UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of December, 2023

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

1010-1075

West Georgia Street

Vancouver,

BC

V6E

3C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: December 21, 2023 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

FORM 51-102F3

MATERIAL

CHANGE REPORT

| Item 1. | | Name and Address of Company |

Orla Mining Ltd. (“Orla”

or the “Company”)

1010 – 1075 West Georgia

Street

Vancouver, BC, V6E 3C9

| Item 2. | | Date of Material Change |

December 15, 2023

A news release announcing

the material change was issued on December 18, 2023 via Canada Newswire and a copy was subsequently filed on SEDAR+.

| Item 4. | | Summary of Material Change |

On December 15, 2023, the

Panamanian Ministry of Commerce and Industry (“MICI”) rejected the requests for extension for the three mining concessions

comprising the Company’s Cerro Quema Project, declared the concessions cancelled and declared the area comprising the concessions

to be a reserve area.

| Item 5. | | Full Description of Material Change |

On December 15, 2023, MICI

rejected the requests for extension for the three mining concessions comprising the Company’s Cerro Quema Project, declared the

concessions cancelled and declared the area comprising the concessions to be a reserve area.

While the Company regrets

this decision by the Panamanian Government, the Company will continue to monitor developments in Panama, which remain uncertain and quickly

evolving. However, until the Company has greater certainty with respect to the mining concessions, as well as fiscal and legal stability

in Panama, the Company will not consider additional spending towards the development of the Cerro Quema Project. The Company will explore

all legal remedies available to protect historical investments and potentially unlock additional value for its stakeholders, including

taking measures to protect its rights under international law.

The Cerro Quema Project

is located on the Azuero Peninsula in the Los Santos Province of Southwestern Panama, about 45 km southwest of the city of Chitre. The

project includes a pre-feasibility-stage, open-pit, heap leach gold project, a copper-gold sulphide resource, and various exploration

targets. The Company believes that the Cerro Quema Project could be an important social and economic contributor to the host communities.

To date, the Company has invested over US$120 million in Panama and, if constructed, the Cerro Quema Project is expected to create employment

and skills development opportunities, and contribute tax, royalty, and other fiscal benefits to the host communities and governments.

On November 3, 2023, the

National Assembly of Panama passed Law 407, which instituted a moratorium on granting, renewing, or extending concessions for the exploration,

extraction, transportation or exploitation of metal mining in Panama. The Company continued to monitor the impact of Law 407 and other

developments in Panama on the Cerro Quema Project. On December 15, 2023, Minera Cerro Quema, S.A., the Company’s subsidiary, received

three resolutions from MICI. The resolutions rejected the request for extension for the concessions, declared the concessions canceled

due to expiration and declared the area comprising the concessions to be a reserve area under the Panamanian mining code. Under the Panamanian

mining code, MICI is prohibited from granting mining concessions for exploration or extraction on a reserve area.

| Item 6. | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7. | | Omitted Information |

Not applicable.

Contact: Etienne Morin,

Chief Financial Officer

Telephone: (604) 564-1852

DATED as of this

21st day of December, 2023.

Forward-looking

Statements

This material

change report contains certain “forward-looking information” and “forward-looking statements” within the meaning

of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section

21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases

made by the United States Securities and Exchange Commission, all as may be amended from time to time, including statements regarding

the Company’s strategy in Panama and the expected benefits of the Cerro Quema Project. Forward-looking statements are statements

that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking

statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and

they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including

without limitation, assumptions regarding: the impact of political, legal and social developments in Panama; the future price of gold,

silver, and copper; anticipated costs and the Company’s ability to fund its programs; the Company’s ability to carry on exploration,

development, and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning and reclamation

estimates; the Company’s ability to secure and to meet obligations under property agreements, including the layback agreement with

Fresnillo plc; that all conditions of the Company’s credit facility will be met; the timing and results of drilling programs; mineral

reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves

on the Company’s mineral properties; that political and legal developments will be consistent with current expectations; the timely

receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction,

and operation of projects; the timing of cash flows; the costs of operating and exploration expenditures; the Company’s ability

to operate in a safe, efficient, and effective manner; the Company’s ability to obtain financing as and when required and on reasonable

terms; the impact of the COVID-19 pandemic on the Company’s operations; that the Company’s activities will be in accordance

with the Company’s public statements and stated goals; and that there will be no material adverse change or disruptions affecting

the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results

and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known

and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include,

but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves; the Company’s dependence

on the Camino Rojo oxide mine; risks related to the Company’s indebtedness; risks related to exploration, development, and operation

activities; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations, including the COVID-19

pandemic; foreign country and political risks, including risks relating to foreign operations and expropriation or nationalization of

mining operations and risks associated with operating in Mexico and Panama; concession risks at the Cerro Quema project; delays in obtaining

or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; delays in

or failures to enter into a subsequent agreement with Fresnillo plc with respect to accessing certain additional portions of the mineral

resource at the Camino Rojo project and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations

for the Camino Rojo project being only estimates and relying on certain assumptions; loss of, delays in, or failure to get access from

surface rights owners; uncertainties related to title to mineral properties; water rights; financing risks and access to additional capital;

risks related to guidance estimates and uncertainties inherent in the preparation of feasibility and pre-feasibility studies; uncertainty

in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold, silver,

and copper; unknown labilities in connection with acquisitions; global financial conditions; uninsured risks; climate change risks; competition

from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the

market price of the Company's securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations;

the Company’s limited operating history; litigation risks; the Company’s ability to identify, complete, and successfully integrate

acquisitions; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; the Company

not having paid a dividend; risks related to the Company’s foreign subsidiaries; risks related to the Company’s accounting

policies and internal controls; the Company’s ability to satisfy the requirements of Sarbanes-Oxley Act of 2002; enforcement of

civil liabilities; the Company’s status as a passive foreign investment company for U.S. federal income tax purposes; information

and cyber security; gold industry concentration; shareholder activism; and risks associated with executing the Company’s objectives

and strategies; as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as

well as its annual information form dated March 20, 2023, which are available on www.sedarplus.ca and www.sec.gov. Except as required

by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking

statements if management’s beliefs, estimates or opinions, or other factors, should change.

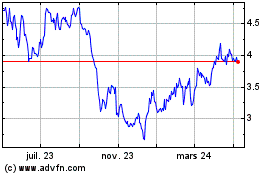

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

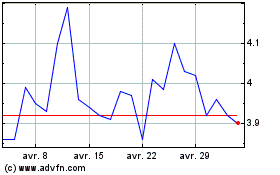

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025