false

0001551901

0001551901

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 1, 2024

(October 30, 2024)

Stellus Capital Investment Corporation

(Exact Name of Registrant as Specified in Charter)

| Maryland |

|

814-00971 |

|

46-0937320 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

4400

Post Oak Parkway, Suite

2200

Houston,

Texas |

|

77027 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (713) 292-5400

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

| |

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

SCM |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On October 30, 2024, Stellus Capital Investment

Corporation (the “Company”) entered into an Increase Agreement (the “Increase Agreement”) to the Amended and Restated

Senior Secured Revolving Credit Agreement by and among the Company, as the borrower, Zions Bancorporation, N.A. dba Amegy Bank, as the

administrative agent, and the lenders that are party thereto from time to time, which, among other things, amends that certain Amended

and Restated Senior Secured Revolving Credit Agreement dated as of September 18, 2020 (as amended, supplemented, and restated or otherwise

modified from time to time, the “Credit Facility”). The Increase Agreement increases the total Commitments under the Credit

Facility from $260,000,000 to $315,000,000 on a committed basis.

The description above is only a summary of the

material provisions of the Increase Agreement and is qualified in its entirety by reference to a copy of the Increase Agreement, which

is filed as Exhibit 10.1 to this current report on Form 8-K and incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of Registrant.

The information contained in Item 1.01 to this

current report on Form 8-K is by this reference incorporated in this Item 2.03.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934 as amended, the Registrant has duly caused this Report on Form 8-K to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: November 1, 2024 |

STELLUS CAPITAL INVESTMENT CORPORATION |

| |

|

|

| |

|

|

| |

By: |

/s/ W. Todd Huskinson |

| |

|

W. Todd Huskinson |

| |

|

Chief Financial Officer |

Exhibit 10.1

INCREASE AGREEMENT TO AMENDED AND RESTATED

SENIOR SECURED REVOLVING CREDIT AGREEMENT

THIS INCREASE AGREEMENT TO

AMENDED AND RESTATED SENIOR SECURED REVOLVING CREDIT AGREEMENT dated as of October 30, 2024 (this “Agreement”),

is among STELLUS CAPITAL INVESTMENT CORPORATION, a Maryland corporation (the “Borrower”), ZIONS BANCORPORATION,

N.A. dba AMEGY BANK, as Administrative Agent (the “Administrative Agent”) and Issuing Bank (the “LC

Issuer”), BANK OZK (“OZK”), and COMMERCE BANK (“Commerce”, and together

with OZK, collectively, the “New Lenders” and each individually, a “New Lender”).

W I T N E S S E T H:

WHEREAS, the Borrower, certain

financial institutions as lenders, Zions Bancorporation, N.A. dba Amegy Bank, as the Swingline Lender, the Issuing Bank, the Multicurrency

Lender and the Administrative Agent are parties to that certain Amended and Restated Senior Secured Revolving Credit Agreement dated as

of September 18, 2020 (as amended by that First Amendment and Commitment Increase to Amended and Restated Senior Secured Revolving Credit

Agreement dated December 22, 2021, that Second Amendment to Amended and Restated Senior Secured Revolving Credit Agreement dated February

28, 2022, that Third Amendment and Commitment Increase to Amended and Restated Senior Secured Revolving Credit Agreement dated May 13,

2022, that Fourth Amendment to Amended and Restated Senior Secured Revolving Credit Agreement dated November 21, 2023, that Fifth Amendment

to Amended and Restated Senior Secured Revolving Credit Agreement dated March 14, 2024, and as further amended, supplemented, and restated

or otherwise modified from time to time, the “Credit Agreement”);

WHEREAS, the Borrower requests

that the Commitments of the Dollar Lenders be increased from $260,000,000 to $315,000,000 in the aggregate; and

WHEREAS, each New Lender is

willing on the terms and subject to the conditions hereinafter set forth, to make a Commitment, subject to the terms and conditions of

this Agreement; and

NOW, THEREFORE, the parties

hereto hereby covenant and agree as follows:

ARTICLE

I

DEFINITIONS

Section 1.1

Certain Definitions. The following terms when used in this Agreement shall have the following meanings (such meanings to

be equally applicable to the singular and plural forms thereof):

“Borrower”

is defined in the preamble.

