, please visit www.permianvilleroyaltytrust.com.

Forward-Looking Statements and Cautionary Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. All statements contained in this

press release, other than statements of historical facts, are

“forward-looking statements” for purposes of these provisions.

These forward-looking statements include the amount and date of any

anticipated distribution to unitholders and expectations regarding

the future generation of net profits from the Underlying

Properties. The anticipated distribution is based, in large part,

on the amount of cash received or expected to be received by the

Trust from the Sponsor with respect to the relevant period. The

amount of such cash received or expected to be received by the

Trust (and its ability to pay distributions) has been and will

continue to be directly affected by the volatility in commodity

prices, which have experienced significant fluctuation since the

beginning of 2020 as a result of a variety of factors that are

beyond the control of the Trust and the Sponsor. Low oil and

natural gas prices will reduce profits to which the Trust is

entitled, which will reduce the amount of cash available for

distribution to unitholders and in certain periods could result in

no distributions to unitholders. Other important factors that could

cause actual results to differ materially include expenses of the

Trust, reserves for anticipated future expenses, and public health

concerns, such as the COVID‑19 pandemic. In addition, future

monthly capital expenditures may exceed the average levels

experienced in 2022 and prior periods. Statements made in this

press release are qualified by the cautionary statements made in

this press release. Neither the Sponsor nor the Trustee intends,

and neither assumes any obligation, to update any of the statements

included in this press release. An investment in units issued by

the Trust is subject to the risks described in the Trust’s filings

with the SEC, including the risks described in the Trust’s Annual

Report on Form 10-K for the year ended December 31, 2022, filed

with the SEC on March 23, 2023. The Trust’s quarterly and other

filed reports are or will be available over the Internet at the

SEC’s website at http://www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218028390/en/

Permianville Royalty Trust Sarah Newell 1 (512) 236-6555

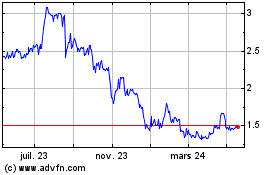

Permianville Royalty (NYSE:PVL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

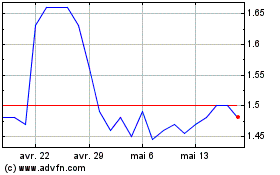

Permianville Royalty (NYSE:PVL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025