NEOVACS ANNOUNCES ITS 2019 HALF-YEAR RESULTS

PRESS RELEASE PRESS

RELEASE · PRESS

RELEASE · PRESS

RELEASE PRESS RELEASE

NEOVACS ANNOUNCES ITS 2019 HALF-YEAR

RESULTS

Paris and Boston, 2nd October, 2019—

9:30 p.m. CEST—NEOVACS (Euronext Paris: ALNEV, eligible for

PEA-PME), a leading provider of therapeutic vaccines for

the treatment of autoimmune diseases, announced today its 2019

half-year results for the period ending on 30th June 2019, approved

by the Board of Directors on 2nd October 2019.

- Results for the first half of 2019:

- Cash balance improved to €3.5m compared to 31/12/18

- Reduction of net loss by 38%

- Reduction in monthly spending by 40%

- Focusing the strategy:

- IFNα KINOID Programme in lupus

- Preclinical programme with IL-4/IL-13 KINOID in allergies

- Financing:

- The drawdown of the 3rd ORNANE tranche representing a nominal

amount of €1.25M and funding of €0.7M under the ORNANE

programme

- Funding of activities until the first quarter of 2020 and

additional financing capacity of €6.5 million under the conditions

of the ORNANE programme

- Reduction of the share capital reducing the nominal value to

€0.05 per share

Vincent

Serra, Chief Executive Officer of Neovacs, announced: "We will

focus exclusively on two key priorities: adoption of the Low Lupus

Disease Activity State (LLDAS) by health authorities and the value

creation of all KINOID technology results both in lupus and

preclinical allergy”.

Neovacs will hold an audio conference ( French

only) call 3rd October, 2019 at 5:45 pm CEST, dial in numbers will

be available via the following link:

https://channel.royalcast.com/webcast/neovacsfr/20191003_2/

1) KEY HIGHLIGHTS H1 2019

- IFNα KINOID CLINICAL PROGRAMME IN LUPUS

PRESENTATION OF THE FULL RESULTS OF THE

PHASE IIB STUDY OF IFNΑ KINOID FOR TREATING LUPUS: TO KEY OPINION

LEADERS SPECIALIZED IN AUTO IMMUNE DISEASES AND RHUMATOLOGY (6th

APRIL, 2019, SAN FRANCISCO, USA)

- A polyclonal immune response to interferon α obtained in 91% of

patients treated with IFNα KINOID associated with a statistically

significant decrease in interferon characteristics

- Statistically significant clinical efficacy on the LLDAS

criterion

- Good treatment tolerance

APPOINTMENT OF Dr VIRGINIA PASCUAL

AS MEDICAL AND SCIENTIFIC ADVISOR

Neovacs appointed Dr Virginia Pascual as Medical

and Scientific Advisor in June 2019, replacing Dr Thérèse

Croughs. Dr Virginia Pascual is the Director and Founder of Gale

and Ira Drukier, Institute of Children’s Health, Weill Cornell

Medicine, New York, U.S. She has received numerous awards, notably

from the National Institute of Allergy and Infectious Diseases, as

well as the Lupus Insight Prize for her research.

AGREEMENT WITH BIOSYN GmbH TO BROADEN

ITS SUPPLY IN KEYHOLE LIMPET HEMOCYANIN (KLH)

Neovacs has approved the KLH protein produced by biosyn GmbH to

meet its development needs for the IFNα Kinoїd vaccine. Following

the acquisition of Stellar Biotechnologies by Edessa Biotech

Neostell has been liquidated. This has neither a financial nor

operational impact on Neovacs.

