Liberty All-Star® Equity Fund

Period Ended March 31, 2024 (Unaudited)

| Fund Statistics |

|

| Net Asset Value (NAV) |

$7.21 |

| Market Price |

$7.15 |

| Discount |

-0.8% |

| |

|

| |

1st Quarter 2024 |

| Distribution* |

$0.17 |

| Market Price Trading Range |

$6.26 to $7.16 |

| Discount Range |

-0.1% to -5.8% |

| |

|

| Performance |

|

| Shares Valued at NAV with Dividends Reinvested |

9.56% |

| Shares Valued at Market Price with Dividends Reinvested |

14.95% |

| Dow Jones Industrial Average |

6.14% |

| Lipper Large-Cap Core Mutual Fund Average |

10.77% |

| NASDAQ Composite Index |

9.31% |

| S&P 500® Index |

10.56% |

| * | Sources of distributions to shareholders may include ordinary dividends, long-term capital gains and return

of capital. The final determination of the source of all distributions in 2024 for tax reporting purposes will be made after year end.

The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during

its fiscal year and may be subject to changes based on tax regulations. Based on current estimates a portion of the distribution consists

of a return of capital. Pursuant to Section 852 of the Internal Revenue Code, the taxability of this distribution will be reported on

Form 1099-DIV for 2024. |

Performance returns for the Fund are total returns,

which include dividends. Returns are net of management fees and other Fund expenses. The return shown for the Lipper Large-Cap Core Mutual

Fund Average is based on open-end mutual funds’ total returns, which include dividends, and are net of fund expenses. Returns for

the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index and the S&P 500®Index are total returns, including dividends.

A description of the Lipper benchmark and the market indices can be found on page 19.

Past performance cannot predict future results.

Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance

information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment

in the Fund involves risk, including loss of principal. Closed-end funds raise money in an initial public offering and shares are listed

and traded on an exchange. Open-end mutual funds continuously issue and redeem shares at net asset value. Shares of closed-end funds frequently

trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are

beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

The views expressed in the President’s

letter reflect the views of the President as of April 2024 and may not reflect his views on the date this report is first published or

anytime thereafter. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions

that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are

subject to change at any time based upon economic, market or other conditions and the Fund disclaims any responsibility to update

such views. These views may not be relied on as investment advice and, because investment decisions for the Fund are based on

numerous factors, may not be relied on as an indication of trading intent.

| Liberty All-Star® Equity Fund |

President’s Letter |

| |

(Unaudited) |

| Fellow Shareholders: |

April 2024 |

Cooling inflation, broad-based economic strength

and corporate earnings that generally topped expectations—boosted by investor enthusiasm for artificial intelligence (AI)—propelled

stocks to record highs in the first quarter of 2024. The period was also the S&P 500® Index’s best opening three months

since 2019.

Posting 22 record highs during the quarter, the

S&P 500® Index returned 10.56 percent. The Dow Jones Industrial Average (DJIA) also rose to new heights, surpassing the 39000

level and returning 6.14 percent. Likewise, the NASDAQ Composite posted multiple new highs during the period and returned 9.31 percent.

One—and perhaps the only—significant

counterweight to the market’s momentum was the Federal Reserve’s stance on interest rates. As data showed inflation stable

but not approaching the Fed’s target 2.0 percent annual rate, policy makers left short-term interest rates unchanged over the quarter.

After the Fed’s March meeting Chair Jerome Powell said the Fed still projected three rate cuts in 2024, but only if warranted by

data. Markets reacted positively, as investors came to believe that the Fed would start trimming rates in June.

The economy built on 2023’s momentum. Reported

in January, 4Q23 GDP exceeded forecasts by coming in at a 3.3 percent annual rate (later revised to 3.4 percent). For full-year 2023,

the economy expanded at a 2.5 percent rate. Although disappointed that rate reductions by the Fed would not be forthcoming as early as

hoped, some investors felt that inflation could remain above target as long as U.S. economic growth held. A sample of other data reported

during the first quarter highlights the overall strength of the economy:

| · | The U.S. added 256,000 jobs in January and 270,000 in February, exceeding most estimates. (After the quarter

closed, data showed that the U.S. added 303,000 jobs in March, 50 percent above estimates.) |

| · | Real consumer spending rose a robust 0.4 percent in February versus an estimate of 0.1 percent. |

| · | Existing home sales jumped 9.5 percent in February compared to the previous month, reaching the fastest

pace in a year while the median sales price reached an all-time high for the month. |

| · | Consumer confidence, as measured by the University of Michigan consumer sentiment survey, climbed to the

highest level since July 2021. |

Stocks actually got off to a sluggish start for

the year, falling over the first few trading sessions. The pause was attributed to profit-taking after the strong run-up in November and

December and a back-up in interest rates as investors came to believe a Fed rate reduction was not imminent.

Optimism prevailed, however, as the S&P 500®

closed January with a gain of 1.68 percent. Technology stocks resumed market leadership and, as noted, corporate earnings reports were

strong. NVIDIA, the acknowledged leader in graphics chips for the AI market, capped earnings season with its February 21 report of soaring

sales and profits and an optimistic outlook. The stock gained 82.46 percent for the quarter and was the top performer in the S&P 500®.

February was the strongest month of the quarter for the index, returning 5.34 percent.

At the same time, however, some stocks in the

“Magnificent Seven” were not as impregnable as in previous quarters. Apple and Tesla both declined and Alphabet encountered

a difficult stretch at mid-quarter. Still, the other four stocks (Amazon, Meta Platforms, Microsoft and NVIDIA) accounted for more than

46 percent of the S&P 500® Index’s first quarter return.

| First Quarter Report (Unaudited) | March 31, 2024 |

1 |

| Liberty All-Star® Equity Fund |

President’s Letter |

| |

(Unaudited) |

Growth stocks outperformed their value counterparts

during the first quarter. The broad market Russell 3000® Growth Index returned 11.23 percent versus 8.62 percent for the corresponding

value index. While this continued the growth-over-value performance seen in 2023, the gap between the two styles’ performance narrowed

for the quarter.

