Record Full-Year Net Sales Driven by Strength

in Residential Segment, Underground Construction, and Golf

Significant Improvement in Cash Generation Supported Increased

Share Repurchases

- Full-year net sales of $4.58 billion, up from $4.55 billion in

fiscal 2023

- Full-year reported diluted EPS of $4.01 and *adjusted diluted

EPS of $4.17, compared to $3.13 reported and $4.21 *adjusted

diluted EPS in fiscal 2023

- Fourth-quarter net sales of $1.08 billion, up from $0.98

billion in the same period of fiscal 2023

- Fourth-quarter reported diluted EPS of $0.87 and *adjusted

diluted EPS of $0.95, compared to $0.67 reported diluted EPS and

$0.71 *adjusted diluted EPS in the same period of fiscal 2023

- Full-year fiscal 2025 guidance of *adjusted diluted EPS in the

range of $4.25 to $4.40

The Toro Company (NYSE: TTC), a leading global provider of

solutions for the outdoor environment, today reported results for

its fiscal fourth-quarter and full-year ended October 31, 2024.

“We delivered our 15th consecutive year of net sales growth in

what remained an extremely dynamic environment,” said Richard M.

Olson, chairman and chief executive officer. “This was a testament

to the strength of our portfolio and the disciplined execution by

our team of talented employees and channel partners.

“In our residential segment, we drove exceptional top-line

growth due to the strength of our mass channel, including the

inaugural year of our strategic partnership with Lowe’s, along with

the success of new product introductions, such as the Havoc™

editions of our next generation lineup of Toro® TimeCutter® and

TITAN® zero turn riding mowers. In our professional segment, our

team drove significant production improvements for underground

construction equipment and golf and grounds solutions, as we

substantially increased output and capitalized on the sustained and

strong end market demand for these products. Our ability to execute

in these areas offset industry-wide dynamics affecting other parts

of our portfolio, including softness in markets tied to snow and

ice management, given the historic lack of snowfall last winter, as

well as homeowner markets tied to lawn care in our dealer channel.

Importantly, we made significant progress in reducing dealer field

inventories of lawn care products, driven by lower shipments,

coupled with retail sales growth. The momentum in sell-through year

over year demonstrates the strength of our brands and market

share.

“Moving to profitability, we successfully drove productivity and

net price benefits during the year, offsetting inflation and the

costs of adjusting production to meet quickly changing demand and

better serve our customers. In the fourth quarter, we enhanced

productivity and carefully controlled expenses. This helped offset

the impact of a higher proportion of lower-margin products in our

net sales than we anticipated, and enabled us to achieve adjusted

diluted EPS in line with our expectations.

”We were extremely pleased to deliver a substantial increase in

*free cash flow during fiscal 2024, to just over $470 million,

which equated to a *conversion rate of 112.4%. This significant

improvement supported the return of nearly $400 million to

shareholders, including an increase in our regular dividend payout

and about $250 million in share repurchases.”

OUTLOOK

“As we enter the new fiscal year, we have confidence in our

ability to deliver earnings growth, supported by the strength of

our diverse portfolio and talented team, along with the momentum we

have generated with our significant productivity initiative,”

continued Olson. “Our market leadership positions across our

portfolio remain strong, supported by our innovative product lineup

and best-in-class distribution networks. For our underground

construction, and golf and grounds businesses, we continue to have

elevated order backlog, and expect demand will remain robust.

Importantly, with our success in driving output, we expect order

backlog will be at or near normal levels by the end of the year.

For our lawn care and snow and ice management businesses, while

field inventories remain higher than ideal, we expect to be

positioned much better than last year as we head into the upcoming

turf season, along with the snow pre-season in the second half of

2025.

“While industry-wide macro and weather dynamics over the past

few years have played out differently than anticipated, our

business fundamentals remain strong. This is supported by our

innovation leadership, with a robust new product pipeline aligned

to market trends and designed to solve our customers’ most pressing

needs. We are excited about the upcoming retail launches of

autonomous products across our portfolio, including residential,

commercial, and golf applications. This includes the early 2025

rollout of our Toro® Haven™ robotic mower, Exmark® Turf Tracer®

with XiQ technology, and GeoLink® Solutions™ autonomous fairway

mower.

