Results first half 2024

02 Septembre 2024 - 8:00AM

UK Regulatory

Results first half 2024

Regulated information – September 2nd

2024– 08:00

Financial results

During the first half of 2024, Campine’s sales

revenue amounted to € 169.1 million. The EBITDA amounted to € 19.7

million, a rise of 18% compared to last year. This result sets a

new record for Campine for the first six months of the year. The

profitability is supported by favourable metal prices.

Although demand and sales volumes for

Specialty Chemicals have remained equally moderate

as in 2023, this division benefitted from a huge surge in prices

for antimony metal and its derivatives at the end of the first

semester. EBITDA rose 60% thanks to increased margins supported by

higher value for the antimony related stocks. In the

Circular Metals division volumes dropped with -10%

due to low demand for lead and car batteries in Europe, but despite

this EBITDA rose with 6% thanks to good prices for different metals

and abundant availability of metal waste and battery scraps, which

are Campine’s most important sources of material input.

“Despite challenging economical circumstances

with limited demand in several of our markets, we have increased

our profits thanks to focused efforts on the purchasing side”

explains CEO De Vos. Campine also managed to increase its profit

margins as a result of strong metal prices, especially thanks to

the very high prices for antimony metal. “Our pioneering efforts in

developing a proprietary antimony recycling technology are paying

off more than ever at these price levels” adds De Vos. Campine’s

R&D department develops an even more advanced technology to

recycle antimony, which should allow the company to not only extend

capacity but also to recycle more complex antimony containing

residues and waste streams in the future.

Results per division/segment

Specialty Chemicals division

Market and Operations

- The turnover in the Specialty Chemicals division amounted to €

74.2 million, an increase of nearly 9% compared to 2023. This

growth is entirely attributed to the Antimony Trioxide business

unit. Campine’s FRMB unit ( flame-retardant masterbatches) as well

as CrP, its PP recycling unit suffered both form sluggish demand as

well as from lower plastics prices.

- The EBITDA rose with 60% to € 6.0 million (2023: € 3.8

million). The enhanced profitability is completely supported by the

rise in antimony prices and related margin and stock value

increases.

Circular Metals division

Market and Operations

- The turnover reduced to € 111.8 million (-11% compared to

2023), this decrease is related to lower demand for lead in

Europe.

- The EBITDA rose to € 13.7 million compared to € 13.0 million in

2023. The increase – despite a volume drop - reflects the good

prices for the different metals Campine recycles, such as lead,

antimony, gold, silver, and tin and the abundant availability of

scraps and waste containing these metals.

Outlook full year 2024

Campine is once again anticipating a

particularly good result for 2024, possibly matching or surpassing

the 2023 record figures. This will of course depend on the

evolution of metal prices and demand for its finished products in

the second semester.

In the Specialty Chemicals

division we expect antimony prices to remain at a high level. Short

term demand and prices for antimony trioxide have increased since

August 15th, date when the Chinese authorities announced

export restrictions on antimony products. With our diversified

antimony metal purchase mainly outside of China and our own

recycling, Campine is well positioned to keep a leadership position

in this market. Forecasts in Europe for recycled plastics and

masterbatches are difficult, but if the recovery starts, polymer

prices and thus margins, should move upwards.

The price of lead on the London Metal Exchange

experienced a serious dip early August in correlation with the

crash on the stock markets, but we expect prices to recover towards

the year-end. In any case, in its Circular Metals

division, Campine is to a certain extent able to balance its

margins in lead recycling, since low demand for end products mostly

means abundant supply of scraps at lower prices on the purchasing

side.

The full interim financial report is available

on our website www.campine.com: Investors/shareholder

information/financial reports and calendar/Financial

reports/interim financial report 2024.

This information is also available in Dutch.

Only the Dutch version is the official version. The English version

is a translation of the original Dutch version.

For further information you can contact Karin

Leysen (tel. no +32 14 60 15 49)

(email: Karin.Leysen@campine.com).

- 24 rep half ENG def

- 24 pers half GB

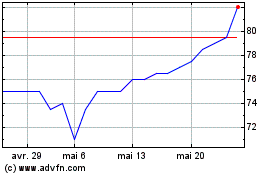

Campine NV (EU:CAMB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Campine NV (EU:CAMB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024