A new Stifel survey finds U.S. consumer views of the importance of

brands operating sustainably has reached parity with Europe, but

also shows greater consumer concerns about the economy and personal

finances. Following three years of near-record inflation, the

survey data indicates heightened price sensitivity, just as the

holiday shopping season kicks into high gear.

While an overwhelming majority of consumers (80%) still believe

it’s important for brands to operate sustainably, only a third

(32%) highly prioritize sustainability when making purchasing

decisions, compared to other factors like good value (68%) and low

price (57%). Amid persistent inflationary pressures, consumer

prioritization of low price reflected the largest gains year over

year (up five points from 52% in 2022).

Roughly three of five consumers (63%), however, remain willing

to pay a premium for brands with leading sustainability

practices.

“We know that many consumers regularly consider and value

sustainability, especially in the active and casual lifestyle

category,” said Jim Duffy, Managing Director and Sports and

Lifestyle Brands Analyst at Stifel. “However, our survey found that

62% of consumers are more concerned about the state of the economy

this year versus last year and 56% are more worried about their

personal finances, so pocketbook issues are having a greater impact

on purchasing decisions.”

Stifel, working with Morning Consult, recently surveyed 6,053

U.S. active/causal lifestyle brand consumers ages 18-55. Other key

findings include:

- 56% (flat versus 2022) of consumers look for information about

a brand’s sustainability practices when contemplating a purchase,

70% (down from 71% in 2022) consider sustainability factors when

choosing between brands, and more than half (59% versus 58% in

2022) have purchased a new product specifically because of

sustainability reasons.

- More than three-quarters (78%) of consumers indicate they are

trying to be more sustainable in their day-to-day life (up from 75%

in 2022) and 70% indicate they care more about the sustainability

of products they buy than a year ago (versus 67% in 2022).

- Most (58%) believe that ethical business practices are “very

important” for brands to prioritize, and ranked giving workers fair

pay and benefits, paying a fair share of taxes, and promoting a

healthy work/life balance as leading priorities.

- Two-thirds of U.S. category consumers (67%) report they are

aware of brands receiving negative attention on social media for a

statement or action taken on a social issue.

- Three of five category purchasers (60%) think it’s important

for brands to take a stance on social issues but three quarters

(74%) indicate a willingness to boycott a brand if the stance was

contrary to their opinion.

“Operating sustainably is a consumer expectation, but brands

weighing in on social issues is a high-wire act,” noted Duffy.

“Consumers want brands to support their issues, but the majority

indicate they would boycott a brand that expresses views opposing

their own. Deep understanding of the customer is essential to this

risk-reward calculus.”

Global Insights

The survey also questioned 4,096 additional active/causal

lifestyle brand consumers ages 18-55 across the UK, Italy, Germany,

and France. Similar to findings among U.S. consumers, at least four

of five category purchasers across all international markets

believe it’s important for brands to operate sustainably, but the

figures declined year over year. Similar to the U.S., value and

price concerns outweigh sustainability practices as purchasing

priorities. Specific findings include:

- Sustainability as a purchasing priority remained essentially

flat compared to last year in the UK (35%) and Italy (40%) but

declined year to year in France (52% versus 59% in 2022) and

Germany (36% versus 39% in 2022).

- “Good value” ranked as the top consideration when making

purchasing decisions, with consumers in Italy (74% versus 75% in

2022), France (72% versus 70% in 2022), the UK (72% versus 69% in

2022), and Germany (71% flat versus 2022) versus 68% of U.S.

consumers.

- The importance of “low price” as a purchasing priority

increased over the last year, with French (55% versus 47% in 2022),

Italian (45% versus 40% in 2022), German (40% versus 35% in 2022),

and UK consumers (53% versus 50% in 2022) listing it as a “top

three” purchasing priority versus 57% of U.S. consumers (up from

52% in 2022).

- Brand environmental efforts are viewed as less important year

to year across each of the European markets, including using less

energy and water, using more renewable or recycled materials,

reducing carbon emissions, and advocating for environmental causes

publicly.

- In the past year, half or more of consumers have become more

concerned about the state of the economy (UK 69%, Italy 65%, U.S.

62%, Germany 59%, and France 58%) and personal finances (UK 63%,

France 62%, U.S. 56%, Italy 53%, and Germany 50%).

“European markets have historically led the U.S. in concern for

brand sustainability, but that gap has narrowed amid economic

pressures,” added Duffy. “The broad-based 2023 European declines in

perception of the importance of brand focus on environmental

efforts may signal ‘sustainability fatigue’ and the peak in

European consumer sustainability concern.”

