TIDMMIND

RNS Number : 3673V

Mind Gym PLC

01 December 2023

1 December 2023

Mind Gym PLC

("Mind Gym", the "Group" or the "Company")

Half year results for the six months ended 30 September 2023

Strong pipeline following a challenging first half

MindGym (AIM: MIND), the global provider of human capital and

business improvement solutions, announces its half year results for

the six months ended 30 September 2023.

6 months 6 months to 12 months

to to 31 Mar

2023

30 Sept 30 Sept 2022 (FY23)

2023

(H1 FY24) (H1 FY23)

Revenue GBP20.9m GBP26.8m GBP55.0m

------------- ---------------- ------------

US Revenue GBP11.1m GBP16.7m GBP31.3m

------------- ---------------- ------------

EMEA Revenue GBP9.8m GBP10.1m GBP23.7m

------------- ---------------- ------------

Gross profit margin 85.4% 87.5% 88.4%

------------- ---------------- ------------

Digitally enabled revenue

mix 69% 71% 68%

------------- ---------------- ------------

Adjusted EBITDA(1) (GBP4.1m) GBP1.9m GBP5.3m

------------- ---------------- ------------

Statutory profit/(loss) (GBP13.2m) GBP0.6m GBP3m

before tax

------------- ---------------- ------------

Diluted EPS (11.34p) 0.84p 2.84p

------------- ---------------- ------------

Cash at bank GBP2.1m GBP4.5m GBP7.6m

------------- ---------------- ------------

Capital expenditure GBP3.0m GBP2.2m GBP5.1m

------------- ---------------- ------------

(1) Adjusted EBITDA represents the underlying level of profit/

(loss), excluding exceptional items. In H1 FY24, exceptional items

totalled GBP7.7m (H1 FY23: GBPnil), comprised of: digital asset

impairment GBP6.6m, US office lease impairment GBP0.5m and

restructuring costs GBP0.6m.

Financial Highlights

-- H1 FY24 revenue of GBP20.9m (H1 FY23: GBP26.8m) impacted by

economic headwinds, resulting in delays and cancellations in Q2,

which have affected the whole industry, particularly in the US

o In the US, revenue declined by 33% to GBP11.1m (H1 FY23:

GBP16.7m), impacted by general market weakness, notably in the

technology sector

o In EMEA, performance was resilient with revenues of GBP9.8m

(H1 FY23: GBP10.1m). GBP2.0m of expected revenue moved into H2

FY24, resulting from a delay to the start of our large energy

framework, which launched successfully in September

-- Digitally enabled revenue, as a proportion of total revenue

in the period, was broadly flat at 69% (H1 FY23: 71%) reflecting a

small increase in the proportion of face-to-face delivery

-- Completed an annualised GBP8.0m cost reduction exercise, of which GBP3.0m will impact FY24:

o Opex reduced by an annualised GBP4.5m, generating savings from

H2 FY24 onwards and leading to a GBP1.1m exceptional restructuring

charge

o Capex reduced by an annualised GBP3.5m to an anticipated

GBP2.5m in FY25. This focuses investment on digital assets which

are already revenue generating, with other activities paused. This

resulted in a one-off, non-cash, impairment charge of GBP6.6m

-- The Group has adequate liquidity, with cash at 30 September

2023 of GBP2.1m (31 March 2023: GBP7.6m) and immediate access to

GBP2.0m of its undrawn GBP10.0m debt facility, which it does not

expect to utilise

Operational Highlights and Board Changes:

-- Following consultation with major shareholders, the Board has

separately announced changes which reflect the planned evolution to

the next stage of MindGym's growth and transition away from a

founder dependent business:

o Christoffer Ellehuus to join MindGym as CEO designate on 8(th)

January 2024 with the intention to join the Board and transition to

CEO by the time of the FY24 AGM

o Octavius Black will move to Executive Chairman as part of a

broader Board restructure to retain strong corporate governance and

support delivery of MindGym's strategy

-- MindGym continues to bring innovative products to market:

o Awarded the prestigious Brandon Hall award for work with

Burberry using Performa

o The recently acquired organisational diagnostics platform is

now in trial with two clients

o Three awards won with the Association of Business

Psychologists for our three year, multi million GBP work with Citi,

utilising our new 'habit-lab' approach to culture change

o Launched the Point of View: 'Wellworking: how we can all be

better at work', with a foreword by Amy Edmondson, Professor of

Leadership at Harvard Business School. This has already been

instrumental in securing a new contract with an estimated value of

c. GBP0.8m

Current Trading & Outlook

-- The Company is trading in line with the Board's recently

revised expectations for the full year

-- H2 FY24 will see a significant benefit from the Energy

framework, which was successfully launched in September 2023, and

continues through FY25

-- Six-month forward bookings at the start of H2 FY24 are higher

than the same position twelve months ago.

