NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Birchcliff Energy Ltd. ("Birchcliff") (TSX:BIR) is pleased to announce its

strong financial and operational results for the second quarter of 2013 with

record funds flow, significant earnings, a continued decrease in per unit

operating costs and an increase in its credit facilities. Birchcliff confirms

its previously announced annual and year end exit production guidance. The full

2013 Second Quarter Report, containing the unaudited interim condensed financial

statements for the three and six month periods ended June 30, 2013 and the

related Management's Discussion and Analysis, is available on Birchcliff's

website at www.birchcliffenergy.com and will be available on SEDAR at

www.sedar.com.

Current Highlights

-- Confirmation of production guidance. Exit production of approximately

30,000 boe per day; fourth quarter average production in the range of

28,000 to 29,000 boe per day; and 2013 average production of

approximately 26,400 boe per day.

-- Planning is underway for the Phase IV expansion of our Pouce Coupe South

Natural Gas Plant ("PCS Gas Plant"). This will expand processing

capacity to 180 MMcf per day from 150 MMcf per day, for a cost of

approximately $10 million. Subject to natural gas prices in 2014, we

intend to fill the Phase IV expansion of the PCS Gas Plant with natural

gas from new wells drilled by Birchcliff.

Second Quarter Highlights

-- Production increased 10% to 24,141 boe per day, an increase from 22,039

boe per day in the second quarter of 2012. On a per common share basis,

production increased by 7%.

-- Funds flow increased by 61% to a record $41.8 million or $0.29 per

common share, up from $26.0 million or $0.19 per common share in the

second quarter of 2012.

-- 15th consecutive quarter of earnings. $10.8 million of net income, up

from $400,000 in the second quarter of 2012, a significant increase of

2,500%.

-- Corporate operating costs of $5.89 per boe, a decrease of 5% from $6.22

per boe in the second quarter of 2012.

-- PCS Gas Plant providing top tier operating costs. In the first half of

2013, operating costs were approximately $0.36 per Mcfe ($2.17 per boe)

at our PCS Gas Plant, where we processed 69% of our natural gas

production.

-- $50 million preferred share issue completed on June 14, 2013. Net

proceeds from the issue of cumulative redeemable preferred shares,

Series C, were used to reduce bank debt.

-- Increased credit facilities to $600 million from $540 million. Bank

syndicate added a $60 million non-revolving five-year term credit

facility.

SECOND QUARTER FINANCIAL AND OPERATIONAL HIGHLIGHTS

---------------------------------------------------

Three months ended Six months ended

June 30, June 30, June 30, June 30,

2013 2012 2013 2012

----------------------------------------------------------------------------

OPERATING

Average daily production

Light oil - (barrels) 3,941 4,447 3,994 4,511

Natural gas -

(thousands of cubic

feet) 116,963 100,843 122,501 98,042

NGLs - (barrels) 706 785 708 699

Total - barrels of oil

equivalent (6:1) 24,141 22,039 25,119 21,550

----------------------------------------------------------------------------

Average sales price ($

CDN)

Light oil - (per

barrel) 91.19 81.45 87.98 85.84

Natural gas - (per

thousand cubic feet) 3.78 2.05 3.58 2.18

NGLs - (per barrel) 86.60 83.53 86.70 87.71

Total - barrels of oil

equivalent(6:1) 35.74 28.77 33.91 30.72

----------------------------------------------------------------------------

----------------------------------------------------------------------------

NETBACK AND COST ($ per

barrel of oil

equivalent at 6:1)

Petroleum and natural

gas revenue 35.99 28.78 34.04 30.74

Royalty expense (3.34) (3.00) (3.03) (3.39)

Operating expense (5.89) (6.22) (5.82) (6.20)

Transportation and

marketing expense (2.59) (2.39) (2.42) (2.38)

----------------------------------------------------------------------------

Netback 24.17 17.17 22.77 18.77

General &

administrative

expense, net (2.44) (2.26) (2.25) (3.17)

Interest expense (2.70) (1.95) (2.65) (2.30)

----------------------------------------------------------------------------

Funds flow netback 19.03 12.96 17.87 13.30

Stock-based

compensation expense,

net (0.42) (0.64) (0.49) (0.75)

Depletion and

depreciation expense (11.53) (11.48) (11.52) (11.52)

Accretion expense (0.23) (0.22) (0.21) (0.22)