Liberty All-Star® Equity Fund

Liberty All-Star® Equity Fund posted strong

results for the first quarter, returning 9.56 percent when shares are valued at net asset value (NAV) with dividends reinvested and 14.95

percent when shares are valued at market price with dividends reinvested. (Fund returns are net of expenses.)

The NAV return was modestly lower than that of

the Fund’s primary benchmark, the Lipper Large-Cap Core Mutual Fund Average, which returned 10.77 percent, as well as the 10.56

percent return of the S&P 500®. The NAV return was well ahead of the DJIA’s return and slightly higher than the NASDAQ Composite.

When measured by market price, the Fund’s 14.95 percent return exceeded all relevant indices in a range of roughly four to almost

nine percentage points.

Coming off a good fourth quarter, the Fund maintained

its momentum entering 2024. The market held onto the greater breadth seen in 4Q23 and the Fund benefited from its greater diversification.

For the quarter five of 11 S&P sectors outperformed the index return—two more than in full-year 2023. As noted, the gap of growth

stocks outperforming value stocks was more muted in the quarter, which also helped the Fund. Underweight allocations to communication

services and information technology detracted from the Fund’s return, but an overweight to financials helped.

During the first quarter the discount range at

which Fund shares traded relative to their underlying NAV narrowed to -0.1 percent to -5.8 percent, ending the quarter at -0.8 percent.

The discount last quarter ended at -5.5 percent, with shares trading in a range of 0.7 percent to -6.3 percent.

In accordance with the Fund’s distribution

policy, the Fund paid a distribution of $0.17 per share in the first quarter. The Fund’s distribution policy has been in place since

1988 and is a major component of the Fund’s total return. The Fund has paid distributions of $30.46 per share for a total of more

than $3.6 billion since 1987 (the Fund’s first full calendar year of operations). We continue to emphasize that shareholders should

include these distributions when determining the total return on their investment in the Fund.

We are gratified with Fund performance in the

first quarter, especially the strong market price return of almost 15 percent. The broader market was a positive contributor for our well-diversified

Fund as history shows that the Fund usually outperforms in the kind of broader market environment that we have experienced over the past

two quarters. Thus, going forward we will hope for a market in which more stocks participate but we do so with the confidence of knowing

that the Fund has performed well over many years and under many market conditions.

Sincerely,

Mark T. Haley, CFA

President

Liberty All-Star® Equity Fund

| |

Table of Distributions, |

| Liberty All-Star® Equity Fund |

Rights Offerings and Tax Credits |

| |

(Unaudited) |

| |

|

Rights Offerings |

|

| Year

| Per Share

Distributions | Month Completed |

Shares Needed to Purchase One Additional Share |

Subscription Price |

Tax Credits1 |

|

|

|

|

|

|

| 1987 |

$1.18 |

|

|

|

|

| 1988 |

0.64 |

|

|

|

|

| 1989 |

0.95 |

|

|

|

|

| 1990 |

0.90 |

|

|

|

|

| 1991 |

1.02 |

|

|

|

|

| 1992 |

1.07 |

April |

10 |

$10.05 |

|

| 1993 |

1.07 |

October |

15 |

10.41 |

$0.18 |

| 1994 |

1.00 |

September |

15 |

9.14 |

|

| 1995 |

1.04 |

|

|

|

|

| 1996 |

1.18 |

|

|

|

0.13 |

| 1997 |

1.33 |

|

|

|

0.36 |

| 1998 |

1.40 |

April |

20 |

12.83 |

|

| 1999 |

1.39 |

|

|

|

|

| 2000 |

1.42 |

|

|

|

|

| 2001 |

1.20 |

|

|

|

|

| 2002 |

0.88 |

May |

10 |

8.99 |

|

| 2003 |

0.78 |

|

|

|

|

| 2004 |

0.89 |

July |

102 |

8.34 |

|

| 2005 |

0.87 |

|

|

|

|

| 2006 |

0.88 |

|

|

|

|

| 2007 |

0.90 |

December |

10 |

6.51 |

|

| 2008 |

0.65 |

|

|

|

|

| 20093 |

0.31 |

|

|

|

|

| 2010 |

0.31 |

|

|

|

|

| 2011 |

0.34 |

|

|

|

|

| 2012 |

0.32 |

|

|

|

|

| 2013 |

0.35 |

|

|

|

|

| 2014 |

0.39 |

|

|

|

|

| 20154 |

0.51 |

|

|

|

|

| 2016 |

0.48 |

|

|

|

|

| 20175 |

0.56 |

|

|

|

|

| 2018 |

0.68 |

|

|

|

|

| 2019 |

0.66 |

|

|

|

|

| 2020 |

0.63 |

|

|

|

|

| 2021 |

0.81 |

November |

102 |

7.78 |

|

| 2022 |

0.69 |

|

|

|

|

| 2023 |

0.61 |

|

|

|

|

| 2024 |

|

|

|

|

|

| 1st Quarter |

0.17 |

|

|

|

|

| Total |

$30.46 |

|

|

|

|

| 1 | The Fund’s net investment income and net realized capital gains exceeded the amount to be distributed

under the Fund’s distribution policy. In each case, the Fund elected to pay taxes on the undistributed income and passed through

a proportionate tax credit to shareholders. |

| 2 | The number of shares offered was increased by an additional 25 percent to cover a portion of the over-subscription

requests. |

| 3 | Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent

to 6 percent. |

| 4 | Effective with the second quarter distribution, the annual distribution rate was changed from 6 percent

to 8 percent. |

| 5 | Effective with the fourth quarter distribution, the annual distribution rate was changed from 8 percent

to 10 percent. |

| First Quarter Report (Unaudited) | March 31, 2024 |

3 |

| |

Stock Changes in the Quarter |

| Liberty All-Star® Equity Fund |

and Distribution Policy |

| |

(Unaudited) |

The following are the largest ($5 million or more)

stock changes - both purchases and sales - that were made in the Fund’s portfolio during the first quarter of 2024.