-- There has been substantial growth in the pipeline in both

regions, including a number of multi-year and multi-million pound

frameworks

-- The level of the pipeline benefit on H2 FY24 is dependent on

the speed of decision making and the rate at which clients

mobilise. We note that:

o Since the start of October, there have been several notable

project wins in EMEA

o Conversion of opportunities in the US remains slow

-- Combined with the impact of the revised cost base, this will

enable a return to strong profitability in H2 FY24

-- The Group continues to target a medium-term EBITDA margin of 15% to 20%.

Analyst and Investor Webcast

The Company will host a webcast and conference call for analysts

and investors at 9:00am BST today. Please contact

mindgym@mhpgroup.com for further information.

Octavius Black, Chief Executive Officer of Mind Gym, said:

"We have had a challenging first half of FY24, with tough market

pressures brought on by significant client restructures, especially

in the US technology sector. These have led to programme delays and

cancellations. We have responded by rapidly realigning the cost

base and focusing capital expenditure on digital assets which are

already revenue generating.

"Moreover, recent wins and strong pipeline growth with several

significant GBP1m+ opportunities in healthcare, industrial and

financial services, means we are confident of a significant

improvement in financial performance in the second half of

FY24.

"We have the right strategy, based on providing integrated

solutions that deliver impact at scale. The opportunity for MindGym

in this large and disaggregated market, remains strong."

Enquiries:

Mind Gym plc

Octavius Black, Chief Executive Officer

Dominic Neary, Chief Financial Officer +44 (0)20 7376 0626

Liberum (Nominated Adviser and Sole

Broker)

Nick How

Edward Mansfield +44 (0)20 3100 2000

-----------------------

MHP (for media enquiries) +44 (0)20 3128 8100

Reg Hoare mindgym@mhpgroup.com

Katie Hunt

Veronica Farah

-----------------------

About MindGym

MindGym is a company that delivers business improvement

solutions using scalable, proprietary products which are based on

behavioural science. The Group operates in three global markets:

business transformation, human capital management and learning

& development. Mind Gym is quoted on the London Stock Exchange

Alternative Investment Market (ticker: MIND) and headquartered in

London. The business has offices in London, New York and Singapore.

Further information is available at www.themindgym.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation ("MAR") EU no.596/2014. Upon the

publication of this announcement via Regulatory Information Service

("RIS"), this inside information is now considered to be in the

public domain.

Operational Review

While trading conditions during H1 FY24 have been challenging,

the Company is well-positioned for future success. Businesses

continue to operate in a tight labour market with a shortage of

skills driving a commercial necessity to invest to attract, retain

and develop talent. There is no scale player in the highly

fragmented $370bn Learning & Development market and MindGym

offers a standout proposition in culture, leadership and

productivity with 23 years of proprietary IP, clients who include

most of FTSE-100 and S&P-100, and an omnichannel solution that

integrates live, virtual and digital, fuelled by data.

Board changes:

As announced separately today, Christoffer Ellehuus will join

MindGym as CEO designate on 8(th) January 2024, transitioning to

CEO by the time of the AGM in July 2024 when Octavius Black will

transition to Executive Chair and Ruby McGregor-Smith's three year

term as Chair ends. In conjunction, a broader Board restructure

will be undertaken to retain strong corporate governance, providing

the right balance of skills, experience and independence and

supporting delivery of MindGym's strategy.

Improvement in pipeline and conversion:

Despite the challenging conditions experienced during H1 FY24

there has been strong pipeline growth in both regions since the end

of the period, including an increasing number of opportunities of

GBP1m-GBP10m in value. Whilst conversion of opportunities in the US

remains slow, there have been several notable project wins recently

in EMEA, which will primarily benefit FY25, with FY24 impact

dependent upon final agreed project phasing.

Developing market leading products

MindGym continues to bring innovative products to market, which

are meeting with client approval:

-- In H1 FY24 we have seen a 31% uplift in the number of users

utilising our Performa product. We were recently awarded the

prestigious Brandon Hall award for our work with Burberry who used

Performa as an integrated part of their MindGym leadership

programme;

-- The Company's proprietary organisational diagnostics

delivered on our new platform is now in trial with two clients and

receiving positive feedback; and

-- We have had success with our new 'habit lab' approach to

culture change, working with Citi on a multi-million, 3-year

programme, which recently won three awards at the prestigious

Association of Business Psychologist's awards. Several other

clients are in conversations with the Company about adopting 'habit

labs' for their culture change initiatives.

New wellness market opportunity

The global market for corporate wellbeing is estimated at

GBP50bn and forecast to grow to GBP70bn [1] by 2030.