Amortization of

deferred financing

fees (0.08) (0.11) (0.08) (0.10)

Gain on sale of assets - - - 0.99

Income tax expense (1.87) (0.30) (1.57) (0.64)

----------------------------------------------------------------------------

Net income 4.90 0.21 4.00 1.06

Preferred share

dividends (0.45) - (0.44) -

----------------------------------------------------------------------------

Net income available to

common shareholders 4.45 0.21 3.56 1.06

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FINANCIAL

Petroleum and natural

gas revenue ($000) 79,065 57,729 154,783 120,562

----------------------------------------------------------------------------

Funds flow from

operations ($000)(1) 41,804 25,985 81,248 52,181

Per common share -

basic ($)(1) 0.29 0.19 0.57 0.39

Per common share -

diluted ($)(1) 0.29 0.19 0.56 0.39

----------------------------------------------------------------------------

Net income ($000) 10,775 416 18,199 4,147

Net income available to

common shareholders

($000)(2) 9,775 416 16,199 4,147

Per common share -

basic ($)(2) 0.07 - 0.11 0.03

Per common share -

diluted ($)(2) 0.07 - 0.11 0.03

----------------------------------------------------------------------------

Common shares

outstanding

End of period - basic 142,390,094 141,433,644 142,390,094 141,433,644

End of period -

diluted 164,109,781 157,232,116 164,109,781 157,232,116

Weighted average

common shares for

period - basic 142,239,928 138,425,779 142,031,761 132,588,343

Weighted average

common shares for

period - diluted 145,164,527 138,837,321 144,788,757 133,885,883

----------------------------------------------------------------------------

Dividends on preferred

shares ($000) 1,000 - 2,000 -

Capital expenditures

($000) 40,386 58,815 121,396 178,667

----------------------------------------------------------------------------

Long-term bank debt

($000) 409,091 400,876 409,091 400,876

Working capital deficit

($000) 44,032 54,832 44,032 54,832

Total debt ($000) 453,123 455,708 453,123 455,708

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Funds flow from operations and per common share amounts are non-GAAP

measures that represent cash flow from operating activities as per the

Statements of Cash Flows before the effects of changes in non-cash

working capital and decommissioning expenditures.

(2) Net income per common share amounts are calculated using net income

available to Birchcliff's shareholders, adjusted for any preferred

share dividends paid and divided by the weighted average number of

common shares outstanding for the period.

PRESIDENT'S MESSAGE FROM THE 2013 SECOND QUARTER REPORT

August 14, 2013

Fellow Shareholders,

Birchcliff Energy Ltd. ("Birchcliff") continues to be on track to exit 2013 with

production of approximately 30,000 boe per day; fourth quarter average

production in the range of 28,000 to 29,000 boe per day; and 2013 average

production of approximately 26,400 boe per day.

We are pleased to announce strong financial and operational results for the

second quarter of 2013 with record funds flow, significant earnings, a continued

decrease in per unit operating costs, a successful preferred share financing

resulting in less bank debt, together with a corresponding increase in our

credit facilities. It is noteworthy that this is our 15th consecutive quarter of

generating earnings.

Production growth during 2013 is expected to come in large increments at the end

of both the third and fourth quarters as multiple wells from the Montney/Doig

multi-well pads are brought on production at the same time. Wells from a

four-well pad have recently been brought on production, wells from a six-well

pad will come on production by September 1, 2013 and seven additional wells from

multi-well pads and two single wells will all come on production in November and

December.

We are focused on drilling additional Montney/Doig horizontal natural gas wells

that will produce to the Pouce Coupe South Natural Gas Plant (the "PCS Gas

Plant"), which is operated at very low cost. We continue to decrease our per

unit operating costs by filling up the spare capacity at the plant, as our costs

at do not significantly increase as processing volumes increase. By keeping

operating costs low we are able to generate a greater return for our

shareholders.

Birchcliff's Board of Directors have approved a Phase IV expansion of the PCS

Gas Plant in 2014 and planning is underway for this project. Processing capacity

will be expanded to 180 MMcf per day from 150 MMcf per day by adding additional

compression and sales pipeline capacity. The estimated cost of the Phase IV

expansion is approximately $10 million, with the majority of the costs to be

incurred in 2014. We anticipate the start-up date of the Phase IV expansion in

the fall of 2014. Subject to natural gas prices in 2014, we intend to fill the

Phase IV expansion of the PCS Gas Plant with natural gas from new wells drilled

by Birchcliff.

