false

2024

FY

0000736012

4851

139

30000

0000736012

2024-01-01

2024-12-31

0000736012

2024-06-28

0000736012

2025-02-25

0000736012

2024-10-01

2024-12-31

0000736012

2024-12-31

0000736012

2023-12-31

0000736012

2023-01-01

2023-12-31

0000736012

intz:SeriesAPreferredStocksMember

2022-12-31

0000736012

us-gaap:CommonStockMember

2022-12-31

0000736012

us-gaap:TreasuryStockCommonMember

2022-12-31

0000736012

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000736012

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000736012

intz:StockSubscriptionReceivbleMember

2022-12-31

0000736012

us-gaap:RetainedEarningsMember

2022-12-31

0000736012

2022-12-31

0000736012

intz:SeriesAPreferredStocksMember

2023-12-31

0000736012

us-gaap:CommonStockMember

2023-12-31

0000736012

us-gaap:TreasuryStockCommonMember

2023-12-31

0000736012

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0000736012

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000736012

intz:StockSubscriptionReceivbleMember

2023-12-31

0000736012

us-gaap:RetainedEarningsMember

2023-12-31

0000736012

intz:SeriesAPreferredStocksMember

2023-01-01

2023-12-31

0000736012

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0000736012

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0000736012

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0000736012

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0000736012

intz:StockSubscriptionReceivbleMember

2023-01-01

2023-12-31

0000736012

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0000736012

intz:SeriesAPreferredStocksMember

2024-01-01

2024-12-31

0000736012

us-gaap:CommonStockMember

2024-01-01

2024-12-31

0000736012

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-12-31

0000736012

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-12-31

0000736012

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-12-31

0000736012

intz:StockSubscriptionReceivbleMember

2024-01-01

2024-12-31

0000736012

us-gaap:RetainedEarningsMember

2024-01-01

2024-12-31

0000736012

intz:SeriesAPreferredStocksMember

2024-12-31

0000736012

us-gaap:CommonStockMember

2024-12-31

0000736012

us-gaap:TreasuryStockCommonMember

2024-12-31

0000736012

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-12-31

0000736012

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0000736012

intz:StockSubscriptionReceivbleMember

2024-12-31

0000736012

us-gaap:RetainedEarningsMember

2024-12-31

0000736012

2024-03-21

2024-03-22

0000736012

intz:SevenGovernmentCustomersMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-12-31

0000736012

intz:SixGovernmentCustomersMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0000736012

