GEN Restaurant Group, Inc. (“GEN” or the “Company”), owner of GEN

Korean BBQ, a fast-growing cook-it-yourself casual dining concept,

today announced financial results for the fourth quarter and year

ended December 31, 2023.

Highlights for the Fourth quarter ended

December 31, 2023 were as follows:

- Revenue increased 10.4% to $45.1 million, compared to $40.8

million in the fourth quarter of 2022;

- Comparable restaurant sales decreased 1.7% as compared to the

fourth quarter in 2022;

- Income from operations was $(0.9) million and (2.0)% of

revenue;

- Restaurant-level adjusted EBITDA(1) was $7.2 million and 16.0%

of revenue;

- Net Income (loss) was $(0.2) million and (0.4%) of

revenue;

- Adjusted EBITDA(1) was $1.6 million and 3.6% of revenue

inclusive of pre-opening expense of approximately $1.2

million.

(1) Adjusted EBITDA and restaurant-level

adjusted EBITDA are non-GAAP measures. For reconciliations of

adjusted EBITDA and restaurant-level adjusted EBITDA to the most

directly comparable GAAP measure see the accompanying financial

tables. For definitions and a discussion of why we consider them

useful, see “Non-GAAP Measures” below.

David Kim, Co-Chief Executive Officer of GEN

Restaurant Group, Inc., stated, “We accomplished much during our

first year as a public company, from achieving record revenues of

$181 million during 2023, representing growth of over 10% year over

year, and successfully opening six new restaurants, to completing

the integration of two operating companies and the transition to

Sysco as our distribution partner. Through the investments we made

in our people during the fourth quarter, we now have a solid

foundation to create great guest experiences and drive further

growth for GEN Korean BBQ as we add new restaurants throughout the

country. Coupled with the attractive new unit economics that are

among the best in the industry, we look forward to capturing the

immense opportunities ahead and enhancing long-term shareholder

value."

Fourth Quarter 2023 Financial

Results

Revenue was $45.1 million in the fourth quarter of

2023 compared to $40.8 million in the fourth quarter of 2022.

Comparable restaurant sales decreased 1.7% in the fourth quarter of

2023 compared to the same period last year.

Total restaurant operating expenses before

pre-opening expenses as a percentage of revenue increased by 368

basis points to 87.2% in the fourth quarter of 2023 from 83.5% in

the fourth quarter of 2022 primarily driven by the following:

- Cost of goods sold decreased 17 basis points primarily due to

more favorable year-over-year commodity pricing and ongoing

negotiations with our vendors.

- Payroll and benefits increased 90 basis points due to increases

in minimum wage rates in certain markets in which we operate,

short-term higher labor costs in newly open restaurants as we train

staff and management, increases in managers in training in

preparation for our ramp up in new restaurant development and

incremental integration cost of the two operating companies.

- Occupancy costs increased 89 basis points primarily due to six

new restaurant openings since the third quarter of 2022, including

openings on the strip in Las Vegas and New York, which are higher

rent markets.

- Other operating costs increased 176 basis points resulting from

standardizing equipment and supplies post IPO across all

locations.

- Depreciation and amortization increased 31 basis points.

- Restaurant pre-opening expenses increased to $1.6 million for

the fourth quarter of 2023 from $0.5 million in the fourth quarter

of 2022 due to the timing of new store openings.

General and administrative expenses increased by

$2.8 million to $5.1 million for the fourth quarter of 2023. As a

percentage of revenues, general and administrative expenses were

approximately 11.3% in the fourth quarter of 2023.

Net income (loss) was $(0.2) million and (0.4%) of

revenue for the fourth quarter of 2023.

Adjusted EBITDA was $1.6 million and 3.6% of

revenue inclusive of pre-opening expense of approximately $1.2

million for the fourth quarter of 2023.

2023 Financial Results

Revenue was $181.0 million in 2023 compared to

$163.7 million in 2022. Comparable restaurant sales increased 0.6%

in 2023 compared to last year.

Total restaurant operating expenses before

pre-opening expenses as a percentage of revenue increased 212 basis

points to 84.4% in 2023 from 82.2% in 2022 primarily driven by the

following:

- Cost of goods sold decreased 98 basis point primarily due to

more favorable year-over-year commodity pricing and ongoing

negotiations with our vendors.

- Payroll and benefits increased 158 basis points due to

increases in minimum wage rates in certain markets in which we

operate, short-term higher labor costs in newly open restaurants as

we train staff and management, and increases in managers in

training in preparation for our ramp up in new restaurant

development.

