Dominion Lending Centres Inc. (TSX:DLCG) (“DLCG” or the

“Corporation”) is pleased to report its financial results for the

three months ended June 30, 2022 (“Q2-2022”) and six months ended

June 30, 2022. For complete information, readers should refer to

the interim financial statements and management discussion and

analysis which are available on SEDAR at www.sedar.com and on the

Corporation’s website at www.dlcg.ca. All amounts are presented in

Canadian dollars unless otherwise stated.

Reference herein to the Dominion Lending Centres

Group of Companies (the “DLC Group” or “Core Business Operations”)

includes the Corporation and its three main subsidiaries, MCC

Mortgage Centres Canada Inc. (“MCC”), MA Mortgage Architects Inc.

(“MA”), and Newton Connectivity Systems Inc. (“Newton), and

excludes the Non-Core Business Asset Management segment and their

corresponding historical financial and operating results. The

“Non-Core Business Asset Management” segment represents the

Corporation’s share of income in its equity-accounted investments

in Club16 Limited Partnership (“Club16”) and Cape Communications

International Inc. (“Impact”) (collectively, the “Non-Core

Assets”), the expenses, assets and liabilities associated with

managing the Non-Core Assets, the non-core credit facility, and

public company costs.

Q2-2022 Financial

Highlights

- Q2-2022 funded

volumes of $21.4 billion, representing a 2% decrease as compared to

Q2-2021;

- Q2-2022 DLC Group

revenue of $21.8 million representing a 2% increase as compared to

Q2-2021;

- Q2-2022 DLC Group

Adjusted EBITDA of $12.6 million as compared to $12.8 million

during Q2-2021, representing a 2% decrease over the prior

period;

- The Corporation

declared a quarterly dividend of $0.03 per class A common share,

resulting in a dividend payment of $1.5 million; and

- The Corporation

implemented a normal-course issuer bid (“NCIB”) that allows the

Corporation to purchase up to 1.2 million Common Shares (during

Q2-22, the Corporation made repurchases under the NCIB of 31,925

Common Shares at an average price of $3.33 per share).

Gary Mauris, Executive Chairman and CEO,

commented, “We are pleased to announce our second quarter financial

and operating results for the period ended June 30, 2022. Looking

back, the Corporation experienced significant growth in funded

volumes in 2021 and we’re encouraged that we’ve maintained that

pace in the first half of 2022. Funded volumes during Fiscal 2021

grew by over 50% while adjusted EBITDA grew by over 70%. Putting

the foregoing into perspective, we are very proud of our team

achieving funded volumes of $21.4 billion, which is the third

highest in our history, after Q3-2021 and Q2-2021. Furthermore, we

are delighted with our ongoing recruiting and reflagging efforts

which resulted in over 10% growth in our overall broker count

year-over-year. Our mortgage professionals are our most important

asset and growing our mortgage professional base will enable us to

better navigate housing market volatility. Looking forward, an

increase in mortgage interest rates have softened overall housing

market activity, however, from our perspective, in a rising

interest rate environment, working with a mortgage broker is even

more critical to ensure Canadians are receiving the best advice as

well as most competitive mortgage rates. While we may see some

short-term volatility in our business, we are not anticipating a

long-term material negative impact on funded volumes.”

Selected Consolidated Financial

Highlights:Below are the highlights of our financial

results for the three and six months ended June 30, 2022 and June

30, 2021.

|

Three months ended June 30, |

|

Six months ended June 30, |

|

(in thousands, except per share) |

|

2022 |

|

2021 |

Change |

|

2022 |

|

2021 |

Change |

|

Revenues |

$ |

21,823 |

$ |

21,316 |

2% |

$ |

38,852 |

$ |

35,204 |

10% |

|

Income from operations |

|

10,853 |

|

10,741 |

1% |

|

16,181 |

|

15,741 |

3% |

|

Adjusted EBITDA(1) |

|

13,391 |

|

13,502 |

(1%) |

|

19,631 |

|

20,521 |

(4%) |

|

Free cash flow attributable to common shareholders(1) |

|

5,507 |

|

4,853 |

13% |

|

6,648 |

|

7,826 |

(15%) |

|

Net income (loss)(2) |

|

6,709 |

|

608 |

NMF(3) |

|

(15,781) |

|

508 |

NMF(3) |

|

Adjusted net income(1) |

|

5,268 |

|

4,245 |

24% |

|

6,349 |

|

4,472 |

42% |

|

Diluted income (loss) per Common Share(2) |

|

0.14 |

|

0.00 |

NMF(3) |

|

(0.34) |

|

(0.01) |

NMF(3) |

|

Adjusted diluted earnings per Common Share(1) |

|

0.11 |

|

0.08 |

38% |

|

0.13 |

|

0.08 |

63% |

|

Dividends declared per share |

$ |

0.03 |

$ |

- |

NMF(3) |

$ |

0.03 |

$ |

- |

NMF(3) |

(1) Please see the Non-IFRS

Financial Performance Measures section of this document for

additional information.

