- Strong demand maintained a high lease renewal retention

ratio at 92.0% and drove committed occupancy up 30 basis points

sequentially to a record-breaking 97.8% with retail committed

occupancy reaching the high water mark of 98.6%;

- Leasing momentum continued with the third consecutive

quarter of double-digit leasing spreads for new and renewal leases

and on a blended basis at 14.2%;

- More than 1,280,000 square feet of leases completed,

comprising 251,000 square feet of new leases and included the

completion of the remainder of the 10 units that resulted from

large tenant failures earlier this year with best-in-class tenants

at higher rents

RioCan Real Estate Investment Trust (“RioCan" or the "Trust”)

(TSX: REI.UN) announced today its financial results for the three

and nine months ended September 30, 2024.

"We are very pleased with the strong performance that the RioCan

team and our high-quality portfolio continue to deliver. Our

results reflect how well our major-market, open-air,

necessity-focused properties perform in all market conditions,"

said Jonathan Gitlin, President and CEO of RioCan. "Our expertise

allows RioCan to capitalize on the favourable environment for

retail real estate and we continue to strategically evolve our

tenant roster to further enhance our income stability and future

growth prospects. We remain dedicated to allocating capital

responsibly. Our recent financing activities underscore our access

to diverse funding and commitment to maintaining ample liquidity

and a strong balance sheet."

Financial

Highlights

Three months ended September

30

Nine months ended September

30

(in millions, except where otherwise

noted, and per unit values)

2024

2023

2024

2023

FFO 1

$

137.9

$

135.4

$

401.6

$

398.4

FFO per unit - diluted 1

$

0.46

$

0.45

$

1.34

$

1.33

Net income (loss)

$

96.9

$

(73.5)

$

347.8

$

156.5

Weighted average Units outstanding -

diluted (in thousands)

300,486

300,471

300,463

300,508

As at

September 30, 2024

December 31, 2023

Net book value per unit

$

25.01

$

24.76

- FFO per unit was $0.46, an increase of $0.01 per unit or 2.2%

over the same period last year. Strong operating performance and

completed developments increased NOI. This growth was partially

offset by disposed NOI relating to the sale of lower quality

commercial properties. Increases in interest income and fee and

other income were offset by higher interest expense.

- Net income of $96.9 million was $170.4 million higher than the

same period last year. In addition to the items described above,

net income included a $159.0 million favourable change in the fair

value of investment properties.

- We maintained financial flexibility with an FFO Payout Ratio1

of 61.7% and Liquidity1 of $1.3 billion, while our Adjusted Debt to

Adjusted EBITDA1 improved to 9.1x. Our financial standing

strengthened further with $1.05 billion of financing at an average

interest rate of 4.48% in the form of debentures, term loans and

CMHC mortgages completed since reporting our Q2 2024 results. For

pro-forma metrics, refer to the Balance Sheet Strength section of

this News Release.

1.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Outlook

- We are on track to achieve our original FFO guidance for the

year of $1.79 to $1.82 per unit, excluding a Q4 2024 restructuring

charge following a corporate reorganization subsequent to quarter

end. In Q4 2024, we reduced our workforce by approximately 9.5% and

expect the resulting charge to be approximately $9 million or $0.03

FFO per unit. Annualized cash savings of approximately $8 million

are anticipated, with an estimated net G&A impact of

approximately $4 million. The corporate restructuring is part of

RioCan’s ongoing responsible cost management, enhances workflow

efficiency, and optimizes resource allocation to better align with

business needs.

- Commercial Same Property NOI excluding provision1 is projected

to grow between 2.0% and 2.5% in 2024. Following previously

disclosed tenant vacancies, we used the opportunity to add more

relevant and resilient retailers at higher rents. The time required

to build out space for users such as grocers is longer, impacting

this metric in the current year while our Commercial SPNOI growth

target for future years remains at ~3%.

- RioCan does not intend to commence new physical construction of

mixed-use properties in 2024 and well into 2025. Development

Spending1 on mixed-use projects, which were in progress prior to

the reduction in new construction starts, is expected to be between

$250 million to $300 million. Development Spending for retail

in-fill projects is expected to be between $30 million to $40

million.

1.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Operational Highlights

(i)

Three months ended September

30

Twelve months ended September

30

2024

2023

2024

2023

Occupancy - committed (ii)

97.8 %

97.5 %

97.8 %

97.5 %

Retail occupancy - committed (ii)

98.6 %

98.3 %

98.6 %

98.3 %

Blended leasing spread

14.2 %

12.9 %

14.8 %

10.8 %

New leasing spread

24.2 %

21.0 %

30.7 %

14.5 %

Renewal leasing spread

12.6 %

11.2 %

10.8 %

9.9 %

(i)

Includes commercial portfolio only.

(ii)

Information presented as at respective

periods then ended.

