TIDMFEVR

RNS Number : 8944N

Fevertree Drinks PLC

26 January 2023

This announcement contains inside information

Fever-Tree Drinks plc

FY22 pre-close trading update

Fever-Tree, the world's leading supplier of premium carbonated

mixers, announces a trading update for the year ending 31(st)

December 2022, ahead of reporting its Preliminary Results on 22(nd)

March 2023.

Financial highlights

Revenue, GBPm FY22 FY21 Change

------------------------ ------ ------ -------

UK 116.2 118.3 (2%)

US 95.6 77.9 23%

Europe (Fever-Tree

brand revenue) 89.2 78.8 13%

Europe total revenue* 101.0 88.2 15%

ROW 31.5 26.7 18%

Total 344.3 311.1 11%

------------------------ ------ ------ -------

*includes GDP portfolio brand revenue

Fever-Tree continued to deliver strong top line growth,

increasing Group revenue by c.11% year-on-year to c.GBP344 million.

We continue to invest behind and successfully pursue a growing

global opportunity, as demonstrated by the c.18% growth achieved

across the US, Europe and Rest of the World regions. Alongside

this, the steps taken by the business to offset significant global

inflationary cost pressures have meant the Group expects to deliver

Adjusted EBITDA of c.GBP39 million, in-line with expectations.

UK

-- Overall revenue declined by 2%, but the brand continues to

gain distribution and market share, remaining the clear leader of

the UK mixer category [1] .

-- On-Trade revenue increased by c.28% year-on-year, however,

the widespread industrial action undertaken across the UK rail

network in the run up to Christmas had a notable impact on sales in

what is traditionally a very strong trading period.

-- In the Off-Trade, whilst the mixer category was annualising

tough comparators after a very strong period of sales during

lockdowns, the brand has increased volume share from pre-COVID

levels [2] . In addition to our core mixers, we have made

significant progress expanding into the adult soft drink category,

with incremental distribution, very positive initial performance

and an ambitious plan for 2023.

US

-- Fever-Tree delivered very good growth in 2022, increasing by

23% (13% at constant currency). This positive performance was

despite the impact of industry-wide port congestion and logistics

disruption, without which the underlying demand for the brand would

have translated to an even stronger sales performance during the

year, giving us confidence going into 2023.

-- We are making good operational progress, continuing to ramp

up local US production, as well as onboarding local glass

supply.

-- We also acquired Powell & Mahoney, a US non-carbonated

cocktail mixer brand. This acquisition provides Fever-Tree with a

platform to accelerate our entry into this exciting adjacent

category in 2023.

Europe

-- Revenue grew by 15% (16% at constant currency), driven by a

strong performance in Southern Europe, and slightly offset by

softening consumer sentiment in Germany.

-- Our On-Trade sales across the region accelerated from Q2

onwards following the removal of restrictions and a strong rebound

of tourism.

-- Fever-Tree continued to perform well in the Off-Trade,

remaining the largest premium mixer brand in Europe and the biggest

driver of growth and premiumisation in the category.

Rest of the World

-- Our momentum continued with growth of 18% (14% at constant

currency), with particularly strong sales growth in Australia,

where the brand is driving premium mixer growth across a broad

range of categories.

-- During the year, we made two significant step changes in our

route-to-market across the globe by transitioning to a new, more

powerful distributor in Canada and signing a partnership agreement

with Asahi Breweries in Japan, reflecting the significant long-term

growth opportunities in two key international markets.

FY23 outlook and guidance

-- Macro-economic volatility and uncertainty remains elevated in

2023. However, as an increasingly diversified global business, we

remain confident of delivering strong growth, with momentum

continuing across our growth regions, especially the US, and a

return to growth in our most established market in the UK.

-- As a result, we are introducing a revenue guidance range of

GBP390m to GBP405m in 2023. This is in line with expectations and

represents growth of +13% to +18% across the Group.

-- Inflationary cost pressures remain, with further double-digit

percentage increases across key input costs including filling fees,

ingredients and packaging.

-- We continue to take steps to off-set these significant

incremental costs. A combination of pricing actions across regions,

including the US, cost-saving initiatives and increased local US

production would have driven margin improvement this year.

-- However, the impact of elevated European energy costs into

glass bottle pricing will be material in 2023. Whilst energy

pricing has recently reduced, it remains volatile and at least

three times higher than 2021 levels, impacting both the cost of raw

materials and the direct energy cost in glass manufacture.

-- As a glass-led business, with c.80% of our sales mix in glass

bottles, we are particularly exposed to this significant headwind.

We now estimate that the direct energy component of glass

manufacture alone represents a c.GBP20m additional cost to the

business in 2023 compared to our prevailing glass pricing in Q1

2022.

-- This premium format remains an integral part of our

long-standing market-leading proposition, and as such we are

working closely with our glass suppliers to mitigate this cost

wherever possible as we progress through the year, whilst any

further recalibration of energy pricing towards more normalised

levels would allow for significant margin improvement in 2024.

-- As a result of the above impacts, most notably the continued

impact of elevated European energy pricing on glass, we are working

to deliver EBITDA in-line with 2022 and introduce an EBITDA

guidance range of GBP36m to GBP42m for 2023.

Tim Warrillow, CEO of Fever-Tree commented:

"2022 has seen the Fever-Tree brand continue to gain traction

and prominence across the globe resulting in double digit revenue

growth and profits in line with expectations. Furthermore, the

brand continues to increase its clear global market leadership

position and remains the primary driver of this increasingly

prominent international drinks category.

Looking ahead to 2023, we remain very confident in delivering

strong top line growth, most notably in the US. Whilst the

initiatives we are implementing would have driven margin

improvement during the year, the energy related cost increases,

which are particularly acute across the glass industry, mean we

expect to deliver absolute EBITDA in-line with 2022. These

temporary additional costs will unwind significantly as the energy

price recalibrates and we are resolute in continuing to invest for

the longer-term, by introducing new products, expanding into

adjacent categories such as adult soft drinks and delivering

exciting new marketing campaigns across our regions."

For more information please contact:

Investor queries

Ann Hyams, Director of Investor Relations I

ann.hyams@fever-tree.com I +44 (0)20 4516 8106

Media queries

Oliver Winters, Director of Communications I

oliver.winters@fever-tree.com I +44 (0)770 332 9024

Nominated Advisor and Broker - Investec Bank plc

David Flin I Alex Wright I +44 (0)20 7597 5970

Corporate Broker - Morgan Stanley & Co. International

plc

Andrew Foster I Jessica Pauley I +44 (0)20 7425 8000

Financial PR advisers - FGS Global

Faeth Birch +44 (0)7768 943 171; Anjali Unnikrishnan +44 (0)7826

534 233

This announcement contains inside information. The person

responsible for arranging the release of this announcement on

behalf of the Company is Andy Branchflower

[1] CGA & IRI

[2] Nielsen 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBAMLTMTATBIJ

(END) Dow Jones Newswires

January 26, 2023 02:00 ET (07:00 GMT)

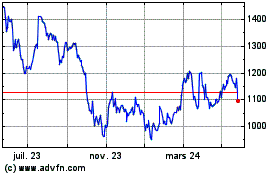

Fevertree Drinks (LSE:FEVR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

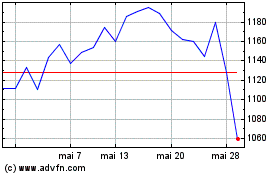

Fevertree Drinks (LSE:FEVR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025