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

intz:ThreeIndividualGovernmentCustomersMember

2024-01-01

2024-12-31

0000736012

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

intz:TwoGovernmentCustomersAndTwoCommercialCustomerMember

2023-01-01

2023-12-31

0000736012

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

intz:ThreeCustomersRepresentMember

2024-01-01

2024-12-31

0000736012

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

intz:FourCustomersRepresentMember

2023-01-01

2023-12-31

0000736012

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

intz:TwoCustomersAccountMember

2024-01-01

2024-12-31

0000736012

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

intz:OneCustomersAccountMember

2023-01-01

2023-12-31

0000736012

intz:ConsultingRevenuesMember

2024-01-01

2024-12-31

0000736012

intz:ConsultingRevenuesMember

2023-01-01

2023-12-31

0000736012

intz:EquipmentFurnitureAndFixturesMember

2024-01-01

2024-12-31

0000736012

us-gaap:LeaseholdImprovementsMember

2024-01-01

2024-12-31

0000736012

intz:OperatingRouLeasesMember

2024-12-31

0000736012

intz:FinanceRouLeasesMember

2024-12-31

0000736012

intz:StreetervilleCapitalMember

intz:Tranche1Member

2022-03-10

0000736012

intz:StreetervilleCapitalMember

intz:Tranche2Member

2022-03-10

0000736012

intz:StreetervilleCapitalMember

intz:Tranche1Member

2022-03-09

2022-03-10

0000736012

intz:StreetervilleCapitalMember

intz:Tranche2Member

2022-06-28

2022-06-29

0000736012

intz:StreetervilleCapitalMember

2023-01-11

0000736012

intz:StreetervilleCapitalMember

2023-01-01

2023-12-31

0000736012

intz:StreetervilleFirstNoteMember

2023-10-16

2023-10-17

0000736012

intz:StreetervilleFirstNoteMember

2023-12-18

2023-12-19

0000736012

intz:StreetervilleDebtMember

us-gaap:CommonStockMember

2024-03-01

2024-03-31

0000736012

intz:StreetervilleDebtMember

us-gaap:SeriesAPreferredStockMember

2024-03-01

2024-03-31

0000736012

intz:StreetervilleDebtMember

us-gaap:SeriesAPreferredStockMember

2024-03-31

0000736012

intz:StreetervilleDebtMember

2024-01-01

2024-12-31

0000736012

intz:StreetervilleDebtMember

2024-12-31

0000736012

intz:StreetervilleDebtMember

2023-12-31

0000736012

intz:StreetervilleDebtMember

2023-01-01

2023-12-31

0000736012

intz:StreetervilleNotesPayableMember

2024-09-30

0000736012

intz:StreetervilleNotesPayableMember

2024-09-29

2024-09-30

0000736012

intz:ScottNotePayable1Member

2024-01-02

0000736012

intz:ScottNotePayable1Member

2024-01-01

2024-01-02

0000736012

intz:ScottNotePayable1Member

2024-01-01

2024-03-31

0000736012

intz:ScottNotePayable2Member

2024-03-20

0000736012

intz:ScottNotePayable2Member

2024-03-19

2024-03-20

0000736012

intz:CommonStockAndCommonStockPurchaseWarrantsMember

2024-04-19

0000736012

2023-10-01

2023-10-02

0000736012

2023-10-02

0000736012

intz:ATMOfferingMember

2024-01-01

2024-12-31

0000736012

intz:StandbyEquityPurchaseAgreementMember

intz:StreetervilleMember

2024-07-02

2024-07-03

0000736012

intz:StandbyEquityPurchaseAgreementMember

intz:StreetervilleMember

2024-12-31

0000736012

intz:StandbyEquityPurchaseAgreementMember

intz:StreetervilleMember

2024-01-01

2024-12-31

0000736012

us-gaap:SeriesAPreferredStockMember

2024-12-31

0000736012

intz:StreetervilleCapitalMember

intz:ExchangeAgreementMember

us-gaap:SeriesAPreferredStockMember

2024-03-14

2024-03-15

0000736012

us-gaap:SeriesAPreferredStockMember

2024-04-03

2024-12-31

0000736012

us-gaap:CommonStockMember

2024-04-03

2024-12-31

0000736012

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-12-31

0000736012

intz:PurchaseAgreement2023Member

us-gaap:CommonStockMember

2024-11-07

2024-11-08

0000736012

intz:PurchaseAgreement2023Member

us-gaap:CommonStockMember

2024-11-08

0000736012

intz:April2024PrivateOfferingMember

us-gaap:CommonStockMember

2024-04-21

2024-04-22

0000736012

intz:April2024PrivateOfferingMember

intz:CommonStockPurchaseWarrantsMember

2024-04-21

2024-04-22

0000736012

intz:April2024PrivateOfferingMember

us-gaap:CommonStockMember

2024-04-22

0000736012

intz:CommonStockWarrantsMember

2024-03-31

0000736012

intz:CommonStockWarrantsMember

2024-04-02

0000736012

intz:CommonStockWarrantsMember

2024-04-07

2024-04-08

0000736012

intz:CommonStockWarrantsMember

2024-11-20

0000736012

intz:CommonStockWarrantsMember

2024-11-21

0000736012

intz:CommonStockWarrantsMember

2024-12-26

2024-12-27

0000736012

intz:CommonStockWarrantsMember

2024-12-31

0000736012

intz:CommonStockWarrantsMember

2024-01-01

2024-12-31

0000736012

intz:EmployeeStockPurchasePlan2023Member

2023-12-31

0000736012

intz:OmnibusIncentivePlanMember

2024-12-31

0000736012

intz:StockIncentivePlan2015Member

2024-12-31

0000736012

us-gaap:StockOptionMember

2024-01-01

2024-12-31

0000736012

us-gaap:StockOptionMember

2023-01-01

2023-12-31

0000736012

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-12-31

0000736012

us-gaap:RestrictedStockUnitsRSUMember

2024-12-31

0000736012

intz:RestrictedStockAwardsMember

2023-01-01

2023-12-31

0000736012

intz:RestrictedStockAwardsMember

2024-01-01

2024-12-31

0000736012

intz:StockOptionAwardsMember

2023-01-01

2023-12-31

0000736012

intz:StockOptionAwardsMember

2024-01-01

2024-12-31

0000736012

intz:StockOptionAwardsMember

2024-12-31

0000736012

intz:Plan2021Member

2024-12-31

0000736012

intz:Plan2015Member

2024-12-31

0000736012

intz:Plan2005Member

2024-12-31

0000736012

intz:Range1Member

2024-01-01

2024-12-31

0000736012

intz:Range1Member

2024-12-31

0000736012

intz:Range2Member

2024-01-01

2024-12-31

0000736012

intz:Range2Member

2024-12-31

0000736012

intz:Range3Member

2024-01-01

2024-12-31

0000736012

intz:Range3Member

2024-12-31

0000736012

intz:Range4Member

2024-01-01

2024-12-31

0000736012

intz:Range4Member

2024-12-31

0000736012

intz:RelatedToCEOMember

2023-01-01

2023-12-31

0000736012

intz:RelatedToCEOMember

2023-12-31

0000736012

intz:JamesGeroMember

2023-10-10

0000736012

intz:JamesGeroMember

2023-10-09

2023-10-10

0000736012

intz:JamesGeroMember

2023-01-01

2023-12-31

0000736012

intz:ScottNotePayable1Member

2024-01-01

2024-12-31

0000736012

intz:ScottNotesPayableMember

2024-01-01

2024-12-31

0000736012

intz:EmployeeRetentionCreditMember

2022-01-01

2022-12-31

0000736012

2023-03-28

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) |

|

|

| ☒ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

|

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024 |

| |

| OR |

| |

|

|

| ☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

|

| For the transition period from to |

COMMISSION FILE NUMBER 001-39608

INTRUSION INC.

(Exact name of registrant as specified in its charter)

| delaware |

75-1911917 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| |

|

101 EAST PARK BLVD, SUITE 1200

PLANO, texas |

75074 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (972) 234-6400

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

INTZ |

Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of

the Act:

None

(Title of class)

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ☐ No ☒

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether

the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large, accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm

that prepared or issued its audit report. ☐

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

State the aggregate

market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the

common equity was last sold, or the average bid and asked price of such common equity, as of June 28, 2024: $4,323,644.

As of February 25, 2025,

19,342,776 shares of the issuer’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the

Registrant’s definitive Proxy Statement to be filed in connection with the Registrant’s 2025 Annual Meeting of

Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

INTRUSION INC.

INDEX

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form

10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities

Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which statements involve

substantial risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report on Form

10-K, including statements regarding our financial position; our ability to continue our business as a going concern; our business, sales,

and marketing strategies and plans; our ability to successfully market, sell, and deliver our INTRUSION Shield commercial

product and solutions to an expanding customer base; are forward-looking statements. In some cases, you can identify forward-looking statements

because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “will,” or “would” or

the negative of these words or other similar terms or expressions. Forward-looking statements contained in this Annual Report on Form

10-K include, but are not limited to, such statements.

You should not rely on forward-looking

statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K

primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial

condition, and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties,

and other factors described in the section titled "Risk Factors" and elsewhere in this Annual Report on Form 10-K.

In addition, statements that

“we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on

information available to us as of the date of this Annual Report on Form 10-K. While we believe that such information provides a reasonable

basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have

conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors

are cautioned not to unduly rely on these statements.

The forward-looking statements

made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation

to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of

this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law.

EXPLANATORY NOTE – REVERSE STOCK SPLIT

Unless otherwise stated, all shares and per share amounts for all periods

presented in this Annual Report on Form 10-K have been adjusted to reflect the 1-for-20 reverse stock split we effected on March 22, 2024.

PART I

Item 1. Business.

Our Corporate Information

We were organized in Texas

in September 1983 and reincorporated in Delaware in October 1995. Our principal executive offices are located at 101 East Park Boulevard,

Suite 1200, Plano, Texas 75074, and our telephone number is (972) 234-6400. Our website URL is www.intrusion.com. We post the following

filings in the “Investors” section of our website as soon as reasonably practicable after they are electronically filed with

or furnished to the Securities and Exchange Commission (the “SEC”): our Annual Reports on Form 10-K; our Quarterly Reports

on Form 10-Q; our Current Reports on Form 8-K; and any amendments to those reports or statements filed or furnished pursuant to Section

13(a) or 15(d) of the Exchange Act. All such filings on our website are available free of charge. Additionally, filings are available

on the SEC’s website (www.sec.gov). In this report, references to the “Company,” “we,” “us,”

“our”, or “Intrusion” refer to Intrusion Inc. and its subsidiaries. TraceCop and Savant

are registered trademarks of the Company. We have also applied for trademark protection for INTRUSION Shield.