“We are well-positioned to capitalize on future growth

opportunities in our attractive end markets, while simultaneously

driving profitability improvement. Our significant productivity

initiative, named AMP, is off to a great start, and we remain on

track to deliver $100 million in run-rate cost savings by fiscal

2027. We intend to reinvest a portion of the savings from this

initiative, to drive further innovation and growth. We look forward

to the coming year with optimism, guided by our enterprise

strategic priorities of accelerating profitable growth, driving

productivity and operational excellence, and empowering

people.”

For fiscal 2025, management expects total company net sales

growth in the range of 0% to 1% and *adjusted diluted EPS in the

range of $4.25 to $4.40. The company's guidance is based on current

visibility and reflects:

- continued strong demand and stable supply for our underground

construction and golf and grounds businesses,

- a continuation of macro factors that have driven increased

consumer and channel caution,

- remaining adjustments needed to normalize field inventories of

lawn care products and snow and ice management solutions, and

- weather patterns aligned with historical averages.

This guidance does not include any policy or regulatory changes

that have not yet been enacted.

FOURTH-QUARTER FISCAL 2024 FINANCIAL

HIGHLIGHTS

Reported

Adjusted*

(dollars in millions, except per share

data)

F24 Q4

F23 Q4

% Change

F24 Q4

F23 Q4

% Change

Net Sales

$

1,076.0

$

983.2

9

%

$

1,076.0

$

983.2

9

%

Net Earnings

$

89.9

$

70.3

28

%

$

97.7

$

74.1

32

%

Diluted EPS

$

0.87

$

0.67

30

%

$

0.95

$

0.71

34

%

FULL-YEAR FISCAL 2024 FINANCIAL

HIGHLIGHTS

Reported

Adjusted*

(dollars in millions, except per share

data)

F24

F23

% Change

F24

F23

% Change

Net Sales

$

4,583.8

$

4,553.2

1

%

$

4,583.8

$

4,553.2

1

%

Net Earnings

$

418.9

$

329.7

27

%

$

435.2

$

443.5

(2

)%

Diluted EPS

$

4.01

$

3.13

28

%

$

4.17

$

4.21

(1

)%

SEGMENT RESULTS

Professional Segment

- Professional segment net sales for the fourth quarter were

$913.9 million, up 10.3% from $828.9 million in the same period

last year. The increase was primarily driven by higher shipments of

golf and grounds products and underground construction equipment,

along with net price realization, partially offset by lower

shipments of compact utility loaders and snow and ice management

products.

- Full-year fiscal 2024 professional segment net sales were $3.56

billion, down 3.2% from $3.67 billion last year. The decrease was

primarily due to lower shipments of lawn care equipment, snow and

ice management products, and compact utility loaders, partially

offset by higher shipments of golf and grounds products and

underground construction equipment.

- Professional segment earnings for the fourth quarter were

$169.7 million, up 36.3% from $124.5 million in the same period

last year, and when expressed as a percentage of net sales, 18.6%,

up from 15.0% in the prior-year period. The positive change was

primarily due to productivity improvements, net sales leverage, net

price realization, and product mix, partially offset by higher

material and manufacturing costs.

- Full-year fiscal 2024 professional segment earnings were $638.9

million, up 25.5% compared with $509.1 million in the prior fiscal

year, and when expressed as a percentage of net sales, 18.0%, up

from 13.9% last year. The change was primarily driven by non-cash

impairment charges in the prior year, productivity improvements,

and product mix, partially offset by higher material and

manufacturing costs and lower net sales volume.

Residential Segment

- Residential segment net sales for the fourth quarter were

$155.1 million, up 4.5% from $148.4 million in the same period last

year. The increase was primarily driven by higher shipments of lawn

care products to the company's mass channel, partially offset by

lower shipments of snow products and higher sales promotions.

- Full-year fiscal 2024 residential segment net sales were $998.3

million, up 16.9% from $854.2 million last year. The increase was

primarily due to higher shipments to the company's mass channel,

partially offset by lower shipments of snow products.

