UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

| Filed

by the Registrant ☒ |

| Filed

by a Party other than the Registrant ☐ |

| Check

the appropriate box: |

| |

|

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under §240.14a-12 |

AgriFORCE

Growing Systems Ltd.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of

Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee computed

on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

| |

(1) |

Title of each class of

securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities

to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other

underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate

value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| |

|

|

| ☐ |

Fee paid previously

with preliminary materials. |

| ☐ |

Check box if

any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration

Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

AgriFORCE

Growing Systems Ltd.

800-525

West 8th Avenue

Vancouver,

BC, Canada V5Z 1C6

October

__, 2024

To

the Shareholders of AgriFORCE Growing Systems, Ltd.:

You

are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of AgriFORCE Growing Systems, Ltd.,

a British Columbia corporation (the “Company”), to be held at 11:00 AM Pacific time on November 25, 2024, at 800-525

West 8th Avenue, Vancouver, BC, Canada V5Z 1C6.

At

the Annual Meeting, Shareholders will be asked to consider and vote upon the following proposals:

| 1. |

Approve

the election of five directors for a one year term expiring in 2025. |

| |

|

| 2. |

The

ratification of the appointment of Marcum LLP, as the Company’s independent registered certified public accountant for the

fiscal year ended December 31, 2024. |

| |

|

| 3. |

To

approve a reverse split of the Company’s issued and outstanding common shares in a ratio of 1:15 to 1:100. |

| |

|

| 4. |

Approval of the Company’s 2024 Equity Incentive

Plan |

| |

|

| 5. |

To

transact such other business as may be properly brought before the 2024 Annual Meeting and any adjournments thereof. |

In

addition, shareholders will receive and consider the financial statements for the Company’s fiscal year ended December 31, 2023,

the report of the Company’s auditor thereon, and the related management discussion and analysis.

THE

BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE ABOVE FOUR PROPOSALS.

Pursuant

to the provisions of the Company’s articles, the board of directors of the Company (the “Board”) has fixed the close

of business on October 11, 2024 as the record date for determining the shareholders of the Company entitled to notice of, and

to vote at, the Annual Meeting or any adjournment thereof. Accordingly, only shareholders of record at the close of business on October

11, 2024 are entitled to notice of, and shall be entitled to vote at, the Annual Meeting or any postponement or adjournment thereof.

Shareholders

who intend to attend the meeting via teleconference or video conference must submit votes by Proxy ahead of the proxy deadline

of 9:00 a.m. (Pacific Time) on November 25, 2024.

Please

review in detail the attached notice and proxy statement for a more complete statement of matters to be considered at the Annual Meeting.

Your

vote is very important to us regardless of the number of shares you own. Whether or not you are able to attend the Annual Meeting in

person, please read the proxy statement and promptly vote your proxy via the internet, by telephone or, if you received a printed form

of proxy in the mail, by completing, dating, signing and returning the enclosed proxy in order to assure representation of your shares

at the Annual Meeting. Granting a proxy will not limit your right to vote in person if you wish to attend the Annual Meeting and vote

in person.

| |

By

Order of the Board of Directors: |

| |

|

| |

/s/

David Welch |

| |

David

Welch, |

| |

Chairman

of the Board of Directors |

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

The

2024 Annual Meeting of shareholders (the “Annual Meeting”) of AgriFORCE Growing Systems, Ltd. (the “Company”)

will be held 11:00 AM Pacific time on Monday, November 25, 2024, at the Company’s principal offices at 800-525 West 8th

Avenue, Vancouver, BC, Canada V5Z 1C6.

At

the Annual Meeting, the holders of the Company’s outstanding common shares will act on the following matters:

| 1. |

Approve

the election of five directors for a one year term expiring in 2025. |

| |

|

| 2. |

The

ratification of the appointment of Marcum LLP, as the Company’s independent registered certified public accountant for the

fiscal year ended December 31, 2024. |

| |

|

| 3. |

Approval

of a reverse split of the Company’s issued and outstanding common shares in a ratio of 1:15 to 1:100. |

| |

|

4. |

Approval

of the Company’s 2024 Equity Incentive Plan |

| |

|

| 5. |

To

transact such other business as may be properly brought before the 2024 Annual Meeting and any adjournments thereof. |

In

addition, shareholders will receive and consider the financial statements for the Company’s fiscal year ended December 31, 2023,

the report of the Company’s auditor thereon, and the related management discussion and analysis.

Shareholders

of record at the close of business on October 11, 2024 are entitled to notice of and to vote at the 2024 Annual Meeting and any

postponements or adjournments thereof.

Shareholders

who intend to attend the meeting via teleconference or video conference must submit votes by Proxy ahead of the proxy deadline

of 9:00 a.m. (Pacific Time) on November 25, 2024.

It

is hoped you will be able to attend the 2024 Annual Meeting but in any event, please vote according to the instructions on the enclosed

proxy as promptly as possible. If you are able to be present at the 2024 Annual Meeting in person , you may revoke your proxy and vote

in person.

| Dated:

October __, 2024 |

|

| |

|

| |

/s/

David Welch |

| |

David

Welch, |

| |

Chairman

of the Board of Directors |

AGRIFORCE

GROWING SYSTEMS LTD.

800-525

West 8th Avenue

Vancouver,

BC V5Z 1C6

ANNUAL

MEETING OF SHAREHOLDERS

To

Be Held November 25, 2024

PROXY

STATEMENT

The

Board of Directors of AgriFORCE Growing Systems, Ltd. (the “Company”) is soliciting proxies from its shareholders to be used

at the 2024 Annual Meeting of shareholders (the “Annual Meeting”) to be held at the Company’s offices at 800-525 West

8th Avenue, Vancouver, BC, Canada V5Z 1C6, and at any postponements or adjournments thereof. This proxy statement contains information

related to the Annual Meeting. This proxy statement and the accompanying form of proxy are first being sent to shareholders on or about

October 14, 2024.

ABOUT

THE ANNUAL MEETING

Why

am I receiving this proxy statement?

You

are receiving this proxy statement because you have been identified as a shareholder of the Company as of the record date which our Board

has determined to be October 11, 2024, and thus you are entitled to vote at the Company’s 2024 Annual Meeting. This document

serves as a proxy statement used to solicit proxies for the 2024 Annual Meeting. This document and the Appendixes hereto contain important

information about the 2024 Annual Meeting and the Company, and you should read it carefully. We formally adjourned the meeting which we had scheduled for September 23, 2024 as we did not receive the required

quorum under Nasdaq rules to hold a meeting and thus have set a new Meeting for November 25, 2024.

Who

is entitled to vote at the 2024 Annual Meeting?

Only

shareholders of record as of the close of business on the record date will be entitled to vote at the 2024 Annual Meeting. As of the

close of business on the record date, there were ______ common shares issued and outstanding and entitled to vote. Each holder

of common shares is entitled to one vote for each common share held by such shareholder on the record date on each of the proposals presented

in this proxy statement.

May

I vote in person?

