0000874761FALSE00008747612024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 1, 2024

_____________________________________________________________________________________________________

THE AES CORPORATION

(Exact name of registrant as specified in its charter)

_________________________________________________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-12291 | | 54-1163725 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

4300 Wilson Boulevard

Arlington, Virginia 22203

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(703) 522-1315

NOT APPLICABLE

(Former name or former address, if changed since last report)

_________________________________________________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | AES | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

_________________________________________________________________________________________________________________

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, The AES Corporation (“AES” or the “Company”) issued a press release announcing its financial results for the quarter and year ended June 30, 2024. A copy of the press release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. Such information is furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation language in such filing.

Item 7.01 Regulation FD Disclosure.

On August 1, 2024, AES issued a press release announcing its financial results for the quarter ended June 30, 2024, its most recent guidance and provided additional forward-looking information. A copy of the press release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. Such information is furnished pursuant to Item 7.01 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of the Securities Act and of the Exchange Act. Such forward-looking statements include, but are not limited to, those related to future earnings, growth, and financial and operating performance. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute AES’ current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to, our expectations regarding accurate projections of future interest rates, commodity price and foreign currency pricing, continued normal levels of operating performance and electricity volume at our distribution companies and operational performance at our generation businesses consistent with historical levels, as well as the execution of PPAs, conversion of our backlog and growth investments at normalized investment levels, and rates of return consistent with prior experience.

Actual results could differ materially from those projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual results are discussed in AES’ filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks discussed under Item 1A “Risk Factors” and Item 7: Management’s Discussion & Analysis in AES’ 2023 Annual Report on Form 10-K and in subsequent reports filed with the SEC. Readers are encouraged to read AES’ filings to learn more about the risk factors associated with AES’ business. AES undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Any Stockholder who desires a copy of the Company’s 2023 Annual Report on Form 10-K filed February 26, 2024, or subsequent filings with the SEC, may obtain a copy (excluding the exhibits thereto) without charge by addressing a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Exhibits also may be requested, but a charge equal to the reproduction cost thereof will be made. A copy of the Annual Report on Form 10-K may also be obtained by visiting the Company’s website at www.aes.com.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit No. Description

99.1 Press Release issued by The AES Corporation, dated August 1, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf of the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | THE AES CORPORATION |

| | | |

| Date: | August 1, 2024 | By: | /s/ Stephen Coughlin |

| | Name: | Stephen Coughlin |

| | Title: | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| Press Release issued by The AES Corporation, dated August 1, 2024 |

| |

| |

| |

| |

| |

| |

| 101 | Inline XBRL Document Set for the Cover Page from this Current Report on Form 8-K, formatted as Inline XBRL |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Press Release

Investor Contact: Susan Harcourt 703-682-1204, susan.harcourt@aes.com

Media Contact: Amy Ackerman 703-682-6399, amy.ackerman@aes.com

AES Reports Record Sales with Data Center Hyperscalers

Now Expects to Achieve Upper Half of 2024 Adjusted EPS Guidance Range

Strategic Accomplishments

•Signed 2.5 GW of new agreements, including 2.2 GW directly with data center customers

◦Signed agreements to support 1.2 GW of new data center load at US utilities; in advanced negotiations for up to another 3 GW over the next 12 months

◦Signed 15-year PPAs for 727 MW of wind and solar to serve data center growth in Texas

◦Signed a 310 MW retail supply agreement to support data centers throughout Ohio

•Total backlog of signed long-term PPAs now 12.6 GW

•Completed the construction or acquisition of 1.6 GW in year-to-date 2024; on track to add 3.6 GW of new projects to operations in full year 2024

Q2 2024 Financial Highlights

•GAAP Financial Metrics

◦Diluted EPS of $0.27, compared to ($0.06) in Q2 2023

◦Net Loss of $39 million, compared to $19 million in Q2 2023

◦Net Income (Loss) Attributable to The AES Corporation of $185 million, compared to ($39) million in Q2 2023

•Non-GAAP Adjusted Financial Metrics

◦Adjusted EPS1 of $0.38, compared to $0.21 in Q2 2023

◦Adjusted EBITDA with Tax Attributes2,3 of $843 million, compared to $607 million in Q2 2023

◦Adjusted EBITDA3 of $652 million, compared to $569 million in Q2 2023

Financial Position and Outlook

•Now expects to achieve upper half of 2024 Adjusted EPS1 guidance range of $1.87 to $1.97

◦Reaffirming annualized Adjusted EPS1 growth target of 7% to 9% through 2025, off a base of 2020

◦Reaffirming annualized Adjusted EPS1 growth target of 7% to 9% through 2027, off a base of 2023 guidance

•Reaffirming 2024 guidance for Adjusted EBITDA2 of $2,600 to $2,900 million

◦Reaffirming annualized growth target2 of 5% to 7% through 2027, off a base of 2023 guidance

◦Now expects 2024 Adjusted EBITDA with Tax Attributes2,3 to be in the upper half of the range of $3,550 to $3,950 million

ARLINGTON, Va., August 1, 2024 – The AES Corporation (NYSE: AES) today reported financial results for the quarter ended June 30, 2024.

1 Adjusted EPS is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EPS and a description of the adjustments to reconcile Adjusted EPS to Diluted EPS for the quarter ended June 30, 2024. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EPS guidance without unreasonable effort.

2 Adjusted EBITDA is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EBITDA and a description of the adjustments to reconcile Adjusted EBITDA to Net Income (Loss) for the quarter ended June 30, 2024. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EBITDA guidance without unreasonable effort.

3 Pre-tax effect of Production Tax Credits, Investment Tax Credits, and depreciation tax deductions allocated to tax equity investors, as well as the tax benefit recorded from tax credits retained or transferred to third parties.

"AES had another strong quarter, extending our leadership in supplying renewable energy solutions to data centers, and we are on track to meet all of our strategic and financial objectives," said Andrés Gluski, AES President and Chief Executive Officer. "Since our last call, we signed 2.2 GW of new agreements with data center hyperscalers, and our backlog of signed Power Purchase Agreements is now 12.6 GW, the majority of which will be completed by 2027. AES' continued success in meeting the clean energy needs of its key corporate customers makes our business model highly resilient and ensures strong growth for years to come."