Our Business

Intrusion is a cybersecurity

company based in Plano, Texas. The company offers its customers access to its exclusive threat intelligence database containing the historical

data, known associations, and reputational behavior of over 8.5 billion Internet Protocol (“IP”) addresses. After years of

gathering global internet intelligence and working exclusively with government entities, the company released its first commercial product

in 2021.

Our Solutions

INTRUSION Shield™

INTRUSION Shield,

our newest cybersecurity solution is a Zero Trust reputation-based Software as a Service (“SaaS”) solution that inspects and

kills dangerous network (in and outbound) connections. What makes our approach unique is that INTRUSION Shield evaluates

every packet and analyzes the IP addresses (source and destination), as well as domain information and the ports utilized and, when combined

with other threat intelligence data reports, blocks malicious connections. Many breaches today are caused by Zero-Day and malware free

compromises that may not trigger alarms in a traditional firewall or endpoint solution. INTRUSION Shield’s

capabilities are designed to continuously evolve as the threats and landscape change over time. Unlike traditional industry approaches

that rely heavily on signatures, complex rules, and human factors mitigation, which malicious actors and nation states have learned to

bypass, INTRUSION Shield’s proprietary architecture isolates and neutralizes malicious traffic and network

flows that existing solutions are ill equipped to handle.

In September 2022, we expanded

the INTRUSION Shield product line to include the Shield Cloud and Shield End-Point solutions. The initial INTRUSION Shield

offering released in early 2021, the Shield On-Premise solution, utilizes hardware and is placed behind a firewall in a data center. Shield

Cloud extends the effectiveness of the Shield On-Premise solution to Infrastructure as a Service (IaaS), Platform as a Service (PaaS),

SaaS and serverless resources in the public cloud. This product serves as a protective gateway to the cloud, providing both Zero Trust

access to, and protecting outbound connections from, virtual hosts and serverless functions within the cloud. Shield Endpoint helps protect

the network outside of the corporate enclave and data center to include protection for remote workers, mobile, and cloud devices. This

product brings the network protection of the Shield On-Premise to these remote user devices establishing a Zero Trust network, both for

intra-organization connectivity and external internet connectivity.

INTRUSION TraceCop®

INTRUSION TraceCop

is a big data tool with extensive IP intelligence canvassing the entire internet. It contains what we believe to be the largest existing

repository of reputation information on known good and known bad active IP addresses (both IPv4 and IPv6). TraceCop contains

an inventory of network selectors and enrichments useful to support forensic investigations. The data contains a history

of IPv4 and IPv6 block allocations and transfers, historical mappings of IP addresses to Autonomous Systems (ASNs) as observed through

BGP, and approximately one billion historically registered domain names and registration context. TraceCop contains tens

of billions of historic DNS resolutions of Fully Qualified Domain Names (FQDNs or hostnames) on each of these domains. Together, the resulting

data shows relationships, hosting, and attribution for internet resources. TraceCop also contains web server

surveys of content, such as natural language and topic of the content on hundreds of millions of websites and servers and OS fingerprints

of services showing applications running on a given IP address. TraceCop also contains a history of threat and reputation

for each hostname and IP address over time. All these features combine to create a very effective network forensics and cybersecurity

analysis tool.

INTRUSION Savant®

INTRUSION Savant

is a network monitoring solution that leverages the rich data available in TraceCop to identify suspicious traffic in real-time.

Savant uses several original patents to uniquely characterize and record all network flows. Savant is a network

reconnaissance and attack analysis tool used by forensic analysts in United States (“U.S.”) government agencies and corporations

with in-house threat research teams. For example, Savant users can create various automated rules to inspect packets matching

(or not) certain criteria such as creating a rule to ensure the Source MAC address field in the Ethernet header and Source IP address

from the IP header are always the same, failing which could indicate MAC or IP Spoofing in progress. Similarly, threat investigators can

create rules using regular expressions to analyze multiple fields in the packet headers.

Our Intellectual Property and Licenses

Our success and our ability

to compete are primarily dependent upon our proprietary technology. We principally rely on a combination of contractual rights, trade

secrets and copyright laws to establish and protect our proprietary rights in our solutions. In addition, we have received two patents,

and we have applied for patents for our INTRUSION Shield family of solutions. We have also entered into non-disclosure agreements

with our suppliers, resellers, and certain customers to limit access to and disclosure of our proprietary information. There can be no

assurance that the steps taken by us to protect our intellectual property will be adequate to prevent misappropriation of our technology

or that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology, although

it would be extremely difficult to replicate the proprietary and comprehensive internet databases we have developed over the past 25+

years.

We have entered into software

and solution license agreements with various suppliers. These license agreements provide us with additional software and hardware components

that add value to our cybersecurity solutions. These license agreements do not provide proprietary rights that are unique or exclusive

to us and are generally available to other parties on the same or similar terms and conditions, subject to payment of applicable license

fees and royalties. We do not consider any of the solution license, software, or supplier agreements to be material to our business, instead,

they are complementary to our business and offerings.

Our Competition

The market for network and

data protection security solutions is intensely competitive and subject to frequent introductions of new technologies, and potentially

improved price and performance characteristics. Industry suppliers compete in areas such as conformity to existing and emerging industry

standards, interoperability with networking and other cybersecurity solutions, management and security capabilities, performance, price,

ease of use, scalability, reliability, flexibility, features, and technical support. Our principal competitors in the data mining and

advanced persistent threat market include Darktrace, Trellix, and Recorded Futures.

There are numerous companies

competing in various segments of the data security market. At this time, we have little or no competitors for TraceCop;

however, we believe competitors could emerge in the future. These competitors currently perform only a portion of the functions that we

can perform with TraceCop. We have been continuously collecting the TraceCop data for more than twenty years,

and we believe that none of our current or future competitors will have the ability to provide and reference this historical data. In

our newest market segment, data mining and advanced persistent threat detection, we compete directly and indirectly with companies and

open-source technologies in the firewall, intrusion detection and prevention, anti-virus, network analysis, endpoint protection, and insider

threat prevention areas of cybersecurity technology.

We believe the INTRUSION

Shield product line is novel and unique in our industry because of our proprietary threat-enriched big data. We believe that

our INTRUSION Shield family of solutions complement our customer’s existing cybersecurity processes and third-party

solutions. If the INTRUSION Shield receives widespread acceptance in the market, we anticipate that other businesses will

seek to compete with INTRUSION Shield; however, we believe our existing, mature, and proprietary database which is integral

to the operation of INTRUSION Shield will be difficult, if not impossible, for other companies in our industry to replicate

and will be a significant barrier to entry of competitors in the near- and long-term future of cyber security solutions.

