Nasdaq Report Identifies Between $25 Billion and $50 Billion in Potential Efficiency Gains in Banks' Risk and Compliance Functions

22 Janvier 2025 - 6:00AM

Between $25 billion and $50 billion in potential efficiency gains

can be realized through targeted enhancements in banks' Risk and

Compliance functions alone without compromising effectiveness,

according to a report released by Nasdaq and Boston Consulting

Group (BCG). The report, titled “The New Growth Imperative: Cutting

through Complexity in the Financial System” reviews the

interconnected challenge of complexity and complicatedness and

finds that while external complexity continues to increase, excess

layers of internal complicatedness have accumulated.

“Financial institutions are particularly exposed to the

exponential growth in complexity across the global economy, from

the evolution of technology paradigms to the expectation of

real-time finance and the explosion of data. What’s more,

regulators have put banks on the front line in the fight against

financial crime and cyber-attacks,” said Nasdaq Chair and CEO Adena

Friedman. “The good news is that as both external complexity and

internal complicatedness have grown, so have the solutions to help

manage them. By leveraging modern technology and embracing a

systems-based approach, we can unlock significant efficiencies and

foster a more resilient and innovative ecosystem towards the dual

goal of resilience and growth. At a time where the demand for

long-term capital is exploding and political mandates are geared

toward change, this report provides novel perspectives on how we

can better tackle complexity without adding to the mounting body of

complicatedness.”

“We are at an inflection point. The dramatic increase in

complexity in business operating environments, furthered by

advances in technology over the past decade, is adding cost and

friction to our financial system,” said BCG CEO Christoph

Schweizer. “Our research highlights significant opportunities for

efficiency gains with equal or greater effectiveness and improved

performance outcomes that could unlock up to $1 trillion of lending

capacity.”

Whereas complexity can be viewed as external factors beyond the

control of individual organizations, complicatedness arises from

how organizations respond, and the mechanisms created to adapt to

that complexity. Nasdaq’s analysis suggests that by reducing

complicatedness in processes across bank Risk & Compliance

functions, significant resources can be released and deployed

towards critical investment areas such as the digitization of the

global economy, the modernization of our energy systems, and the

need for next-generation power solutions to enable the artificial

intelligence revolution.

In addition, the report finds that financial institutions are

turning toward strategic technology partners that offer holistic

best-in-class solutions to their biggest risk and compliance

challenges as a means of addressing the exponential increase in

complexity. Only 22% of industry professionals have a preference to

build software solutions in house, indicating that industry

recognizes the value of systems-based solutions from trusted

partners.

“The most effective solutions will require a comprehensive

recalibration of people, processes, and systems,” said Tal Cohen,

President of Nasdaq. “By shifting from lengthy manual processes to

systems-based and people-led processes, human capital can be

unlocked to focus on decision-making, risk management, oversight,

analysis, and innovation. Getting this right can unlock significant

value through efficiency gains. But that only tells part of the

story. The transformative potential of AI will redefine every

industry - including the financial industry - in the years ahead.

The very same solutions that sit at the core of the complicatedness

challenge, will serve as the foundation for success in tomorrow’s

AI-enabled world. As such, effectively addressing these issues

today could protect and reinforce competitiveness well into the

future.”

The report also provides a call to action to bank leaders to

amplify the talent of their teams by shifting from a people-based

to a people-led approach, where systems serve as the base of

unleashing human potential, reducing rote processes and procedures

and leveraging the scale of software platforms to achieve the same

level of effectiveness with significantly enhanced efficiency. This

call also includes encouraging all stakeholders in the ecosystem,

including regulators, to embrace new ways of working and to better

embrace the capabilities of modern technology.

Additional Insights from the Report:

- Increasing Complexity in Financial

Institutions:

- Research revealed that throughout just over a half-century,

while external complexity had increased more than 6-fold,

organizational complicatedness in response had increased more than

35-fold.

- The complexity of the operating environment within the global

financial system has increased 2x-3x over the past decade, driven

by external factors such as increased regulations and an

interconnected global financial system.

- The number of new regulations per year are now more than 6x

what they were during the Global Financial Crisis.

- Cost of Complexity:

- Despite significant investments in the digitization of the

financial system – i.e. $800 billion in annual tech investments,

30% decrease in bank branches in the U.S. alone – overall operating

costs for banks have not meaningfully declined or improved.

- In addition, significant costs continue to be associated with

non-compliance for banks with nearly $250 billion spent on

regulatory fines – this number excludes the financial impact of

financial crime and related costs to the financial system.

- The Time is Now, and the Opportunity is

Significant:

- Bank executives see significant opportunities for efficiency

gains and improved outcomes from modernization solutions. This

could result in annual savings of $25 billion - $50 billion in Risk

& Compliance operating expenditures, unlocking up to $1

trillion in lending capacity.

- This is particularly powerful given the $80 trillion required

over the next few decades to support major transformation themes

across the global economy.

- Transformation Through Technology:

- The financial system is now at a point where this

transformation is technologically and culturally possible, with

increased comfort in leveraging cloud-based solutions.

- For example, the level of comfort to leverage and deploy

cloud-based solutions across the industry has increased from 11% in

2014 to 93% in 2024.

- Today, bank leaders cite comfort in AI similar to that of cloud

five years ago – paving a runway for similar comfort in AI to build

over the next five years.

- Additionally, only 22% of respondents have a preference to

build software solutions in house, indicating that industry is

looking for systems-base solutions from trusted partners.

Data, insights and research included within the report were

based on interviews with senior banking leaders, an assessment of

industry data sources, and a survey of industry professionals. More

about this research and the full report are available here.

About Nasdaq Nasdaq (Nasdaq: NDAQ) is a leading

global technology company serving corporate clients, investment

managers, banks, brokers, and exchange operators as they navigate

and interact with the global capital markets and the broader

financial system. We aspire to deliver world-leading platforms that

improve the liquidity, transparency, and integrity of the global

economy. Our diverse offering of data, analytics, software,

exchange capabilities, and client-centric services enables clients

to optimize and execute their business vision with confidence. To

learn more about the company, technology solutions, and career

opportunities, visit us on LinkedIn, on X @Nasdaq, or at

www.nasdaq.com.

-NDAQG-

Media Relations Contact:Marleen

Geerlof+1.347.265.1687Marleen.Geerlof@Nasdaq.com

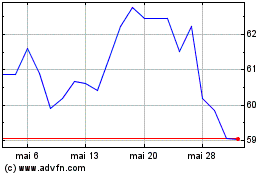

Nasdaq (NASDAQ:NDAQ)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Nasdaq (NASDAQ:NDAQ)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025