- Residential segment loss for the fourth quarter was $13.8

million, or 8.9% of net sales, compared to earnings of $4.5

million, or 3.0% of net sales, in the same period last year. The

change was primarily driven by higher material and freight costs,

higher warranty and marketing expense, and product mix, partially

offset by productivity improvements.

- Full-year fiscal 2024 residential segment earnings were $78.4

million, up 13.8% from $68.9 million in the prior fiscal year, and

when expressed as a percentage of net sales, 7.9%, compared to 8.1%

last year. The change was primarily driven by product mix and

higher material and manufacturing costs, partially offset by

productivity improvements and net sales leverage.

OPERATING RESULTS

Gross margin for the fourth quarter was 32.4%, compared with

33.5% for the same prior-year period. *Adjusted gross margin for

the fourth quarter was 32.3%, compared with 33.6% for the same

prior-year period. The decreases in reported and *adjusted gross

margin were primarily due to higher material, freight, and

manufacturing costs, partially offset by productivity

improvements.

For fiscal 2024, gross margin was 33.8%, compared to 34.6% for

fiscal 2023. *Adjusted gross margin for fiscal 2024 was 33.9%,

compared with 34.7% for fiscal 2023. The decreases in reported and

*adjusted gross margin were primarily driven by higher material and

manufacturing costs and product mix, partially offset by

productivity improvements.

SG&A expense as a percentage of net sales for the fourth

quarter was 22.3%, compared with 23.9% in the prior-year period.

The improvement was primarily driven by net sales leverage, lower

incentive compensation, and lower marketing costs, partially offset

by higher warranty expense.

For fiscal 2024, SG&A expense as a percentage of net sales

was 22.2%, compared with 21.8% for fiscal 2023. The change was

primarily due to higher corporate expenses, partially offset by

lower marketing costs.

Operating earnings as a percentage of net sales for the fourth

quarter were 10.1%, compared with 9.6% in the same prior-year

period. *Adjusted operating earnings as a percentage of net sales

for the fourth quarter were 10.9%, compared with 10.1% in the same

prior-year period.

For fiscal 2024, operating earnings as a percentage of net sales

were 11.6%, compared with 9.5% in fiscal 2023. *Adjusted operating

earnings as a percentage of net sales for fiscal 2024 were 12.2%,

compared with 12.9% for fiscal 2023.

Interest expense was down $0.4 million for the fourth quarter to

$14.5 million, primarily driven by lower average outstanding

borrowings and lower average interest rates. Interest expense was

up $3.2 million for the full year to $61.9 million, primarily

driven by higher average interest rates, partially offset by lower

average outstanding borrowings.

The reported and *adjusted effective tax rates for the fourth

quarter were 17.7% and 16.9%, respectively, compared with 19.1% and

19.3% in the same prior-year period. The decreases were primarily

due to a more favorable geographic mix of earnings.

For fiscal 2024, the reported effective tax rate was 18.3%,

compared with 17.7% in fiscal 2023. The increase was primarily due

to the impact of non-cash impairment charges in the prior year and

lower tax benefits recorded as excess tax deductions for stock

compensation in the current year, partially offset by a more

favorable geographic mix of earnings in the current year. The

*adjusted effective tax rate for fiscal 2024 was 18.8%, compared

with 20.4% in fiscal 2023. The year-over-year improvement was

primarily driven by a more favorable geographic mix of

earnings.

*Non-GAAP financial measure. Please refer to the “Use of

Non-GAAP Financial Information” for details regarding these

measures, as well as the tables provided for a reconciliation of

historical non-GAAP financial measures to the most comparable GAAP

measures.

LIVE CONFERENCE CALL December 18, 2024 at 10:00 a.m.

CST www.thetorocompany.com/invest

The Toro Company will conduct its earnings call and webcast for

investors beginning at 10:00 a.m. CST on December 18, 2024. The

webcast will be available at www.thetorocompany.com/invest. Webcast

participants will need to complete a brief registration form and

should allocate extra time before the webcast begins to register

and, if necessary, install audio software.

