Verde AgriTech Ltd (TSX: “

NPK”)

("

Verde” or the “

Company”) is

pleased to announce Lucas Brown as the new Vice President of

Corporate Development. Mr Brown will lead Verde’s expansion into

the carbon market, in addition to overseeing the Company’s

institutional and investor relations. Lucas Brown has dedicated a

decade working in Brazil, in the last four years serving as the

British Consul to Minas Gerais state. In this role, he was

responsible for diplomacy and bilateral trade. Notably, this

included leading the British government's climate strategy in Minas

Gerais when the United Kingdom held the presidency of COP26. His

efforts culminated with an unprecedented cooperation between the UK

and the government of Minas Gerais, and key cities in the region.

His efforts culminated in Minas Gerais becoming the first state in

Latin America to formalize its commitment to decarbonization and to

join the UN campaign “Race to Zero”1.

"We're thrilled to welcome Mr Brown as our new

Vice President of Corporate Development. With a distinguished

trajectory in diplomacy and climate stewardship, he's perfectly

positioned to elevate our carbon capture initiatives. As Verde

AgriTech continues to innovate in the realm of sustainable

solutions, Mr Brown will amplify our commitment to decarbonization

and achieving international certification for carbon credits. Verde

is entering a new era of with a broader global impact, Lucas is the

leader we’ve been looking to guide us there”, stated Cristiano

Veloso, Verde’s Founder and CEO.

"I am incredibly excited to join Verde AgriTech,

a Company I have been following for several years and whose ESG

values align with my own. I have recently concluded an intense

four-year cycle working on the climate agenda with governments, the

private sector, and the third sector in Brazil, and I recognize the

commitment and opportunities that the country holds to be a global

leader in mitigating and adapting to climate change. I see Verde as

a disruptive Company with its purpose deeply rooted in

sustainability. To achieve our net-zero goals, we will have to

exponentially accelerate the implementation of new low-carbon

technologies and carbon capture methodologies. The invitation to

join Verde to lead this innovative decarbonization project was

impossible to refuse," stated Mr Brown.

Mr Brown graduated from the University of

Liverpool, UK, and holds an MBA from the State University of

Pernambuco, Brazil. His early career was devoted to the automotive

sector, focused on supply chain management. He was a senior analyst

at Stellantis, then FIAT Chrysler, when it built its newest plant

in the Northeast of Brazil. Thereafter he transitioned to the UK's

public service at its Department of Business and Trade, culminating

his career as British Consul to Minas Gerais, Brazil's third

largest state economically with a GDP of over USD 130 billion in

2020.2

Verde’s Carbon Capture

Project

Verde has developed partnerships with British

universities that are leaders in Soil Science3 that have proven

Verde’s K Forte® and Super Greensand® (“Products”)

have the potential to capture carbon dioxide

(“CO2”) from the atmosphere

through Enhanced Rock Weathering (“ERW”).

ERW refers to a suite of techniques aimed at

accelerating natural rock weathering, which involves the breakdown

of minerals and the absorption of CO2 from the atmosphere. In

nature, the process takes centuries as the rocks’ surface is

gradually weathered down and reacts with CO2 to form new stable

carbonate minerals or bicarbonate ions, effectively removing CO2

from the atmosphere and storing it for thousands of years.

By crushing and grinding such minerals and

spreading it over large areas, ERW significantly accelerates the

absorption of CO2. The speed of mineral weathering can be

calculated using a ‘shrinking core model’, which assumes that the

reaction occurs at the surface of the mineral so that the unreacted

core gradually shrinks over time.

As detailed by an independent study conducted at

Newcastle University under the leadership of Prof. David Manning,

PhD, a renowned soil scientist, the carbon dioxide capture

properties of the Products are estimated at 120kg per tonne. The

CO2 removal does not require any change to the Products’ production

and farmland application methods, nor does it change the

nutritional benefits to plants. Thus, the Products undergo ERW to

permanently capture atmospheric CO2 while releasing potassium and

other plant nutrients.

In addition, the Products undergo mineral

dissolution in only a matter of months to a year from its

application to soils, faster than the most rapid reacting silicate

minerals (forsterite), which takes years to decades for a similar

dissolution. Mineral dissolution is directly correlated to the

capture of carbon dioxide from the atmosphere, the faster the

dissolution the faster the absorption of CO2. The conclusion was

reached by a commissioned study conducted by Phil Renforth, Ph.D.,

at Heriot Watt University, based on peer-reviewed publication and

commercial data.

