Market Signals Hint At Bitcoin’s Potential Fall To $52,000—Analyst

05 Octobre 2024 - 8:30AM

NEWSBTC

The Bitcoin market is grappling with mixed predictions, fueled by

both technical analysis and external factors like geopolitics.

Political turmoil has hurt Bitcoin before. When tensions grow,

cryptocurrency prices fall, unlike gold, market analysts say.

Related Reading: Is Crypto Losing Steam? Bitcoin And Ethereum

Addresses Shrink In 2024 Bitcoin shot down to about $59,000 as the

Middle East’s crisis worsened, and then recovered somewhat, but

continuing volatility is probably in the cards. In spite of this

uncertainty, CoinCodex’s latest BTC price prediction offers a huge

40% gain in the price of the crypto asset, which could top out at

$86,428 by November 2024. Market expert Ali Martinez notes that

Bitcoin is moving in a descending parallel channel, a pattern

generally associated with price drops. Bitcoin’s technical setup

says it might drop to $52,000, increasing uncertainty. Though

CoinCodex predicts a bullish climb, BTC’s future is uncertain.

#Bitcoin could drop to $52,000 if the governing pattern behind the

recent price action is a descending parallel channel!

pic.twitter.com/CEAbdWXCrB — Ali (@ali_charts) October 2, 2024

Impact Of Market Sentiment On Bitcoin The price momentum of Bitcoin

would depend on market sentiment. According to CryptoQuant,

Long/Short Volume to Open Interest Ratio is a notable indicator

that reflects trader positioning: when this ratio grows, it

indicates that long positions are dominant and it is commonly seen

as an indication of positive market movement. A little too much

optimism in the markets, however, produces prices to be corrected

downwards. On the other hand, too much short position also hints at

bearish sentiments, but at the extreme, it can be a precursor to

the rebound of prices. BTCUSD trading at $61,696 on the daily

chart: TradingView.com Currently, Bitcoin’s sentiment remains

neutral, with the Fear & Greed Index at 41, reflecting the

caution in the market. This suggests that, despite its stable

performance with 60% green trading days over the last month,

investors are still wary. Geopolitical Factors While geopolitical

events influenced the price movement of Bitcoin aside from

technical analysis, its movements are varied. According to

cryptocurrency analyst Jesse Colombo, the coin usually traded

downhill during periods of increased global tensions. So far, there

is a rebound due to the Middle East crisis, and its traders are

expecting more of the same. This has the consequence of making the

alpha crypto experience drastic value changes mainly when the

tensions in different parts of the world keep rising. Related

Reading: What’s Holding Bitcoin Back? Analyst Says $71,000 Is The

Magic Number The Road Ahead Bitcoin’s future is not by any means

certain with these mixed signals. Ali Martinez has a bearish

forecast, but on this assessment in combination with CryptoQuant’s

market sentiment analysis, the price could well fall to $52,000.

CoinCodex believes that this will provide more reason for optimism

so that BTC can enjoy healthy growth in the coming months or years.

Featured image from Vecteezy, chart from TradingView

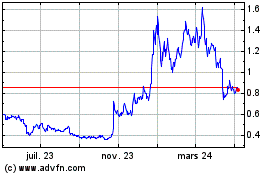

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024