Sequa Petroleum N.V. Bonds Update

24 Juin 2019 - 2:00PM

Business Wire

Regulatory News:

Sequa Petroleum N.V. (BOURSE:MLSEQ)

Further to its press release of 15 April 2019 and 17 June 2019,

Sequa Petroleum N.V. (the “Company”) is taking steps to

finalise the restructuring of the Company’s USD 300,000,000 5.00

per cent convertible bonds due 2020 of which USD 204,400,000 in

principal amount remain outstanding (ISIN: XS1220076779, SEQ01 PRO

EC) issued by the Company in April 2015 (the “Bonds”). On 31

May 2019, the Company in consultation with bondholders has launched

the consent solicitation regarding the Bonds (as amended in

consultation with bondholders on 14 June 2019). On 24 June 2019 the

Company in consultation with bondholders made further amendments

including amendments to the settlement process (the

“Amendment”). Before the date of the Amendment, the

bondholders had an option to elect to receive either (1) ordinary

shares in dematerialized form (deposit shares) or (2) definitive,

registered shares. The bondholders would have automatically

received dematerialised shares if they had not voted by submitting

an electronic instruction. Under the Amendment, all bondholders

will receive definitive, registered shares, and they will not have

the option summarised above. All votes received before the date of

the Amendment will be cancelled and the holders will need to vote

again in order to submit a valid voting instruction.

If the extraordinary resolution is passed, bondholders who do

not submit an electronic instruction or who submit an invalid

electronic instruction, i.e. an electronic instruction without the

address, the full name of the person who will receive the ordinary

shares and the contact details of where the definitive, registered

shares are to be delivered, (“Trust Creditors”) will not

receive ordinary shares in definitive, registered form, but their

share entitlements will be held on trust by GLAS Trustees Limited

(the “Holding Period Trustee”) pursuant to the holding

period trust deed dated 24 June 2019 entered into between the

Holding Period Trustee, the Company and the consent solicitation

agent (the “Holding Period Trust Deed”). The duration of the

time period during which the Holding Period Trustee will hold the

share entitlements on trust is two years from the date thereof

(“Holding Period”) ending on 23 June 2021. As from the date

of the Holding Period Trust Deed, being 24 June 2019, and until the

end of the Holding Period, the Trust Creditors will have a right to

contact the consent solicitation agent to request a copy of the

Holding Period Trust Deed. During the Holding Period, the Trust

Creditors will have a right to submit an instruction to request

that their share entitlement be distributed directly to them (or,

if applicable, its nominated recipients).

The consent expiration date is the date being the earlier of (i)

5:00pm, London time, on 5 July 2019, or (ii) the date on which the

consent solicitation agent receives the valid electronic

instructions from the holders of the Bonds representing in

aggregate not less than three-fourths in principal amount of the

Bonds for the time being outstanding unless the consent is extended

or earlier terminated by the Company in its sole discretion.

Cautionary notice

This press release may contain information that qualifies as

inside information within the meaning of Article 7(1) of the EU

Market Abuse Regulation. This communication includes

forward-looking statements. All statements other than statements of

historical facts may be forward-looking statements. Words such as

possibly, expected and value accretive or other similar words or

expressions are typically used to identify forward-looking

statements. Forward-looking statements are subject to risks,

uncertainties and other factors that are difficult to predict and

that may cause actual results of the Company to differ materially

from future results expressed or implied by such forward-looking

statements. Such factors include, but are not limited to, risks

relating to the Company’s ability to acquire new opportunities;

generate positive cash flows; general economic conditions;

turbulences in the global credit markets and the economy;

geopolitical events; the possibility to restructure the Bonds and

other factors discussed in the Company’s public filings and other

disclosures. Forward-looking statements reflect the current views

of the Company’s management and assumptions based on information

currently available to the Company’s management. Forward-looking

statements speak only as of the date they are made, and the Company

does not assume any obligation to update such statements, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190624005347/en/

Jacob Broekhuijsen, Chief Executive Officer +44 (0)20 3728 4450

or info@sequa-petroleum.com

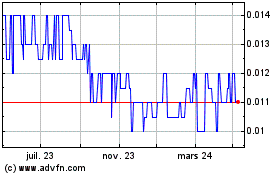

Sequa Petroleum NV (EU:MLSEQ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

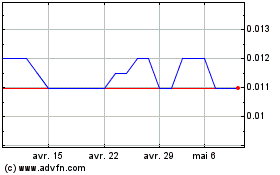

Sequa Petroleum NV (EU:MLSEQ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024