Vince Holding Corp., (NYSE: VNCE) (“VNCE” or the “Company”), a

global contemporary retailer, today announced that it has completed

the previously announced transaction (“Authentic Transaction”) with

Authentic Brands Group (“Authentic”), a global brand development,

marketing and entertainment platform. As part of the transaction,

VNCE and Authentic have entered a strategic arrangement whereby

VNCE has contributed its intellectual property to a newly formed

Authentic subsidiary (“ABG Vince”) for total consideration to Vince

of $76.5 million in cash from Authentic and 25% membership interest

in ABG Vince. Authentic owns the majority stake of 75% membership

interest in ABG Vince.

“We are pleased to have successfully closed this transaction

with Authentic marking a transformative milestone for Vince,” said

Jack Schwefel, Chief Executive Officer of VNCE. “With the proceeds

from this transaction, we strengthened our financial foundation by

repaying in full the outstanding balance of $27.7 million under our

Term Loan Credit Facility as well as a portion of the outstanding

borrowings under our Revolving Credit Facility. With a stronger

balance sheet in place, we are now better positioned to enhance our

focus on driving margin expansion and executing against our

strategic growth initiatives.”

"We are thrilled to officially welcome Vince into the Authentic

fold. Together with the visionary expertise of the Vince team, we

are poised for the brand's category and global expansion," said

Jamie Salter, Founder, Chairman and CEO of Authentic. "We look

forward to engaging with new brand fans as we capture audiences,

broaden the brand’s range and enter this next phase of Vince’s

growth.”

In connection with the Authentic Transaction, VNCE has entered

into an exclusive, long-term license agreement (the “License

Agreement”) with Authentic for usage of the contributed

intellectual property for VNCE’s existing business in a manner

consistent with the Company’s current wholesale, retail and

e-commerce operations. The License Agreement contains an initial

ten-year term and eight ten-year renewal options allowing VNCE to

renew the agreement.

Concurrent with the close of the Authentic Transaction, the

amendment that VNCE previously entered into with its ABL facility

has become effective. The amendment adjusts the initial commitment

level commensurate with the net proceeds after transaction related

fees and the debt pay down, and revised the maturity date to June

30, 2024, among other things.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global retail company that operates the

Vince brand women’s and men’s ready to wear business. Vince,

established in 2002, is a leading global luxury apparel and

accessories brand best known for creating elevated yet understated

pieces for every day effortless style. Vince Holding Corp. operates

49 full-price retail stores, 17 outlet stores, and its e-commerce

site, vince.com and through its subscription service Vince Unfold,

www.vinceunfold.com, as well as through premium wholesale channels

globally. Please visit www.vince.com for more information.

ABOUT AUTHENTIC BRANDS GROUP

Authentic Brands Group (Authentic) is a global brand

development, marketing and entertainment platform, which owns a

portfolio of more than 40 iconic and world-renowned Lifestyle,

Entertainment and Media brands. Headquartered in New York City,

with offices around the world, Authentic connects strong brands

with best-in-class partners and a global network of operators,

distributors and retailers to build long-term value in the

marketplace. Its brands generate approximately $25 billion in

global annual retail sales and have an expansive retail footprint

in more than 150 countries, including 10,800-plus freestanding

stores and shop-in-shops and 380,000 points of sale.

Authentic is committed to transforming brands by delivering

powerful storytelling, compelling content, innovative business

models and immersive experiences. It creates and activates original

marketing strategies to drive the success of its brands across all

consumer touchpoints, platforms and emerging media. Authentic’s

brand portfolio includes Marilyn Monroe®, Elvis Presley®, Muhammad

Ali®, Shaquille O’Neal®, David Beckham®, Dr. J®, Greg Norman®, Neil

Lane®, Thalia®, Sports Illustrated®, Reebok®, Brooks Brothers®,

Barneys New York®, Judith Leiber®, Ted Baker®, Vince®, Hervé

Léger®, Hickey Freeman®, Frye®, Nautica®, Juicy Couture®, Vince

Camuto®, Lucky Brand®, Aéropostale®, Forever 21®, Nine West®, Eddie

Bauer®, Spyder®, Volcom®, Shark®, Tretorn®, Prince®, Airwalk®,

Izod®, Jones New York®, Van Heusen®, Hart Schaffner Marx®, Arrow®

and Thomasville®.

For more information, visit authentic.com. Follow Authentic on

LinkedIn, Instagram and Twitter.

Forward-Looking Statements: This document, and any statements

incorporated by reference herein contain forward-looking statements

under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding, among

other things, our current expectations about possible or assumed

future results of operations of the Company, the expected

completion and timing of the ABG Transaction and other information

relating to the ABG Transaction and are indicated by words or

phrases such as “may,” “will,” “should,” “believe,” “expect,”

“seek,” “anticipate,” “intend,” “estimate,” “plan,” “target,”

“project,” “forecast,” “envision” and other similar phrases.

Although we believe the assumptions and expectations reflected in

these forward-looking statements are reasonable, these assumptions

and expectations may not prove to be correct and we may not achieve

the results or benefits anticipated. These forward-looking

statements are not guarantees of actual results, and our actual

results may differ materially from those suggested in the

forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties, some of which are

beyond our control, including, without limitation: our ability to

realize the benefits of our strategic initiatives; our ability to

maintain adequate cash flow from operations or availability under

our revolving credit facility to meet our liquidity needs; the

impact of the novel coronavirus (COVID-19) pandemic on our

business, results of operations and liquidity; general economic

conditions; the execution and management of our international

expansion; our ability to continue having the liquidity necessary

to service our debt, meet contractual payment obligations, and fund

our operations; further impairment of our goodwill and

indefinite-lived intangible assets; the execution and management of

our retail store growth plans; our ability to make lease payments

when due; our ability to maintain our larger wholesale partners;

the loss of certain of our wholesale partners; our ability to

successfully implement the wind down of the Rebecca Taylor

business; our ability to remediate the identified material weakness

in our internal control over financial reporting; our ability to

comply with domestic and international laws, regulations and

orders; our ability to anticipate and/or react to changes in

customer demand and attract new customers, including in connection

with making inventory commitments; our ability to remain

competitive in the areas of merchandise quality, price, breadth of

selection and customer service; our ability to keep a strong brand

image; our ability to attract and retain key personnel; seasonal

and quarterly variations in our revenue and income; our ability to

mitigate system security risk issues, such as cyber or malware

attacks, as well as other major system failures; ; our ability to

optimize our systems, processes and functions; our ability to

comply with privacy-related obligations; our ability to ensure the

proper operation of the distribution facilities by third-party

logistics providers; fluctuations in the price, availability and

quality of raw materials; commodity, raw material and other cost

increases; the extent of our foreign sourcing; our reliance on

independent manufacturers; other tax matters; and other factors as

set forth from time to time in our Securities and Exchange

Commission filings, including those described under “Item 1A—Risk

Factors” in our Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q. We intend these forward-looking statements to speak only

as of the time of this release and do not undertake to update or

revise them as more information becomes available, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230525005801/en/

Investor Relations: ICR, Inc. Caitlin Churchill,

646-277-1274 Caitlin.Churchill@icrinc.com

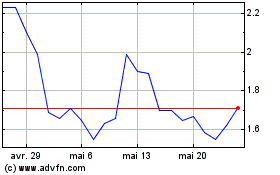

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025