false000147724600014772462025-01-242025-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2025

S&W SEED COMPANY

(Exact name of registrant as specified in Its charter)

|

|

|

Nevada |

001-34719 |

27-1275784 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

|

|

|

2101 Ken Pratt Blvd, Suite 201 Longmont, CO |

|

80501 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (720) 506-9191

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

SANW |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

S&W Seed Company (the “Company”) is furnishing guidance regarding certain financial trends and product timelines. The Company estimates that:

•fiscal 2025 sorghum sales will be within a range of $24.0 to $27.5 million, comprised of traited sorghum sales of $12.0 to $14.5 million and conventional sorghum sales of $12.0 to $13.0 million

•sorghum sales will increase over time, and in fiscal 2033 will be within a range of $80.0 to $90.0 million, comprised of traited sorghum sales of $70.0 to $78.0 million and conventional sorghum sales of $10.0 to $12.0 million

•the compounded annual growth rate (“CAGR”) of sorghum sales from fiscal 2022 through fiscal 2025 will be within a range of 17 to 22 percent and the CAGR of sorghum sales from fiscal 2025 through fiscal 2033 will be within a range of 16 to 18 percent

•fiscal 2025 adjusted gross margins (defined in “Non-GAAP Financial Measures” below) for all sorghum sales will be within a range of 47 to 50 percent, with the adjusted gross margins for traited sorghum sales to be within a range of 68 to 70 percent

•fiscal 2033 adjusted gross margins for all sorghum sales will be within a range of 71 to 75 percent, with the adjusted gross margins for traited sorghum sales to be within a range of 76 to 81 percent

•commercial launch of its second generation of Double Team (DT2™) forage sorghum will occur in fiscal year 2027 in the United States

•commercial launch of DT2 plus Prussic Acid Free (PF™) grain sorghum will occur in fiscal year 2028 in the United States and between fiscal years 2029 to 2030 in certain other countries

•commercial launch of Broad Spectrum HT sorghum will occur in fiscal year 2031 in the United States and fiscal year 2033 in certain other countries

•commercial launch of Insect Tolerant sorghum will occur in fiscal year 2031 in the United States and fiscal year 2033 in certain other countries

•the aggregate U.S grain sorghum market share held by Double Team, DT2, and DT2 plus PF will range from 10 to 12 percent in fiscal 2025 and range from 25 to 30 percent in fiscal 2033

Non-GAAP Financial Measures

The guidance included in this Form 8-K includes both GAAP information and non-GAAP information. The Company has provided the non-GAAP financial measure of adjusted gross margins in this report.

The Company uses non-GAAP financial measures internally to facilitate period-to-period comparisons and analysis of its operating performance and liquidity, and believes they are useful to investors as a supplement to GAAP measures in analyzing, trending and benchmarking the performance and value of its business. However, these measures are not intended to be a substitute for those reported in accordance with GAAP. These non-GAAP measures may be different from non-GAAP financial measures used by other companies, even when similar terms are used to identify such measures.

In order to calculate non-GAAP financial measures, the Company makes targeted adjustments to certain GAAP financial line items found on its condensed consolidated statement of operations, backing out non-recurring or unique items that the Company believes otherwise distort the underlying results and trends of the ongoing business.

Adjusted gross margins is defined by the Company as GAAP gross profit divided by revenue, excluding the impact of inventory write-downs, alfalfa related activities, service revenues, and other sales related activities outside of sorghum or traited sorghum where specified. The Company believes it is important to exclude these amounts in order to better understand its business performance.

The Company does not provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP reported financial measures because the Company is unable to predict with reasonable certainty the reconciling items specified above, without unreasonable effort. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance period. As such, any reconciliations provided would imply a degree of precision that could be confusing or misleading to investors.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "anticipates," "believe," "may," "future," "plan," "should" or "expects." Forward-looking statements in this Form 8-K include, but are not limited to, the performance of our seed technology

products; the timing of the development and anticipated commercial launch of our products currently under development; our success in developing and commercializing high value seed traits; our financial projections and underlying assumptions, including with respect to expected sales growth and expected gross margins; the potential of our sorghum traits to increase our market share, revenues and gross margins over the next decade; and the execution of our strategic and commercial plans. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including risks and uncertainties related to: our proprietary seed trait technology products may not yield their anticipated benefits, including with respect to their impact on sales, revenues and gross margins; sales of our products may be lower than anticipated; our strategic initiatives may not achieve the expected results; the effects of unexpected weather and geopolitical and macroeconomic events, such as global inflation, bank failures, supply chain disruptions, uncertain market conditions, the armed conflict in Sudan, the ongoing military conflict between Russia and Ukraine and related sanctions and conflict in the Middle East, on our business and operations as well as those of our partnership, and the extent to which they disrupt the local and global economies, as well as our business and the businesses of our partnership, our customers, distributors and suppliers; the sufficiency of our cash and access to capital in order to meet our liquidity needs, including our ability to pay our growers as our payment obligations come due; our need to comply with the financial covenants included in our loan agreements and raise additional capital in the future; changes in the competitive landscape and the introduction of competitive products may negatively impact our results of operations; previously experienced logistical challenges in shipping and transportation of our products may become amplified, delaying our ability to recognize revenue and decreasing our gross margins; we may be unable to achieve our efforts to drive growth, improve gross margins and reduce operating expenses; the inherent uncertainty and significant judgments and assumptions underlying our financial outlook for fiscal 2025 and beyond; and the risks associated with our ability to successfully optimize and commercialize our business, such as changes in market conditions, including any unexpected decline in commodity prices. These and other risks are identified in the Company’s filings with the SEC, including, without limitation, the Company’s Annual Report on Form 10-K for the year ended June 30, 2024 and in other filings subsequently made by the Company with the Securities and Exchange Commission. All forward-looking statements contained in this Form 8-K speak only as of the date on which they were made and are based on management's assumptions and estimates as of such date. The Company does not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise.

The information contained or incorporated in this Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for the purposes of or otherwise subject to the liabilities under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless expressly incorporated into a filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, the information contained in this Item 7.01 shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

S&W SEED COMPANY |

|

|

|

|

|

|

|

By: |

/s/ Vanessa Baughman |

|

|

Vanessa Baughman |

Date: January 24, 2025 |

|

Chief Financial Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

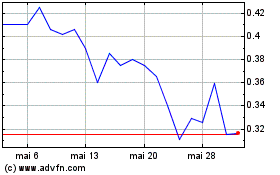

S and W Seed (NASDAQ:SANW)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

S and W Seed (NASDAQ:SANW)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025