- A new leasing spread of 24.2% drove the blended leasing spread

to 14.2%. Renewal leasing spreads were also healthy at 12.6%. The

portfolio's strength and the supply constraint of quality retail

space create sustained leasing momentum.

- 1.3 million square feet of space was leased in the quarter

including 251 thousand square feet of new leases.

- Committed occupancy and retail committed occupancy reached

record highs of 97.8% and 98.6%, respectively, both up 30 basis

points sequentially, reflecting rising demand for RioCan's premium

retail portfolio.

- Commercial in-place occupancy of 97.0% increased 40 basis

points from Q2 2024 due to tenants taking possession.

- As at September 30, 2024, all 10 of the initial vacant units

that resulted from tenant failures discussed in prior quarters have

been leased. As of November 11, 2024, tenants at four of those

locations are paying cash rent. Cash rents from the remaining six

locations will commence at varying points over the next 11 months.

These units were backfilled by relevant and resilient retailers at

improved lease terms featuring 23.9% higher base rents on a

weighted average basis, further improving the portfolio's overall

quality and cash flow growth.

- Finalized a land lease for a 158,000 square foot Costco at

RioCan Centre Burloak. As part of our ongoing initiatives to

continuously improve tenant quality and the quality of our shopping

centres, we strategically replaced fashion-focused tenants with a

strong, service-based anchor. This is expected to attract

significant traffic, draw other tenants and enhance the overall

appeal of the property.

- Commercial Same Property NOI excluding provision1 increased by

0.8% for the Third Quarter and 1.3% year-to-date. We expect

continued improvement in this metric as signed tenancies reach cash

rent commencement.

- Strong and stable tenants comprised 87.9% of annualized net

rent, an improvement of 50 basis points year-over-year.

1.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

RioCan Living Update 1

- Total NOI from our residential rental operations was $7.9

million, an increase of $2.3 million or 40.9% over the same period

last year. Residential Same Property NOI2 growth was 5.2% for the

Third Quarter and 6.0% year-to-date.

- RioCan LivingTM currently operates 14 buildings, with a fair

value of $1.1 billion, comprised of 3,160 residential units in

operation with 12 of these buildings stabilized. These stabilized

buildings are 94.7% leased as of November 11, 2024.

- Construction of suites at FourFifty The WellTM was completed in

the first half of 2024. As of November 11, 2024, 85.8% of the units

are leased at rents in-line with expectations. Due to construction

completion in the Second Quarter, we stopped the capitalization of

interest expense and other carrying costs relating to this

property, which resulted in a year-to-date short-term negative FFO

impact of $2.0 million. We expect a positive contribution as the

NOI from the property ramps up.

- As at September 30, 2024, approximately 90% of the total units

from RioCan’s six active condominium construction projects have

been pre-sold. RioCan expects to generate sales revenue of

approximately $607 million between the remainder of 2024 and 2026

from these condominium and townhouse construction projects. This

amount was reduced from $700 million at the end of the prior

quarter and $800 million at the beginning of the year predominantly

due to the sales of partial interests in the 11YV project, see

below. Of the expected proceeds, approximately $516 million relates

to pre-sold units. These units are under legally binding contracts,

with the majority sold at prices below current market values, and

an average deposit of 18.5% of the purchase price. These factors

motivate buyers to close on their purchase. The funds received will

be allocated towards repaying the construction loans associated

with the condominium projects, with residual return of equity and

profits flowing to the corporate balance sheet.

- The Trust sold a 12.5% interest in the 11YV project in the

Third Quarter, decreasing its interest in the project to 12.5% and

resulting in a gain of $11.6 million. Together with the disposition

of the 12.5% interest in 11YV in Q1 2024, these sales have resulted

in the acceleration of $180 million of the approximate $800 million

of sales revenue expected at the beginning of the year. These

dispositions accelerate revenue, reduce our exposure to

condominiums and preserve capital as purchasers assume the

costs-to-complete and debt obligations.

1.

Units at 100% ownership interest.

2.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Development Highlights

Three months ended September

30

Nine months ended September

30

(in millions except square feet)

2024

2023

2024

2023

Development Completions - sq. ft. in

thousands (i)

30.0

151.0

137.0

327.0

Development Spending

$

72.0

$

114.2

$

264.3

$

305.6

Development Projects Under Construction -

sq. ft. in thousands (ii)

974.0

1,685.0

974.0

1,685.0

(i)

At RioCan's ownership. Represents net

leasable area (NLA) of property under development completions.

Excludes NLA of residential inventory completions.

(ii)

Information presented as at the respective

periods then ended, includes properties under development and

residential inventory, equity-accounted joint ventures and

represents gross floor area of the respective projects.

- During the Third Quarter, $38.1 million or 30,000 square feet

of properties under development were transferred to income

producing properties.

- Value recognized in the Trust's residential inventory and

properties under development balances for zoned projects, excluding

those under construction, is $30.66 per square foot and $19.38 per

square foot for the total pipeline.

