Vince Holding Corp. (NYSE: VNCE) (“VNCE” or the “Company”), a

global contemporary retailer, today reported its financial results

for the first quarter 2023 ended April 29, 2023.

In this press release, the Company is presenting its financial

results for the first quarter ended April 29, 2023 in conformity

with U.S. generally accepted accounting principles ("GAAP") as well

as on an "adjusted" basis. Adjusted results presented in this press

release are non-GAAP financial measures. See "Non-GAAP Financial

Measures" below for more information about the Company's use of

non-GAAP financial measures and Exhibit 3 to this press release for

a reconciliation of GAAP measures to such non-GAAP measures.

Highlights for the first quarter ended April 29, 2023:

- Net sales were $64.1 million compared to $78.4 million in the

same period last year reflecting a 6.3% decrease in Vince brand

sales and a 99.2% decrease in Rebecca Taylor and Parker sales,

combined, driven by the previously announced wind down of the

Rebecca Taylor business.

- Loss from operations was $2.4 million compared to loss from

operations of $5.3 million in the same period last year. Adjusted

loss from operations* in the first quarter of fiscal 2023, which

excludes the Transaction Expenses and the Parker IP Sale Gain (each

as defined below), was $0.3 million.

- Net loss was $0.4 million or $(0.03) per share compared to a

net loss of $7.2 million or $(0.60) per share in the same period

last year. Excluding the Transaction Expenses, the Parker IP Sale

Gain and the Discrete Tax Benefit (as defined below), adjusted net

loss* for the first quarter of fiscal 2023 was $4.4 million or

$(0.36) per share.

Jack Schwefel, Chief Executive Officer of VNCE said, “Our first

quarter results were largely in line with our expectations

supported by our efforts to streamline our organization to focus on

our core strengths while maintaining a disciplined approach to

expense management as we continued to navigate a challenging macro

environment. As we look to the remainder of fiscal 2023, while we

are maintaining a cautious outlook with respect to the environment,

particularly in our wholesale channel, we will continue to focus on

driving improved margin performance. With our strengthened balance

sheet in place driven by our recent transaction with Authentic

Brands Group, we believe we are better positioned to execute our

strategic initiatives and prioritize our commitment to improved

financial performance over time.”

For the first quarter ended April 29, 2023:

- Total Company net sales decreased 18.3% to $64.1 million

compared to $78.4 million in the first quarter of fiscal 2022. The

year-over-year decline was primarily driven by the previously

announced wind down of the Rebecca Taylor business, and to a lesser

extent a decline in Vince brand sales.

- Gross profit was $29.6 million, or 46.2% of net sales, compared

to gross profit of $35.6 million, or 45.5% of net sales, in the

first quarter of fiscal 2022. The increase in gross margin rate was

driven by lower freight costs as well as the wind down of the

Rebecca Taylor business, which historically operated at a lower

overall gross margin, and offset the unfavorable impact from higher

discounts in the wholesale off-price channel as well as an increase

in promotional activity in the Direct-to-consumer segment.

- Selling, general, and administrative expenses were $32.7

million, or 51.1% of sales, compared to $40.9 million, or 52.2% of

sales, in the first quarter of fiscal 2022. The decrease in

SG&A dollars was primarily driven by the wind down of the

Rebecca Taylor business resulting in a $5.9 million net expense

favorability in the first quarter of fiscal 2023. In addition, the

Company also had lower costs associated with compensation and

benefits and rent expense compared to the prior year period, which

was partially offset by $2.9 million in transaction related

expenses (the “Transaction Expenses”) relating to the Authentic

Transaction (as defined below) as well as the sale of the Parker

brand intellectual property (the “Parker IP Sale”) in the first

quarter of fiscal 2023.

- Loss from operations was $2.4 million compared to a loss from

operations of $5.3 million in the same period last year. Adjusted

loss from operations* in the first quarter of fiscal 2023, which

excludes Transaction Expenses as well as the gain on sale of

intangible assets relating to the Parker IP Sale (the “Parker IP

Sale Gain”), was $0.3 million.

- Income tax benefit was $5.3 million primarily as a result of

the $6.1 million discrete tax benefit from the change in

classification of the Company's Vince tradename indefinite-lived

intangibles to Assets Held for Sale as a result of the Authentic

Transaction (such impact, the “Discrete Tax Benefit”), partially

offset by $0.8 million of tax expense from applying the Company’s

estimated effective tax rate for the fiscal year to the

three-months pre-tax loss excluding discrete items. The

aforementioned change in classification resulted in a reversal of

the non-cash deferred tax liability previously created by the

amortization of the indefinite-lived tradename intangible asset

recognized for tax but not for book purposes as this non-cash

deferred liability can now be used as a source to support the

realization of certain deferred tax assets related to the Company’s

net operating losses. Excluding the impact of the Discrete Tax

Benefit, adjusted provision for income taxes* was $0.8

million.

