false

0000736012

0000736012

2025-02-27

2025-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): February 27, 2025

INTRUSION

INC.

(Exact Name of Registrant

as Specified in Its Charter)

| Delaware |

001-39608 |

75-1911917 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File

Number) |

(IRS Employer

Identification No.) |

101

East Park Blvd, Suite

1200

Plano, Texas |

75074 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(888) 637-7770

(Registrant’s Telephone Number,

Including Area Code)

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

INTZ |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 2.02 |

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

The following information is furnished pursuant

to Item 2.02, Disclosure of Results of Operations and Financial Condition.

On February 27, 2025, Intrusion Inc. issued a

press release announcing its financial results for the fiscal year ended December 31, 2024. A copy of the press release is attached as

Exhibit 99.1 hereto and incorporated herein by reference.

| ITEM 9.01 |

|

FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

Intrusion, Inc. |

| |

|

| Dated: February 27, 2025 |

By: |

/s/ Kimberly Pinson |

| |

|

Kimberly Pinson |

| |

|

Chief Financial Officer |

Exhibit 99.1

Intrusion Inc. Reports Fourth Quarter and Full

Year 2024 Results

Recent balance sheet actions position the Company

for future growth

PLANO, Texas, February 27, 2025 (ACCESSWIRE)

-- Intrusion Inc. (NASDAQ: INTZ) (“Intrusion” or the “Company”), a leader in cyberattack prevention solutions,

announced today financial results for the fourth quarter and full year ended December 31, 2024.

Recent Financial & Business Highlights:

| · | Took recent actions to improve the strength of

the balance sheet, resulting in $14.5 million in proceeds to the Company and the elimination of $10.1 million notional value of all Series

A Preferred Stock. |

| · | Expanded cybersecurity portfolio with the introduction

of Intrusion Shield Sentinel that advances network monitoring for large-scale environments. |

| · | Announced Intrusion Shield Command Hub

that harnesses AI for smarter cybersecurity. |

| · | Signed a total of 20 new Intrusion Shield

logos during 2024. |

“We have continued to make progress toward

positioning our business for future sustainable growth and profitability,” said Tony Scott, CEO of Intrusion. “Furthermore,

we are excited about our improved financial health and our third consecutive quarter of sequential revenue growth. Our enhanced performance

was driven by our ability to secure a large contract for a combination of Intrusion Shield and consulting services with the U.S.

Department of Defense and the addition of 20 new commercial Intrusion Shield logos during the year. Looking ahead to 2025, we are

excited about the opportunities that lie ahead of us, and it is our belief that we have only scratched the surface of our potential, as

our customer base and pipeline continue to grow amid the rising demand for cybersecurity solutions.”

Fourth Quarter Financial Results

Revenue for the fourth quarter of 2024 was $1.7

million, an increase of 11% on a sequential basis. The sequential increase in revenue during the fourth quarter of 2024 was driven by

new customers signed in recent quarters, including the U.S. Department of Defense award for the use of both Intrusion Shield technology

and consulting services.

The gross profit margin was 75% for the fourth

quarter of 2024, compared to 79% in the fourth quarter of 2023. Gross margin will vary based on product mix.

Operating expenses in the fourth quarter of 2024

were $3.2 million, flat sequentially and a decrease of $0.3 million from the comparable quarter of last year.

The net loss from operating activities for the

fourth quarter of 2024 was $(1.9) million, representing a $0.5 million or 20% improvement on a year-over-year basis. The improvement was

driven by lower operating expenses.

The net loss for the fourth quarter of 2024 was

$(2.0) million, or $(0.36) per share, compared to a net loss of $(2.8) million, or $(1.80) per share, for the fourth quarter of 2023.

The improved net loss is a result of lower operating expenses and reduced interest expense.

Full Year Financial Results

Revenue for the full year ended December 31, 2024,

was $5.8 million, an increase of $0.2 million compared to 2023.

The gross profit margin was 77% for the full year

ended December 31, 2024, compared to 78% in 2023.

Operating expenses for the full year ended December

31, 2024, were $12.9 million, a decrease of $3.5 million from 2023.

The net loss for the full year ended December

31, 2024, was ($7.8) million, or $(1.63) per share, compared to a loss of ($13.9) million, or $(11.45) per share, in 2023.

