1 de 5

-

25/4/2016 09:08

0

0

waldron

Messages postés: 9905 -

Membre depuis: 17/9/2002

Philips More Likely to Sell Lighting Unit Via IPO Than Private Sale 25/04/2016 6:57am Dow Jones News

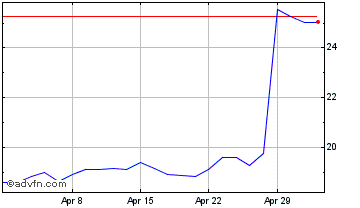

Philips Kon (EU:PHIA)

Intraday Stock Chart Today : Monday 25 April 2016

By Maarten van Tartwijk

AMSTERDAM--Royal Philips NV said Monday it is more likely to sell

its lighting business via an initial public offering rather than a

private sale, citing improved sentiment in financial markets.

The Dutch electronics company is in the midst of separating its

lighting arm and previously said it was exploring either a sale or a

listing. It has received several offers for the business, which could be

valued by as much as EUR5 billion ($5.6 billion).

In its latest earnings report, Philips said it tilts toward an IPO

even as it continues to assess proposals in a private sale process.

"With equity markets' sentiment improving compared with the first couple

of months of the year, an IPO increasingly appears a more likely

outcome," the company said. A decision could be announced "shortly", it

added.

Philips is in the final phase of separating its nearly 125-year-old

lighting arm and has previously said it expects a sale to take place

before the end of June. The move is part of a wider strategic overhaul

in which the company seeks to focus on its more profitable and faster

growing healthcare-technology activities and related products.

The Amsterdam-based firm said tax charges related to the separation

of the lighting business contributed to a drop in earnings in the first

three months of 2016. Net profit was EUR37 million, a drop of 63%

compared with the same period a year earlier.

Adjusted earnings before interest and taxes, the company's

preferred measure of its operational performance, rose to 14% to EUR374

million. Sales rose 3% to EUR5.5 billion.

The company maintained its guidance for 2016, expecting modest comparable sales growth.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

April 25, 2016 02:42 ET (06:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

1 Year Philips Kon Chart

|

1 Month Philips Kon Chart

|

|

2 de 5

-

25/4/2016 09:17

0

0

waldron

Messages postés: 9905 -

Membre depuis: 17/9/2002

Philips bat le consensus au 1er trimestre

Soyez le premier à réagir !