- Net loss was $0.4 million or $(0.03) per share compared to a

net loss of $7.2 million or $(0.60) per share in the same period

last year. Excluding the Transaction Expenses, the Parker IP Sale

Gain and the Discrete Tax Benefit, adjusted net loss* for the first

quarter of fiscal 2023 was $4.4 million or $(0.36) per share.

- The Company ended the quarter with 67 company-operated Vince

stores, a net decrease of 1 store since the first quarter of fiscal

2022.

Vince First Quarter Highlights

- Net sales decreased 6.3% to $64.0 million as compared to the

first quarter of fiscal 2022.

- Wholesale segment sales decreased 3.0% to $32.5 million

compared to the first quarter of fiscal 2022.

- Direct-to-consumer segment sales decreased 9.4% to $31.5

million compared to the first quarter of fiscal 2022.

- Income from operations excluding unallocated corporate expenses

was $9.7 million compared to income from operations of $9.4 million

in the same period last year.

Rebecca Taylor and Parker Fourth Quarter Highlights

- On September 12, 2022, the Company announced the strategic

decision to wind down its Rebecca Taylor business to focus its

resources on the Vince brand. The wind down of the Rebecca Taylor

business is now substantially completed.

- Net sales decreased 99.2% to $0.1 million as compared to the

first quarter of fiscal 2022.

- Income from operations was $1.2 million compared to a loss from

operations of $1.5 million in the same period last year. Income

from operations in the first quarter of fiscal 2023 included a $0.8

million gain on the sale of the Parker tradename and $0.2 million

in transaction related expenses associated with the sale of Parker

intangible assets, with the remainder primarily associated with the

release of Rebecca Taylor operating lease liabilities as a result

of lease terminations.

Net Sales and Operating Results by

Segment:

Three Months Ended

April 29,

April 30,

(in thousands)

2023

2022

Net Sales:

Vince Wholesale

$

32,467

$

33,464

Vince Direct-to-consumer

31,508

34,782

Rebecca Taylor and Parker

81

10,130

Total net sales

$

64,056

$

78,376

Income (loss) from operations:

Vince Wholesale

$

8,571

$

10,163

Vince Direct-to-consumer

1,101

(802)

Rebecca Taylor and Parker

1,192

(1,484)

Subtotal

10,864

7,877

Unallocated corporate(1)

(13,240)

(13,162)

Total loss from operations

$

(2,376)

$

(5,285)

(1) Unallocated corporate expenses are

related to the Vince brand and are comprised of selling, general

and administrative expenses attributable to corporate and

administrative activities (such as marketing, design, finance,

information technology, legal and human resource departments), and

other charges that are not directly attributable to the Company’s

Vince Wholesale and Vince Direct-to-consumer reportable segments.

In addition, unallocated corporate expenses includes the

transaction related expenses associated with the Authentic

Transaction.

Balance Sheet

At the end of the first quarter of fiscal 2023, total borrowings

under the Company’s debt agreements totaled $108.0 million and the

Company had $20.4 million of excess availability under its

revolving credit facility.

Net inventory at the end of the first quarter of fiscal 2023 was

$80.0 million compared to $83.3 million at the end of the first

quarter of fiscal 2022. The year-over-year decrease in inventory

was driven by the wind down of the Rebecca Taylor business,

partially offset by a moderate increase in Vince.

During the quarter ended April 29, 2023, the Company did not

issue shares of common stock under the ATM program. The Company

continues to have shares available under the program to exercise

with proceeds to be used as sources, along with cash from

operations, to fund future growth.

Subsequent Events

On May 25, 2023, the Company announced that it completed the

previously announced transaction with Authentic Brands Group

(“Authentic”). As part of the transaction (“Authentic

Transaction”), VNCE and Authentic entered into a strategic

arrangement whereby VNCE contributed its intellectual property to a

newly formed Authentic subsidiary (“ABG Vince”) for total

consideration to Vince of $76.5 million in cash from Authentic and

25% membership interest in ABG Vince. Authentic owns the majority

stake of 75% membership interest in ABG Vince.

With the proceeds from this transaction, VNCE repaid in full the

outstanding balance of $27.7 million under its Term Loan Credit

Facility as well as a portion of the outstanding borrowings under

its Revolving Credit Facility.

In connection with the Authentic Transaction, VNCE entered into

an exclusive, long-term license agreement (the “License Agreement”)

with Authentic for usage of the contributed intellectual property

for VNCE’s existing business in a manner consistent with the

Company’s current wholesale, retail and e-commerce operations. The

License Agreement contains an initial ten-year term and eight

ten-year renewal options allowing VNCE to renew the agreement.