| |

Shares |

| Security Name |

Purchases (Sales) |

Held as of 3/31/24 |

| Purchases |

|

|

| CVS Health Corp. |

142,888 |

142,888 |

| Dollar General Corp. |

66,338 |

146,080 |

| Humana, Inc. |

22,064 |

22,064 |

| Lowe's Companies, Inc. |

35,328 |

35,328 |

| Meta Platforms, Inc. |

25,947 |

25,947 |

| Pfizer, Inc. |

249,181 |

325,633 |

| Quest Diagnostics, Inc. |

88,899 |

88,899 |

| TotalEnergies SE |

129,992 |

129,992 |

| Waste Management, Inc. |

40,784 |

40,784 |

| |

|

|

| Sales |

|

|

| Cardinal Health, Inc. |

(52,166) |

0 |

| General Electric Co. |

(41,112) |

0 |

| Micron Technology, Inc. |

(64,524) |

132,941 |

| NVIDIA Corp. |

(16,541) |

67,151 |

| Phillips 66 |

(61,100) |

0 |

| SAP SE |

(60,559) |

0 |

| SYSCO Corp. |

(94,500) |

147,191 |

| Wabtec Corp. |

(59,018) |

26,645 |

DISTRIBUTION POLICY

The current policy is to pay distributions on

its shares totaling approximately 10 percent of its net asset value per year, payable in four quarterly installments of 2.5 percent of

the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Sources

of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The final determination

of the source of all distributions in 2024 for tax reporting purposes will be made after year end. The actual amounts and sources of the

amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and

may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides

a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization

(for the full year’s distributions) contained in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary

dividends and long-term capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion,

retain and not distribute capital gains and pay income tax thereon to the extent of such excess.

| Liberty All-Star® Equity Fund |

Top 20 Holdings & Economic Sectors |

| |

March 31, 2024 (Unaudited) |

| Top 20 Holdings* |

Percent of Net Assets |

| Microsoft Corp. |

3.80% |

| NVIDIA Corp. |

3.01 |

| Alphabet, Inc. |

2.98 |

| Amazon.com, Inc. |

2.66 |

| UnitedHealth Group, Inc. |

2.00 |

| Visa, Inc. |

1.94 |

| ServiceNow, Inc. |

1.76 |

| S&P Global, Inc. |

1.33 |

| Charles Schwab Corp. |

1.33 |

| Salesforce, Inc. |

1.28 |

| Danaher Corp. |

1.27 |

| Capital One Financial Corp. |

1.24 |

| Sony Group Corp. |

1.14 |

| Ecolab, Inc. |

1.14 |

| Dollar General Corp. |

1.13 |

| Ferguson PLC |

1.11 |

| Autodesk, Inc. |

1.08 |

| Adobe, Inc. |

1.02 |

| Berkshire Hathaway, Inc. |

0.98 |

| Citigroup, Inc. |

0.92 |

| |

33.12% |

| Economic Sectors* |

Percent of Net Assets |

| Financials |

20.89% |

| Information Technology |

20.62 |

| Health Care |

14.02 |

| Consumer Discretionary |

12.20 |

| Industrials |

8.07 |

| Communication Services |

6.02 |

| Materials |

5.69 |

| Consumer Staples |

5.20 |

| Energy |

1.96 |

| Real Estate |

1.45 |

| Utilities |

1.26 |

| Other Net Assets |

2.62 |

| |

100.00% |

| * | Because the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities

of the indicated issuers and sectors in the future. |

| First Quarter Report (Unaudited) | March 31, 2024 |

5 |

| |

Investment Managers/ |

| Liberty All-Star® Equity Fund |

Portfolio Characteristics |

| |

(Unaudited) |

THE FUND’S ASSETS ARE APPROXIMATELY EQUALLY

DISTRIBUTED AMONG THREE

VALUE MANAGERS AND TWO GROWTH MANAGERS:

ALPS Advisors, Inc., the investment advisor to

the Fund, has the ultimate authority (subject to oversight by the Board of Trustees) to oversee the investment managers and recommend

their hiring, termination and replacement.

MANAGERS’ DIFFERING INVESTMENT STRATEGIES

ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a

regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of a multi-managed portfolio.

The characteristics are different for each of the Fund’s five investment managers. These differences are a reflection of the fact

that each pursues a different investment style. The shaded column highlights the characteristics of the Fund as a whole, while the final

column shows portfolio characteristics for the S&P 500® Index.

PORTFOLIO CHARACTERISTICS As

of March 31, 2024 (Unaudited)

