After discussions with shareholders and

potential suitors for Pipestone I am providing you with my final

update before the shareholder vote on the Strathcona Pipestone

merger. We remind you that although the shareholder meeting

is on Wednesday, September 27th,

2023 the cut-off for providing your proxies to the transfer agent

is 10:00 a.m. Mountain Time on Monday, September 25th.

Beneficial shareholders may have an earlier cut-off. The Monday

deadline is what most shareholders will need to meet. Please feel

free to contact our proxy solicitation firm, Morrow Sodali, for

assistance with voting logistics at 1-800-607-0088 or

1-289-695-3075. We highly recommend you vote against the

proposed merger (preferably by Friday) for the following

reasons:

1) The exchange ratio

is much too low for Pipestone shareholders. Based on production and

cash flow numbers, we believe it represents a minimum 30% dilution,

but probably more. We believe the shares will continue to

underperform should the deal close.1

a. In our Dissident

Circular, we used what we thought was a very generous 5x EV/EBITDA

multiple for Strathcona and the combined entity versus a

conservative 3.5x EV/EBITDA assumed for Pipestone. Since that time,

we have had a number of conversations with other disgruntled

shareholders who have convinced us that based on Strathcona’s high

levels of debt with a substantial near-term maturity2, and a recent

oil sands deal with comparable key metrics to Strathcona3, the

multiple could be considerably worse. If the combined company

trades at 4x EV/2023 EBITDA, the equity would be valued at $1.804

per share.5 In contrast, Pipestone standalone would be valued at

$4.06 per share (assuming 4x EV/2023 EBITDA multiple).5

b. The only way this

merger works for the average Pipestone shareholder is if you assume

a significantly higher multiple for the combined entity. We think

the most relevant comparable companies post-merger would be

Crescent Point Energy, which trades at ~3.5x, and NuVista Energy,

an adjacent Montney property, which trades at ~4x. We now think the

combined entity would likely trade at ~3.5x to ~4x EBITDA.6 We

would be happy to share the thought process behind our valuations

should you give us a call.

2) The share overhang

will be enormous with Strathcona owners and Riverstone holding ~90%

of the combined company. We believe post deal closing, both

entities are sellers.

3) I believe there

are numerous parties interested in bidding for Pipestone, but they

are dissuaded by the Riverstone lockup, termination fee and

Strathcona’s right to match any superior bids. The Pipestone

Circular itself mentions a recent rival offer but disclosed no

details about the offer. Ask yourself why that might be? Since this

deal was announced, I have personally talked to CEOs of four other

companies that are interested in making an offer. All of them have

processing assets and producing acreage near Pipestone and

significantly more operational synergies and stronger balance

sheets/low debt levels than Strathcona. I believe that should this

deal be voted down, these companies would emerge as bidders at

price levels significantly above the Strathcona deal. Also, three

of them expressed a willingness to structure a deal that would be

part cash and part stock. The cash portion would eliminate a

significant part of the overhang from the Riverstone funds that we

believe desire an investment exit. In addition, all four of these

companies are publicly traded already, and have significantly more

liquidity than Pipestone, so trading in their shares after a deal

should be much better.

4) I believe the

market for oil and gas deals in Calgary should improve rapidly from

here for a few reasons. First, oil prices have rebounded while at

the same time multiples have expanded a turn. With the large North

American LNG expansion and tightening inventories (coupled with

ample demand for LNG abroad), natural gas prices should also

rebound in the next year. In addition, recent Montney and Duvernay

land sales have come at prices of $1 million to $4 million per

section, up materially from just a few months ago. As the

availability of drill ready inventory tightens, prices may reach

levels of 20% of capital invested. Since Pipestone will probably

have capacity for six wells a section with capital of $42 million

per section, one could see land values hit $8 million to $14

million per section. With 140 sections that are half undeveloped,

the acreage alone could easily be worth half the current deal

value.

5) There are a number

of value-add initiatives that Pipestone could undergo including

delineation of the eastern half of the acreage, finding a way to

manage the H2S, and securing more and better priced takeaway

capacity. For these reasons and the improving oil and gas market we

believe the best strategy is to run Pipestone standalone for a

couple years to cleanse the psychology of the low deal price,

improve operations, and then sell into a much stronger market. With

Pipestone’s strong free cash flow and low debt, it does not need to

sell itself to generate returns for shareholders. But to be clear,

we would be supportive of a deal to sell the company if a strong

offer emerges in the near term.

6) Pipestone drilled

two wells in the southeastern corner of their acreage that we

thought would be connected and producing by now. These are

offsetting some extremely prolific Crescent Point Energy wells. We

expect they could prove up significant value in the eastern half of

the acreage. Why didn’t the Pipestone Board defer the sale to see

how these wells perform and why is it taking months to connect

them?