- Occupancy costs increased 70 basis points primarily due to six

new restaurant openings since the third quarter of 2022, including

openings on the strip in Las Vegas and New York, which are higher

rent markets.

- Other operating costs increased 80 basis points resulting from

standardizing equipment and supplies across all locations following

the initial public offering.

- Depreciation and amortization increased 2 basis points.

- Restaurant pre-opening expenses increased to $3.7 million for

2023 from $1.5 million in 2022 due to the timing of new store

openings.

General and administrative expenses increased by

$4.9 million to $12.9 million for 2023. As a percentage of

revenues, general and administrative expenses were approximately

7.1% in 2023.

Net income (loss) was $11.4 million and 6.3% of

revenue.

Adjusted EBITDA was $18.8 million and 10.4% of

revenue inclusive of pre-opening expense of approximately $2.6

million.

The following definitions apply to terms

as used in this release:

Comparable restaurant sales

refers to the change in period-over-period sales for the comparable

restaurant base. We include restaurants in the comparable

restaurant base that have been in operation for at least 12 full

months prior to the accounting period presented. Once a restaurant

has been open 12 full months, it must have had continuous

operations during both the current period and the prior year period

being measured to remain a comparable restaurant. If operations

were to be substantially impacted by unusual events that closed the

location or significantly changed its capacity, that location is

excluded from the comparable sales calculation until it has been

operating continuously under normal conditions for both the current

period and the prior year comparison period.

Payback Period refers to the

number of years required to recover the original cash

investment.

Total restaurant operating

expenses includes food cost, payroll & benefits,

occupancy, operating, depreciation and amortization, and

pre-opening costs.

Non-GAAP Measures

Restaurant-level adjusted EBITDA

represents income (loss) from operations plus adjustments to

add-back the following expenses: depreciation and amortization,

pre-opening costs, general and administrative expenses, related

party consulting fees, management fees and non-cash lease expense.

Management believes that restaurant-level adjusted EBITDA is useful

to investors because this measure highlights trends in our core

business that may not otherwise be apparent to investors when

relying solely on GAAP financial measures and enabling investors to

more effectively compare the Company’s performance to prior and

future periods.

Adjusted EBITDA represents net

income (loss) before net interest expense, income taxes,

depreciation and amortization, and consulting fees paid to a

related party and we also exclude non-recurring items, such as

stock-based compensation expense, gain on extinguishment of debt,

and Restaurant Revitalization Fund, or RRF, grants, employee

retention credits, litigation accruals, aborted deferred IPO costs

written off, non-cash lease expenses and non-cash lease expense

related to pre-opening costs. Management believes that

restaurant-level adjusted EBITDA is useful to investors because

this measure highlights trends in our core business that may not

otherwise be apparent to investors when relying solely on GAAP

financial measures and enabling investors to more effectively

compare the Company’s performance to prior and future periods .

Conference Call

The Company will host a conference call to discuss

financial results for the fourth quarter of 2023 today at 5:00 p.m.

Eastern Time. David Kim, Co-Chief Executive Officer, and Tom Croal,

Chief Financial Officer, will host the call.

The conference call can be accessed live over the

phone by dialing 201-689-8263. A replay will be available after the

call and can be accessed by dialing 412-317-6671; the passcode is

13744531. The replay will be available until Wednesday, March 13,

2024.

The conference call will also be webcast live from

the Company’s corporate website at www.genkoreanbbq.com under the

Investor section. An archive of the webcast will be available on

the Company’s corporate website shortly after the call has

concluded.

About GEN Restaurant Group,

Inc.

GEN Korean BBQ is a fast-growing cook-it-yourself

casual dining concept with 37 locations in 7 states. The Company

offers guests a unique dining experience where guests serve as

their own chefs preparing meals on embedded grills in the center of

each table. The extensive menu consists of traditional Korean and

Korean-American food, including high-quality meats, poultry,

seafood and mixed vegetables. With its unique culinary experience

alongside its modern décor and lively atmosphere, GEN Korean BBQ

delivers an engaging and interactive dining experience. For more

information, please visit GEN’s website at

www.genkoreanbbq.com.

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements may be identified by the use

of words such as “believe,” “intend,” “expect”, “will,” “may”, and

other similar words or expressions that predict or indicate future

events. All statements that are not statements of historical fact

are forward-looking statements, including any statements regarding

our strategy, future operations, and growth prospects, any

statements regarding future economic conditions or performance, any

statements of belief or expectation, and any statements of

assumptions underlying any of the foregoing or other future events.

