Press Release: Sanofi announces buy back of shares from L’Oréal

03 Février 2025 - 7:30AM

Sanofi announces buy back of shares from

L’Oréal

Paris, February 3, 2025. Sanofi

today announces the acquisition of 2.3% of its shares from

long-standing shareholder L’Oréal. This transaction is part of

Sanofi’s share buyback program announced on January 30, 2025. It is

fully aligned with Sanofi’s capital allocation policy and focus on

sustainable value creation for shareholders.

François Roger Chief Financial

Officer, Sanofi“L’Oréal has been a trusted shareholder and partner

for decades, playing a key role in supporting Sanofi’s growth and

transformation. We are pleased to retain L’Oréal as one of our

largest shareholders. This transaction highlights Sanofi's

dedication to sustainable value creation while upholding our

strategic priorities and preserving the strength of our key

partnerships.”

The acquisition is structured as an off-market

block trade and is not subject to any specific conditions. The

acquisition is pursuant to an agreement approved by Sanofi’s Board

of Directors as a related-party agreement, in compliance with

article L.225-38 of the French Commercial Code, entered into on

February 2, 2025. It is expected to be completed in the coming

days. The transaction will involve the acquisition of 29,556,650

shares at a price of €101.50 per share, reflecting a discount of

2.8% to the closing price on January 31, 2025. The total

consideration of the transaction amounts to €3 billion. Shares

acquired from L’Oréal will be cancelled at the latest on April 29,

2025. The acquisition of these shares is expected to be accretive

to Sanofi's earnings per share, further enhancing shareholder

value.

After cancellation of the shares and excluding

treasury shares, L’Oréal will own 7.2% of Sanofi, with 13.1% of

voting rights1.

In accordance with the recommendation from the

Autorité des Marchés Financiers, and as recommended by an ad-hoc

committee comprised only of independent board members, Sanofi’s

board of directors appointed Finexsi, represented by Olivier

Peronnet and Olivier Courau, as an independent expert to review the

transaction. In its expert opinion Finexsi confirmed that “Based on

our work and as of the date of this report, the price of the

repurchased shares appears fair for Sanofi and its shareholders.

This transaction will not affect Sanofi’s financial balances and

will be accretive for Sanofi and its shareholders. It is therefore

carried out in the interest of the Company and will be treated as a

related-party transaction.”

About Sanofi We are an innovative global

healthcare company, driven by one purpose: we chase the miracles of

science to improve people’s lives. Our team, across the world, is

dedicated to transforming the practice of medicine by working to

turn the impossible into the possible. We provide potentially

life-changing treatment options and life-saving vaccine protection

to millions of people globally, while putting sustainability and

social responsibility at the center of our ambitions. Sanofi is

listed on EURONEXT: SAN and NASDAQ: SNY

Media RelationsSandrine

Guendoul | + 33 6 25 09 14 25

| sandrine.guendoul@sanofi.comEvan Berland |

+ 1 215 432 0234 | evan.berland@sanofi.comLéo Le

Bourhis | + 33 6 75 06 43 81

| leo.lebourhis@sanofi.comNicolas

Obrist | + 33 6 77 21 27 55

| nicolas.obrist@sanofi.comVictor

Rouault | + 33 6 70 93 71 40

| victor.rouault@sanofi.com Timothy Gilbert |

+ 1 516 521 2929 | timothy.gilbert@sanofi.com

Investor RelationsThomas Kudsk

Larsen |+ 44 7545 513 693 | thomas.larsen@sanofi.com

Alizé Kaisserian | + 33 6 47 04 12 11 |

alize.kaisserian@sanofi.comFelix

Lauscher | + 1 908 612 7239 |

felix.lauscher@sanofi.com Keita

Browne | + 1 781 249 1766 |

keita.browne@sanofi.comNathalie Pham | +

33 7 85 93 30 17 | nathalie.pham@sanofi.comTarik

Elgoutni | + 1 617 710 3587 | tarik.elgoutni@sanofi.com

Thibaud Châtelet | + 33 6 80 80 89 90

| thibaud.chatelet@sanofi.com

Sanofi forward-looking

statementsThis press release contains forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995, as amended. Forward-looking statements are statements

that are not historical facts. These statements include projections

and estimates regarding the marketing and other potential of the

product, or regarding potential future revenues from the product.

Forward-looking statements are generally identified by the words

“expects”, “anticipates”, “believes”, “intends”, “estimates”,

“plans” and similar expressions. Although Sanofi’s management

believes that the expectations reflected in such forward-looking

statements are reasonable, investors are cautioned that

forward-looking information and statements are subject to various

risks and uncertainties, many of which are difficult to predict and

generally beyond the control of Sanofi, that could cause actual

results and developments to differ materially from those expressed

in, or implied or projected by, the forward-looking information and

statements. These risks and uncertainties include among other

things, unexpected regulatory actions or delays, or government

regulation generally, that could affect the availability or

commercial potential of the product, the fact that product may not

be commercially successful, the uncertainties inherent in research

and development, including future clinical data and analysis of

existing clinical data relating to the product, including post

marketing, unexpected safety, quality or manufacturing issues,

competition in general, risks associated with intellectual property

and any related future litigation and the ultimate outcome of such

litigation, and volatile economic and market conditions, and the

impact that pandemics or other global crises may have on us, our

customers, suppliers, vendors, and other business partners, and the

financial condition of any one of them, as well as on our employees

and on the global economy as a whole. The risks and uncertainties

also include the uncertainties discussed or identified in the

public filings with the SEC and the AMF made by Sanofi, including

those listed under “Risk Factors” and “Cautionary Statement

Regarding Forward-Looking Statements” in Sanofi’s annual report on

Form 20-F for the year ended December 31, 2023. Other than as

required by applicable law, Sanofi does not undertake any

obligation to update or revise any forward-looking information or

statements.

1 Number of actual voting rights (excluding

treasury shares) based on the total number of voting rights as of

December 31, 2024.

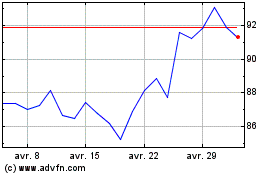

Sanofi (EU:SAN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Sanofi (EU:SAN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025