Therefore, Verde’s Products capture 1 tonne of

CO2 for every 8.3 tonnes applied to fields in a matter of months, a

significantly faster timeframe than any other major ERW project

worldwide.

Previously, following extensive geological

research of the Rock, including over 40,000 meters of drilling and

chemical analyses, Verde had commissioned an independent mineral

resource and reserve study under the Canadian National Instrument

43-101, which has established a combined measured and indicated

mineral resource of 1.47 billion tonnes at 9.28% K2O and an

inferred mineral resource of 1.85 billion tonnes at 8.60% K2O

(using a 7.5% K2O cut-off grade).4 This amounts to 295.70 million

tonnes of potash equivalent in K2O.5

Verde’s total 3.32 billion tonnes of resources

have the potential to remove 0.40 gigatons of CO2 from the

atmosphere. The Company's mid-term goal is to achieve an annual

production capacity of 50 million tonnes, enabling it to capture up

to 6.00 million tonnes of CO2 per year, establishing it as one of

the world's largest carbon capture projects.

As Brazil's largest potash producer by capacity,

Verde has an annual production capacity of 3.00 million tonnes.6

With no need for further CAPEX investment, Verde is capable to

capture and offset up to 0.36 million tonnes of CO2 per year to be

sold as carbon credits7 via its existing production facilities.

The new carbon capture division at Verde that

will be led by Mr Brown, who aims to make the Company

internationally certified to issue carbon credits.

“Verde is currently engaged in discussions with

multiple parties, exploring various options for carbon credit

monetization. Leveraging Mr Brown's expertise in both institutional

relations and climate-related matters, his oversight of Verde's

carbon capture project will be of great value for our business

development in this challenging yet exciting next stage,” commented

Mr Veloso.

Other ERW Initiatives compared to

Verde’s

Globally, there are several different ERW

initiatives, though none stemming originally from a plant-nutrition

focus such as Verde’s carbon capture project. These include

CarbFix,8 from Iceland, which utilizes industrial processes to lock

CO2 into basaltic rocks; Project Vesta,9 which spreads olivine-rich

minerals on beaches and coastal environments to facilitate carbon

sequestration; and UNDO,10 in the UK, that uses crushed basalt

applied to farmland.

Scalable and cost-effective ERW carbon capture

projects depend on farmers' willingness to apply minerals on a

large scale over their farmland. In that sense, Verde has multiple

advantages in ERW:

- The

Products have fast dissolution rate, as evidenced by Phil

Renforth’s research, in addition to agronomic trials and potassium

release rates.

- The

Products are sources of essential macronutrients for plants, which

creates significant motivation for farmers to adopt them in place

of traditional chemical fertilizers;

- The

Company’s resources are compliant with the Canadian National

Instrument 43-101 standard, which assures reliable consistency in

the Products’ mineralogy, carbon capture effectiveness and absence

of deleterious elements;

- The

Products are certified organic by several governmental and

non-governmental organizations, including some of the most

stringent global standards such as the Washington State Fertilizer

Registration and the California Department of Food &

Agriculture;

- The

Products undergo meticulous particle size control within its

manufacturing process, guaranteeing a consistent particle size

distribution. This is advantageous because particle size is

essential for optimal carbon capture and its calculation.

Few carbon capture projects based on ERW

showcase all the above advantages which are consistently delivered

by Verde.

Enhancing institutional and investor

relations through strategic leadership

In addition to spearheading Verde’s expansion

into the carbon market, Mr Brown will take charge of the Company’s

institutional and investor relations. His role will encompass

fostering and maintaining relationships with institutional

investors and analysts, leveraging the valuable contacts he has

cultivated throughout his career to enhance institutional

connections.

Mr Brown will be actively engaged in creating

and nurturing these relationships through regular follow-ups and

strategic engagement, ensuring timely, transparent and effective

communication. These efforts are aimed at amplifying Verde’s global

reputation and fortifying investor confidence.