| |

Investment Style Spectrum |

|

|

| |

Value |

|

|

|

Growth |

|

|

| |

|

|

|

| |

PZENA |

FIDUCIARY |

ARISTOTLE |

SUSTAINABLE |

TCW |

TOTAL FUND |

S&P 500®

INDEX |

| Number of Holdings |

37 |

30 |

43 |

29 |

30 |

148* |

503 |

| Percent of Holdings in Top 10 |

40% |

48% |

34% |

45% |

57% |

22% |

32% |

| Weighted Average Market Capitalization

(billions) |

$85 |

$222 |

$240 |

$623 |

$933 |

$428 |

$809 |

| Average Five-Year Earnings Per Share

Growth |

7% |

9% |

11% |

16% |

18% |

12% |

15% |

| Dividend Yield |

2.5% |

1.2% |

1.7% |

0.7% |

0.4% |

1.3% |

1.4% |

| Price/Earnings Ratio** |

16x |

22x |

23x |

37x |

45x |

26x |

27x |

| Price/Book Value Ratio |

1.6x |

3.7x |

3.3x |

7.2x |

7.1x |

3.4x |

4.5x |

| * | Certain holdings are held by more than one manager. |

| ** | Excludes negative earnings. |

|

Liberty All-Star®

Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (97.38%) | |

| | |

| |

| COMMUNICATION SERVICES (6.02%) | |

| | |

| |

| Entertainment (0.96%) | |

| | | |

| | |

| Netflix, Inc.(a) | |

| 20,352 | | |

$ | 12,360,380 | |

| Walt Disney Co. | |

| 56,586 | | |

| 6,923,863 | |

| | |

| | | |

| 19,284,243 | |

| Interactive Media & Services (3.60%) | |

| | | |

| | |

| Alphabet, Inc., Class A(a) | |

| 134,470 | | |

| 20,295,557 | |

| Alphabet, Inc., Class C(a) | |

| 260,384 | | |

| 39,646,068 | |

| Meta Platforms, Inc., Class A | |

| 25,947 | | |

| 12,599,344 | |

| | |

| | | |

| 72,540,969 | |

| Media (1.46%) | |

| | | |

| | |

| Charter Communications, Inc., Class A(a) | |

| 37,324 | | |

| 10,847,474 | |

| Omnicom Group, Inc. | |

| 115,075 | | |

| 11,134,657 | |

| Trade Desk, Inc., Class A(a) | |

| 86,065 | | |

| 7,523,803 | |

| | |

| | | |

| 29,505,934 | |

| CONSUMER DISCRETIONARY (12.20%) | |

| | | |

| | |

| Automobile Components (1.72%) | |

| | | |

| | |

| Cie Generale des Etablissements Michelin SCA(b)(c) | |

| 420,100 | | |

| 8,049,116 | |

| Lear Corp. | |

| 109,726 | | |

| 15,897,103 | |

| Magna International, Inc., Class A(c) | |

| 194,419 | | |

| 10,591,947 | |

| | |

| | | |

| 34,538,166 | |

| Broadline Retail (2.66%) | |

| | | |

| | |

| Amazon.com, Inc.(a) | |

| 296,893 | | |

| 53,553,559 | |

| | |

| | | |

| | |

| Entertainment (1.14%) | |

| | | |

| | |

| Sony Group Corp.(b)(c) | |

| 268,330 | | |

| 23,006,614 | |

| | |

| | | |

| | |

| Hotels, Restaurants & Leisure (2.04%) | |

| | | |

| | |

| Booking Holdings, Inc. | |

| 4,573 | | |

| 16,590,295 | |

| Starbucks Corp. | |

| 122,436 | | |

| 11,189,426 | |

| Yum! Brands, Inc. | |

| 96,347 | | |

| 13,358,512 | |

| | |

| | | |

| 41,138,233 | |

| Household Durables (1.07%) | |

| | | |

| | |

| Lennar Corp., Class A | |

| 89,000 | | |

| 15,306,220 | |

| Newell Brands, Inc. | |

| 783,352 | | |

| 6,290,317 | |

| | |

| | | |

| 21,596,537 | |

| Specialty Retail (2.68%) | |

| | | |

| | |

| CarMax, Inc.(a) | |

| 189,238 | | |

| 16,484,522 | |

| Home Depot, Inc. | |

| 24,975 | | |

| 9,580,410 | |

| Lowe's Cos., Inc. | |

| 35,328 | | |

| 8,999,101 | |

| O'Reilly Automotive, Inc.(a) | |

| 6,393 | | |

| 7,216,930 | |

| See Notes to Schedule of Investments. |

|

| First Quarter Report (Unaudited) | March 31, 2024 |

7 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | |

| |

| Specialty Retail (continued) | |

| | |

| |

| TJX Cos., Inc. | |

| 48,411 | | |

$ | 4,909,844 | |

| Ulta Beauty, Inc. | |

| 12,955 | | |

| 6,773,910 | |

| | |

| | | |

| 53,964,717 | |

| Textiles, Apparel & Luxury Goods (0.89%) | |

| | | |

| | |

| Gildan Activewear, Inc. | |

| 156,730 | | |

| 5,819,385 | |

| NIKE, Inc., Class B | |

| 44,034 | | |

| 4,138,316 | |

| PVH Corp. | |

| 56,548 | | |

| 7,951,214 | |

| | |

| | | |

| 17,908,915 | |

| CONSUMER STAPLES (5.20%) | |

| | | |

| | |

| Beverages (0.79%) | |

| | | |

| | |

| Coca-Cola Co. | |

| 141,100 | | |

| 8,632,498 | |

| Constellation Brands, Inc., Class A | |

| 26,700 | | |

| 7,255,992 | |

| | |

| | | |

| 15,888,490 | |

| Consumer Staples Distribution & Retail (1.76%) | |

| | | |

| | |

| Costco Wholesale Corp. | |

| 18,413 | | |

| 13,489,916 | |

| Dollar Tree, Inc.(a) | |

| 74,772 | | |

| 9,955,892 | |

| SYSCO Corp. | |

| 147,191 | | |

| 11,948,965 | |

| | |

| | | |

| 35,394,773 | |

| Food Products (0.50%) | |

| | | |

| | |

| Tyson Foods, Inc., Class A | |

| 172,180 | | |

| 10,112,131 | |

| | |

| | | |

| | |

| Household Products (0.40%) | |

| | | |

| | |

| Procter & Gamble Co. | |

| 49,400 | | |

| 8,015,150 | |

| | |

| | | |

| | |

| Multiline Retail (1.13%) | |

| | | |

| | |

| Dollar General Corp. | |

| 146,080 | | |

| 22,797,245 | |

| | |

| | | |

| | |

| Personal Care Products (0.62%) | |

| | | |

| | |

| Unilever PLC(b) | |

| 247,719 | | |

| 12,433,017 | |

| | |

| | | |

| | |