"I'm very excited about AES' continued success in the second quarter. Our construction program is solidly on track, we signed record sales with data centers, and our year-to-date Adjusted EPS more than doubled compared to last year," said Stephen Coughlin, AES Executive Vice President and Chief Financial Officer. "As a result of our strong performance year-to-date and our outlook for the remainder of the year, we now expect our 2024 Adjusted EBITDA with Tax Attributes and Adjusted EPS to be in the upper half of our ranges."

Q2 2024 Financial Results

Second quarter 2024 Net Loss was $39 million, an increase of $20 million compared to second quarter 2023. This increase is the result of losses at commencement of sales-type leases at the Renewables Strategic Business Unit (SBU), partially offset by favorable contributions at the Utilities and Energy Infrastructure SBUs and higher contributions from renewables projects placed in service in the current year.

Second quarter 2024 Adjusted EBITDA4 (a non-GAAP financial measure) was $652 million, an increase of $83 million compared to second quarter 2023, primarily driven by higher contributions at the Utilities SBU, higher revenues under a Power Purchase Agreement (PPA) termination agreement at the Energy Infrastructure SBU, and higher revenues from new projects at the Renewables SBU; partially offset by higher outages at the Energy Infrastructure SBU, and outages in Colombia at the Renewables SBU.

Adjusted EBITDA with Tax Attributes4,5 was $843 million, an increase of $236 million compared to second quarter 2023, primarily due to higher realized tax attributes driven by more renewables projects placed in service, and the drivers above.

Second quarter 2024 Diluted Earnings Per Share from Continuing Operations (Diluted EPS) was $0.27, an increase of $0.33 compared to second quarter 2023, primarily reflecting higher contributions from renewables projects placed in service in the current year, prior year unrealized foreign currency losses at the Energy Infrastructure SBU, and higher margins at the Utilities and Energy Infrastructure SBUs; partially offset by losses at commencement of sales-type leases at the Renewables SBU.

4 Adjusted EBITDA is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EBITDA and a description of the adjustments to reconcile Adjusted EBITDA to Net Income for the quarter ended June 30, 2024. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EBITDA guidance without unreasonable effort.

5 Pre-tax effect of Production Tax Credits, Investment Tax Credits, and depreciation tax deductions allocated to tax equity investors, as well as the tax benefit recorded from tax credits retained or transferred to third parties.

Second quarter 2024 Adjusted Earnings Per Share6 (Adjusted EPS, a non-GAAP financial measure) was $0.38, an increase of $0.17, compared to second quarter 2023, mainly driven by a lower adjusted tax rate, higher contributions from the Utilities SBU, and higher contributions from renewables projects placed in service in the current year.

Strategic Accomplishments

•The Company has now signed 8.1 GW of agreements directly with technology customers, including through transmission and distribution, renewables PPAs and retail supply. Since the Company's first quarter 2024 earnings call in May 2024, the Company signed 2.2 GW of agreements, including:

◦1.2 GW of new data center load at US utilities, which should benefit rate base growth, but is not included in the Company's PPA backlog;

◦15-year PPAs for 727 MW of wind and solar to serve data center growth in Texas; and

◦A 310 MW retail supply agreement to support data centers throughout Ohio, which is not included in the Company's PPA backlog.

•The Company’s PPA backlog, which consists of projects with signed contracts, but which are not yet operational, is 12.6 GW, including 5.1 GW under construction. Since the Company's first quarter 2024 earnings call in May 2024, the Company:

◦Signed 1 GW of long-term PPAs for new renewables, including the acquisition of a 170 MW solar-plus-storage development project that will be added to AES Indiana's rate base.

◦Completed the construction or acquisition of 976 MW of wind, solar and energy storage and expects to add a total of 3.6 GW to its operating portfolio by year-end 2024.

Guidance and Expectations6,7

The Company now expects 2024 Adjusted EBITDA with Tax Attributes6,8 to be in the upper half of the range of $3,550 to $3,950 million, driven by new renewables.

The Company is reaffirming its 2024 guidance for Adjusted EBITDA6 of $2,600 to $2,900 million. Results are expected to be driven by the impacts from significant asset sales closed in 2023 and expected to close in 2024, as well as prior year margins earned on LNG transactions, partially offset by contributions from new renewables projects, improved margins in Chile, rate base growth at US utilities.

The Company is reaffirming its expectation for annualized growth in Adjusted EBITDA6 of 5% to 7% through 2027, from a base of its 2023 guidance of $2,600 to $2,900 million.

6 Adjusted EBITDA is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EBITDA and a description of the adjustments to reconcile Adjusted EBITDA to Net Income for the quarter ended June 30, 2024. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EBITDA guidance without unreasonable effort.

7 Adjusted EPS is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EPS and a description of the adjustments to reconcile Adjusted EPS to Diluted EPS for the quarter ended June 30, 2024. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EPS guidance without unreasonable effort.

8 Pre-tax effect of Production Tax Credits, Investment Tax Credits, and depreciation tax deductions allocated to tax equity investors, as well as the tax benefit recorded from tax credits retained or transferred to third parties.

The Company now expects 2024 Adjusted EPS9 to be in the upper half of its guidance range of $1.87 to $1.97. Growth in 2024 is expected to be primarily driven by new renewables commissionings, rate base growth at US utilities, and improved margins in Chile, but partially offset by asset sales and prior year margins on LNG transactions.

The Company is reaffirming its annualized growth target for Adjusted EPS9 of 7% to 9% through 2025, from a base year of 2020. The Company is also reaffirming its annualized growth target for Adjusted EPS9 of 7% to 9% through 2027, from a base of its 2023 guidance of $1.65 to $1.75.

The Company's 2024 guidance is based on foreign currency and commodity forward curves as of June 30, 2024.

Non-GAAP Financial Measures

See Non-GAAP Measures for definitions of Adjusted EBITDA, Adjusted EBITDA with Tax Attributes, Tax Attributes, Adjusted Earnings Per Share, and Adjusted Pre-Tax Contribution, as well as reconciliations to the most comparable GAAP financial measures.