Full survey results can be found here.

Updating the Stifel Sustainable Lifestyle Brands

Index

In conjunction with the survey, Stifel is updating the “Stifel

Sustainable Lifestyle Brands Index,” which ranks brands based on

U.S. active/casual lifestyle consumer perception of brand

sustainability practices. Brands were measured according to three

metrics of sustainability: environmental, social, and ethical

business practices.

For the third year in a row, Bombas was rated the top

sustainable brand, followed by Yeti (No. 2) and The North Face (No.

3). In fact, Bombas scored highest in each of the three metrics

considered.

Rounding out the top ten are: Carhartt (tied at No. 4),

Patagonia (tied at No. 4), Allbirds (No. 6), Adidas (No. 7),

Columbia (tied at No. 8), Under Armour (tied at No. 8), and

Smartwool + Levi’s (No. 10).

Survey Methodology

Morning Consult conducted n=11,551 online interviews among

general population adults ages 18-55 and active/casual lifestyle

brand purchasers ages 18-55 in the U.S., UK, Italy, Germany, and

France from October 23-30, 2023. Sampling included approximately

n=1,000 general population adults in each market, and an oversample

of active/casual lifestyle brand purchasers in each market.

General population adults and active/casual lifestyle brand

purchasers were separately sampled and weighted to be

demographically representative for their age groups according to

published population statistics for age, gender, region, education,

race, and income in the U.S., and age, gender, region, and

education in the UK, Italy, Germany, and France. Active/casual

lifestyle brand purchasers are defined as those who purchased at

least one of the following types of brands within the past six

months: athletic or activewear clothing or footwear brands; casual

lifestyle clothing or footwear brands; outdoor clothing or footwear

brands (i.e., for hiking, skiing, etc.); or sporting goods or

outdoor recreation equipment brands.

Sustainable Lifestyle Brand Index

Methodology

Stifel and Morning Consult measured sustainability ratings for

50 active/casual lifestyle brands with leading sustainability

practices among n=4,756 active/casual lifestyle brand consumers in

the U.S. Active/casual lifestyle brands were measured according to

three metrics of sustainability: environmental sustainability,

ethical business practices, and social sustainability. Index scores

for each of these metrics were calculated according to the

following methodology, and then averaged together to compute the

overall Sustainable Lifestyle Brand Index Score.

Calculations for each brand focus on those who selected a

response on Stifel’s four-point scale, excluding those who selected

“Don’t Know/No Opinion.” Raw scores were calculated for each brand

by adding value for positive ratings and subtracting value for

negative ratings. “Excellent” and “Poor” were given twice the

weight of “Good” and “Just Fair” to ensure more polarized views

were reflected in the scores. Finally, raw scores were converted to

index scores, where the average score for each metric is indexed to

100. This ensures Stifel’s three metrics are uniform, and have

equal weight when averaged together to compute the overall

Sustainable Lifestyle Brand Index Score.

Stifel Company

Information

Stifel Financial Corp. (NYSE: SF) is a financial

services holding company headquartered in St. Louis, Missouri, that

conducts its banking, securities, and financial services business

through several wholly owned subsidiaries. Stifel’s broker-dealer

clients are served in the United States through Stifel, Nicolaus

& Company, Incorporated, including its Eaton Partners and

Miller Buckfire business divisions; Keefe, Bruyette & Woods,

Inc.; and Stifel Independent Advisors, LLC; in Canada through

Stifel Nicolaus Canada Inc.; and in the United Kingdom and Europe

through Stifel Nicolaus Europe Limited. The Company’s broker-dealer

affiliates provide securities brokerage, investment banking,

trading, investment advisory, and related financial services to

individual investors, professional money managers, businesses, and

municipalities. Stifel Bank and Stifel Bank & Trust offer a

full range of consumer and commercial lending solutions. Stifel

Trust Company, N.A. and Stifel Trust Company Delaware, N.A. offer

trust and related services. To learn more about Stifel, please

visit the Company’s website at www.stifel.com. For global

disclosures, please visit

https://www.stifel.com/investor-relations/press-releases.

Media Contacts Neil Shapiro, +1 (212) 271-3447

shapiron@stifel.com

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/7d1e3f9f-3e59-4f8b-b074-5db3ce1b70efhttps://www.globenewswire.com/NewsRoom/AttachmentNg/421f4a09-5ae5-4588-96e5-8a6d36df7511

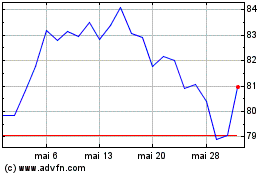

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024