As a result of capital transactions completed

in the fourth quarter of 2024 and the first week of January 2025, the Company raised $14.5 million in proceeds through the sale of common

stock and eliminated $10.1 million notional value of Series A preferred stock. Cash and cash equivalents at December 31, 2024 were $4.9

million. Transactions that closed subsequent to year-end contributed an additional $9.2 million in proceeds to the Company. The transactions

effectuated in December 2024 and January 2025 included:

| · | The sale of $0.3 million in common stock from

the Company's Warrant Inducement Plan on December 27, 2024. |

| · | The sale of $1.7 million in common stock from

draws on the previously announced Standby Equity Purchase Agreement (SEPA) with Streeterville Capital, LLC. |

| · | The sale of approximately $5.0 million of common

stock pursuant to the ATM program during the fourth quarter of 2024. |

| · | The closing of a registered direct offering on

January 7, 2025, resulting in gross proceeds of approximately $7.5 million. |

| · | The execution of a series of transactions exchanging

9,025 shares of Series A Preferred Stock with a notional value of $9.9 million for 3.454 million shares of common stock. |

Conference Call

Intrusion’s

management will host a conference call today at 5:00 P.M. EST. Interested investors can access the live call by dialing 1-888-506-0062,

or 1-973-528-0011 for international callers, and providing the following access code: 764080. The call will also be webcast live

(www.webcaster4.com/Webcast/Page/3014/51802). For

those unable to participate in the live conference call, a replay will be accessible beginning tonight at 7:00 P.M. EST until March 13,

2025, by dialing 1-877-481-4010, or 1-919-882-2331 for international callers, and entering the following access code: 51802. Additionally,

a live and archived audio webcast of the conference call will be available at www.intrusion.com.

About Intrusion Inc.

Intrusion Inc. is a cybersecurity company based

in Plano, Texas. The Company offers its customers access to its exclusive threat intelligence database containing the historical data,

known associations, and reputational behavior of over 8.5 billion IP addresses. After years of gathering global internet intelligence

and working with government entities, the company released its first commercial product in 2021. Intrusion Shield allows businesses

to incorporate a Zero Trust, reputation-based security solution into their existing infrastructure. Intrusion Shield observes traffic

flow and instantly blocks known or unknown malicious connections from entering or exiting a network to help protect against zero-day and

ransomware attacks. Incorporating Intrusion Shield into a network elevates an organization's overall security posture by enhancing

the performance and decision-making of other solutions in its cybersecurity architecture.

Cautionary Statement Regarding Forward-Looking

Information

This press release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), which statements involve substantial risks and uncertainties. All statements

other than statements of historical facts contained herein, including statements regarding our financial position; our ability to continue

our business as a going concern; our business, sales, and marketing strategies and plans; our ability to successfully market, sell, and

deliver our Intrusion Shield commercial product and solutions to an expanding customer base; are forward-looking statements. In some cases,

you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

or “would” or the negative of these words or other similar terms or expressions. Forward-looking statements contained in this

press release include, but are not limited to, such statements.

You should not rely on forward-looking statements

as predictions of future events. We have based the forward-looking statements contained in this press release primarily on our current

expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating

results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors

described in our filings with the Securities and Exchange Commission, including in our most recent reports on Form 10-K and Form 10-Q,

as the same may be updated from time to time.

The forward-looking statements made herein relate

only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made

in this press release to reflect events or circumstances after the date hereof or to reflect new information or the occurrence of unanticipated

events, except as required by law.

IR Contact:

Alpha IR Group

Mike Cummings or Josh Carroll

INTZ@alpha-ir.com

Source: Intrusion Inc.

INTRUSION

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except par value amounts)

| | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,851 | | |

$ | 139 | |

| Accounts receivable, net | |

| 169 | | |

| 364 | |

| Prepaid expenses and other assets | |

| 514 | | |

| 635 | |

| Total current assets | |

| 5,534 | | |

| 1,138 | |

| Noncurrent Assets: | |

| | | |

| | |

| Property and equipment: | |

| | | |

| | |

| Equipment | |

| 2,690 | | |

| 2,069 | |

| Capitalized software development | |

| 3.948 | | |

| 2,791 | |

| Leasehold improvements | |

| 18 | | |

| 15 | |

| Property and equipment, gross | |

| 6,656 | | |

| 4,875 | |

| Accumulated depreciation and amortization | |

| (2,809 | ) | |

| (1,955 | ) |

| Property and equipment, net | |

| 3,847 | | |

| 2,920 | |

| Finance leases, right-of-use assets, net | |

| 491 | | |

| 382 | |

| Operating leases, right-of-use assets, net | |

| 1,356 | | |

| 1,637 | |

| Other assets | |

| 281 | | |

| 171 | |

| Total noncurrent assets | |

| 5,975 | | |

| 5,110 | |

| TOTAL ASSETS | |

$ | 11,509 | | |

$ | 6,248 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable, trade | |

$ | 1,508 | | |

$ | 2,215 | |

| Accrued expenses | |

| 291 | | |

| 222 | |

| Finance lease liabilities, current portion | |

| 405 | | |

| 384 | |

| Operating lease liabilities, current portion | |

| 209 | | |

| 178 | |

| Notes payable | |

| 529 | | |

| 10,823 | |

| Deferred revenue | |

| 730 | | |

| 439 | |

| Total current liabilities | |

| 3,672 | | |

| 14,261 | |

| | |

| | | |

| | |

| Noncurrent Liabilities: | |

| | | |

| | |

| Finance lease liabilities, noncurrent portion | |

| 172 | | |

| 3 | |

| Operating lease liabilities, noncurrent portion | |

| 1,414 | | |

| 1,539 | |

| Total noncurrent liabilities | |

| 1,586 | | |

| 1,542 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Deficit: | |

| | | |

| | |

| Preferred stock, $0.01 par value: Authorized shares – 5,000; Issued shares – 4 in 2024 and 0 in 2023 | |

| 3,827 | | |

| – | |

| Common stock, $0.01 par value: Authorized shares – 80,000; Issued shares – 15,191 in 2024 and 1,848 in 2023; Outstanding shares – 15,590 in 202 and 1,847 in 2023 | |

| 156 | | |

| 18 | |

| Common stock held in treasury, at cost – 1 shares | |

| (362 | ) | |

| (362 | ) |

| Additional paid-in capital | |

| 122,552 | | |

| 101,049 | |

| Stock subscription receivable | |

| (1,872 | ) | |

| – | |

| Accumulated deficit | |

| (118,007 | ) | |

| (110,217 | ) |

| Accumulated other comprehensive loss | |

| (43 | ) | |

| (43 | ) |

| Total stockholders’ deficit | |

| (6,251 | ) | |

| (9,555 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

$ | 11,509 | | |

$ | 6,248 | |

INTRUSION

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, 2024 | | |

December 31, 2023 | | |

December 31, 2024 | | |

December 31, 2023 | |

| Revenue | |

$ | 1,676 | | |

$ | 1,366 | | |

$ | 5,771 | | |

$ | 5,611 | |

| Cost of Revenue | |

| 421 | | |

| 290 | | |

| 1,341 | | |

| 1,257 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 1,255 | | |

| 1,076 | | |

| 4,430 | | |

| 4,354 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 1,194 | | |

| 1,152 | | |

| 4,736 | | |

| 5,670 | |

| Research and development | |

| 1,231 | | |

| 1,138 | | |

| 4,435 | | |

| 5,556 | |

| General and administrative | |

| 733 | | |

| 1,174 | | |

| 3,705 | | |

| 5,174 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Loss | |

| (1,903 | ) | |

| (2,388 | ) | |

| (8,446 | ) | |

| (12,046 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (54 | ) | |

| (629 | ) | |

| (328 | ) | |

| (958 | ) |

| Interest accretion and amortization of debt issuance costs, net | |

| – | | |

| (200 | ) | |

| 990 | | |

| (930 | ) |

| Other (expense) income, net | |

| – | | |

| – | | |

| (6 | ) | |

| 43 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (1,957 | ) | |

$ | (2,817 | ) | |

$ | (7,790 | ) | |

$ | (13,891 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.36 | ) | |

$ | (1.80 | ) | |

$ | (1.63 | ) | |

$ | (11.46 | ) |

| Diluted | |

$ | (0.36 | ) | |

$ | (1.80 | ) | |

$ | (1.63 | ) | |

$ | (11.46 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Common Shares Outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 6,198 | | |

| 1,562 | | |

| 5,275 | | |

| 1,212 | |

| Diluted | |

| 6,198 | | |

| 1,562 | | |

| 5,275 | | |

| 1,212 | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

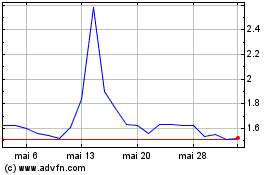

Intrusion (NASDAQ:INTZ)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Intrusion (NASDAQ:INTZ)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025