Hedera (HBAR) Shines: Record-Breaking 164 Million Daily Transactions, Market Cap Reaches $2.9 Billion

27 Janvier 2024 - 2:00AM

NEWSBTC

Hedera (HBAR), the open-source Proof-of-Stake (PoS) blockchain

network, has made significant strides in the fourth quarter (Q4) of

2023, according to a recent report by Messari. The network’s

performance showcased notable growth in key metrics, outpacing the

crypto market. Hedera Outpaces Crypto Market With 78% QoQ Increase

During Q4 2023, Hedera’s circulating market cap experienced a 78%

quarter-over-quarter (QoQ) increase, reaching $2.9 billion. This

growth surpassed the overall crypto market’s growth rate of 54%,

signifying Hedera’s growing influence. The year-on-year (YoY)

change for HBAR stood at 211%, reflecting the network’s progress

and adoption. In the same line, Hedera Network’s revenue witnessed

a substantial 59% QoQ increase, amounting to $1.6 million in Q4

2023, primarily driven by a 66% QoQ surge in transactions, notably

propelled by the Hedera Consensus Service. Related Reading:

Is Chainlink (LINK) Ready To Soar? Key Indicators To Monitor

Furthermore, the revenue generated from Token and Smart Contract

Services contributed approximately 14% of the total revenue,

exemplifying a healthy distribution in Hedera’s revenue streams.

With a fixed total supply of 50 billion HBAR, Q4 2023 saw 33.6

billion HBAR, or 67% of the total supply, in circulation. The

quarterly distribution of HBAR, reported through the Hedera

Treasury Management Report, anticipates an additional 10% of the

total supply to be unlocked in Q1 2024, including new ecosystem

grants. While the number of addresses experienced a decline in Q4

2023, with average daily active addresses decreasing by 22% QoQ to

6,600 and average daily new addresses dropping by 39% QoQ to 5,200,

there was still substantial YoY growth. Active addresses were up

90% YoY, and new addresses witnessed a 123% YoY increase. Hedera

Network achieved a new record in transaction volume for the sixth

consecutive quarter, with an impressive daily average of 164

million transactions in Q4 2023, marking a 66% QoQ surge. The

Hedera Consensus Service remained the primary driver of this

activity, accounting for 99% of all transactions on the network.

DEX Trading Volume Skyrockets 164% QoQ In Q4 2023, the Hedera

network reported 28 billion HBAR staked, representing 85% of the

circulating and 56% of the total supply. Entities such as

Swirlds and Swirlds Labs played a significant role in staking their

HBAR allocations, and the Hedera Treasury supported validators in

meeting the minimum staking threshold for network consensus.

The Hedera network’s Total Value Locked (TVL) demonstrated positive

growth, reaching $64 million by the end of 2023, reflecting a

significant YoY increase of 169%. The TVL denominated in HBAR

reached 733 million, indicating a 16% QoQ and YoY increase.

Interestingly, Hedera’s TVL ranked among the top 40 blockchain

networks. Related Reading: Algorand CEO’s X Account Hacked, Is

Justin Sun Involved? Moreover, Hedera Network experienced a 164%

QoQ increase in average daily decentralized exchange (DEX) trading

volume, reaching $1.3 million, an all-time high. SaucerSwap

dominated DEX trading volume on the Hedera network, accounting for

most of the trading activity, as seen in the chart below. Lastly,

the stablecoin market cap on the Hedera network grew by an

impressive 73% QoQ, culminating in a year-end total of $6.3

million. Circle’s USDC stood as the sole stablecoin available on

Hedera. The network’s rank in the stablecoin market cap among

blockchain networks improved by four spots QoQ, solidifying

Hedera’s position in the stablecoin market. Under current market

conditions, the price of HBAR stands at $0.0736, showcasing

substantial growth in the past 24 hours, with a 5% increase.

Featured image from Shutterstock, chart from TradingView.com

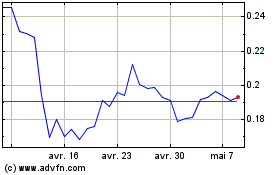

Algorand (COIN:ALGOUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Algorand (COIN:ALGOUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024