Preferred Share Financing

On June 14, 2013, Birchcliff completed a $50 million preferred share issue. The

Corporation issued 2,000,000 preferred shares, Series C, at a price of $25.00

per share. The preferred shares, Series C bear a 7% dividend and are redeemable

by their holders in seven years. The net proceeds of approximately $47.8 million

were used to pay down debt by reducing the Corporation's revolving credit

facilities.

Increase to Credit Facilities

Birchcliff's syndicated credit facilities increased to an aggregate of $600

million from the previous credit limit of $540 million. On May 16, 2013,

Birchcliff's bank syndicate approved a $60 million non-revolving five-year term

credit facility with a maturity date of May 25, 2018. The terms of the other

credit facilities, a $70 million non-revolving five-year term credit facility

and extendible revolving credit facilities of $470 million, remain unchanged,

including the two-year term-out feature of the revolving credit facilities. The

increased aggregate credit facilities amount will provide Birchcliff with

increased financial flexibility.

2013 SECOND QUARTER FINANCIAL AND OPERATIONAL RESULTS

Production

Second quarter production averaged 24,141 boe per day, which is a 10% increase

over production of 22,039 boe per day in the second quarter of 2012. Production

per common share increased 7% from the second quarter of 2012.

Production consisted of approximately 81% natural gas and 19% crude oil and

natural gas liquids in the second quarter. Approximately 69% of Birchcliff's

natural gas production and 58% of corporate production was processed at the PCS

Gas Plant in the first half of 2013.

Funds Flow and Earnings

Funds flow increased 61% from the second quarter of 2012, to a record $41.8

million or $0.29 per basic common share. This increase was largely a result of

the average AECO natural gas spot price increasing by 87% to $3.54 per Mcf in

the second quarter of 2013 compared to $1.89 per Mcf in the second quarter of

2012.

This is the 15th consecutive quarter that Birchcliff has reported earnings.

Birchcliff had net income of $10.8 million as compared to $0.4 million in the

second quarter of 2012, a significant increase of 2,500%.

Operating Costs

Operating costs in the second quarter were $5.89 per boe, down 5% from the

second quarter of 2012. This reduction of operating costs on a per unit basis

was largely due to the cost benefits achieved from processing increased volumes

of natural gas through the PCS Gas Plant and the implementation of various

optimization initiatives.

Debt and Capitalization

At June 30, 2013, Birchcliff's long-term bank debt was $409.1 million from

available credit facilities aggregating $600 million. Total debt, including the

working capital deficit of $44.0 million, was $453.1 million. Birchcliff has a

significant amount of credit capacity and financial flexibility.

At June 30, 2013, Birchcliff had outstanding: 142,390,094 basic common shares;

164,109,781 common shares on a fully diluted basis; 2,000,000 preferred shares,

Series A; and 2,000,000 preferred shares, Series C. The Corporation also had

6,000,000 warrants outstanding, each warrant providing the right to purchase one

common share at an exercise price of $8.30 until August 8, 2014 and 2,939,732

performance warrants outstanding, each performance warrant providing the right

to purchase one common share at an exercise price of $3.00.

PCS Gas Plant Netbacks

Processing natural gas at the PCS Gas Plant has materially improved Birchcliff's

funds flow and net earnings.

In the first half of 2013, net operating costs for natural gas processed at the

PCS Gas Plant averaged $0.36 per Mcfe ($2.17 per boe) and the estimated

operating netback for Birchcliff's natural gas production flowing to the PCS Gas

Plant was $2.97 per Mcfe ($17.82 per boe).

The following table details Birchcliff's net production and estimated operating

netback for wells producing to the PCS Gas Plant, on a production month basis.

