ABN AMRO discloses preliminary outcome of capital requirements for 2024

03 Octobre 2023 - 8:00AM

ABN AMRO discloses preliminary outcome of capital requirements for

2024

ABN AMRO discloses preliminary outcome of capital

requirements for 2024

As part of the 2023 exercise of the Supervisory Review and

Evaluation Process ("SREP"), the European Central Bank has notified

ABN AMRO Bank of the preliminary outcome regarding the capital

requirements for 2024.

The Pillar 2 requirement (P2R) is proposed to increase by 0.25%

to 2.25%. The increase mainly reflects improvements required in the

area of BCBS 239 compliancy and the internal rating-based

approach.

Under this preliminary outcome, the pro forma CET1 requirement

at the end of second quarter 2023 would become 10.7%. This consists

of a Pillar 1 requirement of 4.5%, a Pillar 2 requirement of 2.25%,

a capital conservation buffer of 2.5%, a 1.5% O-SII buffer and a

0.9% countercyclical buffer. The Pillar 2 requirement may be

partially filled by AT1 and T2 capital instruments.

ABN AMRO’s CET1 position of 14.9% at the end of the second

quarter of 2023 is well above the CET1 requirement of 10.7% under

this preliminary SREP outcome.

| ABN AMRO

Press OfficeJarco de SwartSenior Press

Officerpressrelations@nl.abnamro.com+31 20 6288900 |

ABN AMRO

Investor RelationsNiels FarragherInvestor Relations

investorrelations@nl.abnamro.com+31 20

6282282 |

This press release is published by ABN AMRO Bank N.V. and

contains inside information within the meaning of article 7 (1) to

(4) of Regulation (EU) No 596/2014 (Market Abuse Regulation)

- ABN AMRO discloses preliminary outcome of capital requirements

for 2024

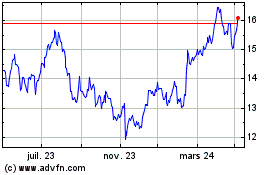

ABN AMRO Bank N.V (EU:ABN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

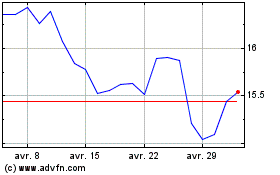

ABN AMRO Bank N.V (EU:ABN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025