If

you are a shareholder of the Company and your shares are registered directly in your name with the Company’s transfer agent, Continental

Stock Transfer and Trust, you are considered, with respect to those shares, the shareholder of record, and the proxy materials and proxy

card, attached hereto as Appendix A, are being sent directly to you by the Company. If you are a shareholder of record, you may attend

the 2024 Annual Meeting to be held on November 25, 2024, and vote your shares in person, rather than signing and returning your

proxy. Only persons attending in person may vote their shares in person.

If

your shares of common stock are held by a bank, broker or other nominee, you are considered the beneficial owner of shares held in “street

name,” and the proxy materials are being forwarded to you together with a voting instruction card by such bank, broker or other

nominee. As the beneficial owner, you are also invited to attend the 2024 Annual Meeting. Since a beneficial owner is not the shareholder

of record, you may not vote these shares in person at the 2024 Annual Meeting unless you obtain a proxy from your broker issued in your

name giving you the right to vote the shares at the 2024 Annual Meeting.

Photo

identification may be required (a valid driver’s license, state identification or passport). If a shareholder’s shares are

registered in the name of a broker, trust, bank or other nominee, the shareholder must bring a proxy or a letter from that broker, trust,

bank or other nominee or their most recent brokerage account statement that confirms that the shareholder was a beneficial owner of shares

of stock of the Company as of the Record Date. Since seating is limited, admission to the meeting will be on a first-come, first-served

basis.

Cameras

(including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting.

If

my Company shares are held in “street name” by my broker, will my broker vote my shares for me?

Generally,

if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee

holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with

respect to matters that are considered to be “routine,” but not with respect to “non-routine”

matters, as discussed further below. Your broker will not be able to vote your shares of common stock without specific instructions from

you for “non-routine” matters.

If

your shares are held by your broker or other agent as your nominee, you will need to obtain a proxy form from the institution that holds

your shares and follow the instructions included on that form regarding how to instruct your broker or other agent to vote your shares.

What

are “broker non-votes”?

If

you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker

non-votes.” “Broker non-votes” occur on a matter when a broker is not permitted to vote on that matter without instructions

from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Since brokers

are permitted to vote on “routine” matters without instructions from the beneficial owner, “broker non-votes”

do not occur with respect to “routine” matters.

All

matters other than Proposal 1 are “routine” matters.

The

determination of “routine” and “non-routine” matters is determined by brokers and those firms responsible to

tabulate votes cast by beneficial owners of shares held in street name and other nominees. Firms casting such votes have generally been

guided by rules of the New York Stock Exchange when determining if proposals are considered “routine” or “non-routine”.

When a matter to be voted on is the subject of a contested solicitation, banks, brokers and other nominees do not have discretion to

vote your shares with respect to any proposal to be voted on.

How

do I cast my vote if I am a shareholder of record?

The

link for the material will be posted on our website: https://ir.agriforcegs.com/news-events/ir-calendar.

If you are a shareholder with shares registered in your name with the Company’s transfer agent, Continental Stock Transfer and

Trust, on the record date, you may vote in person at the 2024 Annual Meeting or by going to https://lsp.continentalstock.com/pxlogin.

Record holders can also vote: via email (cstmail@continentalstock.com), via mail (with the self addressed envelope the transfer

agent will provide).

Whether

or not you plan to attend the 2024 Annual Meeting, please vote as soon as possible to ensure your vote is counted. You may still attend

the 2024 Annual Meeting and vote in person even if you have already voted by proxy. For more detailed instructions on how to vote using

one of these methods, please see the form of proxy card attached to this Schedule 14A and the information below.

| |

● |

To

vote in person. You may attend the 2024 Annual Meeting and the Company will give you a ballot when you arrive. |

| |

|

|

| |

● |

To

vote by proxy by fax or internet. If you have fax or internet access, you may submit your proxy by following the instructions provided

in this proxy statement, or by following the instructions provided with your proxy materials and on the enclosed proxy card or voting

instruction card. |

| |

|

|

| |

● |

To

vote by proxy by mail. You may submit your proxy by mail by completing and signing the enclosed proxy card and mailing it in the

enclosed envelope. Your shares will be voted as you have instructed. |

How

do I cast my vote if I am a beneficial owner of shares registered in the name of any broker or bank?

If

you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, you should have

received a proxy card and voting instructions with these proxy materials from that organization rather than from the Company. Simply

complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as

instructed by your broker or other agent. To vote in person at the 2024 Annual Meeting, you must obtain a valid proxy from your broker

or other agent. Follow the instructions from your broker or other agent included with these proxy materials or contact your broker or

bank to request a proxy form.

What

constitutes a quorum for purposes of the 2024 Annual Meeting?

The

presence at the meeting, in person or by proxy, of the holders of at least one third of the issued and outstanding shares entitled

to vote are present or represented by proxy at the Annual Meeting permitting the conduct of business at the meeting. On the record date,

there were _______ shares of Common Stock and 0 shares of preferred stock issued and outstanding and entitled to vote. Accordingly, the

holders of the ______ shares eligible to vote must be present at the 2024 Annual Meeting to have a quorum. Proxies received but marked

as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the

meeting for purposes of a quorum. Your shares will be counted toward the quorum at the 2024 Annual Meeting only if you vote in person

at the meeting, you submit a valid proxy or your broker, bank, dealer or similar organization submits a valid proxy.

Can

I change my vote?

Yes.

Any shareholder of record voting by proxy has the right to revoke their proxy at any time before the polls close at the 2024 Annual Meeting

by sending a written notice stating that they would like to revoke his, her or its proxy to the Corporate Secretary of the Company; by

providing a duly executed proxy card bearing a later date than the proxy being revoked; or by attending the 2024 Annual Meeting and voting

in person. Attendance alone at the 2024 Annual Meeting will not revoke a proxy. If a shareholder of the Company has instructed a broker

to vote its shares of common stock that are held in “street name,” the shareholder must follow directions received from its

broker to change those instructions.

Who

is soliciting this proxy – Who is paying for this proxy solicitation?

We

are soliciting this proxy on behalf of our Board of Directors. The Company will bear the costs of and will pay all expenses associated

with this solicitation, including the printing, mailing and filing of this proxy statement, the proxy card and any additional information

furnished to shareholders. In addition to mailing these proxy materials, certain of our officers and other employees may, without compensation

other than their regular compensation, solicit proxies through further mailing or personal conversations, or by telephone, facsimile

or other electronic means. We will also, upon request, reimburse banks, brokers, nominees, custodians

and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our stock

and to obtain proxies. We have also retained a proxy solicitor, and the cost of proxy solicitation we estimate to be approximately $10,000.

If

you have any questions or need assistance voting your shares, please call our proxy solicitor, Campaign Management:

Strategic

Stockholder Advisor and Proxy Solicitation Agent

15

West 38th Street, Suite #747, New York, New York 10018

North American Toll-Free Phone:

855-434-5243

Email: info@campaign-mgmt.com

Call Collect Outside

North America: +1 (212) 632-8422

What

vote is required to approve each item?