“Credit

Agreement” is defined in the first recital.

“Increase

Effective Date” is defined in Article IV.

Section 1.2

Other Definitions. Capitalized terms used in this Agreement but not defined herein, shall have the meanings given such terms

in the Credit Agreement.

ARTICLE II

COMMITMENT INCREASE REQUEST

On or before September 11,

2024, the Borrower irrevocably requested that the Commitments of the Dollar Lenders be increased from $260,000,000 to $315,000,000 in

the aggregate (the “Commitment Increase”) pursuant to Section 2.08 of the Credit

Agreement.

ARTICLE

III

AGREEMENT TO INCREASE COMMITMENTS

Subject to the occurrence

of the Increase Effective Date (as hereinafter defined), the Commitments are increased on the Increase Effective Date as follows:

Section 3.1

New Lenders. Each New Lender hereby (i) agrees to commit to provide a Commitment in the amount described on Schedule

1.01(b) attached hereto. Each New Lender confirms that it has received a copy of the Credit Agreement and the other Loan Documents,

together with copies of the most recent financial statements delivered thereunder and such other documents and information as it has deemed

appropriate to make its own credit analysis and decision to enter into this Agreement; (ii) agrees that it will, independently and without

reliance upon the Administrative Agent or any other Lender or agent thereunder and based on such documents and information as it shall

deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Credit Agreement; (iii)

appoints and authorizes the Administrative Agent to take such action as agent on its behalf and to exercise such powers under the Credit

Agreement and the other Loan Documents as are delegated to Administrative Agent by the terms thereof, together with such powers as are

reasonably incidental thereto; and (iv) agrees that it will perform in accordance with their terms all of the obligations which by the

terms of the Credit Agreement are required to be performed by it as a Lender. The Administrative Agent and LC Issuer consent to (i) each

New Lender joining the Credit Agreement as a Lender and (ii) each of OZK and Frost Bank being named a Joint Lead Arranger under the Credit

Agreement. From and after the Increase Effective Date each New Lender shall be deemed to be a party to the Credit Agreement, and a “Lender”

for all purposes of the Credit Agreement and the other Loan Documents, and shall have all of the rights and obligations of a Lender under

the Credit Agreement and the other Loan Documents.

Section 3.2

Commitment Increase. On the Increase Effective Date, adjustments of Borrowings will be made in accordance with Section

2.08(e) of the Credit Agreement that will result in, after giving effect to all such deemed prepayments and borrowings, the Loans

and participations in Letters of Credit, Swingline Loans and Multicurrency Loans being held by the Lenders ratably in accordance with

their Commitments, after giving effect to the Commitment Increase herein, as described on Schedule 1.01(b) attached hereto.

ARTICLE

IV

CONDITIONS TO EFFECTIVENESS

Section 4.1

Effective Date. This Agreement shall become effective on the date first set forth above (the “Increase Effective

Date”) when the Administrative Agent shall have received:

(a)

counterparts of this Agreement duly executed and delivered on behalf of the Borrower, the Administrative Agent, the LC Issuer,

and the New Lenders, together with the Subsidiary Guarantors’ Consent and Agreement executed by each Subsidiary Guarantor;

(b)

a Revolving Credit Note in the maximum principal amount of $45,000,000 executed by Borrower and made payable to Bank OZK;

(c)

a Revolving Credit Note in the maximum principal amount of $10,000,000 executed by Borrower and made payable to Commerce Bank;

(d) an

Officer’s Certificate of Borrower, certifying as to incumbency of officers, specimen signatures, organizational documents, and

resolutions adopted by the Board of Directors of Borrower authorizing this Agreement, in form and substance satisfactory to Administrative

Agent;

(e)

a certificate of existence/good standing for Borrower and each Subsidiary Guarantor from its jurisdiction of formation;