Our Customers: Government

Sales

Sales to U.S. government customers

accounted for 83.8% of our revenues for the year ended December 31, 2024, compared to 46.2% of our revenues in 2023. We expect to continue

to derive a substantial portion of our revenues from sales to governmental entities in the future as we continue to market our products

and data mining products to the government, and we intend to market INTRUSION Shield not only to our long-standing governmental

customer base but to expand our efforts to include more traditionally administrative and civilian governmental entities. Sales to government

clients present risks in addition to those involved in sales to commercial customers that could adversely affect our revenues, including

potential disruption due to irregularities in or interruptions to appropriation and spending patterns, delays in approving a federal budget

and the government’s reservation of the right to cancel contracts and purchase orders for its convenience.

We make our sales under purchase

orders and contracts. Our customers, including government customers, may cancel their orders or contracts with little or no prior notice

and without penalty. Although we transact business with various government entities, we believe that the cancellation of any order in

itself could have a material adverse effect on our financial results. Because we derive and expect to continue to derive a substantial

portion of our revenue from sales to government entities, a large number of cancelled or renegotiated government orders or contracts could

have a material adverse effect on our financial results.

Third-Party Products

We currently utilize commercially

available computers and servers from various vendors which we integrate with our software products for implementation into our customer

networks. We do not consider any of these third-party relationships to be material to the Company’s business or results of operations.

Customer Services

Our solutions may include

installation, operation of our technology and threat data interpretation and reporting.

Sales, Marketing and Customers

Field Sales Force.

Our sales organization focuses on major account sales, channel partners including distributors, value added resellers (“VARs”)

and integrators; promotes our solutions to current and potential customers; and monitors evolving customer requirements. The field sales

and technical support force provides training and technical support to our resellers and end users and assists our customers in designing

cyber secure data networking solutions. We currently conduct sales and marketing efforts from our principal office in Plano, Texas.

Resellers. Resellers

such as domestic and international system integrators and VARs sell our solutions as stand-alone solutions to end users and integrate

our solutions with products sold by other vendors into network security systems that are sold to end users. Our field sales force and

technical support organization provide support to these resellers. Our agreements with resellers are non-exclusive, and our resellers

generally sell other products and solutions that may compete with our solutions. Resellers may place higher priority on products or solutions

of other suppliers who are larger and have more name recognition, and there can be no assurance that resellers will continue to sell and

support our solutions.

Foreign Sales.

Export sales accounted for 4.7% and 0.8% of revenue in 2024 and 2023, respectively.

Marketing. We

have implemented several methods to market our solutions, including participation in trade shows and seminars, distribution of sales literature

and solution specifications and ongoing communication with our resellers and installed base of end-user customers.

Customers. Our

end-user customers include U.S. federal government, state and local government entities, large and diversified conglomerates, and manufacturing

entities. Sales to certain customers and groups of customers can be impacted by seasonal capital expenditure approval cycles, and sales

to customers within certain geographic regions can be subject to seasonal fluctuations in demand.

In 2024, 83.8% of our revenue

was derived from a variety of U.S. government entities through direct sales and indirectly through system integrators and resellers. These

sales are attributable to eight U.S. government customers through direct and indirect channels; three U.S. government customers individually

exceeded 10% of total revenue in 2024. A reduction in our sales to U.S. government entities could have a material adverse effect on our

business and operating results if not replaced.

Backlog. We

believe that only a small portion of our order backlog is non-cancellable, and that the dollar amount associated with the non-cancellable

portion is immaterial. Commercial orders are generally fulfilled within two days to two weeks following receipt of an order. Certain orders

may be scheduled over several months, generally not exceeding one year.

Customer Support, Service

and Warranty. We service, repair, and provide technical support for our solutions. Our field sales and technical support force

works closely with resellers and end-user customers on-site and by telephone to assist with pre- and post- sales support services such

as network security design, system installation and technical consulting. By collaborating closely with our customers, our employees increase

their understanding of end-user requirements and are then able to provide specific input in our solution development process.

We warrant all our solutions

against defects during the service period. Before and after expiration of the solution warranty period, we offer both on-site and factory-based

support, parts replacement, and repair services. Extended warranty services are separately invoiced on a time and materials basis or under

an annual maintenance contract.

Employees

As of December 31, 2024, we

employed a total of fifty people, five of which were part-time. None of our employees are represented by a labor organization, and we are

not a party to any collective bargaining agreement. Competition in the recruiting of personnel in the networking and data security industry

is intense. We believe that our future success will depend in part on our continued ability to hire, motivate and retain qualified management,

sales, marketing, and technical personnel.

Our Code of Conduct

The Company’s directors

and employees, including executive officers, are required to abide by the Company’s Code of Business Conduct and Ethics (the “Code”)

to ensure that the Company’s business is conducted in a consistently legal and ethical manner and to avoid instances of insider

trading. The Code covers areas of professional conduct that include conflicts of interest, fair dealing and the strict adherence to all

laws and regulations applicable to the conduct of the Company’s business.

The Code is published on the

Company’s website under the investor relations tab at www.intrusion.com. The Company intends to disclose future amendments to, or

waivers from, certain provisions of the Codes of Ethics on the Company’s website within four business days following the date of

such amendment or waiver. Upon the written request of any stockholder, the Company will furnish, without charge, a copy of the Code. This

request should be directed to the Company’s Secretary at Intrusion Inc., 101 East Park Blvd., Suite 1200, Plano, TX 75074.

Reverse Stock Split

On March 22, 2024, we effected

a 1-for-20 reverse stock split of our common stock. All share and per share amounts set forth in this Annual Report on Form 10-K, including

the consolidated financial statements and the notes thereto have been retroactively restated to reflect the reverse stock split as if

it had occurred as of the earliest period presented and unless otherwise stated, all other share and per share amounts for all periods

presented.

Item 1A. Risk Factors.

The following are the significant

factors that could materially adversely affect our business, financial condition, or operating results, as well as adversely affect the

value of an investment in our common stock. The risks described below are not the only risks facing our Company. Risks and uncertainties

not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition,

and operating results.

Risks Related to our Financial Position and

Liquidity

Certain regulatory limitations may affect

our ability to consummate future financings.

If our public float as measured

pursuant to General Instruction I.B.6 to Form S-3 falls below $75 million, we will be subject to the restrictions set forth in General

Instruction I.B.6 to Form S-3 that limit our ability to conduct primary offerings under a Form S-3 registration statement. As of February

25, 2025, our public float calculated in accordance with General Instruction I.B.6 of Form S-3 was $112.9 million.