Attachments

Condensed Consolidated Statements of Operations, Segment Information, Condensed Consolidated Balance Sheets, Condensed Consolidated Statements of Cash Flows, Non-GAAP Financial Measures and Parent Financial Information.

Conference Call Information

AES will host a conference call on Friday, August 2, 2024 at 10:00 a.m. Eastern Time (ET). Interested parties may listen to the teleconference by dialing 1-833-470-1428 at least ten minutes before the start of the call. International callers should dial +1-404-975-4839. The Participant Access Code for this call is 863773. Internet access to the conference call and presentation materials will be available on the AES website at www.aes.com by selecting “Investors” and then “Presentations and Webcasts.”

A webcast replay will be accessible at www.aes.com beginning shortly after the completion of the call.

About AES

The AES Corporation (NYSE: AES) is a Fortune 500 global energy company accelerating the future of energy. Together with our many stakeholders, we're improving lives by delivering the greener, smarter energy solutions

9 Adjusted EPS is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EPS and a description of the adjustments to reconcile Adjusted EPS to Diluted EPS for the quarter ended June 30, 2024. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EPS guidance without unreasonable effort.

the world needs. Our diverse workforce is committed to continuous innovation and operational excellence, while partnering with our customers on their strategic energy transitions and continuing to meet their energy needs today. For more information, visit www.aes.com.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of the Securities Act of 1933 and of the Securities Exchange Act of 1934. Such forward-looking statements include, but are not limited to, those related to future earnings, growth and financial and operating performance. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute AES’ current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to, our expectations regarding accurate projections of future interest rates, commodity price and foreign currency pricing, continued normal levels of operating performance and electricity volume at our distribution companies and operational performance at our generation businesses consistent with historical levels, as well as the execution of PPAs, conversion of our backlog and growth investments at normalized investment levels, and rates of return consistent with prior experience.

Actual results could differ materially from those projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual results are discussed in AES’ filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks discussed under Item 1A: “Risk Factors” and Item 7: "Management’s Discussion & Analysis" in AES’ 2023 Annual Report on Form 10-K and in subsequent reports filed with the SEC. Readers are encouraged to read AES’ filings to learn more about the risk factors associated with AES’ business. AES undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except where required by law.

Any Stockholder who desires a copy of the Company’s 2023 Annual Report on Form 10-K filed February 26, 2024 with the SEC may obtain a copy (excluding the exhibits thereto) without charge by addressing a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Exhibits also may be requested, but a charge equal to the reproduction cost thereof will be made. A copy of the Annual Report on Form 10-K may be obtained by visiting the Company’s website at www.aes.com.

Website Disclosure

AES uses its website, including its quarterly updates, as channels of distribution of Company information. The information AES posts through these channels may be deemed material. Accordingly, investors should monitor our website, in addition to following AES' press releases, quarterly SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about AES when you enroll your e-mail address by visiting the "Subscribe to Alerts" page of AES' Investors website. The contents of AES' website, including its quarterly updates, are not, however, incorporated by reference into this release.

THE AES CORPORATION

Condensed Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in millions, except per share amounts) |

| Revenue: | | | | | | | |

| Non-Regulated | $ | 2,070 | | | $ | 2,193 | | | $ | 4,302 | | | $ | 4,480 | |

| Regulated | 872 | | | 834 | | | 1,725 | | | 1,786 | |

| Total revenue | 2,942 | | | 3,027 | | | 6,027 | | | 6,266 | |

| Cost of Sales: | | | | | | | |

| Non-Regulated | (1,671) | | | (1,782) | | | (3,404) | | | (3,579) | |

| Regulated | (718) | | | (747) | | | (1,451) | | | (1,595) | |

| Total cost of sales | (2,389) | | | (2,529) | | | (4,855) | | | (5,174) | |

| Operating margin | 553 | | | 498 | | | 1,172 | | | 1,092 | |

| General and administrative expenses | (66) | | | (72) | | | (141) | | | (127) | |

| Interest expense | (389) | | | (310) | | | (746) | | | (640) | |

| Interest income | 88 | | | 131 | | | 193 | | | 254 | |

| Loss on extinguishment of debt | (9) | | | — | | | (10) | | | (1) | |

| Other expense | (84) | | | (12) | | | (122) | | | (26) | |

| Other income | 21 | | | 14 | | | 56 | | | 24 | |

| Gain (loss) on disposal and sale of business interests | 1 | | | (4) | | | 44 | | | (4) | |

| | | | | | | |

| Asset impairment expense | (230) | | | (174) | | | (276) | | | (194) | |

| Foreign currency transaction gains (losses) | 38 | | | (67) | | | 30 | | | (109) | |

| | | | | | | |

| INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE TAXES AND EQUITY IN EARNINGS OF AFFILIATES | (77) | | | 4 | | | 200 | | | 269 | |

| Income tax benefit (expense) | 35 | | | 2 | | | 51 | | | (70) | |

| Net equity in earnings (losses) of affiliates | 3 | | | (25) | | | (12) | | | (29) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| NET INCOME (LOSS) | (39) | | | (19) | | | 239 | | | 170 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Less: Net loss (income) attributable to noncontrolling interests and redeemable stock of subsidiaries | 224 | | | (20) | | | 378 | | | (58) | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION | $ | 185 | | | $ | (39) | | | $ | 617 | | | $ | 112 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| BASIC EARNINGS PER SHARE: | | | | | | | |

| | | | | | | |

| | | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 0.27 | | | $ | (0.06) | | | $ | 0.88 | | | $ | 0.17 | |

| DILUTED EARNINGS PER SHARE: | | | | | | | |

| | | | | | | |

| | | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 0.27 | | | $ | (0.06) | | | $ | 0.87 | | | $ | 0.16 | |

| DILUTED SHARES OUTSTANDING | 713 | | | 669 | | | 713 | | | 712 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| THE AES CORPORATION |

| Strategic Business Unit (SBU) Information |

| (Unaudited) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| REVENUE | | | | | | | |

