Pulse Seismic Inc. (TSX:PSD) (OTCQX:PLSDF) (“Pulse” or the

“Company”) is pleased to report its financial and operating results

for the year ended December 31, 2021. The audited consolidated

financial statements, accompanying notes and MD&A are being

filed on SEDAR (www.sedar.com) and will be available on Pulse’s

website at www.pulseseismic.com.

“The Company generated its second-highest level of

annual data library sales in 2021, with strong results in each

quarter fuelled mainly by the high volume of M&A activity in

the industry, which led to multiple transaction-based sales,”

stated Neal Coleman, Pulse’s President and CEO. “We are very

pleased with the great improvement in all key metrics from 2020,

and also with the growth we are seeing in data licencing to

companies involved in both energy transition and helium

extraction,” Coleman continued. “The Company’s significant

year-over-year increase in sales revenue allowed us to repay in

full the remaining $28 million of debt we had taken on to double

our seismic data library in 2019.”

Pulse continued to operate with a small team and

low-cost structure throughout 2021. “With $49.2 million of revenue

we were able to generate a cash margin of 87%, and after deducting

income tax and debt costs, to convert 65% of our revenue to

shareholder free cash flow,” said Coleman. “We are now debt-free,

positioned with a very strong balance sheet and we own the largest

licensable seismic data library in Canada.”

Pulse’s improving financial position throughout

2021 enabled several capital allocation decisions by the Board of

Directors in the fourth quarter, including reinstatement of a

regular quarterly dividend, declaration of a special dividend, and

the implementation of a Normal Course Issuer Bid.

Pulse’s Board of Directors today approved a

quarterly dividend of $0.0125 per share. The total of the regular

dividend will be approximately $672,000 based on Pulse’s 53,733,117

common shares outstanding as of February 17, 2022, to be paid on

March 21, 2022 to shareholders of record on March 14, 2022. This

dividend is designated as an eligible dividend for Canadian income

tax purposes. For non-resident shareholders, Pulse’s dividends are

subject to Canadian withholding tax.

HIGHLIGHTS FOR THE YEAR ENDED DECEMBER

31, 2021

- Total revenue was $49.2 million

compared to $11.3 million for the year ended December 31,

2020;

- Net earnings were $21.5 million

($0.40 per share basic and diluted) compared to a net loss of $6.8

million ($0.13 per share basic and diluted) for 2020;

- Cash EBITDA(a) was $42.7 million

($0.79 per share basic and diluted) compared to $7.6 million ($0.14

per share basic and diluted) for the year ended December 31,

2020;

- Shareholder free cash flow(a) was

$32.1 million ($0.60 per share basic and diluted) compared to $5.3

million ($0.10 per share basic and diluted) for the year ended

December 31, 2020;

- At year-end 2021, long-term debt was $2.3 million (net of

deferred financing cost) and the Company had $22.6 million

available on its revolving credit facility. As stated above, the

remaining long-term debt was fully repaid in January 2022. In the

fourth quarter the credit facility was renewed and extended for two

years to January 15, 2025; and,

- In November the Company reinstated a regular annual dividend of

$0.05 per common share to be paid quarterly, and also declared a

special dividend of $0.04 per common share. Dividends of

approximately $2.8 million were paid in December, representing the

initial declaration of the quarterly dividend of $0.0125 per common

share and special dividend of $0.04 per common share.

HIGHLIGHTS FOR THE THREE MONTHS ENDED

DECEMBER 31, 2021

- Total revenue was $16.3 million

compared to $5.2 million for the three months ended December 31,

2020;

- Net earnings were $8.2 million

($0.15 per share basic and diluted) compared to $287,000 ($0.01 per

share basic and diluted) in the fourth quarter of 2020;

- Cash EBITDA was $13.9 million

($0.26 per share basic and diluted) compared to $4.2 million ($0.08

per share basic and diluted) in the fourth quarter of 2020;

and

- Shareholder free cash flow was

$10.8 million ($0.20 per share basic and diluted) compared to $3.0

million ($0.06 per share basic and diluted) in the fourth quarter

of 2020.

|

SELECTED FINANCIAL AND OPERATING INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

