Registration Statement No.333-264388

Filed Pursuant to Rule 433

Subject to Completion,

dated December 23, 2024

Pricing Supplement to the Prospectus dated May 26, 2022,

the Prospectus Supplement dated May 26, 2022 and the Product Supplement dated July 22, 2022

US$ [ ]

Senior Medium-Term Notes, Series I

Autocallable Barrier Notes with Contingent Coupons due January 10, 2028

Linked to the shares of VanEck® Junior Gold Miners ETF

| · | The notes are designed for investors who are seeking monthly contingent periodic interest payments (as

described in more detail below), as well as a return of principal if the closing level of the shares of VanEck® Junior Gold Miners

ETF (the “Reference Asset”) on any monthly Observation Date beginning in January 2026 is greater than 100% of its Initial

Level (the “Call Level”). Investors should be willing to have their notes automatically redeemed prior to maturity, be willing

to forego any potential to participate in the appreciation of the shares of the Reference Asset and be willing to lose some or all of

their principal at maturity. |

| · | The notes will pay a Contingent Coupon on each Contingent Coupon Payment Date at the Contingent Interest

Rate of 0.8167% per month (approximately 9.80% per annum) if the closing level of the Reference Asset on the applicable monthly Observation

Date is greater than or equal to its Coupon Barrier Level. However, if the closing level of the Reference Asset is less than its Coupon

Barrier Level on an Observation Date, the notes will not pay the Contingent Coupon for that Observation Date. |

| · | Beginning on January 07, 2026, if on any Observation Date, the closing level of the Reference Asset is

greater than its Call Level, the notes will be automatically redeemed. On the following Contingent Coupon Payment Date (the “Call

Settlement Date"), investors will receive their principal amount plus the Contingent Coupon otherwise due. After the notes are redeemed,

investors will not receive any additional payments in respect of the notes. |

| · | The notes do not guarantee any return of principal at maturity. Instead, if the notes are not automatically

redeemed, the payment at maturity will be based on the Final Level of the Reference Asset and whether the Final Level of that Reference

Asset has declined from its Initial Level to below its Trigger Level on the Valuation Date (a “Trigger Event”), as described

below. |

| · | If the notes are not automatically redeemed and a Trigger Event has occurred, investors will lose 1%

of the principal amount for each 1% decrease in the level of the Reference Asset from its Initial Level to its Final Level. In such a

case, you will receive a cash amount at maturity that is less than the principal amount, together with the final Contingent Coupon, if

payable. |

| · | Investing in the notes is not equivalent to a direct investment in the Reference Asset. |

| · | The notes will not be listed on any securities exchange. |

| · | All payments on the notes are subject to the credit risk of Bank of Montreal. |

| · | The notes will be issued in minimum denominations of $1,000 and integral multiples of $1,000. |

| · | Our subsidiary, BMO Capital Markets Corp. (“BMOCM”), is the agent for this offering. See

“Supplemental Plan of Distribution (Conflicts of Interest)” below. |

| · | The notes will not be subject to conversion into our common shares or the common shares of any of our

affiliates under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act (the “CDIC Act”). |

Terms of the Notes:1

| Pricing Date: |

January 07, 2025 |

|

Valuation Date: |

January 05, 2028 |

| Settlement Date: |

January 10, 2025 |

|

Maturity Date: |

January 10, 2028 |

1Expected. See “Key Terms of the Notes” below

for additional details.

Specific Terms of the Notes:

Autocallable

Number |

Reference

Asset |

Ticker

Symbol |

Initial

Level |

Contingent

Interest Rate |

Coupon

Barrier

Level |

Trigger

Level |

CUSIP |

Principal

Amount |

Price to

Public1 |

Agent’s

Commission1 |

Proceeds to

Bank of

Montreal1 |

| 4374 |

The shares of VanEck® Junior Gold Miners ETF |

GDXJ |

[ ] |

0.8167% per month (approximately 9.80% per annum) |

[ ], 60.00% of its Initial Level |

[ ], 60.00% of its Initial Level |

06376CP59 |

[ ] |

100% |

Up to 1.60%

[ ] |

At least 98.40%

[ ] |

1 The total “Agent’s Commission” and “Proceeds

to Bank of Montreal” to be specified above will reflect the aggregate amounts at the time Bank of Montreal establishes its hedge

positions on or prior to the Pricing Date, which may be variable and fluctuate depending on market conditions at such times. Certain dealers

who purchased the notes for sale to certain fee-based advisory accounts may forego some or all of their selling concessions, fees or commissions.

The public offering price for investors purchasing the notes in these accounts may be between $984.00 and $1,000 per $1,000 in principal

amount. We or one of our affiliates may also pay a referral fee to certain dealers in connection with the distribution of the notes.

Investing in the notes involves risks, including

those described in the “Selected Risk Considerations” section beginning on page P-5 hereof, the “Additional Risk Factors

Relating to the Notes” section beginning on page PS-6 of the product supplement, and the “Risk Factors” section beginning

on page S-1 of the prospectus supplement and on page 8 of the prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these notes or passed upon the accuracy of this document, the product

supplement, the prospectus supplement or the prospectus. Any representation to the contrary is a criminal offense. The notes will be our

unsecured obligations and will not be savings accounts or deposits that are insured by the United States Federal Deposit Insurance Corporation,

the Deposit Insurance Fund, the Canada Deposit Insurance Corporation or any other governmental agency or instrumentality or other entity.

On the date hereof, based on the terms set forth

above, the estimated initial value of the notes is $976.30 per $1,000 in principal amount. The estimated initial value of the notes on

the Pricing Date may differ from this value but will not be less than $925.00 per $1,000 in principal amount. However, as discussed in

more detail below, the actual value of the notes at any time will reflect many factors and cannot be predicted with accuracy.