- High foot traffic at The WellTM continues to surpass

expectations with significant momentum from the official opening of

Wellington MarketTM in Q2 2024. As of November 11, 2024, 97% of The

Well's total commercial space is leased with 93% or 1,387,000

square feet (at 100% ownership interest) in tenant possession. The

retail space is 95% leased, with more than three quarters of the

space open and operating. Additional retail tenants are expected to

open in the coming months.

Investing and Capital

Recycling

- As of November 11, 2024, closed, firm and conditional

dispositions totalled $124.9 million. Closed investment property

dispositions in 2024 included an enclosed centre, a cinema-anchored

property and three open-air centres for combined sales proceeds of

$41.8 million, with $11.8 million closing subsequent to

quarter-end. Conditional transactions include the disposal of a

portion of an open-air retail site in Quebec for estimated proceeds

at 84% above the IFRS carrying value, after deducting costs related

to tenant relocation and other items.

- A firm agreement was entered into after quarter-end by the

Trust and its co-owner to sell Strada, a residential property

located in downtown Toronto, for sale proceeds of $24.0 million for

RioCan's 50% interest. The sale is expected to close in the coming

months upon the assignment of the $15.0 million CMHC mortgage (at

RioCan's interest) with a contractual interest rate of 4.29%. The

sales price represents a 6% premium to the Trust's IFRS carrying

value.

- RioCan issued $30.4 million of new loans as part of its real

estate lending program in the Third Quarter, bringing the

year-to-date total of new loans advanced to $154.0 million, earning

an average interest rate of 11.0%. Repayment of existing loans

totalled $39.9 million on a year-to-date basis.

Capital Management

Update

- Since reporting Second Quarter 2024 results, RioCan secured

$1.05 billion in financing with a weighted average term to maturity

of 6.4 years and a weighted average interest rate of 4.48% per

annum, including the impact of bond forward hedges. The net

proceeds have been allocated to paying off higher interest rate

loans and will address near-term mortgage maturities, collectively

having a weighted average interest rate of 5.87%. The specifics of

this recent financing activity are:

- During the Third Quarter, the Trust completed $147.8 million of

CMHC financing with a 10-year term at a fixed rate of 3.97%. The

net loan proceeds were used to repay a higher interest floating

rate construction loan.

- On October 2, 2024, RioCan extended the maturity date of the

$200.0 million non-revolving unsecured credit facility to January

31, 2030, at a hedged annual all-in fixed interest rate of

4.47%.

- On October 3, 2024, RioCan issued senior unsecured debentures

totalling $700.0 million in two series; $500.0 million Series AL

senior unsecured debentures, with a coupon rate of 4.623% per annum

maturing on October 3, 2031, and $200.0 million Series AM senior

unsecured debentures, with a coupon rate of 4.004% per annum

maturing on March 1, 2028.

- A portion of the debenture proceeds were used on October 4,

2024, to redeem, in full, its $300.0 million, 6.488% 3NC1 Series AI

senior unsecured debentures due September 29, 2026 in accordance

with their terms.

- The net proceeds were also used to replenish our liquidity by

repaying the $252.0 million drawn balance on the revolving

unsecured operating line of credit as at September 30, 2024.

Balance Sheet Strength

(in millions except percentages)

As at

September 30, 2024

December 31, 2023

Liquidity (i) 1

$

1,340

$

1,964

Adjusted Debt to Adjusted EBITDA (i) 1

9.1x

9.3x

Unencumbered Assets (i) 1

$

8,188

$

8,090

(i)

At RioCan's proportionate share.

- Adjusted Debt to Adjusted EBITDA of 9.1x on a proportionate

share basis as at September 30, 2024, compared to 9.3x as at the

end of 2023 and 9.5x as at Q3 2023. The decrease was primarily due

to higher Adjusted EBITDA, partially offset by higher Average Total

Adjusted Debt balances. We expect to reach the high end of the 8.0x

- 9.0x long-term target range by the end of this year.

- Weighted average term to maturity was 3.50 years, compared to

2.97 years as at December 31, 2023.

- As at September 30, 2024, Liquidity of $1.3 billion included

$1.0 billion available on the revolving line of credit and $0.3

billion in undrawn construction lines and other bank loans.

Liquidity decreased by $624.1 million when compared to the prior

year-end, returning to more typical levels, due to timing of

capital recycling, investment and financing activities.

- RioCan’s Unencumbered Assets were $8.2 billion as at September

30, 2024, increasing from the beginning of the year due to mortgage

repayments.

- Factoring in financing activity subsequent to September 30,

2024 as outlined in the Capital Management Update section above,

RioCan's proforma liquidity and debt metrics on a proportionate

share basis are as follows:

RioCan's proportionate share1

(in millions except percentages and

years)

As at September 30, 2024

Pro-forma

Liquidity

$

1,340

$

1,740

Ratio of floating rate debt to total debt

1

10.0%

3.9%

Floating rate exposure excluding

construction loans

7.3%

1.3%

Weighted average effective interest

rate

4.17%

4.01%

Weighted average term to maturity (in

years)

3.5

4.0

1.