-----------------------------------

Production Processed through the PCS Gas Six months ended Six months ended

Plant June 30, 2013(1) June 30, 2012

Average daily production, net to

Birchcliff:

Natural gas (Mcf) 84,561 57,211

Oil & NGLs (bbls) 375 232

----------------------------------------------------------------------------

Total boe (6:1) 14,468 9,767

Percentage of corporate natural gas

production 69% 58%

Percentage of corporate production 58% 45%

Netback and cost: $/Mcfe $/boe $/Mcfe $/boe

Petroleum and natural gas revenue(2) 3.81 22.88 2.47 14.82

Royalty expense (0.23) (1.39) (0.07) (0.42)

Operating expense, net of recoveries (0.36) (2.17) (0.26) (1.56)

Transportation and marketing expense (0.25) (1.50) (0.22) (1.32)

----------------------------------------------------------------------------

Estimated operating netback 2.97 17.82 1.92 11.52

----------------------------------------------------------------------------

Operating margin(3) 78% 78% 78% 78%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) The PCS Gas Plant processed an average of 102 MMcf per day of gross raw

gas at the inlet during the first half of 2013, against current

licensed capacity of 150 MMcf per day at June 30, 2013.

(2) AECO natural gas price averaged $3.37 per Mcf and $2.02 per Mcf for the

six months ended June 30, 2013 and 2012, respectively.

(3) Operating margin at the PCS Gas Plant is determined by dividing the

estimated operating netback by petroleum and natural gas revenue in the

period.

OPERATIONS UPDATE

Drilling

Birchcliff's 2013 drilling program is focused on our two proven resource plays,

the Montney/Doig Natural Gas Resource Play and the Worsley Light Oil Resource

Play. During the second quarter of 2013 the Corporation focused its efforts on

the Montney/Doig Natural Gas Resource Play in the Pouce Coupe area, drilling

through spring break-up by utilizing multi-well pads.

During the second quarter, Birchcliff drilled 9 (9.0 net) wells, including 8

(8.0 net) natural gas wells, and 1 (1.0 net) oil well. In the first half of 2013

Birchcliff drilled 20 (19.5 net) wells, all of which were horizontal wells.

These wells consist of 13 (13.0 net) gas wells and 7 (6.5 net) oil wells.

Birchcliff currently has three drilling rigs working. Two rigs are drilling

Montney/Doig horizontal natural gas wells and the third rig is in the Worsley

area, drilling Charlie Lake horizontal light oil wells.

Land

The Corporation has been actively buying more land. We have continued to expand

our undeveloped land base and held 548,457 (513,222 net) acres at June 30, 2013,

with a 94% average working interest. During the second quarter of 2013,

Birchcliff acquired 11,520 (11,200 net) acres of undeveloped land, all in its

core area of the Peace River Arch of Alberta.

Birchcliff's land base primarily consists of large contiguous blocks of high

working interest acreage located near facilities owned and/or operated by

Birchcliff or near third party infrastructure. During the second quarter of

2013, essentially all of the new land was purchased at 100% working interest.

Montney/Doig Natural Gas Resource Play

In the second quarter of 2013, Birchcliff drilled 8 (8.0 net) Montney/Doig

horizontal natural gas wells. Year-to-date Birchcliff has successfully drilled

13 (13.0 net) Montney/Doig horizontal natural gas wells as well as recently

drilling a vertical exploration well for the Montney/Doig Natural Gas Resource

Play. Birchcliff continues to expand the Montney/Doig Natural Gas Resource Play

both geographically and stratigraphically.

We are utilizing multi-well pad drilling on our Montney/Doig Natural Gas

Resource Play to improve drilling and completion efficiencies and reduce the

cost per well. The reduction in drilling and completion costs is significant.

Another benefit of pad drilling is that we are able to drill continuously

through spring break-up. Our increased use of pad drilling includes five

multi-well pads in 2013; one six-well pad; two four-well pads, one three-well

pad; and one two-well pad. The remaining three of the 22 horizontal wells in the

2013 Montney/Doig program are single well locations.

We have recently finished the drilling and completion of six horizontal natural

gas wells from one pad and four horizontal natural gas wells from another pad.

Wells from this four well pad have recently been brought on production, wells

from the six-well pad will come on production by September 1, 2013 and seven

additional wells from multi-well pads and two single wells will all come on

production in November and December.

Our budget for 2013 includes 22 (22.0 net) Montney/Doig horizontal natural gas

wells and 1 (1.0 net) Montney/Doig vertical exploration well. Of the 22 (22.0

net) horizontal wells, 20 (20.0 net) wells are targeting the Middle/Lower

Montney Play and 2 (2.0 net) are targeting the Basal Doig/Upper Montney Play.

Currently, we have seven of the 22 (22.0 net) wells on production and we

anticipate 12 of the remaining 13 wells will produce to the PCS Gas Plant by

year-end, utilizing most of its spare capacity.