Mr Brown's comprehensive approach will be

instrumental in aligning stakeholders with the Company’s vision and

objectives, fostering sustained growth and value creation,

particularly during this pivotal phase of business expansion within

Verde.

Corporate restructuring

Mr Brown joins the Company to conclude its

corporate restructuring strategy, underscoring the Company’s

steadfast commitment to reaching the milestone of 50 million tonnes

in annual production and sales, while simultaneously amplifying its

efforts to expedite one of the world’s largest carbon capture

projects.

Recent additions within Verde’s corporate

restructuring strategy include Newton Nagumo11 and Gilson

Guardiero12, joining the Company to strengthen its senior

leadership team as Chief Marketing Officer and Chief Revenue

Officer, respectively.

"With the arrival of Mr Brown, our corporate

restructuring is now complete. We have 2 production plants in

operation, along with a biomanufacturing plant to produce

fertilizers with microorganism input additives. With our installed

annual production capacity of 3.00 million tonnes, Verde is able to

capture and offset up to 0.36 million tonnes of CO2 per year, with

no need for further CAPEX investment. Our focus is to deliver all

this CO2 capacity to the market to be sold as carbon credits. I am

confident that a new era of expansion and growth is beginning for

Verde,” concluded Mr Veloso.

Investor day

Verde AgriTech will host an Investor Day on

Monday, October 16, 2023, at 11:00 AM Eastern Time. The event will

be held virtually and will feature presentations by the company's

senior leadership team, providing updates on Verde's strategy,

followed by a Q&A session.

Subscribe using the link below and receive the

event details by email:

|

Date: |

Monday, October 16, 2023 |

|

Time: |

11:00 am Eastern Time |

|

Subscription link: |

https://bit.ly/Verde_InvestorsDay |

Detailed registration and event information will

be available on Verde's Investor Relations website.

Questions can be submitted in advance through

the following link up to 2 hours before the event:

https://bit.ly/Questions_InvestorDay

About Verde AgriTech

Verde is an agricultural technology company that

produces potash fertilizers. Its purpose is to improve the health

of all people and the planet. Rooting our solutions in nature, it

makes agriculture healthier, more productive, and profitable.

Verde is a fully integrated Company: it mines

and processes its main feedstock from its 100% owned mineral

properties, then sells and distributes the Product.

Verde’s focus on research and development has

resulted in one patent and eight patents pending. Among its

proprietary technologies are Cambridge Tech, 3D Alliance, MicroS

Technology, N Keeper, and Bio Revolution.13 Currently, the Company

is fully licensed to produce up to 2.8 million tonnes per year of

its multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®. In 2022, it became Brazil's

largest potash producer by capacity.14 Verde has a combined

measured and indicated mineral resource of 1.47 billion tonnes at

9.28% K2O and an inferred mineral resource of 1.85 billion tonnes

at 8.60% K2O (using a 7.5% K2O cut-off grade).15 This amounts to

295.70 million tonnes of potash in K2O. For context, in 2021

Brazil’s total consumption of potash in K2O was 6.57 million16.

Brazil ranks second in global potash demand and

is its single largest importer, currently depending on external

sources for over 97% of its potash needs. In 2022, potash accounted

for approximately 3% of all Brazilian imports by dollar

value.17

Corporate Presentation

For further information on the Company, please

view shareholders’ deck:

https://verde.docsend.com/view/mjxisb9by2xbt5y2

Investors Newsletter

Subscribe to receive the Company’s updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be

accessed at: https://bit.ly/InvestorNL_August2023

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

|

(i) |

the estimated amount and grade of Mineral Resources and Mineral

Reserves; |

|

(ii) |

the estimated amount of CO2 removal per tonne of rock; |

|

(iii) |

the PFS representing a viable development option for the

Project; |

|

(iv) |

estimates of the capital costs of constructing mine facilities and

bringing a mine into production, of sustaining capital and the

duration of financing payback periods; |

|

(v) |

the estimated amount of future production, both produced and

sold; |

|

(vi) |

timing of disclosure for the PFS and recommendations from the

Special Committee; |

|

(vii) |

the Company’s competitive position in Brazil and demand for potash;

and, |

|

(viii) |

estimates of operating costs and total costs, net cash flow, net

present value and economic returns from an operating mine. |

Any statements that express or involve discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives or future events or performance (often, but not always,

