Argentex Announces Additional Drill Results from its Pinguino Silver-Gold Project Including 3 Metres Averaging 712.7 g/t Ag a...

19 Décembre 2013 - 2:15PM

Marketwired Canada

Argentex Mining Corporation (TSX VENTURE:ATX)(OTCQB:AGXMF) ("Argentex" or the

"Company") is pleased to announce drilling results from an additional 36 holes

of its 58-hole, 3,003-metre 2013 Phase IX resource development drill program at

its 100%-owned Pinguino silver and gold project, located in Santa Cruz Province,

Argentina. To date, the Company has received results from 44 reverse circulation

("RC") holes, with results from the final 14 RC holes still pending.

"We are excited to see high grade gold intersects in the Ivonne Norte Vein,

continuing on from those discovered in the Savary Vein last year (please refer

to the news release dated October 11, 2012). The high grade intersections in the

oxide zone at Ivonne Norte may represent the upper portions of high grade

shoots, which would open up the potential for additional high grade resources to

be identified in deeper drilling. Overall, I view these results revealing more

of the true potential of the Pinguino system as we advance the development of

the project," commented Michael Brown, President and CEO of Argentex. "We expect

to receive final results from the remaining holes shortly, which will allow us

to focus on updating the resource model in 2014."

Highlights of the 36 holes reported are tabulated below:

---------------------------------------------------------------------------

Length Ag Au Ag Eq. Pb Zn In

Vein Drill Hole From To (m) (g/t) (g/t) (g/t) (%) (%)(g/t)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Ivonne PR288-13 17.00 19.00 2.00 15.5 0.97 63.8 0.12 0.09 8.1

Norte ---------------------------------------------------

36.00 40.00 4.00 20.8 0.51 46.2 0.06 0.58 17.1

-----------------------------------------------------------------

PR289-13 19.00 21.00 2.00 7.8 0.25 20.1 0.13 0.03 19.8

-----------------------------------------------------------------

PR290-13 14.00 42.00 28.00 92.6 1.62 173.4 0.91 0.05 16.5

-----------------------------------------------------------------

including 25.00 34.00 9.00 258.0 3.79 447.3 2.46 0.04 17.3

-----------------------------------------------------------------

and including 28.00 31.00 3.00 712.7 8.24 1124.5 6.90 0.03 24.7

-----------------------------------------------------------------

PR291-13 25.00 34.00 9.00 9.8 0.81 50.3 0.08 0.06 24.3

-----------------------------------------------------------------

PR292-13 20.00 31.00 11.00 22.6 4.50 247.6 0.57 0.07 17.6

-----------------------------------------------------------------

including 25.00 28.00 3.00 64.6 14.07 768.2 1.52 0.14 34.1

-----------------------------------------------------------------

PR293-13 27.00 29.00 2.00 5.0 0.64 37.1 0.03 0.01 12.2

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Marta PR278-13 7.00 16.00 9.00 48.3 0.09 53.0 0.06 0.01 0.0

