Paris, 20 December

2018

No. 19-18

Maurel & Prom

announces the completion of the acquisition of Shell's stake in the

Urdaneta West field in Venezuela

-

New milestone in

Maurel & Prom's growth strategy in Latin America

-

Urdaneta West field is a

producing asset with large reserves and significant upside

potential

-

An appropriate organisational

and contractual framework has been set up to ensure an efficient

redevelopment of the asset and secure payments

Etablissements

Maurel & Prom (Euronext Paris: MAU, ISIN FR0000051070, "Maurel

& Prom") announced in the press release published on 12

October 2018 the signature of a Share Sale and Purchase Agreement

(the "SSPA") for the acquisition of Shell Exploration and

Production Investments B.V.'s ("Shell") 40% interest as

"Shareholder B" in Petroregional del Lago Mixed Company (the "Mixed

Company"), which operates the Urdaneta West field in Lake

Maracaibo, Venezuela (the "Field").

Further to this publication,

Maurel & Prom is delighted to announce that all condition

precedents have been satisfied and that the acquisition has been

completed.

The total consideration for the

acquisition of Shell's shares in the Mixed Company is €70 million,

funded from Maurel & Prom's existing cash resources and

composed as follows:

-

€47 million which have been paid at

closing of the transaction, and

-

€23 million payable in December 2019,

on the anniversary date of the transaction closing.

Maurel & Prom Venezuela,

subsidiary of Maurel & Prom, has replaced Shell as Shareholder

B in the Mixed Company, with a 40% interest. Petróleos de Venezuela

S.A. ("PDVSA"), wholly owned subsidiaries Corporación Venezolana

del Petróleo ("CVP") and PDVSA Social ("PDVSAS") collectively

referred to as "Shareholder A", jointly own the remaining 60% stake

of the Mixed Company.

New milestone in

Maurel & Prom's growth strategy in Latin America

Michel Hochard, Chief Executive

Officer of Maurel & Prom, declared: "This

transaction fits Maurel & Prom's growth strategy, focusing on

opportunities with significant potential in regions and countries

where we have operating experience. It provides us access to an

established producing asset in a world class petroleum system, with

a potential for significant production improvements. Investments in

oil and gas projects require a long term approach, and we expect

that jointly with PDVSA and its subsidiaries we will help boost the

redevelopment of the Field in the years to come. We have operated

in Venezuela in the past and our experience of the region make us

confident in the ability to transform this opportunity into a

successful project."

Producing asset

with large reserves and significant upside potential

The production of the Field in

2018 is estimated to be around 15,500 barrels of oil per day on a

100% basis (approximately 6,200 barrels of oil per day net to

Shareholder B's 40% interest), and there is potential for a swift

ramp-up in production. In particular, it is expected that a number

of targeted well interventions in the first months of operations

could have a significant impact on production.

Maurel & Prom will also

maintain the efforts which have been deployed over the years to

achieve high standards of health, safety, and environmental

practices on the Field.

As announced in the press release

published on 12 October 2018, Maurel & Prom has agreed to a

redevelopment plan to increase the production of the Field. The

redevelopment plan (amounting to up to c.€350 million for the

period 2018-2023) will be partly funded by operating cash flow from

the asset, and partly with funds advanced by Maurel & Prom

Venezuela (the "Project Funding").

In addition to this, the Field

offers significant growth optionality through the development of

additional resources, and the possible extension of the licence

duration beyond its current term in 2026.

An appropriate

organisational and contractual framework set up to ensure an

efficient redevelopment of the asset and secure payments

As part of the transaction, a

number of contracts have been pre-approved by the Mixed Company in

order to ensure the restart of the work programme operations and

guarantee a smooth circulation of cash flows.

On the operational side, Maurel

& Prom Venezuela will provide the Mixed Company with technical

assistance through a dedicated structure controlled by Maurel &

Prom Venezuela, the "Technical Assistance Company" ("TAC"),

registered in Venezuela and established in Maracaibo. In

particular, the Technical Assistance Company is intended to closely

support the Mixed Company for the conception and implementation of

development plans. A significant amount of work has been performed

already in order to start a work programme immediately after

completion and see a swift impact on production.

Maurel & Prom will also

appoint a number of secondees for certain positions within the

Mixed Company, in an agreement similar to what Shell had in place

as Shareholder B.

On the financial side and in order

to secure the access to cash flows and guarantee the payments to

the various stakeholders, it has been agreed that the oil

production of the Field would be split in two parts:

-

A portion of the production will be

retained by PDVSA in order to satisfy Venezuelan taxes and

royalties as well as a portion of the dividends due to the

Shareholder A;

-

The balance of production will be made

available by PDVSA to be lifted by a buyer designated by the Mixed

Company from the Ulé terminal in Lake Maraicabo. The proceeds from

the sale will be denominated and paid in euros to a bank account

located outside Venezuela (the "Collection Account").

Funds transferred to the

Collection Account will be used for the payment of contractors for

operating and capital expenditures, as well as the payment of

dividends to Shareholder B. Reimbursements made to Maurel &

Prom Venezuela under the terms of the Project Funding will also

flow through the Collection Account.

This press release contains inside

information as per the definition of article 7 of Regulation

n°596/2014.

For more information, visit

www.maureletprom.fr

Contacts

MAUREL &

PROM

Press, shareholder and investor

relations

Tel: +33 (0)1 53 83 16 45

ir@maureletprom.fr

NewCap

Financial communications and

investor relations

Julie Coulot/Louis-Victor

Delouvrier

Tel: +33 (0)1 44 71 98 53

maureletprom@newcap.eu

Media

relations

Nicolas Merigeau

Tel: +33 (0)1 44 71 94 98

maureletprom@newcap.eu

This document may

contain forward-looking statements regarding the financial

position, results, business and industrial strategy of Maurel &

Prom. By nature, forward-looking statements contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

projections are based on assumptions we believe to be reasonable,

but which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for

trading on Euronext Paris

CAC All-Share - CAC Oil & Gas -

Next 150 - PEA-PME and SRD eligible

Isin FR0000051070 / Bloomberg MAU.FP /

Reuters MAUP

Maurel & Prom - acquisition

english

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Maurel & Prom via Globenewswire

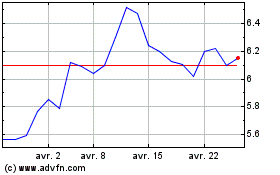

Maurel Et Prom (EU:MAU)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Maurel Et Prom (EU:MAU)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025