MindGym has launched a new point of view in a research paper

'Wellworking: how we can all be better at work' with a foreword by

Amy Edmondson, Professor of Leadership at Harvard Business School.

This has already been instrumental in securing one new contract

with an estimated value of almost GBP1m and the Board expects this

to be a driver of future growth.

Outlook

The Company is trading in line with the Board's recently revised

expectations for the full year. We started H2 FY24 with higher

forward bookings than at the same point in the prior year. We have

also seen substantial growth in the pipeline in both regions,

including a number of multi-year, multi-million pound frameworks,

which will impact both FY25 and H2 FY24. The level of pipeline

impact on H2 FY24 will depend on the speed of decision making and

the rate at which clients mobilise once decisions are taken.

Whilst US conversion of opportunities remains subdued, several

recent wins in EMEA, together with the ramp up of activity under

our major energy framework provide increased confidence that we

will see a step change in revenues vs. H1 FY24. This, coupled with

the impact of the revised cost based will enable a return to strong

profitability in H2 FY24, and into FY25. The Group continues to

target a medium term EBITDA margin of 15% to 20%.

Financial Review:

Revenue and Gross Margin

Revenue in H1 FY24 was GBP20.9m, a reduction of 22% on the

equivalent period in the prior year (H1 FY23: GBP26.8m), impacted

by economic headwinds. In Q2, these trading conditions resulted in

several clients and prospective clients undergoing major

restructuring programmes and showing caution in committing to new

spend. This both pushed out the timeframe for the delivery of

existing programmes and resulted in delays to the procurement of

new projects.

The effects of this were more pronounced in the US, where

MindGym's client base, especially in the technology sector, were

particularly affected. As a result, revenue in the Americas

declined by 33% to GBP11.1m (H1 FY23: GBP16.7m).

In EMEA, performance was more resilient, where revenue declined

3% vs. prior year to GBP9.8m (H1 FY23: GBP10.1m). GBP2m of expected

revenue slipped into H2 FY24, resulting from a delay to the start

of our large energy framework, which launched successfully in

September.

Digitally enabled revenue in the period was broadly flat at as a

proportion of total revenue at 69% (H1 FY23: 71%) reflecting a

small increase in the proportion of face-to-face delivery.

Revenue from the Group's top 25 clients increased slightly to

48% (H1 FY23: 40%) in line with the trend towards a greater

proportion of opportunities of scale.

Gross margin declined slightly to 85.4% (H1 FY23: 87.5%),

reflecting the change in revenue mix from Design and Advisory to

Delivery in the period.

Administrative Expenses

In response to the reduction in revenue, management reacted

during the period to realign the cost base and preserve cash. Since

the start of FY24, annualised cost reductions of GBP8.0m have been

implemented (GBP4.5m in operating expenditure and GBP3.5m in

capital expenditure). The benefit of these savings will have an

impact of c.GBP3m on H2 FY24, with the full year benefit in

FY25.

These actions resulted in an exceptional charge during the

period of GBP7.7m comprising:

-- Digital asset impairment GBP6.6m: This is outlined in the

Digital Asset Impairment section below;

-- Impairment of lease on US office GBP0.5m: With a greater

proportion of the team working remotely, the decision was taken

during the period to vacate a proportion of the office. Directors

are exploring opportunities to sub-let this space, however, with no

certainty over any recovery from such sub-letting and with a

proportion of the office not now being utilised, an impairment

charge in respect of that proportion of the lease has been applied

in the period. The pre-COVID GBP0.8m annual cost of this office

will end in February 2025, and be replaced by a significantly

cheaper alternative; and

-- Restructuring costs GBP0.6m: Reflecting headcount reductions.

Net of these exceptional items and depreciation and amortisation

of GBP1.4m (H1 FY23: GBP1.3m), underlying administrative expenses

of GBP22.0m, represented a below inflation increase of 2% on the

prior period (H1 FY23: GBP21.5m).

Excluding the exceptional restructuring cost of GBP0.6m,

employee costs rose 2% to GBP17.6m in the period (H1 FY23:

GBP17.2m). This reflected average employee numbers of 358, an

increase of 10% on the equivalent period in the prior year,

following an increase in employee numbers during FY23. The period

end employee number of 349, however, represented a 6% reduction on

the start of the period. Including further savings implemented

since the end of the period, the total annualised value of

operating cost savings delivered since the start of FY24 is

GBP4.5m.

Digital Asset Impairment

In response to the downturn in Q2 revenue, with the

corresponding impact that this has had on the cash position, the

directors reviewed the ongoing investment being made across several

digital products in development. Following this revsview, the

decision has been taken to pause ongoing funding on longer-term

opportunities that are not currently revenue generating, primarily

relating to the Digital Experience user journey (DXP) and the

platform which supports this. This decision will result in an

annualised cash reduction of GBP3.5m in capital expenditure.