The

following votes are required to approve each proposal:

| ● |

Proposal

1 - Election of the five directors requires a plurality (the five nominees receiving the most “FOR” votes) of

the votes cast at the 2024 Annual Meeting. |

| |

|

| ● |

Proposal

2 - The ratification of the appointment of Marcum LLP, as the Company’s independent registered certified public accountant

for the fiscal year ended December 31, 2024. “FOR” votes from the holders of a majority of the shares of the Company’s

common stock present in person or represented by proxy and entitled to vote on the matter at the 2024 Annual Meeting are required

to approve this proposal. |

| |

|

| ● |

Proposal

3 – To approve the proposed reverse stock split. “FOR” votes from the holders of a majority of the shares

of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the 2024 Annual

Meeting are required to approve this proposal. “FOR” votes from the holders of a majority of the shares of the Company’s

common stock present in person or represented by proxy and entitled to vote on the matter at the 2024 Annual Meeting are required

to approve this proposal. |

| |

|

| |

Proposal

4 – To approve the proposed 2024 Equity Incentive Plan. “FOR” votes from the holders of a majority of the

shares of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the 2024

Annual Meeting are required to approve this proposal. “FOR” votes from the holders of a majority of the shares of the

Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the 2024 Annual Meeting

are required to approve this proposal. |

| |

|

| ● |

Proposal

5 - To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. “FOR”

votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy

and entitled to vote on the matter at the 2024 Annual Meeting are required to approve this proposal. |

Will

My Shares Be Voted If I Do Not Return My Proxy Card?

If

your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card

by mail or vote at the Annual Meeting. If your broker cannot vote your shares on a particular matter because it has not received instructions

from you and does not have discretionary voting authority on that matter, or because your broker chooses not to vote on a matter for

which it does have discretionary voting authority, this is referred to as a “broker non-vote.” The New York Stock Exchange

(“NYSE”) has rules that govern brokers who have record ownership of listed company stock (including stock such as ours that

is listed on The Nasdaq Capital Market) held in brokerage accounts for their clients who beneficially own the shares. Under these rules,

brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters

(“routine matters”), but do not have the discretion to vote uninstructed shares as to certain other matters (“non-routine

matters”). Neither proposal herein is a routine matter.

If

your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares

the bank, broker or other nominee does not have authority to vote your unvoted shares on any of the other proposals submitted to shareholders

for a vote at the Annual Meeting. We encourage you to provide voting instructions. This ensures your shares will be voted at the Annual

Meeting in the manner you desire.

Can

I access these proxy materials on the Internet?

Yes.

The Notice of Annual Meeting, and this proxy statement and the Appendix hereto are available for viewing, printing, and downloading at

https://ir2.agriforcegs.com/events-presentation. All materials will remain posted

on https://ir2.agriforcegs.com/events-presentation at least until the conclusion

of the meeting.

What

should I do if I receive more than one set of voting materials?

You

may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting

instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction

card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than

one name, you will receive more than one proxy card. Please vote your shares applicable to each proxy card and voting instruction card

that you receive.

How

can I find out the results of the voting at the Annual Meeting?

Preliminary

voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K filed

with the Securities and Exchange Commission within four business days of the 2024 Annual Meeting.

What

interest do officers and directors have in matters to be acted upon?

No

person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year, and no associate

of any of the foregoing persons, has any substantial interest, direct or indirect, in any matter to be acted upon.

Who

can provide me with additional information and help answer my questions?

If

you would like additional copies, without charge, of this proxy statement or if you have questions about the proposals being considered

at the 2024 Annual Meeting, including the procedures for voting your shares, you should contact Richard Wong, the Company’s CFO,

by telephone at 604-757-0952.

Householding

of Annual Disclosure Documents

The

SEC previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our shares

on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our shareholders

reside, if either we or the brokers believe that the shareholders are members of the same family. This practice, referred to as “householding,”

benefits both shareholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The

rule applies to our annual reports, proxy statements and information statements. Once shareholders receive notice from their brokers

or from us that communications to their addresses will be “householded,” the practice will continue until shareholders are

otherwise notified or until they revoke their consent to the practice. Each shareholder will continue to receive a separate proxy card

or voting instruction card.

Those

shareholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our

annual disclosure documents in future years or (ii) who share an address with another one of our shareholders and who would like to receive

only a single set of our annual disclosure documents should follow the instructions described below:

| ● |

shareholders

whose shares are registered in their own name should contact our transfer agent, Continental Stock Transfer & Trust, and inform

them of their request by calling them at 1-800-509-5586 or writing them at 1 State Street, 30th Floor New York, NY 10004-1561 |

| |

|

| ● |

shareholders

whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of their

request, shareholders should be sure to include their name, the name of their brokerage firm and their account number. |

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information known to us regarding the beneficial ownership of our common stock as of October 11, 2024

by:

| ● |

each

person known to us to be the beneficial owner of more than 5% of our outstanding common stock; |

| ● |

each

of our executive officers and directors; and |

| ● |

all

of our executive officers and directors as a group. |

| | |

Common shares | | |

Options Granted vested within 60 days of October 11, 2024 | | |

Warrants | | |

Total | | |

Percentage

beneficially owned | |

| Directors and Officers: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jolie Kahn | |

| 126,646 | | |

| - | | |

| - | | |

| 126,646 | | |

| 0.1 | % |

| Richard Wong | |

| 234,290 | | |

| 21,053 | | |

| - | | |

| 255,343 | | |

| 0.3 | % |

| Mauro Pennella | |

| 425,256 | | |

| 13,495 | | |

| - | | |

| 438,751 | | |

| 0.4 | % |

| John Meekison | |

| 865 | | |

| 4,251 | | |

| - | | |

| 5,116 | | |

| 0.0 | % |

| David Welch | |

| 1,049 | | |

| 4,239 | | |

| - | | |

| 5,288 | | |

| 0.0 | % |

| Amy Griffith | |

| - | | |

| 3,719 | | |

| - | | |

| 3,719 | | |

| 0.0 | % |

| Richard Levychin | |

| - | | |

| 3,719 | | |

| - | | |

| 3,719 | | |

| 0.0 | % |

| Elaine Goldwater | |

| - | | |

| - | | |

| - | | |

| - | | |

| | % |

| Ingo Mueller (Former CEO and Chairman) | |

| 3,954 | | |

| - | | |

| - | | |

| 3,954 | | |

| 0.0 | % |

| Troy McClellan (Former President Design & Construction) | |

| 28,159 | | |

| - | | |

| - | | |

| 28,159 | | |

| 0.0 | % |

| Margaret Honey (Former Director) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | % |

| Total all officers and directors (10 persons)* | |

| 820,219 | | |

| 50,476 | | |

| - | | |

| 870,695 | | |

| 0.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| 5% or Greater Beneficial Owners | |

| | | |

| | | |

| | | |

| | | |

| | |

| - | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The

following table presents information with respect to our officers, directors and significant employees as of the date of this 14A:

| Name |

|

Age |

|

Position |

|

Served

Since |

| Jolie

Kahn |

|

59 |

|

Chief

Executive Officer |

|

June

2024 |

| William

J. Meekison |

|

60 |

|

Director,

Audit Committee, Compensation Committee Chair, and M&A Committee Chair |

|

June

2019 |

| David

Welch |

|

42 |

|

Executive Chairman, Director, M&A Committee |

|

June

2019 |

| Amy

Griffith |

|

52 |

|

Director,

Compensation Committee, Audit Committee and Chair Nominations and Corporate Governance and Strategy Committee |