| ENERGY (1.96%) | |

| | | |

| | |

| Energy Equipment & Services (0.62%) | |

| | | |

| | |

| NOV, Inc. | |

| 316,776 | | |

| 6,183,467 | |

| Schlumberger NV | |

| 116,865 | | |

| 6,405,371 | |

| | |

| | | |

| 12,588,838 | |

| Oil, Gas & Consumable Fuels (1.34%) | |

| | | |

| | |

| Coterra Energy, Inc. | |

| 320,800 | | |

| 8,943,904 | |

| Shell PLC(b) | |

| 134,846 | | |

| 9,040,076 | |

| TotalEnergies SE(b)(c) | |

| 129,992 | | |

| 8,947,349 | |

| | |

| | | |

| 26,931,329 | |

| See Notes to Schedule of Investments. |

|

| 8 |

www.all-starfunds.com |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | |

| |

| FINANCIALS (20.89%) | |

| | |

| |

| Banks (4.51%) | |

| | | |

| | |

| Bank of America Corp. | |

| 343,426 | | |

$ | 13,022,714 | |

| Citigroup, Inc. | |

| 292,523 | | |

| 18,499,154 | |

| Commerce Bancshares, Inc. | |

| 77,395 | | |

| 4,117,414 | |

| Cullen/Frost Bankers, Inc. | |

| 54,900 | | |

| 6,180,093 | |

| JPMorgan Chase & Co. | |

| 48,965 | | |

| 9,807,689 | |

| Mitsubishi UFJ Financial Group, Inc.(b)(c) | |

| 662,800 | | |

| 6,780,444 | |

| PNC Financial Services Group, Inc. | |

| 45,800 | | |

| 7,401,280 | |

| U.S. Bancorp | |

| 204,301 | | |

| 9,132,255 | |

| Wells Fargo & Co. | |

| 273,001 | | |

| 15,823,138 | |

| | |

| | | |

| 90,764,181 | |

| Capital Markets (6.03%) | |

| | | |

| | |

| Ameriprise Financial, Inc. | |

| 28,600 | | |

| 12,539,384 | |

| BlackRock, Inc. | |

| 9,656 | | |

| 8,050,207 | |

| Blackstone Group LP | |

| 70,600 | | |

| 9,274,722 | |

| Charles Schwab Corp. | |

| 369,130 | | |

| 26,702,864 | |

| Goldman Sachs Group, Inc. | |

| 16,458 | | |

| 6,874,342 | |

| MSCI, Inc. | |

| 23,530 | | |

| 13,187,388 | |

| Northern Trust Corp. | |

| 119,642 | | |

| 10,638,567 | |

| S&P Global, Inc. | |

| 62,830 | | |

| 26,731,024 | |

| UBS Group AG | |

| 242,844 | | |

| 7,460,168 | |

| | |

| | | |

| 121,458,666 | |

| Consumer Finance (1.83%) | |

| | | |

| | |

| American Express Co. | |

| 52,531 | | |

| 11,960,783 | |

| Capital One Financial Corp. | |

| 167,718 | | |

| 24,971,533 | |

| | |

| | | |

| 36,932,316 | |

| Financial Services (5.66%) | |

| | | |

| | |

| Berkshire Hathaway, Inc., Class B(a) | |

| 46,789 | | |

| 19,675,710 | |

| Corpay, Inc.(a) | |

| 33,067 | | |

| 10,202,492 | |

| Equitable Holdings, Inc. | |

| 371,413 | | |

| 14,117,408 | |

| Global Payments, Inc. | |

| 73,172 | | |

| 9,780,170 | |

| Mastercard, Inc., Class A | |

| 29,977 | | |

| 14,436,024 | |

| Visa, Inc., Class A | |

| 139,860 | | |

| 39,032,129 | |

| Voya Financial, Inc. | |

| 92,584 | | |

| 6,843,809 | |

| | |

| | | |

| 114,087,742 | |

| Insurance (2.86%) | |

| | | |

| | |

| American International Group, Inc. | |

| 85,780 | | |

| 6,705,423 | |

| Aon PLC, Class A | |

| 42,427 | | |

| 14,158,738 | |

| Arch Capital Group, Ltd.(a) | |

| 98,389 | | |

| 9,095,079 | |

| MetLife, Inc. | |

| 205,815 | | |

| 15,252,950 | |

| See Notes to Schedule of Investments. |

|

| First Quarter Report (Unaudited) | March 31, 2024 |

9 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | |

| |

| Insurance (continued) | |

| | | |

| | |

| Progressive Corp. | |

| 60,112 | | |

$ | 12,432,364 | |

| | |

| | | |

| 57,644,554 | |

| HEALTH CARE (14.02%) | |

| | | |

| | |

| Biotechnology (0.47%) | |

| | | |

| | |

| Amgen, Inc. | |

| 33,500 | | |

| 9,524,720 | |

| | |

| | | |

| | |

| Health Care Equipment & Supplies (4.14%) | |

| | | |

| | |

| Alcon, Inc. | |

| 100,500 | | |

| 8,370,645 | |

| Baxter International, Inc. | |

| 380,684 | | |

| 16,270,434 | |

| Boston Scientific Corp.(a) | |

| 146,269 | | |

| 10,017,964 | |

| Dexcom, Inc.(a) | |

| 66,042 | | |

| 9,160,025 | |

| Intuitive Surgical, Inc.(a) | |

| 24,535 | | |

| 9,791,673 | |

| Koninklijke Philips NV(c) | |

| 405,046 | | |

| 8,100,920 | |

| Medtronic PLC | |

| 168,422 | | |

| 14,677,977 | |

| Smith & Nephew PLC(b)(c) | |

| 278,538 | | |

| 7,063,724 | |

| | |

| | | |

| 83,453,362 | |

| Health Care Providers & Services (4.35%) | |

| | | |

| | |

| CVS Health Corp. | |

| 142,888 | | |

| 11,396,747 | |

| Fresenius Medical Care AG(b) | |

| 854,142 | | |

| 16,467,858 | |

| Humana, Inc. | |

| 22,064 | | |

| 7,650,030 | |

| Quest Diagnostics, Inc. | |

| 88,899 | | |

| 11,833,346 | |

| UnitedHealth Group, Inc. | |

| 81,562 | | |

| 40,348,721 | |

| | |

| | | |

| 87,696,702 | |

| Life Sciences Tools & Services (2.44%) | |

| | | |

| | |

| Danaher Corp. | |

| 102,726 | | |

| 25,652,737 | |

| IQVIA Holdings, Inc.(a) | |

| 39,883 | | |

| 10,086,012 | |

| Thermo Fisher Scientific, Inc. | |

| 22,908 | | |

| 13,314,358 | |

| | |

| | | |

| 49,053,107 | |

| Pharmaceuticals (2.62%) | |

| | | |

| | |

| Bristol-Myers Squibb Co. | |

| 171,240 | | |

| 9,286,345 | |

| Merck & Co., Inc. | |

| 78,500 | | |