We must increase revenue levels in order

to finance our current operations and to implement our business strategies.

For the year ended December

31, 2024, we had a net loss of $7.8 million and had an accumulated deficit of approximately $118.0 million as of December 31, 2024. We

need to increase current revenue levels from the sales of our solutions if we are to regain profitability, and our new INTRUSION Shield

suite of products may take time to achieve market penetration, which could negatively impact future revenues and results of operations.

If we are unable to increase revenue levels, losses could continue for the near term and possibly longer, and we may not regain profitability

or be able to implement our business plan, fund our liquidity needs, or continue our operations.

Business and Operational Risks

Most of our current revenues are generated

from one family of solutions with a limited number of customers, and the decrease of revenue from sales of this family of solutions could

materially harm our business and prospects.

Approximately 50.4% of our

existing revenues result from sales of TraceCop, a cybersecurity solution. TraceCop revenues were $2.9 million

for the year ended December 31, 2024, compared to $2.5 million for the year ended December 31, 2023. We can offer no assurances that our

new INTRUSION Shield solution will reduce our dependence on this single solution and in the absence of a shift in solution

mix, we may continue to face risks if sales of this key solution to these limited customers were to decrease.

We may not be successful in our efforts

to broaden the marketing and sale of the INTRUSION Shield.

We believe that we must expand

our sales and marketing efforts for INTRUSION Shield to achieve marketplace acceptance and to generate revenue for the Company.

However, these efforts depend, in large part, on the success of our channel partners as they market and sell INTRUSION Shield,

which may not be successful. If we are unsuccessful in our efforts to leverage channel and strategic partners, we may not be able to generate

sufficient revenue from INTRUSION Shield to improve the Company’s financial position, results of operations, and cash

flow position.

The current geo-political climate may add

uncertainty in the dealings of our customers and could cause them to delay indefinitely certain cybersecurity initiatives or to determine

not to introduce or implement any new or innovative cyber-solution products into their information networks.

Continuing events in many

regions around the world have introduced a significant level of uncertainty in the dealings of our current and potential customers that

could cause them to be hesitant to implement new cybersecurity initiatives regardless of the efficacy of our INTRUSION Shield

product. Further, these entities may also determine not to deploy their cash reserves in the face of such uncertainty. These uncertainties

could depress the interest or the ability of companies and governmental entities to test, evaluate, and deploy our INTRUSION Shield

in their network environments.

A large percentage of our current revenues

are received from U.S. government entities, and the loss of these customers or our failure to widen the scope of our customer base to

include general commercial enterprises could negatively affect our revenues.

A substantial percentage

of our current revenues result from sales to U.S. government entities. If we were to lose one or more of these customers, our revenues

could decline, and our business and prospects may be materially harmed. Further, sales to the government present risks in addition to

those involved in sales to commercial customers, including potential disruption due to appropriation and spending patterns, delays in

approving a federal budget and the government’s right to cancel contracts and purchase orders for its convenience. The factors that

could cause us to lose these U.S. government customers or otherwise materially harm our business, prospects, financial condition, or results

of operations include:

| |

· |

budget constraints affecting government spending generally, or specific departments or agencies, and changes in fiscal policies or a reduction of available funding; |

| |

|

|

| |

· |

re-allocation of government resources; |

| |

|

|

| |

· |

disruptions in our customers’ ability to access funding from capital markets; |

| |

|

|

| |

· |

curtailment of governments’ use of outsourced service providers and governments’ in-sourcing of certain services; |

| |

|

|

| |

· |

the adoption of new laws or regulations pertaining to government procurement; |

| |

|

|

| |

· |

government appropriations delays or blanket reductions in departmental budgets; |

| |

|

|

| |

· |

suspension or prohibition from contracting with the government or any significant agency with which we conduct business; |

| |

|

|

| |

· |

increased use of shorter duration awards, which increases the frequency we may need to recompete for work; |

| |

|

|

| |

· |

impairment of our reputation or relationships with any significant government agency with which we conduct business; |

| |

|

|

| |

· |

decreased use of small business set asides or changes to the definition of small business by government agencies; |

| |

· |

increased use of lowest-priced, technically acceptable contract award criteria by government agencies; |

| |

|

|

| |

· |

increased aggressiveness by the government in seeking rights in technical data, computer software, and computer software documentation that we deliver under a contract, which may result in “leveling the playing field” for competitors on follow-on procurements; |

| |

|

|

| |

· |

delays in the payment of our invoices by government payment offices; and |

| |

|

|

| |

· |

national or international health emergencies, such as the COVID-19 public health pandemic. |

While we expect that developing

relationships with non-governmental customers will mitigate or eliminate this dependence on, and risk from, serving governmental entities,

we can offer no assurances that we will be able to sufficiently diversify our customer portfolio in a time and manner to adequately mitigate

this risk.

A decline in federal,

state, or local government spending would likely negatively affect our product revenues and earnings.

The success of the cybersecurity

solutions we sell depends substantially on the amount of funds budgeted by federal, state, and local government agencies that make up

our current and potential customers. Global credit and financial markets have experienced extreme disruptions in the recent past, including

severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment

rates and uncertainty about economic stability. There can be no assurance that similar disruptions will not occur in the future. Deterioration

in general economic conditions may result in lower tax revenues that could lead to reductions in government spending. Poor economic conditions

could in turn lead to substantial decreases in our net sales or have a material adverse effect on our operating results, financial position,

and cash flows.

We are highly dependent on sales of our

current solutions through indirect channels, the loss of which would materially adversely affect our operations.

For the years ended December

31, 2024, and 2023, we derived 35.4% and 2.6% of our revenues from sales through indirect sales channels, such as distributors, value-added

resellers, system integrators, original equipment manufacturers and managed service providers. We must expand sales of our current solutions

as well as any new solutions through these indirect channels in order to increase our revenues. We cannot assure you that our current

solutions or future solutions will gain market acceptance in these indirect sales channels or that sales through these indirect sales

channels will increase our revenues. Further, many of our competitors are also trying to sell their products and solutions through these

indirect sales channels, which could result in lower prices and reduced profit margins for the sales of our solutions.

Our business depends on the continued service

of our key management and technical personnel.

Our success depends upon the

continued contributions of our key management, sales, marketing, research and development and operational personnel, including Anthony

Scott, our President, and Chief Executive Officer; T. Joe Head, our Chief Technology Officer; Kimberly Pinson, our Chief Financial Officer;

and other key technical personnel. The loss of the services of one or more of our key employees in the future could have a material adverse

effect on our operating results. We also believe our future success will depend upon our ability to attract and retain additional highly

skilled management, technical, marketing, research and development, and operational personnel with experience in managing large and rapidly

changing companies, as well as training, motivating and supervising employees. The market for hiring and retaining certain technical personnel,

including software engineers, has become more competitive and intense in recent years. Failure to attract and retain a sufficient number

of qualified technical personnel, including software engineers, or retain our key personnel could have a material adverse effect on our

operating results.

