EXEL Industries: 2022–2023 revenue up 12.0%

|

2022–2023 revenue up 12.0% Group revenue crosses

the €1 billion threshold driven by strong growth in Agricultural

Spraying |

|

Q4 sales(July 2023–September 2023) |

2021–2022 |

2022–2023 |

Change (reported) |

Change (LFL*) |

|

Reported |

Reported |

€m |

% |

€m |

% |

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

122.5 |

133.2 |

+10.7 |

+8.7% |

+18.0 |

+14.7% |

| SUGAR BEET

HARVESTERS |

85.3 |

70.7 |

(14.5) |

(17.0)% |

(14.1) |

(16.5)% |

| LEISURE

|

28.1 |

23.7 |

(4.4) |

(15.6)% |

(6.0) |

(21.4)% |

| INDUSTRY

|

61.7 |

73.6 |

+11.9 |

+19.3% |

+14.5 |

+23.5% |

| |

|

|

|

|

|

|

|

EXEL Industries Group |

297.5 |

301.2 |

+3.7 |

+1.2% |

+12.4 |

+4.2% |

|

12 months sales(October 2022–September 2023)

|

2021–2022 |

2022–2023 |

Change (reported) |

Change (LFL*) |

|

Reported |

Reported |

€m |

% |

€m |

% |

| |

|

|

|

|

|

|

| AGRICULTURAL

SPRAYING |

442.3 |

525.2 |

+82.9 |

+18.7% |

+85.3 |

+19.3% |

| SUGAR BEET

HARVESTERS |

146.3 |

158.6 |

+12.3 |

+8.4% |

+16.0 |

+10.9% |

| LEISURE

|

138.9 |

143.6 |

+4.7 |

+3.4% |

(1.2) |

(0.9)% |

| INDUSTRY

|

249.5 |

266.8 |

+17.3 |

+6.9% |

+20.1 |

+8.1% |

| |

|

|

|

|

|

|

|

EXEL Industries Group |

977.0 |

1,094.3 |

+117.3 |

+12.0% |

+120.2 |

+12.3% |

* Like-for-like (LFL) = at constant foreign

exchange rates and scope

Sales per activityFourth

quarter 2022–2023

EXEL Industries posted revenue of €301.2

million for the fourth quarter of fiscal 2022–2023, up

1.2%. However, growth at constant consolidation

scope and foreign exchange rates was 4.2%, the

difference being due to an adverse currency effect and a limited

scope effect arising from the consolidation of the Devaux group:

the early June 2023 acquisition of Devaux led to the consolidation

of a €2.0 million contribution to fourth quarter

revenue.

-

AGRICULTURAL SPRAYING UP

8.7%

The fourth quarter of 2021–2022 was a catch-up

quarter, following two consecutive quarters in which supply

shortages penalized production and, consequently, deliveries. In

the fourth quarter of 2022–2023, Western Europe (France, Germany),

North America and Australia drove growth in machine sales

volumes.

- SUGAR

BEET HARVESTERS DOWN 17.0%

After a first half marked by exceptional

deliveries in Eastern Europe, sales volumes returned to a more

typical seasonal pattern this quarter. Sugar prices, which have

remained at all-time highs throughout 2023, supported demand in

Europe.

Hit by adverse weather conditions, Garden sales

were down in the fourth quarter, in a declining market for the

second consecutive year. Despite a slight upturn in September,

dealers preferred to run down existing inventories rather than

place new orders, thereby impacting volumes. The integration of

Devaux is progressing according to plan.Deliveries in the Nautical

business improved in the fourth quarter, making up for the

shortfall in the third quarter.

Industrial spraying revenue increased

significantly thanks to the completion and invoicing of a large

number of projects. Growth was particularly strong in Western

Europe (Germany) and Asia (China).

Full-year 2022–2023

sales

Full-year 2022–2023 sales amounted to

€1.1 billion, up 12.0%. Growth at

constant foreign exchange rates and scope was

12.3%. This performance was underpinned by price

increases during the year and strong volumes in the agricultural

equipment and industrial segments.