using words or phrases such as "expects", "anticipates", "plans",

"projects", "estimates", "envisages", "assumes", "intends",

"strategy", "goals", "objectives" or variations thereof or stating

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved, or the negative

of any of these terms and similar expressions) are not statements

of historical fact and may be forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

|

(i) |

the presence of and continuity of resources and reserves at the

Project at estimated grades; |

|

(ii) |

the estimation of CO2 removal based on the chemical and

mineralogical composition of assumed resources and reserves; |

|

(iii) |

the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations; |

|

(iv) |

the capacities and durability of various machinery and

equipment; |

|

(v) |

the availability of personnel, machinery and equipment at estimated

prices and within the estimated delivery times; |

|

(vi) |

currency exchange rates; |

|

(vii) |

Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed; |

|

(viii) |

appropriate discount rates applied to the cash flows in the

economic analysis; |

|

(ix) |

tax rates and royalty rates applicable to the proposed mining

operation; |

|

(x) |

the availability of acceptable financing under assumed structure

and costs; |

|

(xi) |

anticipated mining losses and dilution; |

|

(xii) |

reasonable contingency requirements; |

|

(xiii) |

success in realizing proposed operations; |

|

(xiv) |

receipt of permits and other regulatory approvals on acceptable

terms; and |

|

(xv) |

the fulfilment of environmental assessment commitments and

arrangements with local communities. |

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please contact:

Lucas Brown, Vice-President of

Corporate Development

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.verde.ag | www.investor.verde.ag

1 Race To Zero is a global campaign to rally

leadership and support from businesses, cities, regions, investors

for a healthy, resilient, zero carbon recovery that prevents future

threats, creates decent jobs, and unlocks inclusive, sustainable

growth. It mobilizes a coalition of leading net-zero initiatives,

representing 11,309 non-State actors including 8,307 companies, 595

financial institutions, 1,136 cities, 52 states and regions, 1,125

educational institutions and 65 healthcare institutions (as of

September 2022). These ‘real economy’ actors join the largest-ever

alliance committed to achieving net zero carbon emissions by 2050

at the latest. Source: UN Climate Change.

2 See more at:

https://biblioteca.ibge.gov.br/visualizacao/livros/liv101975_informativo.pdf

3 See “Verde’s Products Remove Carbon Dioxide

From the Air” and “Verde’s Products Remove Carbon Dioxide from Air

in Mere Months of Application”.

4 As per the National Instrument 43-101

Standards of Disclosure for Mineral Projects within Canada (“NI 43

-101”), filed on SEDAR in 2022. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2022/05/NI-43-101-Pre-Feasibility-Technical-Report-for-the-Cerrado-Verde-Project.pdf

5 For context, in 2021 Brazil’s total

consumption of potash in K2O was 6.57 million. The country ranks

second in global potash demand and is the largest single importer,

relying on external sources for over 97% of its potash needs.

Source: Brazilian Fertilizer Mixers Association (from "Associação

Misturadores de Adubo do Brasil", in Portuguese).

6 Verde is currently fully licensed to produce

up to 2.8 million tonnes per year of its Products and has submitted

mining and environmental applications for an additional 25 million

tpy awaiting approval.

7 One carbon credit is equivalent to one metric

tonne of carbon dioxide captured.

8 https://www.carbfix.com/

9 https://www.vesta.earth/

10 https://un-do.com/

11 See “Verde Appoints Chief Marketing

Officer”.

12 See “Verde Appoints Chief Revenue

Officer”.

13 Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r9

14 See the release at:

https://investor.verde.ag/verde-starts-ramp-up-of-plant-2s-second-stage-to-reach-production-of-2-4mtpy/

15 As per the National Instrument 43-101

Standards of Disclosure for Mineral Projects within Canada (“NI 43

-101”), filed on SEDAR in 2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

16 Source: Brazilian Fertilizer Mixers

Association (from "Associação Misturadores de Adubo do Brasil", in

Portuguese).

17 Source: Brazilian Comex Stat, available at:

http://comexstat.mdic.gov.br/en/geral

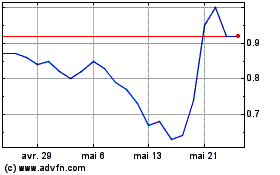

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024