A non-GAAP measurement. For

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Conference Call and

Webcast

Interested parties are invited to participate in a conference

call with management on Tuesday, November 12, 2024 at 10:00 a.m.

(ET). Participants will be required to identify themselves and the

organization on whose behalf they are participating.

To access the conference call, click on the following link to

register at least 10 minutes prior to the scheduled start of the

call: Pre-registration link. Participants who pre-register at any

time prior to the call will receive an email with dial-in

credentials including a login passcode and PIN to gain immediate

access to the live call. Those that are unable to pre-register may

dial-in for operator assistance by calling 1-833-950-0062 and

entering the access code: 418607.

For those unable to participate in the live mode, a replay will

be available at 1-866-813-9403 with access code: 127491.

To access the simultaneous webcast, visit RioCan’s website at

Events and Presentations and click on the link for the webcast.

About RioCan

RioCan is one of Canada’s largest real estate investment trusts.

RioCan owns, manages and develops retail-focused, mixed-use

properties located in prime, high-density transit-oriented areas

where Canadians want to shop, live and work. As at September 30,

2024, our portfolio is comprised of 186 properties with an

aggregate net leasable area of approximately 33 million square feet

(at RioCan's interest). To learn more about us, please visit

www.riocan.com.

Basis of Presentation and Non-GAAP

Measures

All figures included in this News Release are expressed in

Canadian dollars unless otherwise noted. RioCan’s unaudited interim

condensed consolidated financial statements ("Condensed

Consolidated Financial Statements") are prepared in accordance with

International Financial Reporting Standards (IFRS). Financial

information included within this News Release does not contain all

disclosures required by IFRS, and accordingly should be read in

conjunction with the Trust's Condensed Consolidated Financial

Statements and MD&A for the three and nine months ended

September 30, 2024, which are available on RioCan's website at

www.riocan.com and on SEDAR+ at www.sedarplus.com.

Consistent with RioCan’s management framework, management uses

certain financial measures to assess RioCan’s financial

performance, which are not in accordance with generally accepted

accounting principles (GAAP) under IFRS. Funds From Operations

(“FFO”), FFO per unit, Net Operating Income ("NOI"), Same Property

NOI, Commercial Same Property NOI ("Commercial SPNOI"), Commercial

Same Property NOI excluding provision, Residential Same Property

NOI ("Residential SPNOI"), Development Spending, Ratio of floating

rate debt to total debt, Liquidity, Adjusted Debt to Adjusted

EBITDA, RioCan's Proportionate Share, Unencumbered Assets as

well as other measures that may be discussed elsewhere in this News

Release, do not have a standardized definition prescribed by IFRS

and are, therefore, unlikely to be comparable to similar measures

presented by other reporting issuers. RioCan supplements its IFRS

measures with these Non-GAAP measures to aid in assessing the

Trust’s underlying performance and reports these additional

measures so that investors may do the same. Non-GAAP measures

should not be considered as alternatives to net income or

comparable metrics determined in accordance with IFRS as indicators

of RioCan’s performance, liquidity, cash flow, and profitability.

For full definitions of these measures, please refer to the

"Non-GAAP Measures” section in RioCan’s MD&A for the three and

nine months ended September 30, 2024.

The reconciliations for non-GAAP measures included in this News

Release are outlined as follows:

RioCan's Proportionate Share

The following table reconciles the consolidated balance sheets

from IFRS to RioCan's proportionate share basis as at September 30,

2024 and December 31, 2023:

As at

September 30, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Assets

Investment properties

$

13,828,779

$

408,024

$

14,236,803

$

13,561,718

$

411,811

$

13,973,529

Equity-accounted investments

382,110

(382,110)

—

383,883

(383,883)

—

Mortgages and loans receivable

430,361

(5,330)

425,031

289,533

(6,707)

282,826

Residential inventory

295,779

332,484

628,263

217,186

407,946

625,132

Assets held for sale

43,985

—

43,985

19,075

—

19,075

Receivables and other assets

264,053

57,476

321,529

246,652

50,681

297,333

Cash and cash equivalents

39,737

9,768

49,505

124,234

14,506

138,740

Total assets

$

15,284,804

$

420,312

$

15,705,116

$

14,842,281

$

494,354

$

15,336,635

Liabilities

Debentures payable

$

3,689,870

$

—

$

3,689,870

$

3,240,943

$

—

$

3,240,943

Mortgages payable

2,895,000

159,939

3,054,939

2,740,924

158,292

2,899,216

Lines of credit and other bank loans

606,826

184,171

790,997

879,246

231,963

1,111,209

Accounts payable and other liabilities

579,368

76,202

655,570

543,398

104,099

647,497

Total liabilities

$

7,771,064

$

420,312

$

8,191,376

$

7,404,511

$

494,354

$

7,898,865

Equity

Unitholders’ equity

7,513,740

—

7,513,740

7,437,770

—

7,437,770

Total liabilities and equity

$

15,284,804

$

420,312

$

15,705,116

$

14,842,281

$

494,354

$

15,336,635

The following tables reconcile the consolidated statements of

income (loss) from IFRS to RioCan's proportionate share basis for

the three and nine months ended September 30, 2024 and 2023:

Three months ended September 30,

2024

Three months ended September 30,

2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Revenue

Rental revenue

$

279,557

$

8,179

$

287,736

$

269,001

$

8,052

$

277,053

Residential inventory sales

1,479

70,119

71,598

—

48,977

48,977

Property management and other service

fees

5,303

(348)

4,955

2,408

—

2,408

286,339

77,950

364,289

271,409

57,029

328,438

Operating costs

Rental operating costs

Recoverable under tenant leases

92,825

798

93,623

87,274

884

88,158

Non-recoverable costs

9,518

686

10,204

7,880

588

8,468

Residential inventory cost of sales

1,123

58,014

59,137

—

38,972

38,972

103,466

59,498

162,964

95,154

40,444

135,598

Operating income

182,873

18,452

201,325

176,255

16,585

192,840

Other income (loss)

Interest income

10,382

518

10,900

5,988

672

6,660

Income from equity-accounted

investments

15,709

(15,709)

—

14,229

(14,229)

—

Fair value (loss) gain on investment

properties, net

(40,495)

473

(40,022)

(199,528)

(167)

(199,695)

Investment and other income (loss),

net

10,109

(651)

9,458

(502)

(99)

(601)

(4,295)

(15,369)

(19,664)

(179,813)

(13,823)

(193,636)

Other expenses

Interest costs, net

65,672

2,919

68,591

52,051

3,012

55,063

General and administrative

12,250

24

12,274

14,444

—

14,444

Internal leasing costs

3,346

—

3,346

3,020

—

3,020

Transaction and other costs

452

140

592

417

(250)

167

81,720

3,083

84,803

69,932

2,762

72,694

Income (loss) before income

taxes

$

96,858

$

—

$

96,858

$

(73,490)

$

—

$

(73,490)

Current income tax expense

—

—

—

20

—

20

Net income (loss)

$

96,858

$

—

$

96,858

$

(73,510)

$

—

$

(73,510)

Nine months ended September 30,

2024

Nine months ended September 30,

2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Revenue

Rental revenue

$

843,800

$

24,440

$

868,240

$

814,595

$

25,485

$

840,080

Residential inventory sales

24,813

148,050

172,863

—

51,857

51,857

Property management and other service

fees

13,311

(945)

12,366

12,366

—

12,366

881,924

171,545

1,053,469

826,961

77,342

904,303

Operating costs

Rental operating costs

Recoverable under tenant leases

295,045

2,530

297,575

279,704

2,668

282,372

Non-recoverable costs

26,158

2,031

28,189

18,923

1,733

20,656

Residential inventory cost of sales

15,745

120,948

136,693

—

40,359

40,359

336,948

125,509

462,457

298,627

44,760

343,387

Operating income

544,976

46,036

591,012

528,334

32,582

560,916

Other income (loss)

Interest income

30,168

1,594

31,762

18,730

1,940

20,670

Income from equity-accounted

investments

34,530

(34,530)

—

25,573

(25,573)

—

Fair value loss on investment properties,

net

(31,357)

(1,728)

(33,085)

(227,487)

(618)

(228,105)

Investment and other income (loss),

net

13,748

(2,479)

11,269

4,042

(313)

3,729

47,089

(37,143)

9,946

(179,142)

(24,564)

(203,706)

Other expenses

Interest costs, net

191,504

8,821

200,325

150,008

8,231

158,239

General and administrative

40,777

50

40,827

44,908

32

44,940

Internal leasing costs

10,031

—

10,031

8,763

—

8,763

Transaction and other costs

2,730

22

2,752

2,399

(245)

2,154

245,042

8,893

253,935

206,078

8,018

214,096

Income before income taxes

$

347,023

$

—

$

347,023

$

143,114

$

—

$

143,114

Current income tax recovery

(794)

—

(794)

(13,347)

—

(13,347)

Net income

$

347,817

$

—

$

347,817

$

156,461

$

—

$

156,461

NOI and Same Property NOI

The following table reconciles operating income to NOI and Same

Property NOI to NOI for the three and nine months ended September

30, 2024 and 2023:

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2024

2023

2024

2023

Operating Income

$

182,873

$

176,255

$

544,976

$

528,334

Adjusted for the following:

Property management and other service

fees

(5,303)

(2,408)

(13,311)

(12,366)

Residential inventory gains

(356)

—

(9,068)