The scope effect represents €8.1

million in revenue over the 2022–2023 fiscal year,

following the acquisitions of G.F. in February 2022 and Devaux in

June 2023.

-

AGRICULTURAL SPRAYING UP

18.7%

Business was strong throughout the year, after a

2021–2022 fiscal year marked by production difficulties arising

from part and component shortages. Strong demand and production

delays in the previous year at all of our European and American

plants led to a change in the seasonal pattern of our business:

deliveries were strong in the first half for machines that had not

been delivered in the previous period. Price increases incorporated

into the order book over several months in response to inflation

also contributed to revenue growth.

- SUGAR

BEET HARVESTING UP 8.4%

Sales of new machines benefited from record

sugar prices since spring, the early year delivery of machines from

Eastern Europe and the release of the new Terra Dos 5 harvester.

However, the business continued to suffer from supply disruptions.

Finally, inventory clearance of used machines is progressing

steadily.

After last year’s upturn, the sharp decline in

the Western European market (UK, France, Italy) continued during

the fiscal year, without affecting market share. Price increases

made early in the fiscal year helped to mitigate inflation but

failed to offset lower sales volumes.The Nautical business was

broadly stable compared with the previous year, pending the launch

of new models scheduled for 2024. The sales, marketing and

manufacturing teams have now been fully ramped up.

Underlying markets (automotive, furniture and

industry), favorable to spare parts sales, showed encouraging

trends this year, mainly in Asia and Europe, and to a lesser extent

in North America. Furthermore, the construction of electric car

production sites in Asia boosted sales for both high viscosity

products from the Sames iNTEC factory, acquired in 2020, and

electrostatic spraying solutions.Throughout the year, the Technical

Hoses activity was affected by slower B2B demand (construction,

agribusiness), as well as a decline in its Garden business.

Yves Belegaud, Chief Executive Officer of

the EXEL Industries Group:

“For the first time, the EXEL Industries Group

has exceeded the 1-billion-euro revenue mark. Once again, this

year, the Group’s brands were able to compensate for higher

production costs in an inflationary environment, thanks to a

disciplined approach to adjusting their selling prices, regardless

of the end market, and a good industrial performance. Increased

sales volumes in the Agricultural equipment and Industrial spraying

activities made a significant contribution to growth in billings

over the fiscal year.”

Upcoming events

- December

21, 2023, before market opening: 2022–2023 full-year

results & SFAF presentation

- January

25, 2024, before market opening: Q1

2023–2024 sales

- February

6, 2024: Annual General Meeting of Shareholders

About EXEL Industries

EXEL Industries is a French family-owned group

that designs, manufactures, and markets capital equipment and

provides associated services that enable its customers to improve

efficiency and productivity or enhance their well-being while

achieving their CSR objectives.Driven by an innovation strategy for

over 70 years, EXEL Industries has based its development on

innovative ideas designed to offer customers unique, efficient,

competitive, and user-friendly products.Since its inception, the

Group has recorded significant growth in each of its markets

through both organic growth and corporate acquisitions, underpinned

by a stable shareholder base guided by a long-term development

strategy. EXEL Industries employs approximately 3,879 permanent

employees spread across 27 countries and five continents. The Group

posted FY 2022–2023 sales of €1.1 billion.Euronext Paris, SRD Long

only – compartment B (Mid Cap) EnterNext© PEA-PME 150 index

(symbol: EXE/ISIN FR0004527638)

Press release available onsite

www.exel-industries.com

|

Yves BELEGAUDChief Executive Officer |

Thomas GERMAINGroup Chief Financial Officer / Investor

relations |

|

direction.communication@exel-industries.com |

- EXEL Industries_Press release_2023-Q4_EN

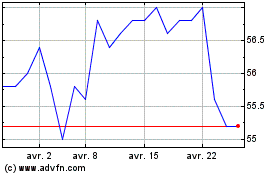

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Exel Industries (EU:EXE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024