Publié le 25/04/2016 à 09h11

Crédit photo © Reuters par Toby Sterling AMSTERDAM (Reuters) - Philips a

publié lundi un bénéfice opérationnel meilleur que prévu pour le premier

trimestre et annoncé une probable introduction en Bourse de sa division

d'éclairage, qui en tant que société indépendante serait le premier

fabricant mondial d'ampoules. Le groupe néerlandais, désormais

recentré sur la santé, dit continuer de préparer simultanément une offre

publique de vente ou une vente privée de Philips Lighting mais il

estime désormais qu'une IPO est "l'issue la plus probable". Pour

les trois premiers mois de l'année, Philips a fait état d'un bénéfice

avant intérêts, impôts et amortissement de 290 millions d'euros après

ajustement alors que les analystes interrogés par Reuters prévoyaient en

moyenne 257 millions. Le directeur général Frans van Houten a

précisé que les perspectives du groupe pour 2016 demeuraient inchangées,

l'amélioration des résultats étant attendue pour l'essentiel au second

semestre du fait de "vents contraires macro-économiques" et de coûts

liés à la séparation de l'éclairage. Frans van Houten avait

annoncé dès 2014 le recentrage sur les équipements médicaux et la

séparation des activités d'éclairage, le métier historique du groupe

fondé en 1891, sans alors trancher entre une IPO ou une cession pure et

simple. "Avec l'amélioration du sentiment sur les marchés

boursiers comparé aux deux premiers mois de l'année, une IPO semble de

plus en plus l'issue la plus probable", a fait savoir l'entreprise lundi

en promettant d'informer rapidement les investisseurs sur les

conclusions de son évaluation. Le cours de Bourse de Philips

affiche une progression de 6,8% cette année mais il sous-performe

légèrement l'indice AEX de la Bourse d'Amsterdam depuis l'arrivée aux

commandes de Frans van Houten il y a cinq ans. La division

d'éclairage, qui a été valorisée à quelque cinq milliards d'euros, a

réalisé au premier trimestre un Ebita de 102 millions d'euros sur un

chiffre d'affaires de 1,69 milliard. Philips réalise l'essentiel

de ses bénéfices avec ses activités dans la santé, qui pour la première

fois ont été séparées en plusieurs divisions pour donner un aperçu du

groupe après la scission de l'éclairage. La division principale,

"Soins personnels", englobe les produits grand public comme les brosses à

dents ou rasoirs électriques, où Philips conserve une forte notoriété. Les

scanners et autres appareils d'imagerie médicale sont regroupés dans un

deuxième pôle et un troisième réunit les services de santé connectés,

comme les systèmes de surveillance des patients ou l'analyse des données

cliniques. Au niveau du groupe, le chiffre d'affaires à périmètre

comparable a progressé de 3% à 5,51 milliards d'euros, dépassant là

encore le consensus qui était à 5,36 milliards. La division

d'éclairage a vu son chiffre d'affaires diminuer de 2%, sous le coup

d'une baisse des ventes d'ampoules traditionnelles, mais elle a augmenté

son Ebita grâce à une hausse des ventes de produits LED, qui permettent

de dégager des marges plus importantes et représentent désormais plus

de 50% du portefeuille de Philips. (Véronique Tison pour le service français)

|

3 de 5

-

16/5/2016 09:45

0

0

waldron

Messages postés: 9905 -

Membre depuis: 17/9/2002

Philips : l'IPO de la branche éclairage sur les rails

Publié le 16/05/2016 à 09h05

(Boursier.com) — Le groupe Philips

a précisé lundi les modalités de l'introduction en Bourse (IPO) de

Philips Lighting, sa filiale éclairage. Le géant néerlandais de

l'électronique, qui compte placer 37,5 millions d'actions de sa filiale

lors de cette opération prévue pour le 27 mai, soit 25% du capital, a

indiqué vouloir lever jusqu'à 970 millions d'euros, a-t-il indiqué à

l'occasion de la publication du prospectus. La fourchette indicative de

prix a été fixée à 18,5-22,5 euros, valorisant la société entre 2,78 et

3,38 MdsE. Fin avril, Philips avait renoncé à mettre en vente sa

filiale éclairage pour opter finalement pour une IPO. Philips Lighting,

basé à Eindhoven, a généré 7,47 milliards d'euros de chiffre d'affaires

en 2015 et espère verser un premier en 2017.

|

4 de 5

-

24/1/2017 11:06

0

0

waldron

Messages postés: 9905 -

Membre depuis: 17/9/2002

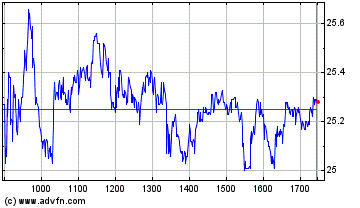

L'action Philips perd 2,4% après ses résultats du 4ème trimestre Koninklijke Philip Eur0.20 (EU:PHIA)

Graphique Intraday de l'Action Aujourd'hui : Mardi 24 Janvier 2017

L'action Royal Philips (PHIA.AE) se replie de 2,4% à 27,20 euros, en

réaction aux résultats faibles publiées par le conglomérat néerlandais

au titre du quatrième trimestre. Les résultats de la division éclairage

du groupe sont inférieurs de 2% aux prévisions du consensus. Daniel

Cunliffe, analyste chez Liberum, souligne que la performance de la

division technologies de santé est inférieure de 2,8% aux estimations du

consensus, en ajoutant que les projections concernant le bénéfice par

action de 2017 sont trop élevées de 2% à 3%. L'annonce d'une enquête de

la Food and Drug Administration (FDA) américaine sur l'activité de

défibrillateurs de Philips n'est pas non plus une bonne nouvelle, ajoute

l'analyste. Liberum a une recommandation "conserver" pour Philips,

assortie d'un objectif de cours de 30 euros.

-David Hodari, Dow Jones Newswires (Version française Maylis Jouaret) ed: ECH

(END) Dow Jones Newswires

January 24, 2017 04:44 ET (09:44 GMT)

|

5 de 5

-

24/1/2017 11:39

0

0

waldron

Messages postés: 9905 -

Membre depuis: 17/9/2002

Philips In Talks With U.S. Authorities Over Defibrillators -- 2nd Update 24/01/2017 10:29am Dow Jones News

Koninklijke Philip Eur0.20 (EU:PHIA)

Intraday Stock Chart Today : Tuesday 24 January 2017

By Maarten van Tartwijk

AMSTERDAM--Royal NV Philips is again caught in the crosshairs of U.S. authorities.

The Dutch health-technology company said Tuesday it is in talks with the U.S. Department

of Justice following inspections of its defibrillator business by the

Food and Drug Administration before and during 2015. The outcome of the

talks could have a "meaningful impact on the operations of this

business" and hurt group earnings this year, it said.