—

Operational lease revenue from ROU

assets

1,850

1,650

5,329

5,079

NOI

$

179,064

$

175,497

$

527,926

$

521,047

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2024

2023

2024

2023

Commercial

Commercial Same Property NOI

$

149,413

$

149,102

$

443,528

$

441,840

NOI from income producing properties:

Acquired (i)

852

16

3,731

1,219

Disposed (i)

730

4,675

1,821

15,157

1,582

4,691

5,552

16,376

NOI from completed commercial

developments

11,199

8,553

31,850

22,393

NOI from properties under de-leasing

(ii)

4,707

5,412

14,122

16,965

Lease cancellation fees

1,515

442

3,226

5,183

Straight-line rent adjustment

2,707

1,660

8,133

3,260

NOI from commercial properties

171,123

169,860

506,411

506,017

Residential

Residential Same Property NOI

5,625

5,345

14,002

13,207

NOI from income producing properties:

Acquired (i)

514

—

2,733

662

Disposed (i)

—

—

17

48

514

—

2,750

710

NOI from completed residential

developments

1,802

292

4,763

1,113

NOI from residential rental

7,941

5,637

21,515

15,030

NOI

$

179,064

$

175,497

$

527,926

$

521,047

(i)

Includes properties acquired or disposed

of during the periods being compared.

(ii)

NOI from limited number of properties

undergoing significant de-leasing in preparation for redevelopment

or intensification.

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2024

2023

2024

2023

Commercial Same Property NOI

$

149,413

$

149,102

$

443,528

$

441,840

Residential Same Property NOI

5,625

5,345

14,002

13,207

Same Property NOI

$

155,038

$

154,447

$

457,530

$

455,047

Commercial Same Property NOI excluding provision

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2024

2023

2024

2023

Commercial Same Property NOI

$

149,413

$

149,102

$

443,528

$

441,840

Add (exclude):

Same property provision for (recovery of)

for credit losses

116

(714)

(742)

(4,549)

Commercial Same Property NOI excluding

provision

$

149,529

$

148,388

$

442,786

$

437,291

FFO

The following table reconciles net income (loss) attributable to

Unitholders to FFO for the three and nine months ended September

30, 2024 and 2023:

Three months ended September

30

Nine months ended September

30

(thousands of dollars, except where

otherwise noted)

2024

2023

2024

2023

Net income (loss) attributable to

Unitholders

$

96,858

$

(73,510

)

$

347,817

$

156,461

Add back (deduct):

Fair value losses, net

40,495

199,528

31,357

227,487

Fair value (gains) losses included in

equity-accounted investments

(473

)

167

1,729

618

Internal leasing costs

3,346

3,020

10,031

8,763

Transaction losses (gains) on investment

properties, net (i)

422

(77

)

1,879

35

Transaction gains on equity-accounted

investments

(21

)

(69

)

(52

)

(69

)

Transaction costs (recoveries) on sale of

investment properties

284

(4

)

1,231

507

ERP implementation costs

958

2,121

5,368

8,530

ERP amortization

(409

)

—

(818

)

—

Change in unrealized fair value on

marketable securities

(5,908

)

1,898

(4,648

)

2,711

Current income tax expense (recovery)

—

20

(794

)

(13,347

)

Operational lease revenue from ROU

assets

1,508

1,283

4,280

3,833

Operational lease expenses from ROU assets

in equity-accounted investments

(17

)

(14

)

(51

)

(39

)

Capitalized interest on equity-accounted

investments (ii)

808

1,059

4,263

2,902

FFO

$

137,851

$

135,422

$

401,592

$

398,392

Add back (deduct):

Debt prepayment gain

(457

)

—

(457

)

—

Restructuring costs

4

720

650

1,344

FFO Adjusted

$

137,398

$

136,142

$

401,785

$

399,736

FFO per unit - basic

$

0.46

$

0.45

$

1.34

$

1.33

FFO per unit - diluted

$

0.46

$

0.45

$

1.34

$

1.33

FFO Adjusted per unit - diluted

$

0.46

$

0.45

$

1.34

$

1.33

Weighted average number of Units -

basic (in thousands)

300,466

300,405

300,463

300,384

Weighted average number of Units -

diluted (in thousands)

300,486

300,471

300,463

300,508

FFO for last four quarters

$

534,482

$

526,035

Distributions paid for last four

quarters

$

329,741

$

317,500

FFO Payout Ratio

61.7

%

60.4

%

(i)

Represents net transaction gains or losses

connected to certain investment properties during the period.

(ii)

This amount represents the interest

capitalized to RioCan's equity-accounted investment in WhiteCastle

New Urban Fund 2, LP, WhiteCastle New Urban Fund 3, LP, WhiteCastle

New Urban Fund 4, LP, WhiteCastle New Urban Fund 5, LP,

RioCan-Fieldgate JV, RC (Queensway) LP, RC (Leaside) LP - Class B,

PR Bloor Street LP and RC Yorkville LP. This amount is not

capitalized to development projects under IFRS but is allowed as an

adjustment under REALPAC’s definition of FFO.