Two drilling rigs are currently drilling on our Montney/Doig Natural Gas

Resource Play; one rig is on a four-well pad and the other rig is drilling a

horizontal exploration well.

PCS Gas Plant Phase IV Expansion

Planning is underway for the Phase IV expansion of the PCS Gas Plant in 2014,

which has been approved by Birchcliff's Board of Directors. Processing capacity

will be expanded to 180 MMcf per day from 150 MMcf per day by adding additional

compression and sales pipeline capacity. The estimated cost of the Phase IV

expansion is approximately $10 million, with the majority of the costs to be

incurred in 2014. The anticipated start-up date of the Phase IV expansion will

be in the fall of 2014. Subject to natural gas prices in 2014, we intend to fill

the Phase IV expansion with natural gas from new wells drilled by Birchcliff.

Worsley Light Oil Resource Play

In the second quarter of 2013, Birchcliff was not actively drilling due to

spring break-up. We started drilling again after break-up and have drilled 3

(3.0 net) wells since break-up. To date in 2013 we have successfully drilled 8

(8.0 net) Charlie Lake horizontal wells utilizing multi-stage fracture

stimulation technology.

Our budget for 2013 includes 11 (11.0 net) Charlie Lake horizontal oil wells,

utilizing multi-stage fracture stimulation technology.

We have recently completed a significant facility optimization and

infrastructure debottlenecking project in the northwest end of the Worley field

that will allow us to meet our exit production targets for this area and provide

opportunity for growth in 2014.

With the continued positive response of the waterflood on our Worsley pool, we

are expanding the water flood area and are conducting the field operations

necessary to convert two wells to injectors and install the associated water

injection infrastructure.

Halfway Light Oil Play

In the second quarter of 2013, Birchcliff drilled 1 (1.0 net) Halfway

exploration horizontal light oil well, which is currently being completed.

Birchcliff previously drilled 4 (2.66 net) wells on the play, all of which have

been successful.

With our continued success on the Halfway Light Oil Play our 2013 budget

includes 4 (2.5 net) Halfway horizontal light oil wells in 2013. This will bring

Birchcliff's total number of Halfway horizontal light oil wells on the Halfway

Light Oil Play to 7 (4.66 net) wells since 2011.

SHAREHOLDER SUPPORT

We thank Mr. Seymour Schulich, our largest shareholder, for his leadership,

unwavering commitment and his ongoing financial support. Mr. Schulich holds 40

million common shares representing 28.2% of the current issued and outstanding

common shares.

BIRCHCLIFF MOURNS THE PASSING OF BOARD MEMBER SCOTTY CAMERON

On June 18, 2013, Gordon W. (Scotty) Cameron, a founding shareholder and

Director of Birchcliff, passed away at the age of 82.

We are deeply saddened by the loss of our friend, Scotty Cameron. Scotty was an

experienced oilman, a dedicated and diligent director whose strong leadership

has been invaluable to Birchcliff. Prior to his involvement with Birchcliff,

Scotty was a founding shareholder and Director of each of Stampeder Exploration

Ltd., Big Bear Exploration Ltd. and Case Resources Ltd. Scotty was a team player

and extremely knowledgeable about the natural gas industry. Scotty's insight,

character and warmth will be dearly missed by his many friends at Birchcliff, as

well as his friends and colleagues throughout the industry and our community. We

grieve the loss of a valued business associate and a wonderful friend, who

through his life's work, left this world a better place.

MANAGEMENT CHANGES

We have recently accepted the resignation of Ms. Karen Pagano, who was

Birchcliff's Vice-President Engineering. Karen has accepted a role with a large

industry player as Vice-President Operations. We thank her for her hard work and

dedication over the past eight years at Birchcliff and wish her the best in the

future.

We are extremely pleased to announce the appointment of Mr. Christopher Carlsen

as Vice-President Engineering. Christopher has been with Birchcliff for five

years, most recently as our North Asset Team Lead and has proven he has the

technical expertise, leadership skills, integrity and passion to be an excellent

member of our Executive Team. On behalf of the current Executive and the

Directors, we welcome Mr. Carlsen to his new role as Birchcliff's Vice President

Engineering.

OUTLOOK

Birchcliff is well into the execution of its $246.6 million 2013 capital budget.