B. PRECLINICAL PROGRAMME

WITH IL-4/IL-13 KINOID IN ALLERGIES:

THE FRENCH AGENCY FOR RESEARCH (ANR) HAS

PROVIDED THE FIRST TRANCHE OF THE SUBSIDY FOR IL-4/IL-13 KINOID IN

ALLERGIES PROGRAMME

The AllergyVACS project agreement signed between

Neovacs and ANR covers an overall grant of €702,000, to be shared

between Neovacs and the project's academic partners: INSERM, the

département Immunologie et Allergie de l’Institut Pasteur

(Immunology and Allergy Department of the Institut Pasteur), led by

Dr Pierre Bruhns and Dr Laurent Reber's Toulouse Purpan

physiopathology centre. This grant will be exclusively dedicated to

funding the AllergyVACS preclinical programme.

THE PRECLINICAL RESULTS OF THE

THERAPEUTIC VACCINE CANDIDATE IL-4/IL-13 KINOΪE WERE PRESENTED AT

THE FOLLOWING SCIENTIFIC CONFERENCES:

"Since the beginning of 2019, the largest

scientific congresses in the field have selected Neovacs to present

the advances of its IL-4 / IL-13 KINOID vaccine in allergies",

states Dr Laurent Reber, from the Antibodies in Therapy and

Pathology research unit of the Immunology department at the Pasteur

Institute, on these results.

- Keystone Allergy Congress —

24th–27th March 2019 — Tahoe, USA

- The "Antibodies and Complement 2019"

Conference — 20th– 25th May 2019 in Girona (Spain)

- The European Academy of Allergy and

Clinical Immunology conference, "EAACI 2019" — 1st–5th

June 2019 in Lisbon (Portugal)

- The European Respiratory Society (ERS)

international conference — 28th September to 2nd October

2019 in Madrid (Spain)

This work, carried out in collaboration with the teams at the

Institut Pasteur and Purpan (Dr Laurent Reber and Dr Pierre

Bruhns), made it possible to demonstrate in a model representing

allergic asthma that treatment with IL-4/IL-13 Kinoїd induces the

production of polyclonal antibodies neutralising the two targeted

cytokines IL-4 and IL-13, factors in the development of respiratory

allergies, thus avoiding the emergence of any symptoms.

- PRIORITIES FOR 2019/2020

IFNα KINOID CLINICAL PROGRAMME IN

LUPUS

Following the results obtained in the clinical

phase IIb in lupus, Neovacs continues to pursue the preparation of

the clinical development programme.

ADOPTION OF LLDAS AS THE PRIMARY

ENDPOINT FOR A PHASE III CLINICAL STUDY

Based on the statistically significant result of

IFNα KinoId obtained with LLDAS in Phase IIb and the approval of

the LLDAS approach by the scientific community1, Néovacs is

currently consulting the Agence Nationale de Sécurité du Médicament

et des produits de santé (ANSM) (French National Agency for the

Safety of Medicines and Health Products) on the adoption of LLDAS

as a primary criterion for Lupus Phase III. The conclusions are

expected in the first quarter of 2020. Consultations with the

European Medicines Agency (EMA) and the Food and Drug

Administration (FDA) will be scheduled in a second phase.

Following the preliminary ODD adoption,

conducted by CKD and Neovacs, the Korean health authorities (MFDS)

have not yet selected LLDAS as a viable clinical evaluation

criterion; the Orphan Drug Designation status request is therefore

suspended.

LUPUS PARTNER

The company reaffirms is willingness to find a

partner to continue its lupus clinical programme with IFNα Kinoїd

in lupus given the level of funding required.

Acceptance of LLDAS as the main evaluation

criteria for a phase III study is one of the key elements required

for a partnership agreement.

PRECLINICAL PROGRAMME WITH IL-4/IL-13

KINOID IN ALLERGIES:

Following preclinical results demonstrating the

efficacy of prophylaxis in asthma, therapeutic model studies are

currently being finalised, which are leading to advances in the

product’s development. These results will be submitted in Q4 2019

in a peer-reviewed scientific journal.

Neovacs has been contacted to extend this

development to animal health, particularly in the treatment of

atopic dermatitis in dogs. The Company is currently

considering this opportunity.