| Renewables SBU | $ | 596 | | | $ | 541 | | | $ | 1,215 | | | $ | 1,036 | |

| Utilities SBU | 896 | | | 852 | | | 1,769 | | | 1,823 | |

| Energy Infrastructure SBU | 1,469 | | | 1,654 | | | 3,083 | | | 3,378 | |

| New Energy Technologies SBU | — | | | 1 | | | — | | | 75 | |

| Corporate and Other | 40 | | | 40 | | | 73 | | | 67 | |

| Eliminations | (59) | | | (61) | | | (113) | | | (113) | |

| Total Revenue | $ | 2,942 | | | $ | 3,027 | | | $ | 6,027 | | | $ | 6,266 | |

THE AES CORPORATION

Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31,

2023 |

| (in millions, except share and per share data) |

| ASSETS | | | |

| CURRENT ASSETS | | | |

| Cash and cash equivalents | $ | 1,773 | | | $ | 1,426 | |

| Restricted cash | 299 | | | 370 | |

| Short-term investments | 61 | | | 395 | |

| Accounts receivable, net of allowance of $22 and $15, respectively | 1,507 | | | 1,420 | |

| Inventory | 661 | | | 712 | |

| Prepaid expenses | 141 | | | 177 | |

| Other current assets, net of allowance of $0 and $14, respectively | 1,458 | | | 1,387 | |

| Current held-for-sale assets | 3,655 | | | 762 | |

| Total current assets | 9,555 | | | 6,649 | |

| NONCURRENT ASSETS | | | |

| Property, Plant and Equipment: | | | |

| Land | 488 | | | 522 | |

| Electric generation, distribution assets and other | 29,467 | | | 30,190 | |

| Accumulated depreciation | (8,270) | | | (8,602) | |

| Construction in progress | 9,047 | | | 7,848 | |

| Property, plant and equipment, net | 30,732 | | | 29,958 | |

| Other Assets: | | | |

| Investments in and advances to affiliates | 1,156 | | | 941 | |

| Debt service reserves and other deposits | 76 | | | 194 | |

| Goodwill | 348 | | | 348 | |

| Other intangible assets, net of accumulated amortization of $420 and $498, respectively | 1,879 | | | 2,243 | |

| Deferred income taxes | 435 | | | 396 | |

| | | |

| | | |

| Other noncurrent assets, net of allowance of $11 and $9, respectively | 2,845 | | | 3,259 | |

| Noncurrent held-for-sale assets | 712 | | | 811 | |

| Total other assets | 7,451 | | | 8,192 | |

| TOTAL ASSETS | $ | 47,738 | | | $ | 44,799 | |

| LIABILITIES AND EQUITY | | | |

| CURRENT LIABILITIES | | | |

| Accounts payable | $ | 1,869 | | | $ | 2,199 | |

| Accrued interest | 242 | | | 315 | |

| Accrued non-income taxes | 229 | | | 278 | |

| Supplier financing arrangements | 553 | | | 974 | |

| Accrued and other liabilities | 1,043 | | | 1,334 | |

| Recourse debt | 890 | | | 200 | |

| Non-recourse debt, including $335 and $1,080, respectively, related to variable interest entities | 2,176 | | | 3,932 | |

| Current held-for-sale liabilities | 2,821 | | | 499 | |

| Total current liabilities | 9,823 | | | 9,731 | |

| NONCURRENT LIABILITIES | | | |

| Recourse debt | 5,256 | | | 4,264 | |

| Non-recourse debt, including $2,087 and $1,715, respectively, related to variable interest entities | 20,232 | | | 18,482 | |

| Deferred income taxes | 1,588 | | | 1,245 | |

| | | |

| Other noncurrent liabilities | 2,452 | | | 3,114 | |

| Noncurrent held-for-sale liabilities | 457 | | | 514 | |

| Total noncurrent liabilities | 29,985 | | | 27,619 | |

| Commitments and Contingencies | | | |

| Redeemable stock of subsidiaries | 901 | | | 1,464 | |

| EQUITY | | | |

| THE AES CORPORATION STOCKHOLDERS’ EQUITY | | | |

| Preferred stock (without par value, 50,000,000 shares authorized; 1,043,050 issued and outstanding at December 31, 2023) | — | | | 838 | |

| Common stock ($0.01 par value, 1,200,000,000 shares authorized; 859,584,456 issued and 710,823,239 outstanding at June 30, 2024 and 819,051,591 issued and 669,693,234 outstanding at December 31, 2023) | 9 | | | 8 | |

| Additional paid-in capital | 7,067 | | | 6,355 | |

| Accumulated deficit | (769) | | | (1,386) | |

| Accumulated other comprehensive loss | (1,409) | | | (1,514) | |

| Treasury stock, at cost (148,761,217 and 149,358,357 shares at June 30, 2024 and December 31, 2023, respectively) | (1,807) | | | (1,813) | |

| Total AES Corporation stockholders’ equity | 3,091 | | | 2,488 | |

| NONCONTROLLING INTERESTS | 3,938 | | | 3,497 | |

| Total equity | 7,029 | | | 5,985 | |

| TOTAL LIABILITIES AND EQUITY | $ | 47,738 | | | $ | 44,799 | |

THE AES CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in millions) | | (in millions) |

| OPERATING ACTIVITIES: | | | | | | | |

| Net income | $ | (39) | | | $ | (19) | | | $ | 239 | | | $ | 170 | |

| Adjustments to net income: | | | | | | | |

| Depreciation and amortization | 308 | | | 277 | | | 620 | | | 550 | |

| Emissions allowance expense | 24 | | | 50 | | | 71 | | | 139 | |

| Loss (gain) on realized/unrealized derivatives | (64) | | | 71 | | | (137) | | | 38 | |

| | | | | | | |

| Loss (gain) on disposal and sale of business interests | (1) | | | 4 | | | (44) | | | 4 | |

| Impairment expense | 230 | | | 179 | | | 276 | | | 199 | |

| Loss on realized/unrealized foreign currency | 78 | | | 71 | | | 78 | | | 71 | |

| Deferred income tax expense (benefit) | (41) | | | (108) | | | 181 | | | (119) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | (131) | | | 2 | | | (27) | | | 91 | |

| Changes in operating assets and liabilities: | | | | | | | |

| (Increase) decrease in accounts receivable | (7) | | | 122 | | | (239) | | | 60 | |

