Andlauer Healthcare Group Inc. (TSX: AND) (“

AHG”

or the “

Company”) today announced that it and

Andlauer Management Group Inc. (the “

Selling

Shareholder”) have successfully completed the previously

announced bought deal offering of 3,500,000 subordinate voting

shares at a price of C$48.20 per subordinate voting share for

aggregate gross proceeds of C$168,700,000 (the

“

Offering”). The Offering was comprised of

2,000,000 subordinate voting shares issued from treasury (the

“

Treasury Shares”) and offered by AHG for gross

proceeds of C$96,400,000 and 1,500,000 subordinate voting shares

offered by the Selling Shareholder, for gross proceeds of

C$72,300,000.

The underwriting syndicate was led by CIBC

Capital Markets and RBC Capital Markets (collectively, the

"Joint Bookrunners"), and included Scotia Capital

Inc., TD Securities Inc., Stifel Nicolaus Canada Inc. and National

Bank Financial Inc. (together with the Joint Bookrunners, the

“Underwriters”).

The Underwriters were granted an over-allotment

option, exercisable for a period of 30 days from the date of the

closing of the Offering, to purchase up to an additional 15% of the

aggregate subordinate voting shares to be sold pursuant to the

Offering. The over-allotment option is comprised of 525,000

subordinate voting shares from the Selling Shareholder and does not

include any subordinate voting shares from treasury.

The Company intends to use the net proceeds of

the sale of subordinate voting shares by it under the Offering to

pay a portion of the cash purchase price payable in connection with

its previously disclosed acquisitions of 100% of the issued and

outstanding shares of T.F. Boyle Transportation, Inc. and the

remaining 51% of the issued and outstanding shares of Skelton USA

Inc. (collectively, the “Acquisitions”). AHG did

not receive any of the proceeds of the sale of subordinate voting

shares by the Selling Shareholder.

Prior to the closing of the Offering, the

Selling Shareholder held all 25,100,000 multiple voting shares and

10,200 subordinate voting shares of the Company, representing

approximately 65.3% of the issued and outstanding shares and 88.2%

of the voting power attached to all outstanding shares. Following

the closing of the Offering (assuming no exercise of the

over-allotment option and prior to giving effect to the

Acquisitions), the Selling Shareholder holds all 23,600,000

multiple voting shares and 10,200 subordinate voting shares of the

Company, representing approximately 58.3% of the issued and

outstanding shares and 84.8% of the voting power attached to all

outstanding shares.

The subordinate voting shares were offered in

Canada by way of a short-form prospectus and the Treasury Shares

were also offered in the United States by way of private placement

to Qualified Institutional Buyers pursuant to the exemption from

registration provided by Rule 144A under the United States

Securities Act of 1933, as amended (the "U.S. Securities

Act") and corresponding exemptions from registration under

state securities laws.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

subordinate voting shares have not been, and will not be,

registered under the U.S. Securities Act, or any state securities

laws. Accordingly, the subordinate voting shares may not be offered

or sold within the United States unless registered under the U.S.

Securities Act and applicable state securities laws or pursuant to

exemptions from the registration requirements of the U.S.

Securities Act and applicable state securities laws. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the subordinate

voting shares in any jurisdiction in which such offer, solicitation

or sale would be unlawful.

About AHG

AHG is a leading and growing supply chain

management company offering a robust platform of customized

third-party logistics ("3PL") and specialized transportation

solutions for the healthcare sector. The Company's 3PL services

include customized logistics, distribution and packaging solutions

for healthcare manufacturers across Canada. AHG's specialized

transportation services, including air freight forwarding, ground

transportation, dedicated delivery and last mile services, provide

a one-stop shop for clients' healthcare transportation needs.

Through its complementary service offerings, available across a

coast-to-coast distribution network, the Company strives to

accommodate the full range of its clients' specialized supply chain

needs on an integrated and efficient basis. For more information on

AHG, please visit: www.andlauerhealthcare.com

Forward Looking Information

This press release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking information") within the meaning of applicable

securities laws, including statements regarding the completion of

the proposed Acquisitions and the intended use of proceeds of the

Offering. In some cases, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "targets", "expects", "is expected", "an opportunity

exists", "budget", "scheduled", "estimates", "outlook",

"forecasts", "projection", "prospects", "strategy", "intends",

"anticipates", "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or, "will", "occur" or "be achieved", and

similar words or the negative of these terms and similar

terminology. In addition, any statements that refer to

expectations, intentions, projections or other characterizations of

future events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management's expectations,

estimates and projections regarding future events or

circumstances.

This forward-looking information is based on our

opinions, estimates and assumptions that, while considered by the

Company to be appropriate and reasonable as of the date of this

press release, are subject to known and unknown risks,

uncertainties, assumptions and other factors that may cause the

actual results, level of activity, performance or achievements to

be materially different from those expressed or implied by such

forward-looking information, including but not limited to that all

conditions to completion of the Acquisitions (including regulatory

approvals and third party consents) will not be satisfied or waived

and those other risks discussed in greater detail under the "Risk

Factors" section of our Annual Information Form which is available

under our profile on SEDAR at www.sedar.com.

If any of these risks or uncertainties

materialize, or if the opinions, estimates or assumptions

underlying the forward-looking information prove incorrect, actual

results or future events might vary materially from those

anticipated in the forward-looking information. Although we have

attempted to identify important risk factors that could cause

actual results to differ materially from those contained in

forward-looking information, there may be other risk factors not

presently known to us or that we presently believe are not material

that could also cause actual results or future events to differ

materially from those expressed in such forward-looking

information.

There can be no assurance that forward-looking

statements will prove to be accurate as actual outcomes and results

may differ materially from those expressed in these forward-looking

statements. Readers, therefore, should not place undue reliance on

any such forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, AHG assumes no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future events or otherwise.

All of the forward-looking information contained

in this press release is expressly qualified by the foregoing

cautionary statements.

For further information, please contact:

|

Peter Bromley |

Bruce Wigle |

| Chief Financial Officer |

Investor Relations |

| Tel: (416) 744-4900 |

Tel: (647) 496-7856 |

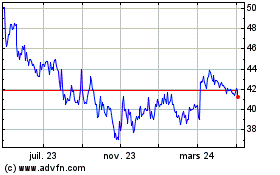

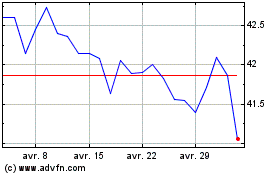

Andlauer Heathcare (TSX:AND)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Andlauer Heathcare (TSX:AND)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025