Concurrent with the close of the Authentic Transaction, the

amendment that VNCE previously entered into with its ABL facility

became effective. The amendment adjusts the initial commitment

level commensurate with the net proceeds after transaction related

fees and the debt pay down, and revised the maturity date to June

30, 2024, among other things.

*Non-GAAP Financial

Measures

In addition to reporting financial results in accordance with

GAAP, the Company has provided, with respect to the financial

results relating to three months ended April 29, 2023, adjusted

loss from operations, adjusted loss before income taxes, adjusted

(benefit) provision for income taxes, adjusted net loss, and

adjusted loss per share, which are non-GAAP measures, in order to

eliminate the effect of the Transaction Expenses, the Parker IP

Sale Gain and the Discrete Tax Benefit. The Company believes that

the presentation of these non-GAAP measures facilitates an

understanding of the Company's continuing operations without the

impact associated with the aforementioned items. While these types

of events can and do recur periodically, they are excluded from the

indicated financial information due to their impact on the

comparability of earnings across periods. Non-GAAP financial

measures should not be considered in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. A reconciliation of GAAP to non-GAAP results has been

provided in Exhibit 3 to this press release.

Conference Call

A conference call to discuss the first quarter results will be

held today, June 8, 2023, at 8:30 a.m. ET, hosted by Vince Holding

Corp. Chief Executive Officer, Jack Schwefel, and Chief Financial

Officer, Amy Levy. During the conference call, the Company may make

comments concerning business and financial developments, trends and

other business or financial matters. The Company’s comments, as

well as other matters discussed during the conference call, may

contain or constitute information that has not been previously

disclosed.

Those who wish to participate in the call may do so by dialing

(833) 470-1428, conference ID 923392. Any interested party will

also have the opportunity to access the call via the Internet at

http://investors.vince.com/. To listen

to the live call, please go to the website at least 15 minutes

early to register and download any necessary audio software. For

those who cannot listen to the live broadcast, a recording will be

available for 12 months after the date of the event. Recordings may

be accessed at http://investors.vince.com.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global retail company that operates the

Vince brand women’s and men’s ready to wear business. Vince,

established in 2002, is a leading global luxury apparel and

accessories brand best known for creating elevated yet understated

pieces for every day effortless style. Vince Holding Corp. operates

49 full-price retail stores, 17 outlet stores, and its e-commerce

site, vince.com and through its subscription service Vince Unfold,

www.vinceunfold.com, as well as through premium wholesale channels

globally. Please visit www.vince.com for more information.

Forward-Looking Statements: This document, and any statements

incorporated by reference herein contain forward-looking statements

under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding, among

other things, our current expectations about possible or assumed

future results of operations of the Company and are indicated by

words or phrases such as “may,” “will,” “should,” “believe,”

“expect,” “seek,” “anticipate,” “intend,” “estimate,” “plan,”

“target,” “project,” “forecast,” “envision” and other similar

phrases. Although we believe the assumptions and expectations

reflected in these forward-looking statements are reasonable, these

assumptions and expectations may not prove to be correct and we may

not achieve the results or benefits anticipated. These

forward-looking statements are not guarantees of actual results,

and our actual results may differ materially from those suggested

in the forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties, some of which are

beyond our control, including, without limitation: our ability to

maintain the license agreement with ABG Vince; ABG Vince’s

expansion of the Vince brand into other categories and territories;

ABG Vince’s approval rights and other actions; our ability to

maintain adequate cash flow from operations or availability under

our revolving credit facility to meet our liquidity needs; our

ability to realize the benefits of our strategic initiatives;

general economic conditions; further impairment of our goodwill;

the execution and management of our direct-to-consumer business

growth plans; our ability to make lease payments when due; our

ability to maintain our larger wholesale partners; our ability to

remediate the identified material weakness in our internal control

over financial reporting; our ability to comply with domestic and

international laws, regulations and orders; our ability to

anticipate and/or react to changes in customer demand and attract

new customers, including in connection with making inventory

commitments; our ability to remain competitive in the areas of

merchandise quality, price, breadth of selection and customer

service; our ability to attract and retain key personnel; seasonal

and quarterly variations in our revenue and income; our ability to

mitigate system security risk issues, such as cyber or malware

attacks, as well as other major system failures; our ability to

optimize our systems, processes and functions; our ability to

comply with privacy-related obligations; our ability to ensure the

proper operation of the distribution facilities by third-party

logistics providers; fluctuations in the price, availability and

quality of raw materials; commodity, raw material and other cost

increases; the extent of our foreign sourcing; our reliance on

independent manufacturers; other tax matters; and other factors as

set forth from time to time in our Securities and Exchange

Commission filings, including those described under “Item 1A—Risk

Factors” in our Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q. We intend these forward-looking statements to speak only

as of the time of this release and do not undertake to update or

revise them as more information becomes available, except as

required by law.