3) 2019 HALF-YEAR FINANCIAL RESULTS

Summary of financial information

|

€K |

30-June-19 |

30-June-18 |

| |

|

|

| Operating income |

264 |

19 |

| Operating

expenses |

4883 |

6640 |

|

Of which R&D expenditure |

3359 |

5161 |

| Operating result |

-4619 |

-6621 |

| Financial result |

-61 |

-582 |

| Current result before

taxes |

-4681 |

-7203 |

| Exceptional

result |

-115 |

-429 |

| Income tax

expense |

1044 |

1535 |

| Net income |

-3752 |

-6096 |

KEY POINTS OF THE 2019 HALF-YEAR RESULTS

- The Company reduced its net loss by 38% in the first half of

2019: -€3.8m compared to -€6.1m by 30th June 2018.

- Thanks to an operating grant received from the ANR and an

additional payment made by Centurion, the Company generated

operating income of €264k.

- In line with progress of the Company's various clinical and

preclinical projects, R&D expenses amounted to €3.4m, 60% of

which was dedicated to the IFNα KINOID programme and long-term

follow-up of patients included in the Phase IIb study.

The Company pursued a diligent management policy

in terms of administrative costs (€1.5m) and the number of

employees remained stable over the period (25).

FINANCIAL STRUCTURE

- The cash balance as at 30th June 2019 improved: €3.5m vs. €1.4m

on 31st December 2018

- The Company's spending also decreased to an average of €0.7m

per month during the first half of 2019 compared with €1.2m six

months earlier.

- On the basis of an assessment of its financial needs, the

available cash allows activities to be funded until the first

quarter of 2020. However, in addition to its available cash, the

Company maintains a funding capacity of approximately €6.5m

(divided into TRANCHEs), subject to certain contractual conditions,

through the "ORNANE" funding agreement, for a maximum amount of

€10m implemented on 25 March 2019 (see section II below), to extend

this visibility.

The 2019 half-yearly financial report will be

made available to the public and filed with the AMF 30th October

2019. It will be made available on the company's website

(www.neovacs.fr).

4) ORNANE FUNDING PROGRAMME SET UP ON 25 MARCH, 2019 AND

ADDITIONAL TRANCHE (ORNANE 2) SET UP ON 23 MAY, 2019

Neovacs issued a third TRANCHE of 125 ORNANEs

for a total nominal amount of €1,250,000 as part of the funding

programme with the European Select Growth Opportunities Fund for a

maximum nominal amount of €10 million (the "Investor")2.

In accordance with the terms of the funding

agreement, the issued ORNANEs were subscribed to at a price equal

to 100% of their nominal value, which was paid up to an amount of

€780,000 in cash, with the balance paid by offsetting against the

Investor's receivable from the Company following the completion of

the profit-sharing programme set up between the Investor and the

Company in connection with the issuance of the second ORNANE3

TRANCHE.

As a result of the completion of the

profit-sharing programme set up between the Additional Investor and

the Company in connection with the issuance of the additional

TRANCHE (ORNANE 2)4, Neovacs also issued 41 ORNANE 2 for a total

nominal amount of €410,000, paid by offsetting the receivable.

The characteristics of the ORNANEs are detailed

in the Company's press release dated 25th March 2019. ORNANE 2 have

the same characteristics as an ORNANE.

The Company maintains on its website a

monitoring table of the ORNANEs, ORNANE 2s and the number of

Neovacs shares in circulation.

The ORNANEs resulting from the drawing of the

third TRANCHE and the ORNANE 2s were issued on the basis of the 9th

resolution of the ordinary and extraordinary general meeting on

29th May 2019, which granted the Board of Directors, with the

option to subdelegate, a delegation of authority to decide on the

issuance of shares and/or debt securities and/or transferable

securities giving immediate or future access to the capital or

giving the right to a debt security, to a benefit of a category of

beneficiaries.

During its meetings of 27th September 2019 and

2nd October 2019, the Board of Directors made use of this

delegation and issued the ORNANEs and ORNANE 2s, in accordance with

the terms and conditions of the funding agreement.