|

July

2021 |

| Richard

Levychin |

|

65 |

|

Director,

Audit Committee Chair, Nominations and Corporate Governance and Strategy Committee and M&A Committee Member |

|

July

2021 |

| Richard

S. Wong |

|

59 |

|

Chief

Financial Officer |

|

October

2018 |

| Elaine

Goldwater |

|

52 |

|

Director,

Compensation Committee Committee, and Nominations and Corporate Governance and Strategy Committee |

|

August

2023 |

| Mauro

Penella |

|

58 |

|

President,

AgriFORCE Brands, Chief Marketing Officer |

|

July

15, 2021 |

Directors

serve until the next annual meeting and until their successors are elected and qualified. Officers are appointed to serve for one year

until the meeting of the Board of Directors following the annual meeting of shareholders and until their successors have been elected

and qualified.

Jolie

Kahn, Chief Executive Officer

Jolie

Kahn has an extensive background in corporate finance and management and corporate and securities law. She has been the proprietor

of Jolie Kahn, Esq. since 2002 and still practices law on a limited basis, including serving as U.S. securities counsel for the Company.

Ms. Kahn has also acted in various corporate finance roles, including extensive involvement of preparation of period filings and financial

statements and playing an integral part in public company audits. She also works with companies and hedge funds in complex transactions

involving the structuring and negotiation of multi-million-dollar debt and equity financings, mergers, and acquisitions. Ms. Kahn has

practiced law in the areas of corporate finance, mergers & acquisitions, reverse mergers, and general corporate, banking, and real

estate matters. She has represented both public and private companies, hedge funds, and other institutional investors in their role as

investors in public companies. She served as Interim CFO of GlucoTrack, Inc. from 2019 – 2023 and has served, on a part

time basis, as CFO of Ocean Biomedical, Inc. since February 2024. Ms. Kahn holds a BA from Cornell University and a J.D. magna cum

laude from the Benjamin N. Cardozo School of Law.

David

Welch, Chairman of the Board and Director

Mr.

Welch is a businessman and lawyer who currently serves as the managing partner for ENSO LAW, LLP, a Los Angeles based International Intellectual

Property and Regulatory law firm. He has overseen and conducted business transactions in the Caribbean, Europe, as well as Central and

South America. As an attorney he has a broad base of experience in representing US, Canadian and Mexican corporate clients in the areas

of litigation, intellectual property and government regulatory advisement and defense. Mr. Welch represents recognizable businesses,

and notable intellectual property portfolios before United States Federal Court, California state courts and the USPTO and TTAB. He obtained

his Juris Doctorate degree from Loyola Law School, Los Angeles with an emphasis on International Trade. He has also studied at the Universidad

Iberoamericana in Baja, Mexico and the University of International Business and Economics in Beijing, China. Mr. Welch’s, who is

also a registered aquaculturist, is conducting various studies of sustainable and regenerative agricultural practices in the Caribbean

in partnership with local governments and businesses. He is suited to serve as our Chairman due to his long-standing experience in international

intellectual property, international agriculture, and international business.

William

John Meekison, Director

Mr.

Meekison is a career Chief Financial Officer and former investment banker. He has spent the last fifteen years serving in a variety of

executive management and CFO roles with both private and public companies, currently as the CFO and Director of Exro Technologies Inc.

(since October 2017), a technology company that creates energy management system, and CFO and Director of ArcWest Exploration Inc. (since

December 2010), a mining exploration company in British Columbia. He is currently on the board of directors of Pike Mountain Minerals

Inc. (since July 2018) and Quest Pharmatech Inc. (since November 2017). Prior to his position at Exro Technologies Inc., Mr. Meekison

spent fifteen years in corporate finance with a focus on raising equity capital for North American technology companies, including nine

years at Haywood Securities Inc. Mr. Meekison received his Bachelor of Arts from the University of British Columbia and is a Chartered

Professional Accountant, Professional Logistician and Certified Investment Manager. He is suited to serve as a director due to his long

time experience as a CFO.

Amy

Griffith, Director

Amy

Griffith, was appointed as a director in July 2021, concurrent with the completion of our IPO. Ms Griffith is Head of Government Relations

& External Affairs for McCain Foods North America. She leads McCains engagement with policymakers in the United States and

Canada. Previously, she led The Coca-Cola Company’s Public Affairs, Communications and Sustainability team for the North

American Operating Unit’s North Zone. Ms. Griffith was previously with Wells Fargo’s State & Local Government Relations

team managing the Keystone Region encompassing Pennsylvania, Delaware and West Virginia. She was recruited to Wells Fargo’s Government

Relations and Public Policy team in 2019. In this role, Griffith leads Wells Fargo’s legislative and political agenda in her region

and manages relationships with a state and local policymakers and community stakeholders.

From

2008-2019, Griffith led government relations for sixteen states in the Eastern United States for TIAA for over a decade. In her role

at TIAA, she successfully lobbied for multiple high-profile issues, including landmark pension reform legislation adopted in Pennsylvania.

Prior to that, she worked in the aerospace, high tech, education, private and public sectors, and has managed multiple high-profile political

campaigns at the local, state and national level.

She

is a graduate of Gwynedd-Mercy College and holds a Bachelor of Arts in History. Our Board has determined that Ms. Griffith is well qualified

to serve as a director due to her significant experience in government relations and politics and years of experience working with companies

in both the private and public sectors.

Mr.

Richard Levychin, Director

Richard

Levychin, CPA, CGMA, was appointed as a director on July 2021, concurrent with the completion of our IPO. Mr. Levychin is a Partner

in Galleros Robinson’s Commercial Audit and Assurance practice where he focuses on both privately and publicly held companies.

Prior to taking this position in October 2018, Richard was the managing partner of KBL, LLP, a PCAOB certified independent registered

accounting firm, since 1994. Mr. Levychin has over 25 years of accounting, auditing, business

advisory services and tax experience working with both privately owned and public entities in various industries including media, entertainment,

real estate, manufacturing, not-for-profit, technology, retail, technology, and professional services. His experience also includes expertise

with SEC filings, initial public offerings, and compliance with regulatory bodies. As a business adviser, he advises companies, helping

them to identify and define their business and financial objectives, and then provides them with the on-going personal attention necessary

to help them achieve their established goals.

Mr.

Levychin has

written articles on a wide range of topics, which have been featured in several periodicals

including Dollars and Sense, New York Enterprise Report, Black Enterprise Magazine, Forbes,

Business Insider, and The Network Journal. He has also conducted seminars on a wide range

of business topics including SEC matters and taxation for several organizations including

the Black Enterprise Entrepreneurs Conference, the Entrepreneurs’ Organization (New

York chapter) and the Learning Annex.

Mr.

