- Closed the acquisition of Pangiam in an all-stock transaction,

combining BigBear.ai’s computer vision capabilities with facial

recognition, image-based anomaly detection and advanced

biometrics.

- Cash balance of $81.4 million as of March 31, 2024.

- Affirming full-year 2024 revenue guidance of $195 - $215

million.

BigBear.ai Holdings, Inc. (NYSE: BBAI) (“BigBear.ai” or

the “Company”), a leader in AI-powered decision intelligence

solutions, today announced financial results for the first quarter

of 2024 and issued an investor letter that has been posted to the

Investor Relations section of the Company’s website.

BigBear.ai CEO Mandy Long said, “Today’s results reflect

BigBear.ai’s steady progress in the first quarter of 2024 as we

continue to operationalize AI at the edge for our customers in

National Security, Digital Identity, and Supply Chain

Management.”

“I am proud of the positive momentum and spirit within the

business, driven by a relentless focus on delivering our solutions

in operational readiness, autonomy at the edge, contested

logistics, modeling & simulation, and digital identity for our

customers,” she continued.

Financial Highlights

- Revenue decreased 21.4% to $33.1 million for the first quarter

of 2024, compared to $42.2 million for the first quarter of 2023.

The year-over-year decrease was primarily driven by the planned

wind-down of the Air Force EPASS program in mid-2023 ($6.8 million)

and the elimination of revenue from Virgin Orbit due to their

bankruptcy announcement in April 2023 ($1.5 million). We also

experienced delays in contract awards due to the continuing

resolutions.

- Gross margin of 21.1% in the first quarter of 2024, a decrease

from 24.2% in the first quarter of 2023, primarily driven by an

increase in equity-based compensation expense of $1.8 million and

the elimination of revenue and gross margin from Virgin Orbit.

- Net loss of $125.1 million for the first quarter of 2024, which

includes a non-cash goodwill impairment charge of $85.0 million,

$24.0 million of non-cash expense which includes a $52.9 million

loss related to the change in fair value of warrants that were

issued in 2023 (the “2023 Warrants”) that were exercised in the

first quarter of 2024, partially offset by gains of $10.6 million,

net of cash proceeds received, related to the issuance of warrants

in the first quarter of 2024 (the “2024 Warrants”), and a gain of

$18.3 million related to the decrease in fair value of the 2024

Warrants from the date of issuance to the end of the first quarter,

$5.2 million of equity-based compensation expense, and $0.9 million

related to restructuring charges. Net loss for the first quarter of

2023 was $26.2 million, which included $10.6 million of non-cash

expense related to the change in fair value of Private Investment

in Public Equity (“PIPE”) warrants that were issued in January

2023, $3.8 million of equity-based compensation expense, and $0.8

million related to restructuring charges.

- Non-GAAP Adjusted EBITDA* of $(1.6) million for the first

quarter of 2024 compared to $(3.8) million for the first quarter of

2023, primarily driven by continued focus on operating expense

reductions, including the recent acquisition of Pangiam.

- SG&A of $16.9 million for the first quarter of 2024

compared to $20.4 million for the first quarter of 2023, primarily

due to continued focus on operating expense reductions including

combined business synergies.

- Recurring SG&A* has been reduced from $15.3 million in the

first quarter of 2023 to $13.6 million in the first quarter of

2024, a net improvement of $1.7 million, including the business

combination with Pangiam.

- Ending cash balance of $81.4 million as of March 31, 2024

compared to $32.6 million as of December 31, 2023, primarily driven

by $53.8 million of proceeds from the 2023 Warrants that were

exercised in the first quarter of 2024 and $13.9 million related to

cash acquired from the acquisition of Pangiam.

- Ending backlog of $296 million as of March 31, 2024.

- The consolidated results include results from Pangiam from the

acquisition date of February 29, 2024 through the end of the

quarter.

Momentum

- The US Army G-3/5/7 recently provided an $8.3 million extension

to BigBear.ai to continue to lead the sustainment and modernization

of mission critical force generation and analytics capabilities.

This commitment along with the previous GFIM-OE extension

demonstrates BigBear.ai's position as the leader in providing

critical enterprise IT capabilities to the Army.