| (Increase) decrease in inventory | (41) | | | 85 | | | 31 | | | 276 | |

| (Increase) decrease in prepaid expenses and other current assets | 94 | | | 7 | | | 133 | | | 71 | |

| (Increase) decrease in other assets | 138 | | | 24 | | | 47 | | | 74 | |

| Increase (decrease) in accounts payable and other current liabilities | (75) | | | (12) | | | (160) | | | (305) | |

| Increase (decrease) in income tax payables, net and other tax payables | (137) | | | (78) | | | (464) | | | (85) | |

| | | | | | | |

| Increase (decrease) in other liabilities | 56 | | | (113) | | | 74 | | | (47) | |

| Net cash provided by operating activities | 392 | | | 562 | | | 679 | | | 1,187 | |

| INVESTING ACTIVITIES: | | | | | | | |

| Capital expenditures | (1,685) | | | (1,845) | | | (3,833) | | | (3,396) | |

| Acquisitions of business interests, net of cash and restricted cash acquired | (16) | | | (290) | | | (73) | | | (290) | |

| Proceeds from the sale of business interests, net of cash and restricted cash sold | — | | | — | | | 11 | | | 98 | |

| | | | | | | |

| Sale of short-term investments | 393 | | | 350 | | | 534 | | | 706 | |

| Purchase of short-term investments | (460) | | | (202) | | | (604) | | | (620) | |

| Contributions and loans to equity affiliates | (29) | | | (92) | | | (50) | | | (112) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Purchase of emissions allowances | (35) | | | (37) | | | (91) | | | (115) | |

| Other investing | (6) | | | (10) | | | (118) | | | (21) | |

| Net cash used in investing activities | (1,838) | | | (2,126) | | | (4,224) | | | (3,750) | |

| FINANCING ACTIVITIES: | | | | | | | |

| Borrowings under the revolving credit facilities | 2,262 | | | 1,106 | | | 4,003 | | | 2,521 | |

| Repayments under the revolving credit facilities | (1,545) | | | (1,076) | | | (2,582) | | | (2,131) | |

| Commercial paper borrowings (repayments), net | (29) | | | 167 | | | 690 | | | 517 | |

| Issuance of recourse debt | 950 | | | 900 | | | 950 | | | 1,400 | |

| | | | | | | |

| Issuance of non-recourse debt | 1,667 | | | 767 | | | 3,798 | | | 1,457 | |

| Repayments of non-recourse debt | (1,811) | | | (284) | | | (2,726) | | | (944) | |

| Payments for financing fees | (44) | | | (49) | | | (75) | | | (67) | |

| Purchases under supplier financing arrangements | 222 | | | 289 | | | 708 | | | 818 | |

| Repayments of obligations under supplier financing arrangements | (539) | | | (275) | | | (1,055) | | | (862) | |

| Distributions to noncontrolling interests | (105) | | | (100) | | | (128) | | | (147) | |

| | | | | | | |

| Contributions from noncontrolling interests | 71 | | | — | | | 97 | | | 18 | |

| Sales to noncontrolling interests | 198 | | | 189 | | | 323 | | | 189 | |

| | | | | | | |

| | | | | | | |

| Dividends paid on AES common stock | (122) | | | (111) | | | (238) | | | (222) | |

| Payments for financed capital expenditures | (12) | | | (3) | | | (19) | | | (7) | |

| | | | | | | |

| | | | | | | |

| Other financing | (10) | | | (7) | | | 13 | | | (11) | |

| Net cash provided by financing activities | 1,153 | | | 1,513 | | | 3,759 | | | 2,529 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (28) | | | (19) | | | (43) | | | (37) | |

| Increase in cash, cash equivalents and restricted cash of held-for-sale businesses | (86) | | | 3 | | | (13) | | | (6) | |

| Total increase (decrease) in cash, cash equivalents and restricted cash | (407) | | | (67) | | | 158 | | | (77) | |

| Cash, cash equivalents and restricted cash, beginning | 1,980 | | | 2,077 | | | 1,990 | | | 2,087 | |

| Cash, cash equivalents and restricted cash, ending | $ | 1,573 | | | $ | 2,010 | | | $ | 2,148 | | | $ | 2,010 | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | |

| Cash payments for interest, net of amounts capitalized | $ | 411 | | | $ | 260 | | | $ | 765 | | | $ | 512 | |

| Cash payments for income taxes, net of refunds | 141 | | | 147 | | | 209 | | | 200 | |

| | | | | | | |

| | | | | | | |

| SCHEDULE OF NONCASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | |

| Conversion of Corporate Units to shares of common stock | $ | 838 | | | $ | — | | | $ | 838 | | | $ | — | |

| Liabilities derecognized due to sale of Warrior Run receivables | 273 | | | $ | — | | | 273 | | | — | |

| Noncash recognition of new operating and financing leases | 56 | | | $ | 63 | | | 180 | | | 82 | |

| Noncash contributions from noncontrolling interests | 25 | | | $ | 30 | | | 25 | | | 30 | |

| | | | | | | |

| Initial recognition of contingent consideration for acquisitions | 5 | | | 218 | | | 14 | | | 218 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED EBITDA, ADJUSTED PTC AND ADJUSTED EPS

We define EBITDA as earnings before interest income and expense, taxes, depreciation, and amortization. We define Adjusted EBITDA as EBITDA adjusted for the impact of NCI and interest, taxes, depreciation, and amortization of our equity affiliates, adding back interest income recognized under service concession arrangements, and excluding gains or losses of both consolidated entities and entities accounted for under the equity method due to (a) unrealized gains or losses pertaining to derivative transactions, equity securities, and financial assets and liabilities measured using the fair value option; (b) unrealized foreign currency gains or losses; (c) gains, losses, benefits and costs associated with dispositions and acquisitions of business interests, including early plant closures, and gains and losses recognized at commencement of sales-type leases; (d) losses due to impairments; and (e) gains, losses, and costs due to the early retirement of debt or troubled debt restructuring. We define Adjusted EBITDA with Tax Attributes as Adjusted EBITDA, adding back the pre-tax effect of Production Tax Credits ("PTCs"), Investment Tax Credits ("ITCs"), and depreciation tax deductions allocated to tax equity investors, as well as the tax benefit recorded from tax credits retained or transferred to third parties.