We could experience damage to our reputation

in the cybersecurity industry in the event that our INTRUSION Shield solution fails to meet our customers’ needs or to achieve

market acceptance.

Our reputation in the industry

may be harmed if we experience delivery delays, or if our customers do not perceive the benefits of purchasing and using INTRUSION

Shield as part of their comprehensive cybersecurity solution, our position as a leader in this technology space may be damaged

and could affect the willingness of our customers, as well as potential customers, to purchase our other solutions that function separately

from INTRUSION Shield. Any reputational damage could result in a decrease in orders for all our solutions, the loss of current

customers, and a decrease in our overall revenues which could in turn have a material adverse effect on our results of operations.

If we fail to respond to rapid technological

changes in the network security industry, we may lose customers, or our solutions may become obsolete.

The network security industry

is characterized by frequent product and service introductions, rapidly changing technology, and continued evolution of new industry standards.

We have and must continue to introduce upgrades to our current solutions rapidly in response to changing circumstances and customer needs

such as the creation and introduction of new computer viruses or other novel external attacks on computer networks. Further, our new INTRUSION

Shield solution represents our efforts to continue to provide state-of-the art first-in-time innovation for our customers’

cybersecurity solutions. As a result, our success depends upon our ability to develop and introduce timely upgrades, enhancements, and

new solutions to meet evolving customer requirements and industry standards. The development of technologically advanced network security

products and solutions is a complex and uncertain process requiring high levels of innovation, rapid response, and accurate anticipation

of technological and market trends. We cannot assure you that we will be able to identify, develop, manufacture, market or support new

or enhanced solutions successfully in a timely manner. Further, we or our competitors may introduce new solutions or enhancements that

shorten the life cycle of our existing solutions or cause our existing solutions to become obsolete.

We must expend time and resources addressing

potential cybersecurity risk, and any breach of our information security safeguards could have a material adverse effect on the Company.

The threat of cyber-attacks

requires additional time and money to be expended in efforts to prevent any breaches of our information security protocols. However, we

can provide no assurances that we can prevent all such attempts from being successful, which could result in expenses to address and remediate

such breaches as well as potentially losing the confidence of our customers who depend upon our services to prevent and mitigate such

attacks on their respective business. Should a material breach of our information security systems occur, it would likely have a material

adverse impact on our business operations, our customer relations, and our current and future sales prospects, resulting in a significant

loss of revenue.

A breach of network security could harm

public perception of our cybersecurity solutions, which could cause us to lose revenues.

If an actual or perceived

breach of network security occurs in the network of a customer of our cybersecurity solutions, regardless of whether the breach is attributable

to our solutions, the market perception of the effectiveness of our solutions could be harmed. This could cause us to lose current and

potential end customers or cause us to lose current and potential value-added resellers and distributors. Because the techniques used

by computer hackers to access or sabotage networks change frequently and generally are not recognized until launched against a target,

we may be unable to anticipate these techniques.

If our solutions do not interoperate with

our customers’ networks, installations will be delayed or cancelled and could harm our business.

Our solutions are designed

to interface with our customers’ existing networks, each of which has different specifications and utilize multiple protocol standards

and products or solutions from other vendors. Many of our customers’ networks contain multiple generations of products that have

been added over time as these networks have grown and evolved. Our solutions will be required to interoperate with many products and solutions

within these networks as well as future products or solutions to meet our customers’ requirements. If we find errors in the existing

software or defects in the hardware used in our customers’ networks, we may have to modify our software or hardware to fix or overcome

these errors so that our solutions will interoperate and scale with the existing software and hardware, which could be costly and negatively

impact our operating results. In addition, if our solutions do not interoperate with those of our customers’ networks, demand for

our solutions could be adversely affected, orders for our solutions could be cancelled, or our solutions could be returned. This could

hurt our operating results, damage our reputation, and seriously harm our business and prospects.

We face intense competition from both start-up

and established companies that may have significant advantages over us and our solutions.

The market for our solutions

is intensely competitive. There are numerous companies competing with us in various segments of the data security markets, and their products

or solutions may have advantages over our solutions in areas such as conformity to existing and emerging industry standards, interoperability

with networking and other cybersecurity products, management and security capabilities, performance, price, ease of use, scalability,

reliability, flexibility, features, and technical support.

Our principal competitors

in the data mining and advanced persistent threat market include Darktrace, Trellix, and Recorded Futures. Our current and potential competitors

may have one or more of the following significant advantages over us:

| |

· |

greater financial, technical, and marketing resources; |

| |

· |

better name recognition; |

| |

· |

more comprehensive security solutions; |

| |

· |

better or more extensive cooperative relationships; and |

| |

· |

larger customer base. |

We cannot assure you that

we will be able to compete successfully with our existing or new competitors. Some of our competitors may have, in relation to us, one

or more of the following:

| |

· |

longer operating histories; |

| |

· |

longer-standing relationships with OEM and end-user customers; and |

| |

· |

greater customer service, public relations, and other resources. |

As a result, these competitors

may be able to more quickly develop or adapt to new or emerging technologies and changes in customer requirements, or devote greater resources

to the development, promotion and sale of their products or solutions. Additionally, it is likely that new competitors or alliances among

existing competitors could emerge and rapidly acquire significant market share.

If we are unable to implement and maintain

effective internal control over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our

financial reports and the market price of our common stock may decline.

As a public company, we are

required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. Further,

we are required to report any changes in internal controls on a quarterly basis. In addition, we are required to furnish a report by management

on the effectiveness of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, as amended

(the “Sarbanes-Oxley Act”).

If we identify material weaknesses

in our internal control over financial reporting, if we are unable to comply with the requirements of Section 404 in a timely manner,

or if we assert that our internal control over financial reporting is ineffective, investors may lose confidence in the accuracy and completeness

of our financial reports and the market price of the common stock could be negatively affected. We also could become subject to investigations

by the stock exchange on which our securities are listed, the Securities Exchange Commission (“SEC”), or other regulatory

authorities, which could require additional financial and management resources, and could have a material adverse effect on the market

price of our common stock.

Scarcity of products and materials in the

supply chain could hinder or prevent the deployment of our INTRUSION Shield for our customers who elect to use the wired version of our

solution.