(f)

a certificate of a duly authorized officer of the Borrower in form and substance satisfactory to the Administrative Agent (i) stating

that each of the applicable conditions set forth in Section 2.08(e) of the Credit Agreement have been satisfied and (ii)

certifying that on and as of the Increase Effective Date, before and after giving effect to the Commitment Increase, (x) the representations

and warranties contained in Article III of the Credit Agreement and the other Loan Documents are true and correct in all material respects

(except those representations and warranties qualified by materiality or by reference to a material adverse effect, which are true and

correct in all respects) on and as of the date hereof as though made on and as of the date hereof (unless such representations and warranties

specifically refer to a specific date, in which case, they shall be complete and correct in all material respects (or, with respect to

such representations or warranties qualified by materiality or by reference to a material adverse effect, complete and correct in all

respects) on and as of such specific date), and (y) no Default or Event of Default exists; and

(g)

payment by the Borrower of all fees payable pursuant to the Increase Agreement Fee Letter dated as of the date hereof between the

Borrower and Amegy Bank.

ARTICLE

V

MISCELLANEOUS

Section 5.1

Representations. The Borrower hereby represents and warrants that (i) this Agreement constitutes a legal, valid and

binding obligation of it, enforceable against it in accordance with its terms, (ii) upon the effectiveness of this Agreement, no Default

or Event of Default shall exist and (iii) its representations and warranties as set forth in the Loan Documents, as applicable, are true

and correct in all material respects (except those representations and warranties qualified by materiality or by reference to a material

adverse effect, which are true and correct in all respects) on and as of the date hereof as though made on and as of the date hereof (unless

such representations and warranties specifically refer to a specific date, in which case, they shall be complete and correct in all material

respects (or, with respect to such representations or warranties qualified by materiality or by reference to a material adverse effect,

complete and correct in all respects) on and as of such specific date).

Section 5.2

Cross-References. References in this Agreement to any Article or Section are, unless otherwise specified, to such Article

or Section of this Agreement.

Section 5.3 Loan

Document Pursuant to Credit Agreement. This Agreement is a Loan Document executed pursuant to the Credit Agreement and shall

(unless otherwise expressly indicated therein) be construed, administered and applied in accordance with all of the terms and

provisions of the Credit Agreement, as amended hereby, including Article IX thereof.

Section 5.4

Successors and Assigns. The provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto

and their respective successors and assigns.

Section 5.5

Counterparts. This Agreement may be executed in counterparts (and by different parties hereto on different counterparts),

each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed

counterpart of a signature page of this Agreement by telecopy electronically (e.g. pdf) shall be effective as delivery of a manually executed

counterpart of this Agreement.

Section 5.6

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

Section 5.7

Full Force and Effect. On and after the Increase Effective Date, each reference in any Loan Document to the Credit Agreement,

“thereunder”, “thereof” or words of like import referring to the Credit Agreement shall mean and be a reference

to the Credit Agreement as amended by this Agreement. Except as specifically amended by this Agreement, the Credit Agreement and the other

Loan Documents shall remain in full force and effect (with the same priority, as applicable) and are hereby ratified and confirmed and

this Agreement shall not be considered a novation. The execution, delivery and performance of this Agreement shall not constitute a waiver

of any provision of, or operate as a waiver of any right, power or remedy of the Administrative Agent or any Lender or any other party

under, the Credit Agreement or any of the other Loan Documents.

[Signatures on Following Pages]

IN WITNESS WHEREOF, the parties

hereto have executed and delivered this Agreement as of the date first above written.