About The Toro Company

The Toro Company (NYSE: TTC) is a leading global provider of

solutions for the outdoor environment including turf and landscape

maintenance, snow and ice management, underground utility

construction, rental and specialty construction, and irrigation and

outdoor lighting solutions. With net sales of $4.6 billion in

fiscal 2024, The Toro Company’s global presence extends to more

than 125 countries through a family of brands that includes Toro,

Ditch Witch, Exmark, Spartan, BOSS, Ventrac, American Augers,

Trencor, Subsite, HammerHead, Radius, Perrot, Hayter, Unique

Lighting Systems, Irritrol, and Lawn-Boy. Through constant

innovation and caring relationships built on trust and integrity,

The Toro Company and its family of brands have built a legacy of

excellence by helping customers work on golf courses, sports

fields, construction sites, public green spaces, commercial and

residential properties and agricultural operations. For more

information, visit www.thetorocompany.com.

Use of Non-GAAP Financial Information

This press release and the related earnings call include certain

non-GAAP financial measures, which are not calculated or presented

in accordance with U.S. GAAP, as information supplemental and in

addition to the most directly comparable financial measures

calculated and presented in accordance with U.S. GAAP. The non-GAAP

financial measures included within this press release and the

related earnings call that are utilized as measures of operating

performance consist of gross profit, gross margin, operating

earnings, earnings before income taxes, net earnings, diluted EPS,

and the effective tax rate, each as adjusted. The non-GAAP

financial measures included within this press release and the

related earnings call that are utilized as measures of liquidity

consist of free cash flow and free cash flow conversion

percentage.

The Toro Company uses these non-GAAP financial measures in

making operating decisions and assessing liquidity because it

believes these non-GAAP financial measures provide meaningful

supplemental information regarding the company's core operational

performance and cash flows, as a measure of the company's

liquidity, and provide the company with a better understanding of

how to allocate resources to both ongoing and prospective business

initiatives. Additionally, these non-GAAP financial measures

facilitate the company's internal comparisons for both historical

operating results and competitors' operating results by factoring

out potential differences caused by charges and benefits not

related to the company's regular, ongoing business, including,

without limitation, certain non-cash, large, and/or unpredictable

charges and benefits; acquisitions and dispositions; legal

judgments, settlements, or other matters; and tax positions. The

company believes that these non-GAAP financial measures, when

considered in conjunction with the financial measures prepared in

accordance with U.S. GAAP, provide investors with useful

supplemental financial information to better understand its core

operational performance and cash flows.

Reconciliations of historical non-GAAP financial measures to the

most comparable U.S. GAAP financial measures are included in the

financial tables contained in this press release. These non-GAAP

financial measures, however, should not be considered superior to,

as a substitute for, or as an alternative to, and should be

considered in conjunction with, the U.S. GAAP financial measures

included within this press release and the company’s related

earnings call. These non-GAAP financial measures may differ from

similar measures used by other companies.

The Toro Company does not provide a quantitative reconciliation

of the company’s projected range for adjusted diluted EPS for

fiscal 2025 to diluted EPS, which is the most directly comparable

GAAP measure, in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The company’s

adjusted diluted EPS guidance for fiscal 2025 excludes certain

items that are inherently uncertain and difficult to predict,

including certain non-cash, large and/or unpredictable charges and

benefits; acquisitions and dispositions; legal judgments,

settlements, or other matters; and tax positions. Due to the

uncertainty of the amount or timing of these future excluded items,

management does not forecast them for internal use and therefore

cannot create a quantitative adjusted diluted EPS for fiscal 2025

to diluted EPS reconciliation without unreasonable efforts. A

quantitative reconciliation of adjusted diluted EPS for fiscal 2025

to diluted EPS would imply a degree of precision and certainty as

to these future items that does not exist and could be confusing to

investors. From a qualitative perspective, it is anticipated that

the differences between adjusted diluted EPS for fiscal 2025 to

diluted EPS will consist of items similar to those described in the

financial tables later in this release, including, for example and

without limitation, certain non-cash, large, and/or unpredictable

charges and benefits, such as impairment and restructuring charges;

acquisitions and dispositions; legal judgments, settlements, or

other matters; and tax positions. The timing and amount of any of

these excluded items could significantly impact the company’s

diluted EPS for a particular period.