Levychin is a member of several organizations including the New York State Society of Certified Public Accountants, the National Association

of Tax Professionals, and the American Institute of Certified Public Accountants (AICPA). Richard was a founding member of the AICPA’s

National Diversity and Inclusion Commission. Richard is a member and a former board member of the New York Chapter of the Entrepreneurs’

Organization (“EO”), a dynamic, global network of more than 14,000 business owners in over 50 countries.

In

2018 Mr. Levychin was a recipient of the 5 Chamber Alliance MWBE Award from the Manhattan

Chamber of Commerce. In 2016 Richard was presented with the 2016 Arthur Ashe Leadership Award. In 2015 Richard was presented by his alma

mater Baruch College with the Baruch College Alumni Association’s “Alumni Leadership Award for Business”. In 2013 Richard

received the title of Best Accountant from The New York Enterprise Report. Mr. Levychin

is a past winner of The Network Journal’s prestigious “40 Under 40” award.

He

is a graduate of Baruch College, where he received a Bachelors in Business Administration Degree (Accounting).

Our

Board has determined that Mr. Levychin is well suited to serve on our Board due to his decades of experience as the managing partner

of a PCAOB certified independent registered accounting firm, which included decades of expertise with SEC filings and initial public

offerings.

Richard

Wong, Chief Financial Officer

Mr.

Wong, who works full time for the Company, has over 25 years of experience in both start-up and public companies in the consumer goods,

agricultural goods, manufacturing, and forest industries. Prior to joining the Company in 2018, he was a partner in First Choice Capital

Advisors from 2008-2016 and a partner in Lighthouse Advisors Ltd. from 2016-2018. Mr. Wong has also served as the CFO of Emerald Harvest

Co., Dan-D Foods, Ltd., and was the Director of Finance and CFO of SUGOI Performance Apparel and had served positions at Canfor, Canadian

Pacific & other Fortune 1000 companies. Mr. Wong is a Chartered Professional Accountant, and a member since 1999. Mr. Wong has a

Diploma in Technology and Financial Management from the British Columbia Institute of Technology.

Elaine

Goldwater, Director

Elaine

Goldwater is an executive in the Bio-Pharmaceutical Industry. She is the Senior Director of Marketing,

Endocrinology at Recordati Rare Diseases. Offering 20 plus years of experience creating and launching complex global marketing strategies

in the competitive pharmaceutical industry, she offers a talent for guiding informed decision-making, leading strategic planning and

strategic operations, and delivering double-digit growth and transform across high-value product portfolios. Most recently driving her

business unit to over 50% growth in 6- months.

Her

expertise includes deep knowledge of the product lifecycle from pre-clinical/early-stage development through launch, loss of exclusivity

(LOE), line-extension, and late lifecycle products. In addition, Elaine’s mastery of country and global operations is leveraged

with a background in building market archetypes, shared best practices, and profitable strategy and execution models. She drives end

to end commercial strategy creation and execution through a collaborative cross functional process that delivers above brand performance

driving to growing net revenue and ensuring patient access. She has brought this strategic expertise into strategy development and into

market execution driving double digit growth and across multiple disease categories from Cushing Disease, Acromegaly, Infectious Disease

(antibiotic, anti-fungal, HIV, HPC); Contraception, hematology, oncology, respiratory, diabetes and urology. Additionally, Elaine has

expertise in orphan drug and rare disease filing, launching, and marketing execution.

She

is especially adept at motivating and uniting cross-functional headquarter global and country teams toward common goals. By gathering

input from internal and external customers and engaging with scientific leader, HCPs, Patients, patient advocacy, and payors, she innovates

solutions, shape and articulate our vision, and generate buy-in across an enterprise. From August 2019-August 2022, Ms. Goldwater was

a Director of Global Marketing for Merck & Co., Inc. (across two product lines), and from December 2022 to present, she has been

a USA Marketing, Senior Director of Marketing for Endocrinology for Recordati Rare Diseases, Inc. The Board and Company believe that

Ms. Goldwater is qualified to serve as a Director due to her long term experience as a high level marketing executive.

Mauro

Penella, President AgriFORCE Brands

Mr.

Pennella is a consumer products veteran with more than 30 years of experience in the consumer-packaged goods industry. From May 2018

until January 2021, he was Chief Growth & Sustainability Officer at McCain Foods, a Canadian multinational frozen food company. In

that role, he was responsible for global marketing, sales, research and development (R&D) and sustainability. From October 2014 to

April 2018, Mr. Pennella served as the President, International of Combe Incorporated, a personal care products company where he oversaw

the international division, R&D and the internal advertising agency. He was also a member of the Executive Committee at Combe Incorporated,

where he was responsible for the P&L—overseeing eight subsidiaries with more than 100 employees around the world. Prior to

that, Mr. Pennella led the Retail and International businesses at Conagra’s Lamb Weston division and developed his career at Diageo

and Procter & Gamble. Mr. Pennella received a Master of Business from Audencia, a premier European business school, as well as an

M.A.B.A. in Marketing and Finance from The Ohio State University Fisher College of Business.

Our

philosophy as to the structure of our management team is a follows:

| Employee

Title |

|

Description

of Employee Duties and Responsibilities |

| |

|

|

| Chief

Executive Officer (Jolie Kahn) |

|

The

Chief Executive Officer in partnership with the Board, is responsible for the success of the organization, making high-level decisions

about the Company’s policies and strategy. Together, the Board and CEO assure the accomplishment of the Company’s vision

and mission, and the accountability of the Company to its stakeholders and shareholders. The Board delegates responsibility for management

and day-to-day operations to the CEO, and he has the authority to carry out these responsibilities, in accordance with the direction

and policies established by the Board. |

| |

|

|

| Chief

Financial Officer (Richard Wong) |

|

As

a key member of the Executive team, the CFO reports to the CEO and assumes an overall strategic role in the Company. The CFO participates

in driving the organization towards achieving its objectives whilst building the Finance and Administration function by demonstrating

ethical leadership and business integrity. The CFO will ensure risk management is put in place with responsibility over internal

controls to ensure transactions are done to prevent fraud while being cost efficient. In so doing, the incumbent will balance short

term concerns and pressures, such as managing cash, liquidity and profitability with long-term vision and sustainable Company success.

The CFO will work closely with the CEO and the rest of the Executive team to drive and manage change and innovation in a quickly

evolving and changing industry landscape whilst fulfilling stewardship responsibilities. In so doing the CFO will ensure effective

compliance and control and respond to regulatory developments and financial reporting obligations. Directly responsibility includes

accounting, finance, forecasting, costing, property management, deal analysis and negotiations, compliance, financing and capital

markets activities. |

| |

|

|

| President

AgriFORCE Brands & Chief Marketing Officer (Mauro Penella) |

|

Reporting

to the CEO, the President of AgriFORCE Brands Division and CMO of AgriFORCE is responsible

for developing and executing a clearly defined commercial strategy, including branding, competitive

positioning and M&A to leverage the AgriFORCE cultivation IP and solutions across multiple

agriculture verticals which include foods, plant based proteins, cannabis, plant based nutraceuticals

and plant based vaccines; in a manner that supports consistent business growth, robust financial

returns and establishes brand equity and awareness to provide consumers and businesses more

sustainable and better-quality products and ingredients.