BMO CAPITAL MARKETS

Key Terms of the Notes:

| Reference Asset: |

The shares of VanEck® Junior Gold Miners ETF (ticker symbol "GDXJ"). See "The Reference Asset" below for additional information. |

| |

|

| Underlying Index: |

The MVIS® Global Junior Gold Miners Index |

| |

|

| Contingent Coupons: |

If the closing level of the Reference Asset on an Observation Date is greater than or equal to its Coupon Barrier Level, a Contingent Coupon will be paid on the corresponding Contingent Coupon Payment Date at the Contingent Interest Rate, subject to the automatic redemption feature. |

| |

|

| Contingent Interest Rate: |

0.8167% per month (approximately 9.80% per annum), if payable. Accordingly, each Contingent Coupon, if payable, will equal $8.167 for each $1,000 in principal amount. |

| |

|

| Observation Dates:1 |

Three trading days prior to each scheduled Contingent Coupon Payment Date. |

| |

|

Contingent Coupon Payment

Dates:1 |

Interest, if payable, will be paid on the 10th day of each month (or, if such day is not a business day, the next following business day), beginning on February 10, 2025 and ending on the Maturity Date, subject to the automatic redemption feature. |

| |

|

| Automatic Redemption: |

Beginning on January 07, 2026, if, on any Observation Date, the closing level of the Reference Asset is greater than its Call Level, the notes will be automatically redeemed. No further amounts will be owed to you under the Notes. |

| |

|

Payment upon Automatic

Redemption: |

If the notes are automatically redeemed, then, on the Call Settlement Date, investors will receive their principal amount plus the Contingent Coupon otherwise due. |

| |

|

| Call Settlement Date:1 |

If the notes are automatically redeemed, the Contingent Coupon Payment Date immediately following the relevant Observation Date. |

| |

|

| Payment at Maturity: |

If the notes are not automatically redeemed, the payment at maturity

for the notes is based on the performance of the Reference Asset.

You will receive $1,000 for each $1,000 in principal amount of the note,

unless a Trigger Event has occurred.

If a Trigger Event has occurred, you will receive at maturity, for each

$1,000 in principal amount of your notes, a cash amount equal to:

$1,000 + [$1,000 x Percentage Change]

This amount will be less than the principal amount

of your note, and may be zero.

You will also receive the final Contingent Coupon, if payable. |

| |

|

| Trigger Event:2 |

A Trigger Event will be deemed to occur if the Final Level of the Reference Asset is less than its Trigger Level on the Valuation Date. |

| |

|

| Percentage Change: |

The quotient, expressed as a percentage, of the following formula:

(Final Level - Initial Level)

Initial Level |

| |

|

| Initial Level:2 |

The closing level of the Reference Asset on the Pricing Date. |

| |

|

| Coupon Barrier Level:2 |

60.00% of the Initial Level. |

| |

|

| Trigger Level:2 |

60.00% of the Initial Level. |

| |

|

| Call Level:2 |

100% of the Initial Level. |

| |

|

| Final Level: |

The closing level of the Reference Asset on the Valuation Date. |

| |

|

| Pricing Date:1 |

January 07, 2025 |

| |

|

| Settlement Date:1 |

January 10, 2025 |

| |

|

| Valuation Date:1 |

January 05, 2028 |

| Maturity Date:1 |

January 10, 2028 |

| Physical Delivery Amount: |

We will only pay cash on the Maturity Date, and you will have no right to receive any shares of the Reference Asset. |

| |

|

| Calculation Agent: |

BMOCM |

| |

|

| Selling Agent: |

BMOCM |

1 Expected and subject to the occurrence of a market disruption

event, as described in the accompanying product supplement. If we make any change to the expected Pricing Date and Settlement Date, the

Contingent Coupon Payment Dates (and therefore the Observation Dates and potential Call Settlement Dates), the Valuation Date and Maturity

Date will be changed so that the stated term of the notes remains approximately the same.

2 As determined by the calculation agent and subject to adjustment

in certain circumstances. See "General Terms of the Notes — Anti-dilution Adjustments to a Reference Asset that Is an Equity

Security (Including Any ETF)" and "— Adjustments to a Reference Asset that Is an ETF" in the product supplement for

additional information.

Additional Terms of the Notes

You should read this document together with the product

supplement dated July 22, 2022, the prospectus supplement dated May 26, 2022 and the prospectus dated May 26, 2022. This document,

together with the documents listed below, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements

as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for

implementation, sample structures, fact sheets, brochures or other educational materials of ours or the agent. You should carefully

consider, among other things, the matters set forth in Additional Risk Factors Relating to the Notes in the product supplement, as the

notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and

other advisers before you invest in the notes.

You may access these documents on the SEC website

at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

Product supplement dated July 22, 2022:

https://www.sec.gov/Archives/edgar/data/927971/000121465922009102/r712220424b2.htm

Prospectus supplement dated May 26, 2022 and prospectus dated

May 26, 2022:

https://www.sec.gov/Archives/edgar/data/0000927971/000119312522160519/d269549d424b5.htm

Our Central Index Key, or CIK, on the SEC website

is 927971. As used in this document, "we", "us" or "our" refers to Bank of Montreal.

We have filed a registration statement (including

a prospectus) with the SEC for the offering to which this document relates. Before you invest, you should read the prospectus in that

registration statement and the other documents that we have filed with the SEC for more complete information about us and this offering.

You may obtain these documents free of charge by visiting the SEC's website at http://www.sec.gov. Alternatively, we will arrange to send

to you the prospectus (as supplemented by the prospectus supplement and product supplement) if you request it by calling our agent toll-free

at 1-877-369-5412.

Selected Risk Considerations

An investment in the notes involves significant risks.

Investing in the notes is not equivalent to investing directly in the Reference Asset. These risks are explained in more detail in the

“Additional Risk Factors Relating to the Notes” section of the product supplement.

Risks Related to the Structure or Features of the Notes

| · | Your investment in the notes may result in a loss. — The notes do not guarantee any return of principal. If the notes

are not automatically redeemed, the payment at maturity will be based on the Final Level and whether a Trigger Event has occurred. If

the Final Level is less than its Trigger Level, a Trigger Event will occur, and you will lose 1% of the principal amount for each 1% that

the Final Level is less than the Initial Level. In such a case, you will receive at maturity a cash payment that is less than the principal

amount of the notes and may be zero. Accordingly, you could lose your entire investment in the notes. |

| · | You may not receive any Contingent Coupons with respect to your notes. — We will not necessarily make periodic interest

payments on the notes. If the closing level of the Reference Asset on an Observation Date is less than its Coupon Barrier Level, we will

not pay you the Contingent Coupon applicable to that Observation Date. If the closing level of the Reference Asset is less than its Coupon

Barrier Level on each of the Observation Dates, we will not pay you any Contingent Coupons during the term of the notes, and you will

not receive a positive return on the notes. Generally, this non-payment of any Contingent Coupons will coincide with a greater risk of

principal loss on your notes. |

| · | Your notes are subject to automatic early redemption. — We will redeem the notes if the closing level of the Reference

Asset on any Observation Date is greater than its Call Level. Following an automatic redemption, you will not receive any additional Contingent

Coupons and may not be able to reinvest your proceeds in an investment with returns that are comparable to the notes. Furthermore, to

the extent you are able to reinvest such proceeds in an investment with a comparable return for a similar level of risk, you may incur

transaction costs such as dealer discounts and hedging costs built into the price of the new notes. |

| · | Your return on the notes is limited to the Contingent Coupons, if any, regardless of any appreciation in the value of the Reference

Asset. — You will not receive a payment at maturity with a value greater than your principal amount plus the final Contingent

Coupon, if payable. In addition, if the notes are automatically redeemed, you will not receive a payment greater than the principal amount

plus the applicable Contingent Coupon, even if the Final Level exceeds the Call Level by a substantial amount. Accordingly, your maximum

return on the applicable notes is limited to the potential return represented by the Contingent Coupons. |

| · | Your return on the notes may be lower than the return on a conventional debt security of comparable maturity. — The

return that you will receive on your notes, which could be negative, may be less than the return you could earn on other investments.