- Following the release of a competitive solicitation for

Biometric International Exit at Ronald Reagan Washington National

Airport (DCA) and Washington Dulles International Airport (IAD),

Metropolitan Washington Airports Authority (MWAA) selected and

awarded Pangiam, a BigBear.ai company, a contract for the provision

of veriScan™ at 127 gates.

- Denver International Airport recently awarded a contract to

Pangiam, a BigBear.ai Company, for the implementation of veriScan™

to facilitate passenger processing for Biometric International

Exit. The initial scope of work includes hardware, software, and

services at 24 gates.

- BigBear.ai’s Pangiam was awarded a contract with a key port

authority in Canada to deploy a biometric-enabled passenger

processing application for entry into the United States. This

brings BigBear.ai’s existing Linkware and VeriScan offerings into a

new space, with the aim of replicating and scaling across multiple

locations.

- BigBear.ai’s Pangiam has signed an agreement with Melbourne

Airport in Australia to trial Project Dartmouth, our AI/ML threat

detection capability, to assist officers in detecting prohibited

items in carry-on baggage. This is BigBear.ai’s first Project

Dartmouth trial in Australia — an exciting partnership to help

inform considerations for deploying such capabilities at scale in

the future.

- BigBear.ai announced it has been designated as an “Awardable”

vendor for the Chief Digital and Artificial Intelligence Office’s

(CDAO) Tradewinds Solutions Marketplace (the “Marketplace”). Five

of the company’s products, including Sensor, Data and AI

Orchestration (ConductorOS), Time-Series Forecasting (VANE),

Contested Logistics Planning (AURORA), Maritime Domain Awareness

(Arcas), and Publicly Available Data Curation (Observe) have been

added to the Marketplace. Achieving ‘Awardable’ on the DoD’s

Tradewinds enables the acceleration of the procurement process of

these technologies across the DoD.

- BigBear.ai formed a teaming agreement with Spinnaker SCA, a

supply chain focused consulting firm, to further bolster consulting

services for manufacturing and warehouse operations. By combining

BigBear.ai's ProModel® simulation software with Spinnaker SCA's

consulting expertise, supply chain, manufacturing and warehousing

clients will benefit from strategic guidance, simulation-based

validation of changes, and data-driven optimization to reduce

costs, increase efficiency, and achieve faster time to value.

Financial Outlook

The following information and other sections of this release

contain forward-looking statements, which are based on the

Company’s current expectations. Actual results may differ

materially from those projected. It is the Company’s practice not

to incorporate adjustments into its financial outlook for proposed

acquisitions, divestitures, changes in law, or new accounting

standards until such items have been consummated, enacted, or

adopted. For additional factors that may impact the Company’s

actual results, refer to the “Forward-Looking Statements” section

in this release.

For the year-ended December 31, 2024, the Company continues to

project:

- Revenue between $195 million and $215 million

- The projections include the results of Pangiam after the

acquisition date of February 29, 2024

Summary of Results for the

First Quarter Ended March 31, 2024 and March 31, 2023

(Unaudited)

Three Months Ended

March 31,

$ thousands (expect per share amounts)

2024

2023

Revenues

$

33,121

$

42,154

Cost of revenues

26,135

31,941

Gross margin

6,986

10,213

Operating expenses:

Selling, general and administrative

16,948

20,362

Research and development

1,144

1,128

Restructuring charges

860

755

Transaction expenses

1,103

—

Goodwill impairment

85,000

—

Operating loss

(98,069

)

(12,032

)

Interest expense

3,555

3,556

Net increase in fair value of

derivatives

23,992

10,567

Other income

(455

)

—

Loss before taxes

(125,161

)

(26,155

)

Income tax (benefit) expense

(14

)

59

Net loss

$

(125,147

)

$

(26,214

)

Basic and diluted net loss per

share

$

(0.67

)

$

(0.19

)

Weighted-average shares

outstanding:

Basic

187,279,204

138,548,599

Diluted

187,279,204

138,548,599

EBITDA* and Adjusted EBITDA*

for the First Quarter Ended March 31, 2024 and March 31, 2023

(Unaudited)