This

position is responsible for strategy, planning, organizing, staffing, training and managing all functions to achieve the Company’s

objectives of sales, growth, profitability, and visibility while ensuring a consistent marketing message and position consistent

with the corporate direction across all of the Company’s brands and or offerings. |

Code

of Business Conduct and Ethics

We

have adopted a Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal

accounting officer or controller or persons performing similar functions and also to other employees. Our Code of Business Conduct and

Ethics can be found on the Company’s website at www.agriforcegs.com.

Family

Relationships

None.

Involvement

in Certain Legal Proceedings

During

the past ten years, none of our officers, directors, promoters or control persons have been involved in any legal proceedings as described

in Item 401(f) of Regulation S-K.

Term

of Office

Our

Board of Directors is comprised of five directors, of which all five seats are currently occupied, and all directors will serve until

the 2025 annual meeting of shareholders (if reelected) and until their respective successors have been duly elected and qualified, or

until such director’s earlier resignation, removal or death. All officers serve at the pleasure of the Board.

Director

Independence

Amy Griffith, Richard Levychin, John

Meekison and Elaine Goldwater are “independent” directors based on the definition of independence in the listing standards

of the NASDAQ Stock Market LLC (“NASDAQ”).

Committees

of the Board of Directors

Our

Board has established three standing committees: an audit committee, a nominations and corporate governance committee, and a compensation

committee, which are described below. Members of these committees are elected annually at the regular board meeting held in conjunction

with the annual stockholders’ meeting. The charter of each committee is available on our website at www.agriforcegs.com.

Audit

Committee

The

Audit Committee members are currently John Meekison and Amy Griffith, with Richard Levychin as Chairman. The Audit Committee has

authority to review our financial records, deal with our independent auditors, recommend to the Board policies with respect to financial

reporting, and investigate all aspects of our business. All of the members of the Audit Committee currently satisfy the independence

requirements and other established criteria of NASDAQ.

The

Audit Committee Charter is available on the Company’s website at http://www.agriforcegs.com/. The Audit Committee has sole authority

for the appointment, compensation and oversight of the work of our independent registered public accounting firm, and responsibility

for reviewing and discussing with management and our independent registered public accounting firm our audited consolidated financial

statements included in our Annual Report on Form 10-K, our interim financial statements and our earnings press releases. The Audit Committee

also reviews the independence and quality control procedures of our independent registered public accounting firm, reviews management’s

assessment of the effectiveness of internal controls, discusses with management the Company’s policies with respect to risk assessment

and risk management and will review the adequacy of the Audit Committee charter on an annual basis.

Nominating

and Governance and Strategy Committee

The

Nominating and Corporate Governance Committee members are currently Elaine Goldwater and Richard Levychin, with Amy Griffith as Chairman.

The Nominating and Corporate Governance Committee has the following responsibilities: (a) setting qualification standards for director

nominees; (b) identifying, considering and nominating candidates for membership on the Board; (c) developing, recommending and evaluating

corporate governance standards and a code of business conduct and ethics applicable to the Company; (d) implementing and overseeing a

process for evaluating the Board, Board committees (including the Committee) and overseeing the Board’s evaluation of the Chairman

and Chief Executive Officer of the Company; (e) making recommendations regarding the structure and composition of the Board and Board

committees; (f) advising the Board on corporate governance matters and any related matters required by the federal securities laws; and

(g) assisting the Board in identifying individuals qualified to become Board members; recommending to the Board the director nominees

for the next annual meeting of shareholders; and recommending to the Board director nominees to fill vacancies on the Board.

The

Nominating and Governance Committee Charter is available on the Company’s website at http://www.agriforcegs.com/. The Nominating

and Governance Committee determines the qualifications, qualities, skills, and other expertise required to be a director and to develop,

and recommend to the Board for its approval, criteria to be considered in selecting nominees for director (the “Director Criteria”);

identifies and screens individuals qualified to become members of the Board, consistent with the Director Criteria. The Nominating and

Governance Committee considers any director candidates recommended by the Company’s shareholders pursuant to the procedures described

in the Company’s proxy statement, and any nominations of director candidates validly made by shareholders in accordance with applicable

laws, rules and regulations and the provisions of the Company’s charter documents. The Nominating and Governance Committee makes

recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a shareholder vote

at the Annual Meeting of shareholders, subject to approval by the Board.

Compensation

Committee

The

Compensation Committee oversees our executive compensation and recommends various incentives for key employees to encourage and reward

increased corporate financial performance, productivity and innovation. Its members are currently John Meekison as Chairman, Elaine

Goldwater and Amy Griffith. All of the members of the Compensation Committee currently satisfy

the independence requirements and other established criteria of NASDAQ.

The

Compensation Committee Charter is available on the Company’s website at http://www.agriforcegs.com/. The Compensation Committee

is responsible for: (a) assisting our Board in fulfilling its fiduciary duties with respect to the oversight of the Company’s compensation

plans, policies and programs, including assessing our overall compensation structure, reviewing all executive compensation programs,

incentive compensation plans and equity-based plans, and determining executive compensation; and (b) reviewing the adequacy of the Compensation

Committee charter on an annual basis. The Compensation Committee, among other things, reviews and approves the Company’s goals

and objectives relevant to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer’s performance

with respect to such goals, and set the Chief Executive Officer’s compensation level based on such evaluation. The Compensation

Committee also considers the Chief Executive Officer’s recommendations with respect to other executive officers and evaluates the

Company’s performance both in terms of current achievements and significant initiatives with long-term implications. It assesses

the contributions of individual executives and recommend to the Board levels of salary and incentive compensation payable to executive

officers of the Company; compares compensation levels with those of other leading companies in similar or related industries; reviews

financial, human resources and succession planning within the Company; recommend to the Board the establishment and administration of

incentive compensation plans and programs and employee benefit plans and programs; recommends to the Board the payment of additional

year-end contributions by the Company under certain of its retirement plans; grants stock incentives to key employees of the Company

and administer the Company’s stock incentive plans; and reviews and recommends for Board approval compensation packages for new

corporate officers and termination packages for corporate officers as requested by management.

Changes

in Nominating Procedures

None.

Board

Leadership Structure and Role in Risk Oversight

Although

we have not adopted a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined, we

traditionally determined that it is in the best interests of the Company and its shareholders to no longer combine these roles and currently

these roles are separated.

Our

Board is primarily responsible for overseeing our risk management processes. The Board receives and reviews periodic reports from management,

auditors, legal counsel, and others, as considered appropriate regarding the Company’s assessment of risks. The Board focuses on

the most significant risks facing the Company and our general risk management strategy, and also ensures that risks undertaken by us

are consistent with the Board’s risk parameters. While the Board oversees the Company, our management is responsible for day-to-day

risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing

the Company and that our board leadership structure supports this approach.

Compliance

with Section 16(a) of the Exchange Act

Section

16(a) of Exchange Act requires our executive officers and directors and persons who beneficially own more than 10% of a registered class

of our equity securities to file with the Commission initial statements of beneficial ownership, statements of changes in beneficial

ownership and annual statement of changes in beneficial ownership with respect to their ownership of the Company’s securities,

on Form 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the Securities and Exchange

Commission regulations to furnish our Company with copies of all Section 16(a) reports they file.