A significant proportion of the features and underlying

technology built in the development of these assets will be

utilised in the integrated products and solutions MindGym continues

to deliver to clients. However, since it is now uncertain whether

this technology will not now form part of discrete and separately

identifiable products in line with IAS38, the directors have taken

the decision to fully impair the carrying value of the impacted

products. This has resulted in a one-off impairment charge of

GBP6.6m in the period.

Profit/ (loss)

The adjusted EBITDA loss for the period (excluding the impact of

the exceptional items) was GBP4.1m (H1 FY23: GBP1.9m profit). The

adjusted profit/ (loss) before tax was a loss of GBP5.5m (H1 FY23:

GBP0.6m profit). Including the exceptional adjusting items, the

loss before tax for the period was GBP13.2m (H1 FY23: GBP0.6m

profit).

On an adjusted basis, basic earnings per share for the period

were -5.61p (loss) (H1 FY23: 0.83p) and diluted earnings per share

were -5.61p (loss) (H1 FY23: 0.84p). On an unadjusted basis

earnings per share for the period were -11.34p (loss) (H1 FY23:

0.83p) and diluted earnings per share were -11.34p (loss) (H1 FY23:

0.84p).

Cash

Despite the loss in the period, the Group has adequate cash

liquidity. Cash at bank at 30 September 2023 was GBP2.1m, a

reduction of GBP5.5m from the year-end balance at 31 March 2023 of

GBP7.6m. Further to this, MindGym retains immediate access to

GBP2.0m of its undrawn GBP10.0m debt facility.

MIND GYM PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to to Year to

30 Sept 30 Sept 31 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Revenue 3 20,905 26,759 55,011

Cost of sales (3,051) (3,344) (6,360)

-------------- -------------- ------------

Gross profit 17,854 23,415 48,651

Administrative expenses (30,978) (22,749) (45,568)

-------------- -------------- ------------

Operating profit/(loss) (13,124) 666 3,083

Finance income 5 30 27 55

Finance costs 5 (78) (52) (174)

-------------- -------------- ------------

(Loss)/profit before taxation (13,172) 641 2,964

Adjusted (loss)/profit before tax (5,497) 641 2,964

Adjusting items 6 (7,675) - -

-------------- -------------- ------------

(Loss)/profit before tax (13,172) 641 2,964

---------------------------------------------- ------ -------------- -------------- ------------

Tax on (loss)/profit 7 1,808 207 (29)

-------------- -------------- ------------

(Loss)/profit for the financial period

from continuing operations attributable

to owners of the parent (11,364) 848 2,935

============== ============== ============

Items that may be reclassified subsequently

to profit or loss

Exchange translation differences on

consolidation 20 785 297

-------------- -------------- ------------

Other comprehensive income for the

period attributable to the owners of

the parent 20 785 297

-------------- -------------- ------------

Total comprehensive income for the

period attributable to the owners of

the parent (11,344) 1,633 3,232

============== ============== ============

(Loss)/earnings per share (pence)

Basic 8 (11.34p) 0.83p 2.93p

Diluted 8 (11.34p) 0.84p 2.84p

-------------- -------------- ------------

Adjusted (loss)/earnings per share

(pence)

Basic 8 (5.61p) 0.83p 2.93p

Diluted 8 (5.61p) 0.84p 2.84p

--------- ------- -------

MIND GYM PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31

30 September 30 September March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 10 7,904 9,787 12,320

Property, plant and equipment 11 2,697 4,584 3,691

Deferred tax assets 2,783 3,084 3,229

Other receivables 233 257 230

-------------- -------------- -----------

13,617 17,712 19,470

Current assets

Inventories 42 35 53

Trade and other receivables 12 7,258 13,553 9,527

Current tax receivable 1,193 594 779

Cash and cash equivalents 2,069 4,507 7,587

-------------- -------------- -----------

10,562 18,689 17,946

-------------- -------------- -----------

Total assets 24,179 36,401 37,416

============== ============== ===========

Current liabilities

Trade and other payables 13 10,010 11,123 11,423

Lease liability 1,118 1,151 1,121

Redeemable preference shares 50 50 50

Current tax payable - - 20

-------------- -------------- -----------

11,178 12,324 12,614

Non-current liabilities

Lease liability 1,529 2,761 1,988

Total liabilities 12,707 15,085 14,602

-------------- -------------- -----------

Net assets 11,472 21,316 22,814

============== ============== ===========

Equity

Share capital 15 1 1 1

Share premium 258 242 242

Share option reserve 474 597 496

Retained earnings 10,739 20,476 22,075

-------------- -------------- -----------

Equity attributable to owners of the

parent Company 11,472 21,316 22,814

============== ============== ===========

The Board of Directors approved these condensed interim

financial statements on 30 November 2023.