| 10,358,075 | |

| Novo Nordisk A/S(b) | |

| 114,323 | | |

| 14,679,073 | |

| Pfizer, Inc. | |

| 325,633 | | |

| 9,036,316 | |

| Zoetis, Inc. | |

| 55,574 | | |

| 9,403,677 | |

| | |

| | | |

| 52,763,486 | |

| INDUSTRIALS (8.07%) | |

| | | |

| | |

| Aerospace & Defense (0.41%) | |

| | | |

| | |

| General Dynamics Corp. | |

| 29,400 | | |

| 8,305,206 | |

| See Notes to Schedule of Investments. |

|

| 10 |

www.all-starfunds.com |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | |

| |

| Building Products (2.31%) | |

| | | |

| | |

| Carlisle Cos., Inc. | |

| 40,984 | | |

$ | 16,059,580 | |

| Carrier Global Corp. | |

| 218,598 | | |

| 12,707,102 | |

| Masco Corp. | |

| 225,229 | | |

| 17,766,064 | |

| | |

| | | |

| 46,532,746 | |

| Commercial Services & Supplies (0.89%) | |

| | | |

| | |

| Veralto Corp. | |

| 12,100 | | |

| 1,072,786 | |

| Waste Connections, Inc. | |

| 46,889 | | |

| 8,065,377 | |

| Waste Management, Inc. | |

| 40,784 | | |

| 8,693,109 | |

| | |

| | | |

| 17,831,272 | |

| Electrical Equipment (0.33%) | |

| | | |

| | |

| Eaton Corp. PLC | |

| 21,476 | | |

| 6,715,116 | |

| | |

| | | |

| | |

| Ground Transportation (0.80%) | |

| | | |

| | |

| Canadian Pacific Kansas City, Ltd. | |

| 182,579 | | |

| 16,097,990 | |

| | |

| | | |

| | |

| Industrial Conglomerates (0.40%) | |

| | | |

| | |

| Honeywell International, Inc. | |

| 39,000 | | |

| 8,004,750 | |

| | |

| | | |

| | |

| Machinery (1.82%) | |

| | | |

| | |

| Oshkosh Corp. | |

| 53,600 | | |

| 6,684,456 | |

| Parker-Hannifin Corp. | |

| 28,900 | | |

| 16,062,331 | |

| Wabtec Corp. | |

| 26,645 | | |

| 3,881,644 | |

| Xylem, Inc. | |

| 77,000 | | |

| 9,951,480 | |

| | |

| | | |

| 36,579,911 | |

| Trading Companies & Distributors (1.11%) | |

| | | |

| | |

| Ferguson PLC | |

| 102,590 | | |

| 22,408,734 | |

| | |

| | | |

| | |

| INFORMATION TECHNOLOGY (20.62%) | |

| | | |

| | |

| Electronic Equipment & Instruments (0.37%) | |

| | | |

| | |

| TE Connectivity Ltd. | |

| 51,086 | | |

| 7,419,731 | |

| | |

| | | |

| | |

| Electronic Equipment, Instruments & Components | |

| (0.86 | %) | |

| | |

| CDW Corp. | |

| 37,838 | | |

| 9,678,204 | |

| Teledyne Technologies, Inc.(a) | |

| 18,026 | | |

| 7,738,922 | |

| | |

| | | |

| 17,417,126 | |

| IT Services (1.46%) | |

| | | |

| | |

| Amdocs, Ltd. | |

| 67,795 | | |

| 6,126,634 | |

| Cognizant Technology Solutions Corp., Class A | |

| 157,262 | | |

| 11,525,732 | |

| Gartner, Inc. | |

| 17,509 | | |

| 8,346,015 | |

| See Notes to Schedule of Investments. |

|

| First Quarter Report (Unaudited) | March 31, 2024 |

11 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | |

| |

| IT Services (continued) | |

| | | |

| | |

| Snowflake, Inc., Class A(a) | |

| 20,716 | | |

$ | 3,347,706 | |

| | |

| | | |

| 29,346,087 | |

| Semiconductors & Semiconductor Equipment (6.02%) | |

| | | |

| | |

| ASML Holding N.V. | |

| 12,571 | | |

| 12,199,778 | |

| Microchip Technology, Inc. | |

| 127,800 | | |

| 11,464,938 | |

| Micron Technology, Inc. | |

| 132,941 | | |

| 15,672,414 | |

| NVIDIA Corp. | |

| 67,151 | | |

| 60,674,958 | |

| QUALCOMM, Inc. | |

| 66,400 | | |

| 11,241,520 | |

| Skyworks Solutions, Inc. | |

| 92,174 | | |

| 9,984,288 | |

| | |

| | | |

| 121,237,896 | |

| Software (11.91%) | |

| | | |

| | |

| Adobe, Inc.(a) | |

| 40,777 | | |

| 20,576,074 | |

| ANSYS, Inc.(a) | |

| 31,000 | | |

| 10,761,960 | |

| Autodesk, Inc.(a) | |

| 83,725 | | |

| 21,803,664 | |

| Crowdstrike Holdings, Inc., Class A(a) | |

| 40,846 | | |

| 13,094,819 | |

| Intuit, Inc. | |

| 19,951 | | |

| 12,968,150 | |

| Microsoft Corp. | |

| 181,873 | | |

| 76,517,609 | |

| Palo Alto Networks, Inc.(a) | |

| 30,809 | | |

| 8,753,761 | |

| Salesforce, Inc. | |

| 85,584 | | |

| 25,776,189 | |

| ServiceNow, Inc.(a) | |

| 46,482 | | |

| 35,437,877 | |

| Workday, Inc., Class A(a) | |

| 52,108 | | |

| 14,212,457 | |

| | |

| | | |

| 239,902,560 | |

| MATERIALS (5.69%) | |

| | | |

| | |

| Chemicals (3.59%) | |

| | | |

| | |

| Corteva, Inc. | |

| 213,500 | | |

| 12,312,545 | |

| Dow, Inc. | |

| 299,505 | | |

| 17,350,324 | |

| Ecolab, Inc. | |

| 99,571 | | |

| 22,990,944 | |

| RPM International, Inc. | |

| 77,800 | | |

| 9,254,310 | |

| Sherwin-Williams Co. | |

| 30,190 | | |

| 10,485,893 | |

| | |

| | | |

| 72,394,016 | |

| Construction Materials (0.73%) | |

| | | |

| | |

| Martin Marietta Materials, Inc. | |

| 24,000 | | |

| 14,734,560 | |

| | |

| | | |

| | |

| Containers & Packaging (1.37%) | |

| | | |

| | |

| Avery Dennison Corp. | |

| 78,934 | | |

| 17,622,016 | |

| Ball Corp. | |

| 146,405 | | |

| 9,861,841 | |

| | |

| | | |

| 27,483,857 | |

| See Notes to Schedule of Investments. |

|

| 12 |