Based

solely on our review of the copies of such reports received by us, and on written representations by our officers and directors regarding

their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act and without conducting any independent

investigation of our own, we believe that with respect to the fiscal year ended December 31, 2020, our officers and directors, and all

of the persons known to us to beneficially own more than 10% of our common stock filed all required reports on a timely basis.

EXECUTIVE

COMPENSATION

Executive

Compensation for our named executive officers as of December 31, 2023:

| Name &

Principal Position | |

Year | | |

Salary | | |

Bonus | | |

Share-Based

Awards | | |

Option-Based

Awards | | |

All

Other Compensation | | |

Total

Compensation | |

| Richard S. Wong, | |

2023 | | |

| 264,041 | | |

| - | | |

| 179,004 | | |

| 42,148 | | |

| 1,793 | | |

| 486,986 | |

| Chief Financial Officer | |

2022 | | |

| 295,216 | | |

| 134,696 | a | |

| 86,456 | | |

| 28,831 | | |

| 1,741 | | |

| 546,940 | |

| Mauro Pennella | |

2023 | | |

| 259,317 | | |

| - | | |

| 158,105 | | |

| 25,544 | | |

| 1,793 | | |

| 444,759 | |

| Chief Marketing Officer, President

AgriFORCE™ Brands | |

2022 | | |

| 268,962 | | |

| - | | |

| 115,269 | | |

| 45,593 | | |

| 1,741 | | |

| 431,565 | |

| Troy T. McClellan, | |

2023 | | |

| 231,755 | | |

| - | | |

| 74,091 | | |

| - | | |

| 1,656 | | |

| 307,502 | |

| Former President Design &

Construction | |

2022 | | |

| 246,732 | | |

| 69,162 | b | |

| 76,846 | | |

| 30,132 | | |

| 1,741 | | |

| 424,613 | |

| Ingo W. Mueller, | |

2023 | | |

| 289,025 | | |

| - | | |

| 86,744 | | |

| - | | |

| - | | |

| 375,769 | |

| Former Chief Executive Officer | |

2022 | | |

| 392,464 | | |

| 375,718 | | |

| 359,881 | | |

| 6,866 | | |

| 1,741 | | |

| 1,136,670 | |

| (a) |

Bonus

was paid out $101,022 in shares and $33,674 in cash. |

| (b) |

Bonus

was paid out $69,162 in shares |

| (c) |

Some

share-based awards were issued net of income taxes. The Company repurchased shares on the issuance date to remit as income taxes

to the appropriate government revenue service agencies. |

Employment

and Related Agreements

Except

as set forth below, we currently have no other written employment agreements with any of our officers and directors as of December 31,

2023. The following is a description of our current executive employment agreements:

Agreements

with Our Named Executive Officers

We

have entered into written employment agreements with each of our named executive officers, as described below. Each of our named executive

officers has also executed our standard form of confidential information and invention assignment agreement.

Employment

Agreement with Richard Wong

Effective

August 1, 2021, the Board of Directors of AgriFORCE Growing Systems, Ltd. (the “Company”) entered into a new employment agreement

with Richard Wong that continues unless and until such employment is terminated by either party pursuant to the terms of the agreement,

as its Chief Executive Officer. Under the terms of this agreement, Mr. Wong is entitled to an annual base salary of CDN $339,406 per

year, and is subject to annual reviews where the Company at its discretion may increase, but not decrease, Mr. Wong’s base salary

each year. Mr. Wong shall also receive on an annual basis, payable quarterly in arrears on the last trading day of each calendar quarter,

$112,505 CAD of common shares of the Company, at a price per share equal to the volume weighted average price of a common share

of the Company listed on the Nasdaq Capital Market for the five trading days preceding the date of issuance, The employment agreement

also entitles Mr. Wong to, among other benefits, the following compensation: (i) eligibility to receive an annual cash bonus of 30% of

base salary at target and up to 100% of base salary based on performance targets established by the Board from time to time; (ii) an

opportunity to participate in any stock option, performance share, performance unit or other equity based long-term incentive compensation

plan commensurate with the terms and conditions applicable to other senior executive officers and (iii) participation in health benefit

plans, practices, policies and programs provided by the Company and its affiliated companies (including, without limitation, medical,

prescription, dental, disability, employee life, group life, accidental death and travel accident insurance plans and programs) to the

extent available to our other senior executive officers. Mr. Wong will be entitled to receive 15% of the new options to be allocated

upon the exercise of the current granted options. These options shall be granted at the IPO price and as soon as practicable. Based on

current recommendations from management it is expected that the number of options to be granted to Wong as of the effective date of this

agreement, will be approximately 114,000 to be vested over 3 years.

Pursuant

to the employment, regardless of the manner in which Wong’s service terminates, each executive officer is entitled to receive amounts

earned during his term of service, including salary, other benefits. In addition, each of them is eligible to receive certain benefits

pursuant to his agreement with us described above.

The

Company is permitted to terminate the employment of Mr. Wong, for the following reasons: (1) death, (2) Termination for Cause (as defined

below) or (3) for no reason. The employment of Mr. Wong automatically terminates upon determination of permanent disability, provided

that the disability renders the executive officer incapable of performing his or her duty.

Each

officer is permitted Termination for Good Reason (as defined below) of such officer’s employment. In addition, each such officer

may terminate his or her employment upon written notice to the Company 30 days prior to the effective date of such termination. In the

event of such officer’s Termination for Cause by the Company or the termination of such officer’s employment as a result

of such officer’s resignation other than a Termination for Good Reason, such officer shall be provided certain benefits provided

in the employment agreement and payment of all accrued and unpaid compensation and wages, but such officer shall have no right to compensation

or benefits for any period subsequent to the effective date of termination. In the event of such officer’s termination without

Cause, the officer shall be entitled to severance in lieu of notice equal to six months of the then base salary, benefits continuation

for a period of three months following the termination date and payment of any outstanding and accrued vacation pay and expenses, as

applicable.

Under

the employment agreements, “Cause” means: any material breach of the employment agreement, and any act, omission, behavior,

conduct or circumstance of the Executive that constitutes just cause for dismissal of the Executive at common law, including an act involving

gross negligence, or willful misconduct, commission or a felony, becoming bankrupt, or any material omission in the performance of Services,

or the doing or condoning any unlawful or manifestly improper act. “Good Reason” means: (i) a material reduction in Executive’s

salary or benefits (excluding the substitution of substantially equivalent compensation and benefits), other than as a result of a reduction

in compensation affecting employees of the Company, or its successor entity, generally; (ii) a material diminution in Executive’s

duties or responsibilities, provided however, that, a mere change in title or reporting relationship alone shall not constitute “Good

Reason;” or (iii) relocation of Executive’s place of employment to a location more than 50 miles from the Company’s

office location.