7) The carbon

intensity that Strathcona has on its heavy and thermal oil assets

is massively greater than Pipestone’s Montney assets. This sale

would be a large step backwards for Pipestone from an ESG

perspective.

8) Lastly, the

Pipestone board, in its rebuttal of our Dissident Circular, tried

to sell a narrative that essentially everybody supported the deal.

I would point out that most of those supporting actors are getting

paid cash from the deal, including the underwriters, rating

agencies, firms providing fairness opinions, management team, and

board members. In particular, I emphasize that the equity incentive

awards awarded to management and the board over the years for their

service to Pipestone are not being paid out in Strathcona stock

under the proposed deal, which is what they are asking Pipestone

shareholders to take. The Pipestone Circular indicates the

executive management team and board members will receive $10.7

million in cash payments in exchange for their awards and to go

along with the change in control.7 Not a bad goodbye kiss. I will

leave it to you to infer whether the board and management think the

stock in the combined entity would be a good deal for Pipestone

shareholders. I would point out that GMT is paying for the costs of

our opposition out of our own pocket. We are not activists. Like

many of you, we have been long-term Pipestone shareholders. Again,

you can conclude what you will about who is more aligned with your

interests.

9) Last but not

least, as mentioned earlier, Strathcona is highly leveraged at 2.1x

Net Debt/TTM Adjusted EBITDA8. As recently as December 2022, their

2026 bonds traded at 74 cents on the dollar9. They have a $675

million term loan due in just five months in February 2024 and

since they have $0 cash as of 6/30/2310, we think they will have to

borrow to pay it off. Pipestone by contrast has a Net Debt/TTM

Adjusted EBITDA of 0.5x11.

In summary, we think there is almost nothing to

like about the Strathcona merger terms. The merger would result in

a combined entity that trades at a lower valuation, suffers from a

huge share overhang, is dangerously levered, and has a poorer ESG

profile. I once again recommend that all Pipestone shareholders

vote against the proposed merger. I believe we can create much more

value in a standalone Pipestone, and if not it appears to us that

there will be a number of suitors at much better valuations. Feel

free to call us at 770-989-8250 to discuss any

aspect of this transaction.

Pipestone shareholders are encouraged to review

our Dissident Circular dated September 15, 2023, which is available

on Pipestone's profile on SEDAR+ at www.sedarplus.ca.

For further information or to receive a copy of the

Dissident Circular please contact:

GMT Capital Corp. 2300 Windy Ridge

ParkwaySuite 550 SouthAtlanta, GA 30339

_______________1 At the current proposed

exchange ratio of 8.87% for Pipestone shareholders, in order for

Pipestone shareholders to “merely maintain” the pre-deal

announcement value per Pipestone share of $2.72 on 7/31/23,

Pipestone shareholders have to have a lot of faith that Strathcona,

a private company with no publicly traded shares, what we believe

to be a weak track record of organic growth and $3.2 billion of net

debt (or 2.1x net debt/TTM EBITDA, which is among the highest

levels among all publicly traded Canadian E&P’s with an average

net debt/TTM of 0.6x), will trade at higher multiples than

Pipestone and majority of publicly traded companies in more

desirable basins in Canada with strong track records of organic

growth and much better balance sheets. Pipestone shareholders also

have to hope that Strathcona, which had $0 cash as of 6/30/23 and

only generated $187.1 million of free cash flow in the first half

of 2023, will be able to pay off or refinance $675 million of bank

term loans due five months from now in February 2024. Strathcona

bondholders also appeared to be concerned as the bonds traded as

low as 74% of par value as recently as December of 2022. Sources:

(i) Management Information Circular filed by Pipestone on SEDAR+ on

August 28, 2023 ("Pipestone Circular"). (ii) Strathcona’s Net Debt

is calculated as long-term debt, minus total current assets

(excluding risk management assets), plus total current liabilities

(excluding lease and other obligations and risk management

liabilities) as of 6/30/23, which is in line with Pipestone’s

methodology for calculating net debt. (iii) Net Debt/ Trailing

Twelve Month ("TTM") Adjusted EBITDA for Strathcona calculated as

Net Debt of $3.2 billion as of June 30, 2023, divided by Adjusted

EBITDA for trailing twelve months as of June 30, 2023 of $1.5

billion. (iv) Average Net Debt/TTM EBITDA for 31 Canadian publicly

traded oil and gas companies with market capitalizations ranging

from $500 million to $92 billion calculated based on information

available on Bloomberg. (v) Strathcona’s December 2022 bond price

based on information available on Bloomberg.2 Source: Pipestone

Circular.3 To give you an example of just how poorly this deal

could potentially turn out for Pipestone shareholders, consider the

recent valuation datapoints from the Suncor/TotalEnergies Canadian

oil sands deal announced in April 2023 where Suncor announced it

will acquire all of TotalEnergies’ Canadian operations for $5.5

billion in cash and $600 million in contingent payments.

