Bitcoin’s Next Move? Coinbase Premium Suggests a Short-Term Rally May Be Brewing

05 Décembre 2024 - 5:30AM

NEWSBTC

According to recent insights, Bitcoin (BTC) seems to be on the

verge of another rally, which suggests the potential for short-term

upward momentum. At the heart of this discussion is the Coinbase

Premium Index, a critical indicator analyzed in one hour by

CryptoQuant analyst Yonsei Dent. This metric and specific moving

average trends have highlighted conditions that could pave the

way for Bitcoin to regain its upward trajectory. Related Reading:

Is Bitcoin $100,000 Goal In Jeopardy? Options Market Show Increased

Downside Protection Upward Move On The Horizon The Coinbase Premium

Index measures the price gap between Bitcoin on Coinbase and other

exchanges, offering a glimpse into market sentiment and

institutional demand. Dent’s analysis zeroes in on the daily

(24-hour) and weekly (168-hour) moving averages. Historical data

indicates that significant Bitcoin price movements tend to occur

when the daily average decisively crosses above the weekly

average—a pattern commonly called a “golden cross.” According to

Dent’s findings, the weekly moving average has recently

transitioned from a negative slope to a positive one, setting the

stage for a potential golden cross. This shift is significant, as

previous instances of a positive slope combined with a golden cross

have been followed by pronounced price increases. Additionally,

Bitcoin is forming higher lows, a bullish signal, while also

shaping a converging triangle pattern. If demand levels rise

adequately, these technical patterns could signal the beginning of

a renewed uptrend. While these indicators point to optimism, the

CryptoQuant analyst emphasizes the importance of sustained demand.

The analyst mentioned that historical patterns suggest that once

this sufficient demand materializes, Bitcoin often experiences

strong upward momentum, potentially attracting retail and

institutional investors back into the market. Technical Outlook On

Bitcoin Bitcoin is trading at $96,216, reflecting a 0.3% increase

in the past day and a 1.3% rise over the past week. Amid this price

activity, a report from another CryptoQuant analyst Burak Kesmeci,

highlights notable behavior among US investors, who seem to be

taking advantage of even minor dips in BTC’s value. Related

Reading: Bitcoin Price Supported By All-Stablecoins Cash Inflow –

Data Reveals Strong Correlation Kesmeci revealed that within the

last 24 hours, Coinbase recorded two significant withdrawal

transactions, each exceeding 8,000 BTC, highlighting sustained

investor interest in the asset. Two Significant Outflows Exceeding

8k #BTC Each from Coinbase in the Last 24h “19,487 $BTC were

withdrawn, with an average cost of $96,043. The total value of

these two transactions amounts to approximately $1.87 billion.” –

By @burak_kesmeci Link 👇https://t.co/4WkEJ2p3vw

pic.twitter.com/ADf1qWvkV2 — CryptoQuant.com (@cryptoquant_com)

December 3, 2024 The analyst noted: Since the approval of spot

Bitcoin ETFs, institutional demand has significantly increased.

With retail investor interest likely to join this trend soon,

Bitcoin appears poised to surpass the $100,000 level in the near

future. Featured image created with DALL-E, Chart from TradingView

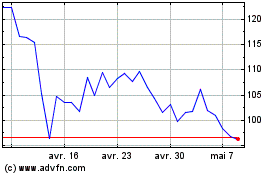

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024