If

within twelve (12) months following a change of control (as defined in the employment agreement), the officer’s employment is terminated

(1) involuntarily by the Company other than for Cause, (2) death, or (3) by such officer pursuant to a Voluntary Termination for Good

Reason, and such officer executes and does not revoke a general release of claims against the Company and its affiliates in a form acceptable

to the Company, then the Company shall provide such officer with, among other benefits:

| |

1. |

a

lump sum payment in the amount equal to twelve months of the then Base Salary; |

| |

2. |

any

outstanding Vacation pay as at the Effective Date of Termination; |

| |

3. |

any

outstanding Expenses as at the Effective Date of Termination; and |

| |

4. |

maintain

the Executive’s then Group Benefits for a period of three months from the Effective Date of Termination. |

Employment

Agreement with Mauro Penella

On

July 15, 2021, the Company entered into an employment agreement with Mr. Pennella that continues unless and until such employment is

terminated by either party pursuant to the terms of the agreement. Under the terms of this agreement, Mr. Pennella is entitled to an

annual base salary of CDN$350,000 beginning on July 15, 2021, and is subject to annual reviews where the Company at its discretion may

increase, but not decrease, Mr. Pennella’s base salary each year. Mr. Pennella shall also receive on an annual basis, payable quarterly

in arrears on the last trading day of each calendar quarter, $150,000 of common shares of the Company, at a price per share equal to

the volume weighted average price of a common share of the Company listed on the Nasdaq Capital Market for the five trading days preceding

the date of issuance, The employment agreement also entitles Mr. Pennella to, among other benefits, the following compensation: (i) eligibility

to receive an annual cash bonus of up to 100% of base salary; based on performance targets established by the Board from time to time

at the sole discretion of the Board and as determined by the Compensation Committee once established or otherwise by the Board commensurate

with the policies and practices applicable to other senior executive officers of the Company; (ii) an opportunity to participate in any

stock option, performance share, performance unit or other equity based long-term incentive compensation plan commensurate with the terms

and conditions applicable to other senior executive officers and (iii) participation in health benefit plans, practices, policies and

programs provided by the Company and its affiliated companies (including, without limitation, medical, prescription, dental, disability,

employee life, group life, accidental death and travel accident insurance plans and programs) to the extent available to our other senior

executive officers.

Pursuant

to the employment, regardless of the manner in which Pennella’s service terminates, each executive officer is entitled to receive

amounts earned during his term of service, including salary, other benefits. In addition, each of them is eligible to receive certain

benefits pursuant to his agreement with us described above.

The

Company is permitted to terminate the employment of Mr. Pennella, for the following reasons: (1) death, (2) Termination for Cause (as

defined below) or (3) for no reason. The employment of Mr. Pennella automatically terminates upon determination of permanent disability,

provided that the disability renders the executive officer incapable of performing his or her duty.

Each

officer is permitted Termination for Good Reason (as defined below) of such officer’s employment. In addition, each such officer

may terminate his or her employment upon written notice to the Company 30 days prior to the effective date of such termination. In the

event of such officer’s Termination for Cause by the Company or the termination of such officer’s employment as a result

of such officer’s resignation other than a Termination for Good Reason, such officer shall be provided certain benefits provided

in the employment agreement and payment of all accrued and unpaid compensation and wages, but such officer shall have no right to compensation

or benefits for any period subsequent to the effective date of termination. In the event of such officer’s termination without

Cause, the officer shall be entitled to severance in lieu of notice equal to six months of the then base salary, benefits continuation

for a period of three months following the termination date and payment of any outstanding and accrued vacation pay and expenses, as

applicable.

Under

the employment agreements, “Cause” means: any material breach of the employment agreement, and any act, omission, behavior,

conduct or circumstance of the Executive that constitutes just cause for dismissal of the Executive at common law, including an act involving

gross negligence, or willful misconduct, commission or a felony, becoming bankrupt, or any material omission in the performance of Services,

or the doing or condoning any unlawful or manifestly improper act. “Good Reason” means: (i) a material reduction in Executive’s

salary or benefits (excluding the substitution of substantially equivalent compensation and benefits), other than as a result of a reduction

in compensation affecting employees of the Company, or its successor entity, generally; (ii) a material diminution in Executive’s

duties or responsibilities, provided however, that, a mere change in title or reporting relationship alone shall not constitute “Good

Reason;” or (iii) relocation of Executive’s place of employment to a location more than 50 miles from the Company’s

office location.

If

within twelve (12) months following a change of control (as defined in the employment agreement), the officer’s employment is terminated

(1) involuntarily by the Company other than for Cause, (2) death, or (3) by such officer pursuant to a Voluntary Termination for Good

Reason, and such officer executes and does not revoke a general release of claims against the Company and its affiliates in a form acceptable

to the Company, then the Company shall provide such officer with, among other benefits:

| |

1. |

a

lump sum payment in the amount equal to twelve months of the then Base Salary; |

| |

2. |

any

outstanding Vacation pay as at the Effective Date of Termination; |

| |

3. |

any

outstanding Expenses as at the Effective Date of Termination; and |

| |

4. |

maintain

the Executive’s then Group Benefits for a period of three months from the Effective Date of Termination. |

Outstanding

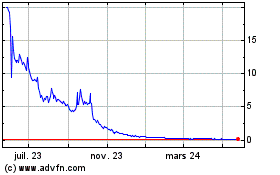

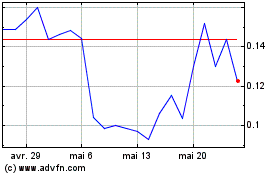

Equity Awards at December 31, 2023

| Name | |

Number

of securities underlying unexercised options (#) exercisable | | |

Number

of securities underlying unexercised options (#) unexercisable | | |

Equity

incentive plan awards: Number of securities underlying unexercised unearned options (#) | | |

Option

exercise price ($) | | |

Option

expiration date |

| Richard

S. Wong | |

| 476 | | |

| 477 | | |

| - | | |

| 57.00 | | |

18-Nov-27 |

| Richard S.

Wong | |

| 722 | | |

| - | | |

| - | | |

| 237.50 | | |

30-Jun-26 |

| Richard S.

Wong | |

| 1,303 | | |

| 202 | | |

| - | | |

| 350.00 | | |

31-May-26 |

| Richard S.

Wong | |

| 4,567 | | |

| 13,701 | | |

| - | | |

| 4.50 | | |

12-Sept-28 |

| Troy T. McClellan

(former President) | |

| 500 | | |

| 496 | | |

| - | | |

| 57.00 | | |

18-Nov-27 |

| Troy T. McClellan

(former President) | |

| 511 | | |

| - | | |

| - | | |

| 237.50 | | |

30-Jun-26 |

| Troy T. McClellan

(former President) | |

| 920 | | |

| 189 | | |

| - | | |

| 350.0 | | |

31-May-26 |

| Mauro Pennella | |

| 752 | | |

| 755 | | |

| - | | |

| 57.00 | | |

18-Nov-27 |

| Mauro Pennella | |

| 768 | | |

| 8,304 | | |

| - | | |

| 4.50 | | |

12-Sept-28 |

Directors’

Compensation

The

following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2023

awarded to, earned by or paid to our directors. The value attributable to any warrant awards reflects the grant date fair values of stock