Sulliden Mining Capital Inc. Announces Intent to Acquire Australian Uranium Licenses

28 Juin 2023 - 12:30AM

Sulliden Mining Capital Inc. (TSX:

SMC) (“Sulliden” or the “Company”) is pleased to announce it

has entered into a purchase agreement dated June 27, 2023 (the

“Agreement”), pursuant to which the Company has agreed to acquire a

75% interest in the Orange Creek Uranium Project (the “Project”)

through the acquisition from a private company (the “Vendor”) of

75% of the issued common shares of Orange Creek Resources Pty.

Ltd., another private Australian company (“Privco”). The Project is

located in the Northern Territory of Australia, 38 km south of

Alice Springs, and is situated adjacent to the Pamela and Angela

Uranium Deposits.

Prior to closing, Privco will hold title to an

exploration license overlying 723.9km2 of the Amadeus Basin in the

Northern Territory. The exploration license is considered

prospective to the discovery of sandstone-hosted roll-front style

uranium mineralisation. The concession is in close proximity to the

Angela and Pamela Deposits (owned by Elevate Uranium Ltd.

(“Elevate”)) that reported a historical Inferred Mineral Resource

of 30.8 Mlb U3O8 at 1,310 ppm U3O8 (please see Elevate’s press

release dated July 8, 2021, which is available at Elevate’s website

at elevateuranium.com.au/wp-content/uploads/2021/06/02382572-2.pdf

and under their ASX profile at www2.asx.com.au). Please note that

production results at or around, and information applicable to, the

Angela and Pamela Deposits are not indications of results that

could be obtained at, or information applicable to, the

Project.

The Project has been explored sporadically since

1977. Several kilometers of redox front boundaries have been

defined by very shallow drilling of vacuum holes, reverse air blast

holes, percussion holes and diamond drill holes between 1997 and

2009 by previous operators. Multiple historical holes returned

geochemically anomalous uranium exceeding 200 ppm U3O8 over core

lengths of 0.25-2.0 m within 50 m of surface. However, these holes

are very widely spaced and no holes have tested the area below the

surface extent of the redox boundary in the sandstone, where

possible ‘steps’ in the front could be anticipated. Such steps are

key structural traps in which uranium mineralization occurs at the

nearby Angela and Pamela Deposits at higher concentrations and over

wider intervals.

The Transaction

Pursuant to the Agreement, Sulliden will acquire

a 75% equity interest in Privco (the “Acquisition”), with the

Vendor retaining the remaining 25% interest. As consideration,

Sulliden has agreed to pay AUD$400,000 to the Vendor, AUD$100,000

on the date that the Agreement is executed (the “Execution Date”),

and an additional AUD$300,000 on the later of the date of closing

the Acquisition (the “Closing”) and 45 days following the Execution

Date. As additional consideration, Sulliden has also agreed to fund

Privco’s ongoing statutory obligations and exploration activities

proposed by the Company during the period from the Execution Date

to the Closing and to fund Privco’s additional exploration

activities over the two-year period following Closing to the value

of AUD$300,000. The Acquisition is an arm’s length transaction for

purposes of the policies of the Toronto Stock Exchange and remains

subject to customary closing conditions. No finder fees are payable

in connection with, and no change of control of Sulliden will

result from, the transaction. The transaction is expected to close

in July 2023.

Qualified Person

The technical information in this news release

has been reviewed and approved by Roger Lemaitre, P. Eng., P.Geo.,

who is considered to be a “Qualified Person” as defined in National

Instrument 43-101 – Standards of Disclosure for Mineral

Projects.

About Sulliden Mining Capital

Inc.

Sulliden is a mining company focused on

acquiring and advancing brownfield, development-stage and early

production-stage mining projects in the Americas.

Sulliden Mining Capital

Inc.

On behalf of the Board“Rennie Morkel”

Chief Executive Officer

For more information:

Ryan PtolemyChief Financial

Officerinfo@sulliden.com

Cautionary statements

There has been insufficient exploration to

define a mineral resource on the Project and it is uncertain if

further exploration will result in any target being delineated as a

mineral resource.

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, the proposed transaction to acquire a 75% equity

interest in Privco, including the conditions to closing and the

timing to complete the transaction. Forward-looking information is

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of the Company to be materially different from

those expressed or implied by such forward-looking information,

including receipt of necessary approvals, risks inherent in the

mining industry and the other risks described in the public

disclosure of the Company which is available under the profile of

the Company on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

THE TSX HAS NOT REVIEWED AND DOES NOT

ACCEPT RESPONSIBILITY FOR THE ACCURACY OF THIS NEWS

RELEASE.

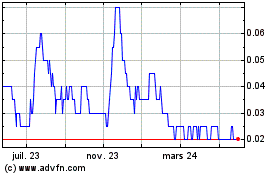

Sulliden Mining Capital (TSX:SMC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

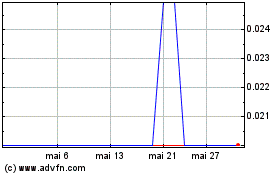

Sulliden Mining Capital (TSX:SMC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025