(thousands of dollars except per share data, |

Three months ended December 31, |

Years ended December 31, |

|

numbers of shares and kilometres of seismic data) |

2021 |

2020 |

2021 |

2020 |

|

Revenue |

|

|

|

|

Data library sales |

16,172 |

5,142 |

48,717 |

11,011 |

|

Other revenue |

133 |

81 |

433 |

338 |

|

Total revenue |

16,305 |

5,223 |

49,150 |

11,349 |

|

|

|

|

|

|

|

Amortization of seismic data library |

2,500 |

2,493 |

10,010 |

11,348 |

|

Net earnings (loss) |

8,158 |

287 |

21,514 |

(6,786 |

) |

|

Per share basic and diluted |

0.15 |

0.01 |

0.40 |

(0.13 |

) |

|

Cash provided by operating activities |

4,010 |

752 |

29,799 |

3,814 |

|

Per share basic and diluted |

0.07 |

0.01 |

0.55 |

0.07 |

|

Cash EBITDA (a) |

13,936 |

4,200 |

42,696 |

7,553 |

|

Per share basic and diluted (a) |

0.26 |

0.08 |

0.79 |

0.14 |

|

Shareholder free cash flow (a) |

10,828 |

2,977 |

32,082 |

5,346 |

|

Per share basic and diluted (a) |

0.20 |

0.06 |

0.60 |

0.10 |

|

|

|

|

|

|

|

Capital expenditures |

|

|

|

|

|

Seismic digitization and related costs |

62 |

96 |

350 |

383 |

|

Property and equipment |

- |

- |

8 |

7 |

|

Total capital expenditures |

62 |

96 |

358 |

390 |

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

|

Basic and diluted |

53,791,997 |

53,793,317 |

53,792,984 |

53,793,317 |

|

Shares outstanding at period-end |

|

|

53,784,717 |

53,793,317 |

|

|

|

|

|

|

|

Seismic library |

|

|

|

|

|

2D in kilometres |

|

|

829,207 |

829,207 |

|

3D in square kilometres |

|

|

65,310 |

65,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL POSITION AND RATIOS |

|

|

|

|

|

|

|

|

December 31, |

December 31, |

|

(thousands of dollars except ratios) |

|

|

2021 |

2020 |

|

Working capital |

|

|

9,749 |

5,601 |

|

Working capital ratio |

|

|

2.7:1 |

3.6:1 |

|

Total assets |

|

|

52,899 |

56,742 |

|

Long-term debt |

|

|

2,265 |

27,715 |

|

Cash EBITDA(a) for the years ended December 31 |

|

|

42,696 |

7,553 |

|

Shareholders’ equity |

|

|

44,141 |

25,266 |

|

Long-term debt to cash EBITDA ratio |

|

|

0.05:1 |

3.67:1 |

|

Long-term debt to equity ratio |

|

|

0.05:1 |

1.10:1 |

|

|

|

|

|

|

(a) The Company’s continuous disclosure

documents provide discussion and analysis of “cash EBITDA”, “cash

EBITDA per share”, “shareholder free cash flow” and “shareholder

free cash flow per share”. These financial measures do not have

standard definitions prescribed by IFRS and, therefore, may not be

comparable to similar measures disclosed by other companies. The

Company has included these non-GAAP financial measures because

management, investors, analysts and others use them as measures of

the Company’s financial performance. The Company’s definition of

cash EBITDA is cash available for interest payments, cash taxes,

repayment of debt, purchase of its shares, discretionary capital

expenditures and the payment of dividends, and is calculated as

earnings (loss) from operations before interest, taxes,

depreciation and amortization less participation survey revenue,

lease payments treated as capital lease and warehouse storage fees,

plus any non-cash and non-recurring expenses. Cash EBITDA excludes

participation survey revenue as these funds are directly

used to fund specific participation surveys and this revenue is not

available for discretionary capital expenditures. The Company

believes cash EBITDA assists investors in comparing Pulse’s results

on a consistent basis without regard to participation survey

revenue and non-cash items, such as depreciation and amortization,

which can vary significantly depending on accounting methods or

non-operating factors such as historical cost. Cash EBITDA per

share is defined as cash EBITDA divided by the weighted average

number of shares outstanding for the period. Shareholder free cash

flow further refines the calculation of capital available to invest

in growing the Company’s 2D and 3D seismic data library, to repay

debt, to purchase its common shares and to pay dividends by

deducting non-discretionary expenditures from cash EBITDA.