Forward-looking statements are based on current information

available at the time the statements are made and on management’s

reasonable belief or expectations with respect to future events,

and are subject to risks and uncertainties, many of which are

beyond the Company’s control, that could cause actual performance

or results to differ materially from the belief or expectations

expressed in or suggested by the forward-looking statements.

Additional factors or events that could cause actual results to

differ may also emerge from time to time, and it is not possible

for the Company to predict all of them. Forward-looking statements

speak only as of the date on which they are made, and the Company

undertakes no obligation to update any forward-looking statement to

reflect future events, developments or otherwise, except as may be

required by applicable law. Investors are referred to the Company’s

Registration Statement on Form S-1(File No. 333-272253), as

amended, and in our subsequent filings with the Securities and

Exchange Commission (“SEC”), which are available on the SEC’s

website at www.sec.gov, for additional information regarding the

risks and uncertainties that may cause actual results to differ

materially from those expressed in any forward-looking

statement.

Investor Relations

Jeff Priester (332) 242-4370

investor@genbbqoffice.com

| |

| GEN

RESTAURANT GROUP Condensed Consolidated Income

Statements (in thousands, except per share

amounts; unaudited) |

| |

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| (in

thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited) |

|

|

|

|

|

Revenue |

|

$ |

45,108 |

|

|

$ |

40,849 |

|

|

$ |

181,007 |

|

|

$ |

163,729 |

|

|

Restaurant operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Food cost |

|

|

14,707 |

|

|

|

13,389 |

|

|

|

58,322 |

|

|

|

54,357 |

|

|

Payroll and benefits |

|

|

14,470 |

|

|

|

12,738 |

|

|

|

56,889 |

|

|

|

48,866 |

|

|

Occupancy expenses |

|

|

3,777 |

|

|

|

3,058 |

|

|

|

14,653 |

|

|

|

12,110 |

|

|

Operating expenses |

|

|

5,035 |

|

|

|

3,841 |

|

|

|

18,043 |

|

|

|

15,019 |

|

|

Depreciation and amortization |

|

|

1,332 |

|

|

|

1,080 |

|

|

|

4,808 |

|

|

|

4,314 |

|

|

Pre-opening Costs |

|

|

1,557 |

|

|

|

480 |

|

|

|

3,680 |

|

|

|

1,455 |

|

|

Total restaurant operating expenses |

|

|

40,878 |

|

|

|

34,586 |

|

|

|

156,395 |

|

|

|

136,121 |

|

|

General and administrative |

|

|

5,115 |

|

|

|

2,267 |

|

|

|

12,937 |

|

|

|

7,988 |

|

|

Consulting fees - related party |

|

|

- |

|

|

|

- |

|

|

|

2,325 |

|

|

|

4,897 |

|

|

Management fees |

|

|

- |

|

|

|

587 |

|

|

|

1,176 |

|

|

|

2,332 |

|

|

Depreciation and amortization - corporate |

|

|

26 |

|

|

|

16 |

|

|

|

84 |

|

|

|

39 |

|

|

Total costs and expenses |

|

|

46,019 |

|

|

|

37,456 |

|

|

|

172,917 |

|

|

|

151,377 |

|

|

Income from operations |

|

|

(911 |

) |

|

|

3,393 |

|

|

|

8,090 |

|

|

|

12,352 |

|

|

Gain on extinguishment of PPP debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

387 |

|

|

Employee retention credits |

|

|

— |

|

|

|

949 |

|

|

|

2,483 |

|

|

|

3,532 |

|

|

Deferred IPO costs - aborted |

|

|

— |

|

|

|

(4,036 |

) |

|

|

— |

|

|

|

(4,036 |

) |

|

Other income (loss) |

|

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

(835 |

) |

|

Interest income (expense), net |

|

|

553 |

|

|

|

(195 |

) |

|

|

347 |

|

|

|

(634 |

) |

|

Equity in income of equity method investee |

|

|

16 |

|

|

|

44 |

|

|

|

535 |

|

|

|

966 |

|

|

Net income before income taxes |

|

|

(342 |

) |

|

|

175 |

|

|

|

11,455 |

|

|

|

11,732 |

|

|

Provision for income taxes |

|

|

149 |

|

|

|

— |

|

|

|

(21 |

) |

|

|

— |

|

|

Net income |

|

|

(193 |

) |

|

|

175 |

|

|

|

11,434 |

|

|

|

11,732 |

|

|

Less: Net Income attributable to noncontrolling interest |

|

|

(169 |

) |

|

|

384 |

|

|

|

3,028 |

|

|

|

1,451 |

|

|

Net income attributable to Gen Restaurant Group, Inc. |

|

|

(24 |

) |

|

|

(209 |

) |

|

|

8,406 |

|

|

|

10,281 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Class A common stock per share - basic

and diluted (1) |

|

$ |

(24 |

) |

|

|

— |

|

|

$ |

324 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares of Class A common stock outstanding - basic