Fourth quarter average production in 2013 is expected to be in the range of

28,000 to 29,000 boe per day and exit production is expected to be approximately

30,000 boe per day, setting us up for a very healthy and active 2014. Yearly

average production for 2013 is expected to be approximately 26,400 boe per day.

Birchcliff continues to be focused on improving capital efficiency. We are

utilizing multi-well pad drilling on our Montney/Doig Natural Gas Resource Play

to improve drilling and completion efficiencies and reduce the cost per well.

The reduction in drilling and completion costs is significant. Another benefit

of pad drilling is that we are able to drill continuously through spring

break-up.

Production growth during 2013 will come in large increments at the end of both

the third and fourth quarters as multiple wells from the Montney/Doig multi-well

pads are brought on production at the same time. Wells from a four-well pad have

recently been brought on production, wells from a six-well pad will come on

production by September 1, 2013 and the seven additional wells from multi-well

pads and two single wells will all come on production in November and December.

Of the 22 (22.0 net) Montney/Doig horizontal gas wells drilled in 2013, 19 (19.0

net) are from five multi-well pads.

We are very pleased and excited with the current and future outlook for

Birchcliff. Our production and opportunity portfolio continues to increase while

our cost structure continues to decrease. To date in 2013 we have added a

significant amount of contiguous land and additional drilling locations in the

heart of our Pouce Coupe area on the Montney/Doig Natural Gas Resource Play,

adjacent to our PCS Gas Plant and existing infrastructure. We now have up to

2,029 net future potential horizontal drilling locations on the Montney/Doig

Natural Gas Resource Play. Birchcliff has now drilled and cased 106 (94.21 net)

Montney/Doig horizontal natural gas wells, utilizing the latest multi-stage

fracture stimulation technology.

We remain focused on our business - growth by the drill bit, in our core area of

the Peace River Arch of Alberta. We continue to use the same services, in the

same area, directed by the same experienced Birchcliff personnel, which provides

consistency, repeatability and reliability in our operations.

Thank you to all of our shareholders for their support and to our staff who

continue to go that extra mile for the benefit of all of us.

With Respect,

A. Jeffery Tonken, President and Chief Executive Officer

ADVISORIES

Non-GAAP Measures: This Press Release uses "funds flow", "funds flow from

operations", "funds flow netback", "funds flow per common share", "netback",

"operating netback", "estimated operating netback" and "operating margin", which

do not have standardized meanings prescribed by generally accepted accounting

principles ("GAAP") and therefore may not be comparable measures to other

companies where similar terminology is used. Netback or operating netback

denotes petroleum and natural gas revenue less royalties, less operating

expenses and less transportation and marketing expenses. Operating costs at the

PCS Gas Plant are calculated on a production month basis. Estimated operating

netback of the PCS Gas Plant (and the components thereof) is based upon certain

cost allocations and accruals directly related to the PCS Gas Plant and the

related wells and infrastructure, calculated on a production month basis. Funds

flow, funds flow netback or funds flow from operations denotes cash flow from

operating activities as it appears on the Corporation's Condensed Statements of

Cash Flows before decommissioning expenditures and changes in non-cash working

capital. Funds flow, funds flow netback or funds flow from operations is derived

from net income plus income tax expense, depletion and depreciation expense,

accretion expense, stock-based compensation expense, amortization of deferred

financing fees and gains on divestitures. Funds flow per common share denotes

funds flow divided by the weighted average number of common shares. Operating

margin is calculated by dividing the estimated operating netback for the period

by the petroleum and natural gas revenue for the period.

Boe Conversions: Barrel of oil equivalent ("boe") amounts have been calculated

by using the conversion ratio of six thousand cubic feet (6 Mcf) of natural gas

to one barrel of oil (1 bbl). Boe amounts may be misleading, particularly if

used in isolation. A boe conversion ratio of 6 Mcf to 1 bbl is based on an

energy equivalency conversion method primarily applicable at the burner tip and

does not represent a value equivalency at the wellhead.

Mcfe, MMcfe, Bcfe and Tcfe Conversions: Thousands of cubic feet of gas

equivalent ("Mcfe"), millions of cubic feet of gas equivalent ("MMcfe"),

billions of cubic feet of gas equivalent ("Bcfe") and trillions of cubic feet of

gas equivalent ("Tcfe") amounts have been calculated by using the conversion

ratio of one barrel of oil (1 bbl) to six thousand cubic feet (6 Mcf) of natural

gas. Mcfe, MMcfe, Bcfe and Tcfe amounts may be misleading, particularly if used

in isolation. A conversion ratio of 1 bbl to 6 Mcf is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead.

