European Economic News Preview: BoE To Cut Interest Rate

07 Novembre 2024 - 3:00AM

RTTF2

The Bank of England is set to lower its benchmark rate by a

quarter-point on Thursday but uncertainty over the future policy

easing escalated after Donald Trump won the US presidential

election.

At the end of two-day policy meeting, the Monetary Policy

Committee of the BoE is expected to lower the bank rate to 4.75

percent from 5.00 percent.

Retail sales from the euro area and industrial production and

foreign trade from Germany are the other major economic reports due

on Thursday.

At 2.00 am ET, Destatis is scheduled to issue Germany's

industrial output and external trade figures. Production is

expected to fall 1.1 percent on month in September after a 2.9

percent gain in August. Germany's exports are forecast to fall 1.4

percent and imports to drop 0.4 percent in September.

In the meantime, UK Halifax house price data is due. House

prices are forecast to grow 0.2 percent on month in October after a

0.3 percent rise seen in September. At 3.00 am ET, industrial

output data is due from Spain. Industrial production is expected to

grow 0.2 percent on year in September, reversing a 0.1 percent fall

in August.

At 3.30 am ET, S&P Global publishes Germany's construction

PMI data.

At 5.00 am ET, Eurostat releases euro area retail sales figures

for September. Economists expect sales to grow 0.4 percent on month

after a 0.2 percent rise in August.

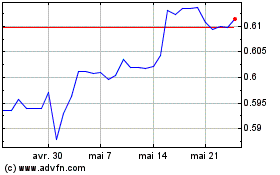

NZD vs US Dollar (FX:NZDUSD)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

NZD vs US Dollar (FX:NZDUSD)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025