Vince Holding Corp. and

Subsidiaries

Exhibit (1)

Condensed Consolidated Statements of

Operations

(Unaudited, amounts in thousands except

percentages, share and per share data)

Three Months Ended

April 29,

April 30,

2023

2022

Net sales

$

64,056

$

78,376

Cost of products sold

34,464

42,741

Gross profit

29,592

35,635

as a % of net sales

46.2%

45.5%

Gain on sale of intangible assets

(765

)

—

Selling, general and administrative

expenses

32,733

40,920

as a % of net sales

51.1%

52.2%

Loss from operations

(2,376)

(5,285)

as a % of net sales

(3.7)%

(6.7)%

Interest expense, net

3,290

1,884

Loss before income taxes

(5,666

)

(7,169

)

(Benefit) provision for income taxes

(5,285

)

—

Net income (loss)

$

(381)

$

(7,169

)

Earnings (loss) per share:

Basic earnings (loss) per share

$

0.03

$

(0.60

)

Diluted earnings (loss) per share

$

0.03

$

(0.60

)

Weighted average shares

outstanding:

Basic

12,342,355

12,030,826

Diluted

12,342,355

12,030,826

Vince Holding Corp. and

Subsidiaries

Exhibit (2)

Condensed Consolidated Balance

Sheets

(Unaudited, amounts in

thousands)

April 29,

January 28,

April 30,

2023

2023

2022

ASSETS

Current assets:

Cash and cash equivalents

$

422

$

1,079

$

1,260

Trade receivables, net

17,372

20,733

25,135

Inventories, net

80,036

90,008

83,347

Prepaid expenses and other current

assets

4,201

3,515

4,644

Total current assets

102,031

115,335

114,386

Property and equipment, net

9,409

10,479

16,236

Operating lease right-of-use assets

68,741

72,616

87,572

Intangible assets, net

—

70,106

75,671

Goodwill

31,973

31,973

31,973

Assets held for sale

69,957

260

—

Other assets

1,983

2,576

3,480

Total assets

$

284,094

$

303,345

$

329,318

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

45,976

$

49,396

$

42,584

Accrued salaries and employee benefits

4,247

4,301

9,437

Other accrued expenses

16,731

15,020

11,938

Short-term lease liabilities

19,354

20,892

22,925

Current portion of long-term debt

3,500

3,500

3,500

Total current liabilities

89,808

93,109

90,384

Long-term debt

102,442

108,078

93,830

Long-term lease liabilities

67,044

72,098

89,018

Deferred income tax liability and other

liabilities

4,499

9,803

6,692

Stockholders' equity

20,301

20,257

49,394

Total liabilities and stockholders'

equity

$

284,094

$

303,345

$

329,318

Vince Holding Corp. and

Subsidiaries

Exhibit (3)

Reconciliation of GAAP to Non-GAAP

measures

(Unaudited, amounts in thousands except

share and per share amounts)

For the three months ended

April 29, 2023

As

Reported (GAAP)

Transaction

Related

Expenses

Associated

with the

Authentic Transaction

Gain on

Sale of

Parker

Intangible

Assets

Transaction

Related

Expenses

Associated

with the

sale of

Parker

Intangible

Assets

Discrete

Tax Benefit

Associated

with

Classification

Change

As Adjusted

(Non-

GAAP)

Loss from

operations

$(2,376)

$(2,741)

$765

$(150)

$—

$(250)

Interest expense,

net

3,290

—

—

—

—

3,290

Loss before

income taxes

(5,666)

(2,741)

765

(150)

—

(3,540)

(Benefit)

Provision for

income taxes

(5,285)

—

—

—

(6,127)

842

Net loss

$(381)

$(2,741)

$765

$(150)

$6,127

$(4,382)

Loss per share(1)

$(0.03)

$(0.22)

$0.06

$(0.01)

$0.50

$(0.36)

(1) Based on a weighted-average shares

outstanding of 12,342,355 for the three months ended April 29,

2023, which excludes the effect of dilutive equity securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230608005340/en/

Investor Relations: ICR, Inc. Caitlin Churchill,

646-277-1274 Caitlin.Churchill@icrinc.com

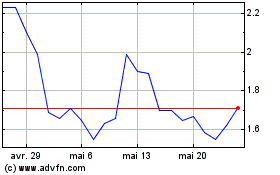

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025