MIND GYM PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Share Share option Retained

capital premium reserve earnings Total equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2022 1 213 608 18,804 19,626

========== ========== ========== =========== ==============

Profit for the period - - - 848 848

Other comprehensive income:

Exchange translation differences

on consolidation - - - 785 785

---------- ---------- ---------- ----------- --------------

Total comprehensive income

for the period - - - 1,633 1,633

Exercise of options - 29 (39) 39 29

Credit to equity for share

based payments 16 - - 28 - 28

At 30 September 2022 1 242 597 20,476 21,316

========== ========== ========== =========== ==============

Profit for the period - - - 2,087 2,087

Other comprehensive income:

Exchange translation differences

on consolidation - - - (488) (488)

---------- ---------- ---------- ----------- --------------

Total comprehensive income

for the period - - - 1,599 1,599

Debit to equity for share

based payments 16 - - (101) - (101)

At 31 March 2023 1 242 496 22,075 22,814

========== ========== ========== =========== ==============

(Loss) for the period - - - (11,364) (11,364)

Other comprehensive income:

Exchange translation differences

on consolidation - - - 20 20

---------- ---------- ---------- ----------- --------------

Total comprehensive income

for the period (11,344) (11,344)

Exercise of options - 16 (8) 8 16

Credit to equity for share

based payments 16 - - (14) - (14)

At 30 September 2023 1 258 474 10,739 11,472

========== ========== ========== =========== ==============

MIND GYM PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

6 months 6 months

to to Year to

30 Sept 30 Sept 31 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit for the financial

period (11,364) 848 2,935

Adjustments for:

Amortisation of intangible assets 10 740 508 743

Impairment of intangible assets 10 6,604 - -

Depreciation of tangible assets 11 610 713 1,468

Impairment of right of use asset 11 516 - -

Net finance costs 5 48 25 119

Taxation (credit)/charge 7 (1,808) (207) 29

(Increase)/decrease in inventories 11 (28) (46)

Decrease/(increase) in trade and

other receivables 12 2,266 (3,489) 524

Increase/(decrease) in payables

and provisions 13 (1,413) (1,606) (1,306)

Share based payment charge 16 (14) 28 (73)

------------

Cash (utilised)/generated from

operations (3,804) (3,208) 4,393

Net tax (paid) 1,864 (128) (766)

--------------- ---------------

Net cash generated from operating

activities (1,940) (3,336) 3,627

--------------- --------------- ------------

Cash flows from investing activities

Purchase of intangible assets 10 (2,928) (2,120) (4,888)

Purchase of property, plant and

equipment (55) (91) (240)

Interest received 30 26 54

--------------- --------------- ------------

Net cash used in investing activities (2,953) (2,185) (5,074)

--------------- --------------- ------------

Cash flows from financing activities

Cash repayment of lease liabilities (610) (683) (1,298)

Issuance of ordinary shares 16 29 29

Interest paid (15) - (52)

Net cash used in financing activities (609) (654) (1,321)

--------------- --------------- ------------

Net (decrease) in cash and cash

equivalents (5,502) (6,175) (2,768)

Cash and cash equivalents at beginning

of period 7,587 10,021 10,021

Effect of foreign exchange rate

changes (16) 661 334

--------------- --------------- ------------

Cash and cash equivalents at the

end of period 2,069 4,507 7,587

=============== =============== ============

Cash and cash equivalents at the

end of period comprise:

Cash at bank and in hand 2,069 4,507 7,587

=============== =============== ============

MIND GYM PLC

NOTES TO THE GROUP FINANCIAL STATEMENTS

1. General information

Mind Gym plc ("the Company") is a public limited company

incorporated in England & Wales and its ordinary shares are

traded on the Alternative Investment Market of the London Stock

Exchange ("AIM"). The address of the registered office is 160

Kensington High Street, London W8 7RG. The group consists of Mind

Gym plc and its subsidiaries, Mind Gym (USA) Inc., Mind Gym

Performance (Asia) Pte. Ltd and Mind Gym (Canada) Inc. (together

"the Group").

The principal activity of the Group is to apply behavioural

science to transform the performance of companies and the lives of

the people who work in them. The Group does this primarily through

research, strategic advice, management and employee development,

employee communication, and related services.

2. Basis of preparation

The condensed interim financial statements have been prepared in

accordance with the requirements of the AIM Rules for Companies. As

permitted, the Company has chosen not to adopt IAS 34 "Interim

Financial Statements" in preparing this interim financial

information. The condensed interim financial statements should be

read in conjunction with the annual financial statements for the

year ended 31 March 2023, which have been prepared in accordance

with International Financial Reporting Standards (IFRS) as adopted

by the European Union, including interpretations issued by the

International Financial Reporting Interpretations Committee

("IFRIC"), and with the Companies Act 2006 applicable to companies

reporting under IFRS. The unaudited interim financial information

does not constitute statutory accounts within the meaning of the

Companies Act 2006. This interim report, which has neither been

audited nor reviewed by independent auditors, was approved by the

Board of directors on 30 November 2023.