Development Spending

Total Development Spending for the three and nine months ended

September 30, 2024 and 2023 is as follows:

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2024

2023

2024

2023

Development expenditures on balance

sheet:

Properties under development

$

31,451

$

57,470

$

128,199

$

191,992

Residential inventory

30,175

51,052

93,767

100,243

RioCan's share of Development Spending

from equity-accounted joint ventures

10,335

5,711

42,337

13,345

Total Development Spending

$

71,961

$

114,233

$

264,303

$

305,580

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2024

2023

2024

2023

Mixed-use projects

$

60,274

$

98,414

$

239,179

$

263,684

Retail in-fill projects

11,687

15,819

25,124

41,896

Total Development Spending

$

71,961

$

114,233

$

264,303

$

305,580

Total Contractual Debt

The following table reconciles total debt to Total Contractual

Debt as at September 30, 2024 and December 31, 2023:

As at

September 30, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Debentures payable

$

3,689,870

$

—

$

3,689,870

$

3,240,943

$

—

$

3,240,943

Mortgages payable

2,895,000

159,939

3,054,939

2,740,924

158,292

2,899,216

Lines of credit and other bank loans

606,826

184,171

790,997

879,246

231,963

1,111,209

Total debt

$

7,191,696

$

344,110

$

7,535,806

$

6,861,113

$

390,255

$

7,251,368

Less:

Unamortized debt financing costs, premiums

and discounts on origination and debt assumed, and

modifications

(35,347)

(472)

(35,819)

(24,019)

(484)

(24,503)

Total Contractual Debt

$

7,227,043

$

344,582

$

7,571,625

$

6,885,132

$

390,739

$

7,275,871

Floating Rate Debt and Fixed Rate Debt

The following table summarizes RioCan's Ratio of floating rate

debt to total debt as at September 30, 2024 and December 31,

2023:

As at

September 30, 2024

December 31, 2023

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Total fixed rate debt

$

6,611,435

$

169,250

$

6,780,685

$

6,543,106

$

212,554

$

6,755,660

Total floating rate debt

580,261

174,860

755,121

318,007

177,701

495,708

Total debt

$

7,191,696

$

344,110

$

7,535,806

$

6,861,113

$

390,255

$

7,251,368

Ratio of floating rate debt to total

debt

8.1%

10.0%

4.6%

6.8%

Total floating rate debt

580,261

174,860

755,121

Increase (Decrease) subsequent to quarter

end from:

Extended the maturity date of the

non-revolving unsecured credit facilities and entered into an

interest rate swap

(199,894)

—

(199,894)

Repayment of the revolving unsecured

operating line of credit

(252,000)

—

(252,000)

Pro-forma floating rate debt

$

128,367

$

174,860

$

303,227

Total debt

7,191,696

344,110

7,535,806

Increase (Decrease) subsequent to quarter

end from:

Debenture issuance

700,000

—

700,000

Debenture redemption

(300,000)

—

(300,000)

Repayment of the revolving unsecured

operating line of credit

(252,000)

—

(252,000)

Pro-forma Total debt

$

7,339,696

$

344,110

$

7,683,806

Pro-forma ratio of floating rate debt

to total debt

1.7%

3.9%

Liquidity

As at September 30, 2024, RioCan had approximately $1.3 billion

of Liquidity as summarized in the following table:

As at

September 30, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Undrawn revolving unsecured operating line

of credit

$

998,000

$

—

$

998,000

$

1,250,000

$

—

$

1,250,000

Undrawn construction lines and other bank

loans

180,018

112,388

292,406

385,715

189,563

575,278

Cash and cash equivalents

39,737

9,768

49,505

124,234

14,506

138,740

Liquidity

$

1,217,755

$

122,156

$

1,339,911

$

1,759,949

$

204,069

$

1,964,018

Increase (decrease) subsequent to quarter

end from:

Debenture issuance

700,000

—

700,000

Debenture redemption

(300,000)

—

(300,000)

Repayment of the revolving unsecured

operating line of credit

(252,000)

—

(252,000)

Increase in the undrawn revolving

unsecured operating line of credit

252,000

—

252,000

Pro-forma Liquidity

$

1,617,755

$

122,156

$

1,739,911

Adjusted EBITDA

The following table reconciles consolidated net income

attributable to Unitholders to Adjusted EBITDA:

Twelve months ended

September 30, 2024

December 31, 2023

(thousands of dollars)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Net income attributable to Unitholders

$

230,158

$

—

$

230,158

$

38,802

$

—

$

38,802

Add (deduct) the following items:

Income tax recovery:

Current

(812)

—

(812)

(13,365)

—

(13,365)

Fair value losses on investment

properties, net

254,278

15,233

269,511

450,408

14,123

464,531

Change in unrealized fair value on

marketable securities (i)

(6,494)

—

(6,494)