The FDA in 2013 warned that thousands of defibrillators made by Philips may not deliver the needed shock during medical

emergencies due to an electrical component failure that could

mistakenly indicate that the device was ready to be used. These

so-called automated external defibrillators are used to restore

patients' heartbeats after cardiac arrest and are used by consumers and

first responders working at fire departments.

Chief Executive Frans van Houten said the discussions with the

Justice Department aren't related to product quality but to

manufacturing procedures. He declined to give further detail on the

talks but said the defibrillator business

is relatively small, accounting for roughly EUR200 million ($215.07

million) in annual sales. The U.S. represents only part of that figure,

suggesting the impact of a potential fine or plant shutdown could be

relatively limited.

Still, Philips shares fell by around 4% in Amsterdam even as it reported better-than-expected fourth-quarter earnings.

The investigation comes as Philips is aiming to resolve a yearslong

brawl with the FDA over a factory in Cleveland that makes diagnostic

imaging tools. Production at the facility was temporarily halted in 2014

after the FDA detected shortcomings in manufacturing controls, causing

Philips to issue multiple profit warnings.

"[The Justice Department investigation] throws doubt into Philips'

ability to run FDA compliant factories in the U.S." ING analyst Nigel

van Putten said. "As the investigation is ongoing, uncertainty is

expected to linger," he said.

The issue adds to wider concerns of Philips' operations in the

U.S., its most important market by sales. The promise of President

Donald Trump to undo the Affordable Care Act is generating uncertainties

in the health-care industry. General Electric Co., one of Philips'

major rivals, last week warned that uncertainties could slow sales of

medical equipment such as MRI and X-ray machines.

Mr. van Houten said the U.S. business

continues to perform well but that the industry has a lot of questions

about the future under the new President. "I have spoken with several

hospital CEOs...Everybody is trying to understand what 'repeal and

replace' could mean. Nobody knows what could happen," he said.

Philips, the maker of products ranging from X-ray machines to electric toothbrushes,

said Tuesday it returned to net profit in the fourth quarter as it

reported a pickup in sales and benefited from cost-savings. Net profit

was EUR640 million ($688 million) in the last three months of 2016, up

from a EUR39 million net loss in the same period a year earlier, beating

market expectations.

Adjusted earnings

before interest, taxes and amortization were EUR1 billion, up from

EUR842 million in the previous year. Sales were EUR7.24 billion, up 3%

on a comparable basis.

The Dutch company, which is in the process of exiting its lighting

business, also presented new financial targets for the next three to

four years despite voicing concerns about its markets. Its new goal is

to achieve 4% to 6% comparable sales growth, while growing adjusted

Ebita by 100 basis points annually.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

January 24, 2017 05:14 ET (10:14 GMT)

|

Hot Features

Hot Features

Philips More Likely to Sell Lighting Unit Via IPO Than Private Sale

25/04/2016 6:57am

Dow Jones News

Philips Kon (EU:PHIA)

Intraday Stock Chart

Today : Monday 25 April 2016

AMSTERDAM--Royal Philips NV said Monday it is more likely to sell

its lighting business via an initial public offering rather than a

private sale, citing improved sentiment in financial markets.

The Dutch electronics company is in the midst of separating its

lighting arm and previously said it was exploring either a sale or a

listing. It has received several offers for the business, which could be

valued by as much as EUR5 billion ($5.6 billion).

In its latest earnings report, Philips said it tilts toward an IPO

even as it continues to assess proposals in a private sale process.

"With equity markets' sentiment improving compared with the first couple

of months of the year, an IPO increasingly appears a more likely

outcome," the company said. A decision could be announced "shortly", it

added.

Philips is in the final phase of separating its nearly 125-year-old

lighting arm and has previously said it expects a sale to take place

before the end of June. The move is part of a wider strategic overhaul

in which the company seeks to focus on its more profitable and faster

growing healthcare-technology activities and related products.

The Amsterdam-based firm said tax charges related to the separation

of the lighting business contributed to a drop in earnings in the first

three months of 2016. Net profit was EUR37 million, a drop of 63%

compared with the same period a year earlier.

Adjusted earnings before interest and taxes, the company's

preferred measure of its operational performance, rose to 14% to EUR374

million. Sales rose 3% to EUR5.5 billion.

The company maintained its guidance for 2016, expecting modest comparable sales growth.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

April 25, 2016 02:42 ET (06:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

1 Year Philips Kon Chart

1 Month Philips Kon Chart