Forward-Looking Statements

This news release contains forward-looking statements, which are

being made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are based on management’s current assumptions and

expectations of future events, and often can be identified by words

such as “expect,” “strive,” “looking ahead,” “outlook,” “guidance,”

“forecast,” “goal,” “optimistic,” “encourage,” “anticipate,”

“continue,” “plan,” “estimate,” “project,” “target,” “improve,”

“believe,” “become,” “should,” “could,” “will,” “would,”

“possible,” “promise,” “may,” “likely,” “intend,” “can,” “seek,”

“pursue,” “potential,” “pro forma,” variations of such words or the

negative thereof, and similar expressions or future dates.

Forward-looking statements involve risks and uncertainties that

could cause actual events and results to differ materially from

those projected or implied. Forward-looking statements in this

release include the company’s fiscal 2025 financial guidance,

expectations regarding demand trends, including incremental growth

from strategic partnership with Lowe’s and the success of new

products, supply chain stabilization and AMP, and other statements

made under the "Outlook" section of this release. Particular risks

and uncertainties that may affect the company’s operating results

or financial position or cause actual events and results to differ

materially from those projected or implied include: adverse

worldwide economic conditions, including inflationary pressures and

higher interest rates; the effect of abnormal weather patterns;

customer, government and municipal revenue, budget spending levels

and cash conservation efforts; loss of any substantial customer;

inventory adjustments or changes in purchasing patterns by

customers; fluctuations in the cost and availability of

commodities, components, parts, and accessories, including steel,

engines, hydraulics, and resins; disruption at or in proximity to

its facilities or in its manufacturing or other operations, or

those in its distribution channel customers, mass retailers or home

centers where its products are sold, or suppliers; risks associated

with acquisitions and dispositions, including the company's

acquisition of the Intimidator Group and possible additional future

impairment of goodwill or other intangible assets; impacts AMP and

any future restructuring activities or productivity or cost savings

initiatives; COVID-19 related factors, risks and challenges; the

effect of natural disasters, social unrest, war and global

pandemics; the level of growth or contraction in its key markets;

the company’s ability to develop and achieve market acceptance for

new products; increased competition; the risks attendant to

international relations, operations and markets; foreign currency

exchange rate fluctuations; financial viability of and/or

relationships with the company’s distribution channel partners;

management of strategic partnerships, key customer relationships,

alliances or joint ventures, including Red Iron Acceptance, LLC;

impact of laws, regulations and standards, consumer product safety,

accounting, taxation, trade, tariffs and/or antidumping and

countervailing duties petitions, healthcare, and environmental,

health and safety matters; unforeseen product quality problems;

loss of or changes in executive management or key employees; the

occurrence of litigation or claims, including those involving

intellectual property or product liability matters; impact of

increased scrutiny on its environmental, social, and governance

practices; and other risks and uncertainties described in the

company’s most recent annual report on Form 10-K, subsequent

quarterly reports on Form 10-Q and other filings with the

Securities and Exchange Commission. The company makes no commitment

to revise or update any forward-looking statements in order to

reflect events or circumstances occurring or existing after the

date any forward-looking statement is made.

(Financial tables follow)

THE TORO COMPANY AND

SUBSIDIARIES

Condensed Consolidated

Statements of Earnings (Unaudited)

(Dollars and shares in

millions, except per-share data)

Three Months Ended

Twelve Months Ended

October 31, 2024

October 31, 2023

October 31, 2024

October 31, 2023

Net sales

$

1,076.0

$

983.2

$

4,583.8

$

4,553.2

Cost of sales

727.0

653.6

3,034.5

2,975.6

Gross profit

349.0

329.6

1,549.3

1,577.6

Gross margin

32.4

%

33.5

%

33.8

%

34.6

%

Selling, general and administrative

expense

240.0

235.1

1,016.0

995.6

Non-cash impairment charges

—

—

—

151.3

Operating earnings

109.0

94.5

533.3

430.7

Interest expense

(14.5

)

(14.9

)

(61.9

)

(58.7

)

Other income, net

14.8

7.3

41.4

28.5

Earnings before income taxes

109.3

86.9

512.8

400.5

Provision for income taxes

19.4

16.6

93.9

70.8

Net earnings

$

89.9

$

70.3

$

418.9

$

329.7

Basic net earnings per share of common

stock

$

0.88

$

0.67

$

4.04

$

3.16

Diluted net earnings per share of common

stock

$

0.87

$

0.67

$

4.01

$

3.13

Weighted-average number of shares of

common stock outstanding — Basic

102.7

104.2

103.8

104.4

Weighted-average number of shares of

common stock outstanding — Diluted

103.2

104.9

104.4

105.3

Segment Data

(Unaudited)

