Form S-8 POS - Securities to be offered to employees in employee benefit plans, post-effective amendments

04 Octobre 2024 - 10:41PM

Edgar (US Regulatory)

| | | | | | | | | | | | | | | | | |

As filed with the Securities and Exchange Commission on October 4, 2024 |

| Registration No. 333-279449 |

| Registration No. 333-271620 |

| Registration No. 333-259062 |

| Registration No. 333-252198 |

| Registration No. 333-250900 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| _________________________ |

| POST-EFFECTIVE AMENDMENT NO. 1 |

| TO |

| FORM S-8 REGISTRATION STATEMENT NO. 333-279449 |

| FORM S-8 REGISTRATION STATEMENT NO. 333-271620 |

| FORM S-8 REGISTRATION STATEMENT NO. 333-259062 |

| FORM S-8 REGISTRATION STATEMENT NO. 333-252198 |

| FORM S-8 REGISTRATION STATEMENT NO. 333-250900 |

| UNDER |

| THE SECURITIES ACT OF 1933 |

| _________________________ |

|

| THE AARON’S COMPANY, INC. |

| (Exact name of registrant as specified in its charter) |

| Georgia

(State or other jurisdiction of

incorporation or organization) | | 85-2483376

(I.R.S. Employer

Identification No.) | | |

400 Galleria Parkway SE, Suite 300 Atlanta, Georgia 30339-3182

(Address, including zip code, of Principal Executive Offices) |

| _________________________ |

| The Aaron’s Company, Inc. Amended and Restated 2020 Equity and Incentive Plan |

| Amended and Restated Employee Stock Purchase Plan |

| The Aaron's 401(k) Retirement Plan |

| (Full title of the plan) |

C. Kelly Wall Chief Financial Officer The Aaron’s Company, Inc. 400 Galleria Parkway SE, Suite 300 Atlanta, Georgia 30339-3182 | |

| (Names and address of agent for service) |

(678) 402-3000

(Telephone number, including area code, of agent for service) |

| Copy to: |

| | | | | | | | | | | | | | | | | |

Joel T. May Jones Day 1221 Peachtree St., NE Suite 400 Atlanta, Georgia 30361 (404) 521-3939 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐

| Accelerated Filer ☒ | |

Non-Accelerated Filer ☐

| Smaller Reporting Company ☐ | |

| Emerging Growth Company ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐ | |

|

DEREGISTRATION OF SECURITIES

These Post-Effective Amendments (the “Post-Effective Amendments”) relate to the following Registration Statements on Form S-8 (the “Registration Statements”) filed by The Aaron’s Company, Inc. (“The Aaron’s Company” or the “Company”) with the Securities and Exchange Commission (the “SEC”):

•Registration Statement No. 333-279449, filed with the SEC on May 16, 2024, relating to the registration of 1,527,000 shares of Common Stock, $0.50 par value per share (“Common Stock”) of the Company under the Company’s Amended and Restated 2020 Equity and Incentive Plan;

•Registration Statement No. 333-271620, filed with the SEC on May 3, 2023, relating to the registration of 850,000 shares of Common Stock under the Company’s Amended and Restated Employee Stock Purchase Plan;

•Registration Statement No. 333-259062, filed with the SEC on August 25, 2021, relating to the registration of 3,475,000 shares of Common Stock under the Company’s Amended and Restated 2020 Equity and Incentive Plan;

•Registration Statement No. 333-252198, filed with the SEC on January 19, 2021, relating to the registration of (i) 500,000 shares of Common Stock under the Company’s 401(k) Retirement Plan and (ii) an indeterminate amount of plan interests under such plan; and

•Registration Statement No. 333-250900, filed with the SEC on November 19, 2020, relating to the registration of (i) 3,300,000 shares of Common Stock under the Company’s 2020 Equity and Incentive Plan, (ii) 200,000 shares of Common Stock available for purchase under the Company’s Employee Stock Purchase Plan; and (iii) up to $9,400,000 of deferred compensation obligations of the Company under the Company’s Deferred Compensation Plan.

On October 3, 2024, Polo Merger Sub, Inc., a Georgia corporation (“Merger Sub”) and a wholly owned subsidiary of IQVentures Holdings, LLC, an Ohio limited liability company (“Parent”), completed its merger (the “Merger”) with and into The Aaron’s Company pursuant to the terms of the Agreement and Plan of Merger, dated June 16, 2024 (the “Merger Agreement”), by and among Parent, Merger Sub, and The Aaron’s Company. The Aaron’s Company was the surviving corporation in the Merger and, as a result, is now a wholly owned subsidiary of Parent.

As a result of the Merger, The Aaron’s Company has terminated all offerings and sales of securities pursuant to the Registration Statements. In accordance with an undertaking made by The Aaron’s Company in the Registration Statements to remove from registration, by means of a post-effective amendment, any of the securities that had been registered for issuance under the Registration Statements that remain unsold at the termination of such offerings, The Aaron’s Company hereby removes from registration all of such securities registered but remaining unsold under the Registration Statements as of the date hereof.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused these Post-Effective Amendments to the Registration Statements described above to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Atlanta, State of Georgia, on October 4, 2024.

| | |

| THE AARON’S COMPANY, INC. |

By: /s/ C. Kelly Wall Name: C. Kelly Wall Title: Chief Financial Officer |

No other person is required to sign these Post-Effective Amendments in reliance on Rule 478 of the Securities Act of 1933.

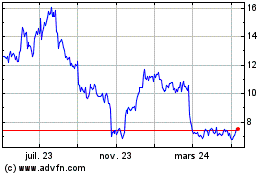

Aarons (NYSE:AAN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

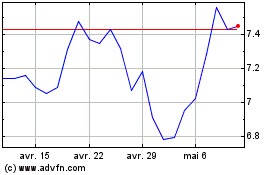

Aarons (NYSE:AAN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025