| |

BORROWER: |

| |

|

|

STELLUS CAPITAL INVESTMENT CORPORATION |

| |

|

| |

By: |

/s/ W. Todd Huskinson |

| |

|

W. Todd Huskinson |

| |

|

Chief Financial Officer, Chief Compliance Officer, Treasurer, and Secretary |

Signature

Page to Increase agreement – Stellus Capital Investment Corporation

| |

ADMINISTRATIVE

AGENT AND LC ISSUER: |

| |

|

|

ZIONS BANCORPORATION, N.A. |

| |

DBA AMEGY BANK |

| |

|

| |

By: |

/s/ Mario Gagetta |

| |

|

Mario Gagetta |

| |

|

Vice President |

Signature

Page to Increase agreement – Stellus Capital Investment Corporation

| |

NEW LENDER: |

| |

|

| |

BANK OZK |

| |

|

| |

By: |

/s/ James Lyons |

| |

Name: |

James Lyons |

| |

Title: |

Senior Managing Director |

Signature

Page to Increase agreement – Stellus Capital Investment Corporation

| |

NEW LENDER: |

| |

|

| |

COMMERCE BANK |

| |

|

| |

By: |

/s/ Jessica Morrison |

| |

Name: |

Jessica Morrison |

| |

Title: |

Senior Vice President |

Signature

Page to Increase agreement – Stellus Capital Investment Corporation

SUBSIDIARY GUARANTORS’ CONSENT AND AGREEMENT

TO

INCREASE AGREEMENT

As an inducement to Administrative

Agent, LC Issuer, and the New Lenders party thereto to execute the Increase Agreement to Credit Agreement (the “Agreement”)

to which this Subsidiary Guarantors’ Consent and Agreement to Increase Agreement is attached, and in consideration of such execution

by the parties thereto (capitalized terms used herein and not otherwise defined shall have the meanings given to such terms in Article

I of the Agreement), each of the undersigned Subsidiary Guarantors hereby consents to the Agreement and the transactions contemplated

thereby, and agrees that the Agreement shall in no way release, diminish, impair, reduce or otherwise adversely affect the obligations

and liabilities of the undersigned under any Guarantee and Security Agreement executed by the undersigned in connection with the Credit

Agreement, or under any Loan Documents, agreements, documents or instruments executed by the undersigned to create liens, security interests

or charges to secure any of the Guaranteed Obligations (as defined in the Guarantee and Security Agreement), all of which are in full

force and effect. Each of the undersigned further represents and warrants to Administrative Agent and the Lenders that, after giving effect

to the Agreement, (a) the representations and warranties in each Loan Document to which the undersigned is a party are true and correct

in all material respects (or, in the case of any portion of the representations and warranties already subject to a materiality qualifier,

true and correct in all respects) on and as of the date of the Agreement as if made on and as of the date of the Agreement (or, if any

such representation or warranty is expressly stated to have been made as of a specific date, as of such specific date), and (b) no Default

or Event of Default has occurred and is continuing. The undersigned Subsidiary Guarantors agree to be bound by the terms, conditions,

covenants and agreements in the Agreement. This Consent and Agreement is executed as of the date of the Agreement and shall be binding

upon each of the undersigned, and their respective successors and assigns, and shall inure to the benefit of Administrative Agent, Lenders,

and their successors and assigns.

[Signatures on Following Page]

Subsidiary

Guarantors’ Consent and Agreement to

Increase Agreement – Stellus Capital Investment Corporation

| |

SUBSIDIARY GUARANTORS: |

| |

|

| |

SCIC – ERC BLOCKER 1, INC. |

| |

SCIC – SKP BLOCKER 1, INC. |

| |

SCIC – APE BLOCKER 1, INC. |

| |

SCIC – CONSOLIDATED BLOCKER, INC. |

| |

SCIC – INVINCIBLE BLOCKER 1, INC. |

| |

SCIC – CC BLOCKER 1, INC. |

| |

SCIC – HOLLANDER BLOCKER 1, INC. |

| |

SCIC – VENBROOK BLOCKER, INC. |

| |

By: |

/s/ W. Todd Huskinson |

| |

|

W. Todd Huskinson |

| |

|

Authorized Signatory of each of the above corporations |

Signature

Page to Subsidiary Guarantors’ Consent and Agreement to

Increase Agreement – Stellus Capital Investment Corporation

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

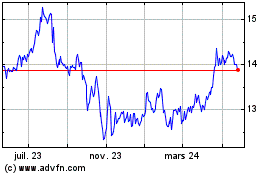

Stellus Capital Investment (NYSE:SCM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

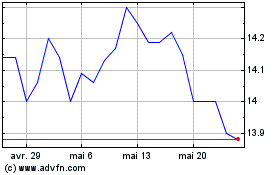

Stellus Capital Investment (NYSE:SCM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025