TIDMALSP

RNS Number : 1919L

Ace Liberty & Stone PLC

29 April 2020

ACE LIBERTY AND STONE PLC

("Ace" or "the Company")

TRADING UPDATE

Ace Liberty and Stone Plc (AQSE: ALSP), the active property

investment company, capitalising on commercial property investment

opportunities across the UK, is pleased to update shareholders on

the current positive state of the Company's business.

A strong portfolio

As at 30 April 2014, the value of the Company's property

portfolio was GBP10,032,267. By 30 April 2019, that value had

increased to GBP88,323,017, with the portfolio predominantly let to

departments of national government (52%), local authorities (7%),

and major industrial and commercial entities (38%). The total

passing rental income generated by this portfolio was GBP6,477,438

at 30 April 2020; the secured loan to value was 52.02% and the

weighted average unexpired lease to break was 8.72 years.

From this position of strength, the Directors followed a policy

of continued stability, making no further purchases and allowing

the Company to enjoy sustained rental income without incurring

costs associated with new acquisitions.

The portfolio was fully tenanted apart from one development

property in Aldershot.

Prior to the national lockdown following the outbreak of

Covid-19, Ace's tenants also had a 100% payment record across the

whole portfolio.

Debt / equity

At 30 April 2019, net debt stood at GBP61,177,102 compared to

total equity of GBP21,170,030, giving a ratio of 289%. At 31

October 2019, this ratio was stable at 292% with 43,198,368

ordinary shares in issue.

The 5% CLN issued in January 2018 was due to mature in December

2019. 3,856,000 new ordinary shares were issued as a result of

conversions, exercise of warrants and interest payments in the

period from 1 November to 31 December 2019 after our last half

yearly report.

As a result of demand for the Company's shares in January 2020,

the directors exercised their options to subscribe for 6,983,333

new shares and immediately sold these on to investors, bringing new

cash funds of GBP4,534,800 to boost the Company's resources.

Assessing the economic impact of Covid-19, the directors decided

to strengthen the Company's position by offering the holders of the

Company's 7% loan the opportunity to convert into new ordinary

shares at an issue price of 50p. This was accepted by eight holders

thereby eliminating debt of GBP2,200,000 and future interest

payments of GBP154,000; 4,421,094 new shares were issued, taking

the aggregate issued capital to 58,466,295 ordinary shares, which

total also includes some minor issues of shares to settle invoice

liabilities.

Minor impact of Covid-19

The Company's tenant base has proven to be remarkably resilient

in the face of the current global crisis. Ace's strategy since

inception was to seek governmental lessees because they are least

likely to default. Ace is currently reaping the rewards of this

strategy. Despite the measures introduced by the UK Government to

contain the Covid-19 virus, only seven tenants (five in the leisure

industry and two in the retail sector) were unable to pay their

rent on the March 2020 quarter day. Payments received represented

82% of rents due.

The vast majority of Ace's tenants will continue to pay their

rent as normal. Four of the aforementioned tenants who are facing a

difficult time during the lockdown period are large organisations

already planning to return to full operations as soon as the

lockdown ends.

Company response to Covid-19

Ace expects to ride out the economic impact of the response to

Covid-19, and the directors have taken steps to preserve the

Company's cash resources and maintain its strong position.

The Company had a healthy cash balance before the impact of the

Covid19 on the economy and the actions detailed above have further

strengthened this position.

Actions taken by the directors to further strengthen the

Company's short-term position include:

-- Temporarily deferring dividend payments;

-- Obtaining deferral of tax payments;

-- Seeking a short-term capital repayment holiday from the Group's bankers; and

-- Implementing working from home procedures for employees.

The Company's Annual Report for the year ending 30 April 2020 is

due for release in September 2020, and the Board will issue a full

appraisal of the Company's business at that time. Ace confidently

expects the results for the year ending 30 April 2020 to be an

improvement on the previous year, subject only to possible

impairments to property values.

Commenting on progress made and outlook, Ismail Ghandour, Chief

Executive Officer, said:

"Our properties with stable, long term tenants (mostly

governmental) and strong yields are highly attractive investments -

even more so during this global crisis. We are extremely pleased

with Ace's position and our strong foundation, which will allow us

to weather the economic effects of Covid-19."

The Directors accept responsibility for this announcement.

- ends -

For further information, please contact:

Ace Liberty & Stone Plc

Ivan Minter, Financial Director Tel: +44 (0) 20 7201 8340

http://acelibertyandstone.com

Alfred Henry Corporate Finance Ltd,

AQSE Growth Market Corporate Adviser Tel: +44 (0) 20 3772 0021

Jon Isaacs / Nick Michaels www.alfredhenry.com

SP Angel Corporate Finance LLP

Broker Tel: +44 (0)20 3470 0470

Abigail Wayne / Rob Rees www.spangel.co.uk

Belvedere Communications

John West / Llew Angus Tel: +44 (0) 20 3687 2756

ACF Equity Research

Christopher Nicholson / Amalia Barnoschi Tel: +44 (0) 20 7558 8974

www.acfequityresearch.com

Notes to Editors

Ace Liberty & Stone Plc is a property investment company

with a diverse portfolio of properties located across the UK,

currently including Leeds, Sunderland, Plymouth, Dudley, Gateshead,

Barnstaple, and London. The Company locates commercial and

residential properties which have the potential for an increase in

value through creative asset management activity, such as change of

tenancy, change of use or new lease negotiation. Ace has maintained

a track record of generating strong profits at disposal of

properties and achieving better-than average returns on capital.

With strong support from shareholders and mortgage lenders, the

Company is currently seeking further investment opportunities in

the UK to create value for existing and new investors.

Ace is run by a Board with extensive property experience, an

excellent network of contacts and relevant professional

qualifications. This sector expertise has allowed the Board to

identify opportunities and act promptly to secure investments.

For more information on the Company please visit

www.acelibertyandstone.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NEXBDGDSRBDDGGI

(END) Dow Jones Newswires

April 29, 2020 02:30 ET (06:30 GMT)

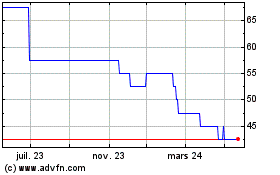

Ace Liberty & Stone (AQSE:ALSP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

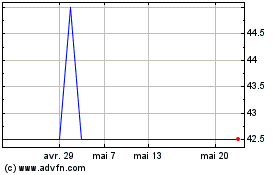

Ace Liberty & Stone (AQSE:ALSP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025