(Dollars in millions)

Three Months Ended

Twelve Months Ended

Segment net sales

October 31, 2024

October 31, 2023

October 31, 2024

October 31, 2023

Professional

$

913.9

$

828.9

$

3,556.9

$

3,674.6

Residential

155.1

148.4

998.3

854.2

Other

7.0

5.9

28.6

24.4

Total net sales*

$

1,076.0

$

983.2

$

4,583.8

$

4,553.2

*Includes international net sales of:

$

231.6

$

191.0

$

923.0

$

947.7

Three Months Ended

Twelve Months Ended

Segment earnings (loss) before income

taxes

October 31, 2024

October 31, 2023

October 31, 2024

October 31, 2023

Professional

$

169.7

$

124.5

$

638.9

$

509.1

Residential

(13.8

)

4.5

78.4

68.9

Other

(46.6

)

(42.1

)

(204.5

)

(177.5

)

Total segment earnings before income

taxes

$

109.3

$

86.9

$

512.8

$

400.5

THE TORO COMPANY AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets (Unaudited)

(Dollars in millions)

October 31, 2024

October 31, 2023

ASSETS

Cash and cash equivalents

$

199.5

$

193.1

Receivables, net

459.7

407.4

Inventories, net

1,038.9

1,087.8

Prepaid expenses and other current

assets

66.8

110.5

Total current assets

1,764.9

1,798.8

Property, plant, and equipment, net

644.8

641.7

Goodwill

450.3

450.8

Other intangible assets, net

498.7

540.1

Right-of-use assets

114.5

125.3

Investment in finance affiliate

49.2

50.6

Deferred income taxes

45.0

14.2

Other assets

15.4

22.8

Total assets

$

3,582.8

$

3,644.3

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current portion of long-term debt

$

10.0

$

—

Accounts payable

452.7

430.0

Accrued liabilities

493.0

499.1

Short-term lease liabilities

20.3

19.5

Total current liabilities

976.0

948.6

Long-term debt

911.8

1,031.5

Long-term lease liabilities

99.1

112.1

Deferred income taxes

0.5

0.4

Other long-term liabilities

43.5

40.8

Stockholders’ equity:

Preferred stock

—

—

Common stock

101.5

103.8

Retained earnings

1,496.4

1,444.1

Accumulated other comprehensive loss

(46.0

)

(37.0

)

Total stockholders’ equity

1,551.9

1,510.9

Total liabilities and stockholders’

equity

$

3,582.8

$

3,644.3

THE TORO COMPANY AND

SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(Dollars in millions)

Twelve Months Ended

October 31, 2024

October 31, 2023

Cash flows from operating activities:

Net earnings

$

418.9

$

329.7

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Non-cash income from finance affiliate

(20.8

)

(19.2

)

Distributions from finance affiliate,

net

22.2

7.9

Depreciation of property, plant, and

equipment

93.7

83.5

Amortization of other intangible

assets

34.5

35.7

Stock-based compensation expense

23.0

19.4

Deferred income taxes

(27.9

)

(47.9

)

Non-cash impairment charges

—

151.3

Other

(2.9

)

(0.2

)

Changes in operating assets and

liabilities, net of the effect of acquisitions:

Receivables, net

(53.1

)

(71.6

)

Inventories, net

27.5

(26.7

)

Other assets

19.9

17.8

Accounts payable

24.3

(149.9

)

Other liabilities

10.6

(23.0

)

Net cash provided by operating

activities

569.9

306.8

Cash flows from investing activities:

Purchases of property, plant, and

equipment

(103.5

)

(149.5

)

Proceeds from insurance claim

4.3

7.1

Business combination

—

(21.0

)

Asset acquisition

(0.8

)

—

Proceeds from asset disposals

0.3

0.4

Proceeds from divestitures

40.0

5.3

Net cash used in investing activities

(59.7

)