Statutory accounts for the year ended 31 March 2023 were

approved by the Board of Directors on 12 June 2023 and delivered to

the Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under Section 498 of

the Companies Act 2006.

The interim financial statements have been prepared on a going

concern basis under the historical cost convention.

The interim financial statements are presented in pounds

sterling. All values are rounded to GBP1,000 except where otherwise

indicated.

The accounting policies used in preparing the interim results

are the same as those applied to the latest audited annual

financial statements.

The Group has chosen to present an adjusted measure of profit

and earnings per share, which excludes certain items which are

separately disclosed due to their size, nature or incidence, and

are not considered to be part of normal operating costs of the

Group. These costs include restructuring costs and impairment

charges.

3. Segmental analysis

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker,

who is responsible for allocating resources and assessing

performance of the business. The chief operating decision maker has

been identified as the Board. The Group has two operating segments:

EMEA (comprising the United Kingdom and Singapore) and America

(comprising the United States and Canada).

Both segments derive their revenue from a single business

activity, the provision of human capital and business improvement

solutions.

The Group's business is not highly seasonal and the Group's

customer base is diversified with no individually significant

customer.

Segment results for the 6 months ended 30 September 2023

(Unaudited)

Segment result

EMEA America Total

GBP'000 GBP'000 GBP'000

Revenue 9,807 11,098 20,905

Cost of sales (1,508) (1,543) (3,051)

Administrative expenses (19,999) (10,979) (30,978)

---------- ---------- ----------

Profit before inter-segment charges (11,700) (1,424) (13,124)

Inter-segment charges (295) 295 -

---------- ---------- ----------

Operating profit - segment result (11,995) (1,129) (13,124)

Finance income 30

Finance costs (78)

----------

(Loss) before tax (13,172)

==========

Adjusted (loss) before tax EMEA America Total

GBP'000 GBP'000 GBP'000

Operating (loss) - segment result (11,995) (1,129) (13,124)

Adjusting items 6,714 961 7,675

Adjusted EBIT (5,281) (168) (5,449)

Finance income 30

Finance costs (78)

----------

Profit before tax (5,497)

==========

The mix of revenue for the six months ended 30 September 2023 is

set out below.

EMEA America Group

Delivery 69.4% 75.0% 72.3%

---------- ------------ ----------

Design 15.0% 9.2% 11.7%

---------- ------------ ----------

Digital 10.2% 8.7% 9.7%

---------- ------------ ----------

Licensing and certification 2.5% 2.6% 3.3%

---------- ------------ ----------

Other 1.8% 4.0% 2.2%

---------- ------------ ----------

Advisory 1.1% 0.5% 0.8%

---------- ------------ ----------

Segment results for the 6 months ended 30 September 2022

(Unaudited)

Segment result

EMEA America Total

GBP'000 GBP'000 GBP'000

Revenue 10,078 16,681 26,759

Cost of sales (1,285) (2,059) (3,344)

Administrative expenses (11,639) (11,110) (22,749)

---------- ---------- ----------

Profit before inter-segment charges (2,846) 3,512 666

Inter-segment charges 3,260 (3,260) -

---------- ---------- ----------

Operating profit - segment result 414 252 666

Finance income 27

Finance costs (52)

----------

Profit before tax 641

==========

The mix of revenue for the six months ended 30 September 2022 is

set out below.

EMEA America Group

Delivery 67.1% 64.7% 65.6%

---------- ------------ ----------

Design 13.2% 14.8% 14.1%

---------- ------------ ----------

Digital 11.6% 10.0% 10.7%

---------- ------------ ----------

Licensing and certification 4.5% 6.7% 5.8%

---------- ------------ ----------

Other 2.1% 2.4% 2.3%

---------- ------------ ----------

Advisory 1.5% 1.4% 1.5%

---------- ------------ ----------

Segment results for the year ended 31 March 2023 (Audited)

Segment result

EMEA America Total

GBP'000 GBP'000 GBP'000

Revenue 23,742 31,269 55,011

Cost of sales (2,740) (3,620) (6,360)

Administrative expenses (23,092) (22,476) (45,568)

---------- ---------- ----------

(Loss)/profit before inter-segment charges (2,090) 5,173 3,083

Inter-segment charges 5,067 (5,067) -

---------- ---------- ----------

Operating (loss)/profit - segment result 2,977 106 3,083

Finance income 55

Finance costs (174)

----------

Loss before tax 2,964

==========

The mix of revenue for the year ended 31 March 2023 is set out

below.