Noroeste -----------------------------------------------------------------

including 9.00 11.00 2.00 129.0 0.35 146.7 0.10 0.01 0.0

-----------------------------------------------------------------

PR279-13 60.00 61.00 1.00 0.9 0.09 5.5 0.01 0.01 0.0

-----------------------------------------------------------------

PR281-13 15.00 18.00 3.00 67.8 0.01 68.2 0.29 0.05 0.0

-----------------------------------------------------------------

including 15.00 16.00 1.00 129.0 0.01 129.4 0.37 0.06 0.0

-----------------------------------------------------------------

PR282-13 89.00 91.00 2.00 45.9 0.10 50.9 0.37 0.06 0.2

-----------------------------------------------------------------

PR283-13 44.00 47.00 3.00 486.0 1.30 550.8 0.16 0.03 0.1

-----------------------------------------------------------------

PR284-13 47.00 48.00 1.00 21.6 0.11 27.3 0.04 0.04 0.0

-----------------------------------------------------------------

PR280-13 13.00 14.00 1.00 0.9 1.23 62.3 0.01 0.01 0.0

---------------------------------------------------------------------------

---------------------------------------------------------------------------

CSN PR264-13 29.00 31.00 2.00 106.2 0.16 114.2 0.11 0.10 0.1

-----------------------------------------------------------------

PR265-13 15.00 17.00 2.00 121.4 0.19 130.7 0.19 0.05 0.1

---------------------------------------------------

32.00 34.00 2.00 83.8 0.23 95.5 0.24 0.24 1.1

-----------------------------------------------------------------

PR266-13 10.00 11.00 1.00 78.5 0.25 90.8 0.46 0.12 0.8

-----------------------------------------------------------------

PR269-13 0.00 2.00 2.00 39.0 0.33 55.6 0.10 0.06 0.9

---------------------------------------------------

6.00 8.00 2.00 54.2 0.17 62.8 0.26 0.05 0.1

-----------------------------------------------------------------

PR270-13 1.00 2.00 1.00 44.6 0.12 50.8 0.02 0.02 0.0

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Karly PR267-13 2.00 5.00 3.00 254.6 0.15 262.1 0.28 0.10 0.6

-----------------------------------------------------------------

PR268-13 14.00 16.00 2.00 63.6 0.19 73.0 0.61 0.06 1.3

---------------------------------------------------------------------------

---------------------------------------------------------------------------

CSS PR271-13 55.00 57.00 2.00 21.3 0.33 37.9 0.17 2.01 1.6

-----------------------------------------------------------------

PR272-13 8.00 25.00 17.00 39.4 0.25 52.0 0.03 0.03 0.1

-----------------------------------------------------------------

including 8.00 11.00 3.00 193.8 0.25 206.4 0.06 0.04 0.5

-----------------------------------------------------------------

PR274-13 4.00 18.00 14.00 44.3 0.79 83.6 0.26 0.05 1.6

-----------------------------------------------------------------

including 4.00 6.00 2.00 142.3 1.06 195.6 0.14 0.03 0.1

-----------------------------------------------------------------

including 12.00 16.00 4.00 11.2 1.98 110.1 0.28 0.06 2.3

-----------------------------------------------------------------

PR273-13 18.00 19.00 1.00 3.9 0.11 9.5 0.01 0.01 0.1

---------------------------------------------------

15.00 16.00 1.00 51.4 0.34 68.5 0.90 0.08 0.9

-----------------------------------------------------------------

PR276-13 13.00 16.00 3.00 48.4 0.09 53.0 0.16 0.08 3.4

---------------------------------------------------

74.00 78.00 4.00 76.7 0.13 83.3 0.54 1.95 1.6

---------------------------------------------------------------------------

(i) Ag Eq is Silver Equivalent of gold plus silver and based upon a price

ratio of 50:1 gold to silver. True widths are estimated to be 85 to 90%

of the drilled intersection length.

The mineralisation at Ivonne Norte (IVN) is interpreted to represent the

earliest higher temperature phase mineralising event at Pinguino. It is

typically more Au-rich than the subsequent phases of mineralisation. The infill

drill program at IVN was designed to define grade and continuity to the vein for

inclusion in the next resource update planned for 2014.

Two of the holes returned high grade mineralisation:

-- Hole PR292-13, in the southern area of the vein, returned 11 m @ 22.6

g/t Ag and 4.5 g/t Au, including 3 m @ 64.6 g/t Ag and 14.07 g/t Au.

-- Hole PR290-13 returned 9 m @ 258.0 g/t Ag and 3.79 g/t Au, including 3m

@ 712.7 g/t Ag and 8.24 g/t Au. The high silver grades in this hole have

not been previously encountered in IVN drilling, and are possibly

related to the southern extension of later Marta Noroeste structure and

mineralisation pulse. These results may indicate the existence of higher

grade shoots within the vein, which would require deeper drilling to

delineate.

Higher grade shoots are considered to be structurally controlled, as is evident

in other veins at Pinguino. The success of the Phase IX drill program in

demonstrating continuity of structure and mineralisation will be reviewed with

the goal of adding the IVN vein to the updated resource model in 2014.

New drilling of the Karly, CSS and CSN veins followed up their initial discovery

in 2012. They represent a more east-west trending vein splay set, which remains

open at depth and to the east, although drilling to date has not encountered

continuous high grades. The drilling at Marta Noroeste (MNW) discovered a

potential higher grade shoot in its southern extent (hole PR283-13), which

included an intersection of 3 m @ 486 g/t Ag and 1.30 g/t Au from 44 m. This

hole was in follow up to mineralisation encountered in trench MNW08-10 and in

drill hole PR250-12. This potential high grade shoot remains open at depth and

could have the same west-north-west plunge as the main shoot.

Work has begun on updating the geological and resource sections in preparation

for an update to the resource model, which is planned for completion in 2014.