It is specified that the aforementioned issues

will not lead to a prospectus being prepared subject to AMF

approval.

The tables below show the impact of the issuance

and conversion of the third ORNANE TRANCHE and the newly issued

ORNANE 2s:

|

|

Shareholder participation (in%) |

|

|

Undiluted Basis |

Diluted basis (after exercice of all dilutive instruments existing

to date) |

|

Before issuance |

1,00% |

0,88% |

|

After issuance of the new Neovacs shares resulting from the

conversion of the 3rd Tranche (including set-off against

receivable) |

0,90% |

0,81% |

|

After issuance of the new Neovacs shares resulting from the

conversion of the additional tranche ORNANE 2 (set-off against

receivable) |

0,88% |

0,79% |

|

|

Shareholders equity per share ratio (in €) |

|

|

|

|

|

|

Undiluted Basis |

Diluted basis (after exercice of all dilutive instruments existing

to date) |

| Before

issuance |

0,033 € |

0,096 € |

|

After issuance of the new Neovacs shares resulting from the

conversion of the 3rd Tranche (including set-off against

receivable) |

0,038 € |

0,078 € |

|

After issuance of the new Neovacs shares resulting from the

conversion of the additional tranche ORNANE 2 (set-off against

receivable) |

0,039 € |

0,079 € |

5 ) CAPITAL REDUCTION

In accordance with the seventeenth resolution

voted on and adopted by the shareholders at the general meeting

of 29 May, 2019, the Company Board of Directors decided to

proceed with a capital reduction as a result of losses, by reducing

the nominal value of the Company's shares, from fifteen euro cents

(€0.15) to five euro cents (€0.05).

The share capital was therefore reduced by

€14,411,703.80 from €21,617,555.70, divided into 144,117,038 shares

of €0.15 each to €7,205,851.90 divided into 144,117,038 shares of

€0.05 each, the number of shares remaining unchanged.

The amount of the capital reduction was

allocated to the "Negative Retained earnings" account to offset

previous losses recorded in this account, thus reducing it from

€108,318, 258 to €93.906.554. This operation has no impact on the

number of shares in circulation and shareholders have no auction to

take.

About NeovacsListed on Euronext

Growth since 2010, Neovacs has become a major player in therapeutic

vaccines targeting the treatment of autoimmune and inflammatory

diseases and certain cancers. Thanks to its innovative technology

inducing a polyclonal immune response, possibly protected until

2032 by four patent families, Neovacs is focusing its clinical

development efforts on IFNα KINOID for the treatment of lupus.

Neovacs also carries out preclinical work on other therapeutic

vaccines for the treatment of allergies. The aim of this "KINOID

approach" is to enable patients to better cope with a life-long

treatment that would be more effective. For more

information: www.neovacs.fr

Contacts

NEOVACS — Corporate Communication & Investor

RelationsCharlène

Massoncmasson@neovacs.com+33 (0)1531 09300

NewCap Media

Annie-Florence Loyer

afloyer@newcap.fr+33 (0)1447 10012 / +33 (0)6882 03559

Léa Jacquin

ljacquin@newcap.fr+33 (0)1447 12041

ORPHEON FINANCE

Financial Communication and Investor Relations

James Palmer +33 (0)7609 27774 j.palmer@orpheonfinance.com

1 Golder V, et al. The Lancet Rheumatology (2019).

2 Company press release dated 25th March 2019.

3 Company press release dated 23rd May 2019.

4 Company press release dated 23rd May 2019.

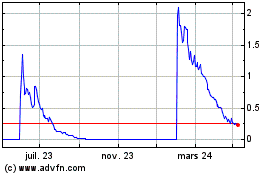

Neovacs (EU:ALNEV)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

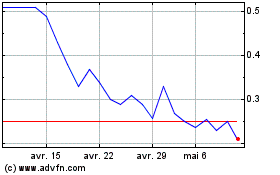

Neovacs (EU:ALNEV)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025