The GAAP measure most comparable to EBITDA, Adjusted EBITDA, and Adjusted EBITDA with Tax Attributes is net income. We believe that EBITDA, Adjusted EBITDA, and Adjusted EBITDA with Tax Attributes better reflect the underlying business performance of the Company. Adjusted EBITDA is the most relevant measure considered in the Company’s internal evaluation of the financial performance of its segments. Factors in this determination include the variability due to unrealized gains or losses pertaining to derivative transactions, equity securities, or financial assets and liabilities remeasurement, unrealized foreign currency gains or losses, losses due to impairments, strategic decisions to dispose of or acquire business interests or retire debt, and the variability of allocations of earnings to tax equity investors, which affect results in a given period or periods. In addition, each of these metrics represent the business performance of the Company before the application of statutory income tax rates and tax adjustments, including the effects of tax planning, corresponding to the various jurisdictions in which the Company operates. EBITDA, Adjusted EBITDA, and Adjusted EBITDA with Tax Attributes should not be construed as alternatives to net income, which is determined in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Reconciliation of Adjusted EBITDA (in millions) | 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) | $ | (39) | | | $ | (19) | | | $ | 239 | | | $ | 170 | |

| Income tax expense (benefit) | (35) | | | (2) | | | (51) | | | 70 | |

| Interest expense | 389 | | | 310 | | | 746 | | | 640 | |

| Interest income | (88) | | | (131) | | | (193) | | | (254) | |

| Depreciation and amortization | 308 | | | 277 | | | 620 | | | 550 | |

| EBITDA | $ | 535 | | | $ | 435 | | | $ | 1,361 | | | $ | 1,176 | |

| | | | | | | |

Less: Adjustment for noncontrolling interests and redeemable stock of subsidiaries (1) | (80) | | | (155) | | | (242) | | | (325) | |

| Less: Income tax expense (benefit), interest expense (income) and depreciation and amortization from equity affiliates | 28 | | | 27 | | | 61 | | | 66 | |

| Interest income recognized under service concession arrangements | 16 | | | 18 | | | 33 | | | 36 | |

Unrealized derivatives, equity securities, and financial assets and liabilities losses (gains) | (53) | | | 32 | | | (138) | | | (7) | |

Unrealized foreign currency losses | 12 | | | 32 | | | 3 | | | 64 | |

Disposition/acquisition losses | 62 | | | 16 | | | 19 | | | 13 | |

| Impairment losses | 114 | | | 164 | | | 140 | | | 173 | |

Loss on extinguishment of debt and troubled debt restructuring | 18 | | | — | | | 50 | | | 1 | |

| | | | | | | |

| Adjusted EBITDA | $ | 652 | | | $ | 569 | | | $ | 1,287 | | | $ | 1,197 | |

| Tax attributes | 191 | | | 38 | | | 419 | | | 51 | |

Adjusted EBITDA with Tax Attributes (2) | $ | 843 | | | $ | 607 | | | $ | 1,706 | | | $ | 1,248 | |

_______________________________

(1) The allocation of earnings and losses to tax equity investors from both consolidated entities and equity affiliates is removed from Adjusted EBITDA.

(2) Adjusted EBITDA with Tax Attributes includes the impact of the share of the ITCs, PTCs, and depreciation deductions allocated to tax equity investors under the HLBV accounting method and recognized as Net loss attributable to noncontrolling interests and redeemable stock of subsidiaries on the Condensed Consolidated Statements of Operations. It also includes the tax benefit recorded from tax credits retained or transferred to third parties. The tax attributes are related to the Renewables and Utilities SBU.

We define Adjusted PTC as pre-tax income from continuing operations attributable to The AES Corporation excluding gains or losses of the consolidated entity due to (a) unrealized gains or losses pertaining to derivative transactions, equity securities, and financial assets and liabilities measured using the fair value option; (b) unrealized foreign currency gains or losses; (c) gains, losses, benefits, and costs associated with dispositions and acquisitions of business interests, including early plant closures, and gains and losses recognized at commencement of sales-type leases; (d) losses due to impairments; and (e) gains, losses, and costs due to the early retirement of debt or troubled debt restructuring. Adjusted PTC also includes net equity in earnings of affiliates on an after-tax basis adjusted for the same gains or losses excluded from consolidated entities.

We define Adjusted EPS as diluted earnings per share from continuing operations excluding gains or losses of both consolidated entities and entities accounted for under the equity method due to (a) unrealized gains or losses pertaining to

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED EBITDA, ADJUSTED PTC AND ADJUSTED EPS

derivative transactions, equity securities, and financial assets and liabilities measured using the fair value option; (b) unrealized foreign currency gains or losses; (c) gains, losses, benefits and costs associated with dispositions and acquisitions of business interests, including early plant closures, and the tax impact from the repatriation of sales proceeds, and gains and losses recognized at commencement of sales-type leases; (d) losses due to impairments; and (e) gains, losses, and costs due to the early retirement of debt or troubled debt restructuring.

The GAAP measure most comparable to Adjusted PTC is income from continuing operations attributable to AES. The GAAP measure most comparable to Adjusted EPS is diluted earnings per share from continuing operations. We believe that Adjusted PTC and Adjusted EPS better reflect the underlying business performance of the Company and are considered in the Company’s internal evaluation of financial performance. Factors in this determination include the variability due to unrealized gains or losses pertaining to derivative transactions, equity securities, or financial assets and liabilities remeasurement, unrealized foreign currency gains or losses, losses due to impairments, and strategic decisions to dispose of or acquire business interests or retire debt, which affect results in a given period or periods. In addition, for Adjusted PTC, earnings before tax represents the business performance of the Company before the application of statutory income tax rates and tax adjustments, including the effects of tax planning, corresponding to the various jurisdictions in which the Company operates. Adjusted PTC and Adjusted EPS should not be construed as alternatives to income from continuing operations attributable to AES and diluted earnings per share from continuing operations, which are determined in accordance with GAAP.