EMEA America Group

Delivery 60.2% 60.6% 60.3%

---------- ------------ ----------

Design 19.0% 15.7% 17.2%

---------- ------------ ----------

Digital 13.4% 12.8% 13.1%

---------- ------------ ----------

Licensing and certification 3.3% 7.5% 5.6%

---------- ------------ ----------

Other 2.4% 2.3% 2.4%

---------- ------------ ----------

Advisory 1.7% 1.1% 1.4%

---------- ------------ ----------

4. Employees

Staff costs were as follows:

6 months to 6 months to Year to 31

30 Sept 2023 30 Sept 2022 March 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Wages and salaries 16,093 15,194 31,036

Social security costs 1,481 1,395 2,944

Pension costs - defined contribution

plans 584 550 1,055

Share-based payments (14) 28 (73)

18,144 17,167 34,962

=============== =============== =============

The average number of Group's employees by function was:

6 months to 6 months to Year to 31

30 Sept 2023 30 Sept 2022 March 2023

(Unaudited) (Unaudited) (Audited)

Delivery 226 208 218

Support 81 77 79

Digital 51 39 44

358 324 341

=============== =============== =============

The period end number of Group's employees by function was:

6 months to 6 months to Year to 31

30 Sept 2023 30 Sept 2022 March 2023

(Unaudited) (Unaudited) (Audited)

Delivery 216 212 241

Support 81 77 86

Digital 52 43 46

349 332 373

=============== =============== =============

5. Net finance costs

6 months to 6 months to Year to 31

30 Sept 2023 30 Sept 2022 March 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Finance income

Bank interest receivable 30 26 54

Finance lease income - 1 1

Finance costs

Bank interest payable (15) - (52)

Lease interest (IFRS 16) (63) (52) (122)

(48) (25) (119)

=============== =============== =============

6. Adjusting items

6 months to 6 months to Year to 31

30 Sept 2023 30 Sept 2022 March 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Restructuring costs 555 - -

Impairment of intangibles 6,604 - -

Impairment of right of use asset 516 - -

7,675 - -

=============== =============== =============

Restructuring costs in the six months ended 30 September 2023

include redundancy costs related to the headcount reduction

exercise undertaken to reduce the cost base.

Impairment of intangible assets are excluded from the adjusted

results of the Group since the costs are one-off charges. These

relate to digital assets not in use that are no longer being

developed.

The Group tested right-of-use assets for impairment, and

recognised an impairment loss on a leased asset.

7. Tax

The statutory tax credit of GBP1,808,000 (six months ended 30

September 2022: credit of GBP207,000); year ended 31 March 2023:

charge of GBP29,000) represents an effective tax rate on loss

before tax of 13.7% (six months ended 30 September 2022: -32%; year

ended 31 March 2023: 1%).

During the period, The Company resubmitted the UK tax returns

for the years ended 31 March 2022 and 31 March 2023, in order to

surrender the Research and Development tax credit for a cash

refund. This resulted in a current tax prior year adjustment of

GBP1.9m and corresponding deferred tax prior year adjustment of

GBP3.3m.

8. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to shareholders of the Company by the weighted average

number of ordinary shares in issue during the year. The Company has

potentially dilutive shares in respect of the share-based payment

plans (see Note 16).

30 Sept 2023 30 Sept 2022 31 March

2023

(Unaudited) (Unaudited) (Audited)

Weighted average number of shares

in issue 100,174,502 100,119,558 100,143,571

Potentially dilutive shares (weighted

average) 4,324,325 1,059,821 3,141,506

-------------- -------------- ---------------

Fully diluted number of shares (weighted

average) 104,498,827 101,179,379 103,285,077

-------------- -------------- ---------------

6 months to 6 months to Year to 31

30 Sept 2023 30 Sept 2022 March 2023

(Unaudited) (Unaudited) (Audited)

pence pence pence

Basic earnings per share (11.34) 0.85 2.93

Diluted earnings per share (11.34) 0.84 2.84

Adjusted basic earnings per share (5.61) 0.85 2.93

Adjusted diluted earnings per share (5.61) 0.84 2.84

9. Dividends

The Board did not propose a final dividend for the year ended 31

March 2023. No interim dividend is proposed for the period to 30

September 2023.

10. Intangible assets

Development

Patents costs Total

GBP'000 GBP'000 GBP'000

Cost

At 1 April 2023 121 15,173 15,294

Additions 16 2,912 2,928

At 30 September 2023 137 18,085 18,222

Amortisation

At 1 April 2023 66 2,908 2,974

Amortisation charge 3 737 740

Impairment - 6,604 6,604

--------- ------------- ---------

At 30 September 2023 69 10,249 10,318

========= ============= =========

Net book value

At 31 March 2023 55 12,265 12,320

--------- ------------- ---------

At 30 September 2023 68 7,836 7,904

========= ============= =========

Development cost additions in the six months ended 30 September

2023 includes software development costs directly incurred in the

creation of new digital assets. The Group undertook an impairment

review and as a result reflected an impairment charge of

GBP6,604k.