Non-discretionary expenditures are defined as debt financing costs

(net of deferred financing expenses amortized in the current

period) and current tax provisions. Shareholder free cash flow per

share is defined as shareholder free cash flow divided by the

weighted average number of shares outstanding for the period.

These non-GAAP financial measures are defined,

calculated and reconciled to the nearest GAAP financial measures in

the Management's Discussion and Analysis.

OUTLOOK

Building on the oil and natural gas industry’s

strong finish to 2021, the current positive forecasts for commodity

prices, global energy demand, capital investment, drilling and

production, along with an improving outlook on pandemic management,

led Pulse to anticipate a continuing recovery in western Canada’s

energy industry in 2022. With zero debt, a low cost structure, high

cash EBITDA margin of 87% percent in 2021, no capital spending

commitments, access to credit on favourable terms, Canada’s largest

licensable seismic data library and strong customer relations, the

Company is favourably positioned to benefit from growing strength

in industry conditions.

Following an estimated $16.0 billion in Canadian

oil and natural gas industry merger-and-acquisition (M&A)

activity in 2021, the driver of transaction-based sales, Pulse

anticipates continued M&A deal flow this year. The Company’s

sales revenue of $48.7 million in 2021 was largely achieved through

transaction-based sales, and Pulse anticipates this again to be the

main source of sales in 2022. M&A transactions do not, however,

provide visibility as to the timing or value of associated demand

for seismic data, so as always Pulse cautions that a

transaction-based data library sale of any size can occur at any

time.

With benchmark WTI crude oil having recently

risen above US$90 per barrel, and intra-Alberta natural gas priced

above $4.50 per gigajoule in early February, forecasts for oil and

natural gas prices remain buoyant for 2022 and industry confidence

continues to strengthen. While inflation is a significant global

issue and there are recessionary signs in some countries,

inflationary environments generally drive higher commodity prices.

Favourable commodity pricing encourages industry capital

investment, drilling and production, along with new-company

formation. In late November the Canadian Association of Oilwell

Drilling Contractors issued an initial drilling forecast of 6,457

wells for 2022, an increase of 27 percent from 2021 and 96 percent

from 2020. Provincial mineral lease auctions or “land sales”, a

traditional leading indicator of field activities, extended the

rebound begun in 2021, with sales in Alberta totalling $37.8

million in January 2022 compared to only $4.5 million the previous

January, and a total of $104.2 million for all of 2021 in

Alberta.

All of these factors, in turn, imply industry

demand for seismic data, the driver of Pulse’s traditional data

library sales. Still, Pulse as always must caution that there is no

direct linkage between industry field conditions and demand for

seismic data and, accordingly, Pulse has innately poor visibility

as to future traditional sales.

While Pulse is optimistic about the year ahead,

the past several years have demonstrated that virtually anything

can happen at any time – including record-setting lows and highs in

business results. Accordingly, Pulse remains focused on the

business practices that have enabled the Company to navigate and

thrive through the full range of conditions: maintaining a strong

balance sheet with access to credit on favourable terms, careful

management of cash resources including distributing cash to

shareholders when it is prudent to do so, a low cost structure, a

disciplined and rigorous approach to growth opportunities, an

experienced and capable management team, and excellent customer

care complemented by the current initiative to enhance the

attractiveness of the seismic data library for broader application

in both traditional and new-energy exploration and development.

CORPORATE PROFILE

Pulse is a market leader in the acquisition,

marketing and licensing of 2D and 3D seismic data to the western

Canadian energy sector. Pulse owns the largest licensable seismic

data library in Canada, currently consisting of approximately

65,310 square kilometres of 3D seismic and 829,207 kilometres of 2D

seismic. The library extensively covers the Western Canada

Sedimentary Basin, where most of Canada’s oil and natural gas

exploration and development occur.