865

—

865

Internal leasing costs

13,187

—

13,187

11,919

—

11,919

Non-cash unit-based compensation

expense

10,085

—

10,085

10,154

—

10,154

Interest costs, net

250,444

11,929

262,373

208,948

11,339

220,287

Debt prepayment gain

(457)

—

(457)

—

—

—

Restructuring costs

674

—

674

1,368

—

1,368

ERP implementation costs

8,870

—

8,870

12,032

—

12,032

Depreciation and amortization

1,737

—

1,737

2,632

—

2,632

Transaction losses (gains) on the sale of

investment properties, net (ii)

2,654

(65)

2,589

1,180

(83)

1,097

Transaction costs on investment

properties

6,331

1

6,332

5,606

1

5,607

Operational lease revenue (expenses) from

ROU assets

5,563

(67)

5,496

5,116

(55)

5,061

Adjusted EBITDA

$

776,218

$

27,031

$

803,249

$

735,665

$

25,325

$

760,990

(i)

The fair value gains and losses on

marketable securities may include both the change in unrealized

fair value and realized gains and losses on the sale of marketable

securities. By adding back the change in unrealized fair value on

marketable securities, RioCan effectively continues to include

realized gains and losses on the sale of marketable securities in

Adjusted EBITDA and excludes unrealized fair value gains and losses

on marketable securities in Adjusted EBITDA.

(ii)

Includes transaction gains and losses

realized on the disposition of investment properties.

Adjusted Debt to Adjusted EBITDA Ratio

Adjusted Debt to Adjusted EBITDA is calculated as follows:

Twelve months ended

September 30, 2024

December 31, 2023

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Adjusted Debt to Adjusted

EBITDA

Average total debt outstanding

$

7,016,318

$

369,811

$

7,386,129

$

6,879,087

$

317,231

$

7,196,318

Less: average cash and cash

equivalents

(60,532)

(10,200)

(70,732)

(120,952)

(11,408)

(132,360)

Average Total Adjusted Debt

$

6,955,786

$

359,611

$

7,315,397

$

6,758,135

$

305,823

$

7,063,958

Adjusted EBITDA (i)

$

776,218

$

27,031

$

803,249

$

735,665

$

25,325

$

760,990

Adjusted Debt to Adjusted

EBITDA

9.0

9.1

9.2

9.3

(i)

Adjusted EBITDA is reconciled in the

immediately preceding table.

Unencumbered Assets

The tables below summarize RioCan's Unencumbered Assets as at

September 30, 2024 and December 31, 2023:

As at

September 30, 2024

December 31, 2023

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity- accounted investments

RioCan's proportionate share

IFRS basis

Equity- accounted investments

RioCan's proportionate share

Investment properties

$

13,828,779

$

408,024

$

14,236,803

$

13,561,718

$

411,811

$

13,973,529

Less: Encumbered investment properties

5,700,550

348,231

6,048,781

5,531,177

352,425

5,883,602

Unencumbered Assets

$

8,128,229

$

59,793

$

8,188,022

$

8,030,541

$

59,386

$

8,089,927

Forward-Looking

Information

This News Release contains forward-looking information within

the meaning of applicable Canadian securities laws. This

information reflects RioCan’s objectives, our strategies to achieve

those objectives, as well as statements with respect to

management’s beliefs, estimates and intentions concerning

anticipated future events, results, circumstances, performance or

expectations that are not historical facts. Forward-looking

information can generally be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “would”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “should”, “plan”, “continue”, or similar expressions

suggesting future outcomes or events. Such forward-looking

information reflects management’s current beliefs and is based on

information currently available to management. All forward-looking

information in this News Release is qualified by these cautionary

statements. Forward-looking information is not a guarantee of

future events or performance and, by its nature, is based on

RioCan’s current estimates and assumptions, which are subject to

numerous risks and uncertainties, including those described in the

“Risks and Uncertainties” section in RioCan's MD&A for the

three and nine months ended September 30, 2024 and in our most

recent Annual Information Form, which could cause actual events or

results to differ materially from the forward-looking information

contained in this News Release. Although the forward-looking

information contained in this News Release is based upon what

management believes are reasonable assumptions, there can be no

assurance that actual results will be consistent with this

forward-looking information.

The forward-looking statements contained in this News Release

are made as of the date hereof, and should not be relied upon as

representing RioCan’s views as of any date subsequent to the date

of this News Release. Management undertakes no obligation, except

as required by applicable law, to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111825401/en/

RioCan Real Estate Investment Trust Dennis Blasutti Chief

Financial Officer 416-866-3033 | www.riocan.com

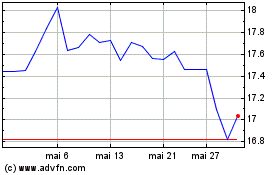

RioCan Real Estate Inves... (TSX:REI.UN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

RioCan Real Estate Inves... (TSX:REI.UN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024