(2) Net income (loss) for the

three and six months ended June 30, 2022 includes $2.5 million and

$28.3 million of non-cash finance expense on the Preferred Share

liability, respectively (June 30, 2021 – $7.1 million and $10.3

million). The quarterly reassessment of the Corporation’s outlook

and forecast for the 2022 fiscal year strengthened since its prior

budgeting period in the fourth quarter of 2021, resulting in an

increase the Corporation’s Preferred Share liability during the six

months ended June 30, 2022 (see the Preferred Shares section).

(3) The percentage change is

Not a Meaningful Figure (“NMF”).

|

Three months ended June 30, |

|

Six months ended June 30, |

|

(in thousands) |

|

2022 |

|

2021 |

Change |

|

2022 |

|

2021 |

Change |

|

Adjusted EBITDA(1) |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

$ |

12,634 |

$ |

12,829 |

(2%) |

$ |

20,390 |

$ |

21,209 |

(4%) |

|

Non-Core Business Asset Management |

|

757 |

|

673 |

12% |

|

(759) |

|

(688) |

(10%) |

|

Adjusted EBITDA(1)(2) |

$ |

13,391 |

$ |

13,502 |

(1%) |

$ |

19,631 |

$ |

20,521 |

(4%) |

(1) Please see the Non-IFRS

Financial Performance Measures section of this document for

additional information.

(2) Adjusted EBITDA for the six

months ended June 30, 2022 includes an increase in professional

fees of $1.6 million compared to the six months ended June 30, 2021

primarily from elevated legal costs and expenses associated with

the stay of the class action legal claim, an ongoing arbitration,

the settlement of legal claims, and the completion of the Newton

Acquisition.

HighlightsThe Corporation’s net

income increased during the three months ended June 30, 2022 when

compared to the same period in the previous year, primarily due to

lower non-cash finance expense on the Preferred Share liability of

$4.6 million, a decrease in interest expense of $0.8 million from

lower interest rates under the Junior Credit Facility when compared

to the previous Sagard credit facility, higher revenues, and a

recovery on share-based compensation. The decrease in finance

expense on the Preferred share liability was due to the

Corporation’s outlook and forecast for the 2022 fiscal year

softening from its previous outlook and forecast assessed during

the first quarter of 2022.

For the six months ended June 30, 2022 the

Corporation incurred a net loss compared to net income during the

same period in the previous year, primarily due to higher non-cash

finance expense on the Preferred Share liability of $18.0 million

and higher general administrative expenses from increased legal

costs and expenses and personnel costs. The Corporation’s outlook

and forecast for the 2022 fiscal year strengthened since its

budgeting period in the fourth quarter of 2021, significantly

increasing the Corporation’s Preferred Share liability during the

six months ended June 30, 2022, which was partly offset by a slight

recovery during the three months ended June 30, 2022. The increase

in expenses was partly offset by higher revenues from higher funded

mortgage volumes, lower interest expense from lower interest rates

under the Junior Credit Facility when compared to the previous

Sagard credit facility, and a recovery on share-based

compensation.

Adjusted net income for the three and six months

ended June 30, 2022 increased compared to the same periods in the

previous year primarily from higher income from operations driven

by increased revenues.

Adjusted EBITDA was relatively consistent for

the three months ended June 30, 2022 and decreased during the six

months ended June 30, 2022 when compared to the same periods in the

previous year. The decrease during the six months ended June 30,

2022 was due to higher general and administrative expenses,

primarily due to elevated legal costs and expenses, and increased

personnel costs; partly offset by higher revenues.

Free cash flow attributable to common

shareholders increased during the three months ended June 30, 2022

when compared to the same period in the prior year primarily due to

the full allocation of Newton cash flows to common shareholders

compared to 70% in 2021. The decrease in adjusted EBITDA

contributed to the decrease in free cash flow attributable to

common shareholders during the six months ended June 30, 2022 when

compared to the same period in 2021.