(157.7

)

Cash flows from financing activities:

Net (repayments) borrowings under the

revolving credit facility

(40.0

)

40.0

Long-term debt repayments

(70.0

)

—

Proceeds from exercise of stock

options

9.1

19.7

Payments of withholding taxes for stock

awards

(3.9

)

(3.8

)

Purchases of TTC common stock

(245.5

)

(60.0

)

Dividends paid on TTC common stock

(149.5

)

(141.9

)

Other

(5.3

)

(1.5

)

Net cash used in financing activities

(505.1

)

(147.5

)

Effect of exchange rates on cash and cash

equivalents

1.3

3.3

Net increase in cash and cash

equivalents

6.4

4.9

Cash and cash equivalents as of the

beginning of the fiscal period

193.1

188.2

Cash and cash equivalents as of the end of

the fiscal period

$

199.5

$

193.1

THE TORO COMPANY AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures (Unaudited)

(Dollars in millions, except per-share data)

The following table provides a reconciliation of the non-GAAP

financial performance measures used in this press release and the

related earnings call to the most directly comparable measures

calculated and reported in accordance with U.S. GAAP for the three

and twelve month periods ended October 31, 2024 and October 31,

2023:

Three Months Ended

Twelve Months Ended

October 31, 2024

October 31, 2023

October 31, 2024

October 31, 2023

Gross profit

$

349.0

$

329.6

$

1,549.3

$

1,577.6

Acquisition-related costs1

—

—

—

0.2

Restructuring charges2

—

1.2

—

1.2

Productivity initiative3

(1.2

)

—

5.7

—

Adjusted gross profit

$

347.8

$

330.8

$

1,555.0

$

1,579.0

Gross margin

32.4

%

33.5

%

33.8

%

34.6

%

Restructuring charges2

—

%

0.1

%

—

%

0.1

%

Productivity initiative3

(0.1

)%

—

%

0.1

%

—

%

Adjusted gross margin

32.3

%

33.6

%

33.9

%

34.7

%

Operating earnings

$

109.0

$

94.5

$

533.3

$

430.7

Acquisition-related costs1

—

—

—

0.4

Restructuring charges2

—

5.0

—

5.0

Productivity initiative3

8.0

—

27.2

—

Non-cash impairment charges4

—

—

—

151.3

Adjusted operating earnings

$

117.0

$

99.5

$

560.5

$

587.4

Operating earnings margin

10.1

%

9.6

%

11.6

%

9.5

%

Restructuring charges2

—

%

0.5

%

—

%

0.1

%

Productivity initiative3

0.8

%

—

%

0.6

%

—

%

Non-cash impairment charges4

—

%

—

%

—

%

3.3

%

Adjusted operating earnings margin

10.9

%

10.1

%

12.2

%

12.9

%

Earnings before income taxes

$

109.3

$

86.9

$

512.8

$

400.5

Acquisition-related costs1

—

—

—

0.4

Restructuring charges2

—

5.0

—

5.0

Productivity initiative3

8.2

—

23.1

—

Non-cash impairment charges4

—

—

—

151.3

Adjusted earnings before income taxes

$

117.5

$

91.9

$

535.9

$

557.2

Income tax provision

$

19.4

$

16.6

$

93.9

$

70.8

Restructuring charges2

—

1.1

—

1.1

Productivity initiative3

0.4

—

3.3

—

Non-cash impairment charges4

—

—

—

36.7

Tax impact of stock-based

compensation5

—

0.1

3.5

5.1

Adjusted income tax provision

$

19.8

$

17.8

$

100.7

$

113.7

Net earnings

$

89.9

$

70.3

$

418.9

$

329.7

Acquisition-related costs1

—

—

—

0.4

Restructuring charges2

—

3.9

—

3.9

Productivity initiative3

7.8

—

19.8

—

Non-cash impairment charges4

—

—

—

114.6

Tax impact of stock-based

compensation5

—

(0.1

)

(3.5

)

(5.1

)

Adjusted net earnings

$

97.7

$

74.1

$

435.2

$

443.5

Diluted EPS

$

0.87

$

0.67

$

4.01

$

3.13

Restructuring charges2

—

0.04

—

0.04

Productivity initiative3

0.08

—

0.19

—

Non-cash impairment charges4

—

—

—

1.09

Tax impact of stock-based

compensation5

—

—

(0.03

)