For further information, please contact:

Neal Coleman, President and CEO Or Pamela

Wicks, Vice President Finance and CFO Tel.: 403-237-5559

Toll-free: 1-877-460-5559 E-mail: info@pulseseismic.com Please

visit our website at www.pulseseismic.com

This document contains information that

constitutes “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking information”) within

the meaning of applicable securities legislation. Forward-looking

information is often, but not always, identified by the use of

words such as “anticipate”, “believe”, “expect”, “plan”, “intend”,

“forecast”, “target”, “project”, “guidance”, “may”, “will”,

“should”, “could”, “estimate”, “predict” or similar words

suggesting future outcomes or language suggesting an outlook.

The Outlook section herein contain

forward-looking information which includes, but is not limited to,

statements regarding:

> The outlook of

the Company for the year ahead, including future operating costs

and expected revenues;

> Recent events

on the political, economic, regulatory, public health and legal

fronts affecting the industry’s medium- to longer-term prospects,

including progression and completion of contemplated pipeline

projects;

> The Company’s

capital resources and sufficiency thereof to finance future

operations, meet its obligations associated with financial

liabilities and carry out the necessary capital expenditures

through 2022;

> Pulse’s capital

allocation strategy;

> Pulse’s

dividend policy;

> Oil and natural

gas prices and forecast trends;

> Oil and natural

gas drilling activity and land sales activity;

> Oil and natural

gas company capital budgets;

> Future demand

for seismic data;

> Future seismic

data sales;

> Pulse’s

business and growth strategy; and

> Other

expectations, beliefs, plans, goals, objectives, assumptions,

information and statements about possible future events,

conditions, results and performance, as they relate to the Company

or to the oil and natural gas industry as a whole.

By its very nature, forward-looking information

involves inherent risks and uncertainties, both general and

specific, and risks that predictions, forecasts, projections and

other forward-looking statements will not be achieved. Pulse does

not publish specific financial goals or otherwise provide guidance,

due to the inherently poor visibility of seismic revenue. The

Company cautions readers not to place undue reliance on these

statements as a number of important factors could cause the actual

results to differ materially from the beliefs, plans, objectives,

expectations and anticipations, estimates and intentions expressed

in such forward-looking information. These factors include, but are

not limited to:

> Uncertainty of

the timing and volume of data sales;

> Volatility of

oil and natural gas prices;

> Risks

associated with the oil and natural gas industry in general;

> The Company’s

ability to access external sources of debt and equity capital;

> Credit,

liquidity and commodity price risks;

> The demand for

seismic data and;

> The pricing of

data library licence sales;

>

Cybersecurity;

> Relicensing

(change-of-control) fees and partner copy sales;

> Environmental,

health and safety risks, including those related to the COVID-19

pandemic;

> Federal and

provincial government laws and regulations, including those

pertaining to taxation, royalty rates, environmental protection,

public health and safety;

> Competition;

> Dependence on

key management, operations and marketing personnel;

> The loss of

seismic data;

> Protection of

intellectual property rights;

> The

introduction of new products; and

> Climate

change.

Pulse cautions that the foregoing list of

factors that may affect future results is not exhaustive.

Additional information on these risks and other factors which could

affect the Company’s operations and financial results is included

under “Risk Factors” in the Company’s most recent annual

information form, and in the Company’s most recent audited annual

financial statements, most recent MD&A, management information

circular, quarterly reports, material change reports and news

releases. Copies of the Company’s public filings are available on

SEDAR at www.sedar.com.

When relying on forward-looking information to

make decisions with respect to Pulse, investors and others should

carefully consider the foregoing factors and other uncertainties

and potential events. Furthermore, the forward-looking information

contained in this document is provided as of the date of this

document and the Company does not undertake any obligation to

update publicly or to revise any of the included forward-looking

information, except as required by law. The forward-looking

information in this document is provided for the limited purpose of

enabling current and potential investors to evaluate an investment

in Pulse. Readers are cautioned that such forward-looking

information may not be appropriate, and should not be used, for

other purposes.

PDF

available: http://ml.globenewswire.com/Resource/Download/b8cd3dcb-6807-4d65-ae67-b0556ea5ccfc

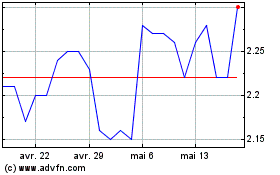

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025