false000147724600014772462024-12-192024-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 19, 2024

S&W SEED COMPANY

(Exact name of registrant as specified in Its charter)

|

|

|

Nevada |

001-34719 |

27-1275784 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

|

|

|

2101 Ken Pratt Blvd, Suite 201 Longmont, CO |

|

80501 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (720) 506-9191

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

SANW |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Mountain Ridge Credit Agreement

On December 19, 2024, S&W Seed Company (the “Company”) entered into a Credit and Security Agreement (the “Mountain Ridge Credit Agreement”) with ABL OPCO LLC (“Mountain Ridge”) as administrative agent, and the lenders party thereto. The Mountain Ridge Credit Agreement provides for a senior secured credit facility of up to $25.0 million (the “Mountain Ridge Credit Facility”), which matures on February 20, 2026, provided, however, that if on or prior to December 22, 2025, the maturity date of the Term Loan Agreement, entered into on June 20, 2023, between the Company and AgAmerica Lending LLC, is extended to a maturity date on or after March 19, 2028, the maturity date under the Mountain Ridge Credit Agreement will be December 19, 2027 (the “Mountain Ridge Maturity Date”).

The initial advance under the Mountain Ridge Credit Facility was used to repay in full the Company’s obligations to CIBC Bank USA (“CIBC”) pursuant to the Amended and Restated Loan and Security Agreement with CIBC, dated March 22, 2023, as amended (the “CIBC Loan Agreement”). Future advances under the Mountain Ridge Credit Facility may be used to finance the Company’s ongoing working capital requirements and other general corporate purposes. Availability of funds under the Mountain Ridge Credit Facility is subject to a borrowing base equal to the sum of (i) up to 95% of eligible letters of credit, plus (ii) up to 70% of eligible accounts (provided, that the maximum amount of eligible accounts that constitute (y) seasonal domestic accounts (after giving effect to the advance rate) which may be included as part of this component of the borrowing base shall not exceed (1) during the calendar months of October, November, December, and January, $3.0 million, (2) during the calendar month of February, $4.0 million, (C) during the calendar months of March, July, August, and September, $5.0 million, or (3) during the calendar months of April, May, and June, $6.0 million, or (z) eligible insured foreign accounts (after giving effect to the advance rate) which may be included as part of this component of the borrowing base shall not exceed $3.5 million); plus (iii) the lesser of (y) the product of 50% multiplied by the net orderly liquidation value of eligible inventory, and (z) $10.0 million, in each case ((i), (ii) and (iii)), as more fully set forth in the Mountain Ridge Credit Agreement and subject to lender reserves that Mountain Ridge may establish from time to time in its discretion, determined in good faith.

Loan advances under the Mountain Ridge Credit Facility bear interest at a rate per annum based on one-month term SOFR plus an applicable margin of 8.0%. The Company’s obligations under the Mountain Ridge Credit Agreement are secured by a first priority security interest in substantially all of the Company’s assets (subject to certain exceptions), including intellectual property.

The Mountain Ridge Credit Agreement contains certain customary representations and warranties, events of default, and affirmative and negative covenants (including a minimum EBITDA covenant), including limitations with respect to debt, liens, fundamental changes, asset sales, restricted payments, investments and transactions with affiliates, all subject to certain exceptions. Amounts due under the Mountain Ridge Credit Agreement may be accelerated upon an “event of default,” as defined in the Mountain Ridge Credit Agreement, such as failure to pay amounts owed thereunder when due, breach of a covenant, material inaccuracy of a representation, or occurrence of bankruptcy or insolvency, subject in some cases to cure periods. Additionally, upon the occurrence and during the continuance of an event of default, Mountain Ridge may elect to increase the existing interest rate on all of the Company’s outstanding obligations by 2.0% per annum.

All amounts outstanding under the Mountain Ridge Credit Agreement, including, but not limited to, accrued and unpaid principal and interest due under the Mountain Ridge Credit Facility, will be due and payable in full on the Mountain Ridge Maturity Date.

In connection with the Company’s entry into the Mountain Ridge Credit Agreement, MFP Partners L.P. (“MFP”) provided a letter of credit, issued by JPMorgan Chase Bank, N.A. for the account of MFP, with a face amount equal to $13.0 million, for the benefit of Mountain Ridge (the “MFP Letter of Credit”), as collateral to support the Company’s obligations under the Mountain Ridge Credit Agreement. In addition, the MFP Letter of Credit constitutes an eligible letter of credit under the Mountain Ridge Credit Agreement and, therefore, provides the Company with borrowing base credit under the Mountain Ridge Credit Facility.

Seventh Amendment to MFP Loan Agreement

Concurrently with the Company’s entry into the Mountain Ridge Credit Agreement, on December 19, 2024, the Company entered into a Seventh Amendment to Subordinate Loan and Security Agreement (the “MFP

Amendment”) with MFP, amending the Company’s Subordinate Loan and Security Agreement with MFP, dated September 22, 2022 (as amended, the “MFP Loan Agreement”). The MFP Amendment makes changes to the MFP Loan Agreement to reflect the payoff of the CIBC Loan Agreement and cancellation of the amended letter of credit previously issued by JPMorgan Chase Bank, N.A. for the account of MFP, for the benefit of CIBC, as additional collateral to support the Company’s obligations under the CIBC Loan Agreement, and to reflect and facilitate the issuance of the MFP Letter of Credit. Except as modified by the MFP Amendment, all terms and conditions of the MFP Loan Agreement remain in full force and effect.

Item 1.02 Termination of a Material Definitive Agreement.

The information included in Item 1.01 related to the CIBC Loan Agreement is incorporated by reference into this Item 1.02.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The description of the Mountain Ridge Credit Agreement in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 8.01 Other Events.

On December 19, 2024, the Company entered into a Stock Purchase Agreement with MFP (the “Stock Purchase Agreement”). Pursuant to the Stock Purchase Agreement, the Company repurchased 200,000 shares of the Company’s common stock (the “Repurchased Shares”) directly from MFP in a private, non-underwritten transaction. The Repurchased Shares were retired and restored to the status of authorized but unissued shares of the Company.

Pursuant to the Stock Purchase Agreement, the Company granted MFP the right to designate one (1) individual, who shall be a representative of MFP reasonably acceptable to the Company, to attend all meetings (whether in person, telephonic or otherwise) of the Company’s Board of Directors (the “Board”) and all committees of the Board in a non-voting, observer capacity, subject to certain exceptions.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

S&W SEED COMPANY |

|

|

|

|

|

|

|

By: |

/s/ Vanessa Baughman |

|

|

Vanessa Baughman |

Date: December 23, 2024 |

|

Chief Financial Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

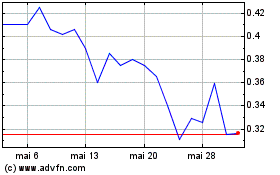

S and W Seed (NASDAQ:SANW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

S and W Seed (NASDAQ:SANW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024