Three Months Ended

March 31,

$ thousands

2024

2023

Net loss

$

(125,147

)

$

(26,214

)

Interest expense

3,555

3,556

Interest income

(447

)

—

Income tax (benefit) expense

(14

)

59

Depreciation and amortization

2,439

1,986

EBITDA

(119,614

)

(20,613

)

Adjustments:

Equity-based compensation

5,156

3,805

Employer payroll taxes related to

equity-based compensation(1)

664

183

Net increase in fair value of

derivatives(2)

23,992

10,567

Restructuring charges(3)

860

755

Non-recurring strategic initiatives(4)

1,334

1,508

Non-recurring litigation(5)

(121

)

—

Transaction expenses(6)

1,103

—

Goodwill impairment(7)

85,000

—

Adjusted EBITDA

$

(1,626

)

$

(3,795

)

(1)

Includes employer payroll taxes due upon

the vesting of equity awards granted to employees.

(2)

The increase in fair value of derivatives

during the quarter ended March 31, 2024, relates to the $52.9

million loss recorded upon the exercise of the 2023 RDO and 2023

PIPE Warrants (the “2023 Warrants”) in connection with the warrant

exercise agreements entered into effect February 27, 2024 and March

4, 2024. This loss was offset by gains of $10.6 million, net of

cash proceeds received, related to the issuance of warrants in 2024

(the “2024 Warrants”), In addition, an $18.3 million reduction in

fair value was recorded on the 2024 Warrants issued in connection

with the warrant exercise agreements as the fair value decreased

from the issue date to quarter end.

(3)

In the first quarter of 2024 and first

quarter of 2023, the Company incurred employee separation costs

associated with a strategic review of the Company’s capacity and

future projections to better align the organization and cost

structure and improve the affordability of its products and

services.

(4)

Non-recurring professional fees related to

the execution of certain strategic initiatives of the Company.

(5)

Non-recurring litigation consists

primarily of legal settlements and related fees for specific

proceedings that we have determined arise outside of the ordinary

course of business based on the following considerations which we

assess regularly: (1) the frequency of similar cases that have been

brought to date, or are expected to be brought within two years;

(2) the complexity of the case; (3) the nature of the remedy(ies)

sought, including the size of any monetary damages sought; (4)

offensive versus defensive posture of us; (5) the counterparty

involved; and (6) our overall litigation strategy.

(6)

Transaction expenses during the quarter

ended March 31, 2024 consist primarily of diligence, legal, and

other related expenses incurred associated with the Pangiam

Acquisition.

(7)

During the quarter ended March 31, 2024,

the Company recognized a non-cash goodwill impairment charge

primarily driven by a decrease in share price during the quarter

compared to the share price of the equity issued as consideration

for the purchase of Pangiam.

*Refer to the “Non-GAAP Financial

Measures” section in this press release.

Consolidated Balance Sheets as

of March 31, 2024 and December 31, 2023 (Unaudited)

$ in thousands

March 31,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

81,412

$

32,557

Accounts receivable, less allowance for

credit losses

36,584

21,949

Contract assets

2,379

4,822

Prepaid expenses and other current

assets

4,661

4,449

Total current assets

125,036

63,777

Non-current assets:

Property and equipment, net

1,570

997

Goodwill

119,769

48,683

Intangible assets, net

120,444

82,040

Deferred tax assets

—

—

Right-of-use assets

9,701

4,041

Other non-current assets

1,107

372

Total assets

$

377,627

$

199,910

Liabilities and stockholders’

deficit

Current liabilities:

Accounts payable

$

6,215

$

11,038

Short-term debt, including current portion

of long-term debt

826

1,229

Accrued liabilities

21,515

16,233

Contract liabilities

3,853

879

Current portion of long-term lease

liability

848

779

Derivative liabilities

24,956

37,862

Other current liabilities

4,857

602

Total current liabilities

63,070

68,622

Non-current liabilities:

Long-term debt, net

194,761

194,273

Long-term lease liability

11,300

4,313

Deferred tax liabilities

14

37

Other non-current liabilities

—

—

Total liabilities

269,145

267,245

Stockholders’ deficit:

Common stock

25

17

Additional paid-in capital

604,384

303,428

Treasury stock, at cost 9,952,803 shares

at March 31, 2024 and December 31, 2023

(57,350

)

(57,350

)

Accumulated deficit

(438,577

)

(313,430

)

Total stockholders’ deficit

108,482

(67,335

)

Total liabilities and stockholders’

deficit

$

377,627

$

199,910

Consolidated Statements of

Cash Flows for the Three Months Ended March 31, 2024 and March 31,

2023 (Unaudited)

Three Months Ended

March 31,

$ in thousands

2024

2023

Cash flows from operating

activities:

Net loss

$

(125,147

)

$

(26,214

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization expense

2,439

1,986

Amortization of debt issuance costs

506

500

Equity-based compensation expense

5,157

3,805

Goodwill impairment

85,000

—

Non-cash lease expense

94

(35

)

Provision for doubtful accounts

171

882

Deferred income tax (benefit) expense

(23

)

54

Net increase in fair value of

derivatives

23,992

10,567

Loss on sale of property and equipment

—

8

Changes in assets and liabilities:

(Increase) in accounts receivable

(8,957

)

(3,469

)

Decrease (increase) in contract assets

2,443

(1,115

)

Decrease in prepaid expenses and other

assets

950

1,488

(Decrease) in accounts payable

(5,960

)

(4,914

)

Increase in accrued liabilities

2,598

4,066

Increase in contract liabilities

1,826

325

Increase in other liabilities

552

49

Net cash used in operating

activities

(14,359

)

(12,017

)

Cash flows from investing

activities:

Acquisition of business, net of cash

acquired

13,935

—

Purchases of property and equipment

(38

)

—

Capitalized software development costs

(1,643

)

—

Net cash provided by investing

activities

12,254

—

Cash flows from financing

activities:

Proceeds from issuance of shares for

exercised RDO and PIPE warrants

53,809

—

Proceeds from issuance of Private

Placement shares

—

25,000

Payment of Private Placement transaction

costs

—

(3,025

)

Repayment of short-term borrowings

(403

)

(763

)

Payments of tax withholding from the

issuance of common stock

(2,532

)

—

Net cash provided by financing

activities

50,960

21,212

Net increase in cash and cash

equivalents

48,855

9,195

Cash and cash equivalents at the beginning

of period

32,557

12,632

Cash and cash equivalents at the end of

the period

$

81,412

$

21,827

Forward-Looking

Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act, and Section 21E of

the Exchange Act. Forward-looking statements generally are

accompanied by words such as “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “should,” “would,”

“plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook,” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding BigBear.ai’s industry, future events, and

other statements that are not historical facts. These statements

are based on various assumptions, whether or not identified herein,

and on the current expectations of BigBear.ai’s management and are

not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by you or any other

investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond our control. These forward-looking statements are subject to

a number of risks and uncertainties, including those relating to:

changes in domestic and foreign business, market, financial,

political, and legal conditions; the uncertainty of projected

financial information; delays caused by factors outside of our

control, including changes in fiscal or contracting policies or

decreases in available government funding; changes in government

programs or applicable requirements; budgetary constraints,

including automatic reductions as a result of “sequestration” or

similar measures and constraints imposed by any lapses in

appropriations for the federal government or certain of its

departments and agencies; influence by, or competition from, third

parties with respect to pending, new, or existing contracts with

government customers; changes in our ability to successfully

compete for and receive task orders and generate revenue under

Indefinite Delivery/Indefinite Quantity contracts; our ability to

realize the benefits of the strategic partnerships; risks that the

new businesses will not be integrated successfully or that the

combined companies will not realize estimated cost savings; failure

to realize anticipated benefits of the combined operations;