TotalEnergies disclosed in a September 2022 presentation that these

operations were expected to generate more than $2.0 billion in

operating cash flows in 2022. This compares to Strathcona who

generated $1.8 billion in Adjusted EBITDA in 2022 (Adjusted EBITDA

is generally comparable to operating cash flows except for G&A

– which was $68.8 million for Strathcona in 2022). Other key

metrics are very similar – TotalEnergies’ Canadian operations

produces 135 MBOED and has 2.1 billion BOE of proved and probable

(“2P”) reserves compared to Strathcona’s 144 MBOED of production

and 1.7 billion BOE of 2P reserves. Assuming the combined company

trades at the multiples of key metrics implied by the recent

Suncor/TotalEnergies deal, Pipestone shareholders could see as

little as $0.56 to $1.51 per share should this deal with Strathcona

go through at the proposed exchange ratio of 8.87% for Pipestone

shareholders. Sources: (i) April 26, 2023 press release

from the Suncor Energy company website at

https://www.suncor.com/en-ca/, (ii) “Investor Day: 2022 Strategy

and Outlook, 2022 Strategy and Outlook” presentation dated 9/28/22

from the TotalEnergies company website at

https://totalenergies.com/, values converted from USD to CAD for

ease of comparison, and (iii) GMT Capital estimate, see footnote

5.4 Unless otherwise indicated, all references to $ set forth in

this document are to Canadian dollars and all references to US$ set

forth in this document are to US dollars.5 Source GMT Capital

estimates: equity value calculated as enterprise value less net

debt, based on September 14, 2023 NYMEX strip prices for oil and

gas; equity value per share for Strathcona standalone calculated as

equity value of Strathcona standalone divided by 2,872,345,233

shares (which is calculated by dividing Pipestone’s current share

count of 279,638,000 by 0.0887, and multiplying the resulting

number by 0.9113); equity value per share for Pipestone standalone

calculated as equity value of Pipestone standalone divided by the

current Pipestone’s share count of 279,638,000 shares; equity value

per share for the combined company calculated as equity value of

combined company, divided by 3,151,983,233 shares (which is

calculated by dividing Pipestone’s current share count of

279,638,000 by 0.0887). We have done this calculation to make

equity values per share for the deal easier to compare from the

perspective of Pipestone shareholders.6 Source: Bloomberg.7 Source:

Based on information provided in the Pipestone Circular. See

Section “Pipestone Incentive Securities” on page 61. Calculated by

adding $7.8 million in cash consideration to be paid to the

executive management team and the board members for Pipestone

Incentive Securities and $2.9 million of Pipestone Change of

Control Payments to be paid to the Pipestone executive officers.8

Strathcona’s Net Debt is calculated as long-term debt, minus total

current assets (excluding risk management assets), plus total

current liabilities (excluding lease and other obligations and risk

management liabilities) as of 6/30/23, which is in line with

Pipestone’s methodology for calculating net debt. Net Debt/TTM

Adjusted EBITDA for Strathcona calculated as Net Debt of $3.2

billion as of June 30, 2023, divided by Adjusted EBITDA for

trailing twelve months as of June 30, 2023 of $1.5 billion.9

Source: Bloomberg.10 Source: Pipestone Circular, see Condensed

Consolidated Interim Financial Statements for the Three and Six

Months June 30, 2023 and 2022.11 Net Debt/TTM Adjusted EBITDA for

Pipestone calculated as Net Debt of $172.394 million as of June 30,

2023, divided by Adjusted EBITDA for trailing twelve months as of

June 30, 2023 of $344.0 million (which is calculated as Adjusted

EBITDA for the full year 2022, less Adjusted EBITDA for the first

six months of 2022, plus Adjusted EBITDA for the first six months

of 2023). Sources: (i) Pipestone August 9 Press Release; (ii) Press

Release filed by Pipestone on SEDAR+ on March 8, 2023.

Or Morrow Sodali at:

North America Toll-Free Phone: 1-800-607-0088

Banks, Brokers and Collect Calls: 1-289-695-3075

Email: assistance@morrowsodali.com

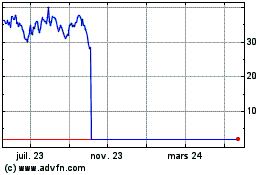

Pipestone Energy (TSX:PIPE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Pipestone Energy (TSX:PIPE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024