The Company reported diluted earnings per share of $0.27 for the three months ended June 30, 2024. For purposes of measuring earnings per share under U.S. GAAP, income available to AES common stockholders is reduced by increases in the carrying amount of redeemable stock of subsidiaries to redemption value, and increased by decreases in the carrying amount to the extent they represent recoveries of amounts previously reflected in the computation of earnings per share. While the adjustment for the second quarter increased earnings per share, it did not impact Net income on the Condensed Consolidated Statement of Operations. For purposes of computing Adjusted EPS, the Company excluded the adjustment to redemption value from the numerator. The table below reconciles the income available to AES common stockholders used in GAAP diluted earnings per share to the income from continuing operations used in calculating the non-GAAP measure of Adjusted EPS.

| | | | | | | | | | | | | | | | | |

Reconciliation of Numerator Used for Adjusted EPS | Three Months Ended June 30, 2024 |

| (in millions, except per share data) | Income | | Shares | | $ per Share |

GAAP DILUTED EARNINGS PER SHARE | | | | | |

Income available to The AES Corporation common stockholders | $ | 191 | | | 713 | | | $ | 0.27 | |

Add back: Adjustment to redemption value of redeemable stock of subsidiaries | (6) | | | — | | | (0.01) | |

NON-GAAP DILUTED EARNINGS PER SHARE | $ | 185 | | | 713 | | | $ | 0.26 | |

The Company reported a loss from continuing operations of $0.06 for the three months ended June 30, 2023. For purposes of measuring diluted loss per share under GAAP, common stock equivalents were excluded from weighted average shares as their inclusion would be anti-dilutive. However, for purposes of computing Adjusted EPS, the Company has included the impact of dilutive common stock equivalents. The tables below reconcile the weighted average shares used in GAAP diluted loss per share to the weighted average shares used in calculating the non-GAAP measure of Adjusted EPS.

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Denominator Used For Adjusted EPS | Three Months Ended June 30, 2023 | | |

(in millions, except per share data) | Loss | | Shares | | $ per Share | | | | | | |

| | | | | | | | | | | |

| GAAP DILUTED LOSS PER SHARE | | | | | | | | | | | |

| Loss from continuing operations attributable to The AES Corporation common stockholders | $ | (39) | | | 669 | | | $ | (0.06) | | | | | | | |

EFFECT OF DILUTIVE SECURITIES | | | | | | | | | | | |

| | | | | | | | | | | |

Stock options | — | | | 1 | | | — | | | | | | | |

Restricted stock units | — | | | 2 | | | — | | | | | | | |

| Equity units | — | | | 40 | | | 0.01 | | | | | | | |

| NON-GAAP DILUTED LOSS PER SHARE | $ | (39) | | | 712 | | | $ | (0.05) | | | | | | | |

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED EBITDA, ADJUSTED PTC AND ADJUSTED EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 | | Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 | |

| Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | | Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | | Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | | Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | |

| (in millions, except per share amounts) | |

| Income from continuing operations, net of tax, attributable to AES and Diluted EPS | $ | 185 | | | $ | 0.26 | | | $ | (39) | | | $ | (0.05) | | | $ | 617 | | | $ | 0.87 | | | $ | 112 | | | $ | 0.16 | | |

Add: Income tax expense (benefit) from continuing operations attributable to AES | (67) | | | | | (16) | | | | | (86) | | | | | 35 | | | | |

| Pre-tax contribution | $ | 118 | | | | | $ | (55) | | | | | $ | 531 | | | | | $ | 147 | | | | |

| Adjustments | | | | | | | | | | | | | | | | |

Unrealized derivatives, equity securities, and financial assets and liabilities losses (gains) | $ | (53) | | | $ | (0.07) | | (2) | $ | 33 | | | $ | 0.05 | | (3) | $ | (138) | | | $ | (0.19) | | (4) | $ | (6) | | | $ | (0.01) | | (5) |

| Unrealized foreign currency losses | 12 | | | 0.01 | | | 33 | | | 0.04 | | (6) | 3 | | | — | | | 64 | | | 0.09 | | (7) |

| Disposition/acquisition losses | 62 | | | 0.08 | | (8) | 16 | | | 0.02 | | | 19 | | | 0.03 | | (9) | 13 | | | 0.02 | | |

| Impairment losses | 114 | | | 0.16 | | (10) | 164 | | | 0.23 | | (11) | 140 | | | 0.20 | | (12) | 173 | | | 0.24 | | (11) |

Loss on extinguishment of debt and troubled debt restructuring | 20 | | | 0.03 | | (13) | — | | | — | | | 54 | | | 0.07 | | (14) | 4 | | | 0.01 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Less: Net income tax benefit | | | (0.09) | | (15) | | | (0.08) | | (16) | | | (0.09) | | (15) | | | (0.08) | | (16) |

| Adjusted PTC and Adjusted EPS | $ | 273 | | | $ | 0.38 | | | $ | 191 | | | $ | 0.21 | | | $ | 609 | | | $ | 0.89 | | | $ | 395 | | | $ | 0.43 | | |

_____________________________

(1)NCI is defined as Noncontrolling Interests.

(2)Amount primarily relates to unrealized gains on foreign currency derivatives at Corporate of $34 million, or $0.05 per share, and unrealized gains on cross currency swaps in Brazil of $25 million, or $0.03 per share.

(3)Amount primarily relates to recognition of unrealized losses due to the termination of a PPA of $72 million, or $0.10 per share, partially offset by unrealized derivative gains at the Energy Infrastructure SBU of $37 million, or $0.05 per share.

(4)Amount primarily relates to net unrealized derivative gains at the Energy Infrastructure SBU of $59 million, or $0.08 per share, unrealized gains on foreign currency derivatives at Corporate of $37 million, or $0.05 per share, and unrealized gains on cross currency swaps in Brazil of $28 million, or $0.04 per share.

(5)Amount primarily relates to unrealized derivative gains at the Energy Infrastructure SBU of $87 million, or $0.12 per share, partially offset by the recognition of unrealized losses due to the termination of a PPA of $72 million, or $0.10 per share.

(6)Amount primarily relates to unrealized foreign currency losses mainly associated with the devaluation of long-term receivables denominated in Argentine pesos of $24 million, or $0.03 per share, and unrealized foreign currency losses at AES Andes due to the depreciating Colombian peso of $15 million, or $0.02 per share.

