UK Inflation Strongest Since Mid-2013

13 Juin 2017 - 10:10AM

RTTF2

UK inflation accelerated unexpectedly to the highest level in

four years as the weakness in the sterling since the 'Brexit' vote

made imports expensive.

Inflation rose to 2.9 percent in May from 2.7 percent in April,

data from the Office for National Statistics showed Tuesday.

This was the highest since June 2013 and notably above the

central bank's target of 2 percent. Economists had forecast the

annual rate to remain unchanged at 2.7 percent.

At the May monetary policy meeting, the Bank of England raised

its inflation outlook for this year to 2.7 percent from 2.4

percent. The projected overshoot entirely reflects the effects of

the falls in sterling since late November 2015 on import

prices.

However, Paul Hollingsworth, an economist at Capital Economics,

said today that inflation is now not far away from its peak.

While the squeeze on households' real incomes is likely to

intensify over the coming months and weigh on spending growth this

year, it should at least be less prolonged than after sterling's

last big devaluation in 2008/09, the economist added.

The Bank of England is widely expected to keep its key rate

unchanged at 0.25 percent until the outlook becomes clear after the

inconclusive general election. The election outcome has raised

uncertainties about Brexit negotiations.

Further, ONS data showed that core inflation that excludes

energy, food, alcoholic beverages and tobacco increased to 2.6

percent from 2.4 percent in April.

On a monthly basis, consumer prices gained 0.3 percent in May,

slightly faster than the 0.2 percent increase economists had

forecast.

The consumer prices index including owner occupiers' housing

costs advanced 2.7 percent annually in May versus 2.6 percent in

April.

Another report from the ONS showed that output price inflation

held steady at 3.6 percent in May. The rate came in line with

expectations.

The latest figures suggest the recent period of rapidly

increasing factory gate prices may have come to an end, the ONS

said.

Following the recent strength of sterling, input price inflation

eased to 11.6 percent, the weakest since September, from 15.6

percent, the ONS said. Economists had forecast inflation to slow

moderately to 13.5 percent.

Month-on-month, output prices edged up 0.1 percent compared to a

0.4 percent increase in April. Meanwhile, input prices fell 1.3

percent, following a 0.3 percent drop.

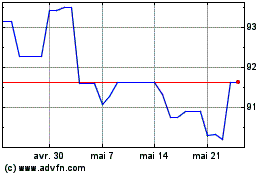

US Dollar vs RUB (FX:USDRUB)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

US Dollar vs RUB (FX:USDRUB)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025