11. Property, plant and equipment

Right-of-use Leasehold Development

asset improvements costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 April 2023 6,189 538 1,793 8,520

Additions 69 - 55 124

Exchange differences 50 5 16 71

-------------- --------------- ------------- ---------

At 30 September 2023 6,308 543 1,864 8,715

Depreciation

At 1 April 2023 3,235 374 1,220 4,829

Depreciation charge 404 41 168 613

Impairment 516 - - 516

Exchange differences 42 6 12 60

-------------- --------------- ------------- ---------

At 30 September 2023 4,197 421 1,400 6,018

============== =============== ============= =========

Net book value

At 31 March 2023 2,954 164 573 3,691

-------------- --------------- ------------- ---------

At 30 September 2023 2,111 122 464 2,697

============== =============== ============= =========

12. Trade and other receivables

31 March

30 Sept 2023 30 Sept 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Trade receivables 5,151 10,657 6,730

Less provision for impairment (94) (259) (102)

-------------- -------------- ------------

Net trade receivables 5,057 10,398 6,628

Other receivables 65 202 80

Prepayments 794 1,074 1,125

Accrued income 1,342 1,879 1,694

7,258 13,553 9,527

============== ============== ============

Non-current assets includes GBP233,000 (30 September 2022:

GBP257,000; 31 March 2023: GBP230,000) of prepayments in respect of

property deposits.

Trade receivables have been aged with respect to the payment

terms as follows:

31 March

30 Sept 2023 30 Sept 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Not past due 4,503 9,311 6,282

Past due 0-30 days 313 693 336

Past due 31-60 days 182 216 74

Past due 61-90 days 74 344 12

Past due more than 90 days 79 92 26

5,151 10,656 6,730

============== ============== ============

13. Trade and other payables

31 March

30 Sept 2023 30 Sept 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Trade payables 1,294 1,019 1,257

Other taxation and social security 2,023 829 744

Other payables 421 623 396

Accruals 3,406 4,248 4,606

Deferred income 2,866 4,404 4,420

10,010 11,123 11,423

============== ============== ============

14. Borrowings

The Group entered into a GBP10 million debt facility (GBP6m RCF,

GBP4m accordion) on 30 September 2021 which matures after 3 years.

The facility remains undrawn as at 30 November 2023.

15. Share capital

30 Sept 30 Sept 30 Sept 30 Sept 31 March 31 March

2023 2023 2022 2022 2023 2023

Cost Cost Cost

Number GBP'000 Number GBP'000 Number GBP'000

Ordinary shares of GBP0.00001

At 1 April 100,167,584 1 100,105,660 1 100,105,660 1

Issue of shares to satisfy

options 30,880 - 61,924 - 61,924 -

Ordinary shares of GBP0.00001

at period end 100,198,464 1 100,167,584 1 100,167,584 1

============= ========= ============= ========= ============= ==========

Share based payments

The Group awards options to selected employees under a Long-Term

Incentive Share Option Plan ("LTIP"). The options granted to date

vest subject only to remaining employed up to the vesting date.

Unexercised options do not entitle the holder to dividends or to

voting rights.

The awards granted in the six months to 30 September 2023 are

subject to performance conditions based on revenues and EBITDA.

The awards granted in the six months to 30 September 2022 are

subject to performance conditions based on revenues and EBITDA.

Some awards granted during this time period are time bound

only.

The awards granted during FY22 are subject to performance

conditions based on revenue, adjusted earnings per share and total

shareholder return.

On the 30(th) September 2019 the Group launched an annual Save

As You Earn Scheme and an Employee Share Purchase Plan for all

eligible employees in the UK and USA respectively.

The total share-based payments (credit)/expense was:

6 months 6 months Year to

to 30 Sept to 30 Sept 31 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Equity settled share-based payments (14) 28 (73)

============== ============== ============

[1] Grandview Research 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKAFESXDFEA

(END) Dow Jones Newswires

December 01, 2023 02:01 ET (07:01 GMT)

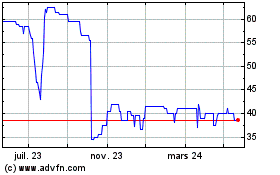

Mind Gym (LSE:MIND)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

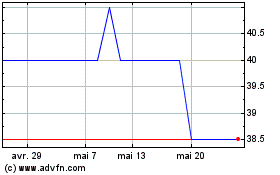

Mind Gym (LSE:MIND)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024