(7)Amount primarily relates to unrealized foreign currency losses mainly associated with the devaluation of long-term receivables denominated in Argentine pesos of $49 million, or $0.07 per share, and unrealized foreign currency losses at AES Andes due to the depreciation Colombian peso of $31 million, or $0.04 per share.

(8)Amount primarily relates to day-one losses at commencement of sales-type leases at AES Renewable Holdings of $63 million, or $0.09 per share.

(9)Amount primarily relates to day-one losses at commencement of sales-type leases at AES Renewable Holdings of $63 million, or $0.09 per share, and the loss on partial sale of our ownership interest in Amman East and IPP4 in Jordan of $10 million, or $0.01 per share, partially offset by a gain on dilution of ownership in Uplight due to its acquisition of AutoGrid of $52 million, or $0.07 per share.

(10)Amount primarily relates to impairment at Brazil of $103 million, or $0.14 per share.

(11)Amount primarily relates to asset impairments at the Norgener coal-fired plant in Chile of $136 million, or $0.19 per share, and the GAF Projects at AES Renewable Holdings of $18 million, or $0.03 per share for the three and six months ended June 30, 2023.

(12)Amount primarily relates to impairment at Brazil of $103 million, or $0.14 per share, and impairment at Mong Duong of $22 million, or $0.03 per share.

(13)Amount primarily relates to losses incurred at AES Andes due to early retirement of debt of $16 million, or $0.02 per share.

(14)Amount primarily relates to losses incurred at AES Andes due to early retirement of debt $29 million, or $0.04 per share, and costs incurred due to troubled debt restructuring at Puerto Rico of $20 million, or $0.03 per share.

(15)Amount primarily relates to income tax benefits associated with the tax over book investment basis differences related to the AES Brasil held-for-sale classification of $59 million, or $0.08 per share, for the three and six months ended June 30, 2024.

(16)Amount primarily relates to income tax benefits associated with the asset impairment at the Norgener coal-fired plant in Chile of $33 million, or $0.05 per share, and income tax benefits associated with the recognition of unrealized losses due to the termination of a PPA of $18 million, or $0.02 per share, for the three and six months ended June 30, 2023.

| | | | | | | | | | | | | | |

| The AES Corporation |

| Parent Financial Information |

Parent only data: last four quarters | | | | |

| (in millions) | 4 Quarters Ended |

| Total subsidiary distributions & returns of capital to Parent | June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 |

| Actual | Actual | Actual | Actual |

Subsidiary distributions1 to Parent & QHCs | $ | 1,531 | | $ | 1,438 | | $ | 1,408 | | $ | 1,625 | |

| Returns of capital distributions to Parent & QHCs | 140 | | 139 | | 194 | | 116 | |

| Total subsidiary distributions & returns of capital to Parent | $ | 1,671 | | $ | 1,577 | | $ | 1,602 | | $ | 1,741 | |

| Parent only data: quarterly | | | | |

| (in millions) | Quarter Ended |

| Total subsidiary distributions & returns of capital to Parent | June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 |

| Actual | Actual | Actual | Actual |

Subsidiary distributions1 to Parent & QHCs | $ | 298 | | $ | 386 | | $ | 536 | | $ | 311 | |

| Returns of capital distributions to Parent & QHCs | 1 | | 1 | | 78 | | 60 | |

| Total subsidiary distributions & returns of capital to Parent | $ | 299 | | $ | 387 | | $ | 614 | | $ | 371 | |

| |

(in millions) | Balance at |

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 |

Parent Company Liquidity2 | Actual | Actual | Actual | Actual |

Cash at Parent & Cash at QHCs3 | $ | 53 | | $ | 90 | | $ | 33 | | $ | 51 | |

Availability under credit facilities | 736 | | 642 | | 1,376 | | 857 | |

| Ending liquidity | $ | 789 | | $ | 732 | | $ | 1,409 | | $ | 908 | |

____________________________

(1)Subsidiary distributions received by Qualified Holding Companies ("QHCs") excluded from Schedule 1. Subsidiary Distributions should not be construed as an alternative to Consolidated Net Cash Provided by Operating Activities, which is determined in accordance with US GAAP. Subsidiary Distributions are important to the Parent Company because the Parent Company is a holding company that does not derive any significant direct revenues from its own activities but instead relies on its subsidiaries’ business activities and the resultant distributions to fund the debt service, investment and other cash needs of the holding company. The reconciliation of the difference between the Subsidiary Distributions and Consolidated Net Cash Provided by Operating Activities consists of cash generated from operating activities that is retained at the subsidiaries for a variety of reasons which are both discretionary and non-discretionary in nature. These factors include, but are not limited to, retention of cash to fund capital expenditures at the subsidiary, cash retention associated with non-recourse debt covenant restrictions and related debt service requirements at the subsidiaries, retention of cash related to sufficiency of local GAAP statutory retained earnings at the subsidiaries, retention of cash for working capital needs at the subsidiaries, and other similar timing differences between when the cash is generated at the subsidiaries and when it reaches the Parent Company and related holding companies.

(2)Parent Company Liquidity is defined as cash available to the Parent Company, including cash at qualified holding companies (QHCs), plus available borrowings under our existing credit facility. AES believes that unconsolidated Parent Company liquidity is important to the liquidity position of AES as a Parent Company because of the non-recourse nature of most of AES’ indebtedness.

(3)The cash held at QHCs represents cash sent to subsidiaries of the company domiciled outside of the US. Such subsidiaries have no contractual restrictions on their ability to send cash to AES, the Parent Company. Cash at those subsidiaries was used for investment and related activities outside of the US. These investments included equity investments and loans to other foreign subsidiaries as well as development and general costs and expenses incurred outside the US. Since the cash held by these QHCs is available to the Parent, AES uses the combined measure of subsidiary distributions to Parent and QHCs as a useful measure of cash available to the Parent to meet its international liquidity needs.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

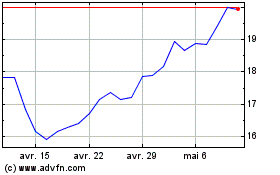

AES (NYSE:AES)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

AES (NYSE:AES)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024