Forward-Looking Information: This Press Release contains forward-looking

information within the meaning of applicable Canadian securities laws.

Forward-looking information relates to future events or future performance and

is based upon the Corporation's current internal expectations, estimates,

projections, assumptions and beliefs. All information other than historical fact

is forward-looking information. Words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate", "may", "will", "potential",

"proposed" and other similar words that convey certain events or conditions

"may" or "will" occur are intended to identify forward-looking information. In

particular, this Press Release contains forward-looking information relating to

anticipated fourth quarter and exit production; planned 2013 capital spending

and sources of funding; anticipated reduction of operating costs of a per unit

basis; the intention to drill and complete future wells; an expansion of the PCS

Gas Plant; and expected future reserves and resource additions.

The forward-looking information is based upon assumptions as to future commodity

prices, currency exchange rates, inflation rates, well production rates, well

drainage areas, success rates for future drilling and availability of labour and

services. With respect to numbers of future wells to be drilled, a key

assumption is that geological and other technical interpretations performed by

the Corporation's technical staff, which indicate that commercially economic

volumes can be recovered from the Corporation's lands as a result of drilling

future wells, are valid. Estimates as to 2013 exit production, average fourth

quarter and annual production rates assume that no unexpected outages occur in

the infrastructure that the Corporation relies on to produce its wells, that

existing wells continue to meet production expectations and future wells

scheduled to come on production in 2013 meet timing and production expectations.

Undue reliance should not be placed on forward-looking information, as there can

be no assurance that the plans, intentions or expectations upon which they are

based will occur. Although the Corporation believes that the expectations

reflected in the forward-looking statements are reasonable, there can be no

assurance that such expectations will prove to be correct. As a consequence,

actual results may differ materially from those anticipated.

Forward-looking information necessarily involves both known and unknown risks

associated with oil and gas exploration, production, transportation and

marketing such as uncertainty of geological and technical data, imprecision of

reserves and resource estimates, operational risks, environmental risks, loss of

market demand, general economic conditions affecting ability to access

sufficient capital, changes in governmental regulation of the oil and gas

industry and competition from others for scarce resources.

The foregoing list of risk factors is not exhaustive. Additional information on

these and other risk factors that could affect operations or financial results

are included in the Corporation's most recent Annual Information Form and in

other reports filed with Canadian securities regulatory authorities.

Forward-looking information is based on estimates and opinions of management at

the time the information is presented. The Corporation is not under any duty to

update the forward-looking information after the date of this Press Release to

conform such information to actual results or to changes in the Corporation's

plans or expectations, except as otherwise required by applicable securities

laws.

About Birchcliff:

Birchcliff is a Calgary, Alberta based intermediate oil and gas company with

operations concentrated within its one core area, the Peace River Arch of

Alberta. Birchcliff's Common Shares, Cumulative Redeemable Preferred Shares,

Series A and Series C and Warrants are listed for trading on the Toronto Stock

Exchange under the symbols "BIR", "BIR.PR.A", "BIR.PR.C" and "BIR.WT",

respectively.

FOR FURTHER INFORMATION PLEASE CONTACT:

Birchcliff Energy Ltd.

Jeff Tonken

President and Chief Executive Officer

(403) 261-6401

(403) 261-6424 (FAX)

Birchcliff Energy Ltd.

Bruno Geremia

Vice-President and Chief Financial Officer

(403) 261-6401

(403) 261-6424 (FAX)

Birchcliff Energy Ltd.

Jim Surbey

Vice-President, Corporate Development

(403) 261-6401

(403) 261-6424 (FAX)

Birchcliff Energy Ltd.

Suite 500, 630 - 4th Avenue S.W.

Calgary, AB T2P 0J9

www.birchcliffenergy.com

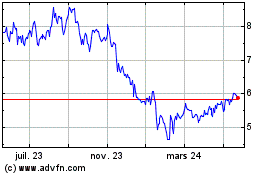

Birchcliff Energy (TSX:BIR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

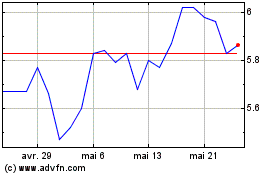

Birchcliff Energy (TSX:BIR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024