Selected Segmented Financial

Highlights:

|

Three months ended June 30, |

|

Six months ended June 30, |

|

(in thousands) |

|

2022 |

|

2021 |

Change |

|

2022 |

|

2021 |

Change |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

$ |

21,823 |

$ |

21,316 |

2% |

$ |

38,852 |

$ |

35,204 |

10% |

|

Revenues |

|

21,823 |

|

21,316 |

2% |

|

38,852 |

|

35,204 |

10% |

|

Operating expenses(1) |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

|

10,488 |

|

9,842 |

7% |

|

21,155 |

|

17,324 |

22% |

|

Non-Core Business Asset Management |

|

482 |

|

733 |

(34%) |

|

1,516 |

|

2,139 |

(29%) |

|

Operating expenses(1) |

|

10,970 |

|

10,575 |

4% |

|

22,671 |

|

19,463 |

16% |

|

Income (loss) from operations |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

|

11,335 |

|

11,474 |

(1%) |

|

17,697 |

|

17,880 |

(1%) |

|

Non-Core Business Asset Management |

|

(482) |

|

(733) |

34% |

|

(1,516) |

|

(2,139) |

29% |

|

Income from operations |

|

10,853 |

|

10,741 |

1% |

|

16,181 |

|

15,741 |

3% |

|

Adjusted EBITDA(2) |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

|

12,634 |

|

12,829 |

(2%) |

|

20,390 |

|

21,209 |

(4%) |

|

Non-Core Business Asset Management |

|

757 |

|

673 |

12% |

|

(759) |

|

(688) |

(10%) |

|

Adjusted EBITDA(2)(3) |

$ |

13,391 |

|

13,502 |

(1%) |

$ |

19,631 |

|

20,521 |

(4%) |

(1) Operating expenses are comprised

of direct costs, general and administrative expenses, share-based

payments (recovery) expense, and depreciation and amortization

expense.

(2) Please see the Non-IFRS Financial

Performance Measures section of this document for additional

information.

(3) Adjusted EBITDA for the six

months ended June 30, 2022 includes an increase in professional

fees of $1.6 million compared to the six months ended June 30, 2021

primarily from elevated legal costs and expenses associated with

the stay of the class action legal claim, an ongoing arbitration,

the settlement of legal claims, and the completion of the Newton

Acquisition.

Non-IFRS Financial Performance

Measures Management presents certain non-IFRS financial

performance measures which we use as supplemental indicators of our

operating performance. These non-IFRS measures do not have any

standardized meaning, and therefore are unlikely to be comparable

to the calculation of similar measures used by other companies and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS. Non-IFRS

measures are defined and reconciled to the most directly comparable

IFRS measure. Non-IFRS financial performance measures include

Adjusted EBITDA, Adjusted net income, Adjusted earnings per share,

and free cash flow. Please see the Non-IFRS Financial Performance

Measures section of the Corporation’s MD&A dated August 10,

2022, for the three and six months ended June 30, 2022, for further

information on these measures. The Corporation’s MD&A is

available on SEDAR at www.sedar.com.

The following table reconciles adjusted EBITDA

from income (loss) before income tax, which is the most

directly-comparable measure calculated in accordance with IFRS:

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

(in thousands) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Income (loss) before income tax |

$ |

9,449 |

|

$ |

3,637 |

|

$ |

(11,737) |

|

$ |

4,317 |

|

|

Add back: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,034 |

|

|

1,064 |

|

|

2,063 |

|

|

2,110 |

|

|

Finance expense |

|

600 |

|

|

1,350 |

|

|

1,032 |

|

|

2,597 |

|

|

Finance expense on the Preferred Share liability(1) |

|

2,535 |

|

|

7,146 |

|

|

28,250 |

|

|

10,292 |

|

|

|

|

13,618 |

|

|

13,197 |

|

|

19,608 |

|

|

19,316 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Share-based payments (recovery) expense |

|

(221) |

|

|

228 |

|

|

(11) |

|

|

1,123 |

|

|

Foreign exchange loss (gain) |

|

1 |

|

|

(153) |

|

|

16 |

|

|

(211) |

|

|

(Gain) loss on contract settlement |

|

(52) |

|

|

355 |

|

|

(27) |

|

|

441 |

|

|

Other income(2) |

|

- |

|

|

(175) |

|

|

- |

|

|

(238) |

|

|

Acquisition, integration and restructuring costs(3) |

|

45 |

|

|

50 |

|

|

45 |

|

|

90 |

|

|

Adjusted EBITDA(4)(5) |

$ |

13,391 |

|

$ |

13,502 |

|

$ |

19,631 |

|

$ |

20,521 |

|

(1) The Corporation’s overall outlook and

forecast has strengthened since its prior budgeting period in the

fourth quarter of 2021, resulting in an increase the Corporation’s

Preferred Share liability during the six months ended June 30, 2022

(see the Preferred Share section).