(0.05

)

Adjusted diluted EPS

$

0.95

$

0.71

$

4.17

$

4.21

Effective tax rate

17.7

%

19.1

%

18.3

%

17.7

%

Restructuring charges2

—

%

0.1

%

—

%

—

%

Productivity initiative3

(0.9

)%

—

%

(0.2

)%

—

%

Non-cash impairment charges4

—

%

—

%

—

%

1.5

%

Tax impact of stock-based

compensation5

0.1

%

0.1

%

0.7

%

1.2

%

Adjusted effective tax rate

16.9

%

19.3

%

18.8

%

20.4

%

1

On January 13, 2022, the company completed

the acquisition of Intimidator Group. Acquisition-related costs for

the fiscal year ended October 31, 2023 represent integration costs

incurred in connection with the acquisition.

2

In the fourth quarter of fiscal 2023, the

company initiated a restructuring program which was completed in

the first quarter of fiscal 2024. The restructuring charges

associated with the program for three and twelve month periods

ended October 31, 2023 represent accrued severance, termination

benefits, and other exit-related expenses.

3

In the first quarter of fiscal 2024, the

company launched a significant productivity initiative named AMP.

Productivity initiative charges for the three and twelve month

periods ended October 31, 2024 represent asset write-offs,

third-party consulting costs, product-line exit costs, and

compensation for fully-dedicated AMP personal, partially offset by

a gain on divestiture.

4

At the end of the third quarter of fiscal

2023, the company recorded non-cash impairment charges within its

Professional reportable segment.

5

The accounting standards codification

guidance governing employee stock-based compensation requires that

any excess tax deduction for stock-based compensation be

immediately recorded within income tax expense. Employee

stock-based compensation activity, including the exercise of stock

options, can be unpredictable and can significantly impact net

earnings, net earnings per diluted share, and effective tax rate.

These amounts represent the discrete tax benefits recorded as

excess tax deductions for stock-based compensation during the three

and twelve month periods ended October 31, 2024 and October 31,

2023.

Reconciliation of Non-GAAP Liquidity Measures

The company defines free cash flow as net cash provided by

operating activities less purchases of property, plant, and

equipment, net of proceeds from insurance claim. Free cash flow

conversion percentage represents free cash flow as a percentage of

net earnings. The company considers free cash flow and free cash

flow conversion percentage to be non-GAAP liquidity measures that

provide useful information to management and investors about the

company's ability to convert net earnings into cash resources that

can be used to pursue opportunities to enhance shareholder value,

fund ongoing and prospective business initiatives, and strengthen

the company's Consolidated Balance Sheets, after reinvesting in

necessary capital expenditures required to maintain and grow the

company's business.

The following table provides a reconciliation of non-GAAP free

cash flow and free cash flow conversion percentage to net cash

provided by operating activities, which is the most directly

comparable financial measure calculated and reported in accordance

with U.S. GAAP for the twelve month periods ended October 31, 2024

and October 31, 2023:

Twelve Months Ended

(Dollars in millions)

October 31, 2024

October 31, 2023

Net cash provided by operating

activities

$

569.9

$

306.8

Less: Purchases of property, plant, and

equipment, net of proceeds from insurance claim

99.2

142.4

Free cash flow

470.7

164.4

Net earnings

$

418.9

$

329.7

Free cash flow conversion percentage

112.4

%

49.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218618179/en/

Investor Relations Jeremy Steffan Director, Investor

Relations (952) 887-7962, jeremy.steffan@toro.com

Media Relations Branden Happel Senior Manager, Public

Relations (952) 887-8930, branden.happel@toro.com

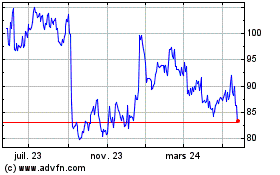

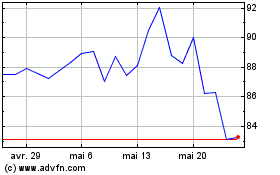

Toro (NYSE:TTC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Toro (NYSE:TTC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024