Aalberts N.V.: Aalberts realises organic revenue growth in line with expectations

07 Novembre 2024 - 7:30AM

Utrecht, 7 November 2024

trading update - first ten months 2024

In the first ten months Aalberts realised -2.9% organic revenue

growth compared to last year, for building technology segment -4.7%

and industrial technology segment -0.7%. The added value margin

remained on a good level.

Productivity improvement, cost savings and inventory reduction

plans are in place to manage cost inflation and lower volumes. We

are deploying our strategic initiatives with our long-term business

plans and portfolio optimisation. We accelerated our operational

excellence program leading to a one-off strategic restructuring

cost of approximately EUR 50 million with an annual benefit of

approximately EUR 25 million.

In eco-friendly buildings we continued to see

lower activity in Europe, especially in Germany and France, where

in Benelux and Switzerland demand improved. We continued to see the

impact of decreasing end-user demand in new build and slowdown in

renovation. Stock levels at wholesales remain low for our products.

We saw better activity in America, Asia and Middle East compared to

Europe. Our water treatment offering for heating systems continued

to grow. Energy & resource efficiency in residential and

commercial buildings remains a long-term growth driver.

In semicon efficiency growth continued with

volatile demand. Our orderbook remained on a high level, where we

are benefiting from a healthy mix of customers. Service and

refurbishments remain a growth activity and we are investing in

more capacity. Our further expansions are on track, enabling the

strategic growth and new business development plans of our

customers. We see the semicon market in transition.

In sustainable transportation we faced lower

demand in automotive, both in Europe and America. Aerospace

continued to grow with strong air travel demand and aging fleets

supporting the need for new deliveries. The demand for precision

manufactured parts and specialised surface technologies remained on

a good level, driven by new developments in e-mobility, lightweight

materials, sustainability and reshoring.

In industrial niches we faced lower activity

with reduced demand in general industries and machine build,

predominantly in Germany and France. Our order intake continued to

be strong for our industrial valves in America.

portfolio optimisationAalberts acquired Steel

Goode Products LLC in America (industrial technology, September), a

thermal spray coating and finishing services provider generating an

annual revenue of approximately USD 15 million. Aalberts divested

Elkhart Products Corporation in America (building technology,

August), a copper solder fitting manufacturer generating an annual

revenue of approximately USD 80 million.CEO

statementStéphane Simonetta comments: “I would like to

thank the Aalberts team for showing strong resilience, serving our

customers while taking all actions possible to manage challenging

markets, cost saving actions and inventory reductions. We continue

to invest for future growth and remain well positioned for the

rebound of activity. We are looking forward to give an update of

our strategy during our Capital Markets Day on 10

December.”contact+31 (0)30 3079 302 (from 8:00 am

CET)investors@aalberts.com regulated

informationThis press release contains information that

qualifies or may qualify as inside information within the meaning

of Article 7(1) of the EU Market Abuse Regulation.

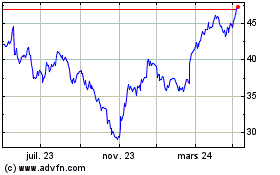

Aalberts NV (EU:AALB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Aalberts NV (EU:AALB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024