Should any of the component

parts required for the hardware interface our customers use to access and to utilize the INTRUSION Shield product become

scarce, we may have to delay or cancel our fulfillment of orders that could defer potential revenues or even result in customer cancellations,

which would have a negative effect on our financial position and results of operations.

We incur significantly increased costs because

of operating as a public company, and our management is required to devote substantial time to compliance matters and initiatives.

As a public company with an

obligation to file reports with the SEC under the Exchange Act, we incur significant legal, accounting, and other expenses that we would

not incur as a private company. In addition, the Sarbanes-Oxley Act imposes various requirements on public companies, including requiring

establishment and maintenance of effective disclosure and financial controls. Our management and other personnel devote a substantial

amount of time to these compliance initiatives. We cannot predict or estimate the amount of additional costs we will incur to meet our

additional disclosure obligations under the Exchange Act or the timing of such costs.

The Sarbanes-Oxley Act requires,

among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. We report

on the effectiveness of our internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. In addition,

in the first Annual Report on Form 10-K following the date on which we no longer qualify as a smaller reporting company, we will be required

to have our independent registered public accounting firm attest to the effectiveness of our internal control over financial reporting.

Our compliance with Section 404 of the Sarbanes-Oxley Act could require that we incur substantial accounting expense and expend significant

management efforts including the potential of hiring additional accounting and financial staff with appropriate public company experience

and technical accounting knowledge. If we are not able to comply with the requirements of Section 404 in a timely manner, or if we or

our independent registered public accounting firm identify deficiencies in our internal control over financial reporting that are deemed

to be material weaknesses, the market price of our stock could decline and we could be subject to sanctions or investigations by the SEC

or other regulatory authorities, which would require additional financial and management resources.

Investment Risks

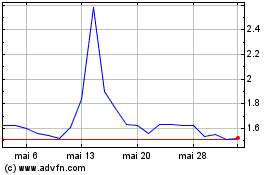

We experience volatility in the market for

our common stock, particularly with respect to swings in the market price as well as volatility in the trading of our common stock.

We experience significant

shifts in the market value of our common stock as it trades on the Nasdaq Capital Market (“Nasdaq") as well as volatility in

the trading volume of our shares on that market. For example, the market price of our common stock fluctuated between $7.34 and $0.35

during the year ended December 31, 2024. These fluctuations may result in a hesitancy for investors to purchase and hold shares of our

common stock, continued depression of the market value of our stock, and ultimately negatively affect our ability to raise capital through

the issuance and sale of our common stock, particularly through our At the Market (“ATM”) program or otherwise.

Nasdaq may delist our common stock from

trading on its exchange, which could limit stockholders’ ability to trade our common stock.

Our common stock is listed

for trading on the Nasdaq Capital Market, which requires us to meet certain financial, public float, bid price and liquidity standards

on an ongoing basis to continue the listing of our common stock. If we fail to meet these continued listing requirements, our common stock

may be subject to delisting.

On October 28, 2024, Intrusion,

Inc. (the “Company”) received a written notice (the “Bid Price Notice”) from the Listing Qualifications department

(the “Nasdaq Staff”) of The Nasdaq Stock Market (“Nasdaq”) indicating that the Company is not in compliance with

the $1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”)

for continued listing on the Nasdaq Capital Market. The notification of noncompliance had no immediate effect on the listing or trading

of the Company’s common stock on The Nasdaq Capital Market under the symbol “INTZ,” and the Company is currently monitoring

the closing bid price of its common stock and evaluating its alternatives, if appropriate, to resolve the deficiency and regain compliance

with this rule.

The Nasdaq rules require

listed securities to maintain a minimum bid price of $1.00 per share and, based upon the closing bid price for the last thirty

consecutive business days as of October 25, 2024, the Company no longer met this requirement. The Bid Price Notice indicated that

the Company has been provided 180 calendar days, or until April 28, 2025, in which to regain compliance. If at any time during this

period the closing bid price of the Company’s common stock is at least $1.00 per share for a minimum of ten consecutive

business days, the Nasdaq Staff will provide the Company with a written confirmation of compliance and the matter will be closed. On

January 29, 2025, the Company received notification from the Nasdaq Staff that it had met the minimum bid price requirement and,

accordingly, had regained compliance with the listing requirement.

There can be no assurance

that we will be able to meet the financial, public float, bid price and liquidity standards on an ongoing basis to for continued listing

of our common stock on the Nasdaq Capital Market. If our common stock is delisted and we are not able to list our common stock on another

national securities exchange, we expect our securities would be quoted on an over-the-counter market. If this were to occur, our stockholders

could face significant material adverse consequences, including limited availability of market quotations for our common stock and reduced

liquidity for the trading of our securities. In addition, we could experience a decreased ability to issue additional securities and obtain

additional financing in the future.

Shares eligible for future sale may adversely

affect the market.

Our equity incentive plans

allow us to issue stock options and award shares of our common stock. We may in the future create additional equity incentive plans, which

may at that time require us to file a registration statement under the Securities Act to cover the issuance of shares upon the exercise

or vesting of awards granted or otherwise purchased under those plans. As a result, any shares issued or granted under the plans may be

freely tradable in the public market. If equity securities are issued under the plans, if implemented, and it is perceived that they will

be sold in the public market, then the price of our common stock could decline substantially.

We have never paid dividends on our common

stock and have no plans to do so in the future.

Holders of shares of our common

stock are entitled to receive such dividends as may be declared by our Board. To date, we have paid no cash dividends on our shares of

common stock, and we do not expect to pay cash dividends on our common stock in the foreseeable future. We intend to retain future earnings,

if any, to provide funds for the operations of our business. Therefore, any return investors in our common stock may have will be in the

form of appreciation, if any, in the market value of their shares of common stock.

Risks Related to our Intellectual Property

We must adequately protect our intellectual

property to prevent loss of valuable proprietary information.

We rely primarily on a combination

of patent, copyright, trademark and trade secret laws, confidentiality procedures, and non-disclosure agreements to protect our proprietary

technology. However, unauthorized parties may attempt to copy or reverse engineer aspects of our solutions or to obtain and use information

that we regard as proprietary. Policing unauthorized use of our solutions is difficult, and we cannot be certain that the steps we have

taken will prevent misappropriation of our intellectual property. This is particularly true in foreign countries whose laws may not protect

proprietary rights to the same extent as the laws of the U.S. and may not provide us with an effective remedy against unauthorized use.

If protection of our intellectual property proves to be inadequate or unenforceable, others may be able to use our proprietary developments

without compensation to us, resulting in potential cost advantages to our competitors.

We may incur substantial expenses defending

ourselves against claims of infringement.