(1) |

|

|

4,140 |

|

|

|

— |

|

|

|

4,140 |

|

|

|

— |

|

|

Weighted-average shares of Class A common stock outstanding -

diluted (2) |

|

|

4,233 |

|

|

|

— |

|

|

|

4,233 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share of Class A common stock - basic |

|

$ |

(0.01 |

) |

|

|

— |

|

|

$ |

0.08 |

|

|

|

— |

|

|

Net income per share of Class A common stock - diluted |

|

$ |

(0.01 |

) |

|

|

— |

|

|

$ |

0.08 |

|

|

|

— |

|

| (1) (2) Basic and

diluted net loss per Class A common stock is presented only for the

period after the Company's organizational transactions. |

|

| |

| GEN

RESTAURANT GROUP Selected Balance Sheet Data and

Selected Operating Data (in thousands, except

restaurants and percentages; unaudited) |

| |

|

|

|

Twelve months ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

(amounts in thousands) |

|

(unaudited) |

|

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

32,631 |

|

|

$ |

11,195 |

|

|

Total assets |

|

$ |

183,870 |

|

|

$ |

138,878 |

|

|

Total liabilities |

|

$ |

146,352 |

|

|

$ |

144,139 |

|

|

Total Stockholders' equity |

|

$ |

36,018 |

|

|

$ |

(6,761 |

) |

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| (in

thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Selected Operating Data |

|

(unaudited) |

|

|

(unaudited) |

|

|

Restaurants at end of period |

|

|

37 |

|

|

|

31 |

|

|

|

37 |

|

|

|

31 |

|

|

Comparable restaurant sales performance |

|

|

-1.7 |

% |

|

n/a |

|

|

|

0.6 |

% |

|

n/a |

|

|

Net income |

|

|

(193 |

) |

|

|

174 |

|

|

|

11,434 |

|

|

|

11,732 |

|

|

Net income margin |

|

|

-0.4 |

% |

|

|

0.4 |

% |

|

|

6.3 |

% |

|

|

7.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

1,645 |

|

|

|

4,985 |

|

|

|

18,848 |

|

|

|

23,958 |

|

|

Adjusted EBITDA margin |

|

|

3.6 |

% |

|

|

12.2 |

% |

|

|

10.4 |

% |

|

|

14.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

(911 |

) |

|

|

3,393 |

|

|

|

8,090 |

|

|

|

12,352 |

|

|

Income from operations margin |

|

|

-2.0 |

% |

|

|

8.3 |

% |

|

|

4.5 |

% |

|

|

7.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant level Adjusted EBITDA |

|

|

7,196 |

|

|

|

7,878 |

|

|

|

33,479 |

|

|

|

33,638 |

|

|

Restaurant level Adjusted EBITDA margin |

|

|

16.0 |

% |

|

|

19.3 |

% |

|

|

18.5 |

% |

|

|

20.5 |

% |

| |

| GEN

RESTAURANT GROUP Reconciliation of Net Income

(Loss) to EBITDA and Adjusted EBITDA (in

thousands; unaudited) |

| |

|

(amounts in thousands) |

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

(193 |

) |

|

$ |

174 |

|

|

$ |

11,434 |

|

|

$ |

11,732 |

|

|

Net Income Margin |

|

|

(0.4 |

)% |

|

|

0.4 |

% |

|

|

6.3 |

% |

|

|

7.2 |

% |

|

Interest income (expense), net |

|

|

(553 |

) |

|

|

195 |

|

|

|

(347 |

) |

|

|

634 |

|

|

Provision for income taxes |

|

|

(149 |

) |

|

|

— |

|

|

|

21 |

|

|

|

— |

|

|

Depreciation and amortization |

|

|

1,358 |

|

|

|

1,096 |

|

|

|

4,892 |

|

|

|

4,353 |

|

|

EBITDA |

|

$ |

463 |

|

|

$ |

1,465 |

|

|

$ |

16,000 |

|

|

$ |

16,719 |

|

|

EBITDA Margin |

|

|

1.0 |

% |

|

|

3.6 |

% |

|

|

8.8 |

% |

|

|

10.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

463 |

|

|

$ |

1,465 |

|

|

$ |

16,000 |

|

|

$ |

16,719 |

|

|

Stock-based compensation expense (1) |

|

|

759 |

|

|

|

— |

|

|

|

1,517 |

|

|

|

— |

|

|

Gain on extinguishment of debt (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(387 |