(2) Other income in the three and six

months ended June 30, 2021 related to a legal settlement and the

derecognition of sales tax receivables and payables on initial

acquisition of the Core Business Operations in 2016,

respectively.

(3) Acquisition, integration and

restructuring costs for the three and six months ended June 30,

2021 related to the restructuring and amalgamation of the

Corporation from Founders Advantage Capital Corp. to Dominion

Lending Centres Inc.

(4) Adjusted EBITDA for the six months

ended June 30, 2022 included an increase in professional fees of

$1.6 million compared to the six months ended June 30, 2021

primarily from elevated legal costs and expenses associated with

the stay of the class action legal claim, an ongoing arbitration,

the settlement of legal claims, and the completion of the Newton

Acquisition.

(5) The amortization of

franchise rights and relationships within the Core Business

Operations of $0.8 million and $1.5 million for the three and

months ended June 30, 2022 (June 30, 2021 – $0.7 million and $1.3

million) are classified as a charge against revenue, and have not

been added back for Adjusted EBITDA.

The following table reconciles free cash flow

from cash flow from operating activities, which is the most

directly-comparable measure calculated in accordance with IFRS:

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

(in thousands) |

|

2022 |

|

|

2021(2) |

|

|

2022 |

|

|

2021(2) |

|

|

Cash flow from operating activities |

$ |

11,644 |

|

$ |

14,040 |

|

$ |

13,465 |

|

$ |

18,653 |

|

|

Changes in non-cash working capital and other non-cash items |

|

(1,053) |

|

|

(4,030) |

|

|

3,079 |

|

|

(2,701) |

|

|

Cash provided from operations excluding changes in non-cash

working capital and other non-cash items |

|

10,591 |

|

|

10,010 |

|

|

16,544 |

|

|

15,952 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Distributions from equity-accounted investees(1) |

|

331 |

|

|

471 |

|

|

481 |

|

|

721 |

|

|

Maintenance CAPEX(1) |

|

(1,048) |

|

|

(615) |

|

|

(4,208) |

|

|

(1,080) |

|

|

NCI portion of cash provided from continuing operations |

|

- |

|

|

(409) |

|

|

(191) |

|

|

(781) |

|

|

Lease payments(1) |

|

(153) |

|

|

(136) |

|

|

(300) |

|

|

(276) |

|

|

Acquisition, integration and restructuring costs(1) |

|

45 |

|

|

50 |

|

|

45 |

|

|

90 |

|

|

(Gain) loss on settlement of a contract(1) |

|

(52) |

|

|

355 |

|

|

(27) |

|

|

441 |

|

|

Other non-cash items(1) |

|

- |

|

|

(175) |

|

|

- |

|

|

(238) |

|

|

|

|

9,714 |

|

|

9,551 |

|

|

12,344 |

|

|

14,829 |

|

|

Free cash flow attributable to Preferred Shareholders |

|

(4,207) |

|

|

(4,698) |

|

|

(5,696) |

|

|

(7,003) |

|

|

Free cash flow attributable to common

shareholders |

$ |

5,507 |

|

$ |

4,853 |

|

$ |

6,648 |

|

$ |

7,826 |

|

(1) Amounts presented reflect the

Corporation’s common shareholders’ proportion and have excluded

amounts attributed to NCI holders.

(2) The Corporation’s calculation of free

cash flow was amended during the three months ended September 30,

2021. Free cash flow for the three and six months ended June 30,

2021 has been updated to conform with the current year calculation,

to replace the adjustment of “CDC attributable to Preferred

Shareholders” with an adjustment for “free cash flow attributable

to the Preferred Shareholders”.

The following table reconciles adjusted net

income from net income (loss), which is the most

directly-comparable measure calculated in accordance with IFRS:

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

(in thousands) |

|

2022 |

|

|

2021(1) |

|

|

2022 |

|

|

2021(1) |

|

|

Net income (loss) |

$ |

6,709 |

|

$ |

608 |

|

$ |

(15,781) |

|

$ |

508 |

|

|

Add back: |

|

|

|

|

|

|

|

|

|

Foreign exchange loss (gain) |

|

1 |

|

|

(153) |

|

|

16 |

|

|

(211) |

|

|

Finance expense on the Preferred Share liability(2) |

|

2,535 |

|

|

7,146 |

|

|

28,250 |

|

|

10,292 |

|

|

(Gain) loss on contract settlement |

|

(52) |

|

|

355 |

|

|

(27) |

|

|

441 |

|

|

Other income |

|

- |

|

|

(175) |

|

|

- |

|

|

(238) |

|

|

Acquisition, integration and restructuring costs |

|

45 |

|

|

50 |

|

|

45 |

|

|

90 |

|

|

Income tax effects of adjusting items |

|

(12) |

|

|

(40) |

|

|

(14) |

|

|

(4) |

|

|

|

|

9,226 |

|

|

7,791 |

|

|

12,489 |

|

|

10,878 |

|

|

Core Business Operations’ adjusted net income attributable to

Preferred Shareholders |

|

(3,958) |

|

|

(3,546) |

|

|

(6,140) |

|

|

(6,406) |

|

|

Adjusted net income |

|

5,268 |

|

|

4,245 |

|

|

6,349 |

|

|

4,472 |

|

|

Adjusted net income attributable to common shareholders |

|

5,259 |

|

|

3,840 |

|

|

6,151 |

|

|

3,681 |

|

|

Adjusted net income attributable to non-controlling interest |

|

9 |

|

|

405 |

|

|

198 |

|

|

791 |

|

|

Diluted adjusted earnings per Common Share |

$ |

0.11 |

|

$ |

0.08 |

|

$ |

0.13 |

|

$ |

0.08 |

|

(1) The Corporation’s calculation of

adjusted net income was amended during the three months ended

September 30, 2021. Adjusted net income for the three and six

months ended June 30, 2021 has been updated to conform with the

current year calculation, replacing the previous adjustment for

“Core Business Operations’ net income attributable to Preferred

Shareholders” with an adjustment for “Core Business Operations’

adjusted net income attributable to Preferred Shareholders”.

(2) Though the quarterly reassessment of

the Corporation’s outlook and forecast for the 2022 fiscal year

resulted in a revaluation recovery during the three months ended

June 30, 2022, the Corporation’s overall outlook and forecast has

strengthened since its prior budgeting period in the fourth quarter

of 2021, resulting in an increase the Corporation’s Preferred Share

liability during the six months ended June 30, 2022.

Forward-Looking Information

Certain statements in this document constitute forward-looking

information under applicable securities legislation.

Forward-looking information typically contains statements with

words such as “anticipate,” “believe,” “estimate,” “will,”

“expect,” “plan,” or similar words suggesting future outcomes or an

outlook. Forward-looking information in this document includes, but

is not limited to: the effect of changes in mortgage interest rates

not materially negatively affecting long-term funded mortgage

volumes.

Such forward-looking information is based on

many estimates and assumptions, including material estimates and

assumptions, related to the following factors below that, while

considered reasonable by the Corporation as at the date of this

MD&A considering management’s experience and perception of

current conditions and expected developments, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking statements. Such factors include, but are not

limited to:

- Changes in

interest rates;

- The DLC Group’s

ability to maintain its existing number of franchisees and add

additional franchisees;

- Changes in

Canadian mortgage lending and mortgage brokerage laws;

- Material

decreases in the aggregate Canadian mortgage lending

marketplace;

- Changes in the

fees paid for mortgage brokerage services in Canada;

- Changes in the

regulatory framework for the Canadian housing and lending

sectors;

- Demand for the

Corporation’s products remaining consistent with historical

demand.

Many of these uncertainties and contingencies

may affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All forward-looking statements made in this

document are qualified by these cautionary statements. The

foregoing list of risks is not exhaustive. The forward-looking

information contained in this document is made as of the date

hereof and, except as required by applicable securities laws, we

undertake no obligation to update publicly or revise any

forward-looking statements or information, whether because of new

information, future events or otherwise.

About Dominion Lending Centres

Inc.The DLC Group is Canada’s leading network of mortgage

professionals. The DLC Group operates through Dominion Lending

Centres and its three main subsidiaries, MCC Mortgage Centre Canada

Inc., MA Mortgage Architects Inc. and Newton Connectivity Systems

Inc., and has operations across Canada. The DLC Group’s extensive

network includes ~8,100 agents and ~545 locations. Headquartered in

British Columbia, the DLC Group was founded in 2006 by Gary Mauris

and Chris Kayat.

Contact information for the Corporation is as

follows:

|

James BellCo-President403-560-0821jbell@dlcg.ca |

Robin BurpeeCo-Chief Financial

Officer403-455-9670rburpee@dlcg.ca |

Amar LeekhaSr. Vice-President, Capital

Markets403-455-6671aleekha@dlcg.ca |

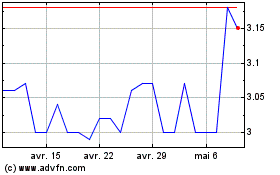

Dominion Lending Centres (TSX:DLCG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Dominion Lending Centres (TSX:DLCG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024