Long sections and cross sections for these results are posted along with the

news release on Argentex's website (www.argentexmining.com).

About Pinguino

Argentex's 10,000-hectare advanced silver and gold exploration Pinguino project

is located in Argentina's Patagonia region, within the Deseado Massif of Santa

Cruz province. The Deseado Massif is an active region of mining with four

precious metal mines currently in production, and includes multiple active

advanced and early stage exploration projects.

The Pinguino system has grown to 70+ individual veins, with a combined strike

length approaching approx. 113 line-kilometers. The Pinguino project is unique

within the Deseado Massif region of Santa Cruz province in that it contains two

different and spatially distinct types of mineralisation; a precious metal

intermediate sulphidation epithermal system and a polymetallic sulphide-rich

system.

Pinguino is easily accessible, situated approximately 400 meters above sea level

in low-relief topography. An existing system of all-weather roads provides

year-round access to the property.

Technical content of this press release has been reviewed and approved by Mr. J.

David Williams, P.Eng., an independent "Qualified Person" as defined by NI

43-101.

Quality Assurance

Samples selected for analysis are sent to Acme Analytical Laboratories' sample

preparation lab in Mendoza, Argentina. From there, sample pulps are sent to its

laboratory in Vancouver, Canada for multi-element ICP-MS analysis (1DX

procedure). Samples overlimit in silver, lead, zinc, and/or copper are

reanalysed by a high detection limit ICP-ES analysis (7AR procedure). Samples

overlimit in silver from that procedure and gold results greater than 300 ppb

are rerun by fire assay (G6 procedure). Acme Analytical Laboratories is an ISO

9000:2001 accredited, full-service commercial laboratory, with its head office

located in Vancouver.

About Argentex

Argentex Mining Corporation is an exploration company focused on developing its

advanced Pinguino silver-gold project located in Santa Cruz, Patagonia,

Argentina. In total, Argentex owns 100% of 100,000+ hectares of highly

prospective land located in the Santa Cruz and Rio Negro provinces. Shares of

Argentex common stock trade under the symbol ATX on the TSX Venture Exchange and

under the symbol AGXMF on the OTCQB.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

On behalf of Argentex Mining Corporation:

Michael Brown, President and CEO

Statements in this news release that are not historical facts are

forward-looking statements that are subject to risks and uncertainties. Words

such as "expects", "intends", "plans", "may", "could", "should", "anticipates",

"likely", "believes" and words of similar import also identify forward-looking

statements. Forward-looking statements in this news release include the

statements: "The high grade intersections in the oxide zone at Ivonne Norte may

represent the upper portions of high grade shoots, which would open up the

potential for additional high grade resources to be identified in deeper

drilling", and "We expect to receive final results from the remaining holes

shortly, which will allow us to focus on updating the resource model in 2014",

and "These results may indicate the existence of higher grade shoots within the

vein, which would require deeper drilling to delineate", and "The success of the

Phase IX drill program in demonstrating continuity of structure, and the

mineralisation will be reviewed with the goal of adding the IVN vein to the

updated resource model in 2014", and "This potential high grade shoot remains

open at depth and could have the same west-north-west plunge as the main shoot",

and "Work has begun on updating the geological and resource sections in

preparation for an update to the resource model, which is planned for completion

in 2014". Actual results may differ materially from those currently anticipated

due to a number of factors beyond the Company's control. These risks and

uncertainties include, among other things, management's assumptions about the

availability of the necessary consultants and capital and the risks inherent in

Argentex's operations, including the risks that the Company may not find any

minerals in commercially feasible quantity or raise enough money to fund its

exploration plans. These and other risks are described in the Company's Annual

Information Form and other public disclosure documents filed on the SEDAR

website maintained by the Canadian Securities Administrators and the EDGAR

website maintained by the Securities and Exchange Commission.

FOR FURTHER INFORMATION PLEASE CONTACT:

Argentex Mining Corporation

Peter A. Ball

EVP Corporate Development

604-568-2496 (ext. 103) or 1-888-227-5285 (ext. 103)

604-568-1540 (FAX)

peter@argentexmining.com

www.argentexmining.com

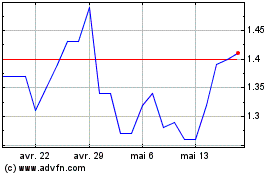

Atex Resources (TSXV:ATX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Atex Resources (TSXV:ATX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025