) |

|

Consulting fees - related party (3) |

|

|

— |

|

|

|

— |

|

|

|

2,325 |

|

|

|

4,897 |

|

|

Employee retention credits (4) |

|

|

— |

|

|

|

(949 |

) |

|

|

(2,483 |

) |

|

|

(3,532 |

) |

|

Litigation accrual (5) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

869 |

|

|

Aborted deferred IPO costs written off |

|

|

|

|

|

4,036 |

|

|

|

— |

|

|

|

4,036 |

|

|

Non-cash lease expense (6) |

|

|

77 |

|

|

|

54 |

|

|

|

379 |

|

|

|

261 |

|

|

Non-cash lease expense related to pre-opening costs (7) |

|

|

346 |

|

|

|

379 |

|

|

|

1,110 |

|

|

|

1,095 |

|

|

Adjusted EBITDA |

|

$ |

1,645 |

|

|

$ |

4,985 |

|

|

$ |

18,848 |

|

|

$ |

23,958 |

|

|

Adjusted EBITDA Margin |

|

|

3.6 |

% |

|

|

12.2 |

% |

|

|

10.4 |

% |

|

|

14.6 |

% |

| |

|

Reconciliation of Income from Operations to

Restaurant-level Adjusted EBITDA (in thousands;

unaudited) |

| |

|

(amounts in thousands) |

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited) |

|

|

|

|

|

Income from Operations |

|

$ |

(911 |

) |

|

$ |

3,393 |

|

|

$ |

8,090 |

|

|

$ |

12,352 |

|

|

Income Margin from Operations |

|

|

(2.0 |

)% |

|

|

8.3 |

% |

|

|

4.5 |

% |

|

|

7.5 |

% |

|

Depreciation and amortization |

|

|

1,358 |

|

|

|

1,096 |

|

|

|

4,892 |

|

|

|

4,353 |

|

|

Pre-opening costs |

|

|

1,557 |

|

|

|

480 |

|

|

|

3,680 |

|

|

|

1,455 |

|

|

General and administrative |

|

|

5,115 |

|

|

|

2,267 |

|

|

|

12,937 |

|

|

|

7,988 |

|

|

Consulting fees - related party |

|

|

- |

|

|

|

— |

|

|

|

2,325 |

|

|

|

4,897 |

|

|

Management Fees |

|

|

- |

|

|

|

587 |

|

|

|

1,176 |

|

|

|

2,332 |

|

|

Non-cash lease expense |

|

|

77 |

|

|

|

54 |

|

|

|

379 |

|

|

|

261 |

|

|

Restaurant-Level Adjusted EBITDA |

|

$ |

7,196 |

|

|

$ |

7,877 |

|

|

$ |

33,479 |

|

|

$ |

33,638 |

|

|

Restaurant-Level Adjusted EBITDA Margin |

|

|

16.0 |

% |

|

|

19.3 |

% |

|

|

18.5 |

% |

|

|

20.5 |

% |

|

(1) |

|

Stock-based compensation expense: During the year ended December

31, 2023, we incurred expenses related to the granting of

Restricted Stock Units ("RSUs") to employees. This was recorded in

General and administrative expense. |

| (2) |

|

Gain on extinguishment of debt:

In the first quarter of 2022, we received loan forgiveness from the

SBA related to the PPP Loans in the amount of $0.4 million. We do

not anticipate receiving additional funds as the program has not

been extended under the CARES Act. |

| (3) |

|

Consulting fees—related party:

These costs ended following the completion of the IPO in June

2023. |

| (4) |

|

Employee retention credits: These

are refundable credits recognized under the provisions of the CARES

Act. |

| (5) |

|

Litigation accruals: This is an

accrual in 2022 related to a specific, one-time, litigation

claim. |

| (6) |

|

Non-cash lease expense: This

reflects the extent to which lease expense is greater than or less

than contractual rent paid. |

| (7) |

|

Non-cash lease expense related to

pre-opening costs: Cost for stores in development in which the

lease expense is greater than the contractual rent paid. |

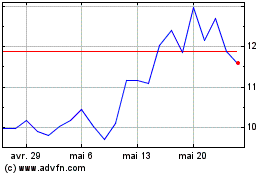

GEN Restaurant (NASDAQ:GENK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

GEN Restaurant (NASDAQ:GENK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025