potential delays or changes in the government appropriations or

procurement processes, including as a result of events such as war,

incidents of terrorism, natural disasters, and public health

concerns or epidemics, such as the coronavirus outbreak; the

identified material weakness in our internal controls over

financial reporting (including the timeline to remediate the

material weakness); increased or unexpected costs or unanticipated

delays caused by other factors outside of our control, such as

performance failures of our subcontractors; the rollout of the

business and the timing of expected business milestones; the

effects of competition on our future business; our ability to

obtain and access financing in the future; and those factors

discussed in the Company’s reports and other documents filed with

the SEC, including under the heading “Risk Factors.” If any of

these risks materialize or our assumptions prove incorrect, actual

results could differ materially from the results implied by these

forward-looking statements. There may be additional risks that

BigBear.ai presently does not know or that BigBear.ai currently

believes are immaterial which could also cause actual results to

differ from those contained in the forward-looking statements. In

addition, forward-looking statements reflect BigBear.ai’s

expectations, plans or forecasts of future events and views as of

the date of this release. BigBear.ai anticipates that subsequent

events and developments will cause BigBear.ai’s assessments to

change. However, while BigBear.ai may elect to update these

forward-looking statements at some point in the future, BigBear.ai

specifically disclaims any obligation to do so. Accordingly, undue

reliance should not be placed upon the forward-looking

statements.

Non-GAAP Financial

Measures

The financial information and data contained in this press

release is unaudited. Some of the financial information and data

contained in this press release, such as EBITDA, Adjusted EBITDA,

and Recurring SG&A have not been prepared in accordance with

United States generally accepted accounting principles (“GAAP”). To

supplement our unaudited condensed consolidated financial

statements, which are prepared and presented in accordance with

GAAP in our press release, we also report certain non-GAAP

financial measures. A “non-GAAP financial measure” refers to a

numerical measure of a company’s historical or future financial

performance, financial position, or cash flows that excludes (or

includes) amounts that are included in (or excluded from) the most

directly comparable measure calculated and presented in accordance

with GAAP in such company’s financial statements. Non-GAAP

financial measures should not be considered in isolation or as a

substitute for the relevant GAAP measures and should be read in

conjunction with information presented on a GAAP basis. Because not

all companies use identical calculations, our presentation of

non-GAAP measures may not be comparable to other similarly titled

measures of other companies.

The presentation of these financial measures is not intended to

be considered in isolation or as a substitute for, or superior to,

financial information prepared and presented in accordance with

GAAP and should not be considered measures of BigBear.ai’s

liquidity. Investors are cautioned that there are material

limitations associated with the use of non-GAAP financial measures

as an analytical tool. In particular, many of the adjustments to

our GAAP financial measures reflect the exclusion of certain items,

as defined in our non-GAAP definitions below, which are recurring

and will be reflected in our financial results for the foreseeable

future. In addition, these measures may be different from non-GAAP

financial measures used by other companies, even where similarly

titled, limiting their usefulness for comparison purposes and

therefore should not be used to compare BigBear.ai’s performance to

that of other companies. We endeavor to compensate for the

limitation of the non-GAAP financial measures presented by also

providing the most directly comparable GAAP measures and

descriptions of the reconciling items and adjustments to derive the

non-GAAP financial measures.

We believe these non-GAAP financial measures provide investors

and analysts with useful supplemental information about the

financial performance of our business, enable comparison of

financial results between periods where certain items may vary

independent of business performance, and allow for greater

transparency with respect to key measures used by management to

operate and analyze our business over different periods of

time.

EBITDA is defined as net loss before interest expense, interest

income, income tax (benefit) expense and depreciation and

amortization. Adjusted EBITDA is defined as EBITDA further adjusted

for equity-based compensation, employer payroll taxes related to

equity-based compensation, net increase in fair value of

derivatives, restructuring charges, non-recurring strategic

initiatives, non-recurring litigation, transaction expenses and

goodwill impairment.

Adjusted EBITDA Margin is defined as Adjusted EBITDA as a

percentage of Revenue.

Recurring SG&A is defined as selling, general and

administrative expense further adjusted for equity-based

compensation allocated to selling, general and administrative

expense, non-recurring strategic integration costs and strategic

initiatives, non-recurring litigation, and reserves on Virgin Orbit

receivables.

Similar excluded expenses may be incurred in future periods when

calculating these measures. BigBear.ai believes these non-GAAP

measures of financial results provide useful information to

management and investors regarding certain financial and business

trends relating to the Company’s financial condition and results of

operations. BigBear.ai believes that the use of these non-GAAP

financial measures provides an additional tool for investors to use

in evaluating projected operating results and trends and in

comparing BigBear.ai’s financial measures with other similar

companies, many of which present similar non-GAAP financial

measures to investors.

Management does not consider these non-GAAP measures in

isolation or as an alternative to financial measures determined in

accordance with GAAP. The principal limitation of these non-GAAP

financial measures is that they exclude significant expenses and

income that are required by GAAP to be recorded in the Company’s

financial statements. In addition, they are subject to inherent

limitations as they reflect the exercise of judgment by management

about which expense and income items are excluded or included in

determining these non-GAAP financial measures.

Management uses EBITDA, Adjusted EBITDA, Adjusted EBITDA margin

and Recurring SG&A as non-GAAP performance measures which are

reconciled to the most directly comparable GAAP measure, in the

tables below. The Company does not reconcile forward-looking

non-GAAP financial measures to the most directly comparable GAAP

financial measure (or otherwise describe such forward-looking GAAP

measure) because it is not able to forecast the most directly

comparable measure calculated and presented in accordance with GAAP

without unreasonable effort. Certain elements of the composition of

the GAAP amounts are not predictable, making it impracticable for

the Company to forecast. As a result, no guidance for the Company’s

net (loss) income or reconciliation of the Company’s Adjusted

EBITDA guidance is provided. For the same reasons, the Company is

unable to assess the probable significance of the unavailable

information, which could have a potentially significant impact on

its future net (loss) income.

We present reconciliations of these non-GAAP financial measures

to the most directly comparable GAAP measures in the tables

below.

Adjusted EBITDA

Reconciliation* for the First Quarter Ended March 31, 2024 and

March 31, 2023 (Unaudited)

Quarters Ended

$ in thousands

1Q 24

1Q 23

Revenue

$

33,121

$

42,154

Net loss

(125,147

)

(26,214

)

Interest expense

3,555

3,556

Interest income

(447

)

—

Income tax (benefit) expense

(14

)

59

Depreciation & amortization

2,439

1,986

EBITDA

$

(119,614

)

$

(20,613

)

Adjustments:

Equity-based compensation

5,156

3,805

Employer payroll taxes related to

equity-based compensation

664

183

Net increase in fair value of

derivatives

23,992

10,567

Restructuring charges

860

755

Non-recurring integration costs and

strategic initiatives

1,334

1,508

Non-recurring litigation

(121

)

—

Transaction expenses

1,103

—

Goodwill impairment

85,000

—

Adjusted EBITDA

$

(1,626

)

(3,795

)

Gross Margin

21.1

%

24.2

%

Net Loss Margin

(377.8

)%

(62.2

)%

Adjusted EBITDA Margin

(4.9

)%

(9.0

)%

Recurring SG&A

Reconciliation* for the First Quarter Ended March 31, 2024 and

March 31, 2023 (Unaudited)

Quarters Ended

$ in thousands

1Q 24

1Q 23

Selling, general and administrative

$

16,948

$

20,362

Equity-based compensation allocated to

selling, general and administrative expense

(2,171

)

(2,803

)

Non-recurring integration costs and

strategic initiatives

(1,334

)

(1,508

)

Non-recurring litigation

121

—

Virgin Orbit AR Reserve

-

(750

)

Adjusted (recurring) selling, general

and administrative expense

$

13,564

$

15,301

About BigBear.ai

BigBear.ai is a leading provider of AI-powered decision

intelligence solutions for national security, digital identity, and

supply chain management. Customers and partners rely on

BigBear.ai’s predictive analytics capabilities in highly complex,

distributed, mission-based operating environments. Headquartered in

Columbia, Maryland, BigBear.ai is a public company traded on the

NYSE under the symbol BBAI. For more information, visit

https://bigbear.ai/ and follow BigBear.ai on LinkedIn: @BigBear.ai

and X: @BigBearai.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502557843/en/

BigBear.ai investors@bigbear.ai

Media Contact media@bigbear.ai

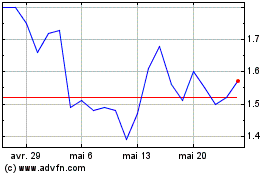

BigBear ai (NYSE:BBAI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

BigBear ai (NYSE:BBAI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025