Form 8-K/A - Current report: [Amend]

11 Août 2023 - 10:01PM

Edgar (US Regulatory)

0001021162truefalse00010211622023-08-022023-08-020001021162tgi:PurchaseRights1Member2023-08-022023-08-020001021162us-gaap:CommonStockMember2023-08-022023-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 2, 2023

TRIUMPH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

1-12235 |

|

51-0347963 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

555 E Lancaster Avenue, Suite 400 |

|

|

Radnor, Pennsylvania |

|

19087 |

(Address of principal executive offices) |

|

(Zip Code) |

(610) 251-1000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $.001 per share |

|

TGI |

|

New York Stock Exchange |

Purchase Rights |

|

|

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Financial Results

On August 2, 2023, Triumph Group, Inc. (the Company) reported preliminary financial results for its first quarter of fiscal 2024, which ended June 30, 2023. The press release also disclosed that the Company was evaluating the final accounting and process around the working capital components of recent legacy Aerospace Structures divestitures and related transition services agreements. The Company has now completed its evaluation, which resulted in the following non-cash adjustments to its previously reported amounts for the three months ended June 30, 2023.

•The Company recognized a loss on sale of approximately $8.7 million.

•The Company recognized a debt modification and extinguishment gain of approximately $3.5 million.

For the three months ended June 30, 2023, the impact of these non-cash adjustments resulted in the following changes to the Company’s previously reports amounts:

•Operating Income from $18.7 million to $10.0 million

•Adjusted EBITDAP from $35.6 million to $35.7 million

•Loss from continuing operations before income taxes from ($11.0) million to ($16.4) million

•Net loss from ($12.8) million to ($18.2) million

•Loss per share from ($0.19) to ($0.27)

•Adjusted loss per share from ($0.10) to ($0.11)

Non-GAAP Financial Measure Disclosures

Adjusted income from continuing operations, before income taxes, adjusted income from continuing operations and adjusted income from continuing operations per diluted share, before non-recurring costs have been provided for consistency and comparability. These measures should not be considered in isolation or as alternatives to income from continuing operations before income taxes, income from continuing operations and income from continuing operations per diluted share presented in accordance with GAAP. The following tables (amounts in thousands, except per share amounts) reconcile income from continuing operations before income taxes, income from continuing operations, and income from continuing operations per diluted share, before non-recurring costs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, 2023 |

|

(amounts in 000s, except per share amounts) |

|

Pre-Tax |

|

|

After-Tax |

|

|

Diluted EPS |

|

Loss from continuing operations - GAAP |

|

$ |

(16,413 |

) |

|

$ |

(18,163 |

) |

|

$ |

(0.27 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

Shareholder cooperation expenses |

|

|

1,905 |

|

|

|

1,905 |

|

|

|

0.03 |

|

Loss on sale of assets and businesses, net |

|

|

12,617 |

|

|

|

12,617 |

|

|

|

0.19 |

|

Debt modification and extinguishment gain |

|

|

(3,391 |

) |

|

|

(3,391 |

) |

|

|

(0.05 |

) |

Adjusted loss from continuing operations - non-GAAP* |

|

$ |

(5,282 |

) |

|

$ |

(7,032 |

) |

|

$ |

(0.11 |

) |

*Differences due to rounding.

Fiscal 2024 Guidance

As a result of these adjustments, the Company is further updating its fiscal 2024 guidance for operating income, from the previously stated range of $159.0 million to $174.0 million, to an updated range of $150.0 million to $165.0 million. All other guidance remains unchanged, including net sales, adjusted EBITDAP, cash flow from operations and free cash flow.

Forward Looking Statements

Statements in this Form 8-K/A which are not historical facts are forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations of or assumptions about financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies and organizational restructurings and our evaluation of potential adjustments to reported amounts, as described above. All forward-looking statements involve risks and uncertainties which could affect the Company's actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, the Company. Further information regarding the important factors that could cause actual results to differ from projected results can be found in Triumph Group's reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2023.

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Date: |

August 11, 2023 |

TRIUMPH GROUP, INC. |

|

|

|

|

|

|

By: |

/s/ Thomas A. Quigley, III |

|

|

|

Thomas A. Quigley, III |

|

|

|

Vice President, Investor Relations, Mergers & Acquisitions and Treasurer |

v3.23.2

Document And Entity Information

|

Aug. 02, 2023 |

| Document And Entity Information [Line Items] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 02, 2023

|

| Securities Act File Number |

1-12235

|

| Entity Registrant Name |

TRIUMPH GROUP, INC.

|

| Entity Central Index Key |

0001021162

|

| Entity Tax Identification Number |

51-0347963

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

555 E Lancaster Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

610

|

| Local Phone Number |

251-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Common Stock, par value $.001 per share

|

| Trading Symbol |

TGI

|

| Security Exchange Name |

NYSE

|

| Purchase Rights [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tgi_PurchaseRights1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

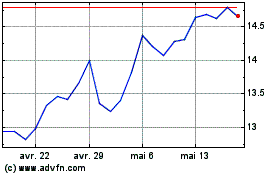

Triumph (NYSE:TGI)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Triumph (NYSE:TGI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024