UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of March, 2024

Commission

File Number: 001-41467

Magic

Empire Global Limited

3/F,

8 Wyndham Street

Central,

Hong Kong

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On

February 28, 2024, Magic Empire Global Limited (the “Company”) received a letter from the Listing Qualifications staff of

The Nasdaq Stock Market (“Nasdaq”) notifying the Company that based on the closing bid price of the Company for the period

from January 16, 2024 to February 27, 2024, the Company no longer meets the continued listing requirement of Nasdaq under Nasdaq Listing

Rules 5550(a)(2), to maintain a minimum bid price of $1 per share.

The

notification has no immediate effect on the listing of the Company’s ordinary shares. Nasdaq has provided the Company with an 180

calendar days compliance period, or until August 26, 2024, in which to regain compliance with Nasdaq continued listing requirement. In

the event that the Company does not regain compliance in the compliance period, the Company may be eligible for an additional 180 calendar

days, should the Company meet the continued listing requirement for market value of publicly held shares and all other initial listing

standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and is able to provide written notice of its

intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. However, if it

appears that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq will provide notice

that the Company’s securities will be subject to delisting.

The

Company is currently evaluating options to regain compliance and intends to timely regain compliance with Nasdaq’s continued listing

requirement. Although the Company will use all reasonable efforts to achieve compliance with Rule 5550(a)(2), there can be no assurance

that the Company will be able to regain compliance with that rule or will otherwise be in compliance with other Nasdaq continued listing

requirement.

This

Form 6-K is filed to satisfy the obligation under Nasdaq Listing Rule 5810(b) that the Company publicly disclose the deficiency within

four (4) business days after the date of the deficiency letter.

Attached

as Exhibit 99.1 to this Report on Form 6-K is a copy of the press release of Magic Empire Global Limited, dated March 1, 2024.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Magic

Empire Global Limited |

| |

|

|

| Date:

March 1, 2024 |

By: |

/s/

Sze Hon, Johnson Chen |

| |

|

Sze

Hon, Johnson Chen |

| |

|

Chief

Executive Officer |

Exhibit

99.1

Magic

Empire Global Limited Announces Receipt of Nasdaq Notification Regarding Minimum Bid Price Deficiency

Hong

Kong, March 1, 2024 (GLOBE NEWSWIRE) – Magic Empire Global Limited (NASDAQ: MEGL) (“MEGL”, or the “Company”)

announced that, on February 28, 2024, the Company received a letter from the Listing Qualifications staff of The Nasdaq Stock Market

(“Nasdaq”) notifying the Company that based on the closing bid price of the Company for the period from January 16, 2024

to February 27, 2024, the Company no longer meets the continued listing requirement of Nasdaq under Nasdaq Listing Rules 5550(a)(2),

to maintain a minimum bid price of $1 per share.

The

notification has no immediate effect on the listing of the Company’s ordinary shares. Nasdaq has provided the Company with an 180

calendar days compliance period, or until August 26, 2024, in which to regain compliance with Nasdaq continued listing requirement. In

the event that the Company does not regain compliance in the compliance period, the Company may be eligible for an additional 180 calendar

days, should the Company meet the continued listing requirement for market value of publicly held shares and all other initial listing

standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and is able to provide written notice of its

intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. However, if it

appears that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq will provide notice

that the Company’s securities will be subject to delisting.

The

Company is currently evaluating options to regain compliance and intends to timely regain compliance with Nasdaq’s continued listing

requirement. Although the Company will use all reasonable efforts to achieve compliance with Rule 5550(a)(2), there can be no assurance

that the Company will be able to regain compliance with that rule or will otherwise be in compliance with other Nasdaq continued listing

requirement.

About

Magic Empire Global Limited

Magic

Empire Global Limited is a financial services provider in Hong Kong which principally engage in the provision of corporate finance advisory

services and underwriting services. Its service offerings mainly comprise (i) IPO sponsorship services; (ii) financial advisory and independent

financial advisory services; (iii) compliance advisory services; (iv) underwriting services; and (iv) corporate services. For more information,

visit the Company’s website at http://www.meglmagic.com.

Safe

Harbor Statement

Certain

statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and

uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes

may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking

statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,”

“continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking

statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you

that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from

the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration

statement and other filings with the SEC, which are available for review at www.sec.gov.

Hong

Kong:

Magic

Empire Global Limited

Ms.

Vivien Tai

Tel:

+852 3577 8770

E-mail:

meglir@giraffecap.com

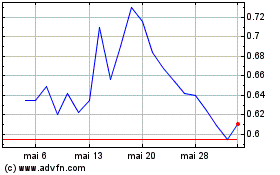

Magic Empire Global (NASDAQ:MEGL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Magic Empire Global (NASDAQ:MEGL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024