The notes do not provide for fixed interest payments and you may not receive any Contingent Coupons over the term of the notes. Even if

you do receive one or more Contingent Coupons and your return on the notes is positive, your return may be less than the return you would

earn if you bought a conventional senior interest bearing debt security of ours with the same maturity or if you invested directly in

the Reference Asset. Your investment may not reflect the full opportunity cost to you when you take into account factors that affect the

time value of money. |

| · | A higher Contingent Interest Rate or lower Trigger Level or Coupon Barrier Level may reflect greater expected volatility of the

Reference Asset, and greater expected volatility generally indicates an increased risk of loss at maturity. — The economic

terms for the notes, including the Contingent Interest Rate, Coupon Barrier Level and Trigger Level, are based, in part, on the expected

volatility of the Reference Asset at the time the terms of the notes are set. “Volatility” refers to the frequency and magnitude

of changes in the level of the Reference Asset. The greater the expected volatility of the Reference Asset as of the Pricing Date, the

greater the expectation is as of that date that the closing level of the Reference Asset could be less than its Coupon Barrier Level on

any Observation Date and that a Trigger Event could occur and, as a consequence, indicates an increased risk of not receiving a Contingent

Coupon and an increased risk of loss, respectively. All things being equal, this greater expected volatility will generally be reflected

in a higher Contingent Interest Rate than the yield payable on our conventional debt securities with a similar maturity or on otherwise

comparable securities, and/or lower Trigger Level and/or Coupon Barrier Level than those terms on otherwise comparable securities. Therefore,

a relatively higher Contingent Interest Rate may indicate an increased risk of loss. Further, a relatively lower Trigger Level and/or

Coupon Barrier may not necessarily indicate that the notes have a greater likelihood of a return of principal at maturity and/or paying

Contingent Coupons. You should be willing to accept the downside market risk of the Reference Asset and the potential to lose a significant

portion or all of your initial investment. |

Risks Related to the Reference Asset

| · | Owning the notes is not the same as owning shares of the Reference Asset or a security directly linked to the Reference Asset.

— The return on your notes will not reflect the return you would realize if you actually owned shares of the Reference Asset or

a security directly linked to the performance of the Reference Asset and held that investment for a similar period. Your notes may trade

quite differently from the Reference Asset. Changes in the level of the Reference Asset may not result in comparable changes in the market

value of your notes. Even if the level of the Reference Asset increases during the term of the notes, the market value of the notes prior

to maturity may not increase to the same extent. It is also possible for the market value of the notes to decrease while the level of

the Reference Asset increases. In addition, any dividends or other distributions paid on the Reference Asset will not be reflected in

the amount payable on the notes. |

| · | You will not have any shareholder rights and will have no right to receive any shares of the Reference Asset (or any company included

in the Reference Asset) at maturity. — Investing in your notes will not make you a holder of any shares of the Reference Asset

or any securities held by the Reference Asset. Neither you nor any other holder or owner of the notes will have any voting rights, any

right to receive dividends or other distributions, or any other rights with respect to the Reference Asset or such underlying securities. |

| · | No delivery of shares of the Reference Asset. — The notes will be payable only in cash. You should not invest in the

notes if you seek to have the shares of the Reference Asset delivered to you at maturity. |

| · | Changes that affect the applicable Underlying Index will affect the market value of the notes, whether the notes will be automatically

redeemed, and the amount you will receive at maturity. — The policies of the applicable index sponsor concerning the calculation

of the applicable Underlying Index, additions, deletions or substitutions of the components of the applicable Underlying Index and the

manner in which changes affecting those components, such as stock dividends, reorganizations or mergers, may be reflected in the applicable

Reference Asset and, therefore, could affect the share price of the Reference Asset, the amounts payable on the notes, whether the notes

are automatically redeemed, and the market value of the notes prior to maturity. The amount payable on the notes and their market value

could also be affected if the applicable index sponsor changes these policies, for example, by changing the manner in which it calculates

the applicable Underlying Index, or if the applicable index sponsor discontinues or suspends the calculation or publication of the applicable

Underlying Index. |

| · | We have no affiliation with the index sponsor of the applicable Underlying Index and will not be responsible for its actions.

— The sponsor of the applicable Underlying Index is not our affiliate and will not be involved in the offering of the notes in any

way. Consequently, we have no control over the actions of the index sponsor of the applicable Underlying Index, including any actions

of the type that would require the calculation agent to adjust the payment to you at maturity. The index sponsors have no obligation of

any sort with respect to the notes. Thus, the applicable index sponsor has no obligation to take your interests into consideration for

any reason, including in taking any actions that might affect the value of the notes. None of our proceeds from the issuance of the notes

will be delivered to the index sponsor of the applicable Underlying Index. |

| · | Adjustments to the Reference Asset could adversely affect the notes. — The sponsor and advisor of the Reference Asset

is responsible for calculating and maintaining the Reference Asset. The sponsor and advisor of the Reference Asset can add, delete or

substitute the stocks comprising the Reference Asset or make other methodological changes that could change the share price of the Reference

Asset at any time. If one or more of these events occurs, the calculation of the amount payable at maturity may be adjusted to reflect

such event or events. Consequently, any of these actions could adversely affect the amount payable at maturity and/or the market value

of the notes. |

| · | We and our affiliates do not have any affiliation with the applicable investment advisor or the Reference Asset Issuer and are

not responsible for their public disclosure of information. — The investment advisor of the Reference Asset advises the issuer

of the Reference Asset (the “Reference Asset Issuer” ) on various matters, including matters relating to the policies, maintenance

and calculation of the Reference Asset. We and our affiliates are not affiliated with the applicable investment advisor or the Reference

Asset Issuer in any way and have no ability to control or predict its actions, including any errors in or discontinuance of disclosure

regarding the methods or policies relating to the Reference Asset. Neither the applicable investment advisor nor the Reference Asset Issuer

is involved in the offerings of the notes in any way and has no obligation to consider your interests as an owner of the notes in taking

any actions relating to the Reference Asset that might affect the value of the notes. Neither we nor any of our affiliates has independently

verified the adequacy or accuracy of the information about the applicable investment advisor or the Reference Asset contained in any public

disclosure of information. You, as an investor in the notes, should make your own investigation into the Reference Asset Issuer. |

| · | The correlation between the performance of the Reference Asset and the performance of the applicable Underlying Index may be imperfect.