There are numerous patents

held by many companies relating to the design and manufacture of network security systems. Third parties may claim that our solutions

infringe on their intellectual property rights. Any claim, with or without merit, could consume our management’s time, result in

costly litigation, cause delays in sales or implementations of our solutions or require us to enter into royalty or licensing agreements.

Royalty and licensing agreements, if required and available, may be on terms unacceptable to us or detrimental to our business. Moreover,

a successful claim of product infringement against us or our failure or inability to license the infringed or similar technology on commercially

reasonable terms could seriously harm our business.

Our solutions are highly technical and if

they contain undetected errors, our business could be adversely affected, and we might have to defend lawsuits or pay damages in connection

with any alleged or actual failure of our solutions and services.

Our solutions are highly technical

and complex, are critical to the operation of many networks and, in the case of ours, provide and monitor network security and may protect

valuable information. Our solutions have contained and may contain one or more undetected errors, defects, or security vulnerabilities.

Some errors in our solutions may only be discovered after a solution has been installed and used by end customers. Any errors or security

vulnerabilities discovered in our solutions after commercial release could result in loss of revenues or delay in revenue recognition,

loss of customers and increased service and warranty cost, any of which could adversely affect our business and results of operations.

In addition, we could face claims for product liability, tort, or breach of warranty. Defending a lawsuit, regardless of its merit, is

costly and may divert management’s attention. In addition, if our business liability insurance coverage is inadequate or future

coverage is unavailable on acceptable terms or at all, our financial condition could be harmed.

Item 1B. Unresolved Staff Comments.

None.

Item 1C. Cybersecurity.

We recognize the importance

of securing our data and information systems and have a process for assessing, mitigating, and managing cybersecurity and related risks.

Our VP of Engineering, who

reports to the CEO, leads our cybersecurity function and is responsible for managing our cybersecurity risk and the protection of our

networks, systems, and data. The VP of Engineering uses both internal and external resources to execute this process including our own

INTRUSION Shield technology, to help prevent, identify, escalate, investigate, and resolve security incidents in a timely

manner. The Company, with the oversight of the CEO, also requires all employees to complete an annual cybersecurity training course.

Governance

Our Board of Directors is

responsible for overseeing our enterprise risk management activities. The CEO reports to the Board of Directors regarding cybersecurity

risks, incidents, and mitigation strategies at least annually.

As of the date of this filing,

we have not experienced any cybersecurity incidents that have materially affected or are reasonably likely to materially affect our company,

including our financial condition and results of operations.

Item 2. Properties.

Our corporate headquarters

is currently located in 10,705 square feet of space at 101 East Park Blvd, Suite 1200, Plano Texas. This facility houses our corporate

administration, engineering, sales, and marketing operations. The lease for this facility extends until March 2035. We also have engineers

and other employees working remotely in Texas as well as several other states.

We believe that the existing

facility will be adequate to meet our operational requirements through the expiration of the lease. We believe that our property insurance

provides adequate coverage for our leased facilities. See Note 5 – Right-of-use Assets and Leasing Liabilities to our Consolidated

Financial Statements for additional information regarding our obligations under leases.

Item 3. Legal Proceedings.

Stockholder Derivative Claim

On June 3, 2022, a verified

stockholder derivative complaint was filed in U.S. District Court, District of Delaware (the “Court”) by the Plaintiff Stockholder

on behalf of Intrusion against certain of the Company’s Defendants. Plaintiff alleges that Defendants through various actions breached

their fiduciary duties, wasted corporate assets, and unjustly enriched Defendants by (a) incurring costs and expenses in connection with

the ongoing SEC investigation, (b) incurring costs and expenses to defend the Company with respect to the consolidated class action, (c)

settling class-wide liability with respect to the consolidated class action, as well as ancillary claims regarding sales of the Company’s

common stock by certain of the Defendants. On September 28, 2023, the Company agreed to settle the claim. On October 2, 2023, public notice

of the settlement was given. The settlement agreement provides in part for (i) an amendment to the Company’s Bylaws, committee Charters,

and other applicable corporate policies to implement certain measures set forth more fully therein, to remain in effect for no less than

three years; (ii) attorneys’ fees and expenses to plaintiff’s counsel of $0.3 million; and (iii) the dismissal of all claims

against the Defendants, including the Company, in connection with the action. The $0.3 million settlement payment was made by the Company’s

insurance provider under its insurance policy since the Company’s $0.5 million retention was previously exhausted. On April 3, 2024,

the Court approved the settlement.

In addition to these legal

proceedings, we are subject to various other claims that may arise in the ordinary course of business. We do not believe that any claims

exist where the outcome of such matters would have a material adverse effect on our consolidated financial position, operating results,

or cash flows. However, there can be no assurance such legal proceedings will not have a material impact on our future results.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s

Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock trades on

the Nasdaq Capital Market, where it is currently listed under the symbol “INTZ.” As of February 26, 2025, there were approximately

sixty-four record holders of record of our common stock. The Company does not have a history of paying dividends on its common stock and

has no present intention of declaring any dividends in the foreseeable future.

All equity compensation plans

under which our common stock is reserved for issuance have previously been approved by our stockholders. The following table provides

summary information as of December 31, 2024, for all our equity compensation plans (in thousands, except per share data). See Note 10

– Stock-Based Compensation to our Consolidated Financial Statements for additional discussion.

| | |

|

| Number of shares of common stock to be issued upon exercise of outstanding options(1) | |

43 |

| Weighted average exercise price of outstanding options | |

$61.26 |

| Number of shares unvested restricted stock units | |

203 |

| Weighted average grant date fair value | |

$1.38 |

| No. of shares of common stock remaining available for future issuance under equity compensation plans | |

2,258 |

| (1) |

Included in the outstanding options are nineteen from the 2015 Stock Option Plan and twenty-four from the 2021 Omnibus Incentive Plan. |

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.

General

The following discussion and

analysis include information management believes is relevant to understand and assess our consolidated financial condition and results

of operations. This section should be read in conjunction with our Consolidated Financial Statements, accompanying notes and the risk

factors contained in this report.

Overview

Intrusion Inc. offers businesses

of all sizes and industries products and services that leverage the Company’s exclusive threat intelligence database of over 8.5

billion IP addresses and domain names. After many years of gathering intelligence and providing our INTRUSION TraceCop and

Savant solutions exclusively to government entities, we released our first commercial product in 2021, the INTRUSION

Shield. INTRUSION Shield was designed to allow businesses to incorporate a Zero Trust, reputation-based security

solution into their existing infrastructure to observe traffic flow and instantly block known malicious or unknown connections from both

entering or exiting a network, making it an ideal solution for protecting from Zero-Day and ransomware attacks.

During 2023 and 2024, our