www.all-starfunds.com |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| REAL ESTATE (1.45%) | |

| | | |

| | |

| Residential REITs (0.31%) | |

| | | |

| | |

| Equity LifeStyle Properties, Inc. | |

| 95,600 | | |

$ | 6,156,640 | |

| | |

| | | |

| | |

| Specialized REITs (1.14%) | |

| | | |

| | |

| American Tower Corp. | |

| 41,989 | | |

| 8,296,607 | |

| Crown Castle, Inc. | |

| 53,500 | | |

| 5,661,905 | |

| Equinix, Inc. | |

| 10,958 | | |

| 9,043,966 | |

| | |

| | | |

| 23,002,478 | |

| UTILITIES (1.26%) | |

| | | |

| | |

| Electric Utilities (0.82%) | |

| | | |

| | |

| Edison International | |

| 143,112 | | |

| 10,122,312 | |

| Xcel Energy, Inc. | |

| 118,000 | | |

| 6,342,500 | |

| | |

| | | |

| 16,464,812 | |

| Gas Utilities (0.44%) | |

| | | |

| | |

| Atmos Energy Corp. | |

| 75,000 | | |

| 8,915,250 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (COST OF $1,466,300,190) | |

| | | |

| 1,961,528,434 | |

| | |

| | | |

| | |

| SHORT TERM INVESTMENTS (4.71%) | |

| | | |

| | |

| MONEY MARKET FUND (2.55%) | |

| | | |

| | |

State Street Institutional US Government Money

Market Fund, Premier Class, 5.27%(d) | |

| | | |

| | |

| | |

| | | |

| | |

| (COST OF $51,454,736) | |

| 51,454,736 | | |

| 51,454,736 | |

| | |

| | | |

| | |

| INVESTMENTS PURCHASED WITH COLLATERAL FROM | |

| | | |

| | |

| SECURITIES LOANED (2.16%) | |

| | | |

| | |

State Street Navigator Securities Lending Government

Money Market Portfolio, 5.34% | |

| | | |

| | |

| (COST OF $43,507,593) | |

| 43,507,593 | | |

| 43,507,593 | |

| | |

| | | |

| | |

| TOTAL SHORT TERM INVESTMENTS | |

| | | |

| | |

| (COST OF $94,962,329) | |

| | | |

| 94,962,329 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS (102.09%) | |

| | | |

| | |

| (COST OF $1,561,262,519) | |

| | | |

| 2,056,490,763 | |

| See Notes to Schedule of Investments. |

|

| First Quarter Report (Unaudited) | March 31, 2024 |

13 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-2.09%) | |

| (42,129,176 | ) |

| | |

| | |

| NET ASSETS (100.00%) | |

$ | 2,014,361,586 | |

| | |

| | |

| NET ASSET VALUE PER SHARE | |

| | |

| (279,557,588 SHARES OUTSTANDING) | |

$ | 7.21 | |

| (a) | Non-income producing security. |

| (b) | American Depositary Receipt. |

| (c) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $60,699,910. |

| (d) | Rate reflects seven-day effective yield on March 31, 2024. |

| See Notes to Schedule of Investments. |

|

| 14 |

www.all-starfunds.com |

| Liberty All-Star® Equity Fund |

Notes to Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

Security Valuation

Equity securities are valued at the last sale

price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market LLC (“NASDAQ”),

which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the

day are valued at the closing bid price on such exchanges or over-the-counter markets.

Cash collateral from securities lending activity

is reinvested in the State Street Navigator Securities Lending Government Money Market Portfolio (“State Street Navigator”),

a registered investment company under the Investment Company Act of 1940 (the “1940 Act”), which operates as a money market

fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered investment companies are valued daily at that investment company’s

net asset value (“NAV”) per share.

The Fund’s investments are valued at market

value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the

Fund's Board of Trustees (the "Board"). The Board has designated ALPS Advisors, Inc. (the “Advisor”) as the Fund’s

Valuation Designee. The Valuation Designee is responsible for determining fair value in good faith for all Fund investments, subject to

oversight by the Board. When market quotations are not readily available, or in management’s judgment they do not accurately reflect

fair value of a security, or an event occurs after the market close but before the Fund is priced that materially affects the value of

a security, the security will be valued by the Advisor’s Valuation Committee using fair valuation procedures established by the

Valuation Designee. Examples of potentially significant events that could materially impact a Fund’s NAV include, but are not limited

to: single issuer events such as corporate actions, reorganizations, mergers, spin-offs, liquidations, acquisitions and buyouts; corporate

announcements on earnings or product offerings; regulatory news; and litigation and multiple issuer events such as governmental actions;

natural disasters or armed conflicts that affect a country or a region; or significant market fluctuations. Potential significant events

are monitored by the Advisor, Sub-Advisers and/or the Valuation Committee through independent reviews of market indicators, general news

sources and communications from the Fund’s custodian. As of March 31, 2024, the Fund held no securities that were fair valued.

Security Transactions

Security transactions are recorded on trade date. Cost is determined

and gains/(losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income Recognition

Interest income is recorded on the accrual basis. Corporate actions

and dividend income are recorded on the ex-date.

The Fund estimates components of distributions

from real estate investment trusts (“REITs”). Distributions received in excess of income are recorded as a reduction of the

cost of the related investments. Once the REIT reports annually the tax character of its distributions, the Fund revises its estimates.

If the Fund no longer owns the applicable securities, any distributions received in excess of income are recorded as realized gains.

| First Quarter Report (Unaudited) | March 31, 2024 |

15 |

| Liberty All-Star® Equity Fund |

Notes to Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

Lending of Portfolio Securities

The Fund may lend its portfolio securities only

to borrowers that are approved by the Fund’s securities lending agent, State Street Bank & Trust Co. (“SSB”). The

Fund will limit such lending to not more than 30% of the value of its total assets. The borrower pledges and maintains with the Fund collateral

consisting of cash (U.S. Dollar only), securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, or

by irrevocable bank letters of credit issued by a person other than the borrower or an affiliate of the borrower. The initial collateral

received by the Fund is required to have a value of no less than 102% of the market value of the loaned securities for securities traded

on U.S. exchanges and a value of no less than 105% of the market value for all other securities. The collateral is maintained thereafter,

at a market value equal to no less than 100% of the current value of the securities on loan. The market value of the loaned securities

is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day.

During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities

are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for

settlement of securities transactions.

Any cash collateral received is reinvested in

State Street Navigator. Non-cash collateral, in the form of securities issued or guaranteed by the U.S. government or its agencies or

instrumentalities, is not disclosed in the Fund’s Schedule of Investments as it is held by the lending agent on behalf of the Fund,

and the Fund does not have the ability to re-hypothecate these securities.

The following is a summary of the Fund’s securities lending positions

and related cash and non-cash collateral received as of March 31, 2024:

|

|

|

|

Market Value of

Securities on Loan |

Cash

Collateral Received |

Non-Cash

Collateral Received |

Total

Collateral Received |

| $60,699,910 |

$43,507,593 |

$18,830,662 |

$62,338,255 |

The risks of securities lending include the risk

that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks,

the Fund benefits from a borrower default indemnity provided by SSB. SSB’s indemnity allows for full replacement of securities lent

wherein SSB will purchase the unreturned loaned securities on the open market by applying the proceeds of the collateral, or to the extent

such proceeds are insufficient or the collateral is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense.

However, the Fund could suffer a loss if the value of the investments purchased with cash collateral falls below the value of the cash

collateral received.

Fair Value Measurements

The Fund discloses the classification of its

fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the

assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be

observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or

liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs

reflect the reporting entity’s own assumptions about the assumptions market participants would use in

pricing the asset or liability that are developed based on the best information available.

| Liberty All-Star® Equity Fund |

Notes to Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

Valuation techniques used to value the Fund’s

investments by major category are as follows: Equity securities that are valued based on unadjusted quoted prices in active markets are

categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities

are valued at the mean of the most recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy.

Investments in open-end mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Various inputs are used in determining the value

of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy,

the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant

to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity

associated with these investments.

These inputs are categorized in the following

hierarchy under applicable financial accounting standards:

| Level 1 – |

Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| |

|

| Level 2 – |

Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets

or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset

or liability; and |

| |

|

| Level 3 – |

Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used

to value the Fund’s investments as of March 31, 2024:

| | |

Valuation Inputs | | |

| |

| Investments in Securities at Value | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks* | |

$ | 1,961,528,434 | $ | |

| – | | |

$ | – | | |

$ | 1,961,528,434 | |

| Short Term Investments | |

| 94,962,329 | | |

| – | | |

| – | | |

| 94,962,329 | |

| Total | |

$ | 2,056,490,763 | $ | |

| – | | |

$ | – | | |

$ | 2,056,490,763 | |

| * | See Schedule of Investments for industry classifications. |

The Fund did not have any securities that used

significant unobservable inputs (Level 3) in determining fair value during the period.

| First Quarter Report (Unaudited) | March 31, 2024 |

17 |

| Liberty All-Star® Equity Fund |

Notes to Schedule of Investments |

| |

March 31, 2024 (Unaudited) |

Indemnification

In the normal course of business, the Fund enters

into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum

exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also, under the Fund’s organizational

documents and by contract, the Trustees and Officers of the Fund are indemnified against certain liabilities that may arise out of their

duties to the Fund. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

| |

Description of Lipper Benchmark |

| Liberty All-Star® Equity Fund |

and Market Indices |

| |

(Unaudited) |

Dow Jones Industrial Average

A price-weighted measure of 30 U.S. blue-chip companies.

Lipper Large-Cap Core Mutual Fund Average

The average of funds that, by portfolio practice,

invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s

U.S. domestic equity large-cap floor. These funds typically have average characteristics compared to the S&P 500® Index.

NASDAQ Composite Index

Measures all NASDAQ domestic and international based common type stocks

listed on the NASDAQ Stock Market.

Russell 3000® Growth Index

Measures the performance of those Russell 3000®

companies with lower book-to-price ratios and higher growth values. The Russell 3000® Index measures the performance

of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 96% of the investable U.S. equity

market.

Russell 3000® Value Index

Measures the performance of those Russell 3000®

companies with higher book-to-price ratios and lower growth values.

S&P 500® Index

A large-cap U.S. equities index that includes 500 leading companies

and represents approximately 80% of the total domestic U.S. equity market capitalization.

An investor cannot invest directly in an index.

| First Quarter Report (Unaudited) | March 31, 2024 |

19 |

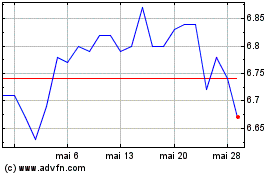

Liberty All Star Equity (NYSE:USA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Liberty All Star Equity (NYSE:USA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024