— The performance of the Reference Asset is linked principally to the performance of the applicable Underlying Index. However, because

of the potential discrepancies identified in more detail in the product supplement, the return on the Reference Asset may correlate imperfectly

with the return on the applicable Underlying Index. |

| · | The Reference Asset is subject to management risks. — The Reference Asset is subject to management risk, which is the

risk that the applicable investment advisor’s investment strategy, the implementation of which is subject to a number of constraints,

may not produce the intended results. For example, the applicable investment advisor may invest a portion of the Reference Asset Issuer’s

assets in securities not included in the relevant industry or sector but which the applicable investment advisor believes will help the

Reference Asset track the relevant industry or sector. |

| · | You must rely on your own evaluation of the merits of an investment linked to the Reference Asset. — In the ordinary

course of their businesses, our affiliates from time to time may express views on expected movements in the prices of the Reference Asset

or the prices of the securities held by the Reference Asset. One or more of our affiliates have published, and in the future may publish,

research reports that express views on the Reference Asset or these securities. However, these views are subject to change from time to

time. Moreover, other professionals who deal in the markets relating to the Reference Asset at any time may have significantly different

views from those of our affiliates. You are encouraged to derive information concerning the Reference Asset from multiple sources, and

you should not rely on the views expressed by our affiliates.

Neither the offering of the notes nor any views which our affiliates from time to time may express in the ordinary course of their businesses

constitutes a recommendation as to the merits of an investment in the notes. |

Risks Relating to VanEck® Junior Gold Miners ETF

| · | The VanEck® Junior Gold Miners ETF, and therefore an investment in the notes, is subject to foreign currency exchange rate

risk. — The share price of the VanEck® Junior Gold Miners ETF will fluctuate based upon their net asset value, which will

in turn depend in part upon changes in the value of the currencies in which the stocks held by the VanEck® Junior Gold Miners ETF

are traded. Accordingly, investors in the notes will be exposed to currency exchange rate risk with respect to each of these currencies.

An investor’s net exposure will depend on the extent to which these currencies strengthen or weaken against the U.S. dollar. If

the dollar strengthens against these currencies, the net asset value of the VanEck® Junior Gold Miners ETF will be adversely affected

and the price of their shares may decrease. |

| · | The VanEck® Junior Gold Miners ETF, and therefore an investment in the notes, is subject to risks associated with foreign securities

markets. — The Underlying Index of the VanEck® Junior Gold Miners ETF tracks the value of certain foreign equity securities.

You should be aware that investments in securities linked to the value of foreign equity securities involve particular risks. The foreign

securities markets comprising the Underlying Index of each of the VanEck® Junior Gold Miners ETF may have less liquidity and may be

more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other

securities markets. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings

in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information

about foreign companies than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange

Commission, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from

those applicable to U.S. reporting companies.

Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical

regions. These factors, which could negatively affect those securities markets, include the possibility of recent or future changes in

a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other

laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in

the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural

disaster or adverse public health developments in the region. Moreover, foreign economies may differ favorably or unfavorably from the

U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. |

| · | The VanEck® Junior Gold Miners ETF, and therefore an investment in the notes, is subject to risks associated with emerging

markets. — The Underlying Index of the VanEck® Junior Gold Miners ETF consists of stocks issued by companies in countries

with emerging markets. Countries with emerging markets may have relatively unstable governments, may present the risks of nationalization

of businesses, restrictions on foreign ownership and prohibitions on the repatriation of assets, and may have less protection of property

rights than more developed countries. The economies of countries with emerging markets may be based on only a few industries, may be highly

vulnerable to changes in local or global trade conditions (due to economic dependence upon commodity prices and international trade),

and may suffer from extreme and volatile debt burdens, currency devaluations or inflation rates. Local securities markets may trade a

small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation

of holdings difficult or impossible at times.

The shares tracked by the Underlying Index of the VanEck® Junior Gold Miners ETF may be listed on a foreign stock exchange. A foreign

stock exchange may impose trading limitations intended to prevent extreme fluctuations in individual security prices and may suspend trading

in certain circumstances. These actions could limit variations in the levels of the VanEck® Junior Gold Miners ETF, as applicable,

which could, in turn, adversely affect the value of, and amount payable on, the notes. |

| · | The VanEck® Junior Gold Miners ETF, and therefore an investment in the notes, is subject to risks associated with concentration

in the gold and silver mining industries. — All or substantially all of the equity securities held by the VanEck® Junior

Gold Miners ETF are issued by gold or silver mining companies. An investment in the notes will be exposed to risks in the gold and silver

mining industries. As a result of being linked to a single industry or sector, the notes may have increased volatility as the share price

of the VanEck® Junior Gold Miners ETF may be more susceptible to adverse factors that affect that industry or sector. Competitive

pressures may have a significant effect on the financial condition of companies in these industries.

In addition, these companies are highly dependent on the price of gold or silver, as applicable. These prices fluctuate widely and may

be affected by numerous factors. Factors affecting gold prices include economic factors, including, among other things, the structure

of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence

in, the U.S. dollar (the currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates,

and global or regional economic, financial, political, regulatory, judicial or other events. Gold prices may also be affected by industry

factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and

other governmental agencies and multilateral institutions which hold gold, levels of gold production and production costs, and short-term

changes in supply and demand because of trading activities in the gold market. Factors affecting silver prices include general economic

trends, technical developments, substitution issues and regulation, as well as specific factors including industrial and jewelry demand,

expectations with respect to the rate of inflation, the relative strength of the U.S. dollar (the currency in which the price of silver

is generally quoted) and other currencies, interest rates, central bank sales, forward sales by producers, global or regional political

or economic events, and production costs and disruptions in major silver producing countries. |

| · | Relationship to gold and silver bullion. — The VanEck® Junior Gold Miners ETF invests in shares of gold and silver

mining companies, but not in gold bullion or silver bullion. The VanEck® Junior Gold Miners ETF may under- or over-perform gold bullion

and/or silver bullion over the term of the notes. |

| · | The VanEck® Junior Gold Miners ETF is subject to risks associated with investing in stocks with small- and mid-capitalization

companies and early stage mining companies that are in the exploration stage that might not ultimately produce gold or silver. —

The VanEck® Junior Gold Miners ETF consists of stocks issued by companies with relatively small market capitalizations. These companies

often have greater stock price volatility, lower trading volume and less liquidity than large-capitalization companies. As a result, the

share price of the VanEck® Junior Gold Miners ETF may be more volatile than that of a market measure that does not track solely small-

and mid-capitalization stocks. A decrease in the price of gold and/or silver bullion could particularly adversely affect the profitability

of small- and medium-capitalization mining companies and their ability to secure financing. Furthermore, companies that are only in the

exploration stage are typically unable to adopt specific strategies for controlling the impact of the price of gold. |

The exploration and development of mineral

deposits involve significant financial risks over a significant period of time which even a combination of careful evaluation, experience

and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. Major expenditures may

be required to establish reserves by drilling and to construct mining and processing facilities at a site. In addition, many early stage

miners operate at a loss and are dependent on securing equity and/or debt financing, which might be more difficult to secure for an early

stage mining company than for a more established counterpart.

General Risk Factors

| · | Your investment is subject to the credit risk of Bank of Montreal. — Our credit ratings and credit spreads may adversely

affect the market value of the notes. Investors are dependent on our ability to pay any amounts due on the notes, and therefore investors

are subject to our credit risk and to changes in the market’s view of our creditworthiness. Any decline in our credit ratings or

increase in the credit spreads charged by the market for taking our credit risk is likely to adversely affect the value of the notes. |

| · | Potential conflicts. — We and our affiliates play a variety of roles in connection with the issuance of the notes, including

acting as calculation agent. In performing these duties, the economic interests of the calculation agent and other affiliates of ours

are potentially adverse to your interests as an investor in the notes. We or one or more of our affiliates may also engage in trading

of shares of the Reference Asset on a regular basis as part of our general broker-dealer and other businesses, for proprietary accounts,

for other accounts under management or to facilitate transactions for our customers. Any of these activities could adversely affect the

level of the Reference Asset and, therefore, the market value of, and the payments on, the notes. We or one or more of our affiliates

may also issue or underwrite other securities or financial or derivative instruments with returns linked or related to changes in the

performance of the Reference Asset. By introducing competing products into the marketplace in this manner, we or one or more of our affiliates

could adversely affect the market value of the notes. |

| · | Our initial estimated value of the notes will be lower than the price to public. — Our initial estimated value of the

notes is only an estimate, and is based on a number of factors. The price to public of the notes will exceed our initial estimated value,

because costs associated with offering, structuring and hedging the notes are included in the price to public, but are not included in

the estimated value. These costs include any underwriting discount and selling concessions, the profits that we and our affiliates expect

to realize for assuming the risks in hedging our obligations under the notes and the estimated cost of hedging these obligations. The

initial estimated value of the notes may be as low as the amount indicated on the cover page hereof. |

| · | Our initial estimated value does not represent any future value of the notes, and may also differ from the estimated value of any

other party. — Our initial estimated value of the notes as of the date hereof is, and our estimated value as determined on the

Pricing Date will be, derived using our internal pricing models. This value is based on market conditions and other relevant factors,

which include volatility of the Reference Asset, dividend rates and interest rates. Different pricing models and assumptions could provide

values for the notes that are greater than or less than our initial estimated value. In addition, market conditions and other relevant

factors after the Pricing Date are expected to change, possibly rapidly, and our assumptions may prove to be incorrect. After the Pricing

Date, the value of the notes could change dramatically due to changes in market conditions, our creditworthiness, and the other factors

set forth herein and in the product supplement. These changes are likely to impact the price, if any, at which we or BMOCM would be willing

to purchase the notes from you in any secondary market transactions. Our initial estimated value does not represent a minimum price at

which we or our affiliates would be willing to buy your notes in any secondary market at any time. |

| · | The terms of the notes are not determined by reference to the credit spreads for our conventional fixed-rate debt. —

To determine the terms of the notes, we will use an internal funding rate that represents a discount from the credit spreads for our conventional

fixed-rate debt. As a result, the terms of the notes are less favorable to you than if we had used a higher funding rate. |

| · | Certain costs are likely to adversely affect the value of the notes. — Absent any changes in market conditions, any secondary

market prices of the notes will likely be lower than the price to public. This is because any secondary market prices will likely take

into account our then-current market credit spreads, and because any secondary market prices are likely to exclude all or a portion of

any underwriting discount and selling concessions, and the hedging profits and estimated hedging costs that are included in the price

to public of the notes and that may be reflected on your account statements. In addition, any such price is also likely to reflect a discount

to account for costs associated with establishing or unwinding any related hedge transaction, such as dealer discounts, mark-ups and other

transaction costs. As a result, the price, if any, at which BMOCM or any other party may be willing to purchase the notes from you in

secondary market transactions, if at all, will likely be lower than the price to public. Any sale that you make prior to the Maturity

Date could result in a substantial loss to you. |

| · | Lack of liquidity. — The notes will not be listed on any securities exchange. BMOCM may offer to purchase the notes in

the secondary market, but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow

you to trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which

you may be able to trade the notes is likely to depend on the price, if any, at which BMOCM is willing to buy the notes. |

| · | Hedging and trading activities. — We or any of our affiliates have carried out or may carry out hedging activities related

to the notes, including purchasing or selling shares of the Reference Asset or securities held by the Reference Asset, futures or options

relating to the Reference Asset or securities held by the Reference Asset or other derivative instruments with returns linked or related

to changes in the performance on the Reference Asset or securities held by the Reference Asset. We or our affiliates may also trade in

the Reference Asset, such securities, or instruments related to the Reference Asset or such securities from time to time. Any of these

hedging or trading activities on or prior to the Pricing Date and during the term of the notes could adversely affect the payments on

the notes. |

| · | Many economic and market factors will influence the value of the notes. — In addition to the level of the Reference Asset

and interest rates on any trading day, the value of the notes will be affected by a number of economic and market factors that may either

offset or magnify each other, and which are described in more detail in the product supplement. |

| · | Significant aspects of the tax treatment of the notes are uncertain. — The tax treatment of the notes is uncertain. We

do not plan to request a ruling from the Internal Revenue Service or from any Canadian authorities regarding the tax treatment of the

notes, and the Internal Revenue Service or a court may not agree with the tax treatment described herein.

The Internal Revenue Service has released a notice that may affect the taxation of holders of “prepaid forward contracts”

and similar instruments. According to the notice, the Internal Revenue Service and the U.S. Treasury are actively considering whether

the holder of such instruments should be required to accrue ordinary income on a current basis. While it is not clear whether the notes

would be viewed as similar to such instruments, it is possible that any future guidance could materially and adversely affect the tax

consequences of an investment in the notes, possibly with retroactive effect.

Please read carefully the section entitled "U.S. Federal Tax Information" herein, the section entitled "Supplemental Tax

Considerations–Supplemental U.S. Federal Income Tax Considerations" in the accompanying product supplement, the section entitled

"United States Federal Income Taxation" in the accompanying prospectus and the section entitled "Certain Income Tax Consequences"

in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation. |

Examples of the Hypothetical Payment at Maturity for a $1,000 Investment

in the Notes

The following table illustrates the hypothetical

payments on a note at maturity, assuming that the notes are not automatically redeemed. The hypothetical payments are based on a $1,000

investment in the note, a hypothetical Initial Level of $100.00, a hypothetical Trigger Level of $60.00 (60.00% of the hypothetical Initial

Level), a hypothetical Call Level of $100.00 (100.00% of the hypothetical Initial Level), a range of hypothetical Final Levels and the

effect on the payment at maturity.

The hypothetical examples shown below are intended

to help you understand the terms of the notes. If the notes are not automatically redeemed, the actual cash amount that you will receive

at maturity will depend upon the Final Level of the Reference Asset. If the notes are automatically redeemed prior to maturity, the hypothetical

examples below will not be relevant, and you will receive on the applicable Call Settlement Date, for each $1,000 principal amount, the

principal amount plus the applicable Contingent Coupon.

As discussed in more detail above, your total return

on the notes will also depend on the number of Contingent Coupon Dates on which the Contingent Coupon is payable. It is possible that

the only payments on your notes will be the payment, if any, due at maturity. The payment at maturity will not exceed the principal amount,

and may be significantly less.

| Hypothetical Final Level |

Hypothetical Final Level Expressed

as a Percentage of the Initial Level |

Payment at Maturity (Excluding

Coupons) |

| $200.00 |

200.00% |

$1,000.00 |

| $180.00 |

180.00% |

$1,000.00 |

| $160.00 |

160.00% |

$1,000.00 |

| $140.00 |

140.00% |

$1,000.00 |

| $120.00 |

120.00% |

$1,000.00 |

| $100.00 |

100.00% |

$1,000.00 |

| $90.00 |

90.00% |

$1,000.00 |

| $80.00 |

80.00% |

$1,000.00 |

| $70.00 |

70.00% |

$1,000.00 |

| $60.00 |

60.00% |

$1,000.00 |

| $59.99 |

59.99% |

$599.90 |

| $40.00 |

40.00% |

$400.00 |

| $20.00 |

20.00% |

$200.00 |

| $0.00 |

0.00% |

$0.00 |

U.S. Federal Tax Information

By purchasing the notes, each holder agrees (in the

absence of a change in law, an administrative determination or a judicial ruling to the contrary) to treat each note as a pre-paid contingent

income-bearing derivative contract for U.S. federal income tax purposes. In the opinion of our counsel, Mayer Brown LLP, it would generally

be reasonable to treat the notes as pre-paid contingent income-bearing derivative contracts in respect of the Reference Asset for U.S.

federal income tax purposes. However, the U.S. federal income tax consequences of your investment in the notes are uncertain and the Internal

Revenue Service could assert that the notes should be taxed in a manner that is different from that described in the preceding sentence.

Please see the discussion in the accompanying product supplement under "Supplemental Tax Considerations—Supplemental U.S. Federal

Income Tax Considerations—Notes Treated as an Investment Unit Consisting of a Debt Portion and a Put Option, as a Pre-Paid Contingent

Income-Bearing Derivative Contract, or as a Pre-Paid Derivative Contract—Notes Treated as a Pre-Paid Contingent Income-Bearing Derivative

Contract," which applies to the notes, except the following disclosure which supplements, and to the extent inconsistent supersedes,

the discussion in the product supplement.

Under current Internal Revenue Service guidance,

withholding on "dividend equivalent" payments (as discussed in the product supplement), if any, will not apply to notes that

are issued as of the date of this pricing supplement unless such notes are "delta-one" instruments. Based on our determination

that the notes are not delta-one instruments, non-United States holders (as defined in the product supplement) should not generally be

subject to withholding on dividend equivalent payments, if any, under the notes.

Supplemental Plan of Distribution (Conflicts of Interest)

BMOCM will purchase the notes from us at a purchase

price reflecting the commission set forth on the cover hereof. BMOCM has informed us that, as part of its distribution of the notes, it

will reoffer the notes to other dealers who will sell them. Each such dealer, or each additional dealer engaged by a dealer to whom BMOCM

reoffers the notes, will receive a commission from BMOCM, which will not exceed the commission set forth on the cover page. We or one

of our affiliates may also pay a referral fee to certain dealers in connection with the distribution of the notes.

Certain dealers who purchase the notes for sale

to certain fee-based advisory accounts may forego some or all of their selling concessions, fees or commissions. The public offering price

for investors purchasing the notes in these accounts may be less than 100% of the principal amount, as set forth on the cover page of

this document. Investors that hold their notes in these accounts may be charged fees by the investment advisor or manager of that account

based on the amount of assets held in those accounts, including the notes.

We will deliver the notes on a date that is greater

than one business day following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade

expressly agree otherwise. Accordingly, purchasers who wish to trade the notes more than one business day prior to the issue date will

be required to specify alternative settlement arrangements to prevent a failed settlement.

We own, directly or indirectly, all of the outstanding

equity securities of BMOCM, the agent for this offering. In accordance with FINRA Rule 5121, BMOCM may not make sales in this offering

to any of its discretionary accounts without the prior written approval of the customer.

We reserve the right to withdraw, cancel or modify

the offering of the notes and to reject orders in whole or in part. You may cancel any order for the notes prior to its acceptance.

You should not construe the offering of the notes

as a recommendation of the merits of acquiring an investment linked to the Reference Asset or as to the suitability of an investment in

the notes.

BMOCM may, but is not obligated to, make a market

in the notes. BMOCM will determine any secondary market prices that it is prepared to offer in its sole discretion.

We may use the final pricing supplement relating

to the notes in the initial sale of the notes. In addition, BMOCM or another of our affiliates may use the final pricing supplement in

market-making transactions in any notes after their initial sale. Unless BMOCM or we inform you otherwise in the confirmation of sale,

the final pricing supplement is being used by BMOCM in a market-making transaction.

For a period of approximately three months following

issuance of the notes, the price, if any, at which we or our affiliates would be willing to buy the notes from investors, and the value

that BMOCM may also publish for the notes through one or more financial information vendors and which could be indicated for the notes

on any brokerage account statements, will reflect a temporary upward adjustment from our estimated value of the notes that would otherwise

be determined and applicable at that time. This temporary upward adjustment represents a portion of (a) the hedging profit that we or

our affiliates expect to realize over the term of the notes and (b) any underwriting discount and the selling concessions paid in connection

with this offering. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the three-month

period.

The notes and the related offer to purchase notes

and sale of notes under the terms and conditions provided herein do not constitute a public offering in any non-U.S. jurisdiction, and

are being made available only to individually identified investors pursuant to a private offering as permitted in the relevant jurisdiction.

The notes are not, and will not be, registered with any securities exchange or registry located outside of the United States and have

not been registered with any non-U.S. securities or banking regulatory authority. The contents of this document have not been reviewed

or approved by any non-U.S. securities or banking regulatory authority. Any person who wishes to acquire the notes from outside the United

States should seek the advice or legal counsel as to the relevant requirements to acquire these notes.

British Virgin Islands. The notes have not

been, and will not be, registered under the laws and regulations of the British Virgin Islands, nor has any regulatory authority in the

British Virgin Islands passed comment upon or approved the accuracy or adequacy of this document. This pricing supplement and the related

documents shall not constitute an offer, invitation or solicitation to any member of the public in the British Virgin Islands for the

purposes of the Securities and Investment Business Act, 2010, of the British Virgin Islands.

Cayman Islands. Pursuant to the Companies

Law (as amended) of the Cayman Islands, no invitation may be made to the public in the Cayman Islands to subscribe for the notes by or

on behalf of the issuer unless at the time of such invitation the issuer is listed on the Cayman Islands Stock Exchange. The issuer is

not presently listed on the Cayman Islands Stock Exchange and, accordingly, no invitation to the public in the Cayman Islands is to be

made by the issuer (or by any dealer on its behalf). No such invitation is made to the public in the Cayman Islands hereby.

Dominican Republic. Nothing in this pricing

supplement constitutes an offer of securities for sale in the Dominican Republic. The notes have not been, and will not be, registered

with the Superintendence of Securities Market of the Dominican Republic (Superintendencia del Mercado de Valores), under Dominican Securities

Market Law No. 249-17 (“Securities Law 249-17”), and the notes may not be offered or sold within the Dominican Republic or

to, or for the account or benefit of, Dominican persons (as defined under Securities Law 249-17 and its regulations). Failure to comply

with these directives may result in a violation of Securities Law 249-17 and its regulations.

Israel. This pricing supplement is intended

solely for investors listed in the First Supplement of the Israeli Securities Law of 1968, as amended. A prospectus has not been prepared

or filed, and will not be prepared or filed, in Israel relating to the notes offered hereunder. The notes cannot be resold in Israel other

than to investors listed in the First Supplement of the Israeli Securities Law of 1968, as amended.

No action will be taken in Israel that would permit

an offering of the notes or the distribution of any offering document or any other material to the public in Israel. In particular, no

offering document or other material has been reviewed or approved by the Israel Securities Authority. Any material provided to an offeree

in Israel may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have

been provided directly by us or the selling agents.

Nothing in this pricing supplement or any other offering

material relating to the notes, should be considered as the rendering of a recommendation or advice, including investment advice or investment

marketing under the Law For Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management, 1995, to purchase

any note. The purchase of any note will be based on an investor’s own understanding, for the investor’s own benefit and for

the investor’s own account and not with the aim or intention of distributing or offering to other parties. In purchasing the notes,

each investor declares that it has the knowledge, expertise and experience in financial and business matters so as to be capable of evaluating

the risks and merits of an investment in the notes, without relying on any of the materials provided.

Mexico. The notes have not been registered

with the National Registry of Securities maintained by the Mexican National Banking and Securities Commission and may not be offered or

sold publicly in Mexico. This pricing supplement and the related documents may not be publicly distributed in Mexico. The notes may only

be offered in a private offering pursuant to Article 8 of the Securities Market Law.

Switzerland. This pricing supplement is not

intended to constitute an offer or solicitation to purchase or invest in any notes. Neither this pricing supplement nor any other offering

or marketing material relating to the notes constitutes a prospectus compliant with the requirements of articles 35 et seq. of the Swiss

Financial Services Act ("FinSA")) for a public offering of the notes in Switzerland and no such prospectus has been or will

be prepared for or in connection with the offering of the notes in Switzerland.

Neither this pricing supplement nor any other offering

or marketing material relating to the notes has been or will be filed with or approved by a Swiss review body (Prüfstelle). No application

has been or is intended to be made to admit the notes to trading on any trading venue (SIX Swiss Exchange or on any other exchange or

any multilateral trading facility) in Switzerland. Neither this pricing supplement nor any other offering or marketing material relating

to the notes may be publicly distributed or otherwise made publicly available in Switzerland.

The notes may not be publicly offered, directly or

indirectly, in Switzerland within the meaning of FinSA except (i) in any circumstances falling within the exemptions to prepare a prospectus

listed in article 36 para. 1 FinSA or (ii) where such offer does not qualify as a public offer in Switzerland, provided always that no

offer of notes shall require the Issuer or any offeror to publish a prospectus pursuant to article 35 FinSA in respect to such offer and

that such offer shall comply with the additional restrictions set out below (if applicable). The Issuer has not authorised and does not

authorise any offer of notes which would require the Issuer or any offeror to publish a prospectus pursuant to article 35 FinSA in respect

of such offer. For purposes of this provision "public offer" shall have the meaning as such term is understood pursuant to article

3 lit. g and h FinSA and the Swiss Financial Services Ordinance ("FinSO").

The notes do not constitute participations in a collective

investment scheme within the meaning of the Swiss Collective Investment Schemes Act. They are not subject to the approval of, or supervision

by, the Swiss Financial Market Supervisory Authority ("FINMA"), and investors in the notes will not benefit from protection

under CISA or supervision by FINMA.

Prohibition of Offer to Private Clients in Switzerland

- No Key Information Document pursuant to article 58 FinSA (Basisinformationsblatt für Finanzinstrumente) or equivalent document

under foreign law pursuant to article 59 para. 2 FinSA has been or will be prepared in relation to the notes. Therefore, the following

additional restriction applies: Notes qualifying as "debt securities with a derivative character" pursuant to article 86 para.

2 FinSO may not be offered within the meaning of article 58 para. 1 FinSA, and neither this pricing supplement nor any other offering

or marketing material relating to such notes may be made available, to any retail client (Privatkunde) within the meaning of FinSA in

Switzerland.

The notes may also be sold in the following jurisdictions,

provided, in each case, any sales are made in accordance with all applicable laws in such jurisdiction:

Additional Information Relating to the Estimated Initial Value of

the Notes

Our estimated initial value of the notes on the

date hereof, and that will be set forth on the cover page of the final pricing supplement relating to the notes, equals the sum of the

values of the following hypothetical components:

| · | a fixed-income debt component with the same tenor as the notes, valued using our internal funding rate for structured notes; and |

| · | one or more derivative transactions relating to the economic terms of the notes. |

The internal funding rate used in the determination

of the initial estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. The value

of these derivative transactions is derived from our internal pricing models. These models are based on factors such as the traded market

prices of comparable derivative instruments and on other inputs, which include volatility, dividend rates, interest rates and other factors.

As a result, the estimated initial value of the notes on the Pricing Date will be determined based on the market conditions on the Pricing

Date.

The Reference Asset

We have derived the following information from publicly

available documents. We have not independently verified the accuracy or completeness of the following information. We are not affiliated

with the Reference Asset Issuer and the Reference Asset Issuer will have no obligations with respect to the notes. This document relates

only to the notes and does not relate to the shares of the Reference Asset or any securities included in the Underlying Index. Neither

we nor any of our affiliates participates in the preparation of the publicly available documents described below. Neither we nor any of

our affiliates has made any due diligence inquiry with respect to the Reference Asset in connection with the offering of the notes. There

can be no assurance that all events occurring prior to the date hereof, including events that would affect the accuracy or completeness

of the publicly available documents described below and that would affect the trading price of the shares of the Reference Asset, have

been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events

concerning the Reference Asset could affect the price of the shares of the Reference Asset on each Observation Date and on the Valuation

Date, and therefore could affect the payments on the notes.

The selection of the Reference Asset is not a recommendation

to buy or sell the shares of the Reference Asset. Neither we nor any of our affiliates make any representation to you as to the performance

of the shares of the Reference Asset. Information provided to or filed with the SEC under the Exchange Act and the Investment Company

Act of 1940 relating to the Reference Asset may be obtained through the SEC’s website at http://www.sec.gov.

We encourage you to review recent levels of the Reference

Asset prior to making an investment decision with respect to the notes.

VanEck® Junior Gold Miners ETF

The VanEck® Junior Gold Miners ETF is an investment

portfolio maintained, managed and advised by Van Eck Associates Corporation. The VanEck® Junior Gold Miners ETF is classified as a

“non-diversified” fund under the Investment Company Act of 1940. The VanEck® Junior Gold Miners ETF seeks to provide investment

results that correspond generally to the price and yield performance, before fees and expenses, of the MVIS® Global Junior Gold Miners

Index. Information about the VanEck® Junior Gold Miners ETF filed with the SEC can be found by reference to its SEC file numbers:

333-123257 and 811-10325 or its CIK Code: 0001137360. Shares of the VanEck® Junior Gold Miners ETF are listed on the NYSE Arca under

ticker symbol "GDXJ."

The MVIS® Global Junior Gold Miners Index

All information in this document regarding the MVIS®

Global Junior Gold Miners Index, including, without limitation, its make-up, method of calculation and changes in its components, is derived

from publicly available information. Such information reflects the policies of, and is subject to change by, MV Index Solutions (“MVIS®”).

Neither we nor any of our affiliates has undertaken any independent review or due diligence of such information. The MVIS® Global

Junior Gold Miners Index is maintained and published by MVIS®. MVIS® has no obligation to continue to publish, and may discontinue

the publication of, the MVIS® Global Junior Gold Miners Index.

The MVIS® Global Junior Gold Miners Index tracks

the performance of gold and silver mining companies. The MVIS® Global Junior Gold Miners Index includes all small-cap companies of

the segment that generate at least 50% of their revenues from gold or silver mining, companies with properties that have the potential

to generate at least 50% of their revenues from gold and silver when developed, or companies that primarily invest in gold or silver.

In addition, stocks included in the MVIS® Global

Junior Gold Miners Index must meet size and liquidity requirements: the full market capitalization has to exceed US$150 million, the three

months average-daily-trading volume must be higher than US$1.0 million and the stocks must have traded at least 250,000 shares per month

over the last six months.

The MVIS® Global Junior Gold Miners Index is

reviewed on a quarterly basis to ensure that 100% of the free-float market capitalization of the investable small-cap universe with at

least 25 companies.

At the time of the quarterly rebalance, the component

security quantities will be modified to conform to the following asset diversification requirements:

| (1) | Companies are valued by full market capitalization (all secondary lines are grouped). All companies (and not securities) are sorted

by full market capitalization in descending order. |

| (2) | Companies covering the top 60% of the full market capitalization are excluded. Only companies ranking between 60% and 98% qualify

for the selection. However, existing components ranking between 55% and 60% or 98% and 99% also qualify for the selection. |

| (3) | All companies which qualified in step 2 are now viewed as securities (companies with secondary lines are ungrouped and treated separately).

Only securities that meet all requirements of the investable index universe are added to the index. |

| (4) | In case the number of eligible companies is below 25, additional companies are added by MVIS®’s decision until the number

of stocks equals 25. |

Companies determined to be “silver” stocks

must not constitute more than 20% of the index. If at the quarterly review, the aggregated weighting of all silver stocks represents more

than 20% of the index, a sector-weighting cap factor is applied. This sector-weighting cap factor is calculated to ensure that the aggregated

weighting of all gold stocks will not be less than 80% and the aggregated weighting of all silver stocks is capped at 20%.

For all corporate events that result in a stock removal

from the index, the removed stock will be replaced with the highest ranked non-component on the most recent selection list immediately

only if the number of components in the index would drop below 20. The replacement stock will be added at the same weight as the removed

stock. Only if the number of components drops below its minimum due to a merger of two or more index components, the replacement stock

will be added with its uncapped free-float market capitalization weight. In all other cases, i.e. there is no replacement, the additional

weight resulting from the removal will be redistributed proportionately across all other index constituents.

15

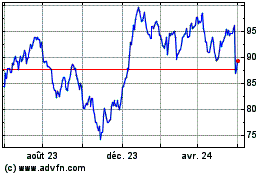

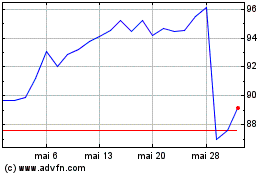

Bank of